Navigating the complexities of student loan repayment can feel overwhelming, especially when unexpected financial challenges arise. Understanding your options, such as deferring your Sallie Mae student loan, is crucial for maintaining financial stability. This guide provides a clear and concise path to successfully deferring your loan, covering eligibility requirements, the application process, and the long-term implications of this decision. We’ll explore various deferment types, alternative repayment strategies, and offer practical advice to help you make informed choices about your student loan debt.

From understanding the different types of deferments available to successfully navigating the application process and considering the long-term financial effects, this comprehensive guide empowers you to manage your Sallie Mae student loan effectively. We’ll examine the impact of deferment on interest accrual and your overall repayment timeline, comparing it to other options like forbearance and income-driven repayment plans. Ultimately, this guide aims to equip you with the knowledge needed to make the best decision for your unique financial situation.

Understanding Sallie Mae Deferment Options

Sallie Mae offers several deferment options to borrowers facing temporary financial hardship. Understanding these options and their eligibility requirements is crucial for managing your student loans effectively and avoiding potential negative consequences like delinquency. Choosing the right deferment can provide much-needed breathing room during challenging periods.

Types of Sallie Mae Loan Deferments

Sallie Mae provides deferments for various circumstances. The specific type of deferment available will depend on your individual situation and the type of loan you hold. It’s essential to carefully review your loan documents and contact Sallie Mae directly to confirm eligibility for a particular deferment.

Eligibility Requirements for Deferments

Eligibility for Sallie Mae loan deferments varies depending on the type of deferment. Generally, you’ll need to provide documentation to support your claim. Failure to provide adequate documentation may result in your deferment request being denied. Keep in mind that deferments are temporary, and interest may still accrue on unsubsidized loans during the deferment period.

Comparison of Sallie Mae Deferment Types

The following table summarizes the key differences between common Sallie Mae deferment options. Remember to check with Sallie Mae for the most up-to-date information and specific requirements.

| Deferment Type | Eligibility Requirements | Interest Accrual | Maximum Deferment Period |

|---|---|---|---|

| Economic Hardship Deferment | Unemployment, reduced income, or other documented financial hardship. Documentation may include proof of unemployment, pay stubs showing reduced income, or other supporting evidence. | May accrue on unsubsidized loans. | Up to 36 months, potentially renewable depending on circumstances. |

| In-School Deferment | Enrollment at least half-time in a degree or certificate program at an eligible institution. Requires proof of enrollment from the educational institution. | May accrue on unsubsidized loans. | Generally for the duration of your enrollment, but subject to program-specific rules. |

| Military Deferment | Active duty in the military or selected reserve programs. Requires documentation of active duty status. | May accrue on unsubsidized loans. | Generally for the duration of active duty, subject to military service regulations. |

| Deferment for Parents Plus Loans | Specific criteria apply depending on the parent’s circumstances, such as unemployment or financial hardship. Requires documentation to support the claim. | May accrue on unsubsidized loans. | Period varies depending on the specific reason for deferment and supporting documentation. |

The Deferment Application Process

Applying for a Sallie Mae loan deferment involves several steps, and careful preparation can ensure a smooth and efficient process. Understanding the required documentation and navigating the online application are key to a successful deferment. This section Artikels the process and provides examples to guide you.

The application process is primarily online, making it convenient to manage. However, gathering the necessary documentation beforehand is crucial to expedite the process. Remember, the specific requirements might vary slightly depending on your deferment reason, so always refer to the most up-to-date information on the Sallie Mae website.

Required Documentation

Having the correct documentation readily available significantly streamlines the application process. Failing to provide the necessary documents can lead to delays in processing your deferment request. The specific documents needed depend on the reason for your deferment request.

- For unemployment deferment: A recent pay stub showing unemployment status, and documentation from your state’s unemployment agency verifying your eligibility for unemployment benefits.

