Navigating the world of student loans can feel overwhelming, but understanding the FAFSA application process is the key to unlocking financial aid for higher education. This guide provides a comprehensive walkthrough, demystifying the process from eligibility requirements to loan repayment strategies. We’ll cover everything you need to know to successfully secure the funding you need to pursue your academic goals.

From gathering necessary documents and completing the online application to understanding different loan types and managing your debt effectively, we’ll equip you with the knowledge and tools to make informed decisions about your financial future. This guide is designed to be your complete resource, providing clear explanations and practical advice every step of the way.

Understanding FAFSA Eligibility

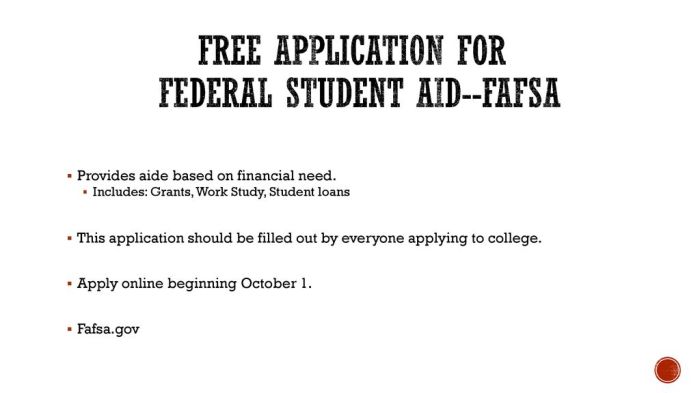

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student financial aid in the United States. Understanding its eligibility requirements is crucial for prospective students and their families. This section will clarify the basic requirements and available aid types, guiding you through the process of determining your eligibility.

FAFSA Basic Eligibility Requirements

To be eligible for federal student aid through FAFSA, you must generally meet several criteria. These include being a U.S. citizen or eligible non-citizen, having a valid Social Security number, possessing a high school diploma or GED, and registering with the Selective Service (for male students). Additionally, you must be enrolled or accepted for enrollment in an eligible educational program at a participating institution. Finally, you must maintain satisfactory academic progress while enrolled. Specific requirements may vary slightly depending on the type of aid sought.

Types of Student Aid Available Through FAFSA

FAFSA opens the door to several types of federal student aid. These include federal student loans (subsidized and unsubsidized), Pell Grants (need-based grants), and Federal Supplemental Educational Opportunity Grants (FSEOGs) which are also need-based. Each aid type has specific eligibility criteria and terms. For example, Pell Grants are only available to undergraduate students who demonstrate significant financial need. Federal student loans, on the other hand, are available to both undergraduate and graduate students, though eligibility and interest rates may differ.

Determining Student Eligibility Based on Income and Other Factors

Determining your eligibility involves providing accurate information on your and your family’s financial situation on the FAFSA form. This includes details such as income, assets, and family size. The FAFSA uses a complex formula to calculate your Expected Family Contribution (EFC), which represents your family’s estimated ability to contribute to your education. A lower EFC generally indicates greater financial need and increased eligibility for need-based aid like Pell Grants. Other factors considered, beyond financial information, include your educational goals, enrollment status, and academic performance. The FAFSA website provides detailed instructions and resources to help you accurately complete the application.

Comparison of Federal Student Loans and Other Financial Aid Options

| Aid Type | Source | Need-Based? | Repayment Required? |

|---|---|---|---|

| Federal Student Loans (Subsidized & Unsubsidized) | Federal Government | Unsubsidized loans are not need-based; subsidized loans are partially need-based. | Yes |

| Pell Grant | Federal Government | Yes | No |

| Federal Supplemental Educational Opportunity Grant (FSEOG) | Federal Government | Yes | No |

| State Grants | State Governments | Often need-based | No |

Gathering Necessary Documents

Completing the FAFSA application requires gathering several key documents. Having these readily available will streamline the process and ensure a smooth application submission. Accurate information is paramount for a successful application, as any discrepancies could lead to delays or even rejection. This section will Artikel the necessary documents and provide tips for efficient organization.

