Facing student loan wage garnishment can be a daunting experience, leaving borrowers feeling overwhelmed and uncertain about their financial future. This guide provides a clear and concise path towards understanding your options, navigating the legal complexities, and ultimately, stopping or reducing the impact of wage garnishment. We’ll explore various strategies, from negotiating repayment plans to seeking professional assistance, empowering you to regain control of your finances.

Understanding the process of wage garnishment, the legal grounds for its implementation, and the various avenues available for recourse are crucial steps in mitigating its effects. This guide aims to demystify the process, offering practical advice and actionable steps to help you effectively address this challenging situation.

Understanding Wage Garnishment for Student Loans

Wage garnishment for student loans is a serious legal process that can significantly impact your finances. It involves a portion of your paycheck being directly seized by the government or a private loan servicer to repay your outstanding student loan debt. Understanding how this process works is crucial for borrowers facing financial hardship.

The Process of Student Loan Wage Garnishment

The process begins when a borrower defaults on their federal student loans. Default occurs after nine months of non-payment. The Department of Education (ED) then typically attempts to contact the borrower through various methods, including mail and phone calls, to arrange repayment. If these attempts are unsuccessful, the ED may refer the debt to a collection agency or initiate wage garnishment. The garnishment order is issued by a court and legally mandates your employer to deduct a specific amount from your wages each pay period and remit those funds to the government. The amount garnished is typically limited by law, but it can still represent a substantial portion of your income. The process varies slightly depending on the state, but the core principle remains consistent: non-payment leads to legal action resulting in wage garnishment.

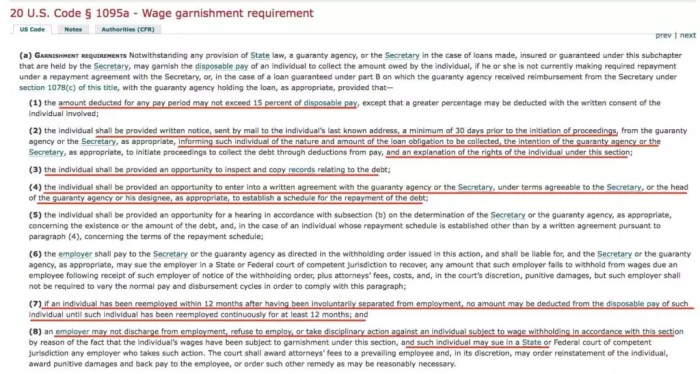

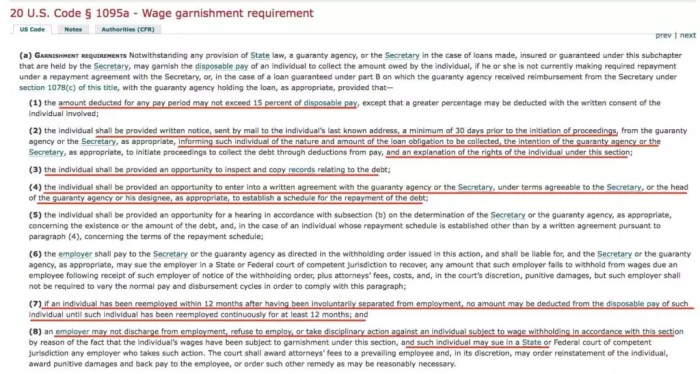

Legal Basis for Wage Garnishment

The legal basis for wage garnishment of student loans stems from the Higher Education Act of 1965 and subsequent amendments. This legislation grants the government the authority to collect defaulted federal student loans through various means, including wage garnishment. The process is governed by federal law and, in some instances, state law as well. Court orders are the formal legal instruments authorizing the garnishment, providing a legal framework for the seizure of wages to satisfy the outstanding debt. The legal protections afforded to borrowers during this process are limited, emphasizing the importance of proactive repayment strategies.

Initiation of Wage Garnishment

Wage garnishment for student loans typically follows a specific sequence of events. First, the borrower defaults on their federal student loans. Next, the Department of Education attempts to contact the borrower to arrange repayment. If these attempts fail, the debt is often referred to a collection agency. The collection agency or the Department of Education may then file a lawsuit to obtain a court order for wage garnishment. Once the court order is issued, it is sent to the borrower’s employer, who is then legally obligated to withhold a portion of the borrower’s wages. The employer is required to forward these withheld wages to the appropriate agency. Finally, the garnished wages are applied to the outstanding student loan debt.