- For economic hardship deferment: Documentation supporting your claim of economic hardship, such as bank statements reflecting low account balances, recent medical bills, or proof of significant income reduction.

- For graduate school deferment: Acceptance letter from a graduate school program, or enrollment verification from the graduate school.

- For military deferment: Official military orders detailing your active duty status.

Step-by-Step Online Application Guide

The Sallie Mae online application process is generally straightforward. Following these steps should help you navigate the process efficiently.

- Log in to your Sallie Mae account: Access your account using your username and password. If you’ve forgotten your login credentials, use the password recovery option to regain access.

- Locate the deferment application: Navigate to the section of your account dedicated to managing your loans. Look for an option related to “deferment,” “payment options,” or “manage payments.” The exact wording might vary slightly.

- Select your deferment reason: Choose the reason for your deferment request from the provided list of options. This will determine the supporting documentation required.

- Upload required documents: Upload clear scans or photos of the supporting documentation. Ensure the documents are legible and easily viewable.

- Review and submit your application: Carefully review all the information provided before submitting your application. Once submitted, you cannot make changes, so double-check everything.

- Track your application status: After submission, you can typically monitor the progress of your application online through your Sallie Mae account.

Financial Hardship and Deferment

Securing a Sallie Mae student loan deferment due to financial hardship requires demonstrating a genuine inability to meet your repayment obligations. This involves providing sufficient evidence to support your claim. The specific requirements may vary slightly depending on your loan type and current circumstances, so always refer to your loan agreement and Sallie Mae’s official website for the most up-to-date information.

Sallie Mae considers a range of financial situations as potential grounds for hardship deferment. These typically involve unexpected or significant negative changes in your financial circumstances that make loan repayment difficult or impossible. It is crucial to accurately represent your situation and provide comprehensive supporting documentation.

Types of Financial Hardship Qualifying for Deferment

Financial hardship justifying a deferment can encompass several scenarios. Examples include unemployment (either job loss or significant reduction in income), medical emergencies resulting in substantial medical bills, and unforeseen events like natural disasters causing significant property damage or loss of income. Additionally, situations such as a reduction in work hours or a significant decrease in income due to business setbacks could also be considered. The key is to demonstrate a substantial and temporary disruption to your ability to meet your loan obligations.

Acceptable Documentation for Hardship Claims

Supporting your claim with appropriate documentation is critical for a successful deferment application. This evidence should directly corroborate the hardship you are experiencing. Sallie Mae will likely request proof of your income, expenses, and the circumstances leading to your inability to repay.

Checklist of Documents to Demonstrate Financial Hardship

To effectively support your application, prepare the following documentation:

- Proof of Income: Pay stubs from the past three months, tax returns (W-2 forms or 1099s), unemployment benefit statements, or self-employment income documentation.

- Proof of Expenses: Bank statements showing significant withdrawals or low balances, medical bills, rent or mortgage statements, and utility bills.

- Documentation of Hardship: This is the most crucial aspect. For unemployment, provide a termination letter or unemployment confirmation. For medical emergencies, include doctor’s bills and any insurance claim details. In the case of a natural disaster, include proof of damage from official sources (e.g., FEMA documentation). For business setbacks, provide financial statements or business records indicating the decline.

- Other Supporting Documents: Any additional documents that help substantiate your claim, such as letters from employers, doctors, or government agencies.

Remember to keep copies of all submitted documents for your records. A complete and well-organized application significantly increases the likelihood of a successful deferment.

Impact of Deferment on Loan Terms

Deferring your Sallie Mae student loan offers temporary relief from repayment, but it’s crucial to understand the long-term implications on your loan’s overall cost and repayment schedule. While deferment provides a much-needed break during financial hardship, it doesn’t eliminate your debt; instead, it shifts the burden into the future.

