Navigating the complexities of student loan repayment can feel overwhelming, especially when understanding the role of Adjusted Gross Income (AGI). This crucial figure significantly impacts your eligibility for various repayment plans and forgiveness programs. This guide provides a clear, step-by-step process to calculate your AGI, demystifying the process and empowering you to make informed decisions about your student loan debt.

We’ll explore how different income sources contribute to your AGI, including employment income, investment returns, and other relevant factors. We’ll also delve into the specific tax forms and schedules you’ll need, offering practical examples to illustrate the calculation process for various income levels. Understanding your AGI is key to unlocking the best repayment options available to you and potentially saving you thousands of dollars over the life of your loans.

Understanding AGI in Student Loan Context

Adjusted Gross Income (AGI) plays a crucial role in determining your eligibility for various student loan repayment programs and benefits. Understanding how AGI is calculated is essential for navigating the complexities of student loan management and accessing potential assistance. This section will clarify the meaning of AGI in the context of student loans and explain how it’s determined.

AGI, or Adjusted Gross Income, represents your total gross income less certain allowable deductions. In the context of student loans, your AGI is used to determine your eligibility for income-driven repayment plans (IDR plans), which adjust your monthly payments based on your income and family size. A lower AGI generally qualifies you for lower monthly payments. Furthermore, some loan forgiveness programs also consider your AGI to assess eligibility.

AGI Calculation Methods for Students

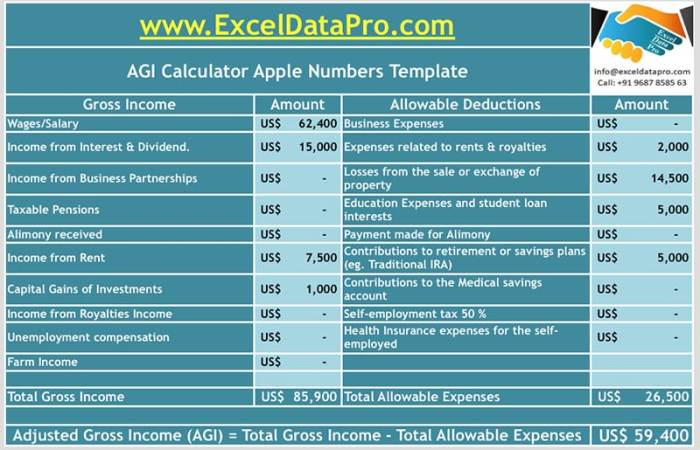

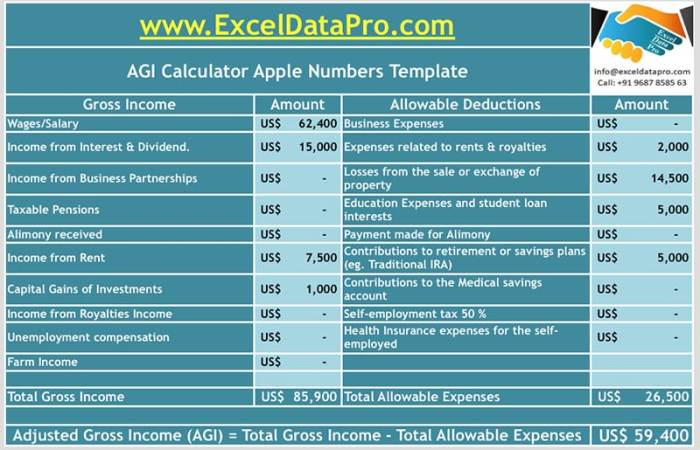

Calculating AGI for student loan purposes involves considering all sources of income received during the tax year. This includes wages, salaries, self-employment income, investment income, and other sources. The Internal Revenue Service (IRS) provides comprehensive guidelines on calculating AGI, and it’s advisable to consult their resources or seek professional tax advice for complex situations. The general process involves subtracting certain above-the-line deductions from your gross income.

Income Sources Included in AGI Calculation

Several income sources are included when calculating AGI for student loan purposes. These commonly include:

- Wages and salaries from employment.

- Income from self-employment, including freelance work or business profits.

