Navigating the world of student loans can feel overwhelming, especially when you’re unsure how to access crucial information about your loans. This guide provides a clear and concise path to understanding your student loan servicer, accessing your online account, and managing your repayment effectively. We’ll demystify the process, offering step-by-step instructions and addressing common concerns to empower you to take control of your student loan journey.

From locating your servicer and understanding your loan details to making payments and knowing your rights, we cover all the essential aspects of managing your student loans. This comprehensive guide aims to equip you with the knowledge and tools necessary to navigate this important financial responsibility with confidence.

Understanding Your Student Loan Servicer

Knowing your student loan servicer is crucial for managing your loans effectively. Your servicer is the company responsible for processing your payments, answering your questions, and providing information about your loan(s). Understanding their role and how to contact them is essential for avoiding missed payments and ensuring a smooth repayment process.

Locating Your Student Loan Servicer

To find your student loan servicer, you’ll need to access your federal student aid account information through the National Student Loan Data System (NSLDS). This is a central database containing information about your federal student loans. Log in using your FSA ID, and navigate to the section displaying your loan details. Your servicer’s name and contact information will be clearly listed there. This is the most reliable method to confirm your servicer and avoid relying on outdated information.

Federal vs. Private Student Loan Servicers

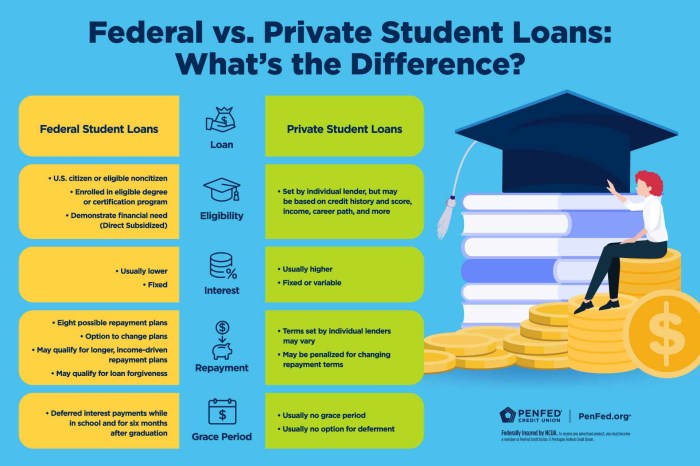

Federal and private student loan servicers have distinct roles. Federal student loan servicers manage loans provided by the U.S. Department of Education. They handle payments, repayment plans, and deferments for federal loans. Private student loan servicers, on the other hand, manage loans from private lenders, such as banks or credit unions. Their services are similar, but the specific programs and options available might differ. It’s essential to understand which type of servicer you’re dealing with to access the appropriate resources and support.

Major Student Loan Servicers in the US

The following table lists some of the major student loan servicers in the United States. Note that servicers can change, and this list is not exhaustive. Always verify your servicer’s information through your federal student aid account.

| Servicer Name | Contact Information | Website URL | Services Offered |

|---|---|---|---|

| (Example Servicer 1 – Replace with actual servicer name) | (Example Phone Number and Address – Replace with actual contact info) | (Example URL – Replace with actual URL) | (Example Services: Payment processing, repayment plan options, loan consolidation, etc. – Replace with actual services) |

| (Example Servicer 2 – Replace with actual servicer name) | (Example Phone Number and Address – Replace with actual contact info) | (Example URL – Replace with actual URL) | (Example Services: Payment processing, repayment plan options, loan consolidation, etc. – Replace with actual services) |

| (Example Servicer 3 – Replace with actual servicer name) | (Example Phone Number and Address – Replace with actual contact info) | (Example URL – Replace with actual URL) | (Example Services: Payment processing, repayment plan options, loan consolidation, etc. – Replace with actual services) |

| (Example Servicer 4 – Replace with actual servicer name) | (Example Phone Number and Address – Replace with actual contact info) | (Example URL – Replace with actual URL) | (Example Services: Payment processing, repayment plan options, loan consolidation, etc. – Replace with actual services) |

Accessing Your Student Loan Account Online

Managing your student loans effectively often involves interacting with your loan servicer’s online portal. This provides a convenient and secure way to track your loan details, make payments, and update your information. This section will guide you through the process of accessing and utilizing your online account.

