Navigating the complexities of student loan repayment can feel overwhelming, especially when unexpected life events arise. Understanding your options for managing your debt is crucial, and one such option is a student loan deferment. This guide provides a clear and concise path to understanding the process of obtaining a deferment, helping you navigate the requirements, application process, and potential alternatives.

From determining your eligibility based on factors like economic hardship or unemployment to understanding the implications of interest accrual and the impact on your credit score, we’ll cover all the essential aspects. We will also explore alternative repayment options and offer strategies for effective communication with your loan servicer. This comprehensive guide aims to empower you with the knowledge you need to make informed decisions about your student loan repayment.

Eligibility for Student Loan Deferment

Securing a student loan deferment can provide crucial financial relief during challenging times. Understanding the eligibility requirements is the first step in accessing this assistance. This section Artikels the various types of deferments available and the criteria you must meet to qualify.

General Requirements for Deferment Eligibility

Generally, to be eligible for a student loan deferment, you must demonstrate a legitimate hardship or circumstance preventing you from making your scheduled payments. This typically involves providing documentation to support your claim. The specific documentation required varies depending on the type of deferment you are applying for. Furthermore, you must be enrolled in a qualifying loan repayment plan and have an active loan in good standing (excluding any existing deferments).

Types of Student Loan Deferments

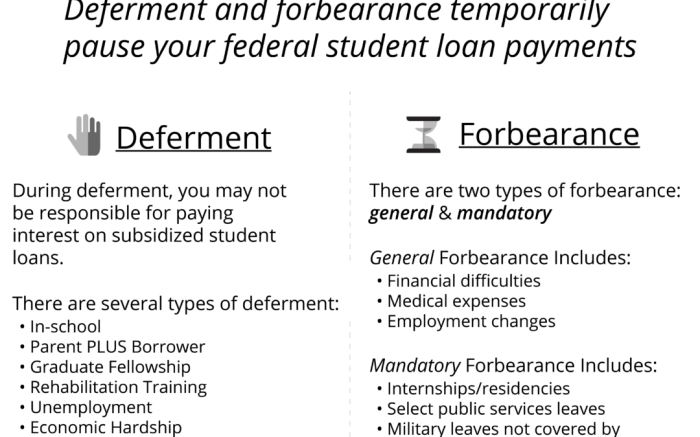

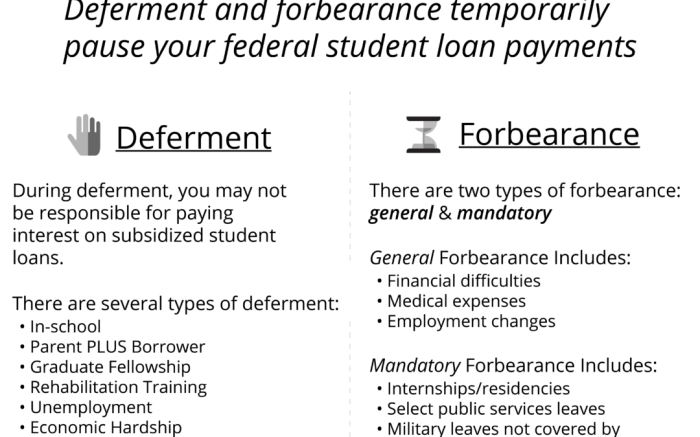

Several types of deferments are available, each with its own set of eligibility requirements. Common types include economic hardship deferments, unemployment deferments, and deferments for those enrolled in graduate or professional school.

Determining Deferment Eligibility: A Step-by-Step Guide

1. Identify your loan servicer: Contact your loan servicer to confirm your loan details and the types of deferments they offer.

2. Determine your hardship: Carefully assess your financial situation to determine if you meet the criteria for any available deferment. This might involve reviewing your income, expenses, and employment status.

3. Gather necessary documentation: Collect all required documentation, such as proof of unemployment, medical bills, or tax returns. The exact documents will depend on the type of deferment you are seeking.

4. Complete the deferment application: Submit a completed deferment application to your loan servicer along with all supporting documentation.

5. Monitor your application status: Follow up with your loan servicer to check the status of your application and ensure your request has been processed.

