Navigating the complexities of student loan repayment can feel daunting, but understanding your options and developing a strategic plan can make the process significantly less stressful. This guide provides a comprehensive overview of how to begin repaying your student loans, from understanding your loan terms to exploring various repayment strategies and budgeting techniques. We’ll cover everything from choosing the right repayment plan to managing your payments effectively and seeking assistance when needed.

Successfully managing student loan debt requires proactive planning and a commitment to responsible financial management. By carefully considering your financial situation, exploring available resources, and implementing effective strategies, you can create a repayment plan that aligns with your individual circumstances and sets you on the path to financial freedom.

Understanding Your Student Loans

Beginning the repayment process for your student loans requires a clear understanding of your debt. This involves identifying the types of loans you have, reviewing their terms and conditions, and calculating your total debt. Knowing these details empowers you to make informed decisions about your repayment strategy.

Federal and Private Student Loans

Student loans are broadly categorized as federal or private. Federal student loans are offered by the U.S. government and typically offer more flexible repayment options and protections for borrowers. Private student loans, on the other hand, are provided by banks, credit unions, and other private lenders. These loans often have less flexible terms and may require a credit check for approval. Understanding this distinction is crucial in determining your repayment options and potential benefits.

Loan Terms and Conditions

Each loan agreement Artikels specific terms and conditions, including the interest rate, repayment plan, and any associated fees. The interest rate determines the cost of borrowing; a higher rate means you’ll pay more in interest over the life of the loan. Repayment plans vary, offering different monthly payment amounts and loan durations. Some plans may offer temporary periods of reduced or deferred payments, while others may require immediate repayment. Carefully reviewing your loan documents is crucial to understanding your obligations and available options.

Total Amount Owed

Calculating your total debt involves adding the principal balance (the original amount borrowed) and any accrued interest. Accrued interest is the interest that has accumulated on your loan since you borrowed the money. This total represents the amount you need to repay. Many online loan calculators and your lender’s website can help you determine this total amount. Regularly checking your loan balance allows you to monitor your progress and make adjustments to your repayment strategy as needed.

Loan Details Table

Understanding your loans requires organizing the key details. The table below provides a sample format to help you track your loans. Remember to replace the sample data with your actual loan information.

| Loan Type | Lender | Principal Balance | Interest Rate | Monthly Payment |

|---|---|---|---|---|

| Federal Subsidized Loan | Sallie Mae | $10,000 | 4.5% | $100 |

| Federal Unsubsidized Loan | Nelnet | $15,000 | 6.0% | $150 |

| Private Loan | Discover | $5,000 | 7.5% | $60 |

Exploring Repayment Options

Choosing the right student loan repayment plan is crucial for managing your debt effectively and minimizing long-term costs. Several options exist, each with its own set of advantages and disadvantages. Understanding these differences will allow you to make an informed decision tailored to your individual financial circumstances.

Standard Repayment Plan

The Standard Repayment Plan is the most basic option. It involves fixed monthly payments over a 10-year period. The advantage lies in its simplicity and the relatively short repayment timeline, leading to less interest paid overall compared to longer-term plans. However, the fixed monthly payments can be substantial, potentially straining your budget, especially in the early years of your career.

Extended Repayment Plan

This plan offers longer repayment terms, typically up to 25 years, resulting in lower monthly payments than the Standard Plan. This can provide more breathing room for your budget, especially if you’re facing financial constraints. The downside is that you’ll pay significantly more in interest over the life of the loan due to the extended repayment period.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase over time. This can be beneficial for borrowers who anticipate increased income in the future. The initial lower payments ease the burden during the early years, but the payments can become quite substantial later on. Similar to the Extended plan, the total interest paid will likely exceed that of the Standard plan.

Income-Driven Repayment Plans

Income-Driven Repayment (IDR) plans link your monthly payments to your income and family size. These plans typically offer lower monthly payments than other options, making them attractive to borrowers with limited incomes. Many IDR plans also qualify for loan forgiveness after a specific number of payments (often 20 or 25 years), depending on the specific plan and your income. However, the extended repayment period usually means higher overall interest payments. Examples of IDR plans include Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has slightly different eligibility criteria and payment calculation methods.

