Understanding how frequently interest accrues on student loans is crucial for effective financial planning. The seemingly small daily addition of interest can significantly impact the total repayment amount over the life of the loan. This impacts both federal and private loans differently, with varying capitalization schedules and repayment plan options influencing the final cost. This guide will clarify the complexities of student loan interest accrual, empowering you to make informed decisions about your repayment strategy.

This exploration will cover the standard interest capitalization schedules for federal loans, highlighting the key distinctions between subsidized and unsubsidized loans. We’ll delve into how interest rates, repayment plans (standard, income-driven, etc.), and periods of deferment or forbearance affect the overall interest accumulation. By examining sample loan statements and providing practical examples, we aim to demystify the process and equip you with the knowledge to manage your student loan debt effectively.

Frequency of Interest Accrual

Understanding how often interest is added to your student loan balance is crucial for effective repayment planning. The frequency of interest accrual and capitalization significantly impacts the total amount you’ll ultimately repay. This section details the standard processes for federal student loans and highlights key differences between subsidized and unsubsidized loans.

Standard Interest Capitalization for Federal Student Loans

Federal student loans typically accrue interest daily. This means interest is calculated each day based on your outstanding principal balance and the applicable interest rate. However, this daily accrued interest isn’t immediately added to your principal. Instead, it’s capitalized at specific intervals, meaning it’s added to your principal balance, thereby increasing the amount on which future interest is calculated. The frequency of capitalization varies depending on the loan type and repayment status. For most federal student loans, capitalization occurs when repayment begins, or if the loan enters deferment or forbearance for an extended period.

Interest Capitalization Differences: Subsidized vs. Unsubsidized Loans

The difference between subsidized and unsubsidized federal student loans lies primarily in whether the government pays the interest while you’re in school or during grace periods. For subsidized loans, the government pays the interest during these periods, preventing it from capitalizing. However, for unsubsidized loans, interest accrues and is capitalized during these periods. This means that the principal balance on an unsubsidized loan will grow even before repayment begins, leading to a larger total repayment amount.

Examples of Interest Accrual and Capitalization

Let’s consider two examples to illustrate how interest accrues and capitalizes.

Example 1: Unsubsidized Loan

Imagine a $10,000 unsubsidized loan with a 5% annual interest rate. If interest is calculated daily, the daily interest rate would be approximately 0.0137% (5%/365). Over a year, without capitalization, the interest accrued would be approximately $500. However, if this interest capitalizes at the end of the year, the new principal balance becomes $10,500, and future interest calculations will be based on this higher amount.

Example 2: Subsidized Loan

Suppose a $10,000 subsidized loan also has a 5% annual interest rate. During a period of deferment, the government pays the interest. Therefore, no interest is added to the principal balance during this time, and the principal remains at $10,000 until repayment begins. Once repayment begins, interest accrues daily and is typically capitalized at the end of each payment period or at the end of a deferment/forbearance period.

Interest Capitalization Frequency Comparison

| Loan Type | Interest Accrual | Capitalization Frequency | Notes |

|---|---|---|---|

| Federal Subsidized | Daily | Typically upon entering repayment | Interest is paid by the government during deferment |

| Federal Unsubsidized | Daily | Typically upon entering repayment or end of deferment/forbearance | Interest accrues during deferment |

| Private Student Loans | Daily or Monthly | Varies widely depending on the lender; check your loan agreement. | Terms and conditions vary greatly between lenders. |

Factors Affecting Interest Calculation

Understanding how student loan interest is calculated is crucial for effective financial planning. Several key factors interact to determine the total interest you’ll pay over the life of your loan. These factors significantly impact your monthly payments and overall repayment burden.

