Navigating the complexities of student loan repayment can feel daunting, but understanding the nuances of interest and employing effective strategies can significantly accelerate your journey to financial freedom. This guide provides a comprehensive roadmap, equipping you with the knowledge and tools to tackle your student loan debt effectively and efficiently.

From understanding different interest types and capitalization to exploring various repayment plans and budgeting techniques, we’ll delve into practical methods for minimizing interest accumulation and accelerating loan payoff. We’ll also cover strategies for increasing your income and seeking professional guidance when needed, ensuring a holistic approach to debt management.

Understanding Student Loan Interest

Understanding student loan interest is crucial for effective repayment planning. The interest accrued on your loans significantly impacts the total amount you’ll repay, potentially adding thousands of dollars to your overall debt. This section will clarify the various types of interest, how it compounds, and the factors influencing its calculation.

Types of Student Loan Interest

Student loans typically accrue either fixed or variable interest rates. Fixed interest rates remain constant throughout the loan’s life, offering predictability in monthly payments. Variable interest rates, however, fluctuate based on market indices like the LIBOR or prime rate, leading to potentially higher or lower payments over time. Understanding this difference is vital for budgeting and long-term financial planning. Some loans may also have a grace period, a time after graduation before interest begins to accrue. However, it’s important to note that interest may still accrue during the in-school period for some loan types, depending on the loan program.

Interest Capitalization

Interest capitalization occurs when accrued but unpaid interest is added to the principal loan balance. This increases the principal amount on which future interest is calculated, resulting in a larger total repayment amount. For example, if you have $10,000 in student loans with 5% interest and you don’t make payments during a grace period, the interest accrued during that period would be capitalized, increasing your principal balance. This means you’ll pay interest on a larger principal amount in the future, increasing the overall cost of your loan. The frequency of capitalization (e.g., annually, semiannually) varies depending on the loan type and lender. Understanding capitalization is key to minimizing the total cost of borrowing.

Factors Influencing Interest Rates

Several factors determine the interest rate you’ll receive on your student loans. These include your credit history (or lack thereof, in the case of many federal student loans), the type of loan (federal or private), the loan’s repayment term (longer terms often mean higher rates), and the current economic climate. For private loans, a higher credit score typically translates to a lower interest rate. Federal student loan rates are typically set by the government and are often lower than private loan rates. Market conditions also significantly impact variable interest rates. A rise in interest rates generally leads to higher payments for those with variable-rate loans.

Fixed vs. Variable Interest Rates

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Rate | Stays the same throughout the loan term | Fluctuates based on market indices |

| Predictability | Highly predictable monthly payments | Monthly payments can change |

| Risk | Lower risk of unexpected payment increases | Higher risk of unexpected payment increases or decreases |

| Long-Term Cost | Potentially higher overall cost if rates are higher at the time of loan origination than at other times | Potentially lower overall cost if rates fall during the loan term, but higher if they rise |

