Navigating the complexities of student loan repayment can feel overwhelming, but understanding how to access your loan information is the first crucial step towards financial clarity. This guide provides a comprehensive overview of the various methods available to view all your student loans, from utilizing online portals and mobile apps to contacting your loan servicer directly. We’ll explore the key details you need to know to effectively manage your student loan debt.

Whether you’re a recent graduate just starting your repayment journey or a seasoned borrower looking to consolidate your loans, gaining a clear picture of your outstanding balances, interest rates, and repayment plans is paramount. This guide will empower you with the knowledge and tools necessary to confidently track and manage your student loan portfolio.

Locating Your Student Loan Servicer

Knowing your student loan servicer is crucial for managing your loans effectively. Your servicer handles your payments, provides account information, and assists with any loan-related inquiries. This section details how to find this important piece of information.

Identifying your student loan servicer is a straightforward process, typically involving checking your federal student aid account or contacting the relevant agencies. However, if you lack access to your online account, alternative methods are available.

Common Student Loan Servicers in the US

Several companies manage federal student loans. Familiarizing yourself with some of the most common servicers can help streamline the identification process. The following table lists some prominent examples, but it’s not exhaustive; your servicer might be different.

| Name | Website URL | Phone Number | Contact Email |

|---|---|---|---|

| Nelnet | www.nelnet.com | (Example: 800-308-2008 – Note: Contact numbers change frequently. Always verify on their website.) | (Example: Contact information varies by service; check their website) |

| Great Lakes | www.greatlakes.org | (Example: 800-236-5525 – Note: Contact numbers change frequently. Always verify on their website.) | (Example: Contact information varies by service; check their website) |

| FedLoan Servicing | www.fedloanservicing.com | (Example: 800-699-2980 – Note: Contact numbers change frequently. Always verify on their website.) | (Example: Contact information varies by service; check their website.) |

| MOHELA | www.mohela.com | (Example: 800-331-6148 – Note: Contact numbers change frequently. Always verify on their website.) | (Example: Contact information varies by service; check their website.) |

Disclaimer: The phone numbers and email addresses provided are examples and may not be current. Always refer to the official website of the respective servicer for the most up-to-date contact information.

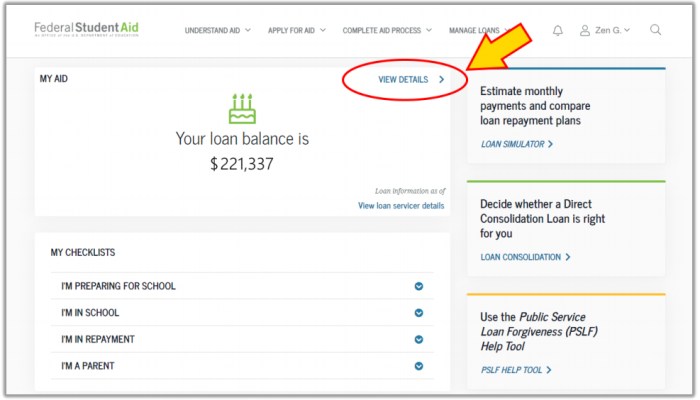

Identifying Your Servicer Using Your Federal Student Aid Account

The most efficient way to find your student loan servicer is by accessing your federal student aid account through StudentAid.gov. This website provides a centralized portal for managing your federal student loans. Once logged in, your loan servicer’s name and contact information will be clearly displayed on your account dashboard. This method is highly recommended for its speed and accuracy.

Finding Your Servicer Without Access to Your Federal Student Aid Account

If you cannot access your federal student aid account, you can still locate your servicer. Contacting the National Student Loan Data System (NSLDS) is a viable option. The NSLDS is a database that contains information about your federal student loans. While they won’t directly provide your servicer’s contact information, they can provide your loan details, which you can then use to contact the servicer directly.

Accessing Your Student Loan Information Online

Accessing your student loan information online offers convenience and efficiency. You can view key details anytime, anywhere, eliminating the need for phone calls or mail. Two primary methods exist: through the National Student Loan Data System (NSLDS) and directly through your loan servicer’s website.

