Navigating the world of student loans can feel overwhelming, a complex maze of federal regulations, interest rates, and repayment plans. This guide aims to demystify the process, providing a clear understanding of how student loans function, from application to repayment. We’ll explore the different types of loans available, eligibility requirements, and the various strategies for managing your debt effectively, empowering you to make informed decisions about your financial future.

Understanding the nuances of student loans is crucial for responsible borrowing and successful repayment. Whether you’re a prospective student planning for higher education or a current borrower seeking clarity, this comprehensive guide offers practical insights and actionable advice to navigate the complexities of student loan debt.

Types of Student Loans

Navigating the world of student loans can feel overwhelming, but understanding the fundamental differences between the main types is crucial for making informed financial decisions. This section will clarify the distinctions between federal and private student loans, outlining their respective advantages and disadvantages. We will also explore the various repayment plans available for federal loans.

Federal vs. Private Student Loans

Federal and private student loans differ significantly in their origins, eligibility criteria, interest rates, and repayment options. Federal student loans are offered by the U.S. government, while private student loans are provided by banks, credit unions, and other private lenders. These differences have significant implications for borrowers.

Federal Student Loan Repayment Plans

Several repayment plans exist for federal student loans, each designed to cater to different financial situations and income levels. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline. Understanding the nuances of each plan is essential for effective debt management.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower and fixed, determined by the government. | Generally higher and can be variable or fixed, determined by the lender and your creditworthiness. |

| Repayment Terms | Standard 10-year repayment, but various income-driven repayment plans are available, extending repayment terms. | Vary depending on the lender and loan terms, typically ranging from 5 to 20 years. |

| Eligibility Requirements | Based on financial need and enrollment status; generally easier to qualify for. | Based on credit history, income, and co-signer availability; often more difficult to qualify for, especially for those with limited credit history. |

| Forgiveness Options | Potential for loan forgiveness through programs like Public Service Loan Forgiveness (PSLF) or Income-Driven Repayment (IDR) plans after a set period of qualifying payments. | Limited or no forgiveness options; bankruptcy may discharge the debt, but this negatively impacts credit. |

Eligibility and Application Process

Securing federal student loans involves meeting specific eligibility requirements and navigating the application process. Understanding these aspects is crucial for prospective students aiming to finance their education. This section details the criteria and steps involved in obtaining federal student aid.

Eligibility for federal student loans hinges primarily on factors related to your educational pursuit and financial situation. The process is designed to ensure that funds are allocated to those who demonstrate both the need and intention to use the funds for education.

Federal Student Loan Eligibility Criteria

Eligibility for federal student loans depends on several key factors. Applicants must be U.S. citizens or eligible non-citizens, possess a valid Social Security number, and be enrolled or accepted for enrollment in an eligible educational program at a participating institution. Furthermore, a high school diploma or GED equivalent is typically required, and applicants must maintain satisfactory academic progress. Finally, they must complete a Free Application for Federal Student Aid (FAFSA) and meet any additional requirements set by their chosen institution. Failure to meet these criteria can result in ineligibility for federal student loan funds.

Applying for Federal Student Loans (FAFSA)

The Free Application for Federal Student Aid (FAFSA) is the cornerstone of the federal student aid application process. Completing the FAFSA accurately and thoroughly is vital to determining your eligibility for various forms of financial aid, including federal student loans. The process is generally straightforward, but requires careful attention to detail.

Step-by-Step Guide to Completing the FAFSA Application

The FAFSA application process can be broken down into several key steps. First, gather necessary information including Social Security numbers, federal tax returns, and income information for both the student and their parents (if applicable). Next, create an FSA ID, a username and password combination that will be used to access and manage your FAFSA information. This is a crucial step for security and access. Then, complete the online application form accurately and completely, ensuring all information is up-to-date and correct. Any inaccuracies can lead to delays or rejection of the application. Following submission, review your Student Aid Report (SAR) carefully to ensure all information is accurate. Finally, monitor your application status and communicate with your school’s financial aid office if any further information or documentation is required. This diligent approach helps ensure a smooth and timely processing of your application.

Interest Rates and Fees

Understanding the financial implications of student loans requires a clear grasp of interest rates and associated fees. These costs significantly impact the total amount you’ll repay, so careful consideration is crucial before borrowing. This section will detail how these costs are determined and provide examples to illustrate their impact.

