Navigating the world of student loans can feel overwhelming, especially when trying to understand the nuances of subsidized loans. Securing financial aid for higher education is a crucial step for many, and understanding the eligibility criteria for subsidized student loans is the first step towards achieving your academic goals. This guide will walk you through the process, demystifying the complexities and providing you with the knowledge to confidently apply for this valuable form of financial assistance.

We’ll explore the key requirements, the FAFSA application process, and the crucial role of your Expected Family Contribution (EFC) in determining your eligibility. Understanding these factors is essential to maximizing your chances of receiving a subsidized student loan. We’ll also delve into different types of federal aid and offer strategies for managing your student loan debt responsibly once you’ve secured funding.

Eligibility Criteria for Subsidized Student Loans

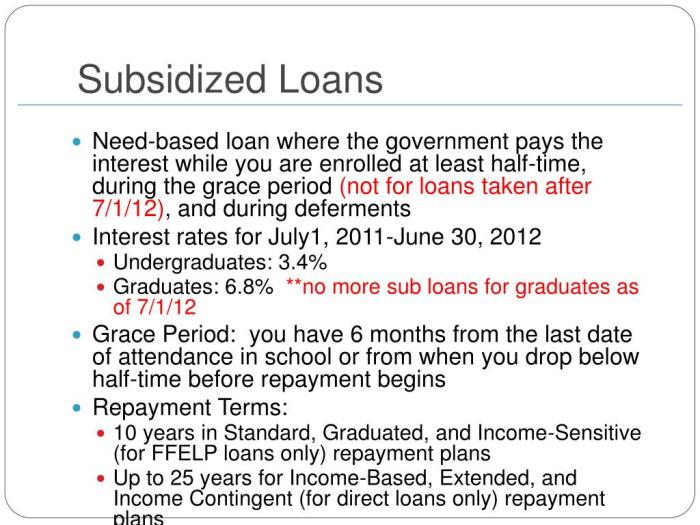

Securing a subsidized federal student loan requires meeting specific eligibility criteria. These loans are advantageous because the government pays the interest while you’re in school, during grace periods, and under certain deferment situations. Understanding these requirements is crucial for successful application.

Basic Requirements for Federal Subsidized Student Loans

To be eligible for a federal subsidized student loan, you must be a U.S. citizen or eligible non-citizen. You must also be enrolled or accepted for enrollment at least half-time in an eligible degree or certificate program at a participating institution. Furthermore, you must demonstrate financial need, as determined by the Free Application for Federal Student Aid (FAFSA). Finally, you must maintain satisfactory academic progress as defined by your school.

Types of Subsidized Loans and Eligibility Differences

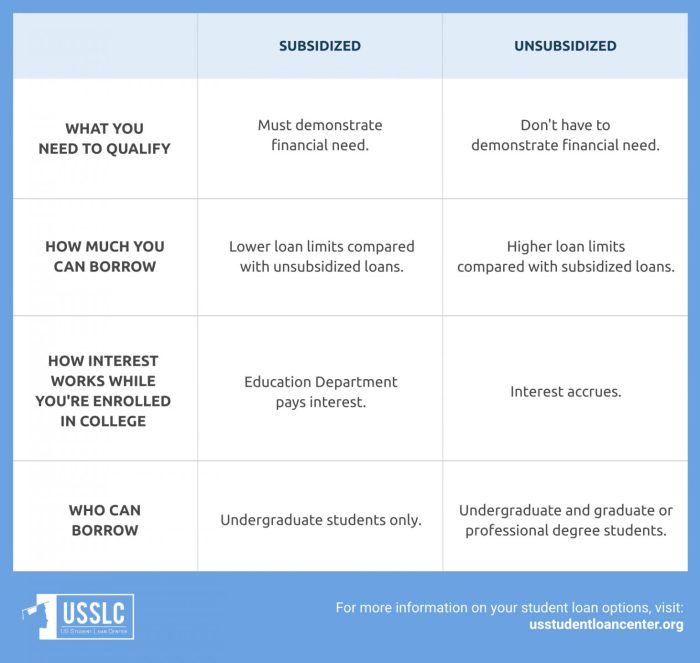

The primary type of subsidized loan is the Direct Subsidized Loan, offered to undergraduate students who demonstrate financial need. Graduate students, on the other hand, are generally ineligible for subsidized loans; their loan options are primarily unsubsidized. There are no other significant types of subsidized federal student loans available to students beyond this distinction. The key difference lies in who pays the interest during certain periods – the government for subsidized loans, and the borrower for unsubsidized loans.