Comparison of Eligibility Criteria for Various Deferment Types

The eligibility requirements vary significantly depending on the type of deferment. For instance, an economic hardship deferment may require documentation of significantly reduced income, while an unemployment deferment requires proof of job loss. Graduate or professional school deferments require proof of enrollment in a qualifying program. Each type of deferment has specific income thresholds and documentation requirements. Failure to meet these criteria can lead to application denial.

Summary of Key Eligibility Requirements

| Deferment Type | Income Requirements | Employment Requirements | Other Requirements |

|---|---|---|---|

| Economic Hardship | Income below a certain threshold (varies by lender) | May be employed, but income is insufficient to meet expenses | Documentation of expenses and income |

| Unemployment | Unemployed or experiencing a significant reduction in work hours | Proof of unemployment (e.g., unemployment benefits statement) | May require a minimum period of unemployment |

| Graduate/Professional School | Enrolled at least half-time in a qualifying program | May or may not be employed | Proof of enrollment (e.g., acceptance letter, transcript) |

The Application Process

Applying for a student loan deferment involves several steps and requires specific documentation depending on the type of deferment you qualify for. The process itself is generally straightforward, but understanding the requirements and timelines is crucial for a successful application. Failure to provide the necessary documentation can lead to delays or rejection.

The process for applying for a student loan deferment varies slightly depending on your loan servicer. However, the general steps remain consistent. You will typically need to complete an application form, gather supporting documentation, and submit your application through your servicer’s online portal or via mail. The processing time can range from a few weeks to several months, depending on the volume of applications and the complexity of your case.

Required Documentation

The specific documents required will depend on the type of deferment you are seeking. For example, a deferment based on unemployment typically requires proof of unemployment, such as a layoff notice or unemployment benefit statements. A deferment for economic hardship might necessitate documentation such as tax returns, bank statements, and proof of medical expenses. For deferments due to graduate school enrollment, official enrollment verification from your institution is typically required.

- Unemployment Deferment: A layoff notice from your employer, recent pay stubs showing a reduction in income, and documentation of unemployment benefits received (if applicable).

- Economic Hardship Deferment: Tax returns for the past two years, bank statements for the past three months, and documentation of significant medical expenses or other unforeseen financial burdens.

- Graduate School Deferment: Official enrollment verification from your graduate program, showing your full-time enrollment status and expected graduation date.

- Military Deferment: A copy of your military orders or official documentation confirming your active-duty service status.

Steps in Completing the Application

It is important to carefully follow these steps to ensure a smooth and efficient application process. Incomplete or inaccurate applications can lead to delays and potential rejection.

- Gather Required Documentation: Collect all necessary documents to support your deferment request. Make copies of all original documents for your records.

- Complete the Application Form: Carefully fill out the deferment application form provided by your loan servicer. Ensure all information is accurate and complete.

- Submit the Application: Submit your completed application form and supporting documentation through your loan servicer’s online portal or via mail, as instructed.

- Track Your Application: Monitor the status of your application through your loan servicer’s online account or by contacting them directly.

Application Processing Times

The processing time for a student loan deferment application can vary significantly. While some servicers might process applications within a few weeks, others may take several months, particularly during periods of high application volume. Factors such as the completeness of your application and the complexity of your situation can also influence processing times. For example, an application with incomplete documentation might require additional review and communication, potentially leading to delays. In some cases, you may experience processing times extending beyond three months, especially during peak seasons. It’s always advisable to apply well in advance of when you anticipate needing the deferment.

Application Process Flowchart

The flowchart below visually represents the typical steps involved in applying for a student loan deferment.

[A textual description of a flowchart is provided below, as image generation is outside the scope of this response. The flowchart would begin with a “Start” box. The next box would be “Determine Deferment Eligibility.” This would branch to two boxes: “Eligible” and “Ineligible.” The “Ineligible” box would lead to an “End” box. The “Eligible” box would lead to “Gather Required Documents.” This would then lead to “Complete Application Form.” Next would be “Submit Application.” Then, “Application Processing” would follow, leading to two final boxes: “Deferment Approved” and “Deferment Denied.” Both of these would lead to an “End” box.]

