Navigating the complexities of student loan repayment can feel overwhelming, but exploring alternative strategies like utilizing 529 plans offers a potential path towards financial freedom. This guide delves into the intricacies of using 529 plan funds for student loan repayment, examining the potential benefits and drawbacks, as well as the crucial IRS regulations that govern such transactions. We will explore various scenarios, compare this approach to other repayment methods, and provide a clear understanding of the financial implications involved.

Understanding the tax advantages and potential penalties associated with 529 plans is paramount. We will analyze the interest rates of typical student loans against the potential investment returns from a 529 plan, providing practical examples and case studies to illustrate the decision-making process. By the end, you will possess a comprehensive understanding of whether leveraging your 529 plan for student loan repayment aligns with your specific financial circumstances.

Understanding 529 Plans and Student Loan Repayment

Using a 529 plan, typically designed for college savings, to repay student loans is a relatively unconventional strategy. While not explicitly intended for this purpose, it can offer advantages in certain circumstances. Understanding the mechanics of 529 plans and their limitations is crucial before considering this approach.

529 Plan Types and Tax Advantages

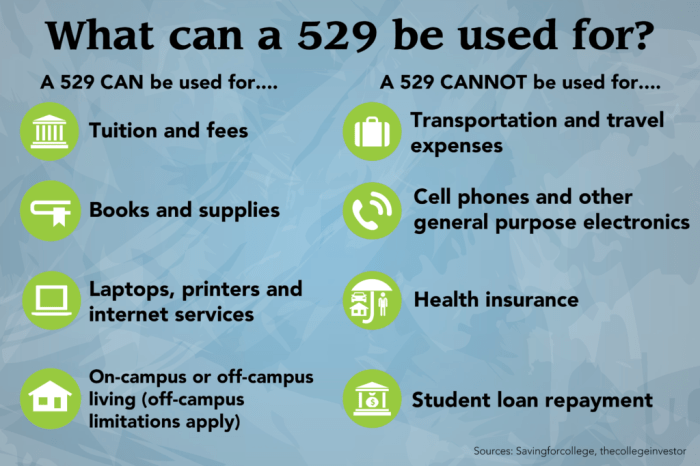

529 plans are education savings plans sponsored by states, offering tax advantages for saving for qualified education expenses. There are two main types: state-sponsored plans and private plans. State-sponsored plans often offer residents of that state additional tax benefits, while private plans may have broader investment options. The key tax advantage is that earnings grow tax-deferred, meaning you don’t pay taxes on investment gains until the money is withdrawn for qualified expenses. Withdrawals used for tuition, fees, and other qualified education expenses are generally tax-free at the federal level.

Restrictions and Penalties for Early Withdrawals

Using 529 funds for student loan repayment is considered a non-qualified withdrawal. This means that the earnings portion of the withdrawal will be subject to both federal and state income taxes, plus a 10% penalty. The original contributions, however, are generally not subject to the penalty. This penalty significantly reduces the attractiveness of using 529 funds for loan repayment unless other factors outweigh the tax burden.

Comparison of Student Loan Interest Rates and 529 Plan Investment Returns

Typical student loan interest rates vary depending on the loan type and borrower’s creditworthiness. They can range from 4% to 10% or more. 529 plan investment returns are not guaranteed and fluctuate based on market performance. Historically, a well-diversified 529 plan portfolio might aim for average annual returns in the range of 6% to 8%, though past performance is not indicative of future results. Whether a 529 plan offers a better return than the interest paid on student loans depends entirely on the investment performance of the plan and the interest rate on the loans.

Scenarios Where Using a 529 Plan for Student Loan Repayment Might Be Beneficial

Using a 529 plan for student loan repayment might be considered in limited scenarios. For example, if the 529 plan has accumulated significantly more funds than needed for college expenses and the student loan interest rate is exceptionally high (making the tax penalty less impactful compared to the interest saved), it might be a viable option. Another scenario might involve a family facing unexpected financial hardship, where the tax penalty is a less significant concern than immediate debt reduction. However, these are niche situations and should be carefully analyzed on a case-by-case basis.