Common Scenarios Leading to Wage Garnishment

Several scenarios can lead to wage garnishment. Job loss or significant reduction in income can make it difficult to meet loan payments, ultimately resulting in default. Unexpected medical expenses or family emergencies can also strain finances, leading to missed payments and subsequent default. Poor financial planning and a lack of understanding of loan repayment options are also contributing factors. In some cases, borrowers may simply neglect their loan obligations, leading to default and subsequent wage garnishment. For example, a recent graduate struggling to find employment after college might fall behind on their student loan payments, leading to default and eventual wage garnishment. Similarly, an individual facing unexpected medical bills might find it difficult to make their loan payments, resulting in the same outcome.

Comparison of Student Loan Types and Susceptibility to Wage Garnishment

| Loan Type | Federal Guarantee | Wage Garnishment Susceptibility | Collection Methods |

|---|---|---|---|

| Federal Direct Loans | Yes | High | Wage garnishment, tax refund offset, credit bureau reporting |

| Federal Perkins Loans | Yes | High | Wage garnishment, tax refund offset, credit bureau reporting |

| Private Student Loans | No | Varies | Wage garnishment (state-dependent), lawsuits, credit bureau reporting |

| Federal PLUS Loans | Yes | High | Wage garnishment, tax refund offset, credit bureau reporting |

Identifying Options to Stop Garnishment

Facing student loan wage garnishment can be stressful, but several avenues exist to halt or lessen its impact. Understanding your options and pursuing them diligently is crucial to regaining financial stability. This section Artikels the legal and financial strategies available to borrowers.

Legal Avenues for Stopping or Reducing Wage Garnishment

Legal recourse to stop or reduce wage garnishment primarily involves demonstrating financial hardship or challenging the legality of the garnishment itself. This might involve proving that the garnishment notice was improperly served or that the debt itself is inaccurate or disputed. Legal representation is often advisable in these situations, as navigating the legal complexities can be challenging. A lawyer specializing in consumer debt or bankruptcy can assess your specific circumstances and advise on the best course of action. They can also help you navigate the complexities of federal and state laws regarding wage garnishment.

Negotiating a Repayment Plan with the Lender

Direct negotiation with your student loan lender is a viable option. Contacting your lender directly and explaining your financial difficulties might lead to a more manageable repayment plan. This could involve reducing your monthly payments, extending the repayment term, or temporarily suspending payments. Be prepared to provide documentation supporting your claim of financial hardship, such as pay stubs, bank statements, and tax returns. The success of this approach depends heavily on your lender’s willingness to negotiate and your ability to present a credible case. For example, a borrower facing unexpected medical expenses could negotiate a temporary forbearance or a reduced payment plan.

Applying for an Income-Driven Repayment Plan

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Eligibility requirements vary depending on the plan, but generally involve demonstrating financial need. The application process typically involves completing a form and providing documentation to verify your income and family size. Once approved, your monthly payments will be recalculated, potentially significantly reducing the amount you owe each month. It’s important to note that IDR plans typically extend the repayment period, resulting in paying more interest over the life of the loan.

Hardship Exemptions and Eligibility Requirements

Hardship exemptions provide temporary relief from wage garnishment due to unforeseen circumstances. These circumstances often include job loss, illness, or disability. Eligibility requirements vary by state and lender, but generally involve proving significant financial hardship. Documentation, such as medical bills, unemployment documentation, or proof of decreased income, is usually required. It’s important to thoroughly research the specific requirements for your state and lender to ensure you meet the criteria for an exemption. Approval is not guaranteed, and the process may involve extensive paperwork and potential legal representation. For example, a borrower who experienced a sudden job loss and is actively seeking employment may qualify for a temporary hardship exemption.

Exploring Repayment Options and Plans

Facing wage garnishment for student loans is stressful, but understanding your repayment options can significantly improve your situation. Several income-driven repayment (IDR) plans are designed to make monthly payments more manageable based on your income and family size. Choosing the right plan can prevent further garnishment and help you gradually pay off your debt.