Both the NSLDS and your loan servicer’s website provide a comprehensive overview of your federal student loans. The NSLDS offers a centralized view of all your federal student loans, regardless of your servicer. Your loan servicer’s website, on the other hand, provides a more detailed account-specific view of your loans with that particular servicer.

Accessing Loan Information via the NSLDS Website

The National Student Loan Data System (NSLDS) is a free online database maintained by the U.S. Department of Education. It provides a central location to view information about your federal student loans. To access your loan information, you’ll need your Social Security number and date of birth.

To log in, navigate to the NSLDS website. You will find a login portal prominently displayed. Enter your Social Security number and date of birth, then click the “Submit” or equivalent button. After successful verification, you will be granted access to a dashboard displaying a summary of your federal student loan information. This includes loan balances, interest rates, loan types, and disbursement dates. You can then drill down into individual loans for more detailed information. The website’s design is generally intuitive, with clear navigation menus and helpful tooltips. Remember to always access the NSLDS through its official website to avoid phishing scams.

Accessing Loan Information via Your Student Loan Servicer’s Website

Each student loan servicer has its own website with a secure login portal. The specific steps to access your loan information will vary slightly depending on your servicer, but the process generally follows a similar pattern. You will typically need your username and password, which you should have received during the loan disbursement process. If you have forgotten your login credentials, most servicers provide a password reset option.

Let’s Artikel a typical process. First, locate your servicer’s website. This will likely be a website with a professional design and clearly labeled login button. Upon accessing the login page, enter your username and password. Once logged in, you should be directed to a dashboard or account summary page. This page usually displays a summary of your loan information, including your loan balance, interest rate, payment due date, and repayment plan. From here, you can navigate to more detailed views of individual loans or access tools for making payments, managing your account, and exploring repayment options. The website’s layout and features will vary slightly between servicers, but the core functionality remains consistent.

Understanding Your Student Loan Documents

Understanding your student loan documents is crucial for effectively managing your debt. These documents provide vital information about your loans, repayment terms, and overall financial obligations. Careful review of these documents will help you avoid late payments and potential negative impacts on your credit score.

Knowing what information to look for and where to find it will empower you to make informed decisions regarding your student loan repayment strategy.

Key Information Found on a Student Loan Statement

Your monthly student loan statement will contain several key pieces of information. Regularly reviewing this information allows you to monitor your loan balance, track payments, and identify any potential discrepancies.

- Loan Balance: The total amount you owe on the loan.

- Minimum Payment Due: The minimum amount required to avoid late payment fees.

- Payment Due Date: The date by which your payment must be received.

- Interest Rate: The percentage rate at which interest accrues on your loan balance.

- Interest Accrued: The amount of interest that has accumulated since your last payment.

- Payment History: A record of your past payments, including dates and amounts.

- Account Number: A unique identifier for your specific loan account.

- Servicer Contact Information: Details on how to contact your loan servicer.

Comparison of NSLDS and Individual Loan Servicer Information

Both the National Student Loan Data System (NSLDS) and your individual loan servicers provide information about your student loans, but the scope and detail of this information differ.

| Feature | NSLDS | Individual Loan Servicer |

|---|---|---|

| Loan Details | Provides a summary of all federal student loans, including loan amounts, disbursement dates, and loan types. | Provides detailed information about a specific loan, including payment history, interest rates, and current balance. |

| Payment History | Shows a general payment history across all federal loans. | Provides a complete payment history for each individual loan. |

| Account Management | Does not offer account management tools, such as making payments or changing repayment plans. | Offers tools for managing your loan, including making payments, updating contact information, and exploring repayment options. |

| Loan Status | Indicates the overall status of your federal student loans (e.g., in repayment, deferment). | Provides specific details on the status of each individual loan. |

Types of Student Loan Documents

Throughout the life of your student loans, you’ll receive various documents. Familiarizing yourself with these documents ensures you’re well-informed about your financial obligations.

- Promissory Note: A legal contract outlining your agreement to repay your student loan. This document details the terms of your loan, including the loan amount, interest rate, and repayment schedule.