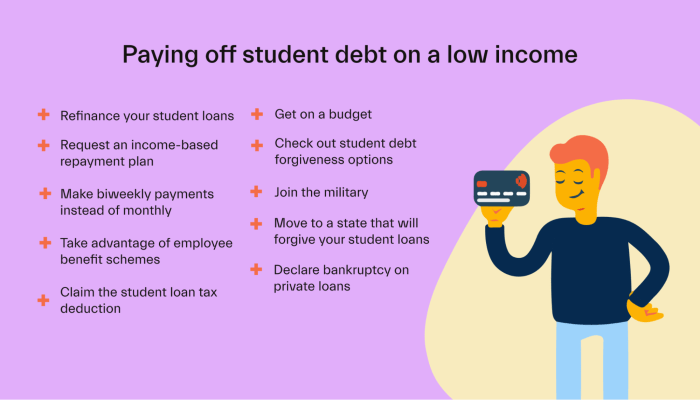

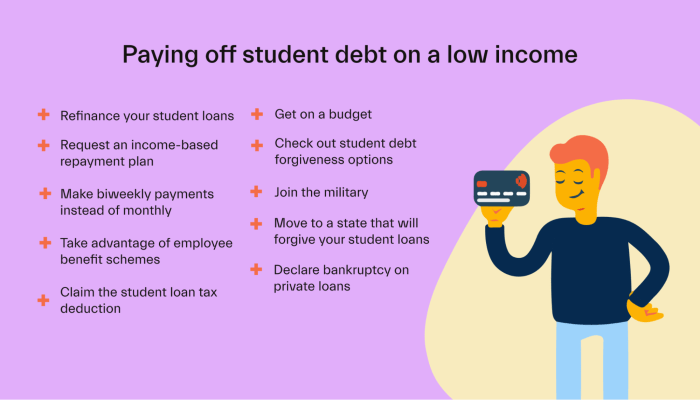

Strategies for Accelerated Repayment

Paying off student loans faster can significantly reduce the overall cost and free up your finances sooner. Several strategies exist to achieve this, ranging from choosing the right repayment plan to employing effective debt repayment methods. Understanding your options and proactively managing your debt is crucial for success.

Standard, Graduated, and Income-Driven Repayment Plans

Different repayment plans offer varying approaches to managing monthly payments. A standard repayment plan involves fixed monthly payments over a 10-year period. Graduated repayment plans start with lower payments that gradually increase over time. Income-driven repayment plans (IDR) base monthly payments on your income and family size, potentially extending the repayment period to 20 or 25 years.

Standard repayment plans offer the quickest payoff, minimizing total interest paid. However, the fixed payments might be challenging initially. Graduated plans offer lower initial payments, easing the financial burden in the early years but leading to higher payments and potentially more interest paid over the loan’s lifetime. IDR plans offer the lowest monthly payments, making them manageable for borrowers with lower incomes, but significantly extend the repayment period, leading to substantially higher total interest payments. The choice depends on your individual financial situation and priorities.

Snowball and Avalanche Methods for Debt Repayment

Two popular methods for tackling multiple debts are the snowball and avalanche methods. The snowball method involves paying off the smallest debt first, regardless of interest rate, providing psychological momentum. The avalanche method prioritizes paying off the debt with the highest interest rate first, minimizing the total interest paid.

The snowball method’s benefit is its motivational aspect; seeing quick wins can encourage continued effort. However, it may result in paying more interest overall. The avalanche method, while potentially saving money on interest, can be less motivating initially as the payoff process may take longer for smaller debts with lower interest rates. For example, if you have a $1,000 loan at 5% interest and a $5,000 loan at 10% interest, the avalanche method would focus on the $5,000 loan first to reduce the overall interest burden. The snowball method would tackle the $1,000 loan first for the psychological boost.

Refinancing Student Loans to Lower Interest Rates

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce the total interest paid and shorten the repayment period. To refinance, you’ll need to shop around for lenders offering competitive rates, check your credit score (a higher score generally leads to better rates), and gather necessary documentation (like proof of income and employment).

Before refinancing, carefully compare the terms and conditions of the new loan with your existing loans. Consider factors such as the interest rate, fees, and repayment period. It’s crucial to ensure that the new loan offers a significant improvement over your current loans to justify the refinancing process. For instance, refinancing from a 7% interest rate to a 4% interest rate could save thousands of dollars over the life of the loan. However, it’s important to remember that refinancing might not always be beneficial, particularly if you are already on a favorable repayment plan or have a low interest rate on your existing loans.

Budgeting and Financial Planning

Effectively managing your finances is crucial for successfully paying off student loans. A well-structured budget, combined with diligent expense tracking, allows you to allocate funds strategically towards loan repayment while maintaining a healthy financial life. This section will guide you through creating a budget that prioritizes loan repayment, offer tips for saving money, and explain the importance of an emergency fund.