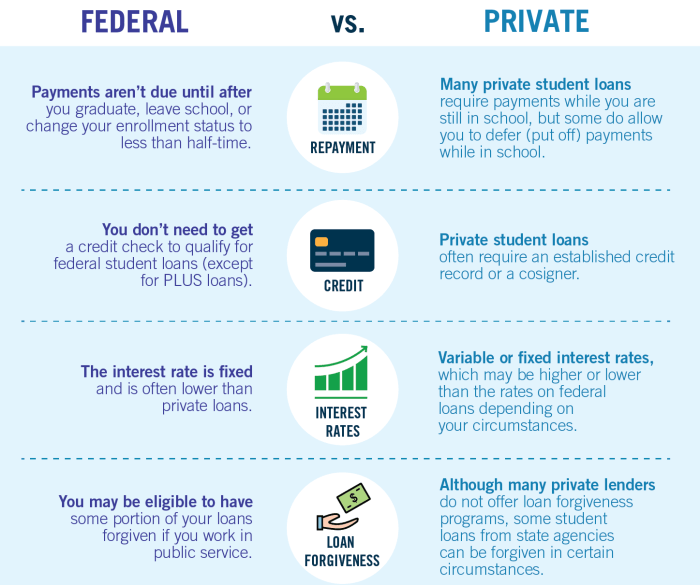

Deferment significantly impacts both interest accrual and the overall repayment timeline. During a deferment period, interest continues to accrue on most federal and private student loans, including Sallie Mae loans, increasing the total amount you eventually owe. This means that the principal loan balance grows larger, leading to a higher total repayment amount upon the end of the deferment period. The longer the deferment period, the more significant this effect becomes.

Interest Accrual During Deferment

Interest continues to accumulate on your Sallie Mae loan during a deferment period. This capitalized interest is added to your principal balance at the end of the deferment, increasing the total amount you owe and lengthening your repayment period. For example, if you defer a $10,000 loan for one year with a 5% interest rate, you’ll owe approximately $500 in additional interest at the end of the deferment period. This $500 will be added to your principal balance, meaning you’ll be paying interest on $10,500, rather than $10,000, once repayment begins.

Impact on Loan Repayment Timeline

The length of your loan repayment period is directly affected by deferment. Because interest accrues during deferment, the total amount you owe increases. This increased balance necessitates a longer repayment period to meet your monthly payment obligations, even if your monthly payment amount remains the same. The longer the deferment, the more extended your repayment timeline will become. For instance, a six-month deferment might add several months to your overall repayment period, while a longer deferment could extend it by several years.

Long-Term Costs of Deferment Compared to Other Repayment Options

Deferment is not always the most cost-effective solution. While it offers temporary relief, the accruing interest significantly increases the overall cost of the loan compared to other repayment options such as income-driven repayment plans or loan consolidation. Income-driven repayment plans adjust your monthly payment based on your income, while loan consolidation combines multiple loans into a single loan with a potentially lower interest rate. These options, while potentially having their own drawbacks, can often lead to lower overall interest payments and shorter repayment periods compared to deferment, ultimately saving you money in the long run. It’s essential to carefully weigh the pros and cons of deferment against these alternatives to determine the most financially sound approach for your specific situation.

Alternatives to Deferment

Deferring your Sallie Mae student loan payments can provide temporary relief, but it’s not always the best solution. Understanding alternative repayment options allows you to choose the strategy that best suits your financial situation and long-term goals. These alternatives offer different levels of flexibility and impact on your loan terms.

Several options exist besides deferment, each with its own advantages and disadvantages. Carefully considering your financial circumstances and long-term objectives is crucial in selecting the most suitable repayment plan.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans link your monthly payments to your income and family size. This means your payments could be significantly lower than your standard repayment amount, potentially making them more manageable during periods of financial strain. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has slightly different eligibility requirements and calculation methods. The primary benefit is lower monthly payments, but a potential drawback is that you’ll likely pay more interest over the life of the loan and the repayment period might be extended. For example, a borrower with a low income might only pay a small portion of their loan balance each month under an IDR plan, leading to a longer repayment timeline and higher total interest paid.