Accurate information is crucial for a successful FAFSA application. Inaccurate data can lead to processing delays, requests for additional documentation, and even the denial of your financial aid. It’s vital to double-check all information before submitting your application. Take your time and ensure everything is correct to avoid potential problems down the line.

Required Documents for FAFSA Completion

Before starting your FAFSA application, gather the following documents. These documents contain the information needed to complete the application accurately and efficiently. Missing documents will significantly delay the process.

- Social Security Number (SSN): Your SSN is essential for identifying you within the system. It’s a crucial piece of information for linking your application to your personal financial records.

- Federal Tax Returns (and W-2s): Your tax returns (IRS Form 1040) and W-2 forms provide essential income information for both you and your parents (if you are a dependent student). This data helps determine your family’s financial need.

- Driver’s License or State ID: While not always explicitly required, having this readily available can assist in verifying your identity, particularly if any discrepancies arise.

- Bank Statements: Although not always directly requested, bank statements can be helpful in verifying financial information, especially if your tax information doesn’t fully reflect your current financial situation.

- Records of Untaxed Income: This includes things like child support received, social security benefits, or other income not reported on your tax returns. It’s important to accurately report all sources of income.

Tips for Efficiently Organizing Documents

Organizing your documents beforehand significantly simplifies the FAFSA application process. A well-organized approach minimizes stress and ensures you have everything needed readily accessible.

- Create a Dedicated Folder: Designate a physical or digital folder specifically for your FAFSA documents. This helps keep everything together and easily accessible.

- Make Copies: Make copies of all important documents before submitting your FAFSA. This protects you from losing original documents.

- Use a Spreadsheet: For complex financial situations, a spreadsheet can help you organize and calculate income, assets, and other relevant financial information needed for accurate reporting on the FAFSA.

- Digital Organization: Scan and save important documents digitally. Cloud storage services can provide a safe and easily accessible backup.

Document Checklist

This checklist summarizes the key documents needed for a successful FAFSA application. Remember to double-check all information for accuracy before submitting your application.

- Social Security Number (SSN)

- Federal Tax Returns (Form 1040)

- W-2 Forms (for you and your parents, if applicable)

- Driver’s License or State ID

- Bank Statements (if needed)

- Records of Untaxed Income

Completing the FAFSA Application

The FAFSA (Free Application for Federal Student Aid) is a crucial step in securing financial aid for higher education. Completing the application accurately and efficiently is essential to maximizing your chances of receiving aid. This section provides a step-by-step guide to navigating the online application process.

The FAFSA application is completed online through the official website, studentaid.gov. The process is generally straightforward, but requires careful attention to detail. Accuracy is paramount, as errors can delay or prevent the disbursement of your financial aid.

Student Information

This section gathers basic information about the student applying for aid. This includes your name, social security number, date of birth, and contact information. Accuracy is crucial here, as any discrepancies may cause delays in processing. Double-check all entries before proceeding. It also asks for your current educational level, intended degree, and the college or university you plan to attend.

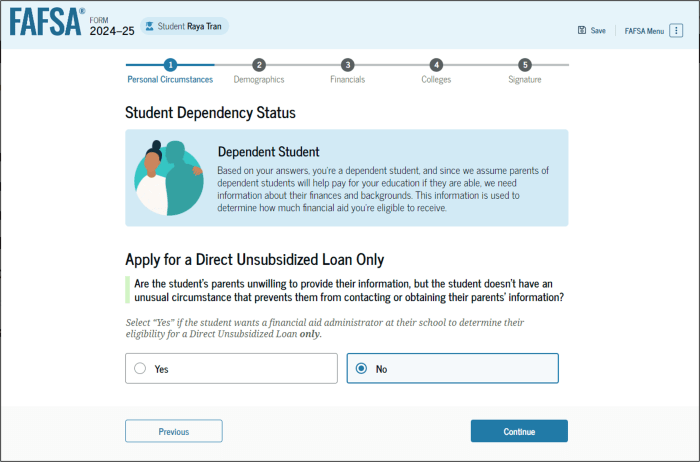

Parent Information

If you are a dependent student (generally under age 24 and not married), the FAFSA requires information about your parents’ financial situation. This section collects details such as their names, social security numbers, income, and assets. Accurate reporting of parental income and assets is vital for determining your eligibility for need-based aid. If your parents are divorced or separated, specific instructions are provided on the FAFSA website to clarify which parent’s information to provide.