Sample Budget Prioritizing Student Loan Repayment

A successful budget involves carefully tracking income and expenses to understand your spending habits and identify areas for improvement. The following example demonstrates a sample budget where student loan repayment is a priority. Remember, this is a template; your specific budget will depend on your individual income and expenses.

| Income | Amount |

|---|---|

| Net Monthly Salary | $3000 |

| Expenses | Amount |

| Student Loan Payment | $500 |

| Rent/Mortgage | $1000 |

| Utilities (Electricity, Water, Gas) | $200 |

| Groceries | $300 |

| Transportation | $200 |

| Health Insurance | $100 |

| Emergency Fund Contribution | $100 |

| Other Expenses (Entertainment, etc.) | $600 |

| Total Expenses | $3000 |

This example shows a balanced budget where all income is allocated. Notice the significant portion dedicated to student loan repayment. Adjusting categories based on your individual circumstances is essential.

Tips for Tracking Expenses and Identifying Areas for Savings

Regularly tracking your spending habits is key to identifying areas where you can save money. Several methods can help. Budgeting apps automatically categorize transactions, providing a clear picture of your spending. Alternatively, manually recording expenses in a spreadsheet or notebook allows for detailed analysis.

- Utilize budgeting apps or spreadsheets to categorize expenses.

- Review bank and credit card statements regularly.

- Identify recurring expenses that can be reduced (e.g., subscriptions, entertainment).

- Explore cheaper alternatives for everyday expenses (e.g., cooking at home instead of eating out).

- Set realistic savings goals and track progress.

By carefully examining your spending, you can pinpoint areas where you can cut back and redirect those funds towards your student loans.

The Importance of an Emergency Fund in Managing Debt Repayment

An emergency fund acts as a safety net, protecting you from unexpected expenses that could derail your loan repayment plan. Having 3-6 months’ worth of living expenses saved can prevent you from needing to use high-interest credit cards or defaulting on your loans.

Having an emergency fund is crucial for maintaining financial stability while repaying student loans.

For example, an unexpected car repair or medical bill could significantly impact your ability to make loan payments. An emergency fund mitigates the financial stress associated with such events.

Calculating Minimum Payments and the Impact of Extra Payments

Understanding your minimum payment and the potential benefits of extra payments is crucial for accelerating repayment. Your loan servicer provides your minimum monthly payment amount. Making extra payments, even small ones, significantly reduces the total interest paid and shortens the repayment period.

Extra payments reduce the principal balance faster, leading to substantial long-term savings.

For instance, consider a $30,000 loan at 5% interest with a 10-year repayment plan. Making the minimum payment would result in a total interest payment of approximately $8,000. However, by adding just $100 to your monthly payment, you could significantly reduce the total interest paid and shorten the repayment period. Loan calculators readily available online can help determine the exact impact of extra payments on your loan.

Additional Income Streams

Accelerating student loan repayment often requires supplementing your primary income. Exploring additional income streams can significantly reduce your loan balance faster and alleviate financial stress. This section will examine various options, their advantages and disadvantages, and strategies for maximizing your earning potential.

Generating extra income requires a proactive approach and a willingness to dedicate time and effort outside of your regular job. The key is to identify opportunities that align with your skills, interests, and available time. Remember to factor in the time commitment versus the potential earnings when choosing a side hustle.

Potential Side Hustles

Many avenues exist for generating supplemental income. Some options require specific skills or training, while others are more accessible to a wider range of individuals. Careful consideration of your personal strengths and resources is crucial in selecting the most suitable option.

- Freelance Writing/Editing: If you possess strong writing and editing skills, freelance platforms offer numerous opportunities. Pros include flexible hours and the potential for high earnings based on experience and project complexity. Cons include inconsistent income and the need to actively market your services.

- Online Tutoring/Teaching: Share your expertise in a particular subject by tutoring students online. Platforms like Chegg and Skooli connect tutors with students seeking assistance. Pros include flexible scheduling and the satisfaction of helping others. Cons include needing subject matter expertise and the need to build a client base.

- Gig Economy Work (e.g., Ridesharing, Delivery Services): Services like Uber, Lyft, DoorDash, and Instacart offer flexible work arrangements. Pros include immediate income and flexible hours. Cons include fluctuating earnings depending on demand and potential expenses related to vehicle maintenance or fuel.

