Navigating the complexities of student loan repayment can feel daunting, especially when understanding how interest accrues and impacts your overall debt. This guide demystifies the process of calculating interest on student loans, providing a clear understanding of both simple and compound interest calculations. We’ll explore the key factors influencing your interest rate and demonstrate how different repayment plans affect your total repayment cost. By the end, you’ll be equipped with the knowledge to effectively manage your student loan debt.

Understanding your student loan interest is crucial for effective financial planning. Whether you’re facing a mountain of debt or just starting your repayment journey, knowing how interest is calculated empowers you to make informed decisions and strategize for efficient repayment. This guide will equip you with the tools and knowledge to confidently tackle this important aspect of your financial future.

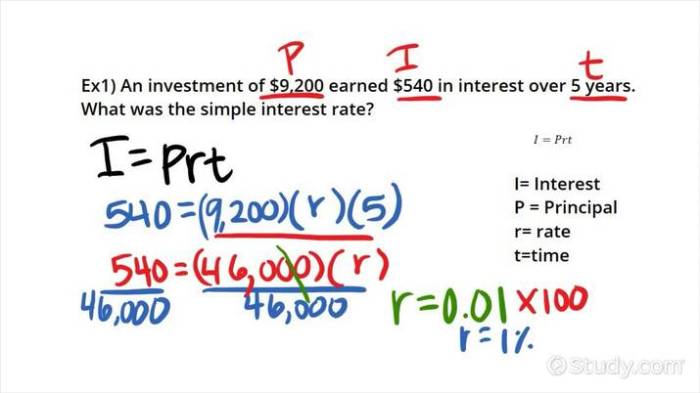

Understanding Simple Interest on Student Loans

Simple interest is a straightforward method of calculating interest on a loan. Unlike compound interest, which accrues interest on both the principal and accumulated interest, simple interest only calculates interest on the original principal amount. This makes it easier to understand and predict the total repayment amount. Understanding simple interest is crucial for budgeting and planning your student loan repayment strategy.

The Formula for Simple Interest

The fundamental formula for calculating simple interest is:

Simple Interest = Principal x Rate x Time

Where:

* Principal: The initial amount of the loan.

* Rate: The annual interest rate (expressed as a decimal).

* Time: The loan term, expressed in years.

Examples of Simple Interest Calculations

Let’s illustrate with a couple of examples.

Example 1: A student takes out a $10,000 loan with a 5% annual simple interest rate for 4 years.

Simple Interest = $10,000 x 0.05 x 4 = $2,000

The total interest paid over the four years would be $2,000. The total amount to be repaid is $12,000 ($10,000 + $2,000).

Example 2: A student borrows $5,000 at a 7% annual simple interest rate for 2 years.

Simple Interest = $5,000 x 0.07 x 2 = $700

The total interest paid would be $700, and the total repayment amount would be $5,700 ($5,000 + $700).

Step-by-Step Calculation of Simple Interest

Calculating simple interest manually is straightforward. Follow these steps:

1. Convert the interest rate to a decimal: Divide the annual interest rate by 100. For example, a 6% rate becomes 0.06.

2. Multiply the principal, rate, and time: Use the formula: Principal x Rate x Time.

3. The result is the total simple interest accrued.

Comparison of Simple Interest Calculations for Various Loan Terms

The following table compares simple interest calculations for different loan amounts, interest rates, and loan terms. Note that most student loans use compound interest, not simple interest; this table is for illustrative purposes only to demonstrate the simple interest calculation.

| Loan Amount | Interest Rate | Loan Term (Years) | Total Interest Paid |

|---|---|---|---|

| $5,000 | 5% | 2 | $500 |

| $10,000 | 6% | 4 | $2,400 |

| $15,000 | 7% | 5 | $5,250 |

| $20,000 | 8% | 10 | $16,000 |

Understanding Compound Interest on Student Loans

Unlike simple interest, which is calculated only on the principal loan amount, compound interest is calculated on the principal amount plus any accumulated interest. This means your interest grows exponentially over time, potentially leading to a larger total repayment amount. Understanding compound interest is crucial for managing your student loan debt effectively.

