Navigating the process of student loan recertification can feel overwhelming, but understanding the steps involved can significantly ease the burden. This guide provides a clear and concise path to successfully recertifying your student loans, ensuring you remain on track with your repayment plan and avoid potential pitfalls. We’ll cover everything from gathering the necessary documentation to understanding the different repayment options available to you.

Recertification is crucial for maintaining eligibility for income-driven repayment plans, which tie your monthly payments to your current income and family size. Failure to recertify can result in higher payments or even loss of eligibility, potentially leading to significant financial hardship. This comprehensive guide aims to empower you with the knowledge and tools to navigate this process confidently and successfully.

Understanding Student Loan Recertification

Student loan recertification is a crucial process that ensures your financial aid package remains accurate and reflects your current circumstances. It’s a regular check-in to confirm your eligibility for continued financial assistance, preventing overpayment or underpayment of your loans. Understanding the process and requirements is vital for maintaining your financial aid and avoiding potential repayment issues down the line.

Student loan recertification verifies the information you provided when you initially applied for financial aid. This reassessment is typically required annually, or as stipulated by your lender or institution. The purpose is to ensure that the aid you receive is appropriate based on your current financial situation, including income, household size, and other relevant factors. Failure to recertify can lead to the suspension of your financial aid.

Eligibility Criteria for Recertification

Eligibility for student loan recertification is generally tied to continued enrollment in your educational program. You must be making satisfactory academic progress towards your degree or certificate. Specific requirements may vary depending on your lender, institution, and the type of loan you have. These requirements are usually Artikeld in your loan agreement or your school’s financial aid documentation. Contacting your financial aid office directly is the best way to confirm your eligibility.

Initiating the Recertification Process

The recertification process usually begins with a notification from your lender or educational institution. This notification will Artikel the necessary steps and deadlines. Typically, the process involves completing a new financial aid application, providing updated documentation, such as tax returns and pay stubs, and submitting it to the designated office. You may be required to attend an interview or provide additional information as needed. It is crucial to respond promptly and accurately to all requests for information. Failing to do so could delay your aid disbursement or even lead to the termination of your financial aid eligibility.

Common Reasons for Recertification

Several factors can trigger the need for student loan recertification. Changes in income, household size, or dependent status are common reasons. For example, a student whose parent’s income significantly increases may no longer qualify for the same level of financial aid. Similarly, a student who gets married or has a child will experience changes to their household size and financial situation, requiring a re-evaluation of their aid eligibility. A change in enrollment status, such as dropping below full-time enrollment, may also necessitate recertification. Finally, significant changes in your assets could also impact your eligibility for financial aid.

Required Documentation and Information

Recertifying your student loans requires submitting specific documentation to verify your current financial situation and eligibility for continued loan benefits. This process ensures the accuracy of your repayment plan and prevents potential overpayment or underpayment. Providing complete and accurate information upfront will streamline the recertification process and avoid delays.

The necessary documents and information vary depending on your lender and the specific loan program. However, some common requirements are consistent across most programs. Careful preparation and organization are crucial for a smooth and efficient recertification.

Necessary Documents for Student Loan Recertification

Generally, you will need to provide documentation proving your current income, household size, and expenses. This helps your lender assess your ability to repay your loans. Failure to provide sufficient documentation may result in delays or denial of your recertification request.

- Tax Returns (Federal and State): These documents provide concrete evidence of your annual income and tax liabilities. You should include all relevant schedules and forms.

- Pay Stubs (Recent): Current pay stubs, ideally from the past three months, verify your current income and employment status. These should clearly show your gross and net pay.

- Proof of Income (Other Sources): If you have income from sources other than employment (e.g., self-employment, investments, alimony), provide supporting documentation such as 1099 forms or bank statements showing these income streams.

- Proof of Expenses (Optional, but helpful): While not always mandatory, documentation supporting significant expenses (e.g., rent or mortgage statements, utility bills) can strengthen your application by demonstrating your financial circumstances.

Information Checklist for a Successful Application

Completing this checklist before submitting your application will help ensure you have all the necessary information. Having this information organized will make the process significantly faster and less stressful.

- Loan Servicer Information: Your loan servicer’s name and contact information.

- Loan Identification Numbers: The unique identification numbers for each of your student loans.

- Personal Information: Your full legal name, address, phone number, Social Security number, and date of birth.

- Household Size: The number of people living in your household who are dependent on your income.

- Income Information: Gross and net income for all sources, including tax returns and pay stubs.

- Expense Information (Optional): Detailed information on significant expenses, supported by documentation.

