Navigating the complexities of student loan repayment can feel overwhelming, especially when grappling with the often-misunderstood concept of compound interest. Understanding how frequently your loan accrues interest—daily, monthly, or annually—significantly impacts the total amount you’ll ultimately repay. This exploration delves into the mechanics of compound interest applied to student loans, examining how different compounding frequencies affect your overall debt burden and offering strategies for minimizing their impact.

This guide will demystify the process, providing clear examples and practical advice to help you make informed decisions about your student loan repayment. We’ll explore the factors influencing compounding frequency, compare different loan providers’ practices, and discuss effective strategies to manage your debt and minimize interest accumulation. By understanding the nuances of compound interest, you can gain a crucial advantage in managing your student loans effectively and achieving financial freedom sooner.

Understanding Loan Interest Calculation

Understanding how compound interest affects student loans is crucial for responsible financial planning. Compound interest, unlike simple interest, calculates interest not only on the principal loan amount but also on accumulated interest from previous periods. This means your debt grows exponentially over time, potentially leading to significantly higher repayment amounts.

Compound interest is calculated using the following formula: A = P (1 + r/n)^(nt), where A represents the future value of the loan, P is the principal amount, r is the annual interest rate (expressed as a decimal), n is the number of times interest is compounded per year, and t is the number of years.

Compound Interest Calculation Example

Let’s illustrate with a $10,000 student loan at a 5% annual interest rate (0.05) over 10 years. We’ll examine different compounding frequencies.

Scenario 1: Annual Compounding (n=1)

A = 10000 (1 + 0.05/1)^(1*10) = $16,288.95. Total interest paid: $6,288.95

Scenario 2: Monthly Compounding (n=12)

A = 10000 (1 + 0.05/12)^(12*10) = $16,470.09. Total interest paid: $6,470.09

Scenario 3: Daily Compounding (n=365)

A = 10000 (1 + 0.05/365)^(365*10) = $16,486.65. Total interest paid: $6,486.65

Impact of Compounding Frequency

As demonstrated, even small differences in compounding frequency can significantly impact the total interest paid over the loan’s lifetime. More frequent compounding leads to higher total interest. While the differences might seem small in the short term, they accumulate substantially over longer loan periods. This underscores the importance of understanding the loan terms and the effect of compounding.

Comparison of Compounding Frequencies

| Loan Term (Years) | Compounding Frequency | Total Interest Paid | Total Amount Owed |

|---|---|---|---|

| 10 | Annually | $6,288.95 | $16,288.95 |

| 10 | Monthly | $6,470.09 | $16,470.09 |

| 10 | Daily | $6,486.65 | $16,486.65 |

Factors Influencing Compounding Frequency

The frequency with which interest is compounded on a student loan significantly impacts the total amount repaid. Understanding the factors that determine this frequency is crucial for borrowers to accurately assess the true cost of their loan and plan their repayment strategy effectively. Several key elements influence how often interest accrues and is added to the principal balance.

The loan agreement itself is the primary determinant of compounding frequency. This legally binding document explicitly states the terms of the loan, including the interest rate, repayment schedule, and crucially, the compounding period. It’s essential for borrowers to carefully review this document to understand exactly how their interest is calculated and applied. While the lender sets the terms, the borrower agrees to them upon loan acceptance.

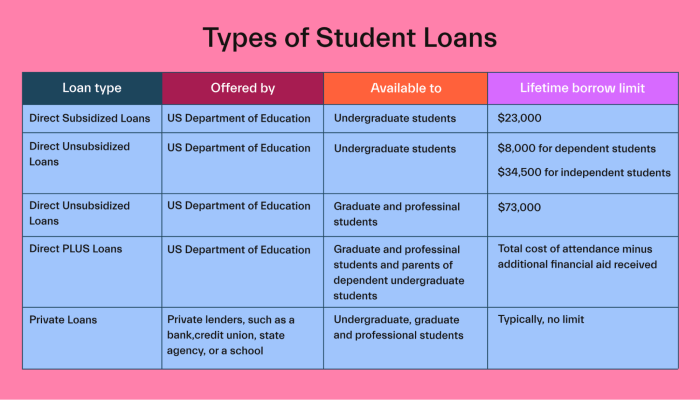

Loan Type and Lender Practices

Different types of student loans, such as federal subsidized loans, federal unsubsidized loans, and private student loans, may have varying compounding frequencies. Federal student loans often compound monthly, reflecting a common practice among government-backed lending programs. However, this is not universally true, and borrowers should check their loan documents. Private lenders, on the other hand, have more flexibility and may choose to compound interest daily, monthly, quarterly, or annually. This variation stems from the differing business models and risk assessments of various private lending institutions. For example, one private lender might prioritize aggressive growth by compounding daily, while another may choose a less frequent approach. The borrower should therefore carefully compare the terms offered by different private lenders before selecting a loan.

