Navigating the complexities of student loan repayment can feel overwhelming, but understanding Income-Based Repayment (IBR) plans can significantly ease the burden. This guide provides a clear and concise overview of the IBR application process, from initial eligibility requirements to long-term financial implications. We’ll demystify the application, payment calculations, and potential benefits and drawbacks, empowering you to make informed decisions about your student loan debt.

This comprehensive resource covers everything from verifying income and family size to understanding the intricacies of IBR payment calculations and the potential impact on your credit score. We’ll also explore the various types of IBR plans available, comparing them to other repayment options and addressing common concerns regarding missed payments and loan forgiveness. Our goal is to equip you with the knowledge necessary to confidently navigate the IBR application process and manage your student loans effectively.

IBR Application Process Overview

Applying for an Income-Based Repayment (IBR) plan can significantly simplify your student loan repayment. This process involves several steps, requiring specific documentation and understanding of the different IBR plan options available. Successfully navigating this process can lead to more manageable monthly payments tailored to your income.

Steps Involved in Applying for an IBR Plan

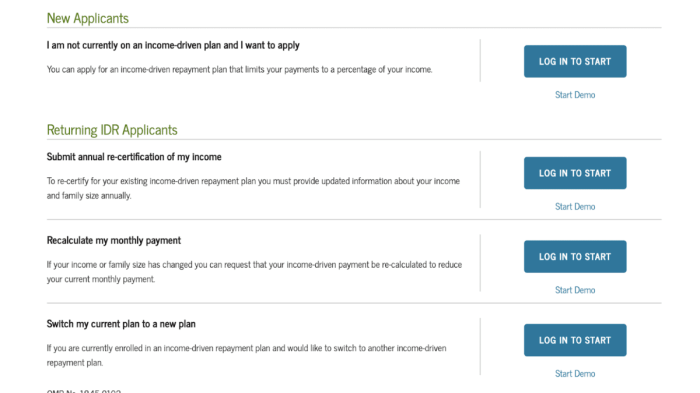

The application process typically begins with gathering the necessary documentation. Next, you’ll submit your application through the appropriate channels, usually online through the student loan servicer’s website. Following submission, your application will be reviewed, and you’ll receive a notification of approval or denial. If approved, your repayment plan will be adjusted accordingly. Finally, it’s crucial to monitor your account regularly to ensure accurate reporting of your income and family size.

Required Documentation for an IBR Application

To apply for an IBR plan, you’ll need to provide documentation verifying your income and family size. This typically includes tax returns (Form 1040 and W-2s) for the most recent tax year, as well as pay stubs or other income verification documents if your tax return isn’t fully reflective of your current income. Documentation proving your family size, such as a marriage certificate or birth certificates for dependents, may also be required. Failure to provide complete and accurate documentation may delay the processing of your application.

Types of IBR Plans and Eligibility Criteria

Several types of IBR plans exist, each with specific eligibility criteria. These include the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans. Eligibility often depends on factors such as loan type, income, and family size. For instance, Direct Subsidized and Unsubsidized Loans, along with Direct PLUS Loans, are typically eligible for IBR plans. However, specific eligibility requirements and income thresholds vary depending on the plan and the lender. It is important to consult the official government website or your loan servicer for the most up-to-date and accurate information on eligibility.

Step-by-Step Guide for Completing the IBR Application Online

The online application process usually starts by logging into your student loan servicer’s website. You will then locate the section dedicated to repayment plans and select the IBR option. Next, you’ll be prompted to provide personal information, including your Social Security number, date of birth, and contact information. The application will then request the necessary documentation Artikeld previously, often allowing for electronic upload. Once all required information is submitted, review your application carefully before final submission. After submission, you’ll receive a confirmation and updates on the status of your application. Remember to keep a copy of your completed application and all supporting documents for your records.

Income and Family Size Verification

Verifying your income and family size is a crucial step in the IBR application process. Accurate reporting is essential for determining your eligibility and the amount of your monthly student loan payments. The Department of Education uses various methods to confirm the information you provide, and discrepancies can lead to delays or even denial of your IBR application.

