Navigating the complexities of student loan repayment can feel overwhelming, but understanding your options is key to financial freedom. Income-Based Repayment (IBR) plans offer a potential pathway to manageable monthly payments and, ultimately, loan forgiveness. This guide delves into the intricacies of IBR plans, providing a clear understanding of eligibility, application processes, payment calculations, and the long-term implications of choosing this repayment strategy. We’ll explore the various IBR plans available, comparing their features and benefits to help you make an informed decision about your financial future.

From understanding the eligibility criteria and required documentation to mastering the nuances of income-based calculations and loan forgiveness timelines, this comprehensive resource equips you with the knowledge to confidently navigate the IBR process. We will also address common misconceptions and provide practical examples to illustrate key concepts, empowering you to take control of your student loan debt.

Understanding IBR Plans

Income-Based Repayment (IBR) plans offer a lifeline to student loan borrowers struggling with high monthly payments. These plans tie your monthly payment to your income and family size, making repayment more manageable. Understanding the nuances of different IBR plans is crucial for choosing the option best suited to your individual financial circumstances.

Types of Income-Based Repayment Plans

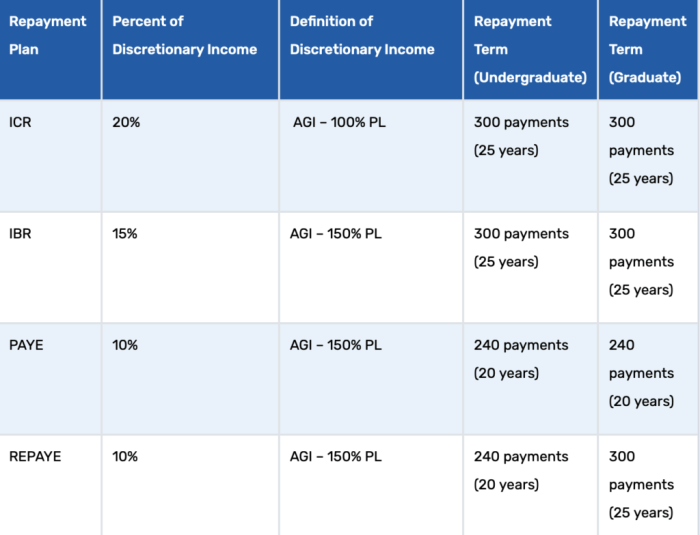

Several IBR plans exist, each with specific eligibility requirements and payment calculation methods. The availability of specific plans may depend on when your loans were originated. It’s important to check with your loan servicer to determine which plans you qualify for. Key plans include the Income-Driven Repayment (IDR) plans offered by the federal government. These plans are designed to make repayment more affordable, often leading to loan forgiveness after a specified period of time (generally 20 or 25 years). The specific requirements and forgiveness provisions vary depending on the plan.

Eligibility Criteria for IBR Plans

Eligibility for IBR plans generally requires borrowers to have federal student loans. Specific requirements can vary slightly depending on the plan. Factors considered may include your income, family size, and loan type. For example, some plans may require borrowers to be enrolled in an income-contingent repayment plan or to demonstrate financial hardship. It’s crucial to carefully review the eligibility requirements for each plan to determine your suitability.

IBR Payment Calculation Methods

IBR plans use different formulas to calculate your monthly payment. The calculation generally involves determining your discretionary income (income above a certain poverty guideline) and dividing it by a specific factor determined by the plan and the length of the repayment period. Some plans may adjust your payment annually based on changes in your income or family size. The exact formula can be quite complex, but the basic principle remains the same: to ensure your monthly payment is affordable given your financial situation. For instance, a plan might calculate your payment as 10% of your discretionary income, while another may use a 15% figure.

Impact of Income and Family Size on Monthly Payments

Your monthly IBR payment is directly affected by both your income and family size. A higher income will generally result in a higher monthly payment, while a larger family size can sometimes lead to a slightly lower payment (as the poverty guideline is adjusted for family size). For example, a single borrower with a high income might have a significantly higher monthly payment than a borrower with a lower income and a larger family. This is because the discretionary income is adjusted based on the poverty guideline for the specific family size.