Determining Income Requirements for Subsidized Loans

Determining if you meet the income requirements involves completing the FAFSA. This form gathers information about your family’s income, assets, and other financial details. The Department of Education uses a formula based on this information to calculate your Expected Family Contribution (EFC). Your EFC is subtracted from the cost of attendance to determine your financial need. A lower EFC generally indicates greater financial need and a higher likelihood of qualifying for subsidized loans. The FAFSA website provides detailed instructions and resources to accurately complete the form.

Eligibility Requirements Comparison: Undergraduate vs. Graduate Students

| Requirement | Undergraduate Students | Graduate Students |

|---|---|---|

| Loan Type | Direct Subsidized Loan (available) | Direct Unsubsidized Loan (primarily available) |

| Financial Need Demonstration | Required | Not Required (for unsubsidized loans) |

| Enrollment Status | At least half-time | At least half-time |

| Citizenship/Residency | U.S. citizen or eligible non-citizen | U.S. citizen or eligible non-citizen |

The FAFSA Application Process

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student financial aid, including subsidized loans. Completing the FAFSA accurately and efficiently is crucial for determining your eligibility for various types of aid. This process involves providing detailed personal and financial information to the government, which is then used to calculate your Expected Family Contribution (EFC) and determine your eligibility for federal student aid.

The FAFSA form itself is a comprehensive document requesting information about you, your parents (if you are a dependent student), your income, assets, and household size. It’s designed to create a standardized assessment of your financial need, allowing the government to fairly distribute limited financial aid resources. The purpose is to ensure that students who demonstrate the greatest financial need receive the support they require to pursue higher education.

Completing the FAFSA Accurately and Efficiently

Accurate completion of the FAFSA is paramount. Inaccuracies can lead to delays in processing your application, incorrect financial aid award amounts, or even the denial of your application altogether. To complete the FAFSA efficiently, gather all necessary documents beforehand. Utilize the IRS Data Retrieval Tool (DRT) to automatically transfer your tax information, reducing the risk of errors. Review your completed application carefully before submitting it to catch any mistakes. The FAFSA website also provides helpful resources and tutorials to guide you through the process.

The Importance of Accurate Information on the FAFSA

Providing accurate information on the FAFSA is not merely a formality; it is a legal and ethical obligation. The information you provide is used to determine the amount of financial aid you are eligible to receive. Submitting false or misleading information can result in serious consequences, including repayment of funds, fines, and even criminal charges. The Department of Education rigorously audits FAFSA applications to ensure accuracy and compliance with federal regulations. Therefore, meticulous attention to detail is essential throughout the entire process.

Documents Needed to Complete the FAFSA Application

It is vital to gather all necessary documents before starting the FAFSA application to ensure a smooth and efficient process. Missing information will delay the processing of your application. Having these documents readily available will save you time and frustration.

- Your Social Security number

- Your driver’s license number (if applicable)

- Your federal tax information (IRS 1040 and W-2 forms or tax return transcripts)

- Your parents’ Social Security numbers (if you are a dependent student)

- Your parents’ federal tax information (if you are a dependent student)

- Your FSA ID (Federal Student Aid ID)

- Your bank account information (if applicable)

- Information about untaxed income (if applicable)

- Records of assets such as savings and checking accounts, investments, and business ownership (if applicable)

Understanding Financial Need and Expected Family Contribution (EFC)

Securing a subsidized student loan hinges on demonstrating financial need. The government assesses this need through a calculation called the Expected Family Contribution (EFC). Understanding the EFC is crucial for navigating the financial aid process and maximizing your chances of loan approval.

The EFC is not a measure of your family’s wealth, but rather an estimate of how much your family is expected to contribute towards your education. It’s a complex calculation that considers various factors, and the resulting figure directly influences your eligibility for subsidized federal student loans. A lower EFC generally translates to a greater demonstrated need and, consequently, a higher likelihood of receiving subsidized loans. The difference between your cost of attendance (COA) and your EFC determines your financial need. Subsidized loans are designed to help fill this gap.

EFC Calculation and its Components

The EFC calculation is performed by the federal government using the information you provide on the Free Application for Federal Student Aid (FAFSA). The formula is quite intricate and takes into account many aspects of your family’s financial situation. Key factors include parental income and assets (if you are a dependent student), your own income and assets (if you are an independent student), family size, and the number of family members attending college. The FAFSA uses a standardized formula to weigh these factors, resulting in a single EFC number. This number is then used by colleges and universities to determine your eligibility for federal financial aid, including subsidized loans. For example, a family with a high income and substantial assets will likely have a higher EFC than a family with a low income and few assets. This means the high-income family would be expected to contribute more towards their child’s education, leaving a smaller amount of financial need to be covered by subsidized loans.