Comparison of Repayment Plan Features

| Plan Name | Payment Calculation | Loan Forgiveness Eligibility | Potential Total Interest Paid |

|---|---|---|---|

| Standard | Fixed monthly payment over 10 years | No | Lowest |

| Extended | Fixed monthly payment over up to 25 years | No | Highest |

| Graduated | Payments increase gradually over time | No | High |

| Income-Driven (IBR, PAYE, REPAYE, ICR) | Based on income and family size | Yes (after 20-25 years, depending on the plan) | Potentially High, but can be significantly lower than other plans if income is low |

Creating a Repayment Budget

Successfully managing student loan repayment requires a well-structured budget. This involves carefully tracking your income and expenses to determine how much you can realistically allocate towards your loans each month while still meeting your other financial obligations. Failing to plan can lead to missed payments, penalties, and increased long-term costs.

Creating a realistic monthly budget that incorporates student loan payments involves several key steps. First, you’ll need to accurately assess your income and expenses. Then, prioritize essential expenses, and finally, identify areas where you can potentially reduce spending to free up funds for loan repayment. Utilizing budgeting tools can significantly simplify this process.

Budgeting Strategies and Tools

Effective budgeting involves a combination of tracking your spending, identifying areas for potential savings, and utilizing budgeting tools to simplify the process. Popular methods include the 50/30/20 rule, zero-based budgeting, and envelope budgeting. Software and apps like Mint, YNAB (You Need A Budget), and Personal Capital can automate many aspects of budget tracking and analysis. Spreadsheet programs like Microsoft Excel or Google Sheets also provide a customizable platform for manual budget creation. These tools offer features like expense categorization, trend analysis, and goal setting, making it easier to visualize your financial situation and track your progress towards your repayment goals.

Reducing Expenses to Free Up Funds

Identifying areas where you can reduce expenses is crucial for creating a budget that accommodates your student loan payments. This requires a careful review of your spending habits. Consider areas like dining out, entertainment, subscriptions, and transportation. For example, preparing meals at home instead of eating out frequently can significantly reduce food costs. Similarly, evaluating your subscription services and canceling any unused or less valuable ones can free up additional funds. Exploring cheaper transportation options, such as public transportation or biking, can also contribute to cost savings. Careful consideration of these discretionary expenses can free up substantial amounts for loan repayment.

Sample Monthly Budget

The following table illustrates a sample monthly budget, allocating funds for loan payments, essential expenses, and discretionary spending. Remember that this is a sample, and your actual budget will vary depending on your individual income and expenses.

| Category | Amount | Category | Amount |

|---|---|---|---|

| Student Loan Payment | $500 | Rent/Mortgage | $1200 |

| Groceries | $400 | Utilities (Electricity, Water, Gas) | $200 |

| Transportation | $150 | Health Insurance | $100 |

| Phone | $75 | Entertainment | $100 |

| Savings | $200 | Dining Out | $50 |

| Debt Payment (other than student loans) | $100 | Other Expenses | $50 |

Managing Your Payments

Successfully navigating student loan repayment requires consistent and responsible payment management. Understanding the importance of timely payments and the available tools for efficient repayment is crucial for avoiding negative consequences and achieving financial stability. This section Artikels strategies for managing your student loan payments effectively.

Making on-time payments is paramount. Late or missed payments can have serious repercussions, including negatively impacting your credit score, incurring late fees, and potentially leading to loan default. A damaged credit score can make it difficult to secure loans, rent an apartment, or even get a job in the future. Defaulting on your loans can result in wage garnishment, tax refund offset, and even legal action. Therefore, prioritizing timely payments is essential for maintaining good financial health.

Online Loan Payments

Many loan servicers offer convenient online payment options. Typically, you will need to create an online account with your servicer using your loan information. Once logged in, you can usually view your loan details, make payments using a debit card, credit card, or electronic bank transfer, and track your payment history. The specific steps may vary slightly depending on your servicer, but the process generally involves selecting the “Make a Payment” option, entering the payment amount, and choosing your payment method. Confirmation of your payment will usually be displayed on the screen and sent to your registered email address.

Automatic Payments

Setting up automatic payments is a highly effective method for ensuring on-time payments and avoiding late fees. Most loan servicers allow you to enroll in automatic debit payments from your bank account. This involves providing your banking information to your servicer and specifying the amount you wish to pay each month. The servicer will then automatically debit the designated amount from your account on your scheduled payment due date. This method removes the risk of forgetting to make a payment and simplifies the repayment process. Remember to monitor your bank account to ensure sufficient funds are available on the payment due date.

