Securing a subsidized student loan can significantly ease the financial burden of higher education. Understanding the eligibility criteria, application process, and repayment options is crucial for navigating this important step towards academic success. This guide provides a comprehensive overview, empowering you to make informed decisions and access the financial aid you deserve.

From exploring eligibility requirements based on income and family size to mastering the FAFSA application, we’ll cover every aspect of obtaining a subsidized student loan. We’ll also delve into the nuances of different loan types, repayment plans, and strategies for managing your student loan debt effectively. The goal is to equip you with the knowledge and tools necessary to confidently pursue your educational aspirations.

Eligibility Criteria for Subsidized Student Loans

Securing a subsidized federal student loan requires meeting specific eligibility criteria established by the U.S. Department of Education. These criteria ensure that federal funds are allocated to students who demonstrate the greatest financial need. Understanding these requirements is crucial for a successful application process.

Factors Influencing Eligibility

Several key factors determine eligibility for subsidized federal student loans. These include the student’s demonstrated financial need, enrollment status, academic standing, and citizenship status. The Free Application for Federal Student Aid (FAFSA) is the primary tool used to assess financial need and determine eligibility. Additional factors, such as prior loan history and the type of institution attended, also play a role. A clean credit history is generally beneficial, although not always a strict requirement.

Income Requirements and Family Size

The FAFSA uses a student’s and their family’s income information to calculate Expected Family Contribution (EFC). The lower the EFC, the greater the demonstrated financial need and, consequently, the higher the likelihood of receiving subsidized loans. Family size is considered in the EFC calculation; larger families often have higher EFCs, which could potentially affect the amount of financial aid awarded. The FAFSA considers income from various sources, including wages, salaries, investments, and business income.

Determining Personal Eligibility Using Online Resources

Determining your eligibility for a subsidized student loan involves several straightforward steps. First, complete the FAFSA form online at studentaid.gov. This form requests detailed financial information from both the student and their parents (if applicable). After submitting the FAFSA, you will receive a Student Aid Report (SAR) which includes your EFC. You can then use the SAR and the information provided by your chosen college or university’s financial aid office to determine your eligibility for subsidized loans and the amount you may receive. Many colleges and universities also have online financial aid calculators that can provide estimates based on your individual circumstances.

Eligibility Requirements: Undergraduate vs. Graduate Students

| Criterion | Undergraduate Students | Graduate Students |

|---|---|---|

| Demonstrated Financial Need | Required; assessed via FAFSA | Required; assessed via FAFSA |

| Enrollment Status | Must be enrolled at least half-time | Must be enrolled at least half-time |

| Academic Progress | Must maintain satisfactory academic progress (SAP) | Must maintain satisfactory academic progress (SAP) |

| Citizenship Status | U.S. citizen or eligible non-citizen | U.S. citizen or eligible non-citizen |

Application Process for Subsidized Student Loans

Securing a subsidized student loan involves navigating the Free Application for Federal Student Aid (FAFSA) process. This application is the gateway to federal student aid, including subsidized loans, which offer significant financial assistance for higher education. Understanding the steps involved and the necessary documentation will streamline the application process and increase your chances of approval.

Completing the FAFSA Form

The FAFSA is an online form that collects information about you, your family, and your finances. Accurate and complete information is crucial for a successful application. The process begins with creating an FSA ID, a username and password combination used to access and manage your FAFSA information. This ID is required for both the student and at least one parent (if the student is a dependent). Once the FSA ID is created, you can begin filling out the form. Key sections include personal information, parental information (if applicable), educational information, and financial information. The form asks for details about income, assets, and tax information, so having your tax returns readily available will significantly expedite the process. Be sure to carefully review each section, ensuring accuracy in every field. Submitting an incomplete or inaccurate FAFSA can delay processing or even lead to rejection.