Creating an online account with your student loan servicer is generally straightforward. You’ll typically need your Social Security number, loan information (such as your loan ID numbers), and a valid email address. The servicer’s website will guide you through a registration process that requires you to create a secure username and password. Remember to choose a strong password that includes a combination of uppercase and lowercase letters, numbers, and symbols, to protect your sensitive financial information. You may also be asked security questions to verify your identity. Once registered, you’ll receive a confirmation email to activate your account.

Accessing Your Account Dashboard

After logging in with your username and password, you’ll be directed to your account dashboard. This is your central hub for managing your student loans. The dashboard typically provides a summary of your loan balances, upcoming payments, and repayment plan details. From here, you can navigate to different sections of your account, each offering more detailed information.

Navigating Account Sections

The specific sections available may vary slightly depending on your servicer, but common features include:

* Payment History: This section displays a record of all your past payments, including the date, amount, and payment method used. This is useful for tracking your payment history and ensuring accurate record-keeping.

* Loan Details: This section provides comprehensive information about each of your student loans, including the loan amount, interest rate, and remaining balance. You’ll also find details regarding your loan’s origination date and disbursement information.

* Repayment Plans: This section allows you to view your current repayment plan and, if eligible, explore other repayment options offered by your servicer. You may be able to adjust your payment amount or change your repayment plan type through this section. Remember to carefully review the terms and conditions of any repayment plan before making changes.

Resetting Your Online Account Password

If you forget your password, most servicers provide a password reset option. Typically, you’ll need to navigate to the login page and click on a link such as “Forgot Password” or “Reset Password.” You’ll then be prompted to enter your username or email address associated with your account. The servicer will then send you a password reset link to your registered email address. Click on this link and follow the instructions to create a new password. Ensure you follow the password complexity guidelines provided by your servicer.

Troubleshooting Password Reset Issues

If you encounter issues resetting your password, such as not receiving the reset link or experiencing errors during the process, check your spam or junk email folder. If the email is still not found, contact your student loan servicer’s customer service directly for assistance. They can help troubleshoot the problem and guide you through the password reset process. Be prepared to provide personal information to verify your identity before they can assist you.

Understanding Your Loan Details

Knowing the specifics of your student loans is crucial for effective repayment planning. Your online student loan account provides a centralized location to access this vital information. Understanding your loan details empowers you to make informed decisions about your financial future.

Your online account typically provides a comprehensive overview of your loans. This includes details such as your loan balance, interest rate, repayment schedule, and the total amount you owe. You can usually find this information by logging into your account and navigating to a section labeled “Loan Summary” or a similar designation. The exact location might vary depending on your loan servicer.

Loan Balance and Interest Rate Information

This section displays the current outstanding balance for each of your loans. It also shows the interest rate applied to each loan, which is typically a fixed or variable rate, clearly indicated. This information is essential for calculating your total repayment cost. For example, a loan with a higher interest rate will accrue more interest over time, leading to a higher overall repayment amount. Understanding these figures is key to budgeting and planning for repayment.

Sample Student Loan Repayment Schedule

The following table illustrates a typical repayment schedule. Note that this is a simplified example, and your actual repayment schedule will depend on your loan terms, repayment plan, and loan amount.

| Month | Beginning Balance | Principal | Interest | Total Payment | Ending Balance |

|---|---|---|---|---|---|

| 1 | $10,000 | $100 | $50 | $150 | $9,900 |

| 2 | $9,900 | $100 | $49.50 | $149.50 | $9,800 |

| 3 | $9,800 | $100 | $49 | $149 | $9,700 |

Student Loan Repayment Plans

Different repayment plans cater to varying financial situations. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline.

Understanding the nuances of each plan is essential for responsible debt management. Contacting your loan servicer for personalized guidance is highly recommended to determine which plan best aligns with your financial circumstances and long-term goals.

Three common repayment plan types include:

- Standard Repayment Plan: This plan typically involves fixed monthly payments over a 10-year period. It’s straightforward but may result in higher monthly payments compared to other options.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This can be beneficial in the early stages of your career when income may be lower, but payments will become significantly higher later on.

- Income-Driven Repayment Plan (IDR): Your monthly payment is based on your income and family size. These plans typically extend the repayment period beyond 10 years, potentially reducing monthly payments but increasing the total interest paid over the life of the loan. Several types of IDR plans exist (e.g., ICR, PAYE, REPAYE), each with its own eligibility criteria and payment calculation method.

