Navigating the complexities of student loans and off-campus housing can feel daunting, but understanding the process empowers students to make informed financial decisions. This guide explores the various types of student loans available, the eligibility requirements, and the crucial steps involved in securing funding for off-campus living. We’ll cover budgeting strategies, finding suitable housing within your means, and managing your loans responsibly to avoid potential pitfalls.

From understanding loan terms and interest rates to creating a realistic budget and exploring different housing options, this comprehensive resource provides practical advice and valuable insights to help you successfully finance your off-campus living arrangements while managing your student loan debt effectively.

Understanding Student Loan Eligibility for Housing

Securing student loans to cover off-campus housing costs requires understanding the eligibility criteria and the application process. Different loan types have varying requirements, and providing sufficient documentation is crucial for approval. This section will clarify the process and highlight important considerations.

Types of Student Loans and Eligibility for Off-Campus Housing

Federal student loans, such as Direct Subsidized and Unsubsidized Loans, and Direct PLUS Loans, are the most common options for students. Eligibility generally hinges on demonstrating financial need (for subsidized loans), maintaining satisfactory academic progress, and being enrolled at least half-time. Private student loans, offered by banks and credit unions, typically have stricter eligibility requirements, often focusing on credit history and co-signer availability. While both federal and private loans can be used for off-campus housing, the terms and conditions will differ. Federal loans usually offer more favorable interest rates and repayment options, but may have stricter limits on the loan amount. Private loans may offer larger loan amounts but often come with higher interest rates. It’s important to compare options carefully.

Applying for Student Loans and Providing Proof of Housing Costs

The application process generally involves completing the Free Application for Federal Student Aid (FAFSA) for federal loans, or a similar application for private loans. You’ll need to provide information about your enrollment status, financial information, and housing costs. To support your off-campus housing expenses, you’ll need to provide documentation proving the cost of your housing. This could be a lease agreement, a rental contract, or a letter from your landlord confirming the monthly rent. Failure to provide sufficient documentation may lead to delays or loan denial.

Acceptable Documentation for Off-Campus Housing Loan Applications

Acceptable documentation varies depending on the lender, but generally includes:

- A signed lease or rental agreement detailing the monthly rent and lease term.

- A letter from your landlord confirming the monthly rent and the address of the property.

- Proof of utilities included or excluded in the rent (e.g., utility bills or a breakdown of costs from the landlord).

- In some cases, proof of security deposit payment.

It is advisable to contact your lender directly to confirm the specific documentation they require.

Comparison of Loan Types and Suitability for Off-Campus Living Expenses

| Loan Type | Eligibility Requirements | Interest Rates | Suitability for Off-Campus Housing |

|---|---|---|---|

| Federal Direct Subsidized Loan | Demonstrated financial need, satisfactory academic progress, at least half-time enrollment | Generally lower than private loans | Suitable, often preferred due to lower interest rates and government protections. |

| Federal Direct Unsubsidized Loan | Satisfactory academic progress, at least half-time enrollment | Generally lower than private loans | Suitable, a good option if you don’t qualify for subsidized loans. |

| Federal Direct PLUS Loan (Parent/Graduate) | Credit check required, may require a co-signer | Generally higher than subsidized/unsubsidized loans | Suitable for parents or graduate students, but higher interest rates should be considered. |

| Private Student Loans | Credit history, co-signer often required, income verification | Generally higher than federal loans | Suitable, but carefully compare interest rates and repayment terms with federal options. |

Budgeting and Financial Planning with Student Loans for Housing

Securing off-campus housing while managing student loan debt requires careful budgeting and financial planning. Understanding your expenses, loan terms, and repayment options is crucial for avoiding financial strain and ensuring a smooth academic experience. This section will guide you through the process of creating a realistic budget, calculating monthly costs, and planning for long-term loan repayment.

Sample Budget for Off-Campus Housing

A sample budget demonstrates how student loan funds can be allocated to cover housing costs. This example assumes a monthly student loan disbursement of $1500, a common amount for many students. Remember, your specific budget will vary depending on your individual circumstances and loan amount.

| Category | Amount |

|---|---|

| Rent | $800 |

| Utilities (electricity, water, gas) | $150 |

| Internet/Cable | $75 |

| Groceries | $250 |

| Transportation | $100 |

| Loan Repayment (estimated) | $125 |

| Miscellaneous/Savings | $100 |

| Total | $1600 |

This budget leaves a small buffer for unexpected expenses. Adjusting categories based on individual needs is essential; for instance, students with cars may have higher transportation costs, while those living with roommates might have lower rent.