Required Documentation for FAFSA

Before starting the FAFSA, gather the necessary documents to ensure a smooth and efficient application process. These documents typically include your Social Security number, your driver’s license or state ID, and your federal tax returns (IRS Form 1040), including W-2s and other relevant tax documents. If you are a dependent student, you will also need your parents’ Social Security numbers, driver’s licenses or state IDs, and their federal tax returns. If you are filing as an independent student, you may still need to provide documentation regarding your income and assets. Having all this information readily available will prevent delays and interruptions during the application process. Remember to double-check all the information for accuracy to avoid any potential complications.

FAFSA Application Process Flowchart

Imagine a flowchart starting with a box labeled “Create FSA ID.” An arrow leads to a box labeled “Complete FAFSA Form,” which branches to boxes representing sections such as “Student Information,” “Parent Information (if applicable),” “School Information,” and “Financial Information.” Arrows connect these sections, indicating the sequential completion of each. From the “Financial Information” box, an arrow leads to a box labeled “Review and Submit FAFSA.” This is followed by a box labeled “FAFSA Processing,” which leads to a final box showing either “FAFSA Approved” or “FAFSA Requires Further Information.” If “FAFSA Requires Further Information,” an arrow loops back to the “Complete FAFSA Form” box to indicate the need for additional documentation or clarification. The flowchart visually represents the step-by-step process, highlighting the importance of accurate information and potential need for further documentation.

Types of Subsidized Student Loans

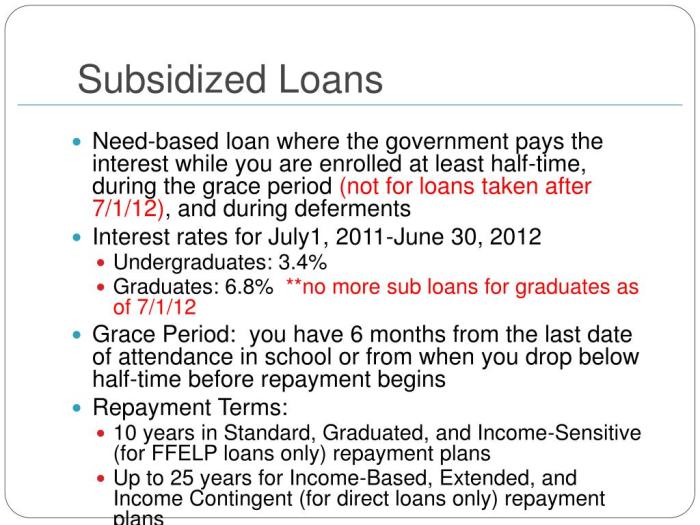

Understanding the different types of subsidized federal student loans is crucial for navigating the financial landscape of higher education. While the term “subsidized” generally refers to the government paying the interest on the loan while you’re in school (and sometimes during grace periods), the specific terms and conditions can vary slightly depending on the type of loan. This section clarifies the key distinctions between these loan options.

Federal Subsidized Direct Stafford Loans

The Federal Subsidized Direct Stafford Loan is the most common type of subsidized student loan. These loans are need-based, meaning your eligibility depends on your demonstrated financial need as determined by the Free Application for Federal Student Aid (FAFSA). The government pays the interest accrued on the loan while you are enrolled at least half-time in an eligible degree program, and during certain grace periods. This is a significant advantage, as it prevents the loan balance from growing larger before you even begin repayment. However, the maximum amount you can borrow is capped annually and cumulatively, depending on your year in school (freshman, sophomore, etc.) and your dependent status. For example, a dependent undergraduate student might be eligible to borrow a maximum of $5,500 in their first year, while an independent undergraduate student could borrow up to $10,500. These amounts are subject to change, so it’s important to check the current federal guidelines. A disadvantage is that the total amount you can borrow may not cover all your educational expenses, necessitating exploration of other financial aid options. This loan type is most beneficial for students with significant financial need who are pursuing an undergraduate degree.

