Navigating the complexities of student loan repayment can feel overwhelming, especially when faced with unexpected financial challenges. Understanding your options for deferment is crucial to avoiding default and maintaining your financial well-being. This guide provides a clear and concise overview of how to defer student loan repayment, covering eligibility, application processes, and the long-term implications of this decision.

From exploring different deferment programs and their respective requirements to understanding the impact on interest accrual and alternative solutions like forbearance, we aim to equip you with the knowledge to make informed choices about your student loan repayment strategy. We’ll also delve into the often-overlooked aspects of loan forgiveness programs and how they relate to deferment.

Eligibility for Deferment

Securing a student loan deferment can provide crucial financial relief during challenging times. Understanding the eligibility requirements is the first step towards accessing this assistance. This section Artikels the criteria for various deferment programs, highlighting key differences between federal and private loan options.

General Eligibility Requirements for Student Loan Deferment

Eligibility for student loan deferment varies depending on the type of loan (federal or private) and the specific deferment program. Generally, federal student loan deferments often require demonstrating an economic hardship or specific life circumstances, such as unemployment or enrollment in a qualifying graduate program. Specific documentation may be needed to support your claim. Private loan deferments are less common and usually have stricter eligibility requirements, often tied to specific hardship provisions Artikeld in the loan agreement. It’s crucial to review your loan documents carefully.

Income-Based Repayment Plan Eligibility and Impact on Deferment

Income-driven repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR), are designed to make monthly payments more manageable based on your income and family size. While not deferments themselves, IDR plans can indirectly impact your ability to access deferment. If you are already enrolled in an IDR plan and experiencing extreme financial hardship, you might still be eligible for a deferment, but this is typically reviewed on a case-by-case basis. The interaction between IDR and deferment options should be clarified directly with your loan servicer.

Comparison of Deferment Options for Federal and Private Student Loans

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Availability | Generally more readily available with various programs. | Less common; often contingent upon specific hardship clauses in the loan agreement. |

| Eligibility Criteria | Often based on economic hardship or specific life circumstances (unemployment, graduate school enrollment). | Typically stricter, requiring demonstrable financial hardship and often adhering to specific definitions Artikeld in the loan contract. |

| Documentation | Requires documentation to support the reason for deferment (e.g., unemployment verification, enrollment verification). | May require extensive documentation proving financial hardship, potentially including tax returns, bank statements, and proof of income. |

| Length of Deferment | Can vary depending on the program and circumstances, sometimes up to three years. | Typically shorter durations and subject to the terms of the private loan agreement. |

Determining Eligibility for Deferment: A Step-by-Step Guide

- Identify your loan type: Determine whether your loans are federal or private. This significantly impacts your eligibility.

- Review your loan documents: Carefully examine your loan agreement for specific deferment provisions and eligibility criteria.

- Assess your circumstances: Determine if your situation qualifies for a deferment based on the available programs (e.g., unemployment, graduate school enrollment, economic hardship).

- Gather necessary documentation: Collect supporting documents such as unemployment verification, pay stubs, tax returns, or enrollment verification, as required.

- Contact your loan servicer: Submit a formal application for deferment to your loan servicer, providing all necessary documentation.

- Review the decision: Your loan servicer will review your application and inform you of their decision.

Types of Deferment Programs

Understanding the different types of student loan deferment programs is crucial for borrowers seeking temporary relief from repayment. Each program has specific eligibility requirements and limitations, impacting the duration of deferment and potential consequences. Choosing the right program depends on your individual circumstances.

Several types of deferment programs exist, each designed for specific situations. These programs provide temporary relief from loan repayment, but it’s important to understand the terms and conditions before applying. Incorrectly choosing a deferment program could have unintended consequences.

Economic Hardship Deferment

Economic hardship deferment is available to borrowers experiencing financial difficulties that prevent them from making their loan payments. This could include job loss, reduced income, or unexpected medical expenses. To qualify, borrowers typically need to demonstrate a significant reduction in income or an unexpected financial burden. The documentation required may include pay stubs, tax returns, or medical bills. The duration of this deferment varies depending on the lender and the borrower’s circumstances, but it’s often granted for a limited period, requiring recertification of hardship. A limitation is that interest may continue to accrue on subsidized loans during this period. For example, a borrower who loses their job and experiences a significant drop in income could qualify for this type of deferment.

