Navigating the complexities of student loan debt and its impact on your credit report can feel overwhelming. Understanding how student loans are reported, the potential consequences of late payments, and the strategies for effective debt management are crucial steps towards achieving financial health. This guide provides a clear path to understanding and improving your credit score in relation to your student loans, empowering you to take control of your financial future.

From exploring different repayment plans and disputing inaccurate information to understanding the long-term effects of various repayment strategies and preventing future credit issues, we’ll equip you with the knowledge and tools needed to navigate this process successfully. We will delve into practical steps, providing actionable advice and resources to help you manage your student loan debt effectively and improve your credit standing.

Understanding Student Loan Reporting on Credit Reports

Student loans significantly impact your credit report and score, influencing your ability to secure future loans, rent an apartment, or even get a job. Understanding how these loans are reported is crucial for responsible financial management. This section details the process, various loan types, and the effects of payment history on your credit.

Student loan information appears on your credit report after the lender reports your loan details to the three major credit bureaus (Equifax, Experian, and TransUnion). This reporting typically begins once your loan is disbursed and includes key information like your loan amount, repayment terms, and most importantly, your payment history. Consistent, on-time payments positively impact your credit, while late or missed payments can severely damage your score.

Types of Student Loans and Reporting

Several types of student loans exist, each handled slightly differently in credit reporting. Federal student loans, including subsidized and unsubsidized Stafford Loans, PLUS loans, and Perkins Loans, are all reported to the credit bureaus. Private student loans, offered by banks and other financial institutions, also appear on your credit report. The reporting process is generally the same across loan types; however, the terms and conditions of each loan can affect the impact on your credit score. For example, a private loan with a higher interest rate might appear differently from a federal loan with a lower rate, although the impact of on-time payments remains consistent.

Negative Impacts of Student Loan Information on Credit Scores

Negative student loan information, such as late or missed payments, significantly impacts your credit score. Even one missed payment can negatively affect your creditworthiness, leading to a lower credit score. This lower score can make it harder to qualify for future loans, mortgages, or even credit cards, often resulting in higher interest rates on any new credit you obtain. Repeated late payments can severely damage your credit, potentially leading to collection actions by the lender. For instance, a consistently poor payment history could result in your credit score dropping by 100 points or more, significantly limiting your financial options.

Impact of Payment History on Credit Scores

The following table illustrates the impact of on-time versus late payments on credit scores. The exact impact can vary depending on your overall credit history and other factors, but it provides a general idea of the potential consequences.

| Loan Type | Payment Status | Credit Score Impact | Potential Consequences |

|---|---|---|---|

| Federal Stafford Loan | On-time payments | Positive impact; score improvement | Improved creditworthiness, access to better loan terms |

| Federal Stafford Loan | Late payments (30+ days) | Negative impact; score decrease (potentially significant) | Higher interest rates on future loans, difficulty securing credit |

| Private Student Loan | On-time payments | Positive impact; score improvement | Improved creditworthiness, potential for lower interest rates on future loans |

| Private Student Loan | Missed payments (90+ days) | Severe negative impact; significant score decrease | Account sent to collections, potential damage to credit history for 7 years or more |

Strategies for Managing Student Loan Debt

Successfully navigating student loan repayment requires a proactive and organized approach. Effective management involves understanding your budget, prioritizing payments, and exploring various repayment options to find the best fit for your financial situation. This section Artikels key strategies to help you effectively manage your student loan debt.

Budgeting and Managing Student Loan Payments

Creating a realistic monthly budget is crucial for managing student loan payments. This involves tracking all income and expenses to identify areas where you can save money and allocate funds towards your loans. Consider using budgeting apps or spreadsheets to categorize your spending and visualize your financial picture. A detailed budget allows you to prioritize essential expenses like housing, food, and transportation, while also ensuring you make consistent loan payments. Remember to factor in unexpected expenses and build an emergency fund to avoid falling behind on payments.