Calculating Monthly Housing Expenses and Loan Repayment Plans

Calculating monthly housing expenses involves summing all recurring costs associated with your off-campus living. This includes rent, utilities, internet, groceries, transportation, and any other relevant expenses. A detailed breakdown, as shown in the sample budget, is recommended.

For loan repayment, consider the following steps:

1. Determine your loan amount: This is the total amount you’ve borrowed.

2. Identify your interest rate: This is the percentage charged on your outstanding loan balance.

3. Choose a repayment plan: Common options include standard, graduated, and income-driven repayment plans. Each plan has different monthly payment amounts and repayment periods. Explore the options available through your loan servicer.

4. Calculate your monthly payment: Many loan servicers provide online calculators to estimate monthly payments based on your loan amount, interest rate, and chosen repayment plan. Alternatively, you can use a standard loan amortization calculator readily available online.

The formula for calculating monthly payments is complex, but online calculators simplify the process.

Impact of Interest Rates and Loan Terms on Long-Term Financial Planning

Higher interest rates translate to larger monthly payments and a higher total amount paid over the life of the loan. Similarly, longer loan terms (e.g., 10 years versus 20 years) reduce monthly payments but increase the total interest paid. For example, a $20,000 loan with a 5% interest rate over 10 years will result in significantly lower total interest paid compared to the same loan over 20 years. This difference can amount to thousands of dollars. Careful consideration of these factors is crucial for long-term financial well-being.

Budgeting Tools and Resources

Several budgeting tools and resources are available to assist students in managing their finances effectively. These include:

- Spreadsheet software (Excel, Google Sheets): Allows for creating personalized budgets and tracking expenses.

- Budgeting apps (Mint, YNAB, Personal Capital): Provide automated tracking, expense categorization, and financial goal setting features.

- Your loan servicer’s website: Offers loan repayment calculators and information on repayment plans.

- Financial literacy websites and resources (e.g., the Consumer Financial Protection Bureau): Provide valuable information on budgeting, debt management, and financial planning.

Utilizing these resources can significantly improve financial literacy and aid in responsible student loan management.

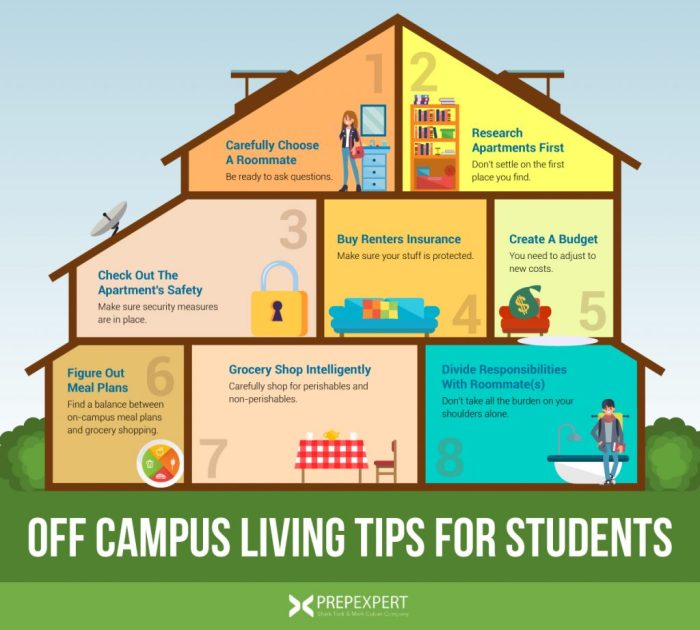

Finding Suitable Off-Campus Housing within Budget

Securing affordable and suitable off-campus housing is a crucial step in the college experience. Finding the right balance between cost, convenience, and comfort requires careful planning and research. This section will guide you through the process of identifying and selecting off-campus housing that aligns with your budget and needs.

Off-Campus Housing Options: Advantages and Disadvantages

Choosing between various housing options significantly impacts your budget and lifestyle. Apartments offer privacy and independence but usually come with higher costs. Shared housing, such as renting a room in a house or joining a shared apartment, is generally more affordable but requires compromises on personal space and potentially involves sharing responsibilities. Consider the trade-offs carefully. For instance, a studio apartment offers complete privacy but might be significantly more expensive than a shared room in a larger house, especially in areas with high demand for student housing. Conversely, sharing a house with roommates could lead to conflicts over cleanliness or lifestyle differences, but it drastically reduces individual housing costs.

