Navigating the complexities of student loan repayment can be daunting. Understanding your loan status and the potential consequences of default is crucial for maintaining your financial well-being. This guide provides a clear and concise path to determining if your student loan is in default, outlining the steps to take should you find yourself in this situation, and offering proactive strategies to prevent default altogether. We’ll explore both federal and private loans, highlighting key differences and resources available to borrowers.

From understanding the definition of default and its ramifications to effectively communicating with your loan servicer and interpreting your loan documents, this guide equips you with the knowledge and tools to manage your student loans responsibly. We’ll delve into the various methods for checking your loan status, explore options available if your loan is in default, and offer practical advice for preventing future issues. Ultimately, our goal is to empower you to take control of your student loan journey.

Understanding Student Loan Default

Student loan default is a serious financial situation that can have lasting negative consequences. It occurs when you fail to make your student loan payments for a specific period, typically 90 days or more, and the lender considers the loan uncollectible. Understanding what constitutes default and its repercussions is crucial for responsible loan management.

Student loan default is simply failing to make your required payments on time for a prolonged period, leading to your loan being considered delinquent and ultimately in default. This isn’t a minor oversight; it has significant and long-term ramifications.

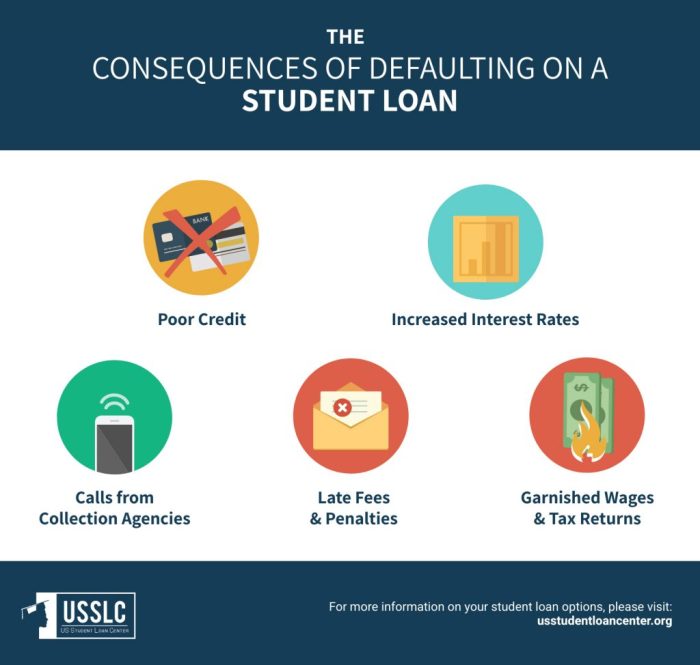

Consequences of Student Loan Default

The consequences of student loan default are severe and far-reaching. They include damage to your credit score, impacting your ability to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of your paycheck is automatically seized to repay the debt, is a possibility. The government may also levy tax refunds to cover the defaulted amount. Furthermore, default can lead to difficulty obtaining federal financial aid in the future, and some professional licenses may be revoked or suspended. In extreme cases, it could even affect your ability to travel internationally. The overall impact significantly hinders your financial stability and future opportunities.

Determining Federal vs. Private Student Loans

Knowing whether your loan is federally or privately held is critical because they are handled differently in the event of default. To determine this, carefully examine your loan documents. Federal loans usually have clear identifiers such as the lender’s name (e.g., Sallie Mae, Navient, Nelnet – but note that these companies service loans, not all of which are federal). The loan documents themselves will typically state explicitly whether it’s a federal loan program like Direct Loan, Perkins Loan, or FFEL Program loan. If the paperwork doesn’t clearly state the loan’s type, contact the lender directly to inquire. Private loans are typically issued by banks, credit unions, or other private financial institutions, and will clearly indicate this in the loan agreement.

