Navigating the complexities of student loan repayment can feel daunting, especially when understanding how monthly interest accumulates. This guide provides a clear and concise approach to calculating your monthly interest, empowering you to make informed decisions about your repayment strategy and ultimately, achieve financial freedom sooner.

From understanding the fundamental differences between fixed and variable interest rates to mastering the intricacies of simple and compound interest calculations, we’ll demystify the process. We’ll explore the impact of various factors, such as loan deferment and repayment plans, on your overall interest burden. By the end, you’ll be equipped with the knowledge to effectively manage your student loan debt and plan for a financially secure future.

Understanding Loan Terms

Calculating your monthly student loan interest requires a clear understanding of your loan’s terms and conditions. This section will break down key aspects of your loan agreement that directly impact your monthly interest calculation.

Understanding the type of interest rate your loan carries is crucial for budgeting and planning repayment. The interest rate determines the percentage of your loan’s principal balance that you’ll pay as interest each year. Knowing whether your rate is fixed or variable will allow you to better predict your future monthly payments.

Fixed Versus Variable Interest Rates

Fixed interest rates remain constant throughout the life of your loan. This provides predictability in your monthly payments, making budgeting easier. Variable interest rates, on the other hand, fluctuate based on market conditions. While they might start lower than fixed rates, they can increase over time, leading to potentially higher monthly payments and overall interest paid. The uncertainty of variable rates can make long-term financial planning more challenging.

Student Loan Statement Components

Your monthly student loan statement contains several key pieces of information relevant to your interest calculations. These typically include the current principal balance (the amount you still owe), the interest rate, the amount of interest accrued during the billing cycle, your minimum payment amount, and your payment due date. The statement will clearly show the breakdown of your payment between principal and interest. Carefully reviewing these components allows you to track your progress towards loan repayment and identify any discrepancies.

Loan Capitalization and its Impact

Loan capitalization is the process of adding accumulated interest to your principal loan balance. This typically happens when you enter a grace period after graduation or if you defer your payments. When interest capitalizes, it increases the principal amount on which future interest is calculated, leading to a larger overall interest payment over the life of the loan. For example, if you have $10,000 in unpaid interest, and this is capitalized, your principal balance increases by $10,000, meaning you’ll pay interest on a larger amount moving forward. This significantly affects your monthly payment and total repayment cost.

Impact of Different Interest Rates on Loan Repayment

The following table demonstrates the significant impact that even small differences in interest rates can have on your total loan repayment cost. These figures are illustrative and assume a fixed interest rate throughout the loan term and consistent monthly payments. Actual results may vary based on individual loan terms and payment schedules.

| Principal | Interest Rate | Monthly Payment (Example) | Total Interest Paid (Example) |

|---|---|---|---|

| $20,000 | 4% | $400 | $3,000 |

| $20,000 | 6% | $430 | $4,800 |

| $20,000 | 8% | $460 | $6,800 |

| $20,000 | 10% | $490 | $9,000 |

Simple Interest Calculation Methods

Understanding how simple interest is calculated is a crucial first step in managing your student loans, although it’s important to remember that most student loans use compound interest, not simple interest. This section will explain the simple interest calculation method, highlight its limitations in the context of student loans, and illustrate why it’s often an inaccurate representation of real-world loan interest accrual.

Simple interest is calculated only on the principal amount of the loan. It doesn’t take into account any accumulated interest from previous periods. This contrasts sharply with compound interest, where interest is calculated on both the principal and accumulated interest.

Simple Interest Calculation

The formula for calculating simple interest is straightforward:

Simple Interest = (Principal × Rate × Time) / 12

Where:

- Principal: The initial amount of the loan.

- Rate: The annual interest rate (expressed as a decimal).

- Time: The loan term in years. We divide by 12 to get the monthly interest.

Let’s illustrate this with an example.

Simple Interest Calculation Example

Consider a student loan with a principal of $10,000 and an annual interest rate of 5%. To calculate the simple monthly interest, we plug the values into the formula:

Simple Interest = ($10,000 × 0.05 × 1) / 12 = $41.67 (approximately)

This means that the simple monthly interest on this loan would be approximately $41.67.

Limitations of Simple Interest for Student Loans

Simple interest calculations are rarely used for student loans. The primary reason is that most student loans accrue interest using compound interest. This means that the interest earned each month is added to the principal, and subsequent interest calculations are based on this increased amount. This leads to significantly higher interest payments over the life of the loan compared to simple interest.

Scenario Illustrating Simple Interest Insufficiency

Imagine a $10,000 student loan with a 5% annual interest rate, amortized over 10 years. Using a simple interest calculation would drastically underestimate the total interest paid. A simple interest calculation would only consider the interest on the initial $10,000, while in reality, a compound interest calculation would factor in the accumulating interest each month, leading to a substantially larger total interest amount over the 10-year period. This difference becomes more pronounced with longer loan terms and higher interest rates.