Student loan interest rates are primarily determined by several factors. The type of loan plays a significant role; federal loans generally have fixed interest rates set by the government, while private loans often have variable rates that fluctuate with market conditions. The interest rate offered also depends on the creditworthiness of the borrower. A strong credit history typically leads to lower rates, while a poor credit history or lack of credit history might result in higher rates. Finally, the loan term can influence the rate; longer repayment periods might come with slightly higher rates to compensate for the increased risk to the lender.

Interest Rate Determination

Federal student loan interest rates are set annually by Congress and are generally fixed for the life of the loan. These rates are often lower than those offered by private lenders. Private student loan interest rates, however, are variable and are influenced by the prevailing market interest rates and the borrower’s creditworthiness. For example, a borrower with an excellent credit score might qualify for a lower interest rate than a borrower with a poor credit history. The specific interest rate will be clearly stated in the loan agreement.

Loan Fees

Several fees are commonly associated with student loans. Origination fees are charges levied by the lender to process and issue the loan. These fees are typically a percentage of the loan amount and are deducted from the loan proceeds before the funds are disbursed to the borrower. Late payment penalties are charged if payments are not made on time. These penalties can significantly increase the total cost of the loan over its lifetime. Other fees may include prepayment penalties (though these are less common in federal student loans) and fees for specific loan servicing functions. It’s crucial to understand all associated fees before accepting a loan.

Comparison of Interest Rates and Fees

The following table provides a simplified comparison. Actual rates and fees can vary depending on the lender, borrower’s creditworthiness, and the specific loan program. This data is for illustrative purposes and should not be considered exhaustive or a substitute for reviewing official loan documents.

| Loan Type | Interest Rate (Example) | Origination Fee (Example) | Late Payment Penalty (Example) |

|---|---|---|---|

| Federal Subsidized Loan | 4.5% (Fixed) | 1% (Deducted upfront) | 1.5% of missed payment |

| Federal Unsubsidized Loan | 6% (Fixed) | 1% (Deducted upfront) | 1.5% of missed payment |

| Private Student Loan (Variable) | 7-10% (Variable) | 0-3% (May vary) | Varies by lender |

| Private Student Loan (Fixed) | 8-12% (Fixed) | 0-3% (May vary) | Varies by lender |

Repayment Options and Plans

Successfully navigating student loan repayment requires understanding the various plans available. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline. Factors such as your income, loan amount, and financial goals should all be considered when making this important decision.

Understanding the different repayment options is crucial for effective debt management. Several plans cater to varying financial situations, allowing borrowers to tailor their repayment strategy to their individual circumstances. Failure to understand these options could lead to unnecessary financial strain or even default.

Standard Repayment Plan

The standard repayment plan is a fixed monthly payment plan spread over 10 years. This plan offers predictable payments but may result in higher monthly payments compared to income-driven plans, especially for borrowers with large loan balances. The simplicity of this plan makes it attractive to those who prefer a straightforward approach to repayment. The fixed payment amount allows for better budgeting and financial planning.

Graduated Repayment Plan

Unlike the standard plan, the graduated repayment plan starts with lower monthly payments that gradually increase over time. This option can be beneficial for borrowers who anticipate increased income in the future, providing more manageable payments in the early years of repayment. However, the increasing payments can become challenging later on if income doesn’t grow as expected.

Extended Repayment Plan

This plan extends the repayment period beyond the standard 10 years, resulting in lower monthly payments. The extended repayment period can range up to 25 years, depending on the loan amount and type. While reducing monthly burden, this option often leads to higher total interest paid over the life of the loan. Borrowers should carefully weigh the reduced monthly payment against the increased total cost.