Compound Interest Explained

Compound interest essentially means “interest on interest.” With simple interest, you only pay interest on the original loan amount. With compound interest, the interest accrued in each period (typically monthly or annually) is added to the principal, and the next period’s interest is calculated on this larger amount. This snowball effect can significantly increase the total interest paid over the life of the loan.

The Compound Interest Formula

The formula for calculating compound interest is:

A = P (1 + r/n)^(nt)

Where:

* A = the future value of the loan, including interest

* P = the principal loan amount (the initial amount borrowed)

* r = the annual interest rate (expressed as a decimal, e.g., 5% = 0.05)

* n = the number of times that interest is compounded per year (e.g., monthly = 12, quarterly = 4, annually = 1)

* t = the number of years the loan is outstanding

Calculating Compound Interest: A Step-by-Step Flowchart

A flowchart visually depicts the calculation process. Imagine a flowchart with the following steps:

1. Start: Begin with the known values (P, r, n, t).

2. Calculate r/n: Divide the annual interest rate (r) by the number of compounding periods per year (n).

3. Calculate nt: Multiply the number of years (t) by the number of compounding periods per year (n).

4. Calculate (1 + r/n)^(nt): Raise the result from step 2 to the power of the result from step 3.

5. Calculate A: Multiply the principal amount (P) by the result from step 4.

6. Calculate Total Interest: Subtract the principal amount (P) from the future value (A).

7. End: The total interest paid is displayed.

Simple Interest vs. Compound Interest: Comparative Examples

Let’s compare simple and compound interest on a $10,000 loan with a 5% annual interest rate over 5 years:

| Interest Type | Calculation | Total Interest Paid | Total Repayment |

|---|---|---|---|

| Simple Interest | 10000 * 0.05 * 5 = $2500 | $2500 | $12,500 |

| Compound Interest (Annual Compounding) | 10000 (1 + 0.05/1)^(1*5) = $12,762.82 | $2762.82 | $12,762.82 |

As you can see, even with annual compounding, compound interest results in a significantly higher total interest paid compared to simple interest over the same loan term. The difference becomes even more pronounced with more frequent compounding (e.g., monthly or daily). Consider a similar scenario with monthly compounding:

| Interest Type | Calculation | Total Interest Paid | Total Repayment |

|---|---|---|---|

| Compound Interest (Monthly Compounding) | 10000 (1 + 0.05/12)^(12*5) ≈ $12,833.59 | $2833.59 | $12,833.59 |

The more frequent the compounding, the higher the total interest paid. This highlights the importance of understanding compound interest when planning for student loan repayment.

Factors Affecting Student Loan Interest Rates

Understanding the factors that influence your student loan interest rate is crucial for managing your debt effectively. The rate you secure significantly impacts the total cost of your education, affecting your monthly payments and overall repayment burden. Several key elements determine the interest rate you’ll receive, and understanding their influence allows you to make informed decisions about your borrowing.

Several factors interact to determine your student loan interest rate. These factors can be categorized broadly into those related to the loan itself and those related to your personal financial profile. The relative importance of these factors varies depending on whether you’re borrowing through a federal or private lending program.

Credit History and Score

Your credit history and credit score are paramount, especially for private student loans. Lenders assess your creditworthiness to determine the risk of lending to you. A higher credit score, indicating a history of responsible credit management, typically results in a lower interest rate. Conversely, a poor credit history or a low credit score often leads to higher interest rates or even loan denial. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower interest rate than someone with a fair credit score (650-699). Federal student loans generally don’t require a credit check for undergraduates, but good credit can influence the terms of parent PLUS loans and graduate student loans.

Loan Type

The type of student loan you choose significantly affects the interest rate. Federal student loans typically offer lower interest rates than private student loans, reflecting the lower risk associated with government-backed loans. Within federal loans, different loan types have varying interest rates. For instance, subsidized federal Stafford loans usually have lower rates than unsubsidized loans because the government pays the interest while you’re in school. Private loans, on the other hand, are subject to market fluctuations and the lender’s risk assessment, resulting in higher interest rates that can vary greatly based on your creditworthiness and other factors.