Gathering and Organizing Required Documents

A systematic approach to gathering and organizing your documents will make the recertification process much easier. Start by creating a dedicated file or folder to store all relevant paperwork.

- Compile Documents: Gather all the necessary documents listed above. Make copies of originals to keep for your records.

- Organize Documents: Arrange the documents logically, perhaps chronologically or by document type. This will make reviewing them much simpler.

- Verify Completeness: Carefully review all documents to ensure they are complete and legible. Missing information or illegible documents can delay the process.

- Secure Documents: Keep all original documents in a safe place, separate from the copies you submit.

Sample Information Collection Form

Using a form to collect your information can help ensure you provide all necessary details accurately. This organized approach minimizes the chance of missing crucial information.

| Information Category | Details |

|---|---|

| Loan Servicer | [Space for Servicer Name and Contact Information] |

| Loan ID Number(s) | [Space for Loan ID Numbers] |

| Personal Information | [Space for Name, Address, Phone Number, SSN, DOB] |

| Household Size | [Space for Number of Dependents] |

| Gross Annual Income | [Space for Total Gross Income] |

| Net Annual Income | [Space for Total Net Income] |

| Significant Expenses (Optional) | [Space for Listing and Supporting Documentation] |

Completing the Recertification Application

Successfully completing your student loan recertification application is crucial to maintaining your eligibility for financial aid. Accuracy and completeness are key to a smooth and timely process. This section provides guidance on navigating the application process effectively.

The application process itself varies depending on your institution, but generally involves providing updated information about your financial circumstances. This typically includes details about your income, assets, household size, and any dependents. It’s essential to review all sections carefully and ensure all information is accurate and up-to-date.

Application Section Guidance

Each section of the recertification application requests specific information. Providing accurate and complete responses is paramount. For example, income documentation should include all sources of income, not just employment. Similarly, asset information should include all bank accounts, investments, and other assets. Failure to disclose all relevant information can result in delays or denial of your aid.

Common Application Mistakes

Several common mistakes can delay or complicate the recertification process. These often stem from inaccuracies or omissions in the provided information. For instance, failing to report a change in income, household size, or dependent status can lead to significant problems. Similarly, submitting incomplete or illegible documentation is a frequent cause of delays. Careful review before submission is crucial.

Ensuring a Complete and Error-Free Application

To ensure a smooth recertification, thoroughly review your application before submitting it. Double-check all figures and ensure that all required documentation is included. Consider having a friend or family member review the application for any potential errors or omissions. Preparing your documentation in advance will significantly reduce the likelihood of mistakes. Keeping copies of all submitted documents is also advisable.

Application Method Comparison

Different institutions offer various methods for submitting your recertification application. Each method has its advantages and disadvantages, which should be considered based on individual circumstances and preferences.

| Application Method | Advantages | Disadvantages | Time to Process |

|---|---|---|---|

| Online Portal | Convenient, fast submission, instant confirmation, often allows for tracking application status. | Requires internet access and technological proficiency. May be susceptible to technical issues. | Generally fastest, often within a few business days. |

| Suitable for individuals without reliable internet access. | Slower processing time, increased risk of lost or delayed mail, lack of immediate confirmation. | Can take several weeks, depending on postal service efficiency. | |

| In-Person | Allows for immediate clarification of any questions. | Requires travel to the institution’s office, may involve waiting times. | Processing time varies depending on the institution’s workload. |

| Fax | Faster than mail, provides confirmation of transmission. | Requires a fax machine, can be prone to transmission errors. Less common now. | Processing time varies, typically faster than mail. |

Income and Financial Information

Recertifying your student loans often requires providing updated income and financial information. This ensures your repayment plan remains appropriate for your current financial situation and helps determine your eligibility for income-driven repayment plans or potential adjustments to your monthly payments. Accurate reporting is crucial to avoid potential issues down the line.

Income verification during the recertification process is designed to ensure the accuracy of the information you provide. The lender will use this information to recalculate your payments if necessary. They may request documentation to support your claimed income, and failing to provide this documentation can delay the process or even result in your loan being placed in default.

Acceptable Income Documentation

Providing accurate and verifiable income documentation is essential for a smooth recertification process. Acceptable forms of documentation vary depending on your employment situation and the lender’s specific requirements, but generally include:

- Pay stubs: Recent pay stubs (typically from the last two months) clearly showing your gross monthly income, including any overtime pay, bonuses, or commissions.

- W-2 forms: Your most recent W-2 form, which summarizes your annual earnings from the previous tax year.