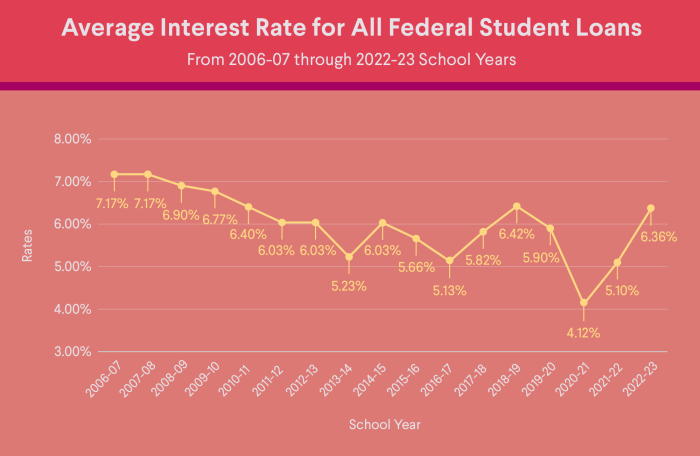

Interest rates are a primary driver of the total interest accrued. The higher the interest rate, the faster interest compounds, leading to a larger overall interest burden. This is because interest is calculated on the principal balance plus any accumulated interest. The frequency of interest capitalization (adding accrued interest to the principal) directly interacts with the interest rate; more frequent capitalization leads to faster growth of the total debt. A higher interest rate combined with more frequent capitalization will result in a significantly larger total interest payment.

Interest Rates and Interest Addition Frequency

The frequency of interest capitalization is often set by the lender and is typically either monthly or daily. Daily interest capitalization means that interest is calculated and added to the principal balance every day. This method leads to slightly higher total interest costs compared to monthly capitalization because of the compounding effect. While the difference might seem small on a daily basis, it accumulates over the life of the loan. For instance, a loan with a 5% annual interest rate will accrue slightly more interest with daily capitalization than with monthly capitalization, resulting in a higher total amount owed.

Impact of Loan Repayment Plans on Interest Accrual

Different repayment plans significantly affect the amount of interest you accrue. Standard repayment plans typically involve fixed monthly payments over a fixed period (e.g., 10 years). Income-driven repayment plans, however, adjust monthly payments based on your income and family size. While income-driven plans often result in lower monthly payments in the short term, they generally extend the repayment period, leading to a greater accumulation of interest over the loan’s lifetime. For example, a borrower with a $30,000 loan at 6% interest might pay significantly less monthly with an income-driven plan, but pay substantially more interest overall than if they were on a standard 10-year plan.

Situations Where Interest May Not Accrue

There are circumstances where interest may not accrue on your student loans. Deferment is a period where you temporarily postpone loan payments, and during this time, interest may or may not accrue depending on the type of loan and the reason for deferment. Forbearance is another option that allows for temporary suspension of payments; however, interest typically continues to accrue during forbearance. Understanding these differences is critical. For example, subsidized federal loans often do not accrue interest during deferment periods, while unsubsidized federal loans and private student loans generally do.

Examples of Repayment Plan Impact on Total Interest Paid

Consider two borrowers, both with a $20,000 loan at a 7% annual interest rate. Borrower A chooses a standard 10-year repayment plan, while Borrower B opts for an income-driven repayment plan with a 20-year repayment period. While Borrower B enjoys lower monthly payments, they will likely pay significantly more in total interest over the 20 years due to the extended repayment period and the continued accrual of interest. The difference could amount to thousands of dollars over the life of the loan. Accurate figures depend on the specific terms of each repayment plan, but the principle of longer repayment leading to higher total interest remains consistent.

Understanding Loan Statements

Understanding your student loan statement is crucial for effectively managing your debt. This section will guide you through interpreting the key components related to interest accrual and capitalization, enabling you to track your loan’s growth and plan for repayment. We will focus on identifying and calculating interest charges, and demonstrating how to utilize the information presented to understand your overall loan status.

Sample Loan Statement with Interest Accrual and Capitalization Highlights

A typical student loan statement will include several key sections. A simplified example might look like this:

| Section | Description | Example |

|---|---|---|

| Beginning Balance | Your loan balance at the start of the billing cycle. | $10,000 |

| Interest Accrued | The amount of interest added to your loan during the billing cycle. | $50 |

| Payments Made | The amount you paid towards your loan during the billing cycle. | $200 |

| Interest Capitalized | Interest added to your principal balance. This typically occurs when payments are insufficient to cover the interest accrued. | $0 (in this example) |

| Ending Balance | Your loan balance at the end of the billing cycle. | $9,850 |

Note: Capitalization is shown as $0 in this example, but it would appear if the interest accrued exceeded the payments made. For example, if only $40 was paid, $10 of interest would be capitalized.