Actions Leading to Student Loan Default

Several actions can contribute to student loan default. For instance, consistently missing loan payments, even if only by a few days, can quickly lead to delinquency and eventually default. Failure to consolidate multiple loans into a single, more manageable payment plan can also increase the risk. Significant life events, such as job loss or unexpected medical expenses, can make payments challenging, but failing to communicate with your lender to explore options like forbearance or deferment significantly increases the chances of default. Finally, simply ignoring your loan and failing to contact the lender regarding repayment challenges greatly increases the likelihood of ending up in default. For example, someone losing their job and failing to contact their lender about their inability to pay, or someone who deliberately avoids making payments, might end up in default.

Checking Your Loan Status

Knowing your student loan status is crucial to avoid default. There are several reliable ways to access this information, ensuring you’re aware of your repayment obligations and any potential issues. Proactive monitoring is key to maintaining a healthy financial standing.

Regularly checking your loan status allows you to identify problems early, such as missed payments or accruing interest, before they escalate into a default. This proactive approach empowers you to take corrective action and prevent serious financial consequences.

Accessing Your Loan Status Online

You can check your federal student loan status through the National Student Loan Data System (NSLDS) and through your loan servicer’s website. The NSLDS provides a centralized view of your federal student aid, while your servicer’s website offers specific details about your individual loans. Both methods are generally quick and easy to use. Remember to keep your login credentials secure.

Loan Servicer Information

The following table lists some common loan servicers, their websites, contact information, and the typical method for checking your loan status. Note that loan servicers can change, so always verify the current information on the official websites.

| Loan Servicer | Website URL | Contact Information | Status Check Method |

|---|---|---|---|

| FedLoan Servicing | www.fedloanservicing.com | (Information varies, check website) | Online account access |

| Navient | www.navient.com | (Information varies, check website) | Online account access |

| Great Lakes | www.greatlakes.org | (Information varies, check website) | Online account access |

| Nelnet | www.nelnet.com | (Information varies, check website) | Online account access |

Information Found on a Loan Status Report

A typical loan status report will include your loan balance, payment history, interest rate, repayment plan, and the current status of your loan (e.g., current, in deferment, forbearance, or default). It will also show your scheduled payment dates and amounts. Understanding this information is crucial for managing your debt effectively.

Indicators of a Defaulted Loan

Several indicators might signal that your student loan is in default. These include:

- Collection agencies contacting you.

- Wage garnishment or tax refund offset.

- Negative marks on your credit report.

- Your loan servicer notifying you of default status.

- Difficulty accessing your loan account online due to account suspension.

If you encounter any of these situations, it’s imperative to contact your loan servicer immediately to discuss your options and explore potential solutions.

Communication with Your Loan Servicer

Effective communication with your student loan servicer is crucial for understanding your loan status and avoiding default. Knowing how to contact them properly and what information to request can significantly simplify the process and ensure your concerns are addressed promptly. This section will guide you through best practices for communicating with your servicer.

Contacting Your Loan Servicer

Locating your loan servicer’s contact information is the first step. This information is typically found on your loan documents or the National Student Loan Data System (NSLDS) website. Once you have their contact information, you can reach them via phone, mail, or email. Phone calls often provide the quickest response, but email allows for a documented record of your communication. Mail should be used for sending important documents requiring physical confirmation of receipt. Always use the official contact channels provided by your servicer to avoid scams.

Questions to Ask Your Loan Servicer

Asking the right questions is vital for obtaining accurate information about your loan status. These questions should directly address your concerns and aim to clarify any ambiguities. Examples include: “What is the current status of my student loans?”, “What is my current loan balance?”, “What is my repayment schedule?”, and “What are my options if I am struggling to make payments?”. Be specific in your questions to avoid misunderstandings and ensure you receive the information you need.

Documenting Communication

Maintaining thorough records of all communication with your loan servicer is essential. This includes keeping copies of all emails, letters, and notes from phone calls. Document the date, time, and the name of the representative you spoke with. If you sent a letter, retain a copy of the letter with proof of mailing (such as a certified mail receipt). This documentation can prove invaluable if disputes arise later. Consider creating a dedicated folder or spreadsheet to organize your records for easy access.

Sample Email Template

Subject: Inquiry Regarding Student Loan Status – [Your Loan ID Number]

Dear [Loan Servicer Name],

I am writing to inquire about the status of my student loan(s), account number [Your Loan ID Number]. I would appreciate it if you could provide me with the following information:

* My current loan balance

* My current repayment schedule

* The status of my payments (current, delinquent, etc.)