Federal Unsubsidized Direct Stafford Loans

While not strictly a “subsidized” loan, it’s important to compare unsubsidized loans to their subsidized counterparts. Unsubsidized Direct Stafford Loans are available to both undergraduate and graduate students regardless of financial need. The key difference is that the borrower is responsible for paying the interest that accrues on the loan while they are in school. This interest can be capitalized (added to the principal balance), increasing the total amount owed. The advantage is that students are not restricted by financial need criteria, providing access to funds regardless of their financial background. However, this comes with the disadvantage of accruing interest throughout the educational period, potentially leading to a higher overall loan repayment amount. Unsubsidized loans might be beneficial for students who do not qualify for subsidized loans, have higher educational expenses, or prefer a larger loan amount, even if it means managing interest accumulation. Careful budgeting and understanding of interest accrual are crucial for managing this type of loan.

Key Differences Between Subsidized and Unsubsidized Loans

The primary difference lies in interest accrual. With subsidized loans, the government covers interest during periods of enrollment and grace periods. Unsubsidized loans, on the other hand, accrue interest from the time the loan is disbursed. This impacts the overall cost of the loan significantly. Subsidized loans are need-based, while unsubsidized loans are not. This means students with higher financial need are more likely to qualify for subsidized loans. The maximum loan amounts also differ, with subsidized loan amounts often lower than unsubsidized loan amounts. The eligibility criteria differ, with subsidized loans requiring a demonstration of financial need through the FAFSA.

Repayment Options for Subsidized Student Loans

Understanding your repayment options is crucial after graduating and starting your career. Choosing the right plan can significantly impact your monthly budget and the total amount you ultimately pay back. The federal government offers several repayment plans designed to accommodate varying financial situations and income levels. Careful consideration of your individual circumstances is key to making an informed decision.

Choosing a suitable repayment plan involves several key factors. Your monthly income, your overall debt load (including non-student loans), and your long-term financial goals all play a significant role. Consider your projected salary increase and anticipated life changes, such as marriage or having children, which can affect your ability to manage monthly payments. The length of the repayment plan and the total interest accrued are also critical factors to weigh.

Standard Repayment Plan

This is the default repayment plan for federal student loans. It typically involves fixed monthly payments over a 10-year period. While offering predictable payments, this plan often results in higher monthly payments compared to income-driven plans. The advantage lies in the shorter repayment period, leading to less total interest paid over the loan’s lifetime. For example, a $30,000 loan with a 5% interest rate would have approximately a $317 monthly payment and a total interest of roughly $10,000 over 10 years.

Extended Repayment Plan

This plan allows for longer repayment periods, typically ranging from 12 to 30 years, depending on the loan amount. This results in lower monthly payments than the standard plan, making it more manageable for borrowers with limited income. However, extending the repayment period will increase the total interest paid over the life of the loan. For instance, stretching the same $30,000 loan over 20 years would significantly reduce the monthly payment, but the total interest paid would be substantially higher.

Graduated Repayment Plan

This plan starts with lower monthly payments that gradually increase over time. This can be beneficial for borrowers anticipating salary increases in the early years of their careers. However, it’s essential to understand that the final payments will be considerably higher than the initial ones, potentially leading to financial difficulties if not carefully planned for. The total interest paid is generally higher than with the standard plan.

Income-Driven Repayment Plans

These plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR), base monthly payments on your discretionary income and family size. Payments are typically lower than other plans, making them attractive for borrowers with lower incomes. However, they usually extend the repayment period to 20 or 25 years, leading to higher total interest paid over the loan’s life. These plans often offer loan forgiveness after a certain number of qualifying payments. For instance, under certain conditions, remaining loan balances could be forgiven after 20 or 25 years of payments.