Prioritizing Student Loan Payments Alongside Other Financial Obligations

Balancing student loan payments with other financial obligations, such as rent, utilities, and credit card debt, can be challenging. A helpful strategy is to prioritize high-interest debts first, as these accrue interest more quickly. For example, if you have a credit card with a high interest rate alongside your student loans, focus on paying down the credit card debt aggressively before allocating extra funds to your student loans. Consider using the debt snowball or debt avalanche methods to strategically prioritize your debt repayment. Consistent and timely payments on all debts will help maintain a positive credit score.

Benefits of Different Repayment Plans

Several repayment plans are available to help borrowers manage their student loan debt. Income-driven repayment (IDR) plans, for example, base your monthly payment on your income and family size. This can significantly reduce your monthly payment amount, making it more manageable, especially during periods of lower income. Other plans, such as standard repayment and extended repayment, offer different terms and payment schedules. Exploring these options and understanding their implications can help you choose a plan that aligns with your financial circumstances and long-term goals. For example, an IDR plan might extend the repayment period, resulting in paying more interest over the life of the loan, but it offers lower monthly payments that may be more sustainable.

Sample Monthly Budget Incorporating Student Loan Payments

Below is a sample monthly budget illustrating how to allocate funds effectively, including student loan payments. Remember, this is a template; you need to adjust it based on your individual income and expenses.

| Category | Amount |

|---|---|

| Housing (Rent/Mortgage) | $1000 |

| Food | $500 |

| Transportation | $200 |

| Utilities | $150 |

| Student Loan Payment | $300 |

| Savings | $100 |

| Other Expenses | $250 |

| Total Expenses | $2500 |

| Monthly Income | $3000 |

| Remaining Amount | $500 |

This budget shows a surplus of $500, which could be used to pay down high-interest debt faster, increase savings, or contribute to an emergency fund. It’s important to track your spending regularly and adjust your budget as needed to ensure you remain on track with your financial goals.

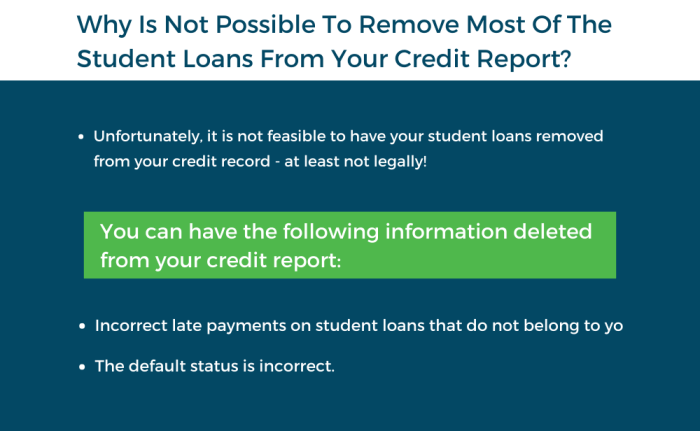

Dispute Incorrect Information on Credit Reports

Incorrect information on your credit report, particularly regarding student loans, can significantly impact your credit score and financial opportunities. Addressing these errors promptly is crucial for maintaining a healthy credit profile. This section Artikels the steps involved in disputing inaccurate student loan information with credit bureaus and loan servicers.

Disputing inaccurate information requires a methodical approach, combining careful documentation with clear communication. It’s important to understand that the process may take time and persistence, but successfully correcting errors can have a lasting positive effect on your credit health.

Steps Involved in Disputing Inaccurate Student Loan Information

The process of disputing inaccurate student loan information involves several key steps, beginning with gathering evidence and concluding with monitoring the resolution. Careful attention to detail at each stage increases the likelihood of a successful outcome.

- Gather Evidence: Collect all relevant documentation, including your credit report showing the error, your loan agreement(s), payment history statements, and any other evidence that contradicts the inaccurate information. This could include proof of on-time payments, loan consolidation documentation, or correspondence with your loan servicer.