Thank you for your time and assistance.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Understanding Your Loan Documents

Your student loan documents are crucial for understanding your repayment status and identifying potential problems. Carefully reviewing these documents regularly can help you avoid default and ensure you’re on track with your payments. Understanding the information contained within these documents empowers you to proactively manage your loans.

Loan documents, including statements and notices from your loan servicer, provide a detailed history of your loan. This history includes your payment activity, outstanding balance, interest accrual, and any fees or penalties applied. Learning to interpret this information effectively allows you to monitor your account accurately and address any discrepancies promptly.

Key Information in Loan Documents

This section details the critical information to locate within your loan documents. This information allows you to track your payment history and overall loan status effectively.

Your loan documents should clearly show your loan balance, payment due dates, the amount of each payment, and your payment history. Look for details on any late payments, missed payments, and the resulting penalties or fees. You should also find information regarding the interest rate, loan type, and the total amount you owe. Compare this information to your own records to ensure accuracy.

Interpreting Servicer Statements and Notices

Loan servicers regularly send statements and notices detailing your account activity. Understanding how to interpret these communications is essential for proactive loan management.

Statements typically summarize your account activity for a specific period, showing your beginning balance, payments made, interest accrued, and ending balance. Notices, on the other hand, often communicate important updates or changes to your loan, such as changes in your servicer, payment plan modifications, or potential delinquency. Pay close attention to the dates and specific details Artikeld in both statements and notices.

Organizing Loan Documents

Organizing your loan documents is crucial for efficient tracking and easy access to important information.

A dedicated file (physical or digital) specifically for your student loan documents is recommended. Consider creating separate folders for each loan if you have multiple ones. Within these files, organize documents chronologically, with the most recent documents readily accessible. You can also utilize a spreadsheet or a personal finance software to digitally track your loan information and key dates, providing an easily accessible overview of your financial standing.

Potential Red Flags Indicating Default

Several indicators within your loan documents might signal an impending or existing default. Recognizing these red flags is critical for timely intervention.

- Multiple missed payments indicated on your statements.

- Notices from your servicer regarding delinquency or impending default.

- Significant increase in your loan balance due to unpaid interest and fees.

- Communication from a debt collection agency regarding your student loan.

- A notation on your credit report indicating your loan is in default.

Dealing with a Potential Default

Discovering your student loan is in default is a serious situation, but proactive steps can mitigate the damage. Immediate action is crucial to prevent further negative consequences. Understanding your options and acting decisively is key to regaining control of your financial situation.

The first step upon discovering a default is to confirm the information. Review your loan documents and contact your loan servicer directly. Obtain official confirmation of the default status and the exact amount owed. This verification ensures you’re addressing the correct issue and prevents unnecessary actions based on misinformation.

Loan Rehabilitation

Loan rehabilitation is a process that can remove the default status from your student loan. It involves making nine on-time payments within 20 months. These payments don’t have to be the full amount due; they can be smaller, agreed-upon amounts. Successful completion of rehabilitation removes the default from your credit report and restores your eligibility for federal student loan programs, such as deferment or forbearance. However, this process does not erase the past-due amounts; you are still responsible for the full loan balance.

Loan Consolidation

Consolidating your federal student loans combines multiple loans into a single loan with a new interest rate and repayment plan. While consolidation itself doesn’t remove a default, it can make managing your debt easier and potentially lead to a more manageable monthly payment. Consolidation may be a viable option if you qualify and can afford the new monthly payments. The benefits include simplified repayment and potentially a lower interest rate (depending on the current interest rates), but drawbacks include extending the repayment period, which might increase the total interest paid over the life of the loan.

Impact on Credit Score and Future Borrowing

A student loan default has a severe negative impact on your credit score. It can significantly lower your credit score, making it difficult to obtain credit cards, loans, or even rent an apartment. The impact can persist for seven years or more, making it challenging to secure favorable interest rates or terms on future borrowing. For example, a default could increase your interest rate on a mortgage by several percentage points, significantly increasing the total cost of your home. It’s also important to note that lenders often consider defaults when assessing applications for future credit, potentially leading to rejection. The negative impact can extend beyond financial matters; it might affect your ability to secure employment opportunities where credit checks are performed.

