Navigating the complexities of student loan repayment can feel overwhelming, especially when unexpected life events arise. Deferred student loans offer a potential lifeline, providing temporary relief from monthly payments. This guide unravels the intricacies of securing a deferment, outlining the various programs available, the application process, and the long-term implications. Understanding these nuances empowers you to make informed decisions about your financial future.

From identifying eligible programs and gathering necessary documentation to navigating the application process and maintaining your deferred status, we’ll cover every step. We’ll also explore the potential impact on your credit score and long-term financial health, equipping you with the knowledge to manage your student loans effectively, both during and after the deferment period. Ultimately, this guide aims to empower you to take control of your student loan debt and chart a path towards financial stability.

Understanding Deferred Student Loan Programs

Deferring student loan payments can provide crucial financial breathing room during periods of hardship or career transition. Several programs offer this option, each with its own set of eligibility criteria and implications. Understanding these differences is key to making informed decisions about your financial future.

Types of Deferred Student Loan Programs

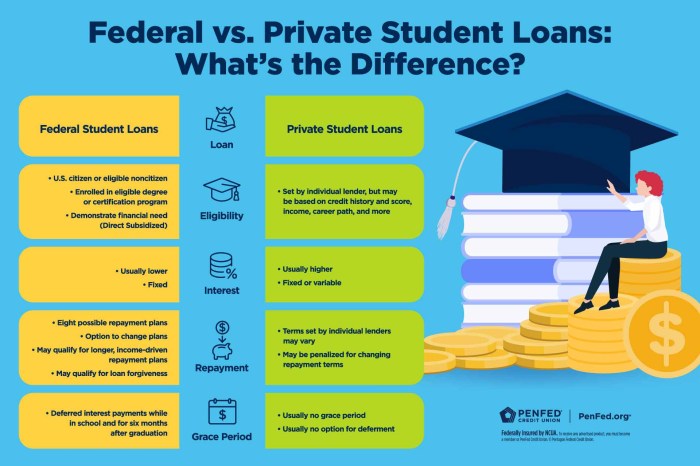

Several types of deferment options exist, primarily categorized by the reason for deferment. These include economic hardship deferments, in-school deferments, and unemployment deferments. The specific programs and their availability depend on the type of loan (federal or private) and the lender.

Eligibility Requirements for Deferred Student Loan Programs

Eligibility requirements vary depending on the specific program and lender. Generally, federal student loan deferments require documentation proving the qualifying circumstance, such as unemployment verification or proof of enrollment in school. Private loan deferments often have stricter requirements and may necessitate negotiation with the lender. Providing accurate and complete documentation is essential for a successful application.

Comparison of Benefits and Drawbacks of Deferred Student Loan Programs

While deferment offers temporary relief from loan payments, it’s crucial to understand the trade-offs. A primary benefit is the immediate reduction in monthly financial burden. However, interest typically continues to accrue during the deferment period, increasing the total loan amount owed upon repayment. Furthermore, some deferment options may have limitations on the total deferment period. Careful consideration of the long-term implications is vital before opting for deferment.

Key Features of Deferred Student Loan Programs

| Program Type | Eligibility | Benefits | Drawbacks |

|---|---|---|---|

| Federal In-School Deferment | Enrollment at least half-time in an eligible educational program. | No payments during enrollment; maintains good standing with loan servicer. | Interest may accrue (unless subsidized loan); length of deferment limited to period of enrollment. |

| Federal Economic Hardship Deferment | Demonstrated financial hardship (e.g., unemployment, low income). Documentation required. | Temporary relief from payments; potentially avoids default. | Interest accrues; requires documentation and approval; deferment period limitations apply. |

| Private Loan Deferment | Varies widely depending on lender; may require specific documentation and negotiation. | Temporary relief from payments; specific terms vary by lender. | Interest typically accrues; may impact credit score; stricter eligibility criteria than federal programs. |

Repayment After Deferment

Successfully navigating a student loan deferment period is a significant step, but understanding the repayment process afterward is equally crucial. The transition from deferment back to repayment requires careful planning and a clear understanding of available options to ensure a manageable and timely repayment strategy.

The end of your deferment period triggers the resumption of your loan payments. Several repayment plans are typically available, each with its own set of terms and implications for your monthly payment amount and overall repayment timeline. Choosing the right plan depends on your individual financial circumstances and long-term goals.

Available Repayment Plans

After the deferment period concludes, borrowers typically have access to several standard repayment plans. These include Standard Repayment, Extended Repayment, Graduated Repayment, and Income-Driven Repayment (IDR) plans. The Standard Repayment plan involves fixed monthly payments over a 10-year period. The Extended Repayment plan stretches payments over a longer period, typically 25 years, resulting in lower monthly payments but higher overall interest paid. Graduated Repayment starts with lower monthly payments that gradually increase over time, while IDR plans (such as Income-Based Repayment, Pay As You Earn, and Revised Pay As You Earn) base monthly payments on your income and family size, offering potentially lower payments but potentially longer repayment periods.