Comparison of Repayment Plans

The following table summarizes the key features of different repayment plans. Note that specific terms and conditions can vary slightly based on the lender and the type of loan.

| Repayment Plan | Payment Amount | Repayment Period | Total Interest Paid |

|---|---|---|---|

| Standard | Higher | 10 years | Lower |

| Extended | Lower | 12-30 years | Higher |

| Graduated | Starts low, increases | 10 years | Higher |

| Income-Driven | Variable, based on income | 20-25 years | Highest |

Understanding Interest Rates and Fees

Subsidized student loans, while offering the benefit of government-subsidized interest during certain periods, still involve interest rates and fees that directly impact the overall cost of your education. Understanding these financial aspects is crucial for responsible borrowing and effective financial planning. This section will clarify how these rates and fees are determined and their implications.

Interest rates on subsidized federal student loans are determined by the government. The specific rate is set annually and is based on a complex formula that considers factors such as the 10-year Treasury note yield, and the cost of borrowing for the federal government. These rates are generally lower than unsubsidized loan rates or private loan rates because the government aims to make higher education more accessible. The rate is fixed for the life of the loan, meaning it will not change after the loan is disbursed. For example, if the rate is 5% when you borrow, it remains 5% until the loan is fully repaid.

Interest Rate Impact on Loan Cost

The interest rate significantly influences the total amount you repay. A higher interest rate means you’ll pay more in interest over the life of the loan, increasing the overall cost. Conversely, a lower interest rate results in lower overall interest payments. To illustrate, consider two scenarios: a $10,000 loan at 5% interest versus the same loan at 7% interest. Over a 10-year repayment period, the higher interest rate will lead to significantly higher total payments. This difference underscores the importance of understanding the interest rate before accepting a loan. Detailed amortization schedules, often available from your loan servicer, can clearly demonstrate the impact of different interest rates on your total repayment amount.

Fees Associated with Subsidized Student Loans

While subsidized federal student loans do not typically include origination fees (a fee charged by the lender when the loan is processed), other fees can arise during the loan’s lifecycle. For instance, late payment fees may be charged if you miss a payment. These fees can add to the overall cost, so maintaining timely payments is essential. Additionally, if you consolidate your loans, there may be small processing fees associated with the consolidation process. It is important to review the terms and conditions of your loan carefully and contact your loan servicer for any clarification on potential fees.

Interest Capitalization

Interest capitalization refers to the process of adding accumulated unpaid interest to the principal loan balance. This typically occurs when your subsidized loan enters the repayment period. During the grace period (usually six months after graduation), interest does not accrue on subsidized loans. However, once the grace period ends and repayment begins, any accumulated interest is added to the principal. This increases the total amount you owe, leading to higher overall interest payments over the life of the loan. For example, if you had $1000 in accumulated interest after the grace period, that $1000 would be added to your principal loan amount, and future interest calculations would be based on this higher amount. Understanding capitalization is crucial to managing your loan repayment effectively.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and consistent effort. Understanding your repayment options and developing a robust budget are crucial steps to ensure timely payments and avoid accumulating additional interest. This section will Artikel effective strategies for managing your student loans and provide resources to support you throughout the repayment process.

Budgeting and Managing Student Loan Debt

Creating a realistic budget is the cornerstone of effective student loan management. This involves carefully tracking your income and expenses to identify areas where you can save and allocate funds towards your loan payments. Consider using budgeting apps or spreadsheets to monitor your spending and ensure you stay on track. A crucial element is prioritizing your loan payments alongside essential living expenses like rent, utilities, and groceries. Failing to account for these payments can lead to missed payments and penalties. Prioritizing these payments over discretionary spending (such as eating out or entertainment) can ensure timely payments.

Staying Organized and Avoiding Late Payments

Maintaining organized records of your loan details, including interest rates, repayment schedules, and payment due dates, is vital. Setting up automatic payments is a highly effective method for preventing late payments. This ensures consistent and timely payments, preventing late fees and negative impacts on your credit score. Many loan servicers offer online portals where you can access your account information, track payments, and make payments directly. Utilize these resources to maintain a clear overview of your loan status and upcoming payment deadlines. Consider setting reminders on your calendar or phone to ensure you never miss a payment.