Making Payments on Your Student Loans

Paying back your student loans is a crucial step towards financial independence. Understanding your payment options and responsibilities ensures a smooth repayment process and helps avoid potential financial difficulties. This section Artikels the various methods available for making payments and discusses strategies for responsible repayment.

Most student loan servicers offer a variety of convenient payment methods. This flexibility allows you to choose the option that best suits your individual needs and preferences. Understanding these options is key to managing your student loan debt effectively.

Payment Methods

You typically have several ways to make your student loan payments. The most common include online payments, payments by mail, and payments by phone. Online payments are often the most efficient and convenient method, while mail and phone payments offer alternatives for those who prefer them.

- Online Payments: Many servicers offer secure online portals where you can make payments directly from your bank account or using a debit or credit card. This method is generally quick, easy, and provides immediate confirmation of your payment.

- Mail Payments: You can also mail a check or money order to your loan servicer’s designated address. Be sure to include your loan ID number and other relevant information to ensure proper processing. Allow sufficient time for the payment to reach your servicer, especially when mailing checks.

- Phone Payments: Some servicers allow payments via phone using an automated system or by speaking with a customer service representative. This option might involve additional fees, so it’s crucial to check your servicer’s policies beforehand.

Setting Up Automatic Payments

Automating your student loan payments offers significant advantages, including convenience and the potential for reduced interest costs. Many servicers offer automatic debit programs that automatically deduct your payment from your bank account on your due date. This eliminates the need to remember to make payments manually, reducing the risk of late payments and their associated penalties.

- Convenience: Automatic payments eliminate the need for manual tracking and ensure timely payments, reducing stress and the risk of missed payments.

- Potential Interest Savings: Some servicers offer a small interest rate reduction as an incentive for enrolling in automatic payments. This can lead to substantial savings over the life of your loan.

Consequences of Late or Missed Payments

Failing to make timely student loan payments can have serious consequences. Late payments can result in penalties, negatively impact your credit score, and potentially lead to loan default. Understanding these risks is essential for responsible loan management. It is crucial to contact your servicer immediately if you anticipate difficulty making a payment.

- Late Payment Fees: Most servicers charge late payment fees, adding to your overall debt. These fees can significantly increase the total cost of your loan.

- Negative Impact on Credit Score: Late payments are reported to credit bureaus, negatively affecting your credit score. A lower credit score can make it harder to obtain loans, credit cards, or even rent an apartment in the future.

- Loan Default: Repeated missed payments can lead to loan default, resulting in wage garnishment, tax refund offset, and other serious financial repercussions.

Options for Borrowers Facing Financial Hardship

If you are experiencing financial difficulties that make it challenging to make your student loan payments, several options are available to help you avoid default. Contacting your loan servicer is the first crucial step to explore these options.

- Deferment: A deferment temporarily postpones your payments, often requiring documentation of financial hardship. Interest may still accrue during a deferment period, depending on your loan type.

- Forbearance: Similar to deferment, forbearance temporarily suspends or reduces your payments. Interest may or may not accrue during forbearance, depending on the type of forbearance granted.

- Income-Driven Repayment Plans: These plans adjust your monthly payments based on your income and family size, making them more manageable for borrowers with lower incomes.

- Loan Consolidation: Combining multiple loans into a single loan can simplify repayment and potentially lower your monthly payment. However, it may not always reduce the total amount you pay.

Contacting Your Student Loan Servicer

Maintaining open communication with your student loan servicer is crucial for managing your loans effectively. Regular contact can help prevent missed payments, address any concerns promptly, and ensure you’re taking advantage of available repayment options. Understanding the various ways to contact your servicer and best practices for effective communication is key to a positive experience.

Effective communication with your student loan servicer is essential for managing your loans successfully. Having the necessary information readily available will streamline the process and ensure your queries are addressed efficiently.

Methods of Contacting Your Student Loan Servicer

Your student loan servicer typically offers multiple ways to get in touch. Choosing the method that best suits your needs and urgency is important.

- Phone: Most servicers provide a dedicated phone number for customer service. This is often the quickest way to address urgent issues or receive immediate assistance.

- Email: Many servicers allow you to contact them via email. This is useful for non-urgent inquiries or to provide documentation. Expect a slightly longer response time compared to phone calls.

- Mail: You can always send correspondence via mail. This is typically used for formal requests or sending physical documentation. Remember to allow ample time for processing.

Best Practices for Communicating with Your Student Loan Servicer

Before contacting your servicer, gather all relevant information. This will help ensure a smooth and efficient interaction.