- Master Promissory Note (MPN): A single promissory note covering multiple loans obtained under the same program. This simplifies the process of borrowing and managing multiple federal student loans.

- Loan Disbursement Information: Documents detailing when and how your loan funds were released to your educational institution.

- Monthly Statements: Regular updates showing your loan balance, payment history, and other important information.

- Repayment Schedules: Artikels your repayment plan, showing your monthly payments and the total time required to repay your loan.

Utilizing Mobile Apps for Student Loan Management

Managing student loans can be complex, involving multiple payments, interest rates, and repayment plans. Fortunately, several mobile applications are designed to simplify this process, providing convenient access to crucial information and tools directly from your smartphone. These apps offer a range of features, from tracking payments and viewing balances to providing personalized repayment strategies. However, it’s important to understand the features and limitations of each app before selecting one for your needs.

Comparison of Student Loan Management Mobile Applications

Choosing the right app depends on your individual preferences and needs. Below is a comparison of three popular student loan management apps, highlighting their key features, advantages, and potential drawbacks. Remember to always verify the information presented in any app with your official loan documents.

| App Name | Key Features | Pros | Cons |

|---|---|---|---|

| Student Loan Hero | Loan tracking, repayment calculators, personalized repayment strategies, debt reduction tools, financial literacy resources. | Provides comprehensive tools for managing and reducing student loan debt; Offers valuable financial education resources. | May not directly connect to all loan servicers; Relies on user input for accurate data. |

| Chase Student Loan Tracker (if applicable) | (Assuming access to Chase accounts) Balance tracking, payment scheduling, payment history, and potentially direct payment options within the Chase banking app. | Convenient integration for Chase customers; Provides a centralized view if you manage other finances through Chase. | Limited functionality if you don’t have a Chase account; Only applicable for loans managed through Chase. |

| National Student Loan Data System (NSLDS) Mobile Access (Indirect) | (Note: NSLDS doesn’t have a dedicated app, but information can be accessed via a mobile browser). Access to federal student loan information, including loan balances, repayment history, and servicer contact information. | Direct access to official federal loan information; Provides a reliable source of data. | Requires separate login; Interface may not be as user-friendly as dedicated apps; Does not provide repayment planning tools. |

Benefits and Drawbacks of Using Mobile Apps for Student Loan Management

Mobile apps offer several advantages for managing student loans. They provide convenient access to your loan information anytime, anywhere, allowing for quick checks of balances and payment due dates. Many apps offer personalized repayment strategies and budgeting tools, helping users create a plan to pay off their loans more efficiently. The ability to schedule and track payments electronically can simplify the repayment process and reduce the risk of missed payments.

However, it’s crucial to be aware of potential drawbacks. Not all apps integrate with every loan servicer, meaning you might need to use multiple apps to manage all your loans. The accuracy of the information displayed depends on the accuracy of the data you input, and some apps may contain advertisements or in-app purchases. It’s essential to carefully review the app’s privacy policy to understand how your data is handled. Finally, always verify information provided by the app with your official loan documents from your servicer.

Contacting Your Student Loan Servicer for Assistance

Maintaining open communication with your student loan servicer is crucial for managing your loans effectively. Understanding the various methods of contact and knowing what information to have prepared will streamline the process and ensure you receive prompt and accurate assistance. This section Artikels the best ways to reach your servicer and what to expect when you do.

Your student loan servicer offers multiple channels for you to contact them. Choosing the most appropriate method depends on your preference and the urgency of your request. Each method offers a different level of immediacy and formality.

Contact Methods Available

Several avenues exist for contacting your student loan servicer, each with its own advantages and disadvantages. Selecting the right method will depend on your individual needs and the urgency of your query.

- Phone: This is often the quickest method for addressing urgent matters or receiving immediate assistance. You can usually find the servicer’s phone number on their website or your loan documents. Be prepared for potential hold times.

- Email: Email allows for a more detailed and documented record of your communication. It’s suitable for non-urgent inquiries or requests requiring written confirmation. Remember to check your email regularly for responses.