Neighborhood Cost of Living Comparisons

Neighborhoods near a university often exhibit significant variations in rental costs. Areas closer to campus tend to be more expensive due to higher demand. Exploring neighborhoods slightly further away can lead to substantial savings without significantly increasing commute times. For example, a neighborhood a 15-minute bus ride from campus might offer apartments for $1000 less per month than those within walking distance. This saving could be significant over the course of an academic year. It’s advisable to research rental prices in different neighborhoods using online resources and local real estate agents to compare costs and assess the trade-off between cost and convenience.

Hidden Costs of Off-Campus Living

Beyond rent, several hidden costs can significantly impact your overall housing budget. Utilities (electricity, water, gas, internet) are often not included in the rental price and can vary depending on the size of the living space and individual consumption habits. Security deposits, typically one or two months’ rent, are required upfront and are refundable upon moving out (provided the property is left in good condition). Other potential costs include renter’s insurance (highly recommended), moving expenses, and potential fees for late rent payments or lease violations. Budgeting for these unforeseen expenses is crucial to avoid financial strain during your tenancy. For example, a seemingly affordable apartment might become expensive if utility costs are high or if there are unexpected repair expenses.

Essential Factors for Off-Campus Housing Search

Before beginning your search, creating a checklist of essential factors will help you stay focused and make informed decisions. This checklist should include:

- Budget: Determine your maximum monthly rent and total allowable housing expenses.

- Location: Consider proximity to campus, transportation options, and neighborhood safety.

- Lease Terms: Understand the lease duration, renewal options, and any penalties for early termination.

- Amenities: Identify desired amenities such as parking, laundry facilities, and internet access.

- Roommates (if applicable): Discuss expectations regarding cleanliness, shared expenses, and lifestyle compatibility.

- Safety and Security: Research the neighborhood’s safety record and the property’s security features.

Thoroughly investigating these aspects before signing a lease will ensure you find a suitable and affordable off-campus living arrangement. Failing to account for these factors can lead to unexpected financial burdens and a less enjoyable living experience.

Managing Student Loans and Off-Campus Housing Responsibilities

Successfully navigating the financial landscape of student loans and off-campus housing requires diligent organization and proactive planning. This section will equip you with the tools and strategies to effectively manage your loan payments, control expenses, and avoid potential pitfalls. Understanding these principles is crucial for maintaining financial stability during your studies and beyond.

Effective tracking of loan payments and expenses is paramount to responsible financial management. This involves more than simply making payments on time; it requires a comprehensive understanding of your financial obligations.

Loan Payment Tracking and Expense Management

Creating a detailed budget is the cornerstone of effective financial management. This budget should meticulously list all sources of income (including student loans, part-time jobs, and financial aid) and all expenses (rent, utilities, groceries, transportation, loan payments, entertainment, etc.). Several budgeting apps and spreadsheets can assist in this process, allowing for easy tracking and analysis of your spending habits. Regularly reviewing your budget will help identify areas where you can cut back and allocate funds more efficiently. Consider using a budgeting app that automatically categorizes transactions for a more streamlined approach. A visual representation, such as a pie chart, can clearly demonstrate where your money is going. For example, if you notice a significant portion of your income is allocated to entertainment, you might consider reducing spending in this area to free up funds for other necessities.

Strategies for Avoiding Late Payments and Minimizing Interest Accumulation

Late payments on student loans can lead to significant financial penalties, including late fees and increased interest charges. To prevent this, set up automatic payments from your checking account. This ensures consistent and timely payments, eliminating the risk of forgetting or missing a deadline. Another effective strategy is to schedule reminders for payment due dates on your calendar or phone. Consider setting up multiple smaller payments throughout the month to align with your pay schedule, making it easier to manage your finances. Always prioritize loan payments to avoid the accumulation of interest, which can significantly increase the total cost of your loan over time. For example, if your loan has a high interest rate, paying it down aggressively will reduce the amount you ultimately owe.