The methods used to verify income and family size vary depending on the applicant’s circumstances and the information provided in the application. Generally, verification involves reviewing tax returns, pay stubs, W-2 forms, and other financial documentation. For self-employed individuals, additional documentation might be required, such as business tax returns and profit and loss statements. Family size is typically verified through documentation such as birth certificates, marriage certificates, or legal guardianship papers.

Income Verification Methods

Several methods are employed to verify the income reported on your IBR application. These methods aim to ensure the accuracy of the information provided and prevent potential abuse of the program. The specific method used will depend on the applicant’s employment status and the type of income they receive.

| Verification Method | Description | Data Source | Reliability |

|---|---|---|---|

| Tax Return Data | Income reported on federal tax returns (Form 1040) is a primary source of income verification. | IRS | High – Directly from the IRS. |

| Pay Stubs | Recent pay stubs showing gross income and deductions. | Employer | Medium – Can be easily manipulated. |

| W-2 Forms | Year-end wage and tax statement from employer. | Employer | High – Official employer documentation. |

| Self-Employment Documentation | Business tax returns, profit and loss statements, bank statements for self-employed individuals. | Applicant | Variable – Dependent on the thoroughness and accuracy of the documentation. |

Impact of Inaccurate Income Reporting

Inaccurate income reporting can significantly impact your IBR plan approval. Providing false or misleading information is a serious offense and could lead to the denial of your application. Even unintentional errors can result in delays and additional documentation requests, prolonging the approval process. In some cases, inaccurate reporting might lead to higher monthly payments than you would otherwise qualify for under an accurate income assessment.

Appealing an IBR Application Denial

If your IBR application is denied due to income discrepancies, you have the right to appeal the decision. The appeal process usually involves submitting additional documentation to support your claim of accurate income reporting. This might include updated tax returns, revised pay stubs, or explanations for any discrepancies identified by the Department of Education. A clear and concise explanation of the situation, along with supporting evidence, is crucial for a successful appeal. The appeal process and timelines are usually Artikeld in the denial letter you receive.

Understanding IBR Payment Calculations

The Income-Based Repayment (IBR) plan calculates your monthly student loan payments based on your discretionary income and family size. This means your payment will be a percentage of your income above a certain threshold, adjusted for your family size and the total amount of your eligible student loans. Understanding how this calculation works is crucial for budgeting and planning your finances.

The precise formula for calculating IBR payments isn’t publicly available as a single, simple equation. The calculation is complex and varies slightly depending on the specific IBR plan (IBR, ICR, PAYE, REPAYE). However, the core principle remains consistent: your payment is a percentage of your discretionary income, determined after considering your adjusted gross income (AGI), family size, and loan balance. The Department of Education uses a complex algorithm incorporating these factors to arrive at your monthly payment amount.

Factors Influencing IBR Payment Amounts

Several key factors significantly impact the final IBR payment calculation. These include your adjusted gross income (AGI), the number of people in your household, and your total student loan debt. Higher incomes generally lead to higher payments, while larger family sizes often result in slightly lower payments. A larger loan balance also increases your monthly payment, even with the same income and family size. Additionally, the type of loan and the interest rate also play a role, although these are less directly involved in the income-based calculation itself.

Examples of IBR Payment Calculations

Let’s illustrate with some hypothetical examples. Assume a 10% payment rate for simplicity. This is not a fixed rate, but serves for illustrative purposes.

Scenario 1: Individual with an AGI of $50,000, no dependents, and $50,000 in student loans. After subtracting the poverty guideline and other factors, their discretionary income is calculated. Let’s assume this calculation results in $30,000 discretionary income. A 10% payment rate would result in a monthly payment of $250 ($30,000 * 0.10 / 12 months).

Scenario 2: A couple with a combined AGI of $80,000, two children, and $75,000 in student loans. Again, assuming a simplified discretionary income calculation resulting in $50,000. A 10% payment rate would yield a monthly payment of approximately $417 ($50,000 * 0.10 / 12 months). Note that the family size influences the discretionary income calculation, potentially resulting in a lower percentage of income applied to the payment.

Scenario 3: Individual with an AGI of $30,000, no dependents, and $20,000 in student loans. After the discretionary income calculation, the resulting amount might be very low, potentially leading to a very low or even $0 monthly payment depending on the specific IBR plan guidelines and applicable poverty guidelines.