Financial Information

This section delves into the financial details of both the student and their parents (if applicable). It requests information on income from various sources (wages, salaries, self-employment, investments, etc.), as well as assets such as savings accounts, checking accounts, and investments. The FAFSA uses this information to calculate your Expected Family Contribution (EFC), a key factor in determining your eligibility for financial aid. Providing accurate and complete information is paramount in this section. It’s recommended to have your tax returns readily available to ensure accuracy.

School Information

This section requires the student to specify the school(s) they plan to attend. You’ll need the school’s Federal School Code, which can usually be found on the school’s financial aid website. You can list multiple schools; however, ensure you accurately indicate your intended enrollment status at each school.

Verification Process

After submitting your FAFSA, you may be selected for verification. This means the government will request additional documentation to confirm the accuracy of the information you provided. This is a standard procedure and does not necessarily indicate an error on your application. Responding promptly and accurately to the verification request is crucial to avoid delays in receiving your financial aid. Common documents requested include tax returns and W-2 forms.

Managing Application Progress

The FAFSA website allows you to track your application’s status online. You can log in to your account to check for updates, view your Student Aid Report (SAR), and monitor the processing of your application. Familiarize yourself with the website’s features to easily monitor your progress and address any issues that may arise. Regularly checking your application status can help identify and resolve any problems promptly.

Common Application Challenges and Error Resolution

Common errors include incorrect social security numbers, inconsistent information, and missing documents. Double-checking all entries before submitting your application is the best preventative measure. If errors occur, the FAFSA website provides detailed instructions on how to correct them. Contacting the FAFSA customer service line or your school’s financial aid office can provide assistance if you encounter significant difficulties. For example, if a student accidentally enters the wrong date of birth, they can correct this error by logging back into their account and making the necessary changes before the submission deadline. Similarly, if a parent’s income information is inaccurate, they can amend this information by accessing the correction tools available within their FAFSA account.

Understanding Student Loan Types

Navigating the world of student loans can feel overwhelming, but understanding the different types available is crucial for making informed financial decisions. Federal student loans offer several options, each with its own set of terms and conditions. Choosing the right loan type depends on your financial need, academic goals, and long-term financial planning.

Federal Student Loan Types: Subsidized, Unsubsidized, and PLUS Loans

Federal student loans are generally preferred over private loans due to their borrower protections and often more favorable interest rates. Three main types of federal student loans exist: subsidized, unsubsidized, and PLUS loans. Each differs significantly in eligibility, interest accrual, and repayment terms.

| Loan Type | Interest Rate (Example Rates – These rates change annually; check the official Federal Student Aid website for current rates) | Repayment Options | Eligibility Criteria |

|---|---|---|---|

| Subsidized Stafford Loan | Variable, set annually by the government (e.g., 4.99% in a given year). | Standard 10-year plan, graduated repayment, income-driven repayment plans (IDR), extended repayment. | Demonstrated financial need as determined by the FAFSA. Undergraduate students are eligible. |

| Unsubsidized Stafford Loan | Variable, set annually by the government (e.g., 5.28% in a given year). | Standard 10-year plan, graduated repayment, income-driven repayment plans (IDR), extended repayment. | Undergraduate and graduate students are eligible. Financial need is not a requirement. |

| PLUS Loan (Parent PLUS or Graduate PLUS) | Variable, set annually by the government (e.g., 7.54% in a given year). | Standard 10-year plan, graduated repayment, extended repayment. Income-driven repayment plans are not available for PLUS loans. | Parents of dependent undergraduate students or graduate students themselves must meet credit requirements. |

Interest Rates and Repayment

Interest rates for federal student loans are set annually by the government and are typically lower than private loan interest rates. Subsidized loans don’t accrue interest while the student is enrolled at least half-time, during grace periods, and in deferment. Unsubsidized and PLUS loans, however, accrue interest from the time the loan is disbursed. Repayment options offer flexibility, allowing borrowers to choose a plan that best suits their financial situation. Income-driven repayment plans (IDRs) can significantly lower monthly payments, especially for borrowers with low incomes. However, IDRs often result in a longer repayment period and may lead to paying more interest overall.

