Navigating the complexities of student loan debt can feel overwhelming, but understanding the strategies to lower your interest rate can significantly impact your long-term financial health. This guide explores various avenues, from government programs and refinancing options to effective budgeting techniques and the value of seeking professional financial advice. By carefully considering these strategies, you can take control of your student loan payments and pave the way for a more secure financial future.

The high cost of higher education often leaves graduates burdened with significant student loan debt. However, proactive management of these loans can lessen the financial strain. This guide provides a comprehensive overview of the different types of student loans, their associated interest rates, and actionable steps to reduce the overall cost of repayment. We will examine various methods for lowering your interest rate, including refinancing, income-driven repayment plans, and strategic budgeting techniques.

Understanding Student Loan Interest Rates

Understanding student loan interest rates is crucial for responsible borrowing and effective repayment planning. The interest rate significantly impacts the total cost of your education, determining how much you’ll ultimately pay back. Several factors influence these rates, and knowing how they work can help you make informed decisions.

Factors Influencing Student Loan Interest Rates

Several key factors determine the interest rate you’ll receive on your student loans. These include your creditworthiness (for private loans), the type of loan, the prevailing market interest rates, and the loan’s term. For federal loans, your credit history generally doesn’t play a role, but other factors like your loan type and the current economic climate do. Private loan rates are more directly tied to your credit score and financial history. Longer loan terms often result in lower monthly payments but higher overall interest costs.

Types of Federal and Private Student Loans and Their Interest Rates

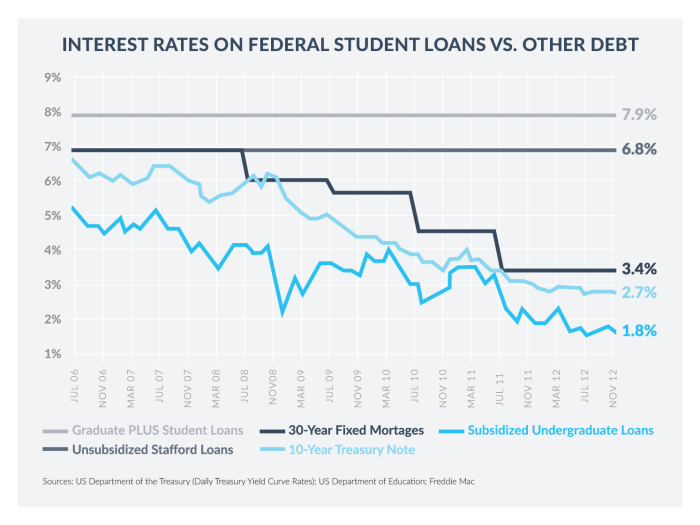

Federal student loans are offered by the U.S. government and typically have lower interest rates than private loans. Federal loan programs include subsidized and unsubsidized Stafford Loans (for undergraduate and graduate students), PLUS Loans (for parents and graduate students), and Perkins Loans (a need-based program). Interest rates for these loans vary depending on the loan type and the year the loan was disbursed. The rates are set annually by the government and are generally fixed for the life of the loan.

Private student loans, on the other hand, are offered by banks, credit unions, and other private lenders. Their interest rates are variable and are determined by a variety of factors, including the borrower’s credit history, credit score, co-signer (if applicable), and the prevailing market conditions. Generally, private student loans carry higher interest rates than federal loans.

Fixed Versus Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains the same throughout the loan’s repayment period, making it easier to budget and predict your monthly payments. A variable interest rate fluctuates over time, based on an index like the prime rate or LIBOR. While a variable rate might start lower than a fixed rate, it could increase significantly over the life of the loan, leading to higher overall costs. Choosing between a fixed and variable rate depends on your risk tolerance and financial projections. A fixed rate offers predictability, while a variable rate might offer initial savings but carries more risk.