Example IBR Payment Calculations Table

| Annual Income | Loan Balance | Family Size | Approximate Monthly Payment (Illustrative – 10% rate) |

|---|---|---|---|

| $40,000 | $40,000 | 1 | $250 (Illustrative) |

| $60,000 | $60,000 | 2 | $375 (Illustrative) |

| $80,000 | $80,000 | 4 | $500 (Illustrative) |

| $30,000 | $20,000 | 1 | $0 – $100 (Illustrative – Potentially very low due to low income) |

Disclaimer: The payment amounts in this table are illustrative examples only and are based on a simplified 10% payment rate. Actual IBR payments will vary significantly depending on numerous factors, including your specific income, family size, loan type, and the applicable poverty guidelines. It’s crucial to consult the Department of Education’s website or a student loan servicer for precise calculations and to determine your eligibility for an IBR plan.

IBR Plan Benefits and Drawbacks

Income-Driven Repayment (IBR) plans offer a significant advantage to student loan borrowers, particularly those facing financial hardship. They adjust monthly payments based on income and family size, making repayment more manageable in the short term. However, it’s crucial to understand both the benefits and potential drawbacks before choosing an IBR plan.

Advantages of IBR Plans

IBR plans offer several key advantages. Lower monthly payments are a primary benefit, allowing borrowers to allocate more funds towards other essential expenses. This can be especially helpful during periods of unemployment or low income. Furthermore, the potential for loan forgiveness after a specified period of qualifying payments is a powerful incentive. This forgiveness can significantly reduce or even eliminate the remaining loan balance, offering a path to financial freedom. The flexibility offered by IBR plans in adjusting payments based on changing income circumstances provides a safety net for borrowers whose financial situations fluctuate.

Disadvantages and Limitations of IBR Plans

While IBR plans provide considerable benefits, several limitations exist. The lower monthly payments often lead to a longer repayment period, resulting in the accrual of more interest over the life of the loan. This ultimately means borrowers may end up paying more in total interest compared to other repayment plans with higher monthly payments. The complexities of the income verification process can be daunting for some borrowers, requiring meticulous documentation and potentially leading to delays in payment adjustments. Finally, loan forgiveness under IBR plans isn’t guaranteed and is contingent upon meeting specific eligibility criteria and making qualifying payments for a significant number of years (typically 20-25 years).

Comparison of IBR Plans with Other Repayment Plans

Choosing the right repayment plan depends heavily on individual financial circumstances and long-term goals. IBR plans differ significantly from other options such as Standard, Extended, and Graduated Repayment plans. Standard plans offer fixed monthly payments over a 10-year period, while Extended plans stretch payments over 25 years. Graduated plans start with lower payments that gradually increase over time. Each plan has its own trade-offs between monthly payment amounts, total interest paid, and loan repayment duration.

| Repayment Plan | Monthly Payment | Repayment Period | Total Interest Paid |

|---|---|---|---|

| Standard | High, fixed | 10 years | Potentially lower |

| Extended | Lower, fixed | 25 years | Potentially higher |

| Graduated | Low initially, increasing | 10 years | Potentially moderate |

| IBR | Variable, income-based | 20-25 years (potential forgiveness) | Potentially high, but with forgiveness possibility |

Managing IBR Payments and Potential Issues

Successfully navigating the Income-Based Repayment (IBR) plan requires understanding the payment process, potential pitfalls, and strategies for effective management. This section details the procedures for making payments, updating income information, handling payment issues, and implementing proactive financial strategies.

Making IBR payments and keeping your information current is crucial for maintaining your plan. Your loan servicer will provide instructions on how to make payments, typically through online portals, mail, or phone. Remember to always retain payment confirmations. Annual income recertification is mandatory; failing to update your information accurately can lead to overpayments or, conversely, inadequate payments that could negatively impact your credit score and loan forgiveness eligibility.

IBR Payment Process and Income Updates

The process for making IBR payments generally involves logging into your student loan servicer’s online portal. You’ll find options to view your payment due date, outstanding balance, and make payments via electronic transfer, check, or other methods. Income recertification usually involves submitting updated tax information (W-2s, 1099s, tax returns) or other relevant documentation proving your current income and family size. Your servicer will provide specific instructions and deadlines for this process. Failure to recertify on time can result in your payments being recalculated based on your previous income, potentially leading to higher monthly payments.