Consequences of Defaulting on Student Loans

Defaulting on your student loans has severe consequences that can negatively impact your financial future. Defaulting means failing to make your loan payments for a specified period. This can result in damage to your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, where a portion of your paycheck is automatically deducted to repay the loan, is another potential consequence. Furthermore, the government may take legal action to recover the outstanding debt, which can include seizing assets. In extreme cases, it could even impact your ability to obtain a professional license or security clearance. The impact on your credit score can last for years, making it challenging to secure favorable financial terms in the future.

Resources for Students Facing Financial Difficulties

Numerous resources are available to assist students facing financial challenges related to housing and loans. Your university’s financial aid office can provide guidance and support, including information about hardship programs and repayment plans. National organizations, such as the National Foundation for Credit Counseling (NFCC), offer free or low-cost credit counseling services. They can help you create a budget, negotiate with lenders, and explore options for managing your debt. Additionally, many non-profit organizations provide emergency financial assistance to students facing housing insecurity. It is crucial to seek help early; proactive engagement with these resources can prevent your financial situation from escalating. Don’t hesitate to reach out for assistance – it’s a sign of strength, not weakness.

Illustrating the Financial Implications of Off-Campus Housing Choices

Choosing between on-campus and off-campus housing significantly impacts a student’s finances, particularly when student loans are involved. Understanding the long-term financial consequences of each choice is crucial for responsible financial planning. This section will compare two scenarios, one with off-campus housing financed by student loans and another with on-campus housing, highlighting the differences in costs and long-term financial implications.

Off-Campus Housing Scenario: Loan Details and Cost Breakdown

Let’s consider a student, Sarah, who chooses to live in an off-campus apartment. She secures a private student loan of $10,000 to cover her housing expenses for the academic year. The loan has a 7% annual interest rate and a 10-year repayment period. Her monthly payment, calculated using a standard amortization formula, is approximately $126. Over the 10-year repayment period, the total interest paid will be approximately $3,772. This means Sarah will pay a total of $13,772 for her housing, significantly more than the initial loan amount. Beyond the loan, she also incurs monthly expenses like rent ($800), utilities ($150), groceries ($200), and transportation ($100), totaling $1250 per month.

On-Campus Housing Scenario: Cost Implications

In contrast, let’s imagine Sarah’s friend, David, opts for on-campus housing. His on-campus housing costs $8,000 per year, including meals. This significantly reduces his monthly housing-related expenses compared to Sarah. David doesn’t need a separate loan for housing; he might still have other student loans for tuition, but the total amount is considerably less. His monthly expenses related to housing are lower, allowing him to allocate more funds towards other essential needs or savings.

Long-Term Financial Impact Comparison

The long-term financial implications of these choices are substantial. The following bullet points highlight key differences:

- Debt Burden: Sarah carries a significant debt burden ($13,772) for her housing, impacting her credit score and future financial opportunities. David’s debt burden is significantly lower, providing greater financial flexibility.

- Monthly Expenses: Sarah faces higher monthly expenses, potentially impacting her ability to save or invest. David enjoys lower monthly expenses, allowing for greater financial freedom.

- Future Earnings: While both might earn similar salaries after graduation, Sarah’s higher debt burden could limit her ability to save for a down payment on a house or other significant investments. David’s lower debt burden provides a better financial foundation for future financial goals. For instance, he might be able to invest more aggressively in retirement plans or other high-yield investments.

- Financial Stress: Sarah might experience greater financial stress due to her high monthly payments and debt burden. David might experience less financial stress, contributing to improved mental and emotional well-being.

Last Point

Securing off-campus housing with student loans requires careful planning and responsible financial management. By understanding your loan options, creating a detailed budget, and diligently tracking expenses, you can successfully navigate the challenges and create a comfortable and financially sustainable living situation. Remember to leverage available resources and seek guidance when needed to ensure long-term financial well-being.

FAQ Insights

Can I use my student loans for a security deposit?

Generally, yes, as long as you can provide documentation showing the deposit is a necessary expense for your off-campus housing.

What happens if I don’t pay my student loans?

Failure to repay your student loans can result in damaged credit, wage garnishment, and potential legal action. It’s crucial to adhere to your repayment plan.

Are there any grants or scholarships that can help with off-campus housing costs?

Yes, many institutions and organizations offer grants and scholarships specifically for housing assistance. Check with your school’s financial aid office and explore external resources.

Can I use my student loans for furniture and utilities?

While the primary purpose is for housing, some loan programs may allow for a portion to cover essential utilities, but furniture is generally not covered. Check your loan terms.