Comparison of Student Loan Interest Rates

The following table provides a general comparison of interest rates for various student loan programs. Note that these rates can change annually and are subject to adjustments. It’s crucial to check the current rates directly with the lender or government sources for the most up-to-date information.

| Loan Type | Interest Rate Type | Approximate Interest Rate Range (as of October 26, 2023 – illustrative purposes only) | Notes |

|---|---|---|---|

| Federal Subsidized Stafford Loan | Fixed | 4.99% – 7.54% (Undergraduate) | Rates vary based on loan disbursement year. |

| Federal Unsubsidized Stafford Loan | Fixed | 4.99% – 7.54% (Undergraduate) | Rates vary based on loan disbursement year. |

| Federal PLUS Loan | Fixed | 7.54% – 10.5% | Rates vary based on loan disbursement year. |

| Private Student Loan | Variable or Fixed | 6% – 15% | Rates vary widely based on creditworthiness and lender. |

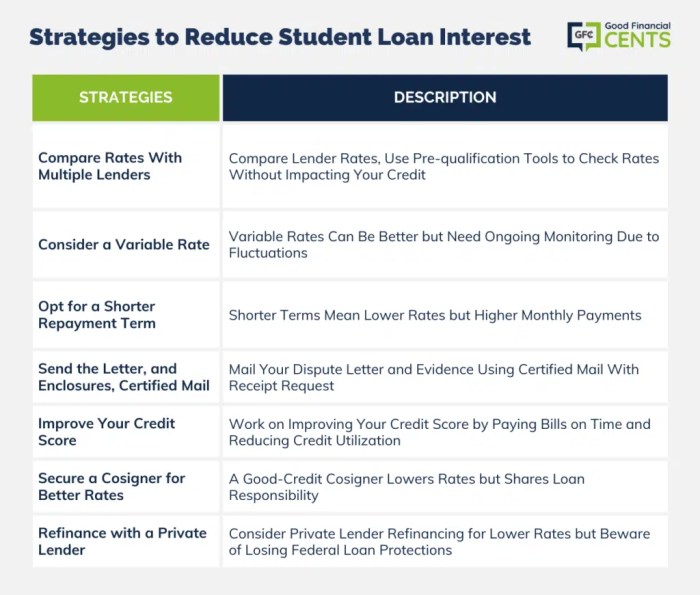

Strategies for Reducing Interest Payments

Managing student loan debt effectively often involves minimizing interest payments. High interest can significantly increase the total cost of your loan, extending repayment timelines and impacting your financial future. Several strategies can help you reduce these costs, ultimately saving you money and accelerating your path to becoming debt-free.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. This can significantly lower your monthly payments, making them more manageable, especially during periods of lower income or unexpected financial hardship. The reduced monthly payments, however, often result in a longer repayment period and potentially higher total interest paid over the life of the loan. Several IDR plans exist, each with specific eligibility criteria and payment calculation methods. Choosing the right plan depends on your individual financial circumstances and long-term goals. The potential benefits include avoiding delinquency, preventing default, and gaining financial stability. However, careful consideration should be given to the trade-off between lower monthly payments and increased overall interest paid.

Refinancing Student Loans

Refinancing your student loans involves consolidating your existing loans into a new loan with a lower interest rate. This is often possible if your credit score has improved since you initially took out your loans. A lower interest rate directly translates to lower monthly payments and a reduced total interest paid over the life of the loan. Before refinancing, it’s crucial to compare interest rates from multiple lenders and carefully review the terms and conditions of the new loan. For example, a borrower with a $50,000 loan at 7% interest could save thousands of dollars by refinancing to a 4% interest rate. However, be aware that refinancing may extend your repayment period. Always carefully weigh the pros and cons before proceeding.