Pros and Cons of Using a 529 Plan for Student Loan Repayment vs. Other Strategies

| Feature | 529 Plan for Loan Repayment | Traditional Loan Repayment | Loan Refinancing |

|---|---|---|---|

| Tax Implications | Taxes and 10% penalty on earnings | Interest is tax-deductible (sometimes) | Interest rate may be lower, tax implications depend on specifics |

| Flexibility | Low flexibility, significant penalties for non-qualified withdrawals | High flexibility, various repayment plans available | Moderate flexibility, depending on the refinancing terms |

| Cost | Potential tax penalties outweigh benefits in most cases | Interest payments can be substantial | Lower monthly payments are possible but may extend repayment period |

| Potential Benefits | May be beneficial in rare circumstances with extremely high interest rates | Systematic debt reduction | Lower interest rates and potentially lower monthly payments |

IRS Regulations and Tax Implications

Using 529 plan funds for student loan repayment is considered a non-qualified withdrawal, meaning it deviates from the plan’s intended purpose of paying for qualified education expenses. This has significant tax implications, governed by IRS regulations. Understanding these regulations is crucial to avoid unexpected tax liabilities.

IRS Rules Concerning 529 Plan Funds for Student Loan Repayment

The IRS generally doesn’t allow 529 plan funds to be used directly for student loan repayment without incurring tax penalties. While the funds can be used for qualified education expenses like tuition, fees, books, and supplies, student loan principal or interest payments are not considered qualified expenses. This restriction is explicitly stated in IRS Publication 970, Tax Benefits for Education. Attempting to circumvent these rules could lead to significant financial penalties.

Tax Penalties for Non-Qualified Withdrawals

Non-qualified withdrawals from a 529 plan are subject to both income tax on the earnings portion and a 10% penalty tax. For example, if you withdraw $10,000 from your 529 plan, and $2,000 represents earnings, you’ll pay income tax on the $2,000 at your ordinary income tax rate. Additionally, you’ll pay a 10% penalty tax on the $2,000 earnings. The original contribution amount is not subject to the penalty tax, only the earnings.

Exceptions to Standard Rules

The IRS does allow for some exceptions, though these are limited. One potential exception involves a beneficiary’s death or disability. In such cases, withdrawals may be made without incurring the 10% penalty. The earnings portion would still be subject to income tax. Specific documentation proving the death or disability will be required. Another exception might be a change in beneficiary, although the requirements for this are quite stringent and may involve significant documentation.

Required Tax Forms and Documentation

For non-qualified withdrawals, you’ll need to file Form 1099-Q, which reports the distribution from the 529 plan. This form details the total distribution, the amount representing earnings, and the amount representing contributions. You will also need to report this information on your federal income tax return (Form 1040). Supporting documentation, such as a statement from the 529 plan administrator detailing the withdrawal and the beneficiary’s identity, might be requested by the IRS during an audit.

Flowchart Illustrating Non-Qualified Withdrawal Request

The following describes a flowchart illustrating the process. The flowchart begins with the decision to use 529 funds for student loan repayment. This leads to a step where the beneficiary contacts the 529 plan administrator to request a non-qualified withdrawal. Next, the administrator processes the request and issues the funds. Following this, the beneficiary receives Form 1099-Q, which reports the distribution. Finally, the beneficiary reports the distribution on their federal income tax return (Form 1040), paying any applicable taxes and penalties. This entire process is documented and can be audited by the IRS. Any deviation from this process could lead to delays or penalties.

Alternative Strategies and Financial Planning

Using a 529 plan to pay down student loans presents a unique approach to debt management, offering potential tax advantages but also requiring careful consideration of alternative strategies and their implications. This section compares 529 plan usage with other methods, explores its effect on financial aid eligibility, and provides a framework for incorporating this strategy into a comprehensive financial plan.

