Securing a subsidized student loan can significantly ease the financial burden of higher education. Understanding the eligibility criteria, the application process, and the long-term implications is crucial for students and their families. This guide navigates the complexities of subsidized student loans, providing a clear path to accessing this valuable form of financial aid.

From navigating the FAFSA application to understanding the various types of subsidized loans and maintaining eligibility, we will demystify the process, empowering you to make informed decisions about your financial future. We’ll explore the factors that influence your eligibility, the benefits of subsidized loans, and how to manage your repayment effectively after graduation.

Eligibility Requirements for Subsidized Loans

Securing a subsidized federal student loan hinges on meeting specific eligibility criteria established by the U.S. Department of Education. These guidelines ensure that federal funds are allocated to students who demonstrate the greatest financial need. Understanding these requirements is crucial for prospective borrowers to determine their eligibility for this valuable form of financial aid.

Federal Income Guidelines and Their Application

The primary determinant of eligibility for subsidized federal student loans is the student’s (and their family’s, if dependent) demonstrated financial need. This need is calculated using the Free Application for Federal Student Aid (FAFSA), a standardized form that gathers detailed financial information. The FAFSA uses a complex formula that considers various income sources to determine the Expected Family Contribution (EFC). A lower EFC generally indicates greater financial need and a higher likelihood of qualifying for subsidized loans.

Types of Income Considered in Eligibility Determination

The FAFSA considers a range of income sources, both from the student and their family (if the student is classified as a dependent student). For dependent students, parental income plays a significant role, encompassing sources like wages, salaries, self-employment income, investment income (dividends, interest), and capital gains. The student’s own income, including wages from employment, is also factored into the calculation. For independent students, only their own income is considered. The FAFSA also accounts for untaxed income, such as child support received, and assets such as savings and investments.

Examples of Ineligibility Despite Low Income

It’s important to note that even students with low income might be ineligible for subsidized loans under certain circumstances. For instance, a student with significant assets, such as substantial savings or inherited wealth, might not qualify, even if their income is low. Similarly, a student who has already accumulated significant student loan debt from previous education may not be eligible for additional subsidized loans. Furthermore, students who are not enrolled at least half-time in a degree or certificate program generally do not qualify. Finally, students who have defaulted on previous federal student loans will be ineligible for further assistance until the default is resolved.

Undergraduate vs. Graduate Student Eligibility Criteria

The core eligibility requirements for subsidized loans remain consistent between undergraduate and graduate students. However, some nuances exist, particularly concerning dependency status and the availability of loan amounts.

| Criteria | Undergraduate Students | Graduate Students | Notes |

|---|---|---|---|

| Demonstrated Financial Need | Required; determined via FAFSA | Required; determined via FAFSA | Lower EFC generally increases chances of eligibility. |

| Enrollment Status | At least half-time enrollment | At least half-time enrollment | Maintaining satisfactory academic progress is also typically required. |

| Dependency Status | Dependent or independent status impacts income considered. | Dependent or independent status impacts income considered. | Independent students have different income thresholds. |

| Loan Limits | Lower annual and aggregate loan limits | Higher annual and aggregate loan limits, but subject to individual program rules. | Loan limits vary based on year in school and dependency status. |

Federal Student Aid (FAFSA) Application Process

Completing the Free Application for Federal Student Aid (FAFSA) is the crucial first step in accessing federal student financial aid, including subsidized loans. This application gathers essential information about you and your family’s financial situation to determine your eligibility for various aid programs. The process, while detailed, is manageable with careful planning and attention to detail.

The FAFSA application process involves a series of steps designed to collect comprehensive financial information. Accurate and timely completion is vital to ensure you receive the maximum financial aid you’re entitled to. Failure to provide accurate information can result in delays or even denial of aid.

FAFSA Step-by-Step Instructions

The FAFSA process generally involves these key steps: Creating an FSA ID, gathering necessary tax information, completing the application online, and reviewing and submitting the application. Each step requires careful attention to ensure accuracy.