Student Loan Consolidation Strategies

Consolidating multiple student loans into a single loan can simplify repayment and potentially lower your interest rate, depending on the terms offered by the consolidation lender. This streamlined approach can make budgeting easier by combining multiple payments into one. Successful consolidation strategies involve researching various lenders, comparing their interest rates and fees, and choosing a plan that aligns with your financial goals. For instance, a borrower with several federal loans at varying interest rates could consolidate them into a single federal loan with a weighted average interest rate, potentially saving money if that average is lower than the highest individual rate. Conversely, consolidating federal loans into a private loan might result in the loss of federal benefits, such as income-driven repayment options, so careful consideration is crucial.

Applying for an Income-Driven Repayment Plan: A Step-by-Step Guide

Applying for an IDR plan typically involves these steps: 1. Determine your eligibility for different IDR plans based on your income and loan type. 2. Gather necessary documentation, including tax returns and pay stubs, to verify your income. 3. Complete the application form for your chosen IDR plan through the appropriate government website or loan servicer. 4. Submit your application along with all required documentation. 5. Wait for your loan servicer to process your application and notify you of your new monthly payment amount. 6. Regularly review and update your income information as required by your IDR plan. Remember to carefully read the terms and conditions of your chosen plan. Failure to update your income information may result in inaccurate payment calculations.

Government Programs and Initiatives

The federal government offers several programs designed to assist borrowers in managing their student loan debt and potentially reducing their interest rates. Understanding these programs and their eligibility requirements is crucial for borrowers seeking to minimize their overall loan costs. These programs are not mutually exclusive; borrowers may qualify for multiple forms of assistance.

Several government programs offer different avenues for reducing the burden of student loan interest. These programs often focus on income-driven repayment plans, loan forgiveness programs, or interest rate subsidies for specific types of loans. Careful consideration of individual circumstances is necessary to determine the most beneficial program.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly student loan payments based on your income and family size. This can lead to lower monthly payments, and in some cases, loan forgiveness after a certain number of qualifying payments. Eligibility typically requires having federal student loans and meeting specific income thresholds. There are several types of IDR plans, including Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE). Each plan has its own specific formulas for calculating payments and loan forgiveness timelines. For example, under REPAYE, your monthly payment is calculated as 10% of your discretionary income, with loan forgiveness possible after 20 or 25 years of qualifying payments, depending on the loan type. The benefits of IDR plans are lower monthly payments and the potential for loan forgiveness, but the downside is that it can take a longer time to repay the loan, and accrued interest may increase the total amount paid over the life of the loan.

Public Service Loan Forgiveness (PSLF) Program

The PSLF program forgives the remaining balance on your federal student loans after you’ve made 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying employer. Qualifying employers include government organizations and certain non-profit organizations. Eligibility requires having federal Direct Loans and making consistent payments under an IDR plan. The benefit is complete loan forgiveness, but the stringent requirements and the lengthy 10-year payment period can be challenging to meet. A crucial aspect is that only Direct Loans qualify; Federal Family Education Loans (FFEL) and Perkins Loans generally do not, unless they have been consolidated into a Direct Consolidation Loan.

Teacher Loan Forgiveness Program

This program provides forgiveness for a portion of your federal student loans if you work as a full-time teacher in a low-income school or educational service agency for five complete and consecutive academic years. Eligibility requires working in a qualifying school or agency and teaching full-time for at least five years. The benefit is partial loan forgiveness, but the program has specific requirements regarding the type of school and the length of service.

List of Government Programs and Key Features

- Income-Driven Repayment (IDR) Plans: Lower monthly payments based on income; potential for loan forgiveness after a set period; various plan types with different formulas and forgiveness timelines.

- Public Service Loan Forgiveness (PSLF): Forgiveness of remaining loan balance after 120 qualifying payments while working full-time for a qualifying employer; requires Direct Loans and consistent IDR payments.

- Teacher Loan Forgiveness Program: Partial loan forgiveness after five consecutive years of full-time teaching at a low-income school or educational service agency; specific requirements regarding school type and teaching role.

Financial Planning and Budgeting

Effective financial planning and budgeting are crucial for successfully managing student loan debt. A well-structured budget allows you to allocate funds strategically, prioritize debt repayment, and minimize the overall interest paid. This involves understanding your income, expenses, and developing a realistic repayment plan that aligns with your financial capabilities.