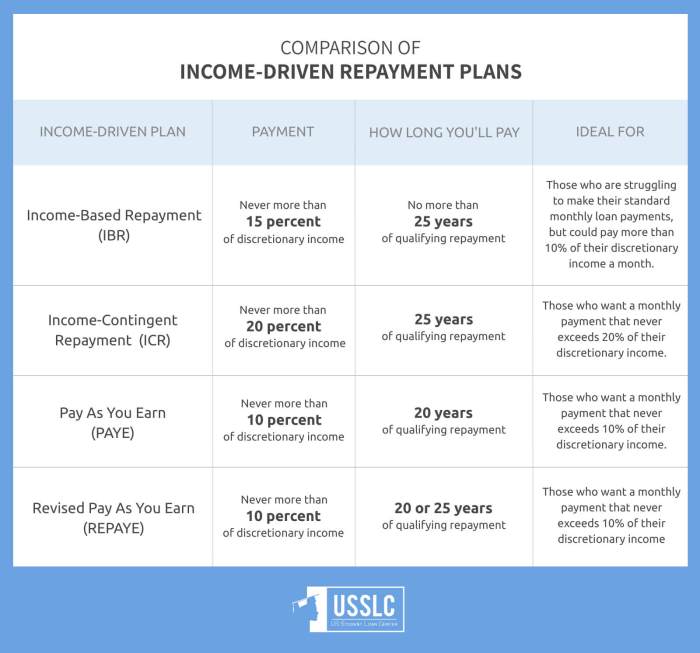

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans base your monthly payment on your income and family size. These plans are designed to make repayment more manageable for borrowers with lower incomes. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has slightly different eligibility requirements and payment calculation methods.

Benefits of Income-Driven Repayment Plans

IDR plans offer several key benefits. They significantly lower monthly payments for eligible borrowers, making repayment more affordable. They also offer the potential for loan forgiveness after a set number of qualifying payments, typically 20 or 25 years, depending on the plan. This forgiveness can substantially reduce or eliminate the remaining loan balance. However, it’s crucial to understand that interest continues to accrue on the unpaid balance, potentially increasing the overall amount paid over time.

Choosing a Repayment Plan: A Decision-Making Flowchart

The following flowchart illustrates the decision-making process for selecting a repayment plan. This is a simplified representation, and individual circumstances may require additional consideration.

[Imagine a flowchart here. The flowchart would start with a diamond shape: “Do you have a stable, high income?”. A “Yes” branch would lead to a rectangle: “Consider Standard or Graduated Repayment”. A “No” branch would lead to a diamond shape: “Do you qualify for an Income-Driven Repayment Plan?”. A “Yes” branch would lead to a rectangle: “Choose an appropriate IDR plan (IBR, PAYE, REPAYE, ICR) based on your income and family size”. A “No” branch would lead to a rectangle: “Consider Extended Repayment Plan”. All rectangles would then lead to a final rectangle: “Begin Repayment”.]

Loan Forgiveness and Cancellation Programs

Student loan forgiveness and cancellation programs offer the possibility of reducing or eliminating your student loan debt under specific circumstances. These programs are designed to alleviate the burden of student loan repayment for individuals who meet certain criteria, often related to their profession or employment situation. Understanding the eligibility requirements and the specifics of available programs is crucial for borrowers hoping to benefit.

Eligibility for student loan forgiveness programs varies widely depending on the specific program. Generally, programs require borrowers to meet criteria related to their employment, income, loan type, and repayment history. Some programs target specific professions providing vital public services, while others consider factors like income-driven repayment plan participation. It’s important to carefully review the requirements of each program to determine eligibility.

Public Service Loan Forgiveness (PSLF)

Public Service Loan Forgiveness (PSLF) is a federal program designed to forgive the remaining balance on Direct Loans after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. To qualify, borrowers must have Direct Loans, be employed full-time by a qualifying employer, and make 120 qualifying monthly payments. A qualifying employer includes government organizations at the federal, state, local, or tribal level, as well as certain non-profit organizations. The program requires consistent employment and on-time payments. Failure to meet these requirements can significantly impact forgiveness eligibility. Borrowers should carefully track their progress and ensure they meet all requirements throughout the 10-year period.

Other Loan Forgiveness Programs

Beyond PSLF, several other loan forgiveness and cancellation programs exist. These programs often target specific professions or situations. For example, some programs offer loan forgiveness for teachers, nurses, and other professionals working in underserved communities. These programs typically have their own specific eligibility requirements and application processes. The details of these programs can vary based on the state or organization offering them. It’s vital to research the specific programs available to determine eligibility and understand the application procedures.

Examples of Eligible Professions

Many professions qualify for loan forgiveness programs, particularly those involving public service. Teachers, nurses, social workers, and law enforcement officers are frequently eligible for programs based on their employment in public service roles. Additionally, some programs extend to professionals working in non-profit organizations focused on public health, education, or community development. The specific professions eligible will vary depending on the particular program. It is advisable to consult the specific program guidelines for a complete list of eligible occupations.

Default and its Consequences

Student loan default is a serious matter with significant financial and legal repercussions. Understanding what constitutes default and the potential consequences is crucial for borrowers to manage their loans responsibly and avoid severe negative impacts on their credit and financial future. Default occurs when a borrower fails to make payments on their student loans for a specific period, typically 270 days or nine months. This triggers a series of actions by the loan servicer and the government, leading to a range of consequences.