Comparing Repayment Plans

The choice between repayment plans involves a trade-off between monthly payment affordability and the total interest paid over the life of the loan. For instance, a Standard Repayment plan offers a shorter repayment period, minimizing total interest paid, but may result in higher monthly payments. Conversely, an IDR plan offers lower monthly payments but extends the repayment period significantly, leading to a higher total interest paid. Extended Repayment sits somewhere in between, offering a balance between affordability and total repayment cost. Carefully weighing these factors is crucial in selecting the most suitable plan.

Transitioning from Deferment to Repayment

The transition from deferment to repayment usually involves receiving a notification from your loan servicer a few months before the deferment period ends. This notification will Artikel the repayment options available and provide information on how to choose a plan and make your first payment. It’s vital to proactively contact your loan servicer well in advance to discuss your options and ensure a smooth transition. Failure to do so could result in late payment fees and negatively impact your credit score. You will need to update your contact information with your loan servicer to ensure timely communication.

Calculating Monthly Payments

Calculating monthly payments can be done using online calculators provided by your loan servicer or through various financial websites. These calculators typically require the loan principal, interest rate, and loan term (repayment period) as input. For example, a $20,000 loan with a 5% interest rate and a 10-year repayment period (Standard Repayment) might result in a monthly payment of approximately $212. However, the same loan on a 25-year Extended Repayment plan could result in a monthly payment of around $110, though the total interest paid would be substantially higher. Remember that these are just examples, and the actual amount will vary depending on the specific terms of your loan. It is crucial to use an online loan calculator that incorporates your specific loan details for an accurate estimate.

Illustrative Examples of Deferred Loan Scenarios

Understanding when deferment is a beneficial strategy and when it might prove detrimental is crucial for effective student loan management. The following scenarios illustrate the potential advantages and disadvantages of deferring student loan payments.

Beneficial Deferment Scenario: Career Transition and Financial Hardship

Imagine Sarah, a recent graduate with $30,000 in student loan debt at a 6% interest rate. She secured a job in her field but was laid off six months later due to unforeseen economic downturn. Unable to find comparable employment immediately, Sarah experienced significant financial hardship, with monthly expenses exceeding her income. Seeking deferment allowed her to temporarily suspend her loan payments for 12 months. During this period, she actively sought new employment, ultimately securing a higher-paying position. While interest still accrued during the deferment period (approximately $1,000), this cost was significantly less than the potential consequences of defaulting on her loans, which could have resulted in damaged credit and additional fees. The deferment provided her the breathing room needed to stabilize her finances and ultimately improve her long-term financial outlook. She resumed payments after securing her new job, confident in her ability to manage her debt responsibly.

Detrimental Deferment Scenario: Unnecessary Delay in Repayment

Consider David, who graduated with $25,000 in student loans at a 4% interest rate. He had a stable job with a comfortable income, but he chose to defer his loans for two years because he wanted to travel extensively. While he enjoyed his travels, the deferment period cost him approximately $2,000 in accumulated interest. This interest, compounded over time, could have been significantly reduced or avoided had he begun making payments promptly. Moreover, the two years of deferred payments extended the overall repayment period, potentially increasing the total interest paid over the life of the loan. In David’s case, the perceived benefits of deferment were outweighed by the financial cost of delaying repayment. Had he prioritized consistent loan repayments, he could have significantly reduced his overall debt burden and potentially saved thousands of dollars in interest.

Outcome Summary

Securing a deferred student loan can provide much-needed financial breathing room, but it’s crucial to understand the implications. This guide has Artikeld the various programs, application processes, and long-term considerations to help you make informed decisions. Remember to carefully weigh the benefits and drawbacks, explore all available options, and seek professional guidance when needed. Proactive planning and a clear understanding of your loan situation are key to navigating the complexities of student loan repayment and achieving long-term financial well-being.

Detailed FAQs

What happens to interest during a student loan deferment?

Interest typically continues to accrue on subsidized and unsubsidized loans during deferment, increasing the total loan amount. However, for subsidized loans, the government may pay the interest during certain deferment periods.

Can I defer my student loans more than once?

The number of times you can defer your loans depends on the loan type and lender. Some programs allow multiple deferments, while others have limitations. Check your loan servicer’s website for specific details.

What if my deferment request is denied?

If your deferment request is denied, you can usually appeal the decision. Carefully review the reason for denial and provide any additional documentation that may support your case. Contact your loan servicer to understand the appeals process.

How does deferment affect my credit score?

While deferment itself doesn’t directly negatively impact your credit score, consistently missing payments after the deferment period ends will. Maintaining good financial habits throughout the process is crucial for protecting your credit.