Factors Influencing EFC Calculation

Several factors significantly influence the EFC calculation. These factors can be broadly categorized into income and asset components.

Income factors include:

- Parental adjusted gross income (AGI) (for dependent students)

- Student’s AGI (for independent students)

- Wages earned by parents and students

- Taxable and non-taxable income sources

Asset factors include:

- Parental assets (for dependent students), such as savings accounts, investments, and retirement funds

- Student’s assets (for independent students)

- Value of family home (often with an allowance for equity)

Beyond these core elements, other factors, such as the number of family members in college, can also influence the EFC. The FAFSA form carefully guides users through the process of providing the necessary information.

Resources for Understanding EFC

Navigating the complexities of the FAFSA and understanding your EFC can be challenging. Fortunately, several resources are available to assist students and families.

Helpful resources include:

- The Federal Student Aid website: This website provides comprehensive information about the FAFSA, EFC calculation, and other financial aid topics.

- Your high school or college financial aid office: These offices often have staff who can provide personalized guidance and assistance with completing the FAFSA and understanding your EFC.

- Online FAFSA calculators and guides: Several websites offer free FAFSA calculators that can help you estimate your EFC based on your financial information. However, remember these are estimates, and the official FAFSA calculation remains the definitive one.

Types of Federal Student Aid and Loan Programs

Navigating the world of federal student aid can feel overwhelming, but understanding the different programs available is crucial for making informed financial decisions. This section will clarify the distinctions between subsidized and unsubsidized federal loans, compare them to private loans, and Artikel the advantages and disadvantages of each type of federal aid. Choosing the right financial aid package can significantly impact your post-graduation financial well-being.

Subsidized vs. Unsubsidized Federal Student Loans

Subsidized and unsubsidized federal student loans are both offered by the federal government, but they differ significantly in how interest accrues. With subsidized loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, even while you’re still studying. This means you’ll owe more than the original loan amount upon graduation if you don’t pay the accruing interest. Choosing between these two depends heavily on your financial situation and ability to manage interest payments during your studies. A lower expected family contribution (EFC) often makes subsidized loans more accessible.

Federal vs. Private Student Loans

Federal student loans offer several advantages over private loans. Federal loans typically have more flexible repayment plans, including income-driven repayment options, which adjust monthly payments based on your income and family size. They also offer protections like deferment and forbearance in case of financial hardship. Private loans, on the other hand, are offered by banks and credit unions and often have higher interest rates and fewer borrower protections. While private loans may be necessary to cover remaining educational costs after exhausting federal loan options, it’s advisable to prioritize federal loans due to their borrower-friendly features. Careful comparison of interest rates and repayment terms is essential before taking out any private loan.

Advantages and Disadvantages of Federal Student Aid

Federal student aid, encompassing grants, scholarships, and loans, offers several advantages. Grants and scholarships don’t need to be repaid, providing valuable financial assistance. Federal loans often have lower interest rates than private loans and offer flexible repayment options. However, federal student loans still represent debt that must be repaid, potentially impacting your financial future. Careful budgeting and financial planning are crucial to manage this debt effectively. Moreover, the application process can be complex and time-consuming, requiring thorough understanding of eligibility criteria and application procedures.

Federal Student Loan Programs

Understanding the various federal student loan programs available is essential for selecting the most appropriate option. The following list Artikels some key programs:

- Direct Subsidized Loans: These loans are need-based and the government pays the interest while you’re in school at least half-time.

- Direct Unsubsidized Loans: These loans are not need-based and interest accrues from disbursement.

- Direct PLUS Loans: These loans are available to graduate students and parents of undergraduate students.

- Direct Consolidation Loans: These loans combine multiple federal student loans into a single loan with a potentially more manageable repayment plan.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and a clear understanding of available repayment options. Responsible borrowing habits during your education can significantly impact your financial well-being after graduation. This section will Artikel strategies for managing your loans effectively.

Effective student loan management begins before you even borrow. Understanding your financial needs, exploring scholarship opportunities, and only borrowing what is absolutely necessary are crucial first steps. Carefully consider your chosen field of study and its potential earning power in relation to the cost of your education. A realistic assessment of your future earning potential can help you avoid taking on an unsustainable level of debt.