Defaulting on student loans has severe consequences that can significantly impact your financial life for years to come. These consequences go beyond simply damaging your credit score; they can lead to legal actions and substantial financial penalties. The most common consequences include wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. These consequences can make it extremely challenging to rebuild your financial stability.

Wage Garnishment

Wage garnishment is a legal process where a portion of your earnings is automatically deducted by your employer and sent to the government to repay your defaulted student loans. The amount garnished can be substantial, significantly reducing your take-home pay and impacting your ability to meet your daily living expenses. The garnishment process can be initiated without prior notice, making it even more critical to avoid default in the first place. The percentage of wages that can be garnished varies depending on state and federal laws, but it can be a significant portion of your income. For example, a borrower might see 15% of their disposable income garnished each pay period.

Tax Refund Offset

The government can also seize a portion or all of your federal tax refund to repay defaulted student loans. This means that if you are expecting a tax refund, it may be significantly reduced or even eliminated entirely to cover your outstanding student loan debt. This can be a particularly harsh consequence, as tax refunds are often relied upon for essential expenses or debt repayment. The IRS works directly with the Department of Education to identify and offset tax refunds owed to borrowers in default.

Steps to Avoid Student Loan Default

It’s crucial to proactively manage your student loans to avoid default. Taking these steps can significantly reduce the risk:

- Create a Budget: Track your income and expenses to understand your financial situation and ensure you can afford your loan payments.

- Explore Repayment Options: Contact your loan servicer to discuss available repayment plans, such as income-driven repayment (IDR) plans, that may lower your monthly payments.

- Communicate with Your Servicer: If you anticipate difficulties making payments, contact your loan servicer immediately. They may be able to offer forbearance or deferment options.

- Consider Loan Consolidation: Combining multiple loans into a single loan can simplify repayment and potentially lower your interest rate.

- Stay Organized: Keep track of your loan details, payment due dates, and contact information for your loan servicer.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and a commitment to responsible financial management. Understanding your repayment options, budgeting effectively, and building strong financial literacy skills are crucial steps towards becoming debt-free. This section will explore strategies for effectively managing your student loan debt and highlight resources available to assist you.

Budgeting and Debt Management Strategies

Creating a realistic budget is the cornerstone of effective student loan repayment. This involves tracking your income and expenses to identify areas where you can reduce spending and allocate more funds towards your loan payments. Consider using budgeting apps or spreadsheets to monitor your finances. Prioritize high-interest loans first to minimize overall interest paid. Explore strategies like the debt snowball or debt avalanche methods to accelerate repayment. The debt snowball method focuses on paying off the smallest debt first for motivational purposes, while the debt avalanche method prioritizes the debt with the highest interest rate. Remember to build an emergency fund to handle unexpected expenses and avoid accumulating further debt.

Financial Literacy and Responsible Borrowing

Financial literacy is essential for responsible debt management. Understanding concepts like interest rates, loan terms, and credit scores empowers you to make informed borrowing decisions. Before taking out student loans, thoroughly research different loan options and compare interest rates and repayment terms. Avoid borrowing more than necessary for your education. Regularly review your credit report to identify and address any errors that could impact your credit score and borrowing ability. Consider seeking guidance from a financial advisor to create a personalized debt repayment plan.

Resources for Managing Student Loan Debt

Numerous resources are available to help borrowers manage their student loan debt. The federal government offers websites and resources providing information on repayment plans, loan forgiveness programs, and financial literacy tools. Many non-profit organizations and credit counseling agencies provide free or low-cost financial guidance and support to borrowers struggling with student loan debt. These agencies can help you create a budget, explore repayment options, and negotiate with your loan servicers. Your college or university may also offer financial aid offices or career services that can provide assistance with student loan management. Remember to utilize available resources and seek professional help when needed.

Understanding Loan Consolidation

Consolidating your student loans means combining multiple federal student loans into a single, new loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount. However, it’s crucial to carefully weigh the potential benefits against the potential drawbacks before making a decision.

The process of consolidating federal student loans involves applying through the Federal Student Aid website. You’ll need to provide information about your existing loans and choose a loan consolidation program. Once approved, your new consolidated loan will replace your old loans, and you’ll make a single monthly payment to your loan servicer. Private loan consolidation is a different process, usually handled directly with a private lender.