Income-driven repayment plans offer lower monthly payments than the standard repayment plan, often resulting in a longer repayment period. However, this extended timeframe can lead to higher overall interest paid. The key is to carefully weigh the short-term benefits of lower monthly payments against the long-term cost of increased interest. Each plan has specific eligibility requirements and calculations for determining your monthly payment amount. Careful consideration of these factors is crucial for choosing the best plan for your individual circumstances.

Income-Driven Repayment Plan Comparison

Several federal income-driven repayment plans exist, each with its own set of rules and benefits. Understanding the differences between these plans is vital in making an informed decision. The following table compares key features of some popular plans. Note that details can change, so always consult the official federal student aid website for the most up-to-date information.

| Plan Name | Income Calculation | Repayment Period | Forgiveness After |

|---|---|---|---|

| Income-Driven Repayment (IDR) | Adjusted Gross Income (AGI) and family size | Up to 20-25 years | Remaining balance forgiven after 20-25 years, potentially subject to taxation |

| Income-Based Repayment (IBR) | AGI and family size | Up to 25 years | Remaining balance forgiven after 25 years, potentially subject to taxation |

| Pay As You Earn (PAYE) | AGI and family size | Up to 20 years | Remaining balance forgiven after 20 years, potentially subject to taxation |

| Revised Pay As You Earn (REPAYE) | AGI and family size, including undergraduate and graduate loans | Up to 20 or 25 years | Remaining balance forgiven after 20 or 25 years, potentially subject to taxation |

It’s important to note that loan forgiveness under IDR plans may be subject to taxation on the forgiven amount. Consult a tax professional for guidance on this matter.

Successful Repayment Plan Negotiation Examples

Successfully negotiating a repayment plan often involves demonstrating financial hardship. This might include providing documentation such as recent pay stubs, tax returns, and proof of significant medical expenses. For example, someone experiencing a job loss might successfully negotiate a temporary forbearance or deferment, pausing payments until their financial situation improves. Another example might involve a borrower with a low income and high debt burden successfully switching to a PAYE plan, significantly reducing their monthly payment amount.

Impact of Repayment Plans on Long-Term Debt

While income-driven repayment plans offer lower monthly payments, they often extend the repayment period. This means you’ll pay more in interest over the life of the loan. For instance, a borrower with a $50,000 loan might pay significantly less per month under an IDR plan compared to the standard plan, but the total interest paid could be considerably higher due to the extended repayment period. Careful consideration of the long-term costs versus the short-term benefits is crucial.

Seeking Professional Assistance

Navigating the complexities of student loan wage garnishment can be overwhelming. Seeking professional assistance from a qualified student loan counselor or attorney can significantly improve your chances of a successful outcome and reduce stress during this challenging process. They possess the expertise and resources to effectively advocate on your behalf.

The Role of Student Loan Counselors and Attorneys

Student loan counselors and attorneys offer distinct yet complementary services. Counselors provide guidance on repayment options, budgeting, and financial planning, often at a lower cost than attorneys. Attorneys, on the other hand, specialize in legal representation and can directly negotiate with creditors, represent you in court if necessary, and help you understand and utilize legal protections. They are equipped to handle complex legal matters and ensure your rights are protected.

Resources for Finding Reputable Legal Assistance

Finding reliable legal assistance is crucial. Several resources can help you locate reputable student loan counselors and attorneys. These resources can provide referrals, background checks, and ensure the professionals you choose have the necessary expertise and ethical standards.

It’s essential to thoroughly vet any professional before engaging their services. Look for professionals with experience in student loan law, positive client reviews, and clear fee structures. Verify their credentials and affiliations with professional organizations.

Potential Costs and Benefits of Hiring a Professional

Hiring a professional carries costs, typically ranging from hourly fees to flat fees depending on the complexity of your case and the professional’s pricing structure. However, the potential benefits often outweigh the costs. A successful negotiation or legal action can prevent wage garnishment, leading to significant financial savings and stress reduction. They can also help you explore alternative repayment options that you might not be aware of, potentially saving you money in the long run.