Compound Interest Calculation Methods

Compound interest is a powerful force in finance, and understanding how it works is crucial for managing student loan debt effectively. Unlike simple interest, which is calculated only on the principal amount, compound interest is calculated on the principal amount plus any accumulated interest. This means your interest grows exponentially over time, potentially leading to a significantly larger total repayment amount.

This section will delve into the mechanics of compound interest calculations as they relate to student loans, comparing them to simple interest calculations and illustrating the cumulative effect of compounding over various loan terms.

Compound Interest Formula

The formula for calculating compound interest is: A = P (1 + r/n)^(nt)

A = the future value of the investment/loan, including interest

P = the principal investment amount (the initial deposit or loan amount)

r = the annual interest rate (decimal)

n = the number of times that interest is compounded per year

t = the number of years the money is invested or borrowed for

This formula demonstrates how the initial principal (P) grows over time (t) due to the interest rate (r), compounded (n) times per year. Understanding each variable is essential for accurate calculations. For example, a loan with an annual interest rate of 6% compounded monthly (n=12) will accrue interest differently than one compounded annually (n=1).

Comparison of Simple and Compound Interest

Simple interest is calculated only on the principal amount. The formula is: I = Prt (where I = interest, P = principal, r = rate, t = time). Compound interest, however, calculates interest on the principal *and* accumulated interest from previous periods. This difference leads to significantly higher total interest payments over the life of a loan, especially for longer loan terms.

Consider a $10,000 loan at a 5% annual interest rate. After one year, simple interest would be $500 ($10,000 * 0.05 * 1), leaving a balance of $10,500. With compound interest (assuming annual compounding), the interest would also be $500 for the first year. However, in the second year, the interest would be calculated on $10,500, resulting in $525 ($10,500 * 0.05). This difference, seemingly small initially, compounds significantly over longer periods.

Compound Interest Accumulation Over Time

The following examples demonstrate how compound interest accumulates over different loan terms, assuming an annual interest rate of 6% compounded annually:

Let’s illustrate this with some calculations. We will assume a principal (P) of $10,000 and an annual interest rate (r) of 6%, compounded annually (n=1).

- 5-year loan: A = 10000 (1 + 0.06/1)^(1*5) = $13,382.26. Total interest paid: $3,382.26

- 10-year loan: A = 10000 (1 + 0.06/1)^(1*10) = $17,908.48. Total interest paid: $7,908.48

- 15-year loan: A = 10000 (1 + 0.06/1)^(1*15) = $23,965.58. Total interest paid: $13,965.58

Notice the dramatic increase in total interest paid as the loan term lengthens. This highlights the importance of understanding compound interest and strategizing for early loan repayment to minimize overall costs.

Factors Affecting Monthly Interest

Several key factors interact to determine the precise amount of monthly interest charged on your student loans. Understanding these factors is crucial for effective loan management and minimizing overall interest costs. This section will detail these influential elements and their impact on your repayment journey.

Loan Interest Rate

The interest rate is the most significant factor influencing your monthly interest payments. This rate, expressed as a percentage, is determined at the time you take out the loan and is typically fixed or variable. A fixed interest rate remains constant throughout the loan’s life, while a variable rate fluctuates based on market conditions. Higher interest rates naturally lead to larger monthly interest charges. For example, a loan with a 7% interest rate will accrue significantly more interest each month than a loan with a 4% interest rate, all else being equal.

Loan Principal

The principal is the original amount of money borrowed. A larger principal balance means more interest will accrue each month. This is because interest is calculated as a percentage of the outstanding principal balance. Therefore, a $50,000 loan will generate substantially higher monthly interest charges than a $20,000 loan, assuming the interest rate is the same.

Loan Deferment or Forbearance

Loan deferment or forbearance temporarily suspends or reduces your monthly loan payments. While this provides short-term financial relief, it’s crucial to understand that interest usually continues to accrue during these periods, increasing your total loan balance. This means that you will ultimately owe more money than the original loan amount at the end of the deferment or forbearance period. The longer the deferment or forbearance, the more significant the impact on the total interest paid.

Late Payments

Making late payments on your student loans can have serious consequences, including additional fees and increased interest charges. Many lenders impose late payment fees, adding to your overall debt. Furthermore, some loans may switch to a higher penalty interest rate after a missed payment, dramatically increasing the amount of interest you accrue. Consistent on-time payments are essential to avoid these penalties and maintain favorable interest rates.