Resources for Students Struggling with Loan Repayment

Numerous resources are available to assist students facing difficulties with loan repayment. Your loan servicer is a primary point of contact; they can provide information on repayment plans, deferment options, and forbearance programs. Additionally, many non-profit organizations and government agencies offer free financial counseling and guidance. These services can help you create a personalized repayment plan, explore options for reducing your monthly payments, and navigate the complexities of student loan management. They can also help you consolidate your loans or explore income-driven repayment plans. Furthermore, some employers offer student loan repayment assistance programs as an employee benefit.

Sample Budget Incorporating Student Loan Payments

This sample budget demonstrates how to incorporate student loan payments into your monthly finances. Remember to adjust the figures based on your individual income and expenses.

| Income | Amount |

|---|---|

| Monthly Salary | $3000 |

| Expenses | Amount |

| Rent | $1000 |

| Utilities | $200 |

| Groceries | $300 |

| Transportation | $150 |

| Student Loan Payment | $350 |

| Other Expenses (Entertainment, Savings, etc.) | $1000 |

| Total Expenses | $3000 |

Note: This is a simplified example. Your actual budget will need to reflect your specific income and expenses. It’s crucial to track your spending carefully and adjust your budget as needed.

Potential Challenges and Solutions

Securing and managing subsidized student loans can present several hurdles for students. Understanding these potential challenges and having proactive solutions in place can significantly reduce stress and improve the overall loan experience. This section Artikels common difficulties and provides practical strategies to overcome them.

Common Application Challenges

The application process for subsidized student loans can be complex and time-consuming. Students may encounter difficulties completing the Free Application for Federal Student Aid (FAFSA), gathering required documentation, or understanding the various loan terms and conditions. Furthermore, navigating the intricacies of different loan programs and eligibility requirements can be overwhelming.

Solutions for Application Difficulties

| Challenge | Solution | Example |

|---|---|---|

| Difficulty completing the FAFSA | Utilize the FAFSA website’s help resources, seek assistance from your school’s financial aid office, or consult a financial aid advisor. | Many colleges offer workshops or one-on-one sessions to guide students through the FAFSA process. Contacting your school’s financial aid office is a good first step. |

| Gathering required documentation | Organize all necessary documents well in advance of the application deadline. Create a checklist to ensure you have everything needed. | Keep tax returns, social security numbers, and parent information readily available. A well-organized binder or digital folder can be helpful. |

| Understanding loan terms and conditions | Carefully read all loan documents and ask questions if anything is unclear. Consult with a financial aid advisor or counselor. | Don’t hesitate to contact the lender directly or seek clarification from your school’s financial aid office if you are unsure about any terms. |

| Navigating different loan programs | Research different loan programs available and compare their terms and conditions. Consider your financial needs and long-term goals. | Compare interest rates, repayment options, and loan fees for different federal and private loan programs before making a decision. |

Common Loan Management Challenges

Once loans are obtained, managing them effectively becomes crucial. This includes understanding repayment schedules, interest accrual, and avoiding delinquency. Students may struggle with budgeting, prioritizing loan payments, or understanding the long-term financial implications of their loan debt.

Solutions for Loan Management Difficulties

| Challenge | Solution | Example |

|---|---|---|

| Difficulty budgeting and prioritizing loan payments | Create a realistic budget that includes all expenses and allocates funds for loan payments. Consider using budgeting apps or tools. | Use a spreadsheet or budgeting app to track income and expenses, and prioritize loan payments alongside essential living costs. |

| Understanding interest accrual | Learn how interest is calculated and how it impacts the total amount owed. Explore options to minimize interest. | Understand the difference between subsidized and unsubsidized loans and how interest accrues during different periods. |

| Avoiding delinquency | Set up automatic payments to avoid missed payments. Contact your lender immediately if you anticipate difficulty making a payment. | Automatic payments ensure timely payments, minimizing late fees and negative impacts on your credit score. |

| Understanding long-term financial implications | Create a long-term financial plan that includes loan repayment. Consider seeking advice from a financial advisor. | Develop a realistic repayment plan that considers your post-graduation income and financial goals. Seek professional advice if needed. |

Alternatives to Subsidized Loans

Securing a subsidized student loan is a significant step towards financing your education, but it’s not the only avenue. Exploring alternative funding options can significantly reduce your reliance on loans and potentially lower your overall debt burden. Understanding the strengths and weaknesses of each option allows for a more informed financial strategy.

