Navigating the complexities of student loan repayment can feel overwhelming, especially when unexpected life events arise. Understanding your options for managing your student loan debt is crucial for maintaining financial stability. This guide provides a comprehensive overview of how to obtain a student loan deferment, outlining eligibility requirements, different deferment programs, the application process, and the potential long-term implications. We’ll clarify the distinctions between deferment and forbearance, helping you make informed decisions about your financial future.

From exploring the various types of deferments available to understanding the necessary documentation and application procedures, we aim to equip you with the knowledge needed to successfully navigate the deferment process. We’ll also address common misconceptions and provide clear examples to illustrate the potential benefits and drawbacks of deferring your student loan payments.

Eligibility for Student Loan Deferment

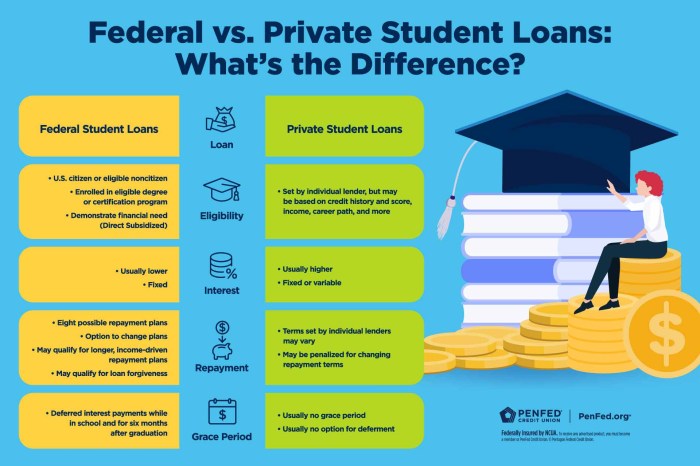

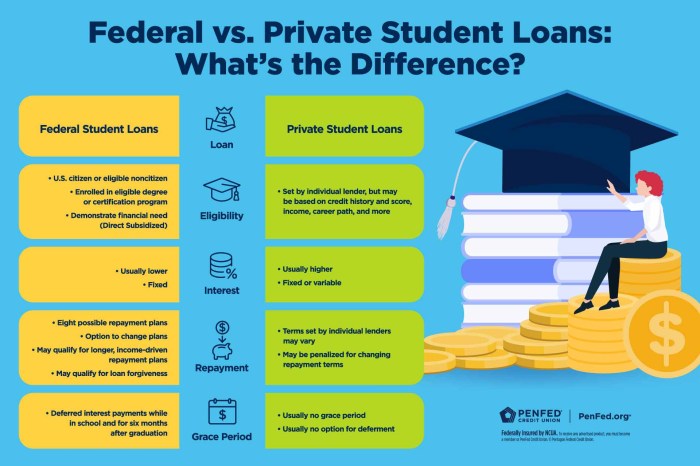

Securing a student loan deferment can provide crucial financial relief during challenging times. Understanding the eligibility requirements is the first step in accessing this assistance. This section details the criteria for various deferment programs, highlighting key differences between federal and private loans.

General Requirements for Deferment

Generally, to be eligible for a deferment, you must demonstrate a valid reason for needing a temporary suspension of your loan payments. This reason typically involves financial hardship or other extenuating circumstances. Specific documentation may be required to support your claim, such as proof of unemployment, enrollment in a qualifying program, or evidence of a medical emergency. The exact requirements can vary depending on the type of loan and the deferment program you are applying for. It is important to carefully review the terms and conditions of your loan agreement and the specific deferment program guidelines.

Income Requirements for Deferment Programs

Income-based deferment programs often have specific income thresholds. These thresholds are designed to ensure that only borrowers facing genuine financial hardship are eligible for the deferment. The exact income limits vary depending on the program and your family size. For example, an income-driven repayment (IDR) plan might require your total annual income to fall below a certain percentage of the poverty guideline for your family size and state of residence. These guidelines are updated annually, so it’s essential to check the most current information from the relevant government agency or loan servicer. Failing to meet these income requirements will result in ineligibility for the specific income-driven deferment program.

Comparison of Deferment Eligibility Across Loan Types

Federal student loans generally offer a wider range of deferment options than private student loans. Federal loan deferments are often more readily available and have more flexible eligibility criteria. Private loan deferments, on the other hand, are usually more restrictive, with stricter requirements and fewer available programs. Some private lenders may offer deferments only under specific circumstances, such as documented unemployment or medical emergencies, and may require extensive documentation to support the deferment request. The terms and conditions associated with private loan deferments can also be less favorable, potentially resulting in higher interest accrual during the deferment period.

Comparison of Deferment Programs and Eligibility Criteria

The following table compares several common deferment programs and their eligibility criteria. Remember that these are general guidelines, and specific requirements may vary. Always check with your loan servicer for the most up-to-date and accurate information.

| Deferment Program | Loan Type | Eligibility Criteria | Income Requirements |

|---|---|---|---|

| Economic Hardship Deferment | Federal | Demonstrated financial hardship (e.g., unemployment, significant medical expenses) | Typically requires documentation of income below a certain threshold; varies by program. |

| In-School Deferment | Federal | Enrollment at least half-time in a degree or certificate program | Not applicable |

| Unemployment Deferment | Federal | Unemployment and active job search | Documentation of unemployment is required. |

| Forbearance (Not a Deferment, but a similar option) | Federal & Private | Financial hardship or inability to make payments | May or may not have specific income requirements depending on the lender. |

Applying for Student Loan Deferment

Applying for a student loan deferment involves navigating the specific requirements and procedures set by your loan servicer. The process can vary depending on the type of deferment you qualify for and your loan provider. This section will guide you through the general steps involved. Remember to always refer to your loan servicer’s website for the most up-to-date and accurate information.