- Identify the Errors: Carefully review your credit report and pinpoint the specific inaccuracies related to your student loans. Note the incorrect account numbers, balances, payment statuses, or dates.

- Contact the Credit Bureaus: Submit a dispute directly to each of the three major credit bureaus (Equifax, Experian, and TransUnion) using their online dispute portals or by mail. Each bureau has its own process, so be sure to follow their specific instructions.

- Contact Your Loan Servicer: Simultaneously, contact your student loan servicer to inform them of the inaccuracies and request a correction. Providing them with the same documentation you submitted to the credit bureaus will strengthen your case.

- Follow Up: After submitting your disputes, monitor your credit reports for updates. If the errors aren’t corrected within a reasonable timeframe (usually 30-45 days), follow up with both the credit bureaus and your loan servicer.

Contacting Credit Bureaus and Loan Servicers to Correct Errors

Effectively communicating with credit bureaus and loan servicers is paramount to resolving inaccuracies. Using a combination of written correspondence and phone calls can expedite the process.

When contacting the credit bureaus, utilize their online dispute portals whenever possible, as this often provides a record of your communication. If using mail, send your dispute via certified mail with return receipt requested to ensure proof of delivery. For your loan servicer, both phone calls and written correspondence can be beneficial, allowing you to clarify details and follow up on progress.

Documentation Needed to Support a Dispute

Supporting your dispute with comprehensive documentation significantly increases the chances of a successful resolution. The more evidence you can provide to back up your claims, the stronger your case will be.

- Copy of your Credit Report: Highlight the specific inaccurate information.

- Loan Documents: Include your loan agreements, promissory notes, and any other official loan documents.

- Payment History: Provide statements showing your on-time payments or evidence of any payment arrangements.

- Correspondence with Loan Servicer: Include any emails, letters, or other communications related to the disputed information.

- Supporting Evidence: This could include bank statements, canceled checks, or other documentation that supports your claims.

Sample Dispute Letter Template

A well-written dispute letter clearly Artikels the inaccuracies and provides supporting evidence. This template can be adapted to fit your specific situation.

To: [Credit Bureau Name]

From: [Your Name]

Address: [Your Address]

Phone: [Your Phone Number]

Account Number: [Your Account Number]Date: [Date]

Subject: Dispute of Inaccurate Student Loan Information

Dear [Credit Bureau Name],

This letter is to formally dispute inaccurate information on my credit report concerning my student loan account. The incorrect information is [Specifically describe the error, including account number, balance, payment status, etc.].

Attached is documentation to support my claim, including [List the attached documents]. I request that you investigate this matter thoroughly and correct the inaccuracies on my credit report. I look forward to your prompt response and resolution of this issue.

Sincerely,

[Your Signature]

[Your Typed Name]

Impact of Student Loan Debt on Credit Score

Student loan debt significantly impacts your credit score, both positively and negatively, depending on how you manage it. While responsible repayment demonstrates creditworthiness, high debt burdens can negatively affect your credit profile and limit your financial opportunities. Understanding this dynamic is crucial for long-term financial health.

Student loan debt’s impact on your credit score is multifaceted and extends beyond the simple presence of the debt itself. The type of loan, repayment strategy, and overall debt management all play a role. Failing to make payments can severely damage your credit, while consistent on-time payments contribute positively. Let’s examine the specifics.

Long-Term Impact of Different Student Loan Repayment Strategies on Credit Scores

Different repayment strategies have varying long-term impacts on credit scores. For example, consistently making on-time payments under an income-driven repayment plan (IDR) will gradually improve your credit history, even if the monthly payment is relatively low. Conversely, defaulting on loans, regardless of the repayment plan, will severely damage your credit score, making it harder to obtain loans or credit cards in the future. Aggressive repayment strategies, such as paying more than the minimum amount each month, can lead to faster debt reduction and a quicker improvement in credit scores. However, it’s crucial to maintain a balance between aggressive repayment and managing other financial obligations.