Navigating Legal Complexities with Professional Help

Legal complexities surrounding student loan wage garnishment can be significant. Professionals possess in-depth knowledge of relevant laws, regulations, and procedures. They can help you understand your rights, identify potential defenses, and develop effective strategies to resolve your situation. Their expertise allows them to navigate the legal system efficiently, saving you time, effort, and potential financial losses.

Questions to Ask When Seeking Professional Help

Before hiring a student loan counselor or attorney, asking the right questions is vital. This ensures you are making an informed decision and choosing a professional who aligns with your needs and expectations.

A structured approach to questioning potential professionals is recommended. Consider the following points when making your decision.

- What is your experience with student loan wage garnishment cases?

- What is your fee structure, and what services are included in that fee?

- Can you provide references from previous clients?

- What is your strategy for resolving my case?

- What is the likely timeline for resolving my case?

- What are the potential risks and benefits of pursuing this course of action?

- What are your qualifications and certifications?

- What is your communication policy, and how often can I expect updates?

Understanding Your Rights and Responsibilities

Facing wage garnishment for student loans can be a stressful experience, but understanding your rights and responsibilities is crucial to navigating this process effectively. Knowing what you’re entitled to and what’s expected of you can help you avoid further complications and potentially find a solution. This section Artikels key aspects of both your rights and responsibilities during wage garnishment.

Borrowers facing wage garnishment retain several important rights. Primarily, you have the right to due process, meaning the government must follow established legal procedures before garnishing your wages. This includes receiving proper notification of the garnishment and an opportunity to challenge it if you believe it’s incorrect or unlawful. You also have the right to request information regarding the amount owed, the garnishment process itself, and available repayment options. Finally, you retain the right to seek legal counsel and explore all available avenues to resolve the situation, including negotiating a repayment plan or appealing the garnishment order.

Borrower Responsibilities During Wage Garnishment

Your responsibilities during the wage garnishment process are equally significant. You are legally obligated to comply with the garnishment order unless you successfully challenge it through legal means. This means allowing the appropriate deductions from your wages as stipulated by the order. You are also responsible for keeping your contact information up-to-date with your lender and relevant government agencies. Failure to do so could lead to further complications and potential penalties. Furthermore, you are expected to actively engage in finding a resolution, whether that involves exploring repayment plans or seeking professional assistance. Ignoring the situation will only worsen the problem.

Common Mistakes Borrowers Make

Many borrowers make mistakes during the wage garnishment process that can exacerbate their situation. One common error is failing to respond promptly to official notices. Ignoring correspondence from lenders or government agencies can lead to missed deadlines and increased penalties. Another frequent mistake is failing to explore all available repayment options before wage garnishment begins or after it has started. Many repayment plans exist, and exploring them can prevent or alleviate the severity of wage garnishment. Finally, some borrowers attempt to hide their assets or income, which is both illegal and ultimately ineffective, as it will only further damage their credit and increase legal complications.

Actions Borrowers Should Avoid

To avoid worsening your situation, several actions should be avoided. Do not ignore official notices or communications. Do not attempt to conceal assets or income. Do not make false statements to lenders or government agencies. Do not miss deadlines related to repayment plans or appeals. Do not fail to seek professional assistance when needed. Ignoring these warnings can significantly hinder your ability to resolve the situation and may lead to further legal action.

Effective Communication with Lenders and Government Agencies

Effective communication is paramount throughout the wage garnishment process. When contacting lenders or government agencies, maintain a professional and respectful tone. Clearly state your concerns and questions. Keep records of all communication, including dates, times, and the names of individuals you spoke with. If possible, communicate in writing to create a documented record of your interactions. Consider seeking assistance from a consumer credit counselor or legal professional to help you navigate these communications effectively. Remember, clear and concise communication can greatly improve your chances of a positive outcome.

Long-Term Strategies for Avoiding Future Garnishment

Preventing student loan wage garnishment requires proactive and responsible financial management. By implementing long-term strategies, you can significantly reduce the risk of facing this serious financial consequence in the future. This involves careful budgeting, effective debt management, and consistent communication with your lenders.

Responsible Student Loan Management

Effective student loan management begins with a thorough understanding of your loan terms, including interest rates, repayment schedules, and any applicable fees. This knowledge empowers you to make informed decisions about your repayment strategy and avoid accumulating unnecessary debt. Regularly reviewing your loan statements and actively monitoring your account ensures you stay informed about your progress and identify potential problems early. A proactive approach is key to preventing future issues.