Effective Budgeting Strategies to Manage Student Loan Debt

Creating a comprehensive budget is the first step towards managing your student loan debt effectively. This involves carefully tracking your income and expenses to identify areas where you can cut back and allocate more funds towards loan repayment. Accurate budgeting allows for a clear picture of your financial situation, enabling informed decisions regarding debt management.

Creating a Realistic Repayment Plan

A realistic repayment plan considers your current financial situation, including your income, expenses, and other debts. Avoid overly ambitious plans that may lead to missed payments and increased interest charges. Instead, opt for a manageable plan that allows for consistent payments without compromising your essential living expenses. For example, if you have a limited income, explore income-driven repayment plans offered by the government. These plans adjust your monthly payments based on your income and family size. Failing to create a realistic plan could lead to increased stress and potential default.

Prioritizing Debt Repayment and Minimizing Interest Accrual

Prioritizing debt repayment involves strategically allocating your funds to maximize your repayment efforts. Several methods exist, including the avalanche method (paying off the highest interest debt first) and the snowball method (paying off the smallest debt first for motivational purposes). Regardless of the method chosen, consistent payments are key to minimizing interest accrual. Making extra payments whenever possible, even small amounts, can significantly reduce the total interest paid over the life of the loan. Consider automating payments to ensure consistency and avoid late fees.

Sample Budget Allocating Funds for Student Loan Repayment

The following sample budget demonstrates how to allocate funds for student loan repayment while maintaining essential living expenses. Remember that this is a sample, and your budget should reflect your individual circumstances.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Monthly Salary | $3000 | Rent/Mortgage | $1000 |

| Side Hustle Income | $500 | Groceries | $300 |

| Total Income | $3500 | Transportation | $200 |

| Utilities | $150 | ||

| Student Loan Payment | $500 | ||

| Savings | $250 | ||

| Other Expenses (Entertainment, etc.) | $1000 | ||

| Total Expenses | $3500 |

Seeking Professional Advice

Navigating the complexities of student loan repayment can be daunting. A financial advisor specializing in student loan debt can provide invaluable support, offering personalized strategies and guidance to optimize your repayment plan and minimize long-term costs. Their expertise can help you avoid common pitfalls and make informed decisions about your financial future.

Seeking professional financial advice offers several key advantages. A qualified advisor can analyze your individual circumstances, considering factors like your income, loan types, interest rates, and overall financial goals. They can then develop a tailored repayment strategy that aligns with your capabilities and aspirations, potentially saving you significant amounts of money over the life of your loans. Beyond repayment strategies, advisors can also help with broader financial planning, ensuring your student loan debt doesn’t overshadow other important financial objectives, such as saving for a down payment on a house or retirement.

Questions to Ask a Financial Advisor

Before engaging a financial advisor, it’s crucial to understand their approach and how they can assist you. This involves asking specific questions to gauge their expertise and determine if they’re the right fit for your needs. These questions should cover their experience with student loan debt management, their fee structure, and their proposed strategies for your specific situation. It’s also vital to inquire about their approach to ethical considerations and any potential conflicts of interest.

Checklist for Choosing a Financial Advisor

Choosing the right financial advisor is a critical step. Several factors should be carefully considered before making a decision. This involves verifying their credentials and experience, checking for any disciplinary actions or complaints filed against them, and understanding their fee structure. It’s also beneficial to read client testimonials and reviews to gain insights into their working style and effectiveness. A comprehensive understanding of these aspects ensures a smooth and productive working relationship.