Understanding Deferment Terms and Conditions

Securing a student loan deferment offers temporary relief from repayment, but it’s crucial to understand the terms and conditions to avoid unexpected consequences. This section clarifies the duration, implications, and potential drawbacks of deferments.

Deferment Lengths

The length of a deferment varies significantly depending on the type of deferment granted. For example, unemployment deferments are typically granted for periods of up to three years, often renewable depending on continued unemployment and verification of circumstances. In contrast, deferments for graduate school or medical residency may last for the duration of the program, potentially several years. Specific deferment lengths are determined by the loan servicer and the type of loan involved. It’s essential to check with your loan servicer for precise details on your specific deferment eligibility and duration.

Interest Accrual During Deferment

A critical aspect of deferment is that interest usually continues to accrue on your loan balance during the deferment period, even though you’re not making payments. This means your total loan balance will increase over time. For subsidized federal loans, the government may pay the interest during certain deferment periods (such as unemployment deferment), but this is not always the case, and unsubsidized loans always accrue interest. Failing to understand this can lead to a significantly larger loan balance upon the resumption of payments. For example, a $20,000 loan with a 5% interest rate will accrue $1,000 in interest annually during a deferment, leading to a higher total debt once repayment begins.

Impact on Credit Score

While a deferment itself doesn’t automatically result in a negative mark on your credit report, it can indirectly impact your credit score. The fact that you are not making payments, even though you’re not legally required to, may be viewed as a negative factor by some lenders, especially if the deferment is for an extended period. Additionally, if your loan balance increases due to accrued interest, this could lower your credit utilization ratio (the amount of credit you’re using compared to your total credit limit), potentially affecting your credit score negatively. Consistent and timely repayment history is a crucial factor in maintaining a healthy credit score.

Reasons for Deferment Denial

Deferment applications are not always approved. Common reasons for denial include providing insufficient documentation to support the claim for deferment (such as proof of unemployment or enrollment in a qualifying program), applying for a deferment type that you don’t qualify for, or having already used the maximum allowed deferment period for a particular loan type. Failure to accurately and completely fill out the application also increases the likelihood of denial. In some cases, borrowers might be encouraged to explore alternative repayment options, such as income-driven repayment plans, if their deferment application is denied.

Advantages and Disadvantages of Deferment

It’s crucial to weigh the pros and cons before pursuing a deferment.

- Advantages: Temporary relief from loan payments, potentially preventing default during difficult financial periods, and allowing borrowers time to address financial challenges.

- Disadvantages: Interest accrual increases the total loan amount, potential negative impact on credit score, and possibility of deferment denial.

Alternatives to Deferment

If a student loan deferment isn’t approved, several alternative options exist to manage your payments temporarily or adjust your repayment schedule for the long term. Understanding these alternatives is crucial for navigating your financial situation effectively and avoiding potential negative consequences. Each option carries its own set of advantages and disadvantages, and the best choice will depend on your individual circumstances and financial goals.

Forbearance

Forbearance is a temporary postponement of your student loan payments. Unlike deferment, forbearance doesn’t require demonstrating financial hardship. However, interest typically continues to accrue during the forbearance period, leading to a larger total loan balance upon resumption of payments. This can significantly impact the overall cost of your education. Consider forbearance only if you anticipate a short-term financial difficulty and can afford to pay the accumulated interest later. The length of forbearance periods varies depending on your lender and the circumstances. For example, a borrower experiencing temporary unemployment might secure a forbearance period of six months, whereas someone facing a longer-term financial challenge might negotiate a longer period.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans link your monthly student loan payments to your income and family size. These plans offer lower monthly payments than standard repayment plans, making them attractive to borrowers with limited income. Several types of IDR plans exist, each with its own eligibility criteria and payment calculation method. For instance, the Revised Pay As You Earn (REPAYE) plan caps your monthly payment at 10% of your discretionary income. The long-term implications of IDR plans include potential loan forgiveness after a specific number of qualifying payments, often 20 or 25 years, depending on the plan. However, this forgiveness may be taxable income. Choosing an IDR plan might result in a longer repayment period and potentially higher total interest paid over the life of the loan. The benefits of lower monthly payments must be carefully weighed against the increased overall cost.

