Navigating the complex world of student loan repayment can feel overwhelming, but with a strategic approach, you can gain control of your finances and pave the way for a brighter financial future. This guide provides a comprehensive roadmap, covering everything from understanding your loan terms to exploring various repayment options and seeking professional assistance when needed. We’ll delve into practical strategies and resources to help you effectively manage your student loan debt and achieve your financial goals.

From identifying the different types of loans and their associated costs to crafting a personalized repayment plan, this guide will empower you to make informed decisions. We will explore various repayment strategies, including income-driven plans and loan consolidation, helping you find the best fit for your unique circumstances. Moreover, we’ll discuss the importance of building good credit and the potential consequences of defaulting, emphasizing proactive financial management.

Understanding Your Student Loans

Navigating the world of student loans can feel overwhelming, but understanding the basics is the first step towards effective management. This section will clarify the different types of loans available, the details typically found in loan agreements, and how to access your loan information online. Armed with this knowledge, you can make informed decisions about repayment and long-term financial planning.

Federal vs. Private Student Loans

Federal and private student loans differ significantly in their origin, terms, and benefits. Federal loans are offered by the U.S. government and generally offer more borrower protections, such as income-driven repayment plans and loan forgiveness programs. Private loans, on the other hand, come from banks, credit unions, or other private lenders. They often have stricter eligibility requirements and may lack the same borrower protections as federal loans. Choosing between federal and private loans depends on your individual financial circumstances and creditworthiness.

Terms and Conditions of a Student Loan Agreement

A student loan agreement is a legally binding contract outlining the terms and conditions of your loan. Key details typically included are the principal loan amount, the interest rate (fixed or variable), the repayment schedule (including the length of the repayment period and monthly payment amount), and any fees associated with the loan. Understanding these terms is crucial for managing your debt effectively. Carefully review your loan agreement to understand your obligations and rights as a borrower. Failure to understand these terms could lead to unforeseen financial difficulties.

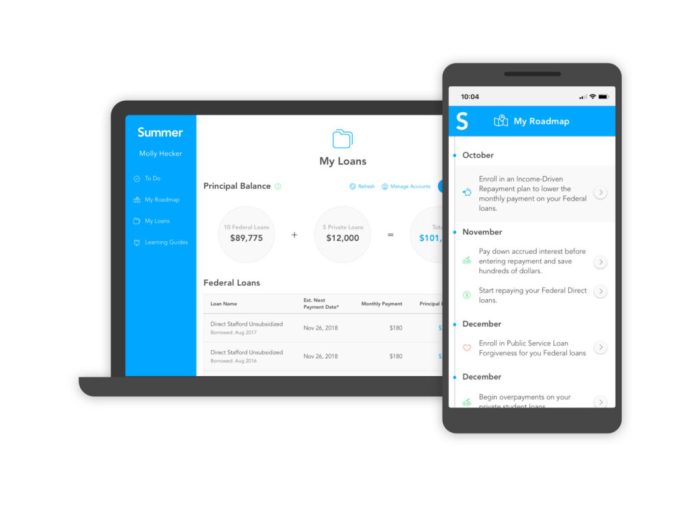

Accessing Your Loan Details Online

Accessing your loan details online is typically straightforward. For federal loans, you can use the National Student Loan Data System (NSLDS) website. This website provides a centralized view of your federal student loan information, including loan balances, interest rates, and repayment schedules. For private loans, you’ll need to log in to your lender’s online portal. The specific steps may vary depending on your lender, but generally involve creating an account and providing your loan information. Regularly checking your online accounts ensures you stay informed about your loan status and upcoming payments.

Comparison of Student Loan Types

| Loan Type | Interest Rate | Repayment Options | Borrower Protections |

|---|---|---|---|

| Federal Subsidized Loan | Variable; set by the government | Standard, graduated, income-driven | Deferment, forbearance, income-driven repayment |

| Federal Unsubsidized Loan | Variable; set by the government | Standard, graduated, income-driven | Forbearance, income-driven repayment |

| Federal PLUS Loan | Variable; set by the government | Standard, graduated, income-driven | Forbearance, income-driven repayment (with limitations) |

| Private Student Loan | Variable or fixed; set by the lender | Varies by lender; often standard repayment only | Limited; varies by lender |

Creating a Repayment Plan

Successfully navigating student loan repayment requires a well-structured plan. This involves understanding your budget, prioritizing loans strategically, and selecting a repayment plan that aligns with your financial circumstances and long-term goals. Failing to plan can lead to missed payments, accruing interest, and ultimately, a longer repayment period.