Forbearance

Forbearance is another option that temporarily suspends or reduces your monthly payments. Unlike deferment, forbearance typically doesn’t require demonstrating financial hardship. However, interest usually continues to accrue during forbearance, increasing your total loan balance. This means you’ll end up paying more overall. Choosing forbearance should be a carefully considered decision, as it can negatively impact your credit score if not managed properly. For instance, a borrower might choose forbearance for a short period to handle a temporary financial setback, knowing the interest will add to the total cost.

Refinancing

Refinancing involves replacing your existing Sallie Mae loan with a new loan from another lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total amount you pay over the life of the loan. However, refinancing might require a good credit score and involves the complexities of applying for a new loan. A borrower with a high credit score might be able to refinance their Sallie Mae loan at a much lower interest rate, resulting in substantial savings over the loan’s duration.

Table Comparing Deferment, Forbearance, and IDR Plans

| Feature | Deferment | Forbearance | Income-Driven Repayment (IDR) |

|---|---|---|---|

| Payment Status | Payments temporarily suspended | Payments temporarily suspended or reduced | Payments adjusted based on income |

| Interest Accrual | May or may not accrue, depending on the loan type and deferment reason. | Usually accrues | Accrues |

| Credit Score Impact | Generally minimal impact | Potentially negative impact if not managed properly | Generally minimal impact |

| Financial Hardship Requirement | Often required | Usually not required | Based on income and family size |

Post-Deferment Planning

Successfully navigating a student loan deferment requires careful planning for the period after the deferment ends. Re-entering repayment can be challenging, but proactive strategies can help borrowers manage their debt effectively and avoid future financial difficulties. This section Artikels key steps for a smooth transition back to repayment.

The end of a deferment period marks a return to regular loan payments. It’s crucial to approach this transition with a well-defined plan to avoid falling behind. This involves understanding your loan terms, assessing your current financial situation, and creating a realistic budget that incorporates your loan payments. Failing to plan adequately can lead to missed payments, negatively impacting your credit score and potentially incurring late fees and penalties.

Creating a Realistic Repayment Budget

Developing a budget that comfortably accommodates your student loan payments is paramount. This requires honestly assessing your income and expenses. Begin by listing all sources of income, including salary, part-time jobs, and any other regular earnings. Next, meticulously track your expenses for a month or two to gain a clear understanding of where your money goes. Categorize your expenses (housing, transportation, food, entertainment, etc.) to identify areas where you can potentially cut back. Remember to factor in unexpected expenses, such as car repairs or medical bills, to ensure your budget remains flexible.

Sample Repayment Plan

Let’s consider a hypothetical example of a borrower with a $30,000 Sallie Mae loan at a 5% interest rate, aiming for a 10-year repayment plan. After their deferment, their monthly payment would be approximately $330 (this is a simplified calculation and actual payments may vary based on loan terms). A sample repayment plan might look like this:

| Category | Monthly Amount |

|---|---|

| Income (Net) | $3000 |

| Student Loan Payment | $330 |

| Housing | $1000 |

| Transportation | $300 |

| Food | $400 |

| Utilities | $200 |

| Other Expenses (Entertainment, Savings, etc.) | $770 |

This example demonstrates a budget where loan repayment constitutes a manageable portion of the borrower’s income, leaving sufficient funds for essential expenses and some discretionary spending. It is crucial to remember that this is a simplified example; individual circumstances will require personalized budget adjustments.

Strategies for Managing Student Loan Debt After Deferment

Several strategies can help borrowers effectively manage their student loan debt post-deferment. These include:

Prioritizing repayment: Consider strategies like the avalanche method (paying off the loan with the highest interest rate first) or the snowball method (paying off the loan with the smallest balance first) to accelerate repayment and minimize interest accrual. Consistent, on-time payments are vital for maintaining a good credit score.