In-School Deferment

In-school deferment is designed for students who are enrolled at least half-time in an eligible degree or certificate program. This type of deferment typically covers the entire period of enrollment, including summer sessions, as long as the borrower maintains half-time enrollment status. The primary requirement is proof of enrollment from the educational institution. Interest may or may not accrue on subsidized loans during this period, depending on the loan type. For instance, a student pursuing a master’s degree would qualify for in-school deferment for the duration of their studies. This deferment typically ends upon graduation or withdrawal from the program.

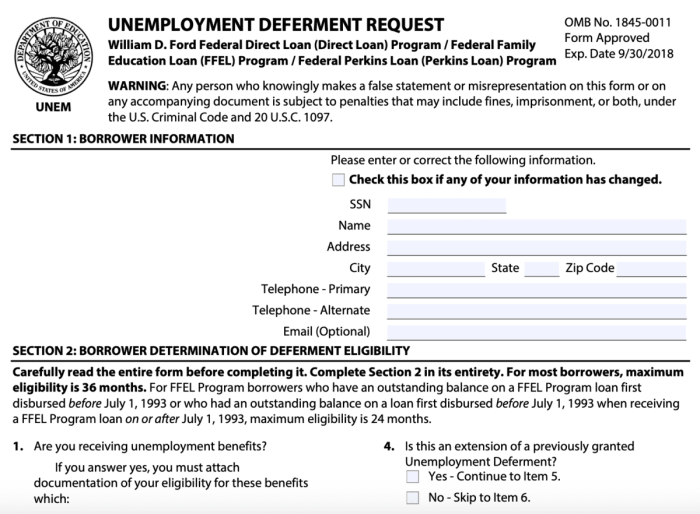

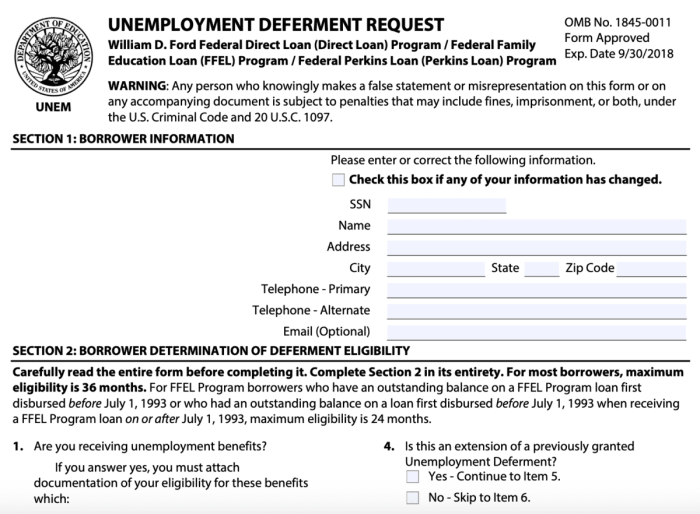

Unemployment Deferment

Unemployment deferment is available to borrowers who are unemployed and actively seeking employment. Borrowers typically need to provide documentation of their unemployment status, such as a confirmation from the unemployment office. The duration of this deferment is usually limited, and it often requires periodic recertification of unemployment. Interest typically continues to accrue on both subsidized and unsubsidized loans during this period. A borrower who has been laid off from their job and is actively searching for new employment could apply for this deferment.

Military Deferment

Military deferment is available to borrowers who are serving in active duty in the military or are performing qualifying national service. This deferment typically covers the period of active duty or national service. Proof of active duty status is required. Interest accrual varies depending on the loan type and the specific terms of the deferment. A service member deployed overseas would be eligible for this type of deferment for the duration of their deployment.

| Program Name | Eligibility | Duration | Limitations |

|---|---|---|---|

| Economic Hardship Deferment | Demonstrated financial hardship | Varies, often requires recertification | Interest may accrue on subsidized loans |

| In-School Deferment | At least half-time enrollment in eligible program | Duration of enrollment | Interest may or may not accrue depending on loan type |

| Unemployment Deferment | Unemployed and actively seeking employment | Limited duration, requires recertification | Interest accrues on subsidized and unsubsidized loans |

| Military Deferment | Active duty military service or qualifying national service | Duration of service | Interest accrual varies depending on loan type |

Application Process for Deferment

Applying for a student loan deferment involves several steps, varying slightly depending on your loan servicer and the type of deferment you’re seeking. It’s crucial to understand the specific requirements and timelines associated with your chosen deferment program. This section provides a general overview of the process.