Comparison of Deferment, Forbearance, and Income-Driven Repayment

Understanding the key differences between these options is crucial for making an informed decision. The following table summarizes the main characteristics:

| Feature | Deferment | Forbearance | Income-Driven Repayment |

|---|---|---|---|

| Payment Status | Temporarily suspended | Temporarily suspended | Reduced monthly payments |

| Interest Accrual | May or may not accrue, depending on the loan type and reason for deferment | Usually accrues | Accrues, but payments are based on income |

| Eligibility Requirements | Generally requires demonstrating financial hardship or enrollment in school | Generally less stringent than deferment | Based on income and family size |

| Long-Term Implications | Can delay repayment, but interest may not accrue | Can lead to significantly higher total interest paid | Potentially longer repayment period, but may lead to loan forgiveness |

Long-Term Financial Implications of Each Option

The long-term financial impact of each option varies considerably. Deferment, if interest doesn’t accrue, offers the best outcome in terms of minimizing total cost. However, delaying repayment means you have less money available for other financial goals. Forbearance can lead to a substantial increase in the total cost due to accumulated interest. IDR plans offer manageable monthly payments, but the extended repayment period can result in higher overall interest costs, although the potential for loan forgiveness mitigates this to some degree. Careful consideration of your financial situation, future income projections, and risk tolerance is essential before making a choice.

Contacting Your Loan Servicer

Direct communication with your loan servicer is crucial for navigating the student loan deferment process successfully. They are the primary point of contact for all your loan-related inquiries and will guide you through the application and approval process. Failing to communicate effectively could lead to delays or even denial of your deferment request.

Understanding how to contact your servicer and what information to provide is essential for a smooth and efficient experience. Clear and concise communication will expedite the process and ensure your request is handled promptly.

Contact Methods

Your loan servicer offers various ways to get in touch. Utilizing the method most convenient for you will ensure your request is efficiently handled. Choosing the right method can also save you time and reduce potential misunderstandings.

- Phone: Most servicers provide a dedicated phone number for student loan inquiries. This allows for immediate interaction and clarification of any questions. Be prepared to wait on hold, however.

- Email: Many servicers offer email support, providing a written record of your communication. This is useful for tracking your request’s progress and referring back to specific details. However, email responses may take longer than phone calls.

- Mail: Sending a formal letter via mail is a reliable option, especially for complex requests or to provide supporting documentation. This method offers a tangible record, but the response time is generally the longest.

Information to Have Ready

Before contacting your servicer, gather all necessary information to expedite the process. Having this information readily available will avoid delays and ensure a more efficient interaction.

- Your full name and date of birth.

- Your student loan account number(s).

- The type of loan(s) you have (e.g., Federal Stafford, Perkins, etc.).

- The reason for requesting a deferment (e.g., unemployment, graduate school enrollment).

- Supporting documentation (e.g., proof of unemployment, enrollment verification).

Effective Communication Tips

Effective communication with your loan servicer is key to a successful deferment request. Following these tips can ensure your request is handled promptly and efficiently.

- Be polite and respectful in all your interactions.

- Clearly state your reason for contacting them and the specific information you need.

- Keep a record of all communication, including dates, times, and the names of the representatives you speak with.

- Follow up if you haven’t received a response within a reasonable timeframe.

- Be patient and persistent, as the process may take some time.

Sample Deferment Request Letter

A formal letter provides a clear and documented record of your request. This approach is particularly useful when providing supporting documentation and ensures a professional interaction.

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address][Date]

[Loan Servicer Name]

[Loan Servicer Address]Subject: Request for Student Loan Deferment – Account Number [Your Account Number]

Dear [Loan Servicer Representative Name],

This letter formally requests a deferment on my student loan(s), account number(s) [Your Account Number(s)]. I am requesting this deferment due to [Clearly state your reason for deferment, e.g., unemployment, enrollment in graduate school]. I have attached supporting documentation to verify this circumstance.

I understand the terms and conditions of a deferment and agree to abide by them. Please confirm receipt of this request and provide an estimated timeframe for processing.

Thank you for your time and consideration.

Sincerely,

[Your Signature]

[Your Typed Name]

Potential Challenges and Solutions

Securing a student loan deferment can be a beneficial step for borrowers facing temporary financial hardship, but the process isn’t always straightforward. Several hurdles can arise, impacting the success of your application. Understanding these potential challenges and having strategies in place to overcome them significantly increases your chances of approval. This section Artikels common difficulties and provides practical solutions.