- Mail: Sending a letter via mail is the least efficient method, but it can be useful for formal requests or sending physical documents. Ensure you use the correct mailing address, which can usually be found on your loan documents or the servicer’s website.

Information to Prepare Before Contacting Your Servicer

Gathering necessary information before contacting your servicer will significantly expedite the process and prevent delays. Having this information readily available will ensure a smooth and efficient interaction.

- Your Loan Information: This includes your loan ID numbers, the type of loan (e.g., Federal Direct Loan, Perkins Loan), and the total loan amount.

- Your Personal Information: Have your full name, date of birth, Social Security number (or other relevant identification number), and contact information readily available.

- Specific Questions or Concerns: Clearly articulate the reason for your contact. The more specific your question, the more effective the response will be. For example, instead of asking “What is my loan balance?”, try “What is the current balance of my Federal Direct Loan with loan ID number 123456789?”

Sample Email Template

A well-structured email ensures your request is clearly understood. This sample provides a framework you can adapt to your specific needs.

Subject: Inquiry Regarding Student Loan [Loan ID Number]

Dear [Servicer Name],

I am writing to inquire about my student loan with the following information:

Loan ID Number: [Your Loan ID Number]

Name: [Your Full Name]

Date of Birth: [Your Date of Birth]

Social Security Number: [Your Social Security Number – Consider redacting this if you are uncomfortable sharing it via email]My question/request is: [Clearly state your question or request. Be as specific as possible.]

Thank you for your time and assistance.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Understanding Different Loan Types and Their Details

Navigating the world of student loans can be complex, particularly when understanding the nuances between different loan types. This section clarifies the key distinctions between federal and private student loans, providing a detailed look at various federal loan programs and how to identify them on your statements. Knowing this information is crucial for effective loan management and repayment planning.

Understanding the differences between federal and private student loans is fundamental to responsible borrowing. Federal loans are offered by the U.S. government, while private loans come from banks, credit unions, or other private lenders. Federal loans generally offer more borrower protections, such as income-driven repayment plans and loan forgiveness programs, which are not always available with private loans. Interest rates on federal loans are typically fixed and lower than those on private loans, which can fluctuate and may be higher. Furthermore, eligibility requirements for federal loans are often less stringent than those for private loans.

Federal and Private Student Loan Differences

Federal and private student loans differ significantly in their terms and conditions. Federal loans, backed by the government, generally offer more favorable repayment options and protections. Private loans, on the other hand, are subject to the lending institution’s policies, potentially resulting in higher interest rates and fewer repayment flexibility options. This table summarizes key differences:

| Feature | Federal Loans | Private Loans |

|---|---|---|

| Lender | U.S. Department of Education | Banks, credit unions, or other private lenders |

| Interest Rates | Generally lower and fixed | Generally higher and may be variable or fixed |

| Repayment Options | More flexible options, including income-driven repayment plans | Fewer repayment options, often less flexible |

| Borrower Protections | Stronger borrower protections, such as loan forgiveness programs | Fewer borrower protections |

| Eligibility | Based on financial need and enrollment status | Based on creditworthiness and income |

Types of Federal Student Loans

Several federal student loan programs cater to different needs and circumstances. Understanding the characteristics of each program is crucial for making informed borrowing decisions.

The following are examples of common federal student loan programs:

- Subsidized Loans: The government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment. This means your loan balance doesn’t grow during these periods. Eligibility is based on financial need.

- Unsubsidized Loans: Interest accrues from the time the loan is disbursed, even while you’re in school. You are responsible for paying this accrued interest. Eligibility is not based on financial need.

- PLUS Loans: These loans are available to graduate or professional students and parents of undergraduate students. Credit checks are required, and approval is not guaranteed. Interest rates are typically higher than subsidized and unsubsidized loans.

Identifying Loan Types on Statements

Your student loan statements should clearly indicate the type of loan (federal or private) and, if federal, the specific program (e.g., Subsidized, Unsubsidized, PLUS). Look for a section detailing loan information, including the loan type, interest rate, and outstanding balance. If the information isn’t clear, contact your loan servicer for clarification. Often, a loan identifier code or program abbreviation will be included. For example, a loan identifier might be prefixed with a code indicating it’s a federal loan and then followed by a designation of Subsidized, Unsubsidized, or PLUS. Private loan statements will typically clearly state they are private loans and identify the private lender.