Contacting Your Loan Servicer

If you encounter any issues with your student loan payments, such as difficulty making a payment or questions about your loan terms, it is crucial to contact your loan servicer promptly. Most servicers provide various contact methods, including phone numbers, email addresses, and online contact forms. When contacting your servicer, be prepared to provide your loan information and clearly explain the issue you are facing. They may be able to offer solutions such as deferment, forbearance, or an income-driven repayment plan, depending on your circumstances. Proactive communication with your servicer is key to resolving payment issues effectively and avoiding further complications.

Considering Loan Consolidation or Refinancing

Navigating the complexities of student loan repayment can feel overwhelming, and exploring options like consolidation or refinancing might offer a path to simplification and potential savings. Understanding the nuances of each is crucial before making a decision that will significantly impact your financial future. Both processes involve combining multiple loans into a single payment, but they differ in their approach and potential benefits.

Consolidation and refinancing can streamline your repayment process by reducing the number of monthly payments you need to track and manage. However, it’s important to carefully weigh the potential advantages against the possible drawbacks, ensuring the chosen path aligns with your long-term financial goals. Incorrectly chosen options can lead to increased overall interest payments and prolong your repayment period.

Interest Rates and Terms Comparison

Refinancing and consolidation often involve different interest rates and loan terms depending on the lender and your creditworthiness. Consolidation typically involves federal loans, often resulting in a fixed interest rate based on a weighted average of your existing loans. This rate might be lower than some of your individual loan rates, but not necessarily lower than what a private lender might offer. Refinancing, on the other hand, usually involves private lenders, who offer variable or fixed interest rates based on your credit score and market conditions. A borrower with excellent credit might secure a significantly lower interest rate through refinancing than through consolidation. The loan terms, including the repayment period, also vary significantly. A longer repayment period will lower your monthly payment, but will lead to a higher overall interest paid. A shorter repayment period will increase your monthly payment but result in less overall interest paid. For example, a borrower might refinance their loans at a lower interest rate (e.g., 5% from 7%), potentially saving thousands of dollars in interest over the life of the loan, even with a slightly longer repayment period.

Long-Term Financial Implications

The long-term financial impact of consolidation or refinancing hinges on several factors, most importantly the interest rate and loan term. A lower interest rate can lead to substantial savings over the life of the loan, potentially freeing up funds for other financial goals. However, extending the repayment period, even with a lower interest rate, can increase the total interest paid over time. For instance, consolidating high-interest private loans into a lower-interest federal loan might seem advantageous initially, but extending the repayment term could ultimately cost more in the long run. Conversely, refinancing with a private lender offering a significantly lower interest rate could result in significant long-term savings, even if the repayment period remains the same or is slightly extended. Careful consideration of the total interest paid and the monthly payment affordability is crucial for making an informed decision.

Steps in the Consolidation or Refinancing Process

Understanding the steps involved in either process is vital for a smooth transition. The process, while similar in broad strokes, differs in specific requirements and procedures.

- Check your credit report: Review your credit report for errors and ensure its accuracy before applying.

- Research lenders: Compare interest rates, fees, and terms offered by various lenders for both consolidation and refinancing options.

- Gather necessary documents: Prepare documents such as tax returns, pay stubs, and loan details.

- Complete the application: Submit a complete application to your chosen lender.

- Review the loan terms: Carefully review the final loan terms before signing the agreement.

- Make your first payment: Once approved, make your first payment according to the agreed-upon schedule.

Seeking Financial Guidance

Navigating student loan repayment can be challenging, and many resources are available to help borrowers manage their debt effectively. Seeking guidance when facing difficulties is crucial to avoid delinquency and potential negative impacts on your credit score. Understanding the options available for assistance can significantly ease the burden of repayment.

Exploring repayment options and managing your budget are important first steps, but sometimes additional support is needed. Several organizations and government programs provide financial guidance and assistance to those struggling with student loan debt. This section will Artikel some of these key resources.