Budgeting for Student Loan Payments

Creating a realistic budget is crucial for successful student loan repayment. This involves meticulously tracking all income and expenses to determine how much you can comfortably allocate towards your loans each month. Consider using budgeting apps or spreadsheets to monitor your spending habits and identify areas where you can potentially cut back. Remember to factor in essential living expenses like rent, utilities, food, and transportation, as well as any other financial obligations, such as credit card debt or car payments. Allocating a specific amount each month for loan repayment, even if it’s a small amount, helps build a consistent repayment habit. For example, if your monthly income is $3000 and your essential expenses total $2000, you could realistically allocate $500 towards student loan payments, leaving $500 for savings or other discretionary spending.

Prioritizing Loan Payments

Prioritizing loan payments effectively can save you money on interest in the long run. Generally, it’s most advantageous to focus on loans with the highest interest rates first, as these accrue debt more quickly. This strategy, known as the avalanche method, minimizes the total interest paid over the life of the loans. Alternatively, the snowball method involves paying off the smallest loan first, regardless of interest rate, to build momentum and maintain motivation. Both methods have their merits; the avalanche method is financially optimal, while the snowball method can be psychologically beneficial. For example, if you have one loan with a 7% interest rate and another with a 4% interest rate, the avalanche method would prioritize the 7% loan.

Repayment Plan Options

Several repayment plans are available, each with its own benefits and drawbacks. The standard repayment plan typically involves fixed monthly payments over a 10-year period. While straightforward, it may result in higher monthly payments compared to other options. Extended repayment plans stretch payments over a longer period (up to 25 years), lowering monthly payments but increasing the total interest paid. Income-driven repayment plans (IDR) adjust monthly payments based on your income and family size. These plans can significantly lower monthly payments, particularly during periods of lower income, but may extend the repayment period considerably and potentially lead to higher overall interest payments. Choosing the right plan depends on your individual financial situation and long-term goals.

Long-Term Financial Implications

The choice of repayment strategy significantly impacts your long-term financial health. A standard repayment plan, while resulting in higher monthly payments, minimizes the total interest paid and allows you to become debt-free sooner. Extended repayment plans offer lower monthly payments but increase the total interest paid and extend the debt burden. IDR plans provide flexibility and affordability but may lead to significantly higher overall interest payments and a longer repayment timeline. For example, a $50,000 loan with a 6% interest rate repaid over 10 years (standard plan) will cost significantly less in total interest than the same loan repaid over 25 years (extended plan). Careful consideration of these long-term implications is essential before selecting a repayment plan.

Exploring Repayment Options

Choosing the right repayment strategy is crucial for effectively managing your student loans and minimizing long-term costs. Several options exist, each with its own set of eligibility requirements and potential benefits. Understanding these options empowers you to make informed decisions aligned with your financial situation and goals.

Income-Driven Repayment Plan Application

Applying for an income-driven repayment (IDR) plan involves completing a detailed application form provided by your loan servicer. This application typically requires you to provide information about your income, family size, and other relevant financial details. The specific forms and processes vary slightly depending on your loan type (federal or private) and your servicer. Once submitted, your servicer will review your application and determine your eligibility. If approved, your monthly payment will be recalculated based on your income and family size, ensuring affordability. The process generally takes several weeks, so it’s advisable to apply well in advance of your desired start date.

Eligibility Requirements for Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, offering the potential to eliminate a portion or all of your student loan debt. Eligibility criteria vary significantly depending on the specific program. For instance, Public Service Loan Forgiveness (PSLF) requires 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Teacher Loan Forgiveness programs have their own set of requirements, often including a commitment to teaching in a low-income school for a specified number of years. Careful review of each program’s specific requirements is essential before applying, as failing to meet all criteria will result in ineligibility.

Loan Consolidation: Simplifying Repayment

Loan consolidation combines multiple student loans into a single loan with a new interest rate and repayment schedule. This simplifies repayment by reducing the number of monthly payments and potentially lowering your overall monthly payment amount. However, it’s important to note that consolidation may not always result in a lower interest rate, especially if you have loans with low interest rates already. For example, consolidating several loans with interest rates ranging from 4% to 7% might result in a new loan with an interest rate around 6%. While this simplifies management, it’s crucial to carefully compare the terms of the consolidated loan to your existing loans before proceeding. This process typically involves completing an application with your loan servicer.

Refinancing Student Loans: A Step-by-Step Guide

Refinancing involves replacing your existing student loans with a new loan from a private lender. This can offer benefits such as a lower interest rate, a shorter repayment term, or both. However, refinancing federal loans with private lenders means losing access to federal repayment plans and forgiveness programs.

- Check your credit score: Lenders will review your credit history. A higher score generally leads to better interest rates.

- Shop around for lenders: Compare interest rates, fees, and repayment terms offered by various lenders.

- Pre-qualify for a loan: This allows you to see what rates you qualify for without impacting your credit score.