Repayment Plan

While the repayment plan doesn’t directly influence the initial interest rate, it impacts the total interest paid over the life of the loan. Choosing a longer repayment term will lower your monthly payments, but you’ll pay significantly more interest overall. Conversely, a shorter repayment term leads to higher monthly payments but less interest paid in the long run. For example, a 10-year repayment plan will have higher monthly payments than a 20-year plan, but the total interest paid will be substantially less.

Loan Amount and Term Length

Larger loan amounts often correlate with higher interest rates, particularly with private lenders, reflecting increased risk for the lender. Similarly, longer loan terms generally result in higher overall interest payments, although the monthly payments will be lower. Lenders consider the length of the loan as a factor in their risk assessment, influencing the interest rate.

Current Market Interest Rates

Interest rates for student loans, especially private loans, are influenced by prevailing market interest rates. When market interest rates rise, lenders typically increase their rates on new loans to reflect the higher cost of borrowing. Conversely, during periods of low market interest rates, borrowers may secure lower rates on their student loans. These fluctuations are beyond the borrower’s direct control but significantly affect the final interest rate.

Comparison of Federal and Private Student Loan Interest Rates

| Loan Type | Interest Rate Characteristics |

|---|---|

| Federal Subsidized Stafford Loans | Generally lower rates; interest subsidized during certain periods. |

| Federal Unsubsidized Stafford Loans | Higher rates than subsidized loans; interest accrues during all periods. |

| Federal PLUS Loans | Rates are typically higher than Stafford loans; credit check required. |

| Private Student Loans | Rates vary widely based on credit score, loan amount, and market conditions; generally higher than federal loan rates. |

Calculating Interest Based on Different Repayment Plans

Understanding how different repayment plans affect your student loan interest is crucial for effective financial planning. The interest calculation method remains consistent (simple or compound, as discussed previously), but the payment schedule significantly impacts the total interest paid over the loan’s life. Different plans offer varying monthly payments and repayment periods, leading to diverse interest accumulation patterns.

The three main repayment plan categories – standard, graduated, and income-driven – each influence how quickly you pay down the principal and, consequently, how much interest accrues. Standard plans involve fixed monthly payments over a set period. Graduated plans feature lower initial payments that gradually increase, while income-driven plans tie monthly payments to your income, potentially extending the repayment period significantly.

Interest Calculation Under Different Repayment Plans

The core interest calculation remains the same regardless of the repayment plan. The interest accrued each month is calculated on the outstanding principal balance. However, the repayment plan dictates the principal reduction rate, which directly impacts future interest calculations. For example, with a standard plan, a larger portion of each payment goes towards the principal early on, reducing the interest accrued in subsequent months compared to a graduated or income-driven plan where a larger portion of early payments may go toward interest.

Comparison of Interest Paid Across Repayment Plans

The following table illustrates a hypothetical comparison of interest paid under three different repayment plans for a $20,000 student loan with a 5% annual interest rate. Note that these figures are simplified examples and actual results will vary based on specific loan terms and individual circumstances.

| Repayment Plan | Monthly Payment | Loan Term (Years) | Total Interest Paid |

|---|---|---|---|

| Standard | $387 | 5 | $1866 |

| Graduated | $300 (initially), increasing annually | 10 | $3600 |

| Income-Driven (Example) | $200 (average) | 20 | $12000 |

As the table demonstrates, while income-driven plans offer lower monthly payments, they significantly extend the repayment period and lead to substantially higher total interest paid. Standard plans offer the lowest total interest, but require higher monthly payments. Graduated plans fall somewhere in between.

Estimating Interest Payments Using Online Loan Calculators

Online loan calculators provide a convenient way to estimate interest payments under different repayment scenarios. These calculators typically require you to input the loan amount, interest rate, and repayment plan. They then calculate the estimated monthly payment, total interest paid, and loan amortization schedule.

A step-by-step guide to using such a calculator might look like this:

- Find a reputable online student loan calculator. Many banks and financial websites offer these tools.

- Input your loan details: loan amount, interest rate (annual percentage rate or APR), and loan term (if known).