Credit Counseling Agencies and Non-Profit Organizations

Numerous credit counseling agencies and non-profit organizations offer free or low-cost financial guidance and assistance to individuals struggling with debt, including student loans. These agencies often provide budgeting advice, debt management strategies, and negotiation services with creditors. They can help you create a realistic repayment plan and explore options like debt consolidation or management programs. While they cannot erase your debt, they can provide valuable support in navigating the process. Examples of such organizations include the National Foundation for Credit Counseling (NFCC) and the Consumer Credit Counseling Service (CCCS). You can typically find a local agency through online searches or by contacting the NFCC or CCCS directly. It’s important to research any agency thoroughly before engaging their services, ensuring they are reputable and non-profit.

Student Loan Servicer Assistance Programs

Your student loan servicer is responsible for managing your loans and providing customer service. Most servicers offer various repayment assistance programs, including forbearance, deferment, and income-driven repayment plans. Forbearance temporarily suspends your payments, while deferment postpones them. Income-driven repayment plans adjust your monthly payment based on your income and family size. Contacting your servicer directly to discuss your financial situation and explore these options is a crucial step. They can provide detailed information about the eligibility criteria and the potential impact of each program on your loan repayment. It’s advisable to maintain open communication with your servicer to proactively address any challenges.

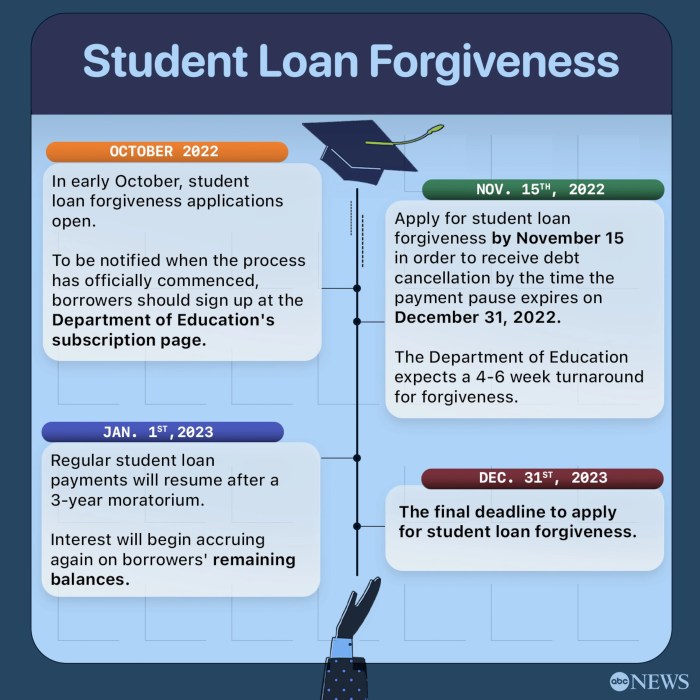

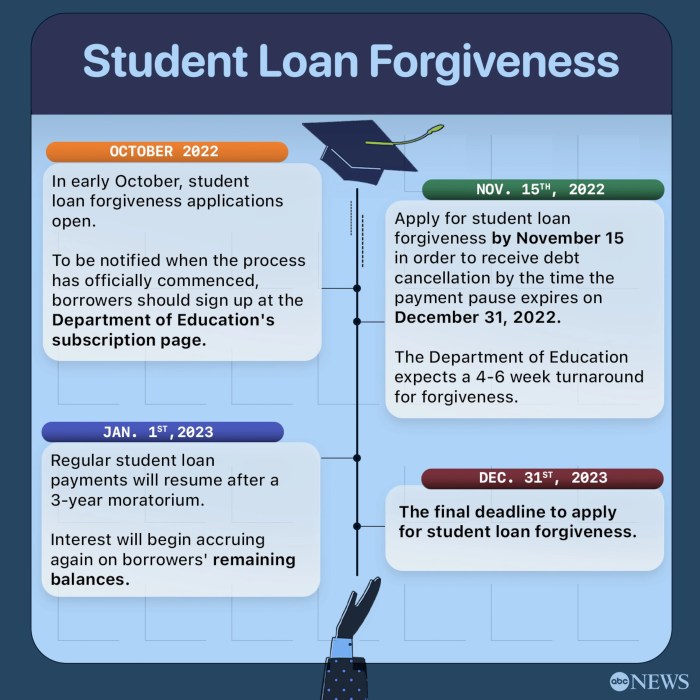

Government Programs for Loan Forgiveness or Repayment Assistance

Several government programs offer loan forgiveness or repayment assistance to specific groups of borrowers. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal student loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Teacher Loan Forgiveness Program offers partial loan forgiveness to eligible teachers who have completed five years of full-time teaching in a low-income school. The Income-Driven Repayment (IDR) plans, such as ICR, PAYE, REPAYE, and IBR, are also government programs that cap monthly payments at a percentage of your discretionary income. These programs offer varying levels of forgiveness after a set number of years, depending on the plan. Eligibility requirements vary for each program, so careful review of the program guidelines is essential. The Federal Student Aid website (studentaid.gov) provides comprehensive information on these programs.