Steps to Apply for Student Loan Deferment

The application process generally involves these steps: First, you’ll need to determine your eligibility for a deferment. Next, you’ll gather the necessary documentation. Finally, you’ll submit your application to your loan servicer and monitor its status.

- Gather Required Documentation: This is a critical first step. The necessary documents will vary based on the type of deferment you are applying for. For example, unemployment deferment will require proof of unemployment, while a graduate school deferment will require proof of enrollment in a graduate program. Specific examples are detailed in the following section.

- Complete the Application Form: Your loan servicer will provide the application form, which you’ll need to fill out completely and accurately. Be sure to double-check all information for accuracy before submitting.

- Submit Your Application: Applications can typically be submitted online through your loan servicer’s website, by mail, or by fax. Check your servicer’s website for the preferred method.

- Track Your Application Status: Once you submit your application, regularly check its status through your loan servicer’s online portal or by contacting them directly. This allows you to stay informed about the progress of your application and address any potential delays.

Required Documentation Examples

The specific documents required will depend heavily on the type of deferment sought. However, common examples include:

| Deferment Type | Required Documentation Examples |

|---|---|

| Unemployment Deferment | Unemployment benefit statements, proof of job search activities (e.g., resume, job application records), letter from employer confirming job loss. |

| Graduate School Deferment | Acceptance letter from a graduate program, enrollment verification from the school, official transcripts (sometimes). |

| Economic Hardship Deferment | Proof of income (pay stubs, tax returns), documentation of significant medical expenses, proof of eviction or foreclosure (if applicable). |

Submitting the Application and Tracking its Status

Most loan servicers offer online portals where you can submit your application and monitor its progress. This typically involves logging into your account, accessing the deferment application section, uploading your supporting documents, and submitting the completed form. After submission, you’ll usually receive a confirmation email or message. You can then track the status of your application through the same online portal, often with updates showing the application’s current stage in the review process. If you don’t have online access or prefer a different method, contact your loan servicer directly via phone or mail to inquire about the status of your application. Expect some processing time; delays may occur due to high application volumes or incomplete submissions.

Impact of Deferment on Loans

Deferring your student loan payments can provide temporary relief, but it’s crucial to understand the long-term financial consequences. While pausing payments offers immediate breathing room, it significantly impacts the overall cost of your loans due to accruing interest. The effects vary depending on the type of loan and the length of the deferment period.

Interest Accrual During Deferment

During a deferment period, interest continues to accrue on most federal student loans, though the way it’s handled differs slightly depending on the loan type. Subsidized federal loans typically have the government pay the interest while you’re in deferment (provided you meet the eligibility requirements). Unsubsidized federal loans and private student loans, however, will accrue interest that is added to your principal balance, increasing the total amount you owe. This capitalized interest increases the total amount you ultimately repay. The longer the deferment period, the more interest accrues, leading to a larger debt burden upon repayment resumption.

Long-Term Financial Implications of Deferment

Deferring student loans can have significant long-term financial implications. The primary impact is the increased total cost of repayment due to the accumulation of interest during the deferment period. This can lead to a longer repayment timeline and higher monthly payments when repayment resumes. Furthermore, deferment can negatively affect your credit score, especially if you miss payments even during the deferment period or subsequently fall behind after the deferment ends. This lower credit score can make it harder to secure loans, mortgages, or even some rental agreements in the future. Careful planning and consideration of the long-term effects are crucial before opting for deferment.

