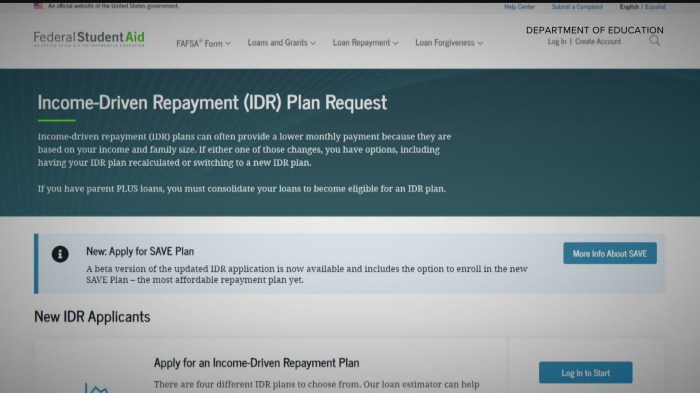

Navigating the complexities of student loan forgiveness can feel daunting, but understanding the process is key to potentially relieving significant financial burden. This guide provides a clear and concise pathway to applying for the SAVE student loan program, outlining eligibility criteria, required documentation, and the step-by-step application procedure. We’ll demystify the process, empowering you to confidently pursue loan forgiveness.

From understanding income requirements and eligible loan types to mastering the application form and tracking your progress, we’ll cover all aspects. We’ll also address common pitfalls and offer solutions to ensure a smooth application process. This guide aims to equip you with the knowledge and tools needed to successfully navigate your journey towards student loan forgiveness.

Eligibility Criteria for Student Loan Forgiveness Programs

Navigating the complexities of student loan forgiveness programs requires a clear understanding of the eligibility requirements. These programs, designed to alleviate the burden of student debt, have specific criteria that must be met to qualify. Failure to meet these criteria can result in denial of forgiveness, leaving borrowers still responsible for their loan balances. Understanding these requirements is crucial for successful application and debt relief.

Income Requirements for Student Loan Forgiveness

Income-driven repayment (IDR) plans, and some forgiveness programs like Public Service Loan Forgiveness (PSLF), base eligibility on your adjusted gross income (AGI). This is the income reported on your federal tax return after certain deductions. Specific income thresholds vary depending on the program and family size. For example, PSLF doesn’t have a specific income cap, but your payments must be made under an IDR plan, which considers your income to determine your monthly payment amount. Lower income borrowers often benefit most from these programs, as their monthly payments are reduced, and they may qualify for forgiveness sooner. It is essential to consult the specific program guidelines for precise income limitations and calculation methods.

Eligible Student Loan Types for Forgiveness

Not all student loans qualify for forgiveness programs. Generally, federal student loans are eligible, including Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans (for graduate students and parents), and Federal Stafford Loans. However, private student loans typically do not qualify for federal forgiveness programs. It’s crucial to verify the specific loan types accepted by the program you’re applying for. For instance, PSLF only considers Direct Loans, not Federal Family Education Loans (FFEL) or Perkins Loans (unless consolidated into Direct Loans).

Reasons for Student Loan Forgiveness Denial

Several factors can lead to the denial of your student loan forgiveness application. Common reasons include: inconsistent or missing payments under an IDR plan; failure to meet the required employment criteria (for programs like PSLF, which requires employment in public service); inaccurate or incomplete application information; failure to certify employment annually (as required by some programs); and having ineligible loan types. Carefully reviewing the program’s requirements and submitting a complete and accurate application is crucial to avoid denial.