- Selling Goods Online (e.g., Etsy, eBay): If you have crafting skills or unused items, selling online can generate extra cash. Platforms like Etsy and eBay provide avenues to reach a broad audience. Pros include potential for high profit margins if you have a desirable product. Cons include needing to manage inventory, marketing, and shipping.

Strategies for Salary Negotiation and Job Advancement

Negotiating a higher salary or seeking a better-paying job is a crucial strategy for increasing your overall income and accelerating loan repayment. This involves preparation, confidence, and a clear understanding of your worth.

Improving your marketability is key. This includes acquiring additional skills through certifications or further education, showcasing your accomplishments through a strong resume and portfolio, and networking effectively within your industry. When negotiating a salary increase, research industry standards, quantify your contributions to the company, and present a confident and well-prepared case. Seeking out higher-paying roles in your field or exploring related fields with better compensation is also a viable option.

Resources for Finding Freelance Work and Gig Opportunities

Numerous online platforms and resources connect freelancers and gig workers with potential clients and employers. Utilizing these resources effectively can significantly increase your chances of finding suitable opportunities.

- Freelance Platforms: Upwork, Fiverr, Guru, Freelancer.com

- Gig Economy Apps: Uber, Lyft, DoorDash, Instacart, TaskRabbit

- Job Boards: Indeed, LinkedIn, Monster

- Online Marketplaces: Etsy, eBay, Amazon Handmade

Seeking Professional Guidance

Navigating the complexities of student loan repayment can be overwhelming. Seeking professional guidance can significantly improve your chances of successful and timely repayment, minimizing stress and maximizing your financial well-being. Financial advisors and credit counseling agencies offer valuable expertise and support tailored to your specific circumstances.

Financial advisors and credit counselors play distinct but complementary roles in managing student loan debt. Financial advisors provide a holistic view of your finances, considering your student loans alongside other financial goals like saving for retirement or buying a home. Credit counseling agencies, on the other hand, specialize in debt management and can offer practical strategies for repayment and potentially negotiating with lenders.

The Role of a Financial Advisor in Managing Student Loan Debt

A financial advisor can help you create a comprehensive financial plan that incorporates your student loan repayment strategy. They can analyze your income, expenses, and assets to determine the most effective repayment approach, considering your risk tolerance and long-term financial objectives. This might involve exploring different repayment plans, such as income-driven repayment or refinancing options, and advising on the potential tax implications of each. They can also help you prioritize debt repayment against other financial goals, ensuring a balanced approach to managing your finances. For example, a financial advisor might help you determine whether aggressively paying down student loans is more beneficial than maximizing contributions to a retirement account, based on your individual circumstances and projections.

The Benefits of Seeking Advice from Credit Counseling Agencies

Credit counseling agencies offer valuable services to individuals struggling with student loan debt. They provide education on debt management strategies, helping you understand your options and create a realistic repayment plan. Some agencies may also be able to negotiate with your lenders to lower interest rates or modify repayment terms, potentially reducing your monthly payments. This can be particularly beneficial for individuals facing financial hardship. Additionally, credit counseling agencies can offer support and guidance throughout the repayment process, providing encouragement and accountability to help you stay on track. For example, a credit counselor might help you establish a realistic budget and identify areas where you can reduce expenses to free up more money for loan repayment.

Questions to Ask When Consulting a Financial Professional

Before engaging a financial advisor or credit counselor, it’s crucial to ask clarifying questions to ensure they are the right fit for your needs. Consider asking about their experience with student loan debt management, their fees, and their approach to developing a personalized repayment plan. Inquire about the specific strategies they employ and whether they have experience working with your type of student loans (federal, private, etc.). It’s also important to ask about their credentials and affiliations to ensure they are reputable and qualified to provide financial advice. Finally, understanding the potential limitations of their services is key to setting realistic expectations.