Comparison of 529 Plan Use and Student Loan Refinancing

Refinancing student loans and using 529 plan funds for repayment represent distinct strategies with differing benefits and drawbacks. Refinancing typically involves consolidating multiple loans into a single loan with a potentially lower interest rate. This can lead to significant savings over the loan’s life, particularly for borrowers with high interest rates. However, refinancing may eliminate certain federal protections, such as income-driven repayment plans. Conversely, using 529 plan funds avoids the complexities of refinancing but is subject to the limitations and tax implications associated with 529 plans. The optimal choice depends on individual circumstances, including the borrower’s credit score, interest rates on existing loans, and the availability of 529 plan funds. For instance, a borrower with excellent credit and high-interest student loans might find refinancing advantageous, while someone with limited credit history and substantial 529 funds might prioritize using the 529 plan.

Impact of 529 Plan Funds on Income-Driven Repayment Plan Eligibility

Utilizing 529 plan funds to pay down student loans can affect eligibility for income-driven repayment (IDR) plans. IDR plans, such as ICR, PAYE, and REPAYE, base monthly payments on a borrower’s income and family size. While using 529 funds doesn’t directly disqualify someone from an IDR plan, it can reduce the outstanding loan balance, potentially impacting the calculated monthly payment amount under the plan. A lower loan balance might result in a smaller monthly payment, but it also means less time to qualify for loan forgiveness under some IDR programs. The decision to use 529 funds should therefore consider the long-term implications for IDR plan participation and loan forgiveness. For example, a borrower aiming for Public Service Loan Forgiveness (PSLF) might strategically delay using 529 funds to maximize their loan forgiveness eligibility.

Calculating Potential Savings (or Losses) from Using a 529 Plan

Determining the financial benefits of using 529 plan funds requires a step-by-step calculation.

- Determine the total student loan balance: List all outstanding student loans and their respective interest rates.

- Calculate the total interest payable without 529 funds: Use a student loan amortization calculator to determine the total interest paid over the loan’s repayment period.

- Determine the amount of available 529 funds: Subtract any applicable penalties for non-qualified withdrawals.

- Calculate the new loan balance after using 529 funds: Subtract the 529 funds from the total student loan balance.

- Calculate the total interest payable with 529 funds: Use a student loan amortization calculator to determine the total interest paid on the reduced loan balance.

- Calculate the net savings (or loss): Subtract the total interest payable with 529 funds from the total interest payable without 529 funds. A positive result indicates savings, while a negative result indicates a loss.

For example, if a borrower has $50,000 in student loans with a 6% interest rate and $20,000 in 529 funds, they would compare the total interest paid on the $50,000 loan to the total interest paid on a $30,000 loan. This comparison reveals the potential savings from utilizing the 529 plan. It is crucial to consider the tax implications of the 529 withdrawal.

Factors to Consider When Deciding Whether to Use a 529 Plan for Student Loan Repayment

Several factors should be carefully weighed before using 529 funds for student loan repayment.

- Available 529 plan funds and potential penalties: Assess the amount available and any tax penalties for non-qualified withdrawals.

- Student loan interest rates: Higher interest rates make using 529 funds more attractive.

- Eligibility for income-driven repayment plans and loan forgiveness programs: Consider the impact on long-term repayment strategies.

- Alternative investment opportunities: Compare the potential returns from investing the 529 funds versus using them to pay down debt.

- Future education expenses: Evaluate the need for 529 funds for future education expenses.

A thorough evaluation of these factors ensures an informed decision aligns with overall financial goals.

Incorporating This Strategy into a Comprehensive Financial Plan

Integrating the 529 plan for student loan repayment into a broader financial plan requires careful consideration of several aspects. It should be integrated with budgeting, debt management strategies, and long-term financial goals, such as retirement planning and investment strategies. For example, a financial plan might prioritize using 529 funds to pay off high-interest student loans while simultaneously contributing to retirement accounts and maintaining an emergency fund. This approach demonstrates a holistic strategy that balances immediate debt reduction with long-term financial security. A financial advisor can provide personalized guidance in creating a plan that incorporates this strategy effectively.

