Navigating the complex world of student loans can feel overwhelming. The question of “how much is too much?” isn’t easily answered with a single number. It’s a deeply personal question, influenced by factors ranging from your chosen career path and earning potential to your lifestyle preferences and long-term financial goals. This exploration delves into the multifaceted considerations that help you determine your own personal threshold for manageable student loan debt.

Understanding the long-term implications of student loan debt is crucial for responsible financial planning. High debt can significantly impact your ability to save for retirement, buy a home, or even start a family. This guide provides practical strategies for assessing your debt, developing a repayment plan, and exploring alternative funding options to minimize your reliance on loans. We’ll also examine the psychological toll that significant debt can take and offer resources to help you navigate these challenges.

Impact of Loan Amount on Future Financial Planning

The amount of student loan debt you accrue significantly impacts your long-term financial well-being. High debt burdens can restrict opportunities, delaying major life milestones and increasing financial stress. Understanding the implications is crucial for effective financial planning.

The weight of substantial student loan debt extends far beyond the immediate post-graduation period. It casts a long shadow over future financial decisions, potentially hindering the ability to save for a down payment on a house, invest for retirement, or even comfortably manage unexpected expenses. The ripple effect of this debt can influence career choices, limiting the pursuit of lower-paying but potentially more fulfilling professions.

Long-Term Financial Consequences of High Student Loan Debt

High student loan debt can lead to a cascade of negative financial consequences. Borrowers may face difficulty securing favorable interest rates on mortgages, car loans, or other forms of credit. This can result in paying significantly more over the life of these loans. Furthermore, the persistent monthly payments can limit disposable income, hindering savings goals and potentially impacting credit scores if payments are missed or delayed. Delayed homeownership, limited investment opportunities, and reduced financial security are common outcomes. For instance, a borrower burdened with $100,000 in student loan debt might postpone homeownership by several years, losing out on potential appreciation and building equity.

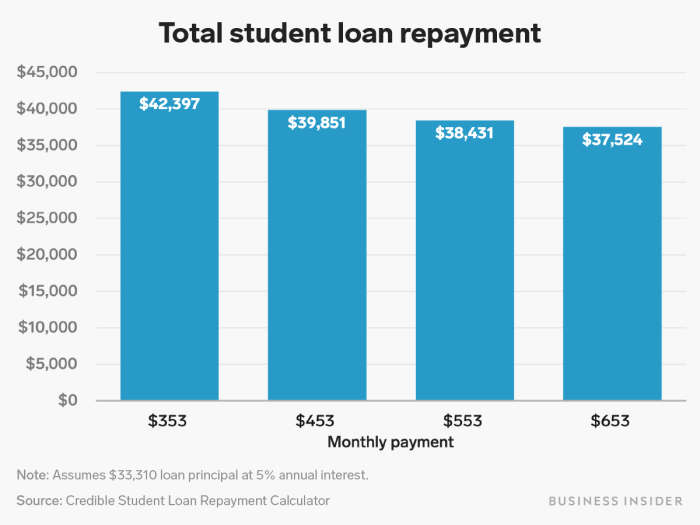

Effect of Interest Accumulation on Total Repayment Amount

Interest accumulation is a silent but powerful force that significantly inflates the total repayment amount. The longer it takes to repay the loan, the more interest accrues, compounding the original principal. This is especially true with variable interest rates, which can fluctuate, leading to unpredictable repayment schedules. For example, a $50,000 loan with a 6% interest rate over 10 years will accumulate significantly more interest than the same loan repaid over 5 years. The difference can easily amount to tens of thousands of dollars. Understanding the amortization schedule—a detailed breakdown of principal and interest payments over the life of the loan—is essential for comprehending the true cost of borrowing.

Comparison of Different Repayment Plans

Several repayment plans are available, each with its own implications for long-term financial goals. Standard repayment plans offer fixed monthly payments over a set period (typically 10 years), while extended repayment plans stretch the repayment period, reducing monthly payments but increasing the total interest paid. Income-driven repayment (IDR) plans adjust monthly payments based on income and family size, offering lower payments in the short term but potentially extending the repayment period significantly. Each plan presents trade-offs; borrowers must carefully weigh the benefits of lower monthly payments against the increased overall cost. For instance, an IDR plan might provide immediate relief but could result in a much larger total repayment amount over the long run.

Budgeting and Financial Planning with Significant Student Loan Debt

Managing significant student loan debt requires a structured approach to budgeting and financial planning.

- Create a Realistic Budget: Track all income and expenses meticulously. Prioritize essential expenses (housing, food, transportation) and identify areas for potential savings.

- Prioritize Loan Repayment: Determine the most effective repayment strategy based on your financial situation and long-term goals. Consider exploring options like refinancing to potentially lower interest rates.

- Build an Emergency Fund: Aim for 3-6 months of living expenses in an easily accessible savings account to cushion against unexpected job loss or medical emergencies.