Key Differences and Considerations

The main difference between subsidized and unsubsidized Stafford loans lies in interest accrual during school. Subsidized loans are need-based and offer interest-free periods. Unsubsidized loans are not need-based and interest begins accruing immediately. PLUS loans are available to parents of dependent undergraduate students or to graduate students. Credit checks are required for PLUS loan eligibility. It’s crucial to carefully compare the interest rates, repayment options, and eligibility criteria of each loan type before making a decision. Choosing the right loan type can significantly impact your overall borrowing cost and repayment burden.

Managing Your Student Loans

Securing student loans is a significant step towards higher education, but responsible management is crucial for avoiding future financial difficulties. Effective budgeting, understanding repayment options, and awareness of the consequences of default are key to navigating this phase successfully. This section will provide practical strategies to help you manage your student loan debt effectively.

Budgeting and Managing Student Loan Debt

Creating a realistic budget is paramount to successfully managing student loan repayments. This involves tracking your income and expenses meticulously to identify areas where you can save and allocate funds towards your loan payments. A well-structured budget will help you prioritize essential expenses while ensuring consistent loan repayments. Consider using budgeting apps or spreadsheets to monitor your financial health and make informed decisions. Unexpected expenses can disrupt your budget, so building an emergency fund is also recommended. This fund can act as a buffer against unforeseen circumstances, preventing you from falling behind on your loan payments.

Loan Repayment Options and Plans

Several loan repayment options exist, each tailored to different financial situations. Standard repayment plans involve fixed monthly payments over a set period (typically 10 years). However, income-driven repayment plans adjust your monthly payments based on your income and family size. These plans typically extend the repayment period, potentially reducing your monthly payments but increasing the total interest paid over the life of the loan. Deferment and forbearance offer temporary pauses in repayment, but interest may still accrue during these periods. It’s crucial to research and understand the terms and conditions of each plan before making a decision. Contact your loan servicer to discuss the best option for your circumstances.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe financial repercussions. It can lead to wage garnishment, where a portion of your paycheck is automatically deducted to repay the debt. Your credit score will be significantly damaged, making it difficult to obtain loans, rent an apartment, or even secure certain jobs in the future. The government may also take legal action, including seizing assets or tax refunds. In some cases, default can result in further penalties and fees, significantly increasing the total amount owed. Avoiding default is crucial for maintaining long-term financial stability.

Sample Budget Incorporating Student Loan Payments

Below is a sample monthly budget demonstrating how to incorporate student loan payments. This is a simplified example and needs to be adjusted based on individual income and expenses.

| Income | Amount |

|---|---|

| Net Monthly Salary | $2500 |

| Expenses | Amount |

| Rent | $1000 |

| Utilities | $200 |

| Groceries | $300 |

| Transportation | $150 |

| Student Loan Payment | $350 |

| Savings | $200 |

| Other Expenses | $300 |

| Total Expenses | $2500 |

Remember: This is a sample budget. Your actual budget will vary depending on your individual circumstances. It is essential to create a budget that accurately reflects your income and expenses and allows for consistent student loan payments.

Seeking Additional Financial Aid

Securing federal student loans through FAFSA is a crucial first step in funding your education, but it often doesn’t cover the entire cost. Many students find themselves needing additional financial assistance to bridge the gap. Fortunately, numerous resources exist beyond federal loans to help alleviate the financial burden of higher education. Exploring these options diligently can significantly impact your ability to afford college.

Exploring additional financial aid options requires proactive research and strategic application. This involves identifying potential sources, understanding their eligibility requirements, and carefully crafting compelling applications. The effort invested in this process can lead to substantial savings and reduce the overall debt incurred during your studies.

Types of Scholarships

Scholarships represent a significant source of non-repayable financial aid. They are typically awarded based on merit, academic achievement, talent, or specific demographic criteria. Many scholarships are offered by colleges and universities themselves, while others are provided by private organizations, corporations, and community groups. A thorough search across various databases and websites is essential to uncover suitable opportunities.