- Complete the application: Provide necessary documentation, such as proof of income and employment.

- Review and sign the loan documents: Carefully review all terms before signing.

- Make your first payment: Once the loan is disbursed, begin making your monthly payments on time.

For example, a borrower with a high credit score and stable income might be able to refinance their loans at a significantly lower interest rate, saving thousands of dollars over the life of the loan. Conversely, a borrower with a lower credit score might find that refinancing doesn’t offer significant advantages and could even result in higher interest rates.

Managing Your Finances

Successfully navigating student loan repayment requires a comprehensive approach to personal finance. This involves not only creating a repayment plan but also implementing effective strategies for saving money and building a strong financial foundation. Careful budgeting, mindful spending, and proactive credit management are crucial elements in achieving financial stability while managing your student loan debt.

Managing your finances effectively while repaying student loans demands a strategic approach. Prioritizing essential expenses and identifying areas where you can reduce spending are vital. This might involve tracking your spending habits, creating a realistic budget, and exploring opportunities to lower your monthly bills. For example, you might consider negotiating lower rates with service providers, switching to a more affordable phone plan, or reducing your entertainment spending. Simultaneously, increasing your income through a part-time job or freelancing can significantly accelerate your loan repayment process.

Strategies for Saving Money While Paying Off Student Loans

Saving money while tackling student loan debt requires discipline and planning. A well-structured budget is the cornerstone of this process. Start by listing all your monthly income and expenses. Identify non-essential spending categories where you can cut back. Consider automating savings by setting up regular transfers from your checking account to a savings account. Even small, consistent savings add up over time. For example, saving $50 a month translates to $600 a year, a significant contribution to your overall financial health. Additionally, explore opportunities to increase your income through side hustles or negotiating a raise at your current job.

Resources for Financial Counseling and Student Loan Assistance

Several resources can provide valuable support and guidance in managing your student loans and finances. The National Foundation for Credit Counseling (NFCC) offers free and low-cost financial counseling services, including assistance with budgeting, debt management, and credit counseling. Many universities and colleges also have financial aid offices that can provide guidance and resources to their alumni. The U.S. Department of Education’s website offers comprehensive information about federal student loan programs and repayment options. Finally, non-profit organizations like the Student Loan Borrower Assistance Project provide free legal aid to students struggling with their loans.

Building Good Credit While Managing Student Loan Debt

Paying your student loans on time and consistently is crucial for building a good credit score. A good credit score is essential for obtaining loans, mortgages, and credit cards with favorable interest rates in the future. Regularly checking your credit report for errors and understanding your credit utilization ratio can help maintain a positive credit history. A low credit utilization ratio (the amount of credit you use compared to your total available credit) contributes positively to your credit score. For example, using only 30% of your available credit is generally considered good credit management. Avoid opening multiple credit accounts simultaneously as this can negatively impact your score.

Consequences of Defaulting on Student Loans

Defaulting on your student loans can have severe consequences. These consequences can include wage garnishment, tax refund offset, damage to your credit score, and difficulty obtaining future loans. In addition, it can impact your ability to rent an apartment, secure a mortgage, or even obtain certain types of employment. The government can take legal action to recover the outstanding debt, including seizing assets. The long-term financial implications of default are substantial and can severely hinder your ability to achieve your financial goals. Understanding the potential consequences is crucial in motivating responsible loan management.

Understanding Additional Costs and Fees

Student loans, while crucial for accessing higher education, often come with associated costs beyond the principal loan amount. Understanding these fees is vital to effectively managing your debt and avoiding unexpected financial burdens. Failing to account for these additional costs can significantly impact your overall repayment burden.

Late Fees

Late fees are charged when a student loan payment is not received by the lender on or before the due date. These fees vary depending on the lender and the loan type, but they can range from a small percentage of the missed payment to a fixed dollar amount. Consistent and timely payments are the best way to avoid these charges. For example, setting up automatic payments directly from your bank account can help ensure you never miss a deadline. Furthermore, diligently tracking your due dates using a calendar or budgeting app is crucial for proactive payment management.

Origination Fees

Origination fees are charges levied by the lender to cover the administrative costs associated with processing your loan application. These fees are typically a percentage of the total loan amount and are deducted from the disbursed funds before you receive the money. For instance, a 1% origination fee on a $10,000 loan would result in a $100 fee, meaning you’d receive $9,900. While unavoidable, understanding these fees upfront allows you to factor them into your overall borrowing strategy. Choosing a lender with lower origination fees can potentially save you money in the long run.