Interpreting Interest Charges on a Monthly Statement

The “Interest Accrued” section of your monthly statement shows the interest charged for that specific billing period. This amount is calculated based on your daily interest rate and your outstanding principal balance. A higher principal balance will result in higher interest charges. The statement will also clearly display the interest rate applied to your loan.

Calculating Total Interest Paid to Date

Calculating the total interest paid requires reviewing all your past statements. Add up the “Interest Accrued” amount from each statement since the loan’s inception. This sum represents the total interest paid to date. The total interest can also sometimes be found summarized on the statement itself.

Step-by-Step Guide to Understanding Interest on a Student Loan Statement

Understanding your student loan statement’s interest-related information can be broken down into these steps:

- Locate the “Interest Accrued” section: This section displays the interest charged for the current billing cycle.

- Identify the interest rate: The statement should clearly state the annual interest rate applied to your loan.

- Review the “Beginning Balance” and “Ending Balance”: These figures show how the loan balance changed during the billing period. The difference, after accounting for payments, represents the interest accrued.

- Check for “Interest Capitalized”: If present, this amount was added to your principal balance, increasing the total amount you owe.

- Review past statements: To determine the total interest paid to date, accumulate the “Interest Accrued” amounts from all previous statements.

Impact of Interest on Loan Repayment

Understanding how interest affects your student loan repayment is crucial for effective financial planning. The seemingly small daily or monthly accrual of interest can significantly inflate the total cost of your loan over its lifetime, impacting your post-graduation financial health. This section will explore the magnitude of this impact and strategies to mitigate it.

Interest capitalization, the process of adding accumulated interest to your principal loan balance, dramatically increases the total amount you repay. The more frequently interest is compounded (added to the principal), the faster your loan balance grows. This compounding effect makes even small differences in interest rates or capitalization policies noticeably impactful over the long term. Understanding this effect is essential to make informed decisions about your repayment strategy.

Capitalization’s Effect on Total Repayment

Let’s consider a hypothetical example: A $20,000 student loan with a 5% annual interest rate, repaid over 10 years. Without interest capitalization, the total repayment amount, including interest, would be approximately $26,670. However, if the interest capitalizes annually, the total repayment could increase to around $27,500 or more, depending on the specific repayment plan and interest calculation method. This seemingly small difference in total repayment cost represents a significant increase in the overall cost of borrowing. The difference highlights the considerable long-term financial impact of interest capitalization.

Long-Term Financial Consequences of Different Interest Accrual Frequencies

The frequency of interest accrual (daily, monthly, or annually) directly influences the total interest paid. Daily compounding, for instance, results in the highest total interest payment compared to monthly or annual compounding because interest is calculated and added to the principal more frequently. A loan with daily compounding will generally accumulate a larger amount of interest over the loan’s lifespan than a loan with monthly or annual compounding, leading to a higher overall repayment amount. This difference can amount to hundreds or even thousands of dollars depending on the loan amount, interest rate, and loan term. For example, a 10-year, $10,000 loan with a 6% interest rate could see a difference of several hundred dollars in total interest paid between daily and annual compounding.

Impact of Interest on Overall Loan Cost

Interest significantly increases the overall cost of a student loan. It represents the price you pay for borrowing money. The longer the repayment period, the more interest you accumulate. Consider a $30,000 loan at 7% interest. Repaying this over 10 years might cost you an additional $15,000 in interest, doubling the original loan amount. Extending the repayment period to 20 years would further increase the total interest paid. This demonstrates how interest, even at a seemingly modest rate, can substantially inflate the final cost.

Strategies to Minimize Interest Impact

Understanding how interest impacts your loan is only half the battle; knowing how to mitigate its effects is equally important. Here are several key strategies:

- Aggressive Repayment: Making extra payments beyond your minimum monthly payment reduces the principal balance faster, minimizing the amount of interest accrued over time. Even small extra payments can make a substantial difference in the long run.