Locating Scholarship Opportunities

Finding scholarships requires a dedicated search strategy. Begin by exploring your college or university’s financial aid office website; they often maintain a comprehensive list of scholarships for their students. Next, utilize online scholarship search engines such as Fastweb, Scholarships.com, and Peterson’s. These platforms allow you to filter results based on criteria like major, GPA, and demographics. Don’t overlook local scholarships offered by community organizations, professional associations, and even businesses in your area. Checking with your high school guidance counselor or college career services office can also yield valuable leads.

The Scholarship Application Process

The scholarship application process varies depending on the provider. However, most applications require a completed application form, official transcripts, letters of recommendation, and an essay or personal statement. Carefully review each scholarship’s specific requirements and deadlines. Pay close attention to essay prompts and tailor your responses to demonstrate your qualifications and align with the scholarship’s goals. Submitting a polished and well-written application significantly increases your chances of success. Proofreading carefully is essential to avoid errors that could negatively impact your application.

Types of Grants

Grants, like scholarships, provide non-repayable financial aid. However, grants are often awarded based on financial need rather than merit. Federal Pell Grants are a prime example of a need-based grant program administered through FAFSA. Many state and local governments also offer grants to students attending in-state colleges and universities. Private organizations and foundations may also provide grants based on various criteria, including academic achievement, community involvement, or specific areas of study.

Locating Grant Opportunities

Similar to scholarships, finding grants requires diligent searching. Check your college or university’s financial aid website for a list of available grants. Explore the websites of state and local government agencies responsible for higher education funding. Additionally, research private foundations and organizations that align with your academic interests or personal background. Many grant opportunities are announced through professional associations or community organizations. Utilizing online grant search engines can also be beneficial.

The Grant Application Process

The application process for grants often involves submitting a detailed application form, demonstrating financial need through documentation like tax returns, and providing supporting materials such as transcripts or letters of recommendation. Many grant applications require essays or personal statements highlighting your academic goals and financial circumstances. Meeting all deadlines and submitting a complete application is critical. It is advisable to carefully review all application instructions and contact the grant provider with any questions.

Understanding Loan Repayment

Successfully navigating the FAFSA process and securing student loans is only half the battle. Understanding your repayment options and planning strategically is crucial to avoiding financial hardship after graduation. This section will Artikel the various repayment plans available for federal student loans and the factors influencing your monthly payments and overall repayment timeline.

Federal student loans offer a range of repayment plans designed to accommodate varying financial situations. Choosing the right plan significantly impacts your monthly budget and the total interest you pay over the life of the loan.

Federal Student Loan Repayment Plans

Several federal student loan repayment plans cater to different financial circumstances. The most common include the Standard Repayment Plan, Graduated Repayment Plan, Extended Repayment Plan, and Income-Driven Repayment (IDR) Plans. Each plan has a unique structure affecting monthly payments and the total repayment period.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s the simplest plan, but may result in higher monthly payments compared to other options.

- Graduated Repayment Plan: Payments start low and gradually increase every two years. This can be helpful initially, but payments become significantly higher later in the repayment period.

- Extended Repayment Plan: This plan stretches repayment over a longer period, typically up to 25 years, resulting in lower monthly payments but higher total interest paid.

- Income-Driven Repayment (IDR) Plans: These plans (including ICR, PAYE, REPAYE, and IBR) base your monthly payment on your income and family size. Payments are typically lower, and any remaining loan balance may be forgiven after 20 or 25 years, depending on the plan, though this forgiveness is considered taxable income.

Factors Influencing Loan Repayment

Several factors determine your monthly loan payments and the total repayment time. These include the loan principal amount (the original loan amount), the interest rate, the chosen repayment plan, and any applicable fees. A higher principal balance, higher interest rate, and longer repayment plan will generally lead to higher total interest paid.

Examples of Repayment Plan Impact

Let’s consider a $30,000 loan with a 5% interest rate.

- Standard Repayment Plan (10 years): The monthly payment would be approximately $330, resulting in a total repayment of around $39,600 (including interest).

- Extended Repayment Plan (25 years): The monthly payment would be significantly lower, perhaps around $165, but the total repayment would be considerably higher, potentially exceeding $50,000 due to accumulated interest.

- Income-Driven Repayment Plan (Example): If your income is low, your monthly payment under an IDR plan could be as low as $100, but the repayment period could extend to 20 or 25 years, leading to substantial interest accumulation.