- Interest and dividend income from investments.

- Capital gains from the sale of assets.

- Rental income from properties.

- Alimony received (for divorces finalized before 2019).

It’s important to accurately report all income sources to ensure accurate AGI calculation and avoid potential issues with loan repayment programs.

Income Sources Excluded from AGI Calculation

Not all income sources are included in the AGI calculation. Some common examples of excluded income include:

- Tax-exempt interest income (e.g., from municipal bonds).

- Certain scholarships and grants used for qualified education expenses.

- Child support payments received.

The specific rules regarding income inclusion and exclusion can be complex, and it is crucial to refer to the official IRS guidelines or consult a tax professional for clarification.

Example of AGI Calculation

Let’s consider a student, Sarah, who earned $25,000 in wages from a part-time job, $5,000 in interest from a savings account, and received a $2,000 scholarship for tuition. Her gross income is $30,000 ($25,000 + $5,000). Since the scholarship was used for qualified education expenses, it is excluded from her gross income. Assuming no other deductions, Sarah’s AGI would be $30,000. However, if Sarah had other above-the-line deductions, her AGI would be reduced accordingly. For example, if she contributed $1,000 to a traditional IRA, her AGI would be $29,000. These are simplified examples, and individual circumstances may vary significantly. It is always advisable to consult the official IRS guidelines or a tax professional for accurate calculations.

Gathering Necessary Financial Information

Accurately calculating your Adjusted Gross Income (AGI) for student loan purposes requires assembling the correct financial documentation. This process ensures a precise AGI calculation, impacting your eligibility for various student loan programs and repayment plans. Careful record-keeping is crucial throughout the year.

The following steps will guide you through gathering the necessary financial information. Remember, the specific documents needed may vary depending on your individual financial situation and the specific student loan program you’re applying for.

Required Financial Documents

Before beginning the AGI calculation, you’ll need to collect several key documents. These documents provide the foundational data for determining your AGI, reflecting your total income and allowable deductions.

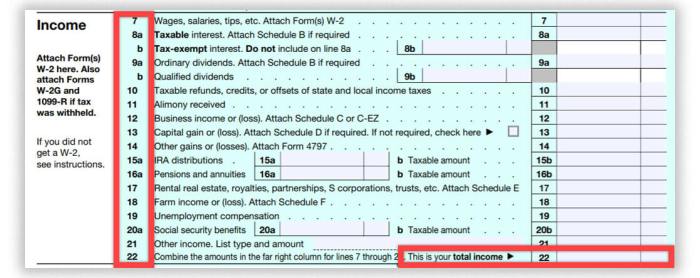

- Tax Returns (Form 1040): Your most recent federal income tax return (Form 1040) is paramount. This document provides a comprehensive overview of your income, deductions, and taxable income for the previous year. Ensure you have both the original return and any supporting schedules (like Schedule C for self-employment income or Schedule D for capital gains).

- W-2 Forms (Wage and Tax Statement): If you’re an employee, your W-2 forms from your employer(s) detail your wages and the taxes withheld. These forms are essential for accurately reporting your earned income.

- 1099 Forms (Miscellaneous Income): If you received income from sources other than employment (e.g., freelance work, interest, dividends, or rental income), you’ll likely have 1099 forms. These forms report various types of income not covered by W-2s. Different 1099 forms exist for different income types (e.g., 1099-INT for interest, 1099-DIV for dividends).

- Pay Stubs: While not always strictly required, pay stubs can be helpful in verifying income reported on your W-2 forms, particularly if you’re self-employed or have multiple income sources. They offer a detailed breakdown of your earnings for each pay period.

- Investment Income Statements: Statements from banks, brokerage accounts, and other investment entities showing interest, dividends, capital gains, or losses are crucial for a complete AGI calculation. These statements usually arrive annually and detail the year’s investment activity.

Organizing Financial Information

Once you’ve gathered all necessary documents, organizing the information is crucial for efficient calculation. A structured approach prevents errors and ensures accuracy.