Consequences of Missed or Late IBR Payments

Missed or late IBR payments have significant consequences. Late payments will likely incur late fees, negatively impacting your credit score. Repeated late payments can lead to your loan being sent to collections, further damaging your credit history and potentially incurring additional fees. Furthermore, consistent late payments can jeopardize your eligibility for loan forgiveness programs, ultimately extending the repayment period and increasing the total amount you pay over the life of the loan. For example, a consistent pattern of late payments could lead to the denial of Public Service Loan Forgiveness (PSLF).

Resolving IBR Payment Issues and Disputes

If you encounter issues with your IBR payments, promptly contact your loan servicer. Common issues include discrepancies in payment amounts, difficulties with the online portal, or questions about income recertification. Keep detailed records of all communications, including dates, times, and the names of the individuals you spoke with. If you’re unable to resolve the issue with your servicer, you may need to escalate the complaint to the Department of Education or consider seeking assistance from a consumer protection agency or legal professional. Documentation is key to successfully resolving disputes.

Strategies for Effective IBR Payment Management

Effective IBR payment management requires proactive financial planning. Creating a realistic budget that includes your IBR payment is crucial. Explore budgeting apps or methods to track your income and expenses. Consider setting up automatic payments to avoid late payments. Regularly review your budget and adjust as needed. If you anticipate financial hardship, contact your loan servicer immediately to discuss potential options, such as forbearance or deferment. Proactive communication is essential to preventing serious issues.

Long-Term Implications of IBR

Choosing an Income-Driven Repayment (IBR) plan for your student loans has significant long-term consequences that extend beyond your monthly payment amount. Understanding these implications is crucial for making informed financial decisions. This section will explore the potential effects of IBR on your credit score, taxes, and overall financial health.

Impact on Credit Scores

IBR plans, while beneficial for managing monthly payments, can indirectly affect your credit score. Consistent on-time payments, even smaller amounts under IBR, positively impact your credit score. However, a prolonged period of repayment under IBR, especially if your payments are consistently low relative to your loan balance, might lead to a lower credit score. This is because credit scoring models often consider the ratio of your debt to your credit limit, and a large, outstanding student loan balance could negatively influence this ratio. Conversely, if the IBR plan allows you to avoid delinquency or default, it will positively impact your credit score compared to situations where the payments are unmanageable under standard repayment plans.

Tax Implications of IBR and Loan Forgiveness

A crucial aspect of IBR is the potential for loan forgiveness after a specific repayment period (typically 20 or 25 years, depending on the plan). However, this forgiven amount is considered taxable income by the IRS. This means that when your loan is forgiven, you will need to report the forgiven amount as income on your tax return for that year, potentially leading to a significant tax liability. For example, if $50,000 of your student loans are forgiven, you would need to declare this amount as income, potentially resulting in a substantial tax bill. It’s wise to consult with a tax professional to understand the implications and plan for this potential tax burden. Careful financial planning, such as setting aside money throughout the repayment period, can help mitigate this impact.

Loan Forgiveness Under IBR

IBR plans offer the possibility of loan forgiveness after a set number of qualifying payments. This forgiveness is contingent upon making consistent, on-time payments according to the IBR plan’s terms for the specified period. It’s important to note that the exact terms and conditions for forgiveness vary depending on the specific IBR plan and the type of federal student loans involved. Furthermore, the amount forgiven may be substantial, potentially affecting your credit score and future financial planning as previously discussed. The exact amount forgiven depends on your loan balance at the time of forgiveness. The process can be lengthy and requires careful monitoring of your repayment progress.

Hypothetical Scenario: Long-Term Financial Effects of IBR

Let’s consider Sarah, who has $100,000 in federal student loans. Under a standard repayment plan, her monthly payment would be significantly higher than under an IBR plan. Choosing IBR, her monthly payments are manageable, allowing her to save for a down payment on a house and invest in her retirement. However, after 25 years of payments under IBR, $40,000 of her loan is forgiven. This forgiven amount is considered taxable income, resulting in a substantial tax liability. While the lower monthly payments under IBR allowed Sarah to build financial stability, the tax implications of loan forgiveness must be factored into her long-term financial planning. This scenario highlights the trade-offs inherent in choosing an IBR plan. While providing immediate financial relief, it can lead to a significant tax burden later.