Visual Representation of Loan Information

Visualizing your student loan debt can significantly aid in understanding its scope and developing an effective repayment strategy. Transforming complex numerical data into easily digestible charts and graphs provides a clear picture of your overall debt and the distribution of different loan types. This allows for more informed decision-making regarding repayment plans and budgeting.

A visual representation offers a concise overview of your financial obligations, highlighting areas requiring immediate attention and facilitating better financial planning. By understanding the proportions of different loan types and their associated balances, you can prioritize repayment strategies and potentially identify opportunities for saving money through refinancing or other methods.

Sample Visual Representation: Bar Graph and Pie Chart

Let’s consider a hypothetical example. Suppose a student has the following student loan breakdown:

* Federal Subsidized Loans: $20,000

* Federal Unsubsidized Loans: $15,000

* Private Loans: $10,000

This data can be represented using a bar graph and a pie chart.

Bar Graph: The horizontal axis would list the loan types (Federal Subsidized, Federal Unsubsidized, Private). The vertical axis would represent the loan balance in dollars. Three bars would visually depict the balance of each loan type, with the height of each bar corresponding to the loan amount. The bar representing Federal Subsidized Loans would be the tallest, followed by Federal Unsubsidized Loans, and finally Private Loans.

Pie Chart: The entire pie represents the total loan amount ($45,000). Each slice of the pie would correspond to a loan type, with the size of the slice proportional to the loan balance. The largest slice would represent Federal Subsidized Loans, followed by Federal Unsubsidized Loans, and then Private Loans. Percentage labels for each slice would further clarify the proportional breakdown of each loan type within the total debt.

This visual representation clearly illustrates the dominant portion of the debt is from Federal Subsidized Loans, followed by Federal Unsubsidized, and finally Private Loans. This visual clarity helps prioritize repayment strategies.

Benefits of Visual Representations for Student Loan Debt

Visual representations, such as bar graphs and pie charts, offer several key advantages in managing student loan debt:

* Improved Understanding: They simplify complex financial data, making it easier to grasp the overall debt picture.

* Enhanced Decision-Making: They facilitate informed decisions regarding repayment strategies and budgeting.

* Effective Communication: They provide a clear and concise way to communicate your debt situation to others, such as financial advisors.

* Progress Tracking: They allow you to visually track your progress over time as you repay your loans.

Creating a Personal Student Loan Repayment Plan Visual Aid

Creating a visual aid for your personal student loan repayment plan involves gathering your loan information (loan type, balance, interest rate, minimum payment), inputting it into a spreadsheet program (like Excel or Google Sheets), and then using the program’s charting tools to generate a visual representation. This could be a bar graph showing the remaining balance of each loan over time, a line graph illustrating the projected balance decrease based on your chosen repayment plan, or a combination of charts to represent different aspects of your repayment strategy. The visual aid should be regularly updated to reflect your progress. This allows you to monitor your repayment plan’s effectiveness and make adjustments as needed.

Summary

Successfully managing your student loans requires proactive engagement and a clear understanding of your financial obligations. By mastering the methods Artikeld in this guide—from online portals to direct servicer contact—you can effectively monitor your loan details, ensuring you remain informed and in control of your repayment strategy. Remember, taking the initiative to understand your student loans is a significant step toward achieving long-term financial well-being.

Essential FAQs

What if I don’t know my student loan servicer?

You can usually find this information on your federal student aid account or by contacting the National Student Loan Data System (NSLDS).

How often should I check my student loan statements?

It’s recommended to review your statements at least monthly to monitor your balance, interest accrual, and payment history.

What if I’m having trouble logging into my servicer’s website?

Contact your servicer’s customer support for assistance with password resets or account access issues. Their contact information should be available on their website.

Can I consolidate my student loans?

Yes, consolidating your loans may simplify repayment, but it’s important to understand the potential impact on your interest rate and repayment term. Consult with a financial advisor before making this decision.