A simple method is to create a spreadsheet. List each source of income (e.g., wages, interest, dividends, capital gains) separately, along with the corresponding amount from each document. This allows for easy summation of your total gross income. Next, list all deductible expenses that reduce your taxable income, referencing the relevant tax form or statement. Finally, subtract your total deductions from your gross income to arrive at your adjusted gross income (AGI).

For example: A spreadsheet might have columns for “Income Source,” “Document,” and “Amount.” Rows would then list items like “Wages,” “W-2 Form,” “$50,000”; “Interest Income,” “1099-INT,” “$500”; etc. A separate section could list deductible expenses.

Impact of AGI on Student Loan Repayment Plans

Your Adjusted Gross Income (AGI) plays a crucial role in determining your eligibility for and the terms of your student loan repayment plan. Understanding how AGI impacts your repayment options is vital for managing your student loan debt effectively. Lower AGI generally translates to lower monthly payments and potentially faster access to loan forgiveness programs.

AGI influences your eligibility for income-driven repayment (IDR) plans, which are designed to make monthly payments more manageable based on your income and family size. These plans typically recalculate your payment each year, taking into account changes in your AGI. Higher AGI levels can result in higher monthly payments under these plans, while lower AGI can lead to significantly reduced payments, sometimes even resulting in $0 monthly payments in certain circumstances. Different IDR plans (such as PAYE, REPAYE, IBR, and ICR) have varying formulas and AGI thresholds, so the impact of your AGI will vary depending on the specific plan you choose.

AGI and Income-Driven Repayment (IDR) Plan Eligibility

IDR plans are designed to make student loan repayment more affordable for borrowers with lower incomes. Eligibility for these plans is often directly tied to your AGI. For example, some plans may require your AGI to be below a certain threshold to qualify. Meeting this threshold doesn’t guarantee acceptance into a plan, as other factors, such as loan type and family size, also play a role. However, a higher AGI might disqualify you from certain IDR plans or result in higher monthly payments within the plan itself.

Impact of Varying AGI Levels on Monthly Payments Under IDR Plans

The relationship between AGI and monthly payments under IDR plans is generally direct: a higher AGI leads to higher monthly payments, while a lower AGI results in lower monthly payments. For instance, a borrower with an AGI of $30,000 might have a monthly payment of $200 under a particular IDR plan, while a borrower with an AGI of $60,000 might see a monthly payment of $400. The exact amount varies considerably based on the specific IDR plan used, the total loan amount, and the interest rate. It is important to note that these are illustrative examples; actual payments can differ based on individual circumstances.

AGI Thresholds for Student Loan Forgiveness Programs

Several student loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, have AGI requirements or indirectly use AGI as a factor in determining eligibility. While these programs don’t explicitly state AGI as a direct eligibility threshold, your income (often closely tied to AGI) plays a role in determining your eligibility for the program. For instance, PSLF requires qualifying payments made while employed by a qualifying government or non-profit organization. The income earned during this period (which often correlates with AGI) does not directly determine eligibility but affects the overall repayment timeline and therefore the time to reach forgiveness. Forgiveness programs often have other requirements beyond AGI, such as the type of loan and the length of employment.

Resources and Further Assistance

Understanding your Adjusted Gross Income (AGI) and its impact on your student loan repayment options is crucial for effective financial planning. This section provides resources to help you navigate this process and access further assistance if needed. We’ll Artikel reliable websites and government agencies that can provide additional information and support.

Finding reliable information on AGI and student loan repayment can sometimes feel overwhelming. Fortunately, several trustworthy resources are available to guide you. These resources offer comprehensive information, tools, and contact details to help you manage your student loans effectively.