- Refinancing: If interest rates fall after you’ve taken out your loan, refinancing to a lower rate can significantly reduce your overall interest payments.

- Income-Driven Repayment Plans: These plans adjust your monthly payments based on your income, making them more manageable, but they may extend your repayment period and ultimately increase the total interest paid.

- Consolidation: Combining multiple loans into a single loan with a potentially lower interest rate can simplify repayment and potentially reduce overall interest costs. However, careful comparison of interest rates is crucial.

Private vs. Federal Student Loan Interest

Understanding the differences between private and federal student loan interest is crucial for responsible borrowing and long-term financial planning. The interest calculation methods, rates, and capitalization practices vary significantly, impacting the total cost of repayment. This section will clarify these key distinctions.

Federal and private student loans employ different approaches to interest calculation, impacting the overall cost of borrowing. Federal loans generally offer more predictable and often more favorable terms, while private loans present a wider range of options with varying levels of risk. Understanding these differences is essential for making informed borrowing decisions.

Interest Calculation Methods

Federal student loans typically use a simple interest calculation method. Interest accrues daily on the principal balance, and this accumulated interest is added to the principal at specified intervals, usually at the end of the repayment period or upon capitalization. Private loans, however, can utilize different methods, including simple interest, compound interest (where interest accrues on both the principal and previously accumulated interest), and other more complex calculations. The specific method is Artikeld in the loan agreement.

Typical Interest Rates and Compounding Periods

Federal student loan interest rates are set by the government and are generally lower than those offered by private lenders. These rates fluctuate based on market conditions and the type of loan (e.g., subsidized vs. unsubsidized). Interest typically compounds monthly or annually for federal loans. Private loan interest rates are determined by the lender based on creditworthiness, and are typically higher than federal loan rates. Compounding periods can also vary widely depending on the lender and the loan terms, ranging from daily to annually.

Interest Capitalization Practices in Private Loans

Interest capitalization, where accrued interest is added to the principal balance, increasing the amount on which future interest is calculated, is a common feature of both federal and private loans. However, the frequency and conditions of capitalization can differ significantly among private lenders. Some lenders may capitalize interest annually, while others might do so more frequently or only under specific circumstances, such as during periods of deferment or forbearance. This variation can lead to substantial differences in the total amount repaid. For instance, a loan with annual capitalization will accrue less interest over time than a loan with monthly capitalization.

Examples of Significant Interest Cost Impacts

Consider two scenarios: A student borrows $20,000 for undergraduate studies. In Scenario A, they use only federal subsidized loans at a 4% interest rate with annual compounding. In Scenario B, they use a private loan with a 7% interest rate and monthly compounding. Over a 10-year repayment period, the total interest paid in Scenario B would likely be considerably higher than in Scenario A, even with identical principal amounts. This illustrates how the choice of loan type can significantly affect overall interest costs. A second example: A student needing to borrow an additional $5,000 for graduate studies might find a lower interest rate from a private lender based on improved credit score since undergraduate studies. In this case, the private loan might be a more cost-effective option than a new federal loan, despite generally higher rates for private loans. However, careful comparison of all loan terms is essential before making such a decision.

Closing Notes

Successfully navigating the intricacies of student loan interest requires a clear understanding of how often interest is added and the factors influencing this process. From the daily accrual of interest to the various capitalization schedules and repayment plan options, understanding these nuances is critical for minimizing your overall loan cost. By actively monitoring your loan statements, strategically choosing a repayment plan, and employing effective debt management strategies, you can significantly reduce the long-term financial burden of your student loans. Armed with this knowledge, you can confidently manage your debt and achieve your financial goals.

Questions Often Asked

What happens if I miss a student loan payment?

Missing a payment can lead to late fees, negatively impacting your credit score and potentially accelerating interest accrual.

Can I pay extra towards my principal to reduce interest?

Yes, paying extra towards your principal reduces the amount of interest accruing over time, potentially saving you money in the long run.

How do I find my student loan interest rate?

Your interest rate is typically stated on your loan documents and monthly statements. Contact your lender if you cannot locate it.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), while unsubsidized loans accrue interest regardless of your enrollment status.