Comparison of Forgiveness Program Eligibility Requirements

| Program | Income Requirements | Eligible Loan Types | Employment Requirements |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | No income cap, but payments must be made under an IDR plan. | Direct Loans (consolidated FFEL and Perkins loans may qualify). | 120 qualifying monthly payments while employed full-time by a qualifying government or non-profit organization. |

| Teacher Loan Forgiveness | Income-based, with specific thresholds. | Federal Stafford, Subsidized and Unsubsidized Loans, and Direct Subsidized and Unsubsidized Loans. | 5 years of full-time teaching in a low-income school or educational service agency. |

| Income-Driven Repayment (IDR) Forgiveness | Income-based, with varying thresholds depending on the plan and family size. | Direct Loans and FFEL loans (if consolidated into Direct Loans). | 20-25 years of qualifying payments (depending on the IDR plan). |

Application Process Overview

Applying for student loan forgiveness can seem daunting, but breaking it down into manageable steps simplifies the process. This section provides a clear, step-by-step guide, along with the necessary documentation for each stage. Remember, specific requirements may vary depending on the program you’re applying for, so always refer to the official program guidelines.

Step-by-Step Application Guide

The application process generally involves several key steps. Careful preparation and attention to detail at each stage will increase your chances of a successful application.

- Gather Required Documentation: This initial step is crucial. You’ll need proof of income, employment history, student loan details (including loan servicer information and loan balances), and potentially other supporting documents depending on the specific forgiveness program. Examples include tax returns, pay stubs, and official transcripts from your educational institution.

- Complete the Application Form: Each forgiveness program has its own application form. Ensure you complete it accurately and thoroughly. Double-check all information for errors before submitting. Inaccurate information can lead to delays or rejection.

- Submit Supporting Documentation: Along with the completed application form, you’ll need to submit all the supporting documentation you gathered in step one. Organize your documents logically and clearly label each one for easy review by the loan servicer or government agency processing your application.

- Track Your Application Status: After submitting your application, regularly monitor its progress. Most programs provide online portals or methods to track your application status. This allows you to identify any potential issues early on.

- Respond to Requests for Additional Information: Be prepared to respond promptly to any requests for additional information from the loan servicer or agency. Failure to do so can significantly delay the processing of your application.

- Review the Outcome: Once a decision is made, carefully review the outcome. Understand the reasoning behind any rejection and explore options for appeal or correction if necessary.

Application Process Flowchart

Imagine a flowchart with six distinct boxes connected by arrows.

Box 1: Gather Documentation (Arrow points to Box 2) This box contains a list of required documents like tax returns, pay stubs, loan details.

Box 2: Complete Application Form (Arrow points to Box 3) This box highlights the importance of accuracy and thoroughness in filling out the application.

Box 3: Submit Application & Documents (Arrow points to Box 4) This box emphasizes the need for organized and clearly labeled documents.

Box 4: Track Application Status (Arrow points to Box 5) This box shows the importance of regular monitoring through online portals.

Box 5: Respond to Information Requests (Arrow points to Box 6) This box stresses the need for prompt responses to avoid delays.

Box 6: Review Outcome This box indicates the final stage, where the applicant reviews the decision and explores appeal options if needed.

Required Documentation by Step

The specific documentation needed will vary by program, but common requirements include:

| Step | Required Documentation |

|---|---|

| Gather Required Documentation | Tax returns (past few years), Pay stubs (recent months), Student loan details (loan servicer, loan balances, etc.), Official college transcripts, Employment verification |

| Complete the Application Form | The official application form for the specific forgiveness program. |

| Submit Supporting Documentation | All documents listed in the “Gather Required Documentation” section, organized and clearly labeled. |

| Track Your Application Status | Access to the online portal or tracking system provided by the loan servicer or government agency. |

| Respond to Requests for Additional Information | Any additional documents or information requested by the loan servicer or government agency. |

| Review the Outcome | The official decision letter or notification from the loan servicer or government agency. |

Understanding Required Documentation

Applying for student loan forgiveness requires submitting several key documents to verify your identity, employment history, and income. Providing complete and accurate documentation is crucial for a smooth and timely processing of your application. Failure to do so may result in delays or rejection of your application.

Acceptable Forms of Identification

Acceptable forms of identification must clearly show your full legal name and date of birth. The documents should be current and unaltered. Providing a photocopy is generally sufficient, but the program guidelines may specify whether original documents are required for verification purposes. Examples of acceptable identification include a valid driver’s license, state-issued identification card, passport, or military identification card. Social Security cards are not usually sufficient on their own, but may be required as supplemental identification.