Interest Capitalization

Interest capitalization is the process of adding accumulated interest to the principal loan balance. This typically occurs when your loan enters a grace period (a period after graduation before repayment begins) or if you defer or forbear your payments. The capitalized interest then accrues interest itself, leading to a larger overall loan balance and higher total repayment costs. Imagine a scenario where $1,000 in interest is capitalized. That $1,000 then becomes part of the principal, and future interest calculations will be based on the larger amount, leading to a snowball effect of increasing debt.

Illustrative Example of Loan Debt Growth

The following table illustrates how loan debt grows over time with different interest rates, assuming a starting loan balance of $10,000 and no additional payments made. This is a simplified illustration and does not account for compounding interest on a daily or monthly basis.

| Year | 5% Interest | 7% Interest | 10% Interest |

|—|—|—|—|

| 1 | $10,500 | $10,700 | $11,000 |

| 2 | $11,025 | $11,449 | $12,100 |

| 3 | $11,576 | $12,250 | $13,310 |

| 4 | $12,155 | $13,108 | $14,641 |

| 5 | $12,763 | $14,026 | $16,105 |

This simple illustration demonstrates the significant impact that even small differences in interest rates can have on the total amount owed over time. Higher interest rates dramatically increase the total cost of borrowing.

Seeking Professional Help

Navigating the complexities of student loan repayment can be overwhelming. While self-management is possible, seeking professional guidance can significantly improve your outcomes and reduce stress. A financial advisor specializing in student loan debt can provide personalized strategies and support, leading to a more efficient and less stressful repayment journey.

Professional help can be particularly beneficial when dealing with high debt loads, complex repayment plans, or unexpected financial challenges. Understanding when to seek assistance is crucial, as early intervention can prevent serious financial difficulties.

Qualifications of a Reputable Financial Advisor

A reputable financial advisor specializing in student loan debt should possess relevant certifications, such as a Certified Financial Planner (CFP) designation or a similar credential demonstrating expertise in personal finance. Experience working specifically with student loan debt is crucial, as the nuances of repayment plans and available options require specialized knowledge. Look for advisors with a proven track record and positive client testimonials. Transparency in fees and services is also a key indicator of professionalism. Avoid advisors who promise unrealistic results or charge exorbitant fees.

Resources for Finding Non-Profit Student Loan Counseling

Several non-profit organizations offer free or low-cost student loan counseling services. The National Foundation for Credit Counseling (NFCC) is a well-established organization with a network of certified credit counselors across the country. Similarly, many universities and community colleges provide free workshops and one-on-one counseling sessions for their alumni and students. The Federal Student Aid website (studentaid.gov) also provides a directory of approved student loan counselors. These resources can help you find reputable organizations that offer unbiased advice and support. Always verify the organization’s legitimacy and accreditation before engaging their services.

Benefits of Seeking Professional Guidance

Professional guidance offers several key advantages. A financial advisor can help you develop a personalized repayment plan tailored to your financial situation and goals. They can explain the intricacies of different repayment options, such as income-driven repayment plans or loan consolidation, and help you choose the best strategy for your circumstances. They can also provide guidance on budgeting, debt management techniques, and strategies for improving your credit score. Furthermore, a financial advisor can act as a buffer between you and your loan servicers, advocating for your rights and helping you navigate any disputes or challenges. This can significantly reduce stress and improve your overall financial well-being.

Determining Your Need for Professional Help

Several factors indicate a need for professional help. If you are struggling to make your monthly payments, feeling overwhelmed by your debt, or unsure about which repayment plan is best for you, seeking professional assistance is advisable. If you’ve experienced a significant life change, such as job loss or illness, that impacts your ability to repay your loans, professional guidance can be invaluable. Likewise, if you’re facing potential default or are unsure how to navigate the complexities of income-driven repayment plans, a financial advisor can provide crucial support and direction. Consider professional help as a proactive measure to secure your financial future and avoid potential pitfalls.

Ultimate Conclusion

Successfully managing student loans requires a proactive and informed approach. By understanding your loan terms, creating a realistic budget, exploring various repayment options, and seeking professional help when necessary, you can significantly reduce the stress and financial burden associated with student loan debt. Remember, taking control of your student loan repayment is an investment in your long-term financial well-being. With careful planning and consistent effort, you can achieve financial freedom and build a secure future.

Commonly Asked Questions

What happens if I miss a student loan payment?

Missing a payment can lead to late fees, damage your credit score, and potentially result in default, which has serious consequences.

Can I deduct student loan interest from my taxes?

Possibly. The rules change, so check current IRS guidelines for eligibility and limitations.

What is the difference between forbearance and deferment?

Forbearance temporarily suspends payments, but interest usually still accrues. Deferment postpones payments, and under certain circumstances, interest may be suspended as well.

How do I find a reputable financial advisor for student loans?

Look for certified financial planners (CFPs) or those with experience in student loan debt management. Check online reviews and verify their credentials.