Creating a Realistic Budget

A realistic budget is the cornerstone of responsible financial management. Follow these steps to create one:

- Track your income and expenses: For at least a month, meticulously record every dollar earned and spent. Use budgeting apps, spreadsheets, or even a notebook to maintain a clear picture of your financial inflows and outflows.

- Categorize your expenses: Group your expenses into categories like housing, transportation, food, entertainment, and debt payments. This allows you to identify areas where you might be overspending.

- Allocate funds for student loan payments: Ensure your budget includes a dedicated amount for your student loan payments. This amount should be realistic and achievable, considering your income and other expenses.

- Identify areas for reduction: Once you have a clear picture of your spending habits, identify areas where you can cut back. This might involve reducing discretionary spending, finding cheaper alternatives, or negotiating lower bills.

- Regularly review and adjust: Your budget is not static. Regularly review and adjust it to reflect changes in your income, expenses, or financial goals. Life circumstances change, and your budget needs to adapt accordingly.

Effective Debt Management Strategies

Effective debt management goes beyond simply making minimum payments. Consider these strategies:

- Prioritize high-interest debt: Focus on paying down debts with the highest interest rates first, as this will save you money in the long run. This strategy, known as the avalanche method, minimizes the total interest paid.

- Explore debt consolidation: Consolidating multiple loans into a single loan can simplify payments and potentially lower your interest rate. However, carefully compare offers before consolidating.

- Consider debt management plans: If you are struggling to manage your debt, a debt management plan (DMP) from a credit counseling agency might be an option. A DMP helps you create a manageable repayment plan and negotiate lower interest rates with your creditors.

Proactive Communication with Lenders

Open and proactive communication with your student loan lenders is crucial. Don’t wait until you’re in crisis. Regularly contact your lenders to:

- Discuss repayment options: If you anticipate difficulties making payments, contact your lender to explore options like income-driven repayment plans or deferment.

- Update your contact information: Ensure your lender has your current address and phone number to avoid missed communications.

- Request clarification on your account: If you have any questions or concerns about your loan, don’t hesitate to contact your lender for clarification.

Best Practices for Avoiding Future Wage Garnishment

Avoiding future wage garnishment involves a multi-faceted approach. These best practices are essential:

- Budget diligently and consistently: Maintain a realistic budget and stick to it. This ensures you have enough funds allocated for student loan payments.

- Prioritize loan repayment: Treat student loan payments as a high priority expense, similar to rent or mortgage payments.

- Communicate proactively with lenders: Maintain open communication with your lenders, especially if you anticipate difficulties making payments.

- Explore repayment options: Familiarize yourself with various repayment plans and choose the one that best suits your financial situation.

- Seek professional help if needed: Don’t hesitate to seek help from a financial advisor or credit counselor if you are struggling to manage your student loans.

Epilogue

Successfully navigating student loan wage garnishment requires a proactive and informed approach. By understanding your rights, exploring available repayment options, and seeking professional help when needed, you can significantly improve your chances of resolving this financial challenge. Remember, responsible financial planning and proactive communication with your lenders are key to preventing future wage garnishments and securing your long-term financial well-being. Take control of your situation today and begin charting a course towards financial stability.

Clarifying Questions

Can I stop wage garnishment if I’m currently unemployed?

Unemployment may qualify you for hardship exemptions or alternative repayment plans. You need to contact your loan servicer immediately to discuss your options and provide documentation of your unemployment status.

What happens to my garnished wages?

Garnished wages are typically sent directly to your student loan servicer to be applied towards your outstanding debt.

How long can wage garnishment last?

The duration varies depending on your loan type, repayment plan, and your ability to make consistent payments. It can continue until the debt is paid off or a suitable repayment plan is established.

Will wage garnishment affect my credit score?

Yes, wage garnishment is a negative mark on your credit report and will likely lower your credit score.

Can I negotiate a lower garnishment amount?

You may be able to negotiate a lower amount, especially if you demonstrate financial hardship. This often requires providing documentation of your income and expenses.