Effect of a High Debt-to-Income Ratio on Creditworthiness

A high debt-to-income (DTI) ratio, which compares your monthly debt payments to your gross monthly income, is a significant factor in creditworthiness. Lenders use DTI to assess your ability to manage debt. A high DTI ratio (generally above 43%) suggests a higher risk to lenders, as a larger portion of your income is already committed to debt payments. This can result in higher interest rates, loan denials, or difficulty securing favorable credit terms. For instance, someone with a high student loan payment relative to their income may find it harder to qualify for a mortgage or auto loan, even if their payment history is excellent.

Tips for Improving Credit Scores After Paying Off Student Loans

Paying off student loans is a significant achievement that can positively impact your credit score. However, simply eliminating the debt isn’t the end of the process. To further improve your credit score, consider these steps: Maintain a low credit utilization ratio (the amount of credit you use compared to your total available credit). Continue making all other credit payments on time. Monitor your credit report regularly for errors and take steps to correct them. Consider diversifying your credit mix by responsibly using other credit products, such as credit cards, while keeping utilization low.

Factors Affecting Credit Scores

Understanding how different factors influence your credit score is vital for proactive credit management. The following points highlight key elements:

- Payment History: This is the most significant factor, accounting for approximately 35% of your credit score. Consistent on-time payments are crucial. Late or missed payments can significantly lower your score.

- Amounts Owed: This refers to your credit utilization ratio, representing the percentage of available credit you’re using. Keeping this ratio low (ideally below 30%) is beneficial.

- Length of Credit History: The longer your credit history, the better. A longer history demonstrates a consistent track record of responsible credit management.

Exploring Options for Loan Consolidation or Refinancing

Student loan debt can feel overwhelming, but exploring options like consolidation and refinancing can potentially simplify repayment and even save you money. These strategies involve combining multiple loans into one or securing a new loan with better terms. Understanding the nuances of each is crucial for making informed decisions.

Consolidating or refinancing your student loans can offer several advantages, but it’s important to weigh them against potential drawbacks. Choosing the right path depends heavily on your individual financial situation and loan characteristics.

Loan Consolidation: Combining Multiple Loans

Loan consolidation combines multiple federal student loans into a single, new federal loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount. However, it doesn’t necessarily lower your overall interest rate, and it might extend the repayment period, ultimately costing you more in interest over the life of the loan.

Eligibility Requirements for Federal Loan Consolidation

To be eligible for federal loan consolidation, you must have eligible federal student loans. This typically includes Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans. You’ll need to apply through the Federal Student Aid website, providing necessary documentation like your loan details and Social Security number.

Refinancing Student Loans: Securing a New Loan with Better Terms

Refinancing involves replacing your existing student loans with a new private loan from a bank or credit union. This offers the potential for a lower interest rate, a shorter repayment term, or both. However, refinancing federal loans means losing access to federal repayment plans and protections, such as income-driven repayment options and forbearance.

Eligibility Requirements for Student Loan Refinancing

Eligibility for refinancing depends on the lender. Generally, you’ll need a good credit score (typically above 670), a stable income, and a low debt-to-income ratio. Lenders will assess your creditworthiness to determine your eligibility and interest rate. Some lenders may require a co-signer if your credit history is less than ideal.

Comparing Consolidation and Refinancing Options

The table below summarizes the key differences between loan consolidation and refinancing:

| Feature | Consolidation (Federal) | Refinancing (Private) |

|---|---|---|

| Loan Type | Federal | Private |

| Interest Rate | Weighted average of existing loans (may not change) | Potentially lower than existing rates |

| Repayment Terms | May be longer, potentially increasing total interest paid | Potentially shorter, reducing total interest paid |

| Government Benefits | Retains access to federal repayment plans and protections | Loses access to federal repayment plans and protections |

| Eligibility | Requires eligible federal loans | Requires good credit and stable income |

Calculating Potential Savings from Refinancing: A Hypothetical Example

Let’s assume you have $30,000 in student loan debt with an interest rate of 7%. Your monthly payment is approximately $300. If you refinance to a 5% interest rate and a 10-year repayment term, your monthly payment might decrease to approximately $290. While the monthly savings are modest ($10), over the life of the loan, you would save approximately $2,000 in interest. This is a simplified example; actual savings will vary based on individual loan terms and interest rates.