Exploring Repayment Options: Contact Sallie Mae to discuss available repayment plans, such as income-driven repayment (IDR) plans, which adjust your monthly payments based on your income and family size. These plans may offer lower monthly payments, but they typically extend the repayment period, leading to higher overall interest payments. Weigh the pros and cons carefully before making a decision.

Building an Emergency Fund: Having a savings account for unexpected expenses can prevent you from falling behind on your loan payments during unforeseen financial difficulties. Aim to save at least three to six months’ worth of living expenses.

Illustrative Examples of Deferment Scenarios

Let’s examine how deferring a Sallie Mae student loan can affect your repayment, using a hypothetical scenario to illustrate the potential financial implications. Understanding these impacts can help you make informed decisions about whether deferment is the right choice for your circumstances.

Deferment can significantly alter the trajectory of your loan repayment. While it provides temporary relief from payments, it doesn’t eliminate the accruing interest. This accumulated interest can lead to a larger overall loan balance and potentially higher total repayment costs. The following example demonstrates the impact of deferment on a typical student loan.

Loan Repayment Trajectory with and without Deferment

Consider a $20,000 student loan with a 5% annual interest rate. We’ll compare two scenarios: one where repayment begins immediately, and another where repayment is deferred for two years. The standard repayment plan is assumed to be a 10-year plan.

| Scenario | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Year 10 | Total Paid |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Immediate Repayment | $2,307 | $2,307 | $2,307 | $2,307 | $2,307 | $2,307 | $2,307 | $2,307 | $2,307 | $2,307 | $23,070 |

| Deferment for 2 Years | $0 | $0 | $2,622 | $2,622 | $2,622 | $2,622 | $2,622 | $2,622 | $2,622 | $2,622 | $23,600 |

The table above illustrates a simplified example. Actual repayment amounts may vary based on the specific loan terms and repayment plan. Note that in the deferment scenario, interest continues to accrue during the two-year deferment period, increasing the total amount repaid. The higher repayment amounts in years 3-10 reflect the accumulated interest. This visual representation clearly shows the increased total cost of the loan due to deferment.

Consequences of Extended Deferment Periods

Extending the deferment period beyond a short-term necessity significantly increases the overall cost of the loan. The longer the deferment, the more interest accumulates, leading to a substantially larger loan balance at the end of the deferment period. This snowball effect can make repayment significantly more challenging and potentially lead to a longer repayment period, resulting in paying substantially more in interest over the life of the loan. For example, deferring for five years instead of two would dramatically increase the final amount owed, potentially requiring a longer repayment term or significantly higher monthly payments. This underscores the importance of considering the long-term financial implications before opting for extended deferments.

Closure

Successfully deferring a Sallie Mae student loan requires careful planning and a thorough understanding of the process. By carefully reviewing your eligibility, completing the application accurately, and considering the long-term financial implications, you can effectively manage your student loan debt during periods of financial hardship. Remember to explore all available options and create a realistic post-deferment repayment plan to ensure a smooth transition back to regular payments. Proactive financial management is key to achieving long-term financial well-being.

FAQ Corner

What happens to interest during a Sallie Mae loan deferment?

Interest typically continues to accrue on your loan during a deferment period, though the specific terms depend on the type of deferment.

Can I defer my Sallie Mae loan indefinitely?

No, deferments are generally granted for specific periods, and there are limits on how long you can defer your loan. You’ll need to reapply if you need further deferment.

What if my application for deferment is denied?

If denied, review the reasons for denial and consider appealing the decision or exploring alternative repayment options such as forbearance or income-driven repayment plans.

How does a Sallie Mae deferment affect my credit score?

While a deferment might not negatively impact your credit score as severely as defaulting, it could still have some effect. It’s best to avoid deferments if possible.

Are there any fees associated with deferring a Sallie Mae loan?

Generally, there are no fees associated with deferring a Sallie Mae loan, but it’s crucial to check your loan agreement for specific terms and conditions.