Repayment Plan Impact on Total Interest Paid

A visual representation, in the form of a bar graph, could effectively compare the total interest paid under different repayment plans. The horizontal axis would list various repayment plans (e.g., Standard, Extended, Graduated, Income-Driven). The vertical axis would represent the total interest paid over the life of the loan. Each bar would correspond to a specific repayment plan, with its height indicating the total interest paid under that plan. For instance, a longer repayment plan like an extended plan might have a taller bar representing higher total interest, while an aggressive repayment plan would show a shorter bar representing lower total interest. This visual would clearly demonstrate how the choice of repayment plan directly impacts the overall cost of the loan. For example, an Income-Driven Repayment (IDR) plan might initially show a lower monthly payment and a higher total interest paid over the longer repayment term compared to a Standard Repayment plan with a higher monthly payment but lower overall interest paid.

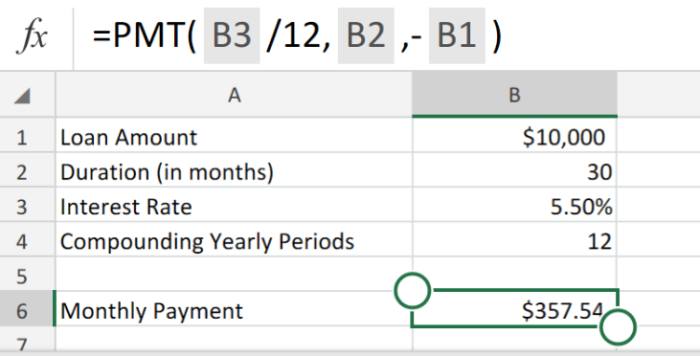

Using Online Calculators and Resources

Calculating monthly student loan interest manually can be time-consuming and prone to errors, especially with complex loan structures. Fortunately, numerous online resources simplify this process. These tools offer convenience and often provide detailed breakdowns of interest calculations, making them invaluable for understanding your loan repayment.

Online student loan interest calculators provide a quick and easy way to estimate your monthly interest payments. However, it’s crucial to understand their limitations and use them responsibly. While they streamline the calculation process, they don’t replace the need for understanding the underlying principles of interest calculations.

Reputable Online Resources and Calculators

Several websites offer free student loan interest calculators. While a comprehensive list is beyond the scope of this document, a responsible approach involves checking the reputation and accuracy of any calculator before using it. Look for calculators affiliated with reputable financial institutions or educational organizations. Always compare results from multiple calculators to ensure consistency. Consider using calculators from sources like government financial aid websites or well-known financial planning tools. These often include detailed explanations of their calculation methods.

Advantages and Disadvantages of Using Online Calculators

Online calculators offer several advantages over manual calculations. They significantly reduce the time and effort required, minimizing the chance of calculation errors. They often provide a clear, step-by-step breakdown of the calculation, enhancing understanding. Moreover, many calculators can handle various loan types and interest rates, simplifying the process for complex loans.

However, online calculators also have limitations. They may not account for all possible scenarios, such as changes in interest rates or unexpected payments. The accuracy depends on the quality and reliability of the calculator itself, and relying solely on one calculator without understanding the underlying principles could be problematic. Additionally, some calculators may contain hidden fees or lead to unwanted subscriptions.

Interpreting Results from Online Calculators

Online student loan interest calculators typically present the monthly interest amount, total interest paid over the loan’s life, and potentially a repayment schedule. Understanding these results requires careful attention to the input parameters used (loan amount, interest rate, loan term). Compare the calculated monthly interest with your loan statement to verify the accuracy of the online tool’s calculation. A significant discrepancy could indicate an error in either the online calculator or your understanding of your loan terms.

Evaluating the Accuracy and Reliability of Online Interest Calculators

Before using an online student loan interest calculator, assess its reliability. Check the website’s reputation and look for information about the calculator’s methodology. Does the site clearly explain how the calculation is performed? Is the site affiliated with a reputable financial institution or educational organization? Compare the results with those obtained from other reputable calculators using the same input parameters. Significant discrepancies may suggest inaccuracies in one or more of the calculators. If possible, compare the results to a manual calculation using the same parameters. Finally, be wary of calculators that request excessive personal information or promote questionable financial products.

Outcome Summary

Understanding how to calculate your monthly student loan interest is crucial for effective debt management. By grasping the concepts of simple and compound interest, and considering the influence of various factors like repayment plans and loan deferments, you gain control over your financial future. Remember to utilize the online resources available to verify your calculations and explore different repayment strategies to find the most suitable option for your circumstances. Taking proactive steps towards understanding your student loan debt empowers you to make informed decisions and achieve long-term financial well-being.

Quick FAQs

What is the difference between fixed and variable interest rates?

A fixed interest rate remains constant throughout the loan term, while a variable interest rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates may offer lower initial rates but carry greater risk.

Can I prepay my student loan without penalty?

Most student loans allow prepayment without penalty. However, it’s always best to check your loan agreement for specific terms and conditions.

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to loan default. Contact your loan servicer immediately if you anticipate difficulty making a payment.

How does loan consolidation affect my interest rate?

Consolidating your loans may result in a weighted average interest rate, which could be higher or lower than your current rates, depending on your individual loans.