Savings = Total Interest Paid with Original Loan – Total Interest Paid with Refinanced Loan

Preventing Future Credit Report Issues

Maintaining a clean credit report regarding student loans requires proactive measures throughout the loan lifecycle. By understanding the potential pitfalls and implementing preventative strategies, borrowers can significantly reduce the risk of negative marks impacting their creditworthiness. This involves diligent financial management, consistent communication with lenders, and a keen awareness of your credit report’s accuracy.

Preventing future negative marks on your credit report related to student loans necessitates a multi-pronged approach encompassing responsible borrowing habits, effective communication, and proactive credit monitoring. Neglecting these aspects can lead to late payments, defaults, and other damaging entries, significantly impacting your credit score and future borrowing capabilities.

Maintaining Open Communication with Loan Servicers

Regular and proactive communication with your loan servicer is crucial. This involves promptly responding to any correspondence, keeping your contact information updated, and actively participating in any loan modification or hardship programs if necessary. Ignoring communication can lead to missed payments and negatively impact your credit report. Consider setting reminders for payment due dates and proactively contacting your servicer to discuss any potential challenges in making timely payments. This open dialogue can help prevent misunderstandings and potential negative consequences.

Best Practices for Managing Finances and Avoiding Future Debt

Effective financial management is key to avoiding future debt issues. This includes creating and sticking to a realistic budget, tracking expenses, and prioritizing debt repayment. Consider using budgeting apps or spreadsheets to monitor income and expenses effectively. Prioritize high-interest debts first, such as credit card debt, while maintaining consistent payments on your student loans. Developing good saving habits, even small amounts regularly, can provide a financial cushion for unexpected expenses and reduce the reliance on additional borrowing. Avoid accumulating unnecessary debt by carefully considering large purchases and prioritizing needs over wants.

Visual Representation of Student Loan Lifecycle and Credit Impact

Imagine a timeline depicting the student loan journey. The first stage, “Origination,” shows the loan application and approval, with the loan amount initially having no impact on the credit report. The next phase, “Repayment,” begins after graduation or the end of the grace period. Consistent on-time payments during this period build positive credit history, represented by a gradually increasing credit score on the timeline. However, missed or late payments during this phase lead to negative marks on the credit report, indicated by a drop in the credit score. Finally, “Loan Closure” represents the successful repayment of the loan, resulting in the removal of the loan’s payment history from the credit report after a set period (but the positive history remains). The timeline visually demonstrates the direct correlation between responsible repayment and a healthy credit score.

Closure

Successfully managing student loan debt and its reflection on your credit report requires a proactive and informed approach. By understanding the reporting process, employing effective debt management strategies, and actively addressing any inaccuracies, you can significantly improve your financial well-being. Remember, proactive communication with lenders and credit bureaus is key to maintaining a healthy credit profile and achieving long-term financial success. This guide serves as a foundation for your journey towards a brighter financial future, free from the unnecessary burdens of negative credit impacts from student loans.

FAQ Summary

Can I remove paid-off student loans from my credit report?

While paid student loans will remain on your report for seven years from the date of your last payment, they will generally no longer negatively impact your score after they are paid in full.

What if my student loan information is incorrect?

Immediately contact your loan servicer and the credit bureaus to dispute the inaccurate information. Provide documentation to support your claim.

How long does it take to dispute inaccurate information?

The process can take several weeks or even months. Be persistent and follow up on your dispute.

Will a bankruptcy discharge remove student loans from my credit report?

While bankruptcy can impact how student loans are handled, they typically remain on your credit report, even after discharge. The impact on your credit score will be different.