- Establish Savings Goals: While prioritizing loan repayment, allocate funds towards other important financial goals such as retirement savings, down payment for a house, or investments.

- Regularly Review and Adjust: Financial circumstances change, so it’s crucial to periodically review your budget and repayment strategy to ensure it aligns with your evolving needs and goals.

Lifestyle Choices and Debt Management

Navigating the complexities of student loan repayment often necessitates careful consideration of lifestyle choices. The amount of debt directly influences the financial flexibility available for various life experiences, creating a delicate balance between immediate gratification and long-term financial well-being. Managing this balance effectively is crucial for timely debt reduction and achieving future financial goals.

The relationship between lifestyle and loan repayment is a direct one: higher spending often translates to slower debt repayment, while more frugal habits can accelerate the process. This isn’t about deprivation, but rather conscious decision-making to prioritize debt reduction. For instance, opting for used textbooks instead of new ones, or choosing affordable entertainment options over expensive outings, can significantly impact the available funds for loan repayment. These seemingly small choices, when consistently applied, can collectively contribute substantially to reducing the loan burden.

Lifestyle Adjustments for Quicker Loan Repayment

Making conscious lifestyle changes can dramatically accelerate student loan repayment. This involves critically evaluating spending habits and identifying areas where adjustments can be made without sacrificing overall well-being. For example, individuals might consider reducing dining out expenses, opting for less expensive transportation options, or minimizing non-essential subscriptions. By tracking expenses and identifying areas of overspending, individuals can create a more effective budget, allocating a larger portion of their income towards debt repayment. Such budgeting exercises allow for a more holistic approach to debt management, combining financial planning with mindful consumption.

Impact of Delaying Major Life Decisions on Debt Reduction

Delaying significant life decisions, such as purchasing a home or starting a family, can significantly impact the speed of debt reduction. These major life events often come with substantial financial commitments, potentially diverting funds away from loan repayment. For instance, a mortgage payment can significantly reduce the disposable income available for loan payments, potentially extending the repayment period. Similarly, raising a family adds considerable expenses related to childcare, healthcare, and education, further impacting the ability to aggressively pay down student loans. While these are important life milestones, strategically delaying them until student loan debt is significantly reduced can improve overall financial stability. This strategic approach prioritizes long-term financial health, setting a stronger foundation for future financial endeavors.

Resources for Individuals Struggling with Student Loan Repayment

Many resources exist to support individuals facing challenges in student loan repayment. The federal government offers various programs, including income-driven repayment plans that adjust monthly payments based on income and family size. Additionally, several non-profit organizations provide free financial counseling and guidance on debt management strategies. These organizations can assist in navigating the complexities of repayment options, exploring debt consolidation strategies, and developing personalized repayment plans. Furthermore, many universities and colleges offer career services that can help graduates find higher-paying jobs, increasing their ability to repay loans more quickly. Seeking assistance from these resources can significantly alleviate the stress associated with student loan debt and facilitate a more manageable repayment journey.

Seeking Professional Guidance

Navigating the complexities of student loan debt often requires seeking expert assistance. Understanding the resources available and the questions to ask can significantly improve your ability to manage your debt effectively and plan for your financial future. This section explores the roles of financial professionals and the processes involved in optimizing your student loan repayment strategy.

Financial Advisors and Student Loan Debt Management

Financial advisors can provide comprehensive guidance on managing student loan debt as part of a broader financial plan. They can analyze your income, expenses, and debt load to create a personalized repayment strategy, considering factors such as your risk tolerance and long-term financial goals. They may help you explore options like refinancing or consolidation, and advise on budgeting and savings strategies to accelerate debt repayment. A financial advisor’s holistic approach ensures that your student loan repayment plan integrates seamlessly with other financial priorities, such as saving for retirement or a down payment on a house. For example, a financial advisor might recommend prioritizing high-interest debt repayment while simultaneously maximizing contributions to tax-advantaged retirement accounts.

Services Offered by Non-Profit Organizations

Numerous non-profit organizations offer free or low-cost services to assist individuals with student loan debt. These services often include financial counseling, debt management workshops, and assistance with loan applications and repayment plans. These organizations often specialize in helping borrowers understand their repayment options and navigate the complexities of the student loan system. They may provide personalized guidance on income-driven repayment plans, loan forgiveness programs, and other strategies to reduce the overall cost and burden of student loan debt. Examples of such services include budgeting tools, resources for understanding loan terms and repayment options, and connections to relevant government programs.

Student Loan Consolidation and Refinancing

Consolidating student loans involves combining multiple loans into a single loan with a new repayment schedule. This can simplify the repayment process by reducing the number of payments and potentially lowering the monthly payment amount. Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can significantly reduce the total interest paid over the life of the loan, potentially saving thousands of dollars. However, it’s crucial to compare offers carefully, considering factors such as interest rates, fees, and repayment terms. For instance, refinancing federal loans into private loans can mean losing access to government-backed repayment assistance programs.