Responsible Borrowing and Repayment Planning

Creating a comprehensive repayment plan is essential to avoid financial hardship. This involves estimating your post-graduation income and comparing it to your total loan amount and associated interest. Several online tools and financial advisors can assist in this process. It’s recommended to create a realistic budget that incorporates your loan payments before you even graduate. This proactive approach allows you to adjust your spending habits and prepare for the financial obligations ahead.

Repayment Options After Graduation

The federal government offers several repayment plans designed to accommodate varying financial situations. These plans differ in monthly payment amounts and loan repayment periods. Understanding the nuances of each plan is vital in selecting the one that best aligns with your financial circumstances.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It is the default repayment plan unless you choose a different one.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This option might provide relief initially but can lead to higher overall interest payments.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), reducing monthly payments but increasing total interest paid.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payment on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans can significantly lower monthly payments, but they typically extend the repayment period and may lead to higher total interest paid.

Loan Deferment and Forbearance Programs

Life circumstances can sometimes make it challenging to meet your loan payments. In such cases, deferment and forbearance programs offer temporary relief. However, it’s crucial to understand that interest may still accrue during these periods, potentially increasing your overall loan balance.

- Deferment: Postpones your loan payments temporarily, often due to specific circumstances like unemployment or enrollment in school. Depending on the type of loan, interest may or may not accrue during a deferment period.

- Forbearance: Reduces or suspends your loan payments for a short period. Interest typically continues to accrue during forbearance, increasing your total loan balance.

Creating a Realistic Budget Including Student Loan Payments

A well-structured budget is crucial for managing student loan debt. Start by listing all your monthly income and expenses. Then, allocate a specific amount for your student loan payment. Consider using budgeting apps or spreadsheets to track your income and expenses effectively. Adjust your spending habits as needed to ensure you can comfortably meet your loan obligations without compromising other essential needs.

For example, a recent graduate earning $40,000 annually might allocate $300-$500 monthly for student loan repayment, depending on their loan amount and repayment plan. This would require careful budgeting of remaining income to cover rent, utilities, food, transportation, and other essential expenses. Tracking expenses and regularly reviewing the budget is key to staying on track.

Resources and Further Assistance

Navigating the complexities of student financial aid can be challenging. Fortunately, numerous resources are available to provide guidance and support throughout the application process and beyond. Understanding where to find reliable information and who to contact for assistance is crucial for a successful outcome.

This section Artikels key resources, contact information for relevant agencies, answers to frequently asked questions, and emphasizes the importance of seeking professional financial advice when needed.

Reliable Sources of Information Regarding Student Financial Aid

The federal government is the primary source of information on federal student aid programs. The Federal Student Aid website (studentaid.gov) offers comprehensive information on eligibility requirements, application procedures, loan types, repayment options, and much more. It provides interactive tools, calculators, and resources to help students understand their financial aid options and make informed decisions. Additionally, your college or university’s financial aid office is an invaluable resource. They can provide personalized guidance, assist with the application process, and answer specific questions related to your institution’s financial aid programs. Independent, non-profit organizations also offer valuable information and support, often providing free counseling services.

Contact Information for Relevant Government Agencies and Organizations

Federal Student Aid (FSA): studentaid.gov; 1-800-4-FED-AID (1-800-433-3243)

National Center for Education Statistics (NCES): nces.ed.gov; This agency provides data and research on education, including information on student financial aid trends and outcomes.

The Department of Education: 202-245-6000; ed.gov; This is the overarching agency responsible for overseeing federal education programs, including student financial aid.

Note: Contact information is subject to change. Always verify information directly on the official website.

Frequently Asked Questions About Subsidized Student Loans

Below is a table addressing common questions about subsidized student loans. Understanding these answers can significantly clarify the process and help you make informed decisions.

| Question | Answer |

|---|---|

| What is a subsidized student loan? | A subsidized loan is a federal student loan where the government pays the interest while you are in school at least half-time, during grace periods, and during deferment. |

| Who is eligible for a subsidized loan? | Eligibility is based on demonstrated financial need as determined by the FAFSA. Students must also be pursuing a degree or certificate at an eligible institution. |

| How much can I borrow in subsidized loans? | The maximum amount you can borrow depends on your year in school, your dependency status, and your school’s cost of attendance. There are annual and aggregate borrowing limits. |

| What are the repayment options for subsidized loans? | Several repayment plans are available, including standard, graduated, extended, and income-driven repayment plans. The best option depends on your individual financial circumstances. |

The Importance of Seeking Professional Financial Advice

Seeking professional financial advice, particularly from a financial advisor specializing in student loan debt management, is highly recommended. A financial advisor can help you create a comprehensive financial plan, explore various repayment options, and develop strategies for effectively managing your student loan debt. They can provide personalized guidance based on your specific financial situation and goals, helping you avoid potential pitfalls and make informed decisions about your financial future. This is especially valuable when dealing with complex financial situations or significant debt burdens. They can also provide guidance on budgeting, saving, and investing, ensuring a more secure financial future after graduation.