Case Studies and Practical Examples

Understanding the practical application of using 529 plans for student loan repayment requires examining both successful and less-than-ideal scenarios. This section provides hypothetical case studies to illustrate the potential benefits and drawbacks, highlighting the importance of considering individual circumstances and loan terms.

Successful 529 Plan Utilization for Student Loan Repayment

Let’s consider Sarah, a recent graduate with $30,000 in federal student loans at a 5% interest rate. She also has a $25,000 balance in her 529 plan, originally intended for her education. Due to unforeseen circumstances, she decided to use a portion of her 529 funds to pay off her loans. By strategically applying the $25,000, Sarah significantly reduced her loan principal, lowering her monthly payments and overall interest accrued over the life of the loan. The remaining loan balance, paid off with traditional methods, required fewer monthly payments, and resulted in a considerable savings on interest compared to a scenario without using the 529 funds. This resulted in a quicker payoff and a substantial reduction in total interest paid.

Unsuccessful 529 Plan Utilization for Student Loan Repayment

Conversely, consider Mark, who also has $30,000 in student loans at a 5% interest rate. However, his 529 plan only holds $10,000. While he could use these funds to partially repay his loans, the remaining $20,000 still carries a significant interest burden. In Mark’s case, the tax implications of withdrawing the 529 funds might outweigh the benefits of reducing his loan principal, especially if he has other investment opportunities with potentially higher returns. He might have been better served by strategically allocating the $10,000 towards high-interest debt and continuing to make regular payments on his student loans.

Impact of Different Student Loan Types on 529 Plan Usage

The type of student loan significantly influences the decision to utilize 529 funds. Federal subsidized loans, for example, typically have lower interest rates than unsubsidized loans or private loans. If a student has a substantial balance in subsidized loans with low interest, utilizing the 529 funds might not provide as much financial benefit compared to tackling higher-interest debt first. Conversely, a high-interest private loan might make using 529 funds more attractive, despite the tax implications.

Comparative Financial Data

| Case Study | Loan Amount | Interest Rate | 529 Plan Balance | Interest Saved (Estimate) |

|---|---|---|---|---|

| Sarah | $30,000 | 5% | $25,000 | $5,000 – $7,000 (depending on repayment timeline) |

| Mark | $30,000 | 5% | $10,000 | $1,000 – $2,000 (depending on repayment timeline and tax implications) |

Visual Representation of Financial Impact

Imagine a bar graph. One bar represents the total interest paid over the life of Sarah’s loan without using the 529 plan, showing a significantly higher amount. A second, shorter bar represents the total interest paid after using the 529 funds. For Mark, the graph would show a smaller difference between the two bars, reflecting the limited impact of the 529 withdrawal. The difference in bar height visually illustrates the financial advantage (or lack thereof) of utilizing 529 funds in each scenario. This visual comparison clearly demonstrates the potential savings realized by strategic 529 plan utilization for loan repayment.

Summary

Ultimately, the decision of whether to use a 529 plan for student loan repayment is highly personal and depends on individual financial situations. While the potential for tax savings and accelerated debt reduction exists, careful consideration of the IRS regulations, potential penalties, and alternative repayment strategies is crucial. This guide provides a framework for making an informed decision, empowering you to navigate this complex financial landscape effectively and strategically manage your student loan debt.

Popular Questions

Can I use my 529 plan for any type of student loan?

While you can use 529 funds for most federal and private student loans, the specific terms of your loan and the type of 529 plan may influence your options. It’s best to consult with a financial advisor to determine eligibility.

What if I withdraw more from my 529 than needed for loan repayment?

Any excess funds withdrawn will be subject to the usual tax penalties for non-qualified withdrawals. Careful planning and calculation are crucial to avoid unnecessary tax burdens.

Are there income limits for using 529 funds for student loan repayment?

There are no income limits specifically for using 529 funds for student loan repayment. However, your overall income may affect your eligibility for certain income-driven repayment plans if you choose to utilize this method.

What documentation do I need to provide to the IRS?

You will need to file Form 1099-Q, which reports the distribution from your 529 plan, along with any relevant documentation pertaining to your student loan repayment.