Reliable Websites and Government Resources

The following table lists several valuable resources for obtaining further information on AGI and student loan repayment. These websites provide detailed explanations, calculators, and contact information for assistance.

| Resource Name | Website URL | Description | Contact Information |

|---|---|---|---|

| StudentAid.gov | studentaid.gov | The official U.S. Department of Education website for student aid. Provides information on federal student loans, repayment plans, and income-driven repayment options. | Contact information varies depending on the specific need; details are available on the website. |

| Federal Student Aid (FSA) | studentaid.gov | Offers a comprehensive guide to federal student aid programs, including information on calculating AGI and its impact on repayment plans. | 1-800-4-FED-AID (1-800-433-3243) |

| Internal Revenue Service (IRS) | irs.gov | Provides information on calculating your AGI, which is essential for determining your eligibility for income-driven repayment plans. | Information available on the IRS website; contact options vary depending on your inquiry. |

| National Foundation for Credit Counseling (NFCC) | nfcc.org | A non-profit organization offering free and low-cost credit counseling services, including assistance with student loan repayment strategies. | Contact information is available on their website. |

Contact Information for Relevant Government Agencies and Student Loan Servicers

Direct contact with relevant government agencies and your student loan servicer can provide personalized assistance with specific questions or challenges you may encounter. Remember to have your student loan information readily available when contacting these agencies. Contact information may vary depending on your specific loan servicer. Always verify information found on the servicer’s official website.

Illustrative Examples

Understanding how Adjusted Gross Income (AGI) is calculated is crucial for determining eligibility for various student loan repayment plans. The following scenarios illustrate how different income sources and deductions affect AGI calculations and subsequent loan repayment plan options. Remember that these are simplified examples and individual situations may require more complex calculations. Consult a tax professional for personalized advice.

Scenario 1: Student with Part-Time Employment

This scenario involves a student working part-time while attending college. Let’s assume Sarah earns $12,000 annually from her part-time job. She has no other income sources, no itemized deductions, and takes the standard deduction. For the 2023 tax year, let’s assume the standard deduction is $13,850 for single filers. Since her gross income ($12,000) is less than the standard deduction, her AGI will be $0. This is because the standard deduction reduces her taxable income to zero. Her low AGI would likely qualify her for income-driven repayment plans like ICR or PAYE, offering lower monthly payments based on her limited income.

Scenario 2: Student with Significant Investment Income

This scenario involves a student, David, with significant investment income alongside part-time employment. Suppose David earns $15,000 from a part-time job and $20,000 in investment income (dividends and capital gains). His gross income is $35,000. He itemizes his deductions, claiming $5,000 in deductible investment expenses. His adjusted gross income (AGI) is calculated as follows: $35,000 (Gross Income) – $5,000 (Itemized Deductions) = $30,000 (AGI). David’s higher AGI, compared to Sarah’s, would likely affect his eligibility for income-driven repayment plans. He might still qualify, but his monthly payments would be higher reflecting his greater income.

Scenario 3: Student with No Income

This scenario involves a student, Maria, who is not employed and has no other sources of income. She is solely reliant on financial aid. Her gross income is $0. Assuming she takes the standard deduction, her AGI will also be $0. Maria’s zero AGI would almost certainly qualify her for income-driven repayment plans, resulting in very low or potentially zero monthly payments until her income increases after graduation. This demonstrates how the absence of income directly impacts AGI and subsequently, student loan repayment options.

Final Thoughts

Mastering the calculation of your AGI is a crucial step in effectively managing your student loan debt. By understanding how your income influences your eligibility for income-driven repayment plans and forgiveness programs, you can make informed decisions that align with your financial goals. Remember to consult the resources provided to ensure accuracy and seek professional advice if needed. Taking control of your AGI calculation empowers you to navigate the student loan repayment process with confidence and achieve long-term financial well-being.

Popular Questions

What happens if I make a mistake calculating my AGI?

Incorrectly calculating your AGI could lead to inaccurate eligibility assessments for income-driven repayment plans or forgiveness programs. It’s crucial to review your calculations carefully and consult the IRS website or a tax professional if you’re unsure.

Can I use tax software to help calculate my AGI?

Yes, many tax software programs can assist in calculating your AGI. These programs often include features to guide you through the process and ensure accuracy. However, always double-check the results.

Where can I find more information about income-driven repayment plans?

The Federal Student Aid website (studentaid.gov) provides comprehensive information on various income-driven repayment plans and their eligibility requirements. You can also contact your loan servicer for personalized guidance.

What if my income fluctuates throughout the year?

For income-driven repayment plans, your AGI is typically based on your prior tax year’s income. However, significant changes in income may warrant contacting your loan servicer to discuss potential adjustments to your repayment plan.