Exploring Debt Consolidation Options

Debt consolidation involves combining multiple loans into a single loan, often with a lower interest rate. This can simplify repayment by reducing the number of monthly payments and potentially lowering the overall cost of borrowing. However, it’s crucial to carefully evaluate the terms of any consolidation loan before proceeding. Consider factors such as the interest rate, fees, and the length of the repayment term. It’s also important to understand the potential impact on your credit score. While consolidation can be beneficial in certain circumstances, it’s not always the best solution for everyone. For instance, consolidating federal student loans into a private loan may mean losing access to income-driven repayment plans or other federal benefits. A financial advisor can help you determine if debt consolidation is a suitable strategy for your specific situation.

Visualizing Progress and Maintaining Motivation

Paying off student loans can feel like a marathon, not a sprint. Maintaining momentum requires more than just a repayment plan; it necessitates a proactive approach to visualizing progress and staying motivated throughout the journey. A key element of this is tracking your progress effectively and rewarding yourself for reaching milestones.

Visualizing your progress provides tangible evidence of your hard work and helps you stay focused on your goal. A clear picture of your progress can significantly boost motivation and commitment.

Visual Representation of Accelerated Repayment

Imagine a bar graph. The horizontal axis represents time, broken down into months or years, depending on your loan repayment timeline. The vertical axis represents the principal balance of your loan. The initial bar shows your starting loan balance. Subsequent bars illustrate the decreasing balance as you make regular payments. Crucially, a distinct color or shading should highlight the additional principal payments you’re making beyond the minimum required. This visual contrast dramatically showcases the accelerated reduction in your loan balance due to your extra payments. For example, if your initial balance was $30,000 and you made consistent extra payments of $100 per month, you could visually see the significant difference in the loan balance reduction compared to only making the minimum payment. The graph would clearly show how much faster you’re approaching your goal of a zero balance.

Motivational Strategies for Consistent Repayment

Maintaining motivation requires a multifaceted approach. Regularly reviewing your progress graph can serve as a powerful motivator. Consider setting smaller, achievable milestones within your overall repayment plan. For example, celebrate reaching 25%, 50%, and 75% of your loan repayment. This creates a sense of accomplishment and encourages continued effort. Additionally, connecting your repayment efforts to a long-term goal, such as buying a house or starting a family, can provide further motivation. Remember that setbacks are normal; don’t let occasional slip-ups derail your entire plan. Adjust your strategy as needed and refocus on your long-term objective.

Celebrating Milestones and Reward Systems

Celebrating milestones is crucial for maintaining motivation. Acknowledge and reward yourself for reaching significant progress points. These rewards should be aligned with your financial goals and should not jeopardize your repayment plan. Examples include a small treat, a night out, or a purchase you’ve been saving for. Avoid using large, potentially debt-inducing rewards.

Examples of effective reward systems could include: After paying off 10% of your loan, treat yourself to a weekend getaway. Upon reaching the halfway point, purchase a new piece of technology you’ve been wanting. Once you pay off 75%, consider a larger reward like a down payment on a new car. The key is to link rewards to tangible progress, making the connection between effort and reward clear and motivating. This positive reinforcement strengthens the behavior of consistent repayment.

Closing Notes

Successfully managing and paying off student loan interest requires a multifaceted approach encompassing financial literacy, strategic planning, and consistent effort. By understanding the mechanics of interest, implementing effective repayment strategies, and actively managing your finances, you can significantly reduce your debt burden and achieve long-term financial well-being. Remember to leverage available resources and seek professional advice when necessary to navigate this journey successfully.

FAQ Section

What is interest capitalization?

Interest capitalization is when unpaid interest is added to your principal loan balance, increasing the amount you owe and subsequently increasing the interest you accrue.

Can I deduct student loan interest from my taxes?

Possibly. Tax laws vary, so consult a tax professional or the IRS website for current eligibility requirements and limitations.

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to default, which has serious financial consequences.

Are there any government programs to help with student loan repayment?

Yes, several government programs offer income-driven repayment plans and other assistance. Check the Department of Education’s website for details.