Verifying Employment and Income

Proof of employment and income is essential to determine your eligibility for loan forgiveness programs. This usually involves providing documentation that confirms your employment history and your income for the relevant period. Acceptable forms include W-2 tax forms, pay stubs, tax returns (1040), or official employment verification letters from your employer. The specific requirements will depend on the program you are applying to and the length of time you’ve been employed. For self-employed individuals, tax returns (Schedule C) and bank statements might be necessary to prove income.

Obtaining Missing or Incorrect Documents

If you are missing or have incorrect documents, it’s crucial to rectify the issue as soon as possible. Contact the issuing agency for replacement documents; for example, contact your state’s Department of Motor Vehicles for a replacement driver’s license. For employment verification, reach out to your employer’s human resources department. Allow sufficient time for processing replacement documents, as delays could impact your application timeline. If you cannot obtain a document, thoroughly document your efforts to obtain it and include this documentation with your application. The program administrator may offer guidance on alternative documentation or extend deadlines in such circumstances.

Necessary Documents Checklist

- Completed application form

- Valid government-issued photo identification (driver’s license, passport, etc.)

- Social Security card (or other proof of Social Security number)

- Proof of employment (W-2 forms, pay stubs, employment verification letter)

- Tax returns (Form 1040 and supporting schedules, if applicable)

- Bank statements (if self-employed or required by the program)

- Any other documentation specified by the loan forgiveness program

Completing the Application Form

Successfully navigating the application form is crucial for a smooth and timely processing of your student loan forgiveness application. Accuracy and completeness are paramount; errors can lead to delays or even rejection. This section details the process of completing the form, emphasizing the importance of providing correct information and offering strategies to avoid common mistakes.

The application form itself is typically structured in sections, each requesting specific information. Each section should be completed meticulously and thoroughly. Failure to do so can result in significant delays, requiring additional correspondence and verification steps, potentially extending the processing time considerably.

Section-Specific Guidance

The specific sections within the application will vary depending on the particular student loan forgiveness program you are applying for. However, common sections usually include personal information, employment history, loan details, and income verification. It’s essential to carefully review each section’s instructions before providing your information. Many applications have online help sections or FAQs that can clarify any uncertainty.

Providing Accurate Information

Accuracy is paramount throughout the application process. Inaccurate information, even seemingly minor errors, can lead to delays and potential rejection. For instance, a misspelling in your name or Social Security number could cause your application to be flagged for review, potentially delaying the process for several weeks. Similarly, incorrect income figures could lead to an inaccurate assessment of your eligibility. Always double-check all information before submitting your application. Use official documents as references whenever possible.

Consequences of Incomplete or Inaccurate Applications

Submitting an incomplete or inaccurate application can have several serious consequences. The most common is a delay in processing. The application may be returned to you for correction, significantly prolonging the overall timeline. In some cases, an incomplete or inaccurate application might be rejected outright, requiring you to reapply and potentially missing crucial deadlines. In severe cases of fraudulent information, penalties may be incurred.

Avoiding Common Application Errors

Several common errors can be avoided with careful preparation and attention to detail. First, ensure you have all necessary documentation readily available before beginning the application. This includes tax returns, pay stubs, loan details, and any other supporting evidence requested. Second, take your time and complete each section thoroughly. Don’t rush the process; accuracy is more important than speed. Third, proofread your application carefully before submission. Check for typos, inconsistencies, and missing information. Finally, consider having someone else review your completed application before submitting it; a fresh pair of eyes can often catch errors you might have missed.

Submitting the Application and Tracking Progress

Submitting your student loan forgiveness application is the final, crucial step in the process. Accurate and timely submission ensures your application is processed efficiently. Understanding the various submission methods and how to track your application’s progress is key to a smooth experience.

After completing your application form, you’ll need to submit it through one of the approved channels. The availability of these methods may vary depending on your specific loan servicer and the forgiveness program you’re applying for. Always refer to your servicer’s website for the most up-to-date instructions.