Costs Associated with Financial Advice

The cost of financial advice varies greatly depending on the advisor’s experience, the complexity of your situation, and the services provided. Some advisors charge hourly fees, while others may work on a percentage-based commission structure or a flat fee. It’s essential to understand the full scope of fees upfront to avoid any surprises. For example, an advisor specializing in complex debt restructuring might charge a higher hourly rate than one offering basic budgeting advice. Transparency regarding fees is crucial for ensuring a fair and equitable financial planning process. Budgeting for these costs should be a key consideration before engaging an advisor’s services. Exploring various fee structures and comparing different advisors’ offerings is vital in selecting the most cost-effective solution that aligns with your financial circumstances.

Long-Term Financial Implications

The choices you make regarding your student loan repayment strategy significantly impact your long-term financial health. Understanding the long-term effects of high versus low interest rates, and how student loan debt influences your creditworthiness and borrowing power, is crucial for making informed decisions. Careful management of student loan debt can lead to greater financial stability and opportunities in the future.

The cumulative effect of interest payments over the life of your loan is substantial. High interest rates exponentially increase the total amount you repay, leaving less money available for other financial goals. Conversely, lower interest rates translate to lower total repayment costs, freeing up resources for saving, investing, and other important life events. This difference can amount to tens of thousands of dollars over the loan’s lifespan, impacting your ability to achieve long-term financial objectives.

Impact on Credit Scores and Future Borrowing

Student loan debt directly influences your credit score. Consistent on-time payments demonstrate responsible credit management, positively impacting your score. Conversely, missed or late payments can severely damage your credit, making it harder to secure loans, mortgages, or even rent an apartment in the future. A lower credit score translates to higher interest rates on future borrowing, creating a vicious cycle of debt. For example, someone with a lower credit score might face significantly higher interest rates on a mortgage, potentially costing them tens of thousands of dollars over the life of the loan.

Examples of How Student Loan Debt Management Impacts Financial Well-being

Effective student loan management significantly improves overall financial well-being. Consider two scenarios: In the first, an individual aggressively pays down their high-interest student loans, freeing up considerable income for saving and investing. This allows them to build wealth faster, potentially affording a down payment on a house sooner or achieving financial independence earlier. In the second scenario, an individual struggles with high-interest loan payments, constantly living paycheck to paycheck. They may delay major life decisions, such as buying a home or starting a family, due to financial constraints. They might also miss opportunities for career advancement that require relocation or further education due to their debt burden.

Illustrative Comparison of Repayment Strategies

Imagine a graph charting the total interest paid over time for two different repayment strategies on a $50,000 student loan. The first line, representing a standard repayment plan, shows a steep upward curve, illustrating the significant accumulation of interest over 10 years. The second line, depicting an aggressive repayment strategy with additional principal payments, demonstrates a much flatter curve, showing considerably less interest paid over the same period. The difference between the two lines visually represents the substantial savings achieved through proactive debt management. The aggressive repayment strategy might show a total interest paid of $15,000, while the standard repayment plan could result in a total interest paid of $30,000, highlighting the substantial long-term financial benefits of strategic repayment.

Conclusion

Successfully reducing your student loan interest rate requires a multifaceted approach encompassing understanding your loan type, exploring available government programs, and implementing sound financial planning. By combining strategic budgeting, potentially refinancing your loans, and leveraging income-driven repayment plans, you can significantly decrease the overall cost of your student loan debt and improve your long-term financial well-being. Remember that seeking professional financial advice can provide personalized guidance and ensure you’re making informed decisions throughout this process.

Essential Questionnaire

What is the difference between fixed and variable interest rates on student loans?

Fixed interest rates remain constant throughout the loan’s life, while variable rates fluctuate based on market conditions. Fixed rates offer predictability, while variable rates could potentially lead to lower payments initially but higher payments later.

Can I refinance my federal student loans?

You cannot refinance federal student loans with a private lender, but you can consolidate them through the government’s Direct Consolidation Loan program. This may not lower your interest rate, but it simplifies payments.

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score, lead to late fees, and potentially result in default, which has severe financial consequences.

How long does it take to refinance student loans?

The timeframe for student loan refinancing varies depending on the lender and your application’s complexity, but it typically takes a few weeks.