Illustrative Comparison of Repayment Plans

Imagine a bar graph. The x-axis represents the different repayment plans (Standard, Graduated, Extended, IDR). The y-axis represents the total interest paid. The bar for the Standard Repayment Plan would be relatively short, representing lower total interest. The bar for the Extended Repayment Plan would be the tallest, showing significantly higher total interest due to the longer repayment period. The Graduated Repayment Plan’s bar would be taller than the Standard but shorter than the Extended. The IDR plan’s bar height would depend on the individual’s income and repayment period; it could be shorter or longer than the others. This visualization illustrates how different repayment plans can significantly impact the overall cost of your loan.

Troubleshooting Common Issues

Applying for federal student aid through FAFSA can sometimes present challenges. This section addresses common problems encountered during the application process and provides solutions to help you navigate these hurdles smoothly. Remember, seeking assistance is key if you encounter persistent difficulties.

Data Retrieval Errors

Errors during the data retrieval process are common. This often happens when the FAFSA system cannot access information from the IRS or state tax agencies. This may result in an incomplete application or inaccurate information.

If you encounter a data retrieval error, carefully review the error message provided by the FAFSA system. The message usually indicates the specific issue and suggests possible solutions. For example, the error may state that your tax information is not available.

Check that you have entered your Social Security number and date of birth correctly. Ensure that the tax year selected matches the information you’re trying to retrieve. If the problem persists, contact the IRS or your state tax agency directly to verify your tax information is up-to-date and accessible. You may also need to manually enter your tax information into the FAFSA form.

Incorrect or Missing Information

Providing incorrect or missing information is another frequent issue. This can lead to delays in processing your application or even rejection. Accuracy is paramount.

Double-check all entered information for accuracy before submitting the FAFSA form. Pay close attention to details such as names, dates, addresses, and Social Security numbers. Carefully review the information you’ve provided, ensuring it matches your official documents.

If you realize you’ve made a mistake, you can correct the application by logging back into your FAFSA account. You’ll usually have the option to edit your information until the deadline. However, if you’re close to the deadline, contact the FAFSA customer service immediately.

FSA ID Problems

Many applicants struggle with creating or accessing their FSA ID, a username and password combination required to sign the FAFSA.

If you’re having trouble creating an FSA ID, ensure you’re using a valid email address and a strong password. Follow the instructions provided on the FSA ID website carefully. If you forget your FSA ID, use the “Forgot your FSA ID?” feature on the website to recover your credentials.

If you are encountering persistent issues with your FSA ID, contact the Federal Student Aid customer support for assistance. They can help you troubleshoot login problems or guide you through the ID creation process.

Application Submission Issues

Sometimes, technical difficulties prevent the successful submission of the FAFSA. This can range from internet connectivity problems to website errors.

Ensure you have a stable internet connection before attempting to submit the FAFSA form. If you’re experiencing website errors, try clearing your browser’s cache and cookies or trying a different browser. If the issue persists, contact the FAFSA customer service for assistance.

Be aware of deadlines. Submitting the application well before the deadline gives you time to resolve any technical issues that might arise.

Conclusive Thoughts

Securing a student loan through FAFSA is a significant step towards achieving your educational aspirations. By carefully reviewing your eligibility, gathering the necessary documents, and diligently completing the application, you can access crucial financial support. Remember to thoroughly understand the various loan types and repayment options to make informed choices that align with your financial goals. Proactive planning and responsible management of your student loans will pave the way for a successful academic journey and a brighter future.

General Inquiries

What happens if I make a mistake on my FAFSA application?

You can correct errors through the FAFSA website. Log in to your account and make the necessary changes. It’s important to do this as soon as possible.

How long does it take to process a FAFSA application?

Processing times vary, but generally, you can expect a response within several weeks. Check your FAFSA account for updates.

Can I appeal a FAFSA decision?

Yes, if you believe there’s been an error or omission, you can contact the FAFSA office to initiate an appeal process.

What if I don’t qualify for federal student loans?

Explore alternative options such as private loans, scholarships, grants, or work-study programs. Your college’s financial aid office can assist you in exploring these possibilities.