Application Submission Methods

Typically, you can submit your application through several methods, each offering a different level of convenience and security. Choosing the right method depends on your personal preference and access to technology.

- Online Portal: Many loan servicers offer secure online portals where you can upload your completed application and supporting documents. This is often the fastest and most convenient method.

- Mail: You may be able to mail your application and supporting documents to the designated address provided by your loan servicer. This method requires careful attention to detail, ensuring all documents are included and the envelope is correctly addressed.

- Fax: In some cases, faxing may be an acceptable submission method. However, this is becoming less common due to security concerns. Always confirm with your servicer if faxing is still an option.

Tracking Application Status

Once your application is submitted, it’s essential to track its progress. Most servicers provide online tools to monitor the status of your application. This typically involves logging into your account on their website.

The online portal usually displays the current stage of processing, such as “received,” “under review,” or “approved/denied.” Regularly checking for updates will keep you informed about the application’s progress and allow you to address any potential delays promptly.

Addressing Delays or Rejections

Delays or rejections can be frustrating, but understanding the reasons behind them and taking appropriate action is vital. Delays often occur due to missing or incomplete documentation. A rejection might be due to ineligibility based on the program’s criteria or errors in the application itself.

If your application is delayed, contact your loan servicer immediately to inquire about the reason for the delay and provide any missing information. If your application is rejected, carefully review the rejection notice to understand the reason. You may be able to resubmit your application after correcting any errors or providing additional documentation.

Contacting Relevant Authorities

If you encounter difficulties or have questions throughout the application process, contacting the relevant authorities is crucial. This could involve your loan servicer, the Department of Education, or other relevant agencies depending on your specific situation.

Your loan servicer’s contact information is typically available on their website. The Department of Education also provides various resources and contact information on their website for assistance with student loan programs. It’s always best to begin by contacting your loan servicer directly; they are usually the first point of contact for application-related inquiries.

Understanding Post-Application Procedures

After submitting your SAVE student loan application, understanding the next steps is crucial for a smooth process. This section details how to track your application’s progress, what to expect if approved or denied, and how to appeal a denial. Clear communication and proactive engagement with the loan servicer are key throughout this phase.

Receiving Application Status Updates

The loan servicer will typically provide updates on your application status through various channels. These may include email notifications, updates to your online account portal, and potentially, phone calls. Regularly checking your online account is recommended, as this is often the primary method for communication. It’s important to keep your contact information updated within the application system to ensure timely delivery of these updates. If you haven’t received an update within the expected timeframe (check the servicer’s website for estimated processing times), contacting customer support directly is advisable.

Application Approval Procedures

Upon approval, you’ll receive official notification detailing the amount of loan forgiveness granted and the schedule for its disbursement. This notification will likely include information about any remaining loan balances and future payment obligations. You should carefully review all details to ensure accuracy. In some cases, the funds may be directly applied to your loan balance, reducing the outstanding amount. In others, you might receive a refund check. It’s essential to understand the specifics of your approval to avoid any misunderstandings or delays.

Application Denial Procedures

If your application is denied, the notification will typically explain the reasons for the denial. This explanation is crucial in determining your next steps. Common reasons include missing documentation, incomplete information, or failure to meet eligibility criteria. The notification may also Artikel the appeal process and the required steps to take if you wish to challenge the decision. It is important to carefully read the reasons for denial and gather any supporting documentation that may help strengthen your appeal.

Appealing a Denied Application

Appealing a denied application involves submitting additional documentation or information to address the reasons for the initial denial. The appeal process usually involves submitting a formal request, along with supporting evidence, to the loan servicer within a specified timeframe. This timeframe is usually clearly stated in the denial notification. Strong appeals often include detailed explanations, supporting evidence (such as updated financial information or additional documentation), and a clear understanding of the eligibility criteria. Failure to follow the appeal procedures correctly might result in your appeal being dismissed.