- Select the repayment plan you wish to simulate (standard, graduated, or income-driven).

- The calculator will generate an estimate of your monthly payment, total interest paid over the life of the loan, and an amortization schedule showing the principal and interest portions of each payment over time.

- Experiment with different repayment plans and loan terms to see how your choices affect your total interest cost.

Remember that these are estimates. The actual interest paid may vary slightly depending on the specific lender’s policies and any changes in your financial situation.

Illustrating Interest Rate Calculation with Visual Aids

Understanding how interest accrues on a student loan is crucial for effective financial planning. This section will provide a practical example of interest calculation and illustrate the growth of interest visually, comparing simple and compound interest scenarios. We will also compare total interest paid under various loan conditions using a bar chart.

Scenario: Student Loan Interest Calculation

Let’s consider a student loan of $20,000 with a fixed annual interest rate of 6%. We’ll examine both simple and compound interest calculations over a 10-year repayment period.

Simple Interest Calculation

Simple interest is calculated only on the principal amount. The formula is:

Simple Interest = Principal × Rate × Time

In this case:

Simple Interest = $20,000 × 0.06 × 10 = $12,000

The total amount repaid under simple interest would be $20,000 (principal) + $12,000 (interest) = $32,000.

Compound Interest Calculation

Compound interest is calculated on the principal amount plus accumulated interest. The formula for compound interest is more complex and typically involves iterative calculations or a specialized formula:

A = P (1 + r/n)^(nt)

Where:

* A = the future value of the investment/loan, including interest

* P = the principal investment amount (the initial deposit or loan amount)

* r = the annual interest rate (decimal)

* n = the number of times that interest is compounded per year

* t = the number of years the money is invested or borrowed for

Assuming annual compounding (n=1), the calculation would be:

A = $20,000 (1 + 0.06/1)^(1*10) = $35,816.96

Therefore, the total interest paid under compound interest would be $35,816.96 – $20,000 = $15,816.96.

Visual Representation of Interest Growth

A line graph would effectively illustrate the difference. The x-axis would represent the years (0-10), and the y-axis would represent the accumulated interest. Two lines would be plotted: one for simple interest, showing a straight line representing consistent annual interest growth; and another for compound interest, showing an upward curving line reflecting the exponential growth due to interest accumulating on interest. The difference between the two lines would visually demonstrate the significantly higher total interest paid under compound interest over the 10-year period.

Bar Chart Comparing Interest Paid Under Different Loan Scenarios

A bar chart would effectively compare total interest paid under different scenarios. The x-axis would list the different loan scenarios (e.g., “6% interest, 10-year term,” “8% interest, 10-year term,” “6% interest, 15-year term”). The y-axis would represent the total interest paid. Each bar’s height would correspond to the total interest calculated for that specific scenario. This visual would clearly show how changes in interest rate and loan term significantly impact the total interest paid over the life of the loan. For example, a bar representing an 8% interest rate and a 10-year term would be considerably taller than a bar representing a 6% interest rate and a 10-year term, illustrating the impact of a higher interest rate. Similarly, a bar for a 6% interest rate and a 15-year term would be taller than the 6% interest rate and 10-year term bar, showcasing the effect of a longer repayment period.

Ending Remarks

Mastering the calculation of student loan interest empowers you to proactively manage your debt and make informed financial decisions. By understanding the nuances of simple and compound interest, the factors affecting your interest rate, and the implications of various repayment plans, you can develop a repayment strategy that aligns with your financial goals. Remember, proactive planning and a solid understanding of your loan terms are key to successful repayment.

FAQ Overview

What is the difference between simple and compound interest?

Simple interest is calculated only on the principal loan amount, while compound interest is calculated on the principal plus accumulated interest.

How does my credit score affect my student loan interest rate?

A higher credit score generally results in a lower interest rate, as lenders perceive you as a lower risk.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but carefully compare offers and consider the terms before refinancing.

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payments on your income and family size, potentially lowering your monthly payments but extending your repayment period.

Where can I find a reliable online loan calculator?

Many reputable financial websites and loan providers offer free online loan calculators.