Resources and Support for IBR Applicants

Navigating the complexities of the Income-Driven Repayment (IBR) program for student loans can be challenging. Fortunately, numerous resources are available to help applicants understand the program, complete their applications, and manage their payments effectively. This section Artikels key resources and support options for those seeking assistance with IBR.

Understanding the IBR process and accessing the right support is crucial for successful loan management. Whether you need help with the application, understanding your payment calculations, or resolving payment issues, several avenues for assistance exist. This information aims to equip you with the tools and knowledge to navigate the IBR system confidently.

Reliable Resources and Websites

The federal government and various non-profit organizations offer valuable information regarding IBR. The StudentAid.gov website, maintained by the Federal Student Aid office, is an excellent starting point. It provides comprehensive information on all federal student loan repayment plans, including IBR, and offers tools to estimate payments and explore repayment options. Additionally, the National Foundation for Credit Counseling (NFCC) and other non-profit credit counseling agencies offer free or low-cost guidance on managing student loan debt and navigating repayment plans. These agencies can provide personalized advice and assistance in choosing the best repayment plan based on your individual financial circumstances. Remember to carefully vet any third-party resource to ensure it is reputable and trustworthy.

Contact Information for Government Agencies and Student Loan Servicers

The primary contact for federal student loan information is the Federal Student Aid office, accessible through the StudentAid.gov website. This website includes contact information for various inquiries, including IBR applications and payment issues. Your specific student loan servicer will also be a valuable resource. Your servicer handles your account and can answer questions about your specific IBR plan, payment amounts, and account status. Contact information for your servicer can be found on your student loan statements or through the National Student Loan Data System (NSLDS) website. The NSLDS provides a centralized location to view your federal student loan information, including your servicer’s contact details.

Seeking Assistance with IBR Applications or Payment Issues

The process of seeking assistance typically begins with reviewing the information available on StudentAid.gov and contacting your student loan servicer. If you are experiencing difficulties understanding the application process or have questions about your payment calculations, your servicer can provide clarification and guidance. If you encounter significant challenges or require more in-depth assistance, you can contact a non-profit credit counseling agency. These agencies can provide personalized financial counseling, help you understand your repayment options, and potentially assist with negotiating with your loan servicer. For more complex situations, seeking legal advice from a lawyer specializing in student loan law might be necessary. However, it’s often advisable to exhaust other resources first.

Helpful Resources for IBR Applicants

Below is a list of key resources to aid in navigating the IBR process:

- StudentAid.gov: The official website for federal student aid.

- National Student Loan Data System (NSLDS): Provides access to your federal student loan information.

- Your Student Loan Servicer: Handles your account and answers questions about your IBR plan.

- National Foundation for Credit Counseling (NFCC): Offers free or low-cost credit counseling services.

- Local Non-profit Credit Counseling Agencies: Provide personalized financial guidance and support.

Ending Remarks

Successfully managing student loan debt requires careful planning and a thorough understanding of available repayment options. The Income-Based Repayment (IBR) program offers a potentially valuable path towards manageable monthly payments and, in some cases, eventual loan forgiveness. By understanding the application process, payment calculations, and potential long-term implications, you can make informed choices that align with your financial goals. Remember to utilize the resources provided and seek professional advice when needed to ensure a smooth and successful experience with your IBR application.

Popular Questions

What happens if my income changes after I apply for IBR?

You must update your income information with your loan servicer. Failure to do so can result in inaccurate payment calculations.

Can I switch from another repayment plan to IBR?

Yes, you can generally switch to an IBR plan from other repayment plans. However, there may be specific eligibility requirements and timing considerations.

What if my IBR application is denied?

You typically have the right to appeal the decision. Review the denial letter carefully and follow the instructions for appealing the decision.

How long does it take to process an IBR application?

Processing times vary, but it can take several weeks or even months. It’s advisable to apply well in advance of needing the plan to take effect.