Comparison of Total Repayment Costs

The following table illustrates a hypothetical comparison of total repayment costs with and without a deferment period, highlighting the impact of interest capitalization. These are simplified examples and actual costs will vary based on interest rates, loan amounts, and deferment lengths.

| Loan Type | Original Loan Amount | Interest Rate | Deferment Period (Years) | Total Repaid (Without Deferment) | Total Repaid (With Deferment) |

|---|---|---|---|---|---|

| Subsidized Federal Loan | $10,000 | 5% | 2 | $12,155 | $12,155 |

| Unsubsidized Federal Loan | $10,000 | 5% | 2 | $12,155 | $12,750 |

| Private Loan | $10,000 | 7% | 2 | $14,000 | $15,000 |

Alternatives to Deferment

Deferment isn’t the only way to manage student loan repayments during financial hardship. Several other options exist, each with its own advantages and disadvantages. Understanding these alternatives allows borrowers to choose the best strategy for their specific circumstances. Careful consideration of the long-term implications is crucial before selecting any option.

Forbearance

Forbearance, unlike deferment, temporarily suspends your loan payments but typically accrues interest. This means that while you’re not making payments, the principal balance of your loan will grow larger due to accumulating interest. This can lead to a larger total repayment amount in the long run. However, it provides a short-term solution for borrowers facing unexpected financial challenges, such as unemployment or medical emergencies.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. Several types of IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans generally result in lower monthly payments than standard repayment plans, potentially making them more manageable during periods of low income. However, because the lower monthly payment often doesn’t cover the accruing interest, it may extend the repayment period significantly, resulting in paying more interest overall.

Comparison of Deferment, Forbearance, and IDR Plans

| Feature | Deferment | Forbearance | Income-Driven Repayment (IDR) |

|---|---|---|---|

| Payment Status | Suspended | Suspended | Reduced |

| Interest Accrual | May or may not accrue (depends on the loan type and deferment program) | Usually accrues | Usually accrues |

| Loan Balance | Stays the same (if interest doesn’t accrue) or increases (if interest accrues) | Increases | Increases (often significantly) |

| Length of Repayment | Extended by the deferment period | Extended by the forbearance period | Significantly extended |

| Eligibility | Based on specific qualifying circumstances | Generally more flexible than deferment | Based on income and family size |

| Suitability | Short-term financial hardship with specific qualifying circumstances | Short-term unexpected financial hardship | Long-term lower income or fluctuating income |

Choosing the Best Option

The most suitable option depends heavily on the individual’s circumstances and the nature of their financial difficulty. For example, a borrower facing a short-term job loss might find forbearance preferable to an IDR plan, as the shorter period of suspension might be less costly in the long run. However, someone anticipating lower income for an extended period might find an IDR plan more beneficial, even with the longer repayment timeline, because it offers manageable monthly payments. A student facing a temporary medical emergency might qualify for a deferment, offering a temporary reprieve without accruing interest in some cases.

Understanding Loan Forgiveness Programs

Student loan forgiveness programs offer the potential to eliminate a portion or all of your student loan debt under specific circumstances. These programs are designed to provide relief to borrowers facing financial hardship or who have dedicated their careers to public service. However, it’s crucial to understand the eligibility requirements, application processes, and potential long-term implications before relying on these programs.

Types of Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, each with its own eligibility criteria and benefits. The most prominent include Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment (IDR) plans that can lead to forgiveness after a certain number of payments. Eligibility varies significantly depending on the program and the type of loan. For example, PSLF requires borrowers to work full-time for a qualifying government or non-profit organization, while Teacher Loan Forgiveness has specific requirements related to teaching in low-income schools. IDR plans, while not forgiveness programs in themselves, can lead to loan forgiveness after 20 or 25 years of payments, depending on the plan and income level.

Eligibility Requirements and Application Processes

Eligibility for student loan forgiveness programs hinges on factors such as loan type, employment history, income, and the specific program requirements. For instance, PSLF requires borrowers to make 120 qualifying monthly payments under an IDR plan while employed full-time by a qualifying employer. Teacher Loan Forgiveness requires five years of consecutive teaching in a low-income school. The application process often involves completing forms, providing documentation of employment and income, and potentially undergoing an audit of repayment history. It’s essential to carefully review the specific requirements for each program and meticulously document all necessary information to ensure a successful application.

Impact of Loan Forgiveness on Credit Scores and Taxes

The impact of loan forgiveness on credit scores is complex and depends on how the forgiveness is handled. While the forgiven amount may not directly negatively impact credit scores, the fact that the debt was previously outstanding will still be a part of your credit history. However, having a record of consistently making payments before forgiveness can still positively contribute to your credit score. Regarding taxes, forgiven student loan debt is generally considered taxable income. This means that the forgiven amount may be subject to federal and state income taxes. However, there may be exceptions or specific rules depending on the program and individual circumstances. It’s advisable to consult with a tax professional to understand the tax implications in your specific situation.