- Your Loan Information: Have your loan ID numbers, account numbers, and the type of loan readily available. This allows the servicer to quickly access your account details.

- Personal Information: Be prepared to provide your full name, date of birth, and Social Security number (or other relevant identification) for verification purposes.

- Specific Questions or Requests: Clearly articulate your reason for contacting the servicer. Having a concise and well-defined question will help them understand your needs immediately.

- Supporting Documentation: If your inquiry involves specific circumstances, such as a request for deferment or forbearance, gather any necessary supporting documentation beforehand. This may include employment verification or medical records.

Requesting Loan Deferment or Forbearance

Deferment and forbearance are temporary pauses in your loan repayment schedule. They are available under specific circumstances, such as unemployment or financial hardship. The process for requesting either involves providing documentation to support your claim.

- Gather Required Documentation: This might include proof of unemployment, documentation of financial hardship (such as a letter from a financial advisor), or medical documentation. The specific requirements will vary depending on the type of deferment or forbearance you’re seeking and your servicer’s policies.

- Submit Your Request: You can typically submit your request through your online account, by phone, or via mail. Follow your servicer’s instructions carefully and ensure all necessary documentation is included.

- Review Your Servicer’s Response: Once you’ve submitted your request, monitor your account for updates. Your servicer will notify you of their decision. If approved, the deferment or forbearance will be applied to your account, and your repayment schedule will be adjusted accordingly.

Understanding Your Rights and Responsibilities as a Borrower

Understanding your student loan terms and conditions is crucial for responsible borrowing and avoiding future financial difficulties. This section Artikels your rights and responsibilities as a borrower, providing you with the knowledge necessary to navigate the student loan repayment process effectively. Familiarizing yourself with these details will empower you to make informed decisions and protect your financial well-being.

Knowing your rights and responsibilities as a federal student loan borrower protects you from unfair practices and helps you manage your debt effectively. Federal law provides significant protections, ensuring fair treatment and access to resources during repayment.

Borrower Rights and Protections Under Federal Law

Federal student loan programs offer several key borrower protections. These protections are designed to prevent predatory lending practices and provide borrowers with options when facing financial hardship. Understanding these rights is essential for managing your loans responsibly. For instance, borrowers have the right to receive clear and concise information about their loans, including interest rates, repayment plans, and potential consequences of default. They also have access to various repayment options tailored to their individual financial circumstances, such as income-driven repayment plans. Furthermore, borrowers are protected against unfair collection practices and have avenues for appealing decisions made by their loan servicer. The U.S. Department of Education provides resources and support to help borrowers understand and exercise their rights.

Navigating Student Loan Payment Difficulties

Experiencing difficulty making your student loan payments can be stressful, but understanding your options is crucial. The following flowchart Artikels the steps to take if you are facing challenges:

Flowchart: Addressing Student Loan Payment Difficulties

(Imagine a flowchart here. The flowchart would begin with a box labeled “Difficulty Making Payments?” A “Yes” branch would lead to a box suggesting contacting your loan servicer. From there, branches would lead to options such as exploring income-driven repayment plans, deferment, forbearance, or seeking loan consolidation. A “No” branch would simply lead to a box indicating continued on-time payments. Each option would have a brief description within its box. The final box would be “Resolution Achieved?” with “Yes” leading to a box suggesting continued monitoring of finances and “No” leading to a box suggesting seeking additional assistance from a credit counselor or other financial advisor.)

Last Point

Successfully managing your student loans requires understanding your servicer, accessing your online account, and utilizing available resources. By following the steps Artikeld in this guide, you can confidently navigate the complexities of student loan repayment. Remember, proactive engagement with your servicer and a thorough understanding of your loan terms are key to a successful repayment journey. Take charge of your financial future and ensure a smoother path towards loan repayment.

Top FAQs

What if I don’t know my student loan servicer?

You can typically find your servicer’s information through the National Student Loan Data System (NSLDS) website using your FSA ID.

What if I forgot my online account password?

Most servicers provide a password reset option on their login page. Follow the instructions provided to reset your password via email or security questions.

What are the consequences of missing a payment?

Missing payments can lead to late fees, negative impacts on your credit score, and potential loan default. Contact your servicer immediately if you anticipate difficulty making a payment.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan with a new repayment plan. The Federal Student Aid website provides information on consolidation options.

Where can I find information about income-driven repayment plans?

Information on income-driven repayment plans is available on the Federal Student Aid website and through your student loan servicer.