- Create FSA IDs: You and at least one parent (if you are a dependent student) will need to create FSA IDs. These are usernames and passwords that allow you to access and manage your FAFSA information securely. This is a one-time process, and these IDs will be used for future FAFSA applications.

- Gather Necessary Information: Before starting the application, gather all the required tax information, including your and your parents’ (if applicable) Social Security numbers, federal income tax returns, W-2s, and other relevant financial records. Having this information readily available will streamline the application process.

- Complete the Online Application: Access the FAFSA website and begin the application. The form will ask for personal information, family details, and financial data. Answer all questions accurately and completely. Take your time and double-check your responses.

- Review and Submit: Before submitting, carefully review all the information you’ve entered. Make sure everything is accurate and consistent. Once you’re confident in the accuracy of your application, submit it electronically.

Tips for Accurate and Efficient Completion

Successfully navigating the FAFSA application requires careful planning and attention to detail. These tips can help ensure a smooth and efficient process.

- Start Early: Begin the process well in advance of deadlines to avoid last-minute rushes and potential errors.

- Use the IRS Data Retrieval Tool: This tool allows you to securely transfer tax information directly from the IRS to your FAFSA application, minimizing the risk of errors.

- Keep Records: Maintain copies of all documents used to complete the FAFSA for future reference.

- Seek Assistance if Needed: If you encounter difficulties or have questions, seek assistance from your school’s financial aid office or a qualified advisor.

Importance of Accurate Information on the FAFSA

Providing accurate information on the FAFSA is paramount. Inaccurate information can lead to delays in processing your application, reduced financial aid eligibility, and in some cases, even the requirement to repay funds already received. The consequences of providing false information can be significant.

Accurate information ensures you receive the correct amount of financial aid you are eligible for, avoiding potential issues and ensuring a smooth financial aid process.

FAFSA Application Process Flowchart

Imagine a flowchart starting with a box labeled “Start.” An arrow points to a box labeled “Create FSA IDs.” Another arrow leads to “Gather Tax Information.” These boxes are then connected to a box labeled “Complete Online Application,” followed by a box, “Review and Submit.” Finally, an arrow from “Review and Submit” points to a box labeled “Application Submitted,” marking the end of the process. Each box represents a key step in the application process, and the arrows show the sequential order of these steps.

Types of Subsidized Loans and Their Benefits

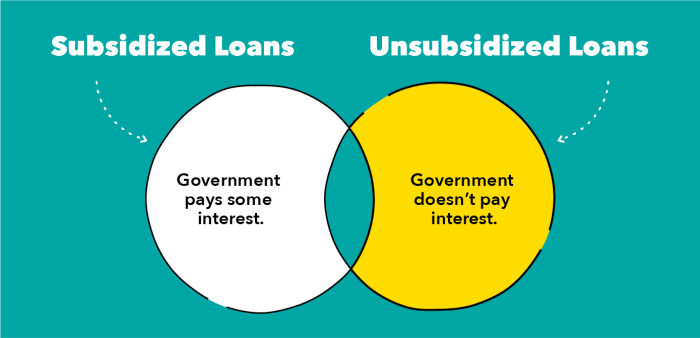

Understanding the different types of subsidized federal student loans and their benefits is crucial for making informed decisions about financing your education. Subsidized loans offer significant advantages over unsubsidized loans, primarily because the government pays the interest while you’re in school, during grace periods, and under certain deferment situations. This section will clarify the distinctions between subsidized loan types and compare them to other financial aid options.

While the terminology might seem complex, the core difference lies in whether the government subsidizes (pays) the interest during certain periods. This significantly impacts the total amount you’ll ultimately repay. Let’s examine the primary type of subsidized federal student loan and its key features.

Direct Subsidized Loans

Direct Subsidized Loans are the most common type of subsidized federal student loan available to undergraduate students who demonstrate financial need. The key benefit is that the government pays the interest on the loan while you’re enrolled at least half-time, during a grace period (typically six months after graduation or leaving school), and in certain deferment situations. This prevents the loan’s principal balance from growing before you even begin repayment. Eligibility is determined through the Free Application for Federal Student Aid (FAFSA).