Key Differences Between Deferment and Loan Forgiveness Programs

Understanding the core differences between deferment and loan forgiveness is vital for making informed decisions about managing student loan debt.

- Deferment temporarily postpones loan payments, but the debt remains outstanding and interest may still accrue (depending on the loan type). It’s a short-term solution for managing immediate financial hardship.

- Loan Forgiveness permanently eliminates a portion or all of the loan debt after meeting specific criteria. It’s a long-term solution that requires meeting stringent eligibility requirements and often involves a significant time commitment.

- Eligibility: Deferment eligibility is generally based on financial hardship, while loan forgiveness eligibility depends on factors like employment type, income, and repayment history.

- Impact on future payments: Deferment postpones payments, but the full loan balance remains due after the deferment period. Loan forgiveness eliminates the debt permanently.

- Tax Implications: Deferment has no direct tax implications. Loan forgiveness may result in taxable income.

Visual Representation of Interest Accrual During Deferment

Understanding how interest accrues during a student loan deferment is crucial for managing your debt effectively. While payments are paused, interest continues to accumulate, increasing the total loan balance. This section illustrates this process with a concrete example.

Let’s consider a scenario involving a student loan with a principal balance of $20,000 and a fixed annual interest rate of 6%. During a 12-month deferment period, interest will accrue monthly. The calculation for monthly interest is: (Annual Interest Rate / 12) * Principal Balance. In this case, the monthly interest would be (0.06 / 12) * $20,000 = $100.

Interest Accrual Over 12 Months

The following table visually represents the growth of the loan balance due to accumulated interest over the 12-month deferment period. Note that this calculation assumes simple interest and does not include any compounding effects, which would slightly increase the final balance. For simplicity, we are showing the interest accrued each month and the cumulative balance.

| Month | Interest Accrued | Cumulative Balance |

|---|---|---|

| 1 | $100 | $20,100 |

| 2 | $100 | $20,200 |

| 3 | $100 | $20,300 |

| 4 | $100 | $20,400 |

| 5 | $100 | $20,500 |

| 6 | $100 | $20,600 |

| 7 | $100 | $20,700 |

| 8 | $100 | $20,800 |

| 9 | $100 | $20,900 |

| 10 | $100 | $21,000 |

| 11 | $100 | $21,100 |

| 12 | $100 | $21,200 |

This table demonstrates that after 12 months of deferment, the loan balance has increased by $1200, solely due to accumulated interest. The borrower will owe $21,200 at the end of the deferment period, not the original $20,000. This underscores the importance of understanding the implications of deferment before choosing this option.

Last Point

Successfully navigating student loan repayment requires careful planning and a thorough understanding of available options. This guide has provided a framework for understanding how to defer student loan repayment, encompassing eligibility criteria, application processes, and the potential long-term financial effects. Remember to carefully weigh the pros and cons of deferment against alternatives such as forbearance or income-driven repayment plans, selecting the strategy that best aligns with your individual circumstances and financial goals. Proactive management of your student loans is key to long-term financial success.

FAQ Compilation

What happens to my interest during a deferment period?

Interest typically continues to accrue on subsidized and unsubsidized federal loans during a deferment, increasing your overall loan balance. The specifics vary depending on the loan type and deferment program.

Can I defer private student loans?

The availability of deferment for private student loans depends entirely on your lender. Contact your lender directly to inquire about their deferment policies and eligibility requirements.

How long can I defer my student loans?

The maximum deferment period varies depending on the type of loan and the reason for deferment. Some programs have set time limits, while others may allow for extensions under certain circumstances. Check the specifics of your chosen deferment program.

What if I can’t afford my student loan payments even after deferment?

If you still struggle to manage your payments after a deferment, explore options like income-driven repayment plans or forbearance. Contact your loan servicer to discuss your options and explore potential solutions.

Will deferring my loans affect my credit score?

While deferment itself doesn’t directly impact your credit score as much as a default, consistently deferring loans can indicate financial difficulties, potentially affecting your credit rating. It’s best to explore deferment only as a short-term solution.