Visualizing Long-Term Repayment

Understanding your long-term repayment strategy is crucial for successfully managing your student loans. A visual representation can significantly aid in this process, allowing you to grasp the overall impact of your repayment plan on your finances over time. This helps you make informed decisions and stay motivated throughout the repayment journey.

Visualizing your repayment schedule can be achieved through various methods, including spreadsheets or dedicated loan repayment calculators. However, a simple table can also effectively illustrate the key aspects of your repayment journey.

Sample Loan Repayment Schedule

Let’s imagine a $30,000 student loan with a 6% annual interest rate, repaid over 10 years using a standard repayment plan. The following table represents a simplified visualization, showing approximate yearly principal and interest payments. Note that these figures are estimates and actual amounts may vary slightly due to compounding interest calculations.

| Year | Starting Balance | Annual Payment (approx.) | Principal Paid (approx.) | Interest Paid (approx.) | Ending Balance |

|---|---|---|---|---|---|

| 1 | $30,000 | $3,869 | $2,369 | $1,500 | $27,631 |

| 2 | $27,631 | $3,869 | $2,569 | $1,300 | $25,062 |

| 3 | $25,062 | $3,869 | $2,769 | $1,100 | $22,293 |

| 4 | $22,293 | $3,869 | $2,969 | $900 | $19,324 |

| 5 | $19,324 | $3,869 | $3,169 | $700 | $16,155 |

| 6 | $16,155 | $3,869 | $3,369 | $500 | $12,786 |

| 7 | $12,786 | $3,869 | $3,569 | $300 | $9,217 |

| 8 | $9,217 | $3,869 | $3,769 | $100 | $5,448 |

| 9 | $5,448 | $3,869 | $3,969 | -$100 | $1,479 |

| 10 | $1,479 | $1,479 | $1,479 | $0 | $0 |

This table shows a gradual decrease in the interest paid each year as the principal balance reduces. The final year shows a smaller payment as it covers the remaining balance.

Impact of Different Repayment Plans and Interest Rates

A change in repayment plan, such as opting for an income-driven repayment plan, would alter the annual payment amount and the overall repayment timeline. Income-driven plans typically result in lower monthly payments but extend the repayment period, leading to a higher total interest paid over the life of the loan. For example, an income-driven plan might extend the repayment period to 20 years, resulting in lower annual payments but significantly higher overall interest costs.

Similarly, a higher interest rate would increase the total interest paid and possibly the monthly payment, while a lower interest rate would reduce both. A loan with a 7% interest rate, for instance, would require higher annual payments compared to a 6% interest rate loan, even with the same repayment period. Conversely, a 5% interest rate would lead to lower annual payments and less overall interest paid.

Closing Notes

Repaying student loans is a significant financial undertaking, but with careful planning and a proactive approach, it’s entirely manageable. By understanding your loan terms, exploring various repayment options, creating a realistic budget, and utilizing available resources, you can successfully navigate the repayment process and achieve your financial goals. Remember, seeking professional guidance when needed is a sign of strength, not weakness. Take control of your financial future and embark on a journey towards a debt-free life.

Essential Questionnaire

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage to your credit score, and potentially even loan default, leading to serious financial consequences.

Can I consolidate my federal and private student loans?

You can consolidate federal loans through the government’s Direct Consolidation Loan program. Consolidating private loans is typically done through a private lender and may or may not offer better terms.

What if I can’t afford my student loan payments?

Contact your loan servicer immediately to discuss options like forbearance, deferment, or income-driven repayment plans. You may also want to seek guidance from a credit counselor.

How often should I check my student loan account?

It’s advisable to check your account regularly, at least monthly, to monitor your balance, payment history, and ensure everything is accurate.