The amount you can borrow depends on several factors, including your cost of attendance, financial need, and year in school. It’s important to remember that subsidized loans are only available to eligible undergraduate students; graduate students are not eligible for subsidized federal loans.

- Advantage: Interest is paid by the government during specific periods, minimizing the overall loan cost.

- Advantage: Lower overall repayment cost compared to unsubsidized loans.

- Advantage: Helps keep your monthly payments manageable after graduation.

- Disadvantage: Requires demonstrating financial need through the FAFSA.

- Disadvantage: Borrowing limits are established, and may not cover the full cost of education.

Subsidized Loans Compared to Unsubsidized Loans and Other Aid

Choosing between subsidized loans and unsubsidized loans significantly impacts the total cost of your education. Unsubsidized loans accrue interest from the time the loan is disbursed, even while you’re in school. This means the principal balance grows over time, leading to a higher total repayment amount. Subsidized loans, conversely, postpone interest accrual, reducing the overall cost.

Other financial aid options, such as grants and scholarships, don’t need to be repaid. Therefore, prioritizing these options before taking out loans is always advisable. Grants are generally based on financial need, while scholarships can be merit-based or need-based. Exploring these options before relying on loans can significantly reduce your long-term debt burden.

- Subsidized Loan Advantage over Unsubsidized Loan: Interest does not accrue during certain periods, leading to lower total repayment.

- Subsidized Loan Advantage over Unsubsidized Loan: Lower monthly payments after graduation due to less accumulated interest.

- Subsidized Loan Disadvantage compared to Grants/Scholarships: Requires repayment, increasing overall education cost.

- Subsidized Loan Disadvantage compared to Grants/Scholarships: May still leave a gap in funding despite receiving aid.

Maintaining Eligibility for Subsidized Loans

Securing a subsidized student loan is a significant step toward financing your education. However, maintaining eligibility throughout your studies requires consistent effort and adherence to specific guidelines. Understanding these requirements is crucial to ensuring uninterrupted funding and avoiding potential disruptions to your academic journey. This section will Artikel the factors influencing continued eligibility and provide guidance on navigating potential challenges.

Maintaining eligibility for subsidized federal student loans hinges on several key factors. Your enrollment status, academic progress, and compliance with federal regulations all play a significant role. Changes in any of these areas could jeopardize your continued access to loan funds.

Factors Affecting Continued Eligibility

Continued eligibility for subsidized loans depends primarily on your enrollment status and satisfactory academic progress (SAP). Maintaining at least half-time enrollment is generally required. This typically translates to at least six credit hours per semester, but the exact number can vary based on your institution’s definition of half-time status. Additionally, you must demonstrate satisfactory academic progress, typically measured by your grade point average (GPA) and completion rate. Each institution establishes its own SAP standards, which are usually Artikeld in the student handbook or on the financial aid office’s website. Failure to meet these standards can result in the loss of federal financial aid, including subsidized loans.

Examples of Situations Leading to Loss of Eligibility

Several scenarios can lead to a loss of eligibility. For instance, dropping below half-time enrollment without prior authorization from the financial aid office could result in the termination of your subsidized loan benefits. Similarly, failing to maintain satisfactory academic progress, as defined by your institution, can also lead to ineligibility. This might involve receiving a low GPA or failing to complete a sufficient number of credits within a specified timeframe. Changes in your citizenship status or enrollment in a program not eligible for federal student aid could also affect your eligibility. Furthermore, providing false or misleading information on your FAFSA application can result in the revocation of your eligibility. Finally, failing to meet the loan repayment terms after graduation could impact your eligibility for future federal student aid.