Potential Outcomes and Next Steps

| Outcome | Next Steps | Timeframe (Estimate) | Contact Information |

|---|---|---|---|

| Application Approved | Review the approval details, ensure accuracy of loan reduction, and monitor account for disbursement. | Within 30-60 days of approval notification (varies by servicer). | Loan servicer’s customer support number or online portal. |

| Application Denied | Review the reasons for denial, gather additional documentation, and file an appeal within the specified timeframe. | Appeal process timeframe varies; check denial notification for specifics. | Loan servicer’s appeal department contact information (provided in denial notification). |

| Appeal Approved | Same as “Application Approved.” | Within 30-60 days of appeal approval (varies by servicer). | Loan servicer’s customer support number or online portal. |

| Appeal Denied | Consider seeking legal counsel or exploring other available options, if any. | No further official timeframe. | Legal professional specializing in student loan law. |

Illustrative Examples of Successful Applications

Successful applications for student loan forgiveness programs often share common threads: meticulous preparation, accurate documentation, and proactive problem-solving. Understanding these elements can significantly increase your chances of a positive outcome. The following examples highlight key aspects of successful applications and potential pitfalls to avoid.

Successful Application Scenario: Sarah’s Journey

Sarah, a teacher with ten years of experience in a low-income school district, applied for the Teacher Loan Forgiveness Program. She meticulously gathered all necessary documentation well in advance of the deadline. This included her employment verification forms, signed by her principal, detailing her years of service and the school’s low-income status; her federal student loan promissory notes; and her tax returns for the relevant years, demonstrating her income level. She organized these documents into clearly labeled folders, creating a comprehensive application package. Sarah encountered a minor challenge when one employment verification form had a minor clerical error. She immediately contacted her principal, who quickly corrected and reissued the document. This proactive approach ensured the application remained on track.

Documentation Used in Sarah’s Application

Sarah’s application included:

- Employment verification forms (signed by her principal, clearly indicating her employment at a low-income school and years of service).

- Federal student loan promissory notes (showing the loans she wished to have forgiven).

- Tax returns (for the past several years, providing proof of income and meeting the income requirements).

- Copies of her driver’s license and social security card (for verification purposes).

Challenging Application Scenario: Mark’s Experience

Mark, a nurse working in a rural hospital, applied for the Public Service Loan Forgiveness (PSLF) program. He faced a significant challenge: his initial loan servicer had made errors in his repayment plan, resulting in some payments not being correctly applied towards PSLF. He discovered this error during the application process. Mark immediately contacted his loan servicer and the Federal Student Aid (FSA) office, providing evidence of his payments and requesting a correction. After providing detailed documentation and engaging in persistent communication, the errors were corrected, and his application proceeded successfully.

Potential Pitfalls and Avoidance Strategies

One common pitfall is failing to meet the specific requirements of the program. For example, some programs require a certain number of years of qualifying employment or a specific type of employment. Thoroughly researching the program requirements and ensuring all criteria are met before applying is crucial. Another common issue is submitting incomplete or inaccurate documentation. This can lead to delays or rejection of the application. Organizing documents meticulously and carefully reviewing each form before submission can prevent such issues. Finally, not tracking the application status can cause unnecessary anxiety. Regularly checking the application status online and contacting the relevant office if there are any delays can significantly improve the experience.

Summary

Securing student loan forgiveness can be a transformative experience, significantly impacting your financial future. By meticulously following the steps Artikeld in this guide, understanding the eligibility requirements, and preparing the necessary documentation, you can increase your chances of a successful application. Remember to stay organized, maintain accurate records, and don’t hesitate to seek assistance if needed. Your commitment to understanding the process is the first step towards financial freedom.

Questions and Answers

What happens if my application is denied?

If your application is denied, you’ll receive a notification explaining the reason. You usually have the right to appeal the decision, providing additional documentation or addressing the concerns raised.

How long does the application process take?

Processing times vary, but it’s advisable to allow several weeks or even months for your application to be reviewed and processed.

Can I apply for forgiveness if I have multiple student loans?

Yes, you can generally apply for forgiveness across multiple student loans, provided each loan meets the eligibility criteria.

Where can I find the most up-to-date information on SAVE loan programs?

The official government website for student aid is the best resource for the most current information and program details.