Loan Agreement Specifications

The loan agreement provides all the necessary information regarding interest calculation, including the compounding frequency. This is usually clearly stated within the document, often in a section dedicated to interest rate and repayment terms. For example, a loan agreement might state: “Interest will be calculated daily and compounded monthly.” This means that while interest is calculated daily based on the outstanding principal balance, it’s only added to the principal at the end of each month. Understanding this distinction is vital, as daily compounding will result in a slightly higher overall interest cost compared to monthly compounding over the loan’s lifetime, even if the stated annual interest rate is identical. The exact wording might differ slightly across lenders, but the core information regarding compounding frequency is always present.

Comparison of Compounding Practices

A direct comparison of compounding practices across different student loan providers requires examining individual loan agreements. There’s no single, universal standard. However, a general observation is that federal student loans tend to follow a more standardized, often monthly, compounding schedule, while private student loans exhibit greater variability. This variability highlights the importance of comparing not only the interest rate but also the compounding frequency when choosing between loan options. A slightly lower interest rate with daily compounding could ultimately result in a higher total repayment amount compared to a slightly higher interest rate with less frequent compounding. This necessitates a careful evaluation of the total cost of the loan over its lifespan.

Implications for Repayment Strategies

The compounding frequency directly impacts the total interest paid over the life of the loan. More frequent compounding leads to higher interest accumulation. Understanding this allows borrowers to make informed decisions about their repayment strategy. For instance, borrowers with loans subject to daily compounding might prioritize aggressive repayment to minimize the overall interest burden. Conversely, those with less frequent compounding might have more flexibility in their repayment plan. Moreover, understanding the compounding frequency informs the effective interest rate calculation, providing a clearer picture of the true cost of borrowing. This, in turn, aids in effective budgeting and financial planning.

Impact of Compounding on Repayment

Understanding how compounding affects student loan repayment is crucial for effective financial planning. The frequency with which interest is compounded significantly impacts the total amount you’ll pay back over the life of the loan. More frequent compounding means you’ll pay more in interest overall.

The effect of compounding becomes increasingly pronounced over longer loan terms. A seemingly small difference in compounding frequency can translate into thousands of dollars in additional interest paid over the life of a loan. This is because interest accrues not only on the principal loan amount but also on the accumulated interest itself.

Compounding’s Effect on Total Repayment Across Loan Terms

Let’s consider a $20,000 student loan with a 5% annual interest rate. We’ll compare repayment over 10 and 20 years under different compounding scenarios: annual, semi-annual, quarterly, and monthly. A higher compounding frequency leads to a larger total repayment amount. For example, with monthly compounding, the total interest paid will be substantially higher compared to annual compounding. Over a 20-year period, the difference would be considerably more significant than over a 10-year period.

Visual Representation of Loan Growth Under Different Compounding Scenarios

Imagine a graph with time (in years) on the x-axis and the total loan amount (principal + interest) on the y-axis. Multiple lines would represent different compounding frequencies. The line representing monthly compounding would show the steepest upward curve, indicating the fastest growth in the total amount owed. The line for annual compounding would have the gentlest slope. The difference between these lines would visually demonstrate how much more expensive the loan becomes with increased compounding frequency. The area between the lines would represent the additional interest paid due to more frequent compounding.

Comparison of Monthly Payments and Total Interest Paid

To illustrate the impact, let’s use the same $20,000 loan example. The table below Artikels the differences in monthly payments and total interest paid across different compounding frequencies for both a 10-year and a 20-year loan term.

| Compounding Frequency | 10-Year Loan: Monthly Payment | 10-Year Loan: Total Interest Paid | 20-Year Loan: Monthly Payment | 20-Year Loan: Total Interest Paid |

|---|---|---|---|---|

| Annual | $212.47 (approx) | $5,988.24 (approx) | $136.73 (approx) | $12,038.64 (approx) |

| Semi-Annual | $213.24 (approx) | $6,150.12 (approx) | $137.42 (approx) | $12,261.58 (approx) |

| Quarterly | $213.66 (approx) | $6,220.22 (approx) | $137.79 (approx) | $12,365.08 (approx) |

| Monthly | $213.92 (approx) | $6,256.47 (approx) | $138.01 (approx) | $12,429.77 (approx) |

*Note: These figures are approximate and can vary slightly depending on the calculation method used.*

Repayment Schedules Under Different Compounding Frequencies

The following bullet points summarize the key differences in repayment schedules based on compounding frequency:

- Annual Compounding: Lowest monthly payment and total interest paid. Simplest calculation.