Challenges in the Deferment Application Process

Navigating the deferment application process can present several obstacles. Successful applicants often proactively address these challenges. Careful preparation and clear communication are key to a smooth process.

- Challenge: Incomplete or inaccurate application forms. Missing information or errors can lead to delays or rejection.

- Solution: Thoroughly review all forms before submission. Double-check for accuracy and completeness. Gather all required documentation well in advance.

- Challenge: Difficulty providing sufficient documentation to support your claim of hardship. Loan servicers require proof of your financial circumstances. Insufficient evidence can weaken your application.

- Solution: Gather comprehensive documentation such as pay stubs, bank statements, medical bills (if applicable), and any other relevant financial records that demonstrate your need for a deferment. Organize these documents logically for easy review.

- Challenge: Unclear communication with your loan servicer. Misunderstandings or lack of response can hinder the process.

- Solution: Maintain clear and consistent communication with your loan servicer. Keep records of all correspondence. If you don’t receive a response within a reasonable timeframe, follow up with a phone call or written inquiry.

- Challenge: Ineligibility for a deferment due to not meeting specific criteria. Each deferment type has specific requirements; failure to meet these can result in denial.

- Solution: Carefully review the eligibility requirements for the type of deferment you are seeking. If you don’t meet the criteria, explore alternative options, such as forbearance or income-driven repayment plans.

- Challenge: Delayed processing times due to high application volumes or internal servicing issues. This is often beyond the borrower’s control.

- Solution: Apply well in advance of when you anticipate needing the deferment. Track the status of your application regularly and proactively contact your servicer if there are any delays.

Strategies for Improving Approval Chances

Proactive measures significantly enhance the likelihood of a successful deferment application. These strategies focus on presenting a compelling case to your loan servicer.

- Thorough Documentation: Provide comprehensive and well-organized supporting documentation. This demonstrates the legitimacy of your hardship.

- Clear and Concise Communication: Explain your situation clearly and concisely in your application and any subsequent correspondence. Avoid jargon and ambiguity.

- Early Application: Submit your application well in advance of needing the deferment to allow sufficient processing time.

- Follow-up: Regularly check the status of your application and follow up promptly if you experience delays or encounter any issues.

- Consider Alternative Options: If you are unsure about your eligibility, explore alternative options such as forbearance or income-driven repayment plans.

Examples of Successful Deferment Applications

While specific details of successful applications are generally confidential due to privacy concerns, the common thread is meticulous preparation and clear communication. For example, a borrower experiencing unemployment due to a documented illness successfully obtained a deferment by providing medical records, doctor’s notes confirming their inability to work, and bank statements demonstrating reduced income. Another example involves a borrower who experienced a family emergency; their application, supported by documentation of the emergency and its financial impact, was approved. In both cases, the clarity of the explanation, coupled with supporting documentation, was instrumental in the successful outcome.

Last Point

Securing a student loan deferment can provide much-needed financial breathing room during challenging times. By carefully reviewing your eligibility, diligently completing the application process, and maintaining open communication with your loan servicer, you can increase your chances of success. Remember to explore alternative options if a deferment isn’t feasible and to always prioritize long-term financial planning. Understanding your rights and responsibilities as a borrower is key to effectively managing your student loan debt.

Essential FAQs

What happens to interest during a deferment?

Interest typically continues to accrue on most federal student loans during a deferment, although some types of deferments may temporarily suspend interest accrual. Check your loan terms for specifics.

How long does the deferment application process take?

Processing times vary depending on the lender and the type of deferment. Allow several weeks to several months for a decision.

Can I defer my private student loans?

The availability of deferments for private student loans depends entirely on your lender’s policies. Contact your lender directly to inquire about their deferment options.

What if my deferment application is denied?

If your application is denied, review the reasons provided and consider appealing the decision or exploring alternative repayment options like forbearance or income-driven repayment plans.

Will a deferment affect my credit score?

While a deferment itself won’t necessarily damage your credit score, consistently needing deferments or failing to make payments after the deferment period could negatively impact your credit.