Illustrative Examples of Loan Eligibility Scenarios

Understanding the nuances of subsidized student loan eligibility requires examining specific cases. The following examples illustrate how various financial factors influence a student’s ability to qualify for this type of federal aid.

Scenario: Student Qualifies for a Subsidized Loan

Maria, a dependent student, is pursuing a bachelor’s degree in nursing. Her parents’ combined adjusted gross income (AGI) is $60,000, and they have significant medical expenses, reducing their taxable income. Maria demonstrates exceptional academic achievement, maintaining a high GPA. The FAFSA calculation shows her family’s Expected Family Contribution (EFC) is low relative to the cost of attendance at her chosen university. Because her EFC is significantly lower than the cost of attendance, and she maintains satisfactory academic progress, she qualifies for a subsidized loan. The government subsidizes the interest on her loan while she is enrolled at least half-time.

Scenario: Student Does Not Qualify for a Subsidized Loan

John, an independent student, is attending a private university. He works part-time, earning $15,000 annually. However, the cost of tuition and living expenses at his university significantly exceeds his earnings and savings. His FAFSA calculation reveals a relatively high EFC, exceeding the financial aid available through grants and scholarships. Furthermore, his academic performance is below the minimum requirement for continued federal aid eligibility. Consequently, John does not qualify for a subsidized loan, although he may be eligible for unsubsidized loans. The higher EFC and failure to meet academic standards preclude him from receiving subsidized aid.

Hypothetical Student’s Financial Situation and Loan Eligibility

Consider Sarah, a dependent student applying for financial aid. Her parents’ AGI is $85,000, and they have significant assets, including a home and retirement savings. Sarah attends a public in-state university, where the cost of attendance is $25,000 per year. She receives a $5,000 merit-based scholarship. Her family’s EFC, as calculated by the FAFSA, is $15,000. This means her demonstrated financial need is $10,000 ($25,000 – $15,000 = $10,000). Given her financial need and her satisfactory academic standing, Sarah would likely qualify for a subsidized loan to cover a portion of her remaining expenses, though the amount would depend on the availability of funds and the specific loan program.

Impact of Financial Factors on Subsidized Loan Eligibility

Several financial factors significantly influence eligibility for subsidized loans. A lower EFC increases the likelihood of qualification. This is because a low EFC demonstrates greater financial need. High parental income and significant assets generally lead to a higher EFC, reducing the chances of receiving subsidized loans. The cost of attendance at the chosen institution also plays a crucial role; higher costs can increase the likelihood of needing financial aid, even with a moderately high EFC. Finally, maintaining satisfactory academic progress is a non-negotiable requirement for continued eligibility for federal student aid, including subsidized loans. Failing to meet these academic standards will directly impact eligibility.

Final Summary

Securing a subsidized student loan can significantly alleviate the financial burden of higher education. By carefully reviewing your eligibility, completing the FAFSA accurately, and understanding your financial need, you can increase your chances of receiving this valuable form of assistance. Remember to utilize the resources provided and seek professional advice when needed. With careful planning and preparation, you can confidently navigate the application process and pave the way for a successful academic journey.

Frequently Asked Questions

What is the difference between subsidized and unsubsidized loans?

With subsidized loans, the government pays the interest while you’re in school (and sometimes during grace periods). Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I get a subsidized loan if I’m a graduate student?

Yes, but the eligibility criteria and maximum loan amounts may differ from undergraduate loans. You’ll still need to demonstrate financial need.

What happens if I don’t complete the FAFSA accurately?

Inaccurate information can delay or prevent you from receiving financial aid. It’s crucial to provide accurate and complete information.

What if my EFC is higher than expected?

A higher EFC indicates a greater capacity to contribute to your education costs, potentially reducing your eligibility for subsidized loans. You might still qualify for unsubsidized loans or other forms of aid.

Where can I find more information about loan repayment options?

The Federal Student Aid website (studentaid.gov) provides comprehensive information on repayment plans, deferment, and forbearance.