- Semi-Annual Compounding: Slightly higher monthly payment and total interest compared to annual compounding.

- Quarterly Compounding: Higher monthly payment and total interest compared to semi-annual compounding.

- Monthly Compounding: Highest monthly payment and total interest paid. Most complex calculation.

These differences, while seemingly small on a monthly basis, accumulate significantly over the loan’s lifetime. Choosing a repayment plan with a lower compounding frequency can result in substantial savings.

Strategies to Minimize Interest Accumulation

Minimizing the impact of compounding interest on your student loans requires a proactive approach to repayment. Understanding how interest accrues and strategically managing your payments can significantly reduce the total amount you pay over the life of your loans. This involves careful consideration of repayment plans, exploring refinancing options, and adopting disciplined budgeting habits.

Extra Principal Payments and Accelerated Repayment

Making extra principal payments is one of the most effective ways to reduce the overall interest paid on your student loans. Every extra dollar you pay goes directly towards the principal balance, reducing the amount of interest calculated in subsequent periods. This accelerates the repayment process, ultimately saving you money. For example, if you have a $30,000 loan at 6% interest, an extra $100 per month towards the principal can significantly reduce your total interest paid and shorten the repayment period by several years. The impact is magnified by the compounding effect – as your principal balance decreases, the interest calculated on the remaining balance also decreases.

Repayment Plan Effects on Interest and Compounding

Different repayment plans directly influence the total interest paid and the compounding effect. A standard repayment plan typically spreads payments over a longer period (e.g., 10 years), resulting in higher total interest due to more time for interest to compound. Conversely, an accelerated repayment plan, which involves higher monthly payments and a shorter repayment term (e.g., 5 years), significantly reduces the overall interest paid because of less time for compounding. For instance, a 10-year repayment plan might result in a total interest payment of $10,000, while a 5-year plan for the same loan might only result in $5,000 in interest paid. The choice of repayment plan directly impacts the compounding effect and overall cost of the loan.

Student Loan Refinancing

Refinancing student loans can be a viable strategy to reduce interest accumulation. By refinancing, you may obtain a lower interest rate or a different repayment plan, potentially leading to substantial savings. However, refinancing involves replacing your existing loans with a new loan, and there are advantages and disadvantages to consider. A lower interest rate directly reduces the amount of interest accrued each month, decreasing the overall cost of borrowing. Changing to a shorter repayment term will reduce the compounding period, resulting in lower total interest paid. However, be aware of potential fees associated with refinancing and ensure the new loan terms are truly beneficial before proceeding. Always carefully compare offers from multiple lenders before making a decision.

Practical Tips for Managing Student Loan Debt

Effective management of student loan debt is crucial to minimize the effects of compounding interest. This involves creating a realistic budget that prioritizes loan repayments, exploring income-driven repayment plans if necessary, and actively monitoring your loan balances and interest rates. Automating payments can help ensure consistent on-time payments, avoiding late fees that can further increase your debt. Regularly reviewing your loan terms and exploring options for reducing your interest rate or repayment period is also important for proactive debt management. Seeking financial advice from a qualified professional can provide personalized guidance tailored to your specific financial situation.

End of Discussion

In conclusion, the frequency at which your student loan compounds significantly influences the total amount you repay. While the specifics vary depending on your loan type and lender, understanding the mechanics of compound interest is paramount. By employing strategies like making extra principal payments, exploring different repayment plans, and potentially refinancing, you can mitigate the impact of compounding and navigate your student loan repayment journey with greater confidence and control. Remember, proactive management and informed decision-making are key to minimizing your long-term debt burden.

Question & Answer Hub

What is the difference between simple and compound interest?

Simple interest is calculated only on the principal amount borrowed, while compound interest is calculated on the principal plus accumulated interest, leading to faster debt growth.

Can I change my loan’s compounding frequency?

Generally, you cannot change the compounding frequency of your existing student loan. This is determined by your loan agreement.

How does my credit score affect my student loan interest rate and compounding?

A higher credit score often qualifies you for a lower interest rate, reducing the overall impact of compounding interest.

Are there penalties for paying off my student loan early?

Most federal student loans do not have prepayment penalties. However, it’s always wise to check your loan agreement.