Benefits of Loan Consolidation

Consolidation can offer several advantages. A lower monthly payment can make budgeting easier, especially if you’re struggling to manage multiple loan payments. A fixed interest rate can provide predictability and avoid the risk of fluctuating interest rates associated with some loan types. Simplified repayment with a single monthly payment and servicer streamlines the process, reducing administrative hassle. Finally, consolidating federal loans can make you eligible for income-driven repayment plans, which can further reduce your monthly payment based on your income and family size.

Drawbacks of Loan Consolidation

While consolidation offers advantages, there are potential drawbacks to consider. You may end up paying more interest over the life of the loan, especially if you consolidate into a loan with a higher interest rate than some of your existing loans. The overall repayment period might be extended, meaning you’ll pay off your debt over a longer period. Certain loan forgiveness or cancellation programs might be lost if you consolidate federal loans that were eligible for such programs. Finally, consolidating private loans can lead to the loss of favorable terms or benefits that were previously available on individual loans.

Comparison of Loan Consolidation Options

The primary distinction lies between federal and private loan consolidation. Federal loan consolidation, managed by the Department of Education, offers access to income-driven repayment plans and other federal benefits. Private loan consolidation, handled by private lenders, may offer lower interest rates in some cases but typically lacks the flexibility and benefits offered by federal consolidation. The choice depends heavily on the types of loans you possess and your individual financial circumstances. For example, someone with only federal loans might benefit greatly from the federal consolidation program’s flexibility, while someone with a mix of federal and private loans may need to consider a more complex strategy involving both federal and private consolidation options.

Illustrative Example: A Student’s Loan Journey

Sarah, a bright and ambitious student, decided to pursue a degree in engineering. Knowing the high cost of tuition, she researched her student loan options early in her college career. This proactive approach proved invaluable in navigating the complexities of financing her education.

Sarah’s journey began with exploring the different types of federal student loans available. She learned about subsidized and unsubsidized loans, understanding the nuances of interest accrual during her studies. After careful consideration of her financial needs and expected post-graduation income, she decided to apply for a combination of federal subsidized and unsubsidized loans, supplementing this with a small private loan to cover the remaining tuition costs. The process involved completing the FAFSA (Free Application for Federal Student Aid) and providing supporting documentation to her chosen lender.

Loan Selection and Application

Sarah diligently completed the FAFSA form, providing accurate information about her family’s income and assets. This application determined her eligibility for federal student aid. She then worked directly with her university’s financial aid office to understand her loan offers and to complete the necessary paperwork for disbursement. She also explored the terms and conditions offered by a reputable private lender for her supplementary loan, comparing interest rates and repayment options carefully before accepting the offer.

Repayment Plan Choices and Challenges

Upon graduation, Sarah faced the reality of repaying her student loans. She carefully examined the various repayment plans available, including the standard 10-year plan, graduated repayment (where payments increase over time), and income-driven repayment (where payments are tied to her income). Considering her starting salary and anticipated career trajectory, she opted for an income-driven repayment plan, recognizing that this would provide more flexibility in her early career years. However, she also understood that this plan might result in a longer repayment period and potentially higher overall interest costs.

Managing Repayment

Managing her student loan debt presented ongoing challenges. Unexpected expenses, such as car repairs and medical bills, sometimes made it difficult to meet her monthly payments. She utilized online tools to track her loan balances, interest accrual, and payment history. She also proactively communicated with her loan servicers whenever she anticipated potential difficulties in making timely payments, exploring options such as forbearance or deferment to temporarily reduce or postpone her payments. This proactive approach prevented her from falling into default. By consistently monitoring her budget and making responsible financial decisions, Sarah successfully navigated the complexities of student loan repayment.

Closing Summary

Securing a higher education shouldn’t be financially crippling. By understanding the intricacies of student loans – from choosing the right type of loan and navigating the application process to selecting a suitable repayment plan and exploring loan forgiveness options – you can take control of your financial well-being. Remember, responsible borrowing and proactive debt management are key to a successful journey through higher education and beyond. This guide serves as a foundational resource; further research and consultation with financial professionals are always recommended.

Detailed FAQs

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

Can I consolidate my private and federal student loans?

Generally, you cannot consolidate private and federal loans together. You can consolidate federal loans, but private loans must be handled separately.

How long does it take to repay student loans?

The repayment period varies depending on the loan type, repayment plan, and loan amount. It can range from 10 to 25 years or more.

What is the difference between a subsidized and unsubsidized federal loan?

Subsidized loans don’t accrue interest while you’re in school (at least half-time), during grace periods, or deferment. Unsubsidized loans accrue interest from the time the loan is disbursed.