The Application Process for Different Deferment Types

The application process generally involves completing a form provided by your loan servicer and submitting it along with the necessary supporting documentation. The specific forms and required documents differ based on the type of deferment you are seeking. For instance, an in-school deferment might require proof of enrollment, while an unemployment deferment would need verification of unemployment status. Each loan servicer may also have slightly different processes.

Step-by-Step Instructions for Completing Application Forms

Generally, the process involves these steps: 1. Obtain the necessary application form from your loan servicer’s website. 2. Carefully read all instructions and complete each section accurately and completely. 3. Gather all required supporting documentation. 4. Submit the completed application and documentation to your loan servicer through their preferred method (online portal, mail, fax). 5. Track the status of your application and follow up if necessary. Remember that failing to provide accurate information or necessary documentation can delay the processing of your application.

Necessary Documentation for Each Program

The documentation required varies depending on the type of deferment. For example, an in-school deferment typically requires proof of enrollment, such as a copy of your class schedule or enrollment verification form from your school. An unemployment deferment usually requires documentation proving your unemployment status, such as a letter from your employer or proof of unemployment benefits. For economic hardship deferments, you may need to provide financial documentation such as tax returns or bank statements to demonstrate your financial need. Always check with your loan servicer for their specific requirements.

A Flowchart Illustrating the Application Process

The flowchart would begin with a box labeled “Determine Deferment Eligibility”. This would lead to two branches: “Eligible” and “Not Eligible”. The “Not Eligible” branch would end. The “Eligible” branch would lead to a box labeled “Obtain Application Form from Servicer”. This would lead to “Complete Application Form and Gather Supporting Documentation”. This would lead to “Submit Application and Documentation”. This would lead to “Servicer Reviews Application”. This would branch into two: “Application Approved” and “Application Denied”. “Application Approved” would lead to “Deferment Granted”. “Application Denied” would lead to a box labeled “Review Denial Reasons and Resubmit if Necessary”. This would loop back to “Servicer Reviews Application”. The entire flowchart visually represents the sequential steps involved in the deferment application process.

Potential Impacts of Deferment

Deferring your student loans can offer temporary relief, but it’s crucial to understand the potential long-term consequences. While pausing payments might seem beneficial in the short term, it can impact your credit score, increase your overall loan cost, and affect your future borrowing capacity. Let’s explore these impacts in detail.

Credit History Impact

Deferment is generally reported to credit bureaus, and while it won’t show as a missed payment, it can still negatively affect your credit score. Lenders view deferment as a sign of potential financial instability, potentially lowering your credit score. The extent of the impact varies depending on your overall credit history and the length of the deferment period. A short deferment may have a minimal effect, while a prolonged period could significantly impact your score, making it harder to obtain loans or credit cards in the future with favorable interest rates. For example, a borrower with an excellent credit score might see a slight dip, whereas someone with a fair score could experience a more substantial drop.

Long-Term Financial Implications

The most significant long-term implication of deferment is the accumulation of interest. While payments are paused, interest typically continues to accrue on both subsidized and unsubsidized loans. This means that your loan balance will grow larger over time, leading to a higher total repayment amount. For instance, a $20,000 loan with a 5% interest rate deferred for two years could accumulate several thousand dollars in interest, extending the repayment period and increasing the total cost. This can have substantial long-term financial repercussions, potentially delaying major life goals such as homeownership or retirement savings.

Loan Repayment Plan Effects

Deferment can affect your repayment plan in several ways. Depending on your loan type and servicer, the deferment period might reset your repayment schedule, potentially extending the length of your repayment plan and increasing the total amount you pay. Some repayment plans, such as income-driven repayment plans, may require recalculation after a deferment period, which could result in higher monthly payments in the future. This can create uncertainty and make budgeting more challenging.

Future Borrowing Impact

A history of loan deferments can negatively impact your ability to secure future loans. Lenders often view deferments as an indicator of financial risk, making it harder to qualify for loans, such as mortgages or auto loans, in the future. Even if you qualify, you might face higher interest rates due to your perceived increased risk. For example, someone with multiple deferments on their student loans might find it more difficult to secure a mortgage with a favorable interest rate compared to a borrower with a clean credit history.

Conclusion

Successfully navigating the student loan deferment process requires careful planning and a thorough understanding of your eligibility and the various programs available. By carefully considering your individual circumstances and weighing the potential short-term and long-term consequences, you can make informed decisions that align with your financial goals. Remember to utilize the resources provided to ensure you have the support needed throughout the process. Proactive management of your student loans empowers you to take control of your financial future.

Question & Answer Hub

What happens to interest during a deferment?

The answer depends on the type of loan. For subsidized federal loans, the government usually pays the interest during deferment. Unsubsidized federal loans and private loans typically accrue interest during deferment, which is added to the principal balance.

How long can I defer my student loans?

The maximum deferment period varies depending on the loan type and the specific deferment program. Some programs allow for a limited period, while others may offer extensions under certain circumstances. Check with your loan servicer for details.

Will deferring my loans affect my credit score?

While a deferment itself doesn’t directly impact your credit score as much as a delinquency, it can indirectly affect it if you’re unable to resume payments after the deferment period ends. It’s best to have a repayment plan in place before your deferment ends.

Can I defer my loans multiple times?

The possibility of multiple deferments depends on your loan type and the specific program. There may be limits on the total number of deferments allowed, or the duration of deferments allowed over your loan lifetime. Consult your loan servicer for specific details.