Appealing a Decision Regarding Loan Eligibility

If your eligibility for subsidized loans is denied or terminated, you have the right to appeal the decision. The appeals process typically involves submitting a written request to your institution’s financial aid office, clearly outlining the reasons for your appeal and providing supporting documentation. This documentation might include medical records (in case of illness or disability), letters of explanation from professors, or evidence of extenuating circumstances that affected your academic performance. The financial aid office will review your appeal and make a decision based on the information provided. The specific procedures for appealing a decision may vary between institutions; therefore, consulting the financial aid office directly is crucial.

Actions to Maintain Eligibility for Subsidized Loans

Maintaining eligibility for subsidized loans requires proactive measures. The following steps can significantly improve your chances of continued funding:

- Maintain at least half-time enrollment status.

- Meet your institution’s satisfactory academic progress (SAP) requirements.

- Regularly check your student account for any updates or notices from the financial aid office.

- Contact the financial aid office promptly if you anticipate any changes in your enrollment status or academic performance.

- Keep your contact information updated with the financial aid office.

- Understand and comply with all federal regulations regarding student financial aid.

- Seek academic advising to ensure you’re on track to graduate on time.

Understanding Loan Repayment Options

Successfully navigating the world of student loans requires a thorough understanding of repayment options. Choosing the right plan significantly impacts your long-term financial health, affecting your monthly budget and overall debt payoff timeline. Careful consideration of your financial situation and future goals is crucial in selecting the most suitable repayment plan.

Available Repayment Plans for Subsidized Loans

Several repayment plans are available for federal student loans, including subsidized loans. The best option depends on individual circumstances and income levels. The federal government offers a variety of plans designed to accommodate different financial situations.

- Standard Repayment Plan: This is the default plan, typically requiring fixed monthly payments over 10 years. It’s straightforward but results in higher monthly payments.

- Graduated Repayment Plan: Payments start low and gradually increase over time, making them more manageable initially. However, the total repayment period remains 10 years.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher overall interest paid.

- Income-Driven Repayment (IDR) Plans: These plans link monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans offer lower monthly payments but can extend the repayment period beyond 20 years, leading to increased interest costs.

Utilizing Resources for Personalized Repayment Planning

Creating a personalized repayment plan involves assessing your financial situation and exploring available resources. Several tools and resources can assist in this process.

- Federal Student Aid Website (studentaid.gov): This website provides a loan simulator and repayment calculators to estimate monthly payments under different plans.

- Loan Servicer: Your loan servicer can provide personalized guidance and help you choose the most appropriate repayment plan.

- Financial Advisors: Consulting a financial advisor can offer comprehensive financial planning, including student loan repayment strategies.

Long-Term Financial Implications of Different Repayment Plans

The long-term financial implications of different repayment plans vary significantly. Choosing a plan with lower monthly payments often leads to a longer repayment period and increased total interest paid. Conversely, opting for a shorter repayment period typically results in higher monthly payments but lower overall interest costs.

- Example: A $30,000 loan repaid under the standard 10-year plan might have a total interest cost of $5,000. The same loan under an extended 25-year plan could incur $15,000 in interest due to the extended repayment period.

Infographic: Repayment Plan Options and Costs

The infographic would feature a central title: “Navigating Your Student Loan Repayment.” It would use a clean, visually appealing design with a color-coded system to represent different repayment plans. Each plan (Standard, Graduated, Extended, and IDR) would be represented by a distinct color-coded box. Within each box, key information would be displayed: Plan Name, Monthly Payment Example (using a $30,000 loan as a baseline), Total Repayment Period, Total Interest Paid (estimated), and a small icon representing the plan’s key characteristic (e.g., a graph for Graduated, a clock for Extended, a dollar sign for IDR). A bar graph would visually compare the total interest paid across different plans, clearly showing the significant differences. A simple table summarizing the key features of each plan would be included below the bar graph for easy comparison. The infographic would conclude with a call to action: “Consult your loan servicer or a financial advisor to create a personalized plan.” The overall visual style would be modern and easy to understand, using clear fonts and concise language.