Subsidized loans, while helpful, come with the eventual responsibility of repayment, including interest accumulation after the grace period. Other financial aid options, like scholarships and grants, offer funding without the same repayment obligations. This section will compare and contrast subsidized loans with these alternatives, highlighting their respective benefits and drawbacks to help you make the best choice for your financial situation.

Comparison of Subsidized Loans with Scholarships and Grants

Scholarships and grants represent non-repayable forms of financial aid, unlike subsidized loans. Scholarships are typically awarded based on merit, while grants are often need-based. Both can significantly reduce the amount of money you need to borrow. However, securing scholarships and grants can be competitive and require diligent research and application.

| Funding Option | Pros | Cons | Examples of How to Secure Funding |

|---|---|---|---|

| Subsidized Loan | Relatively easy to obtain; government-backed; interest does not accrue while in school (under certain conditions). | Requires repayment with interest; contributes to overall student debt. | Apply through the FAFSA (Free Application for Federal Student Aid). |

| Scholarship | Free money; does not need to be repaid; can be based on merit, talent, or need. | Competitive; requires extensive research and application; availability varies. | Search online databases like Fastweb or Scholarship America; apply for scholarships offered by colleges, universities, professional organizations, and private companies. |

| Grant | Free money; does not need to be repaid; typically based on financial need. | Limited availability; highly competitive; requires demonstrating financial need through the FAFSA. | Apply through the FAFSA; explore grants offered by state and local governments, colleges, and private foundations. |

| Work-Study | Earns money to help pay for education; often subsidized by the government; provides valuable work experience. | Requires time commitment; may limit academic focus; income may not cover all educational expenses. | Apply through the FAFSA; contact the financial aid office at your college or university. |

Exploring and Securing Alternative Funding Sources

Beyond federal aid, various alternative funding sources exist. These options can supplement loans, scholarships, and grants, providing a more comprehensive financial plan. Proactive exploration and strategic application are key to securing these funds.

For example, many community organizations and local businesses offer scholarships or grants targeted towards specific demographics or fields of study. Furthermore, some employers offer tuition reimbursement programs, providing financial assistance for employees pursuing further education. Thorough research and networking are crucial in uncovering these opportunities. Creating a detailed budget and exploring crowdfunding platforms can also provide supplementary funding. Finally, carefully considering part-time employment options during the academic year or during breaks can contribute towards covering educational costs.

Closing Notes

Successfully navigating the world of subsidized student loans requires careful planning and a thorough understanding of the process. By understanding your eligibility, completing the application diligently, and selecting a suitable repayment plan, you can leverage this valuable resource to fund your education. Remember to explore all available options and seek assistance when needed to ensure a smooth and successful journey towards achieving your academic goals. Proactive planning and informed decision-making are key to managing your student loan debt effectively and responsibly.

Common Queries

What is the difference between subsidized and unsubsidized loans?

With subsidized loans, the government pays the interest while you’re in school (under certain conditions). Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I lose my subsidized loan eligibility?

Yes, eligibility depends on factors like income and enrollment status. Changes in these circumstances can affect your eligibility.

What happens if I don’t repay my student loan?

Failure to repay can lead to negative consequences, including damage to your credit score, wage garnishment, and potential legal action.

How can I appeal a loan denial?

Contact the financial aid office at your school to understand the appeals process and provide any additional documentation that may support your application.