- Tax returns: Copies of your federal and state income tax returns (Form 1040 and relevant state forms), including all schedules and supporting documentation.

- Self-employment income documentation: If you are self-employed, you will need to provide documentation such as profit and loss statements, bank statements, and tax returns reflecting your business income.

- Employer verification letter: A letter from your employer confirming your current employment status, salary, and dates of employment.

Impact of Income Changes on Loan Repayment Plans

Changes in your income, whether an increase or a decrease, can significantly impact your student loan repayment plan. A decrease in income might make you eligible for a lower monthly payment under an income-driven repayment plan, while a substantial increase might lead to higher payments or a faster repayment timeline. It’s important to report any significant changes promptly to avoid accumulating arrears or missing out on potential benefits. For example, if your income drops by 20% due to job loss, you might qualify for a reduced monthly payment under an ICR (Income Contingent Repayment) plan. Conversely, a significant promotion resulting in a 50% income increase could shorten your repayment period.

Examples of Accurately Reporting Income Changes

Accurate reporting is key. If you experience a change in employment, ensure you report your new income promptly, providing updated pay stubs or a new W-2 form. If you’re self-employed and your income fluctuates, maintain detailed financial records and report your average income over a reasonable period, usually the last 12 months, to reflect a realistic picture of your financial situation. For instance, if you received a significant bonus in one month, you should report your average monthly income over the year rather than just the month with the bonus to avoid misrepresentation. Similarly, if you experienced a temporary pay cut, you might want to report the income from the previous 12 months to demonstrate a more stable income average.

Understanding Your Loan Repayment Plan

Choosing the right student loan repayment plan is crucial for managing your debt effectively. Your repayment plan dictates your monthly payment amount, the total interest you’ll pay, and the length of time it takes to repay your loans. Recertification can impact your plan, potentially lowering your payments or adjusting your repayment schedule.

Types of Student Loan Repayment Plans

Several repayment plans are available, each with its own set of advantages and disadvantages. Understanding these differences is essential for selecting the plan that best suits your financial situation.

- Standard Repayment Plan: This is the default plan for most federal student loans. It typically involves fixed monthly payments over a 10-year period. The benefit is a shorter repayment term, leading to less interest paid overall. However, monthly payments can be higher than other plans.

- Graduated Repayment Plan: Payments start low and gradually increase over time, typically every two years, for a 10-year period. This plan offers lower initial payments, making it easier to manage early on. However, you’ll end up paying more interest overall due to the longer time it takes to repay the principal.

- Extended Repayment Plan: This plan stretches repayments over a longer period, up to 25 years, resulting in lower monthly payments. While this reduces short-term financial strain, you’ll pay significantly more interest over the life of the loan.

- Income-Driven Repayment (IDR) Plans: These plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR), base your monthly payment on your income and family size. Payments are typically lower and potentially affordable, but the repayment period can extend beyond 20 years. Remaining balances may be forgiven after 20 or 25 years, depending on the plan, but this forgiven amount is considered taxable income.

Recertification’s Impact on Repayment Plans

Recertification, typically required annually for income-driven repayment plans, reassesses your income and family size. This reassessment directly impacts your monthly payment. A decrease in income might result in a lower monthly payment under an IDR plan, while an increase could lead to a higher payment. For standard, graduated, and extended repayment plans, recertification usually doesn’t directly alter the monthly payment amount unless there’s a loan consolidation or modification.

Calculating Monthly Payments

Calculating your monthly payment depends on the repayment plan and your loan details. While online calculators and your loan servicer’s website provide tools, understanding the basic principles is helpful.

- Standard, Graduated, and Extended Repayment Plans: These typically use an amortization schedule to determine fixed or graduated monthly payments. The formula is complex, involving principal, interest rate, and loan term. However, loan calculators readily provide these calculations based on your loan details.

- Income-Driven Repayment Plans: These calculations are more intricate, considering your adjusted gross income (AGI), family size, and the applicable repayment plan’s formula. The specific formula varies by plan, but it generally involves a percentage of your discretionary income. Again, online calculators and your loan servicer can provide accurate calculations based on your provided information.

Example: Let’s say your annual discretionary income is $20,000, and your REPAYE plan dictates a 10% payment rate. Your annual payment would be $2,000, resulting in a monthly payment of approximately $166.67. This is a simplified example, and actual calculations involve more factors.

Potential Issues and Solutions

Recertifying your student loans can sometimes present challenges. Understanding common problems and their solutions can significantly ease the process and prevent delays in your loan repayment plan adjustments. This section will address frequent issues encountered during recertification, offering practical solutions and strategies for successful resolution.