Impact of Financial Aid on Overall College Costs

Subsidized student loans can significantly impact the total cost of a college education, both positively and negatively. While they provide crucial funding to make college accessible, they also represent debt that needs careful management to avoid overwhelming financial burdens after graduation. Understanding how these loans affect overall costs and employing effective strategies for minimizing borrowing is crucial for successful financial planning during and after college.

Subsidized loans, unlike unsubsidized loans, don’t accrue interest while the student is enrolled at least half-time and during grace periods. This means the total amount borrowed remains lower compared to unsubsidized loans, reducing the overall debt burden. However, the total cost of college still includes tuition, fees, room and board, books, and other living expenses, even with financial aid. The amount of financial aid received, including subsidized loans, will directly influence the remaining amount a student needs to cover out-of-pocket or through other forms of borrowing.

Strategies for Minimizing Borrowing Needs

Minimizing borrowing requires a proactive approach to managing college expenses. Careful planning and budgeting are essential. This includes exploring scholarships and grants, working part-time, and choosing a college with a lower overall cost of attendance. Prioritizing needs over wants and exploring affordable housing options can also significantly reduce overall expenses.

Effective Budgeting While Using Student Loans

Creating a realistic budget is paramount for managing expenses while using student loans. This involves tracking income (including loan disbursements and any part-time earnings) and meticulously recording all expenses. Categorizing expenses (housing, food, transportation, books, entertainment) helps identify areas where spending can be adjusted. Budgeting apps and spreadsheets can be invaluable tools in this process. Regularly reviewing and adjusting the budget based on actual spending patterns is key to staying on track.

Sample Student Budget

The following table illustrates a sample monthly budget for a student using student loans. Remember that this is just an example, and individual budgets will vary based on location, lifestyle, and the specific college’s cost of attendance. Adjustments should be made to reflect personal circumstances.

| Income | Expense Category | Amount ($) | Notes |

|---|---|---|---|

| Student Loan Disbursement | Housing (Rent/Dorm) | 700 | Consider affordable housing options. |

| Part-time Job Earnings ($10/hour, 10 hours/week) | Food | 300 | Cook at home frequently; avoid eating out excessively. |

| Transportation | 100 | Utilize public transportation or carpool when possible. | |

| Books & Supplies | 50 | Buy used textbooks or rent them. | |

| Utilities (Phone, Internet) | 75 | Shop around for the best deals. | |

| Personal Care | 50 | Avoid unnecessary spending. | |

| Entertainment | 50 | Limit entertainment expenses. | |

| Total: $1200 | Savings | 100 | Prioritize saving a small amount each month. |

| Loan Repayment (if applicable) | 0 | Deferment or forbearance may apply during studies. | |

| Total Expenses | 1200 |

Final Summary

Successfully securing subsidized student loans requires careful planning and a thorough understanding of the eligibility requirements and application process. By diligently completing the FAFSA, maintaining good academic standing, and choosing a repayment plan that aligns with your post-graduation financial goals, you can effectively manage your student loan debt and pave the way for a successful future. Remember, accurate information and proactive planning are key to navigating this crucial aspect of higher education financing.

FAQs

What is the difference between subsidized and unsubsidized loans?

With subsidized loans, the government pays the interest while you’re in school (under certain conditions). Unsubsidized loans accrue interest from the time the loan is disbursed.

Can I still qualify for subsidized loans if my parents have a high income?

Eligibility for subsidized loans depends on your demonstrated financial need, which is calculated using your and your parents’ income and assets (if you are a dependent student). Even with high parental income, you might still qualify based on other factors like exceptional circumstances or your own financial resources.

What happens if I don’t maintain satisfactory academic progress?

Failure to maintain satisfactory academic progress (SAP) can result in the loss of your eligibility for federal student aid, including subsidized loans. Each institution sets its own SAP standards, so it’s essential to understand your school’s requirements.

What if my financial situation changes after I’ve been awarded a subsidized loan?

Significant changes in your financial circumstances, such as a job loss or a major medical expense, could potentially affect your eligibility for continued funding. You may need to contact your financial aid office to discuss your situation.