Checklist of Questions to Ask When Seeking Professional Advice

Before engaging a financial advisor or non-profit organization, it’s important to have a clear understanding of their services and qualifications. A prepared list of questions will ensure you receive the most relevant and helpful advice.

- What are your qualifications and experience in student loan debt management?

- What specific services do you offer related to student loan debt?

- What is your fee structure, and are there any hidden costs?

- What strategies do you recommend for managing my specific student loan debt situation?

- What are the potential risks and benefits of each strategy you recommend?

- What is your process for monitoring my progress and making adjustments to my repayment plan as needed?

- Can you provide references from past clients who have successfully managed their student loan debt with your assistance?

- What resources or tools do you provide to help me track my progress and stay organized?

The Psychological Impact of Student Loan Debt

The weight of significant student loan debt extends far beyond the purely financial; it profoundly impacts the mental and emotional well-being of borrowers. The constant pressure of repayment, coupled with the potential for long-term financial instability, can lead to considerable stress, anxiety, and even depression. This section explores these psychological challenges and offers strategies for coping.

The emotional toll of substantial student loan debt is often underestimated. The feeling of being trapped in a cycle of debt, the constant worry about making ends meet, and the perceived limitations on future opportunities can all contribute to a sense of hopelessness and overwhelm. This can manifest in various ways, including difficulty sleeping, changes in appetite, irritability, and a general lack of motivation. For some, the stress may lead to more serious mental health conditions, such as anxiety disorders or depression. The pressure to succeed professionally, often fueled by the investment in education, can create a self-imposed burden that exacerbates these feelings.

Stress and Anxiety Management Techniques

Effective stress management is crucial for navigating the challenges of student loan repayment. A multifaceted approach is often most beneficial. This might involve incorporating regular exercise into one’s routine, as physical activity releases endorphins that have mood-boosting effects. Mindfulness practices, such as meditation or deep breathing exercises, can help to center the mind and reduce feelings of anxiety. Prioritizing self-care activities, such as spending time in nature or engaging in hobbies, is equally important for maintaining mental well-being. Seeking support from friends, family, or a therapist can provide a valuable outlet for processing emotions and developing coping strategies. Furthermore, creating a realistic budget and sticking to it can provide a sense of control and reduce financial anxieties.

Resources for Mental Health Support

Individuals struggling with the mental health implications of student loan debt can access a range of support resources. Many universities and colleges offer counseling services to students and alumni, providing a confidential space to discuss concerns and develop coping mechanisms. Numerous non-profit organizations, such as the National Alliance on Mental Illness (NAMI) and the Anxiety & Depression Association of America (ADAA), offer information, support groups, and resources for individuals experiencing mental health challenges. These organizations often provide online resources, hotlines, and referrals to mental health professionals. Additionally, many employers offer employee assistance programs (EAPs) that include mental health services. It’s vital to remember that seeking professional help is a sign of strength, not weakness.

Coping Mechanisms for Overwhelming Debt

Developing effective coping mechanisms is vital for managing the stress associated with high student loan debt. This involves a combination of practical strategies and emotional support. Creating a detailed budget to track income and expenses can provide a sense of control and clarity. Exploring options for loan repayment, such as income-driven repayment plans or loan consolidation, can alleviate some of the financial pressure. Regular communication with loan servicers is crucial for staying informed and addressing any potential issues promptly. Building a strong support network of friends, family, or a support group can provide emotional comfort and practical advice. Prioritizing self-care activities, such as exercise, meditation, or hobbies, can help to manage stress and improve overall well-being. Finally, reframing negative thoughts and focusing on achievable goals can contribute to a more positive outlook.

Last Recap

Ultimately, determining how much student loan debt is “too much” is a highly individual process. There’s no magic number; instead, a thoughtful assessment of your financial situation, career aspirations, and personal values is paramount. By carefully considering the factors Artikeld in this guide – including debt-to-income ratios, repayment plans, lifestyle adjustments, and available resources – you can make informed decisions that align with your long-term financial well-being and overall happiness. Remember, proactive planning and seeking professional guidance when needed are key to navigating this significant financial undertaking.

FAQ Explained

What is a good debt-to-income ratio for student loans?

Generally, a debt-to-income ratio (DTI) below 36% is considered good, but for student loans, aiming for a lower DTI is ideal. The specific ideal DTI depends on your individual circumstances and risk tolerance.

Can I get my student loans forgiven?

Loan forgiveness programs exist, but eligibility requirements vary significantly depending on the type of loan and your employment. Research federal and state programs to determine your options.

What if I can’t afford my student loan payments?

Contact your loan servicer immediately. They can discuss options like deferment, forbearance, or income-driven repayment plans to help you manage your payments.

How can I consolidate my student loans?

Loan consolidation combines multiple loans into a single payment, potentially simplifying repayment. Explore federal and private consolidation options and compare interest rates and terms carefully.