Comparison of Key IBR Plan Features

| Plan Name | Eligibility | Payment Calculation | Forgiveness Provisions |

|---|---|---|---|

| Income-Driven Repayment (IDR) Plans (e.g., ICR, PAYE, REPAYE) | Federal student loans; meet income requirements | Varies by plan; generally based on discretionary income | Loan forgiveness after 20 or 25 years of payments; remaining balance forgiven |

| IBR (Older Plans) | Specific eligibility criteria (may vary based on loan origination date) | Based on discretionary income; specific formula varies | Loan forgiveness after 25 years of payments |

*Note: This table provides a general overview. Specific eligibility criteria and payment calculation methods may vary depending on the plan and your individual circumstances. Always consult your loan servicer for the most accurate and up-to-date information.*

Applying for IBR

The application process for an Income-Based Repayment (IBR) plan involves several steps, from gathering necessary documentation to verifying your income. Understanding these steps can streamline the process and help ensure a smooth transition to a more manageable repayment plan. The specific requirements and procedures may vary slightly depending on your loan servicer, so always refer to their official website or contact them directly for the most up-to-date information.

The application process for IBR is generally straightforward, but requires careful attention to detail to ensure accurate and timely processing. You’ll need to provide information about your income and family size to determine your monthly payment amount. The process also involves verifying the accuracy of this information with your loan servicer.

Required Documentation for IBR Plan Application

To apply for an IBR plan, you will typically need to provide documentation verifying your income and family size. This usually includes tax returns (Form 1040), W-2 forms, pay stubs, and possibly other supporting documentation depending on your employment situation. Your loan servicer will specify the exact documents needed. Providing complete and accurate documentation upfront will expedite the application process. Failure to provide sufficient documentation may delay or even prevent your application from being processed.

Income Verification for IBR

Income verification is a crucial part of the IBR application. Your loan servicer will use the information you provide to calculate your monthly payment. They may require you to submit documentation such as tax returns or pay stubs to verify your income. If your income changes significantly during the year, you may need to re-verify your income to adjust your monthly payment accordingly. The specific methods of verification may vary among loan servicers, but generally involve submitting digital copies of required documents through a secure online portal.

Switching from a Different Repayment Plan to IBR

Switching to an IBR plan from another repayment plan usually involves completing a new application with your current loan servicer. You will need to provide updated income and family size information. The servicer will then review your application and process the switch. There may be a short processing time before your payments are adjusted to reflect the new IBR plan. It’s important to note that any outstanding payments on your previous plan will need to be addressed before the switch is complete. Contacting your servicer directly will allow you to understand the specific timeline and requirements for your situation.

Step-by-Step Guide for Applying for IBR

Applying for an IBR plan can be broken down into these key steps:

- Gather necessary documentation, including tax returns, W-2s, and pay stubs.

- Log in to your student loan servicer’s website.

- Locate the IBR application or enrollment form.

- Complete the application form accurately and completely, providing all required information.

- Upload or submit the required documentation as instructed by your servicer.

- Review your application before submitting it to ensure accuracy.

- Submit your application and await confirmation from your loan servicer.

- Monitor your account for updates regarding the status of your application.

IBR Payment Calculations

Understanding how your monthly IBR payment is calculated is crucial to managing your student loan debt effectively. The calculation hinges on your discretionary income, which is your income minus certain allowable expenses, as determined by the federal government. This process, while seemingly complex, is designed to ensure your payments are manageable while still working towards loan repayment.

Discretionary Income Determination

The government calculates your discretionary income by taking your adjusted gross income (AGI) from your tax return and subtracting 150% of the poverty guideline for your family size and state of residence. This poverty guideline is updated annually. Importantly, only certain expenses are considered in this calculation; others are excluded. For example, student loan interest is not deductible from AGI in this calculation. The specific formula used is readily available on the official government websites for student aid. This ensures fairness and consistency in the calculation process across all borrowers.

Income Changes and Monthly Payments

Changes in your income directly impact your monthly IBR payment. An increase in income will typically lead to a higher monthly payment, while a decrease in income usually results in a lower payment. The Department of Education recalculates your payment annually based on your previous year’s tax return. You can also request a recalculation if you experience a significant change in income during the year. This flexibility ensures the payment plan remains adaptable to your evolving financial circumstances.

IBR