Preventing Student Loan Default

Avoiding student loan default requires proactive planning and consistent effort. By implementing effective strategies and maintaining open communication with your loan servicer, you can significantly reduce the risk of default and secure your financial future. This section Artikels practical steps to achieve this goal.

Effective Strategies for Avoiding Student Loan Default

Proactive management of your student loans is crucial to prevent default. This involves understanding your repayment options, creating a realistic budget, and consistently making your payments on time. Ignoring your loans or failing to understand your repayment plan significantly increases your risk of default. Regularly reviewing your loan details and staying informed about any changes in your repayment plan are essential aspects of responsible loan management.

Budgeting for Student Loan Payments

Creating a detailed budget is fundamental to successful student loan repayment. A budget helps you track your income and expenses, ensuring you allocate sufficient funds for your loan payments. Failing to budget appropriately can lead to missed payments and eventual default. A well-structured budget allows you to prioritize essential expenses and allocate the remaining funds towards your student loan payments.

| Income | Amount |

|---|---|

| Monthly Salary | $3000 |

| Part-time Job | $500 |

| Total Monthly Income | $3500 |

| Expenses | Amount |

| Rent/Mortgage | $1000 |

| Utilities | $200 |

| Groceries | $400 |

| Transportation | $300 |

| Student Loan Payment | $500 |

| Other Expenses | $100 |

| Total Monthly Expenses | $2500 |

| Monthly Savings | $1000 |

This example budget shows a monthly income of $3500 and expenses of $2500, leaving $1000 for savings. Adjusting this template to reflect your own income and expenses is vital. Remember to include all sources of income and all regular expenses, even small ones. Regularly review and update your budget to reflect any changes in your financial situation.

Proactive Communication with Your Loan Servicer

Maintaining open and consistent communication with your loan servicer is vital. This includes promptly reporting any changes to your income, employment status, or contact information. Regularly checking your loan account online and reviewing your statements will help you identify any potential issues early on. Don’t hesitate to contact your servicer if you anticipate difficulties making your payments; they may offer options like deferment or forbearance. Proactive communication allows your servicer to work with you to find solutions before the situation escalates into default.

Creating a Plan for Consistent Loan Payments

Developing a comprehensive repayment plan is essential for preventing default. This involves determining your repayment strategy (e.g., standard, extended, income-driven), setting up automatic payments, and tracking your progress regularly. Consider exploring options like refinancing to secure a lower interest rate or consolidate multiple loans into a single payment. A well-defined plan provides structure and accountability, helping you stay on track and avoid missed payments. Regularly review and adjust your plan as needed to reflect changes in your circumstances. For example, if you experience a job loss, contact your servicer immediately to explore available options.

Closing Summary

Successfully managing your student loans requires proactive engagement and a clear understanding of your rights and responsibilities. By utilizing the resources and strategies Artikeld in this guide, you can confidently monitor your loan status, effectively communicate with your servicer, and take appropriate action should your loan enter default. Remember, proactive communication and careful financial planning are key to avoiding default and securing your financial future. Taking control of your student loan repayment now will prevent future financial hardship.

Query Resolution

What happens if I ignore my student loan payments?

Ignoring payments will eventually lead to default, resulting in damage to your credit score, wage garnishment, and potential tax refund offset.

Can I get my student loans forgiven?

Loan forgiveness programs exist, but eligibility requirements are strict and vary depending on the loan type and program. Research programs like Public Service Loan Forgiveness (PSLF) to see if you qualify.

What is loan rehabilitation?

Loan rehabilitation is a process that allows you to bring your defaulted federal student loan back into good standing by making a series of on-time payments.

How often should I check my loan status?

It’s advisable to check your loan status at least once a year, or more frequently if you anticipate any payment difficulties.

Where can I find my loan servicer’s contact information?

Your loan servicer’s contact information is typically found on your monthly statements and on the NSLDS website.