Common Application Errors

Many application errors stem from simple mistakes or omissions. Careful review of the application before submission is crucial. For example, inaccurate reporting of income, failure to provide necessary documentation, or missing deadlines are common reasons for application delays or rejection. Addressing these issues proactively can prevent significant setbacks. Solutions involve double-checking all entered information for accuracy, ensuring all required documents are included and properly formatted (e.g., legible copies), and submitting the application well before the deadline to allow time for corrections if needed. Remember to keep copies of all submitted documents for your records.

Appealing a Recertification Decision

If your recertification application is denied, you have the right to appeal the decision. The appeal process typically involves submitting a formal request, along with any supporting documentation that addresses the reasons for the denial. This might include evidence of extenuating circumstances affecting your income or a detailed explanation of any errors in the initial application. Each lender has a specific appeals process; therefore, carefully review your lender’s guidelines for detailed instructions. For instance, if a denial was based on a perceived discrepancy in income, providing additional pay stubs or tax documentation could strengthen your appeal.

Successful Resolution Strategies

Successfully navigating recertification challenges often involves proactive communication and thorough documentation. For example, if you experience a sudden change in income, immediately contact your loan servicer to explain the situation. Providing supporting documentation, such as a layoff notice or a letter from your employer, can help expedite the process and demonstrate the validity of your claim. Another successful strategy is organizing all your financial documents in advance, including tax returns, pay stubs, and bank statements. This ensures you have everything readily available when completing the application or responding to any requests from your lender. A well-organized approach minimizes delays and increases the likelihood of a positive outcome. For instance, one student successfully appealed a denial by providing detailed medical documentation explaining their temporary inability to work, leading to a revised repayment plan.

Post-Recertification Procedures

After submitting your student loan recertification application, several important steps follow to ensure a smooth process and accurate reflection of your current financial situation. Understanding these procedures will help manage expectations and proactively address any potential issues.

Following submission, you’ll enter a period where your information is reviewed and processed by the loan servicer. This involves verifying the accuracy and completeness of the data provided, comparing it against previous submissions, and potentially cross-referencing it with other relevant financial information.

Application Processing Timeline

The time it takes to receive a decision on your recertification application varies depending on several factors, including the complexity of your application, the volume of applications the servicer is currently processing, and the timeliness of any requested supplemental documentation. Generally, you can expect a response within 4-6 weeks. However, it’s not uncommon for this process to take longer, especially during peak periods. You should receive notification via mail or email when a decision has been reached. If you haven’t heard back within eight weeks, it’s advisable to contact your loan servicer directly to inquire about the status of your application.

Updating Loan Information Post-Recertification

Once your recertification is processed and your repayment plan is adjusted (if necessary), it’s crucial to keep your contact information and financial details up-to-date. This ensures that you receive important notifications about your loan, such as payment due dates, changes to your repayment plan, and any other relevant updates. Most loan servicers have online portals where you can easily update your information. Regularly review your loan account details to verify accuracy and make necessary changes promptly.

Understanding Recertification Outcomes

The outcome of your recertification will determine your new repayment plan, if any changes are necessary. You’ll receive official notification detailing the changes, if any, to your monthly payment amount, repayment schedule, or other pertinent details. Carefully review this notification to fully understand its implications. If you have questions or are unsure about any aspect of the outcome, don’t hesitate to contact your loan servicer directly. They can clarify any confusing elements and help you navigate the next steps. For instance, if your income has significantly decreased, your recertification may result in a lower monthly payment or a change to an income-driven repayment plan. Conversely, if your income has increased, your payment amount might adjust upward to reflect your improved financial standing. It is important to carefully review the specifics of your new repayment plan to ensure it aligns with your current financial capabilities.

Resources and Further Assistance

Successfully navigating the student loan recertification process often requires accessing various resources and support systems. This section provides a compilation of helpful resources, contact information for relevant agencies, guidance on using the recertification website, and a visual representation of the entire process. Understanding these resources can significantly streamline the recertification process and minimize potential complications.

Numerous resources are available to assist borrowers throughout the student loan recertification process. These resources range from official government websites and dedicated helplines to non-profit organizations offering financial literacy and guidance.

Helpful Resources for Student Loan Borrowers

Accessing the right resources is crucial for a smooth recertification experience. The following list provides a range of options, each designed to offer different types of support and information.

- The National Student Loan Data System (NSLDS): This U.S. Department of Education website provides a central location to access your federal student loan information, including loan balances, repayment plans, and servicer contact information. You can access this at studentaid.gov.

- Your Loan Servicer: Your loan servicer is the company responsible for managing your student loans. They can answer specific questions about your loans, the recertification process, and provide assistance with completing the necessary forms. Contact information for your servicer should be available on your loan documents or through the NSLDS website.

- Federal Student Aid (FSA): The FSA website (studentaid.gov) offers comprehensive information on federal student aid programs, including resources and guides related to loan repayment and recertification. This is an excellent resource for understanding your rights and responsibilities as a borrower.

- Non-profit Credit Counseling Agencies: These agencies provide free or low-cost financial counseling services, including assistance with managing student loan debt and navigating the recertification process. They can offer personalized guidance and support based on your individual financial situation. You can find a list of accredited agencies through the National Foundation for Credit Counseling (NFCC).

Contact Information for Relevant Agencies and Organizations

Direct contact with relevant agencies can be crucial for addressing specific concerns or resolving issues during the recertification process. Having the correct contact information readily available can save time and effort.

| Agency/Organization | Contact Information |

|---|---|

| Federal Student Aid (FSA) | Visit studentaid.gov for various contact options, including phone numbers and email addresses. |

| Your Loan Servicer (varies) | Contact information is typically found on your loan documents or through the NSLDS. |

| National Foundation for Credit Counseling (NFCC) | Their website (nfcc.org) provides a directory of accredited credit counseling agencies. |

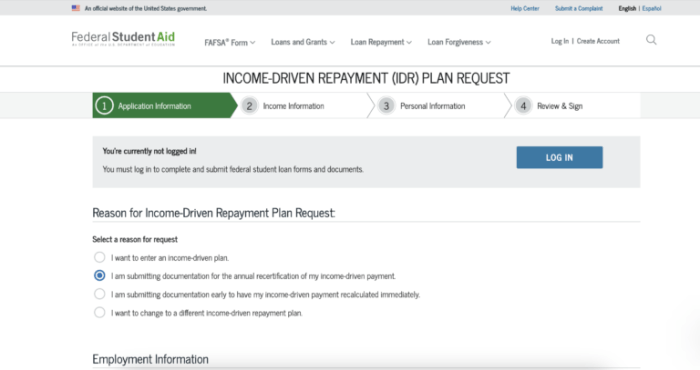

Navigating the Student Loan Recertification Website

Understanding the layout and functionality of the student loan recertification website is vital for a successful application. This section provides a simplified guide to help you navigate the site effectively.

Generally, recertification websites will follow a similar structure. Look for clear sections outlining required documentation, application forms, and frequently asked questions (FAQs). The FAQs section is particularly useful for addressing common questions and concerns. If you encounter difficulties, use the website’s help section or contact customer support.

Recertification Process Flowchart

A visual representation of the recertification process can be helpful in understanding the steps involved. The following describes a sample flowchart; specific steps may vary depending on the lender and program.

The flowchart would begin with a “Start” box. This would be followed by a series of boxes representing each step: 1. Receive Recertification Notification; 2. Gather Required Documents; 3. Complete Application; 4. Submit Application; 5. Application Review; 6. Approval/Denial Notification; 7. Appeal (if applicable); 8. Updated Repayment Plan; 9. “End”. Arrows would connect each box, indicating the flow of the process. Decision points, such as application approval or denial, would be represented with diamond-shaped boxes leading to different paths.

End of Discussion

Successfully recertifying your student loans requires careful planning and attention to detail. By following the steps Artikeld in this guide, and addressing potential issues proactively, you can ensure a smooth and efficient process. Remember, understanding your repayment options and accurately reporting your financial information are key to securing the best possible outcome. Proactive planning and a thorough understanding of the process can alleviate stress and pave the way for responsible and manageable student loan repayment.

FAQ Overview

What happens if I don’t recertify my student loans?

Failure to recertify can result in your repayment plan being adjusted to a standard repayment plan, leading to significantly higher monthly payments. In some cases, you may lose eligibility for income-driven repayment altogether.

How often do I need to recertify my student loans?

The frequency of recertification varies depending on your loan type and repayment plan. It’s typically required annually or every few years. Check your loan servicer’s website or contact them directly for specific details.

What if my income changes significantly after I’ve already recertified?

You should contact your loan servicer immediately to report any significant changes in your income. They may be able to adjust your repayment plan to reflect your new circumstances.

Can I recertify my student loans online?

Most loan servicers offer online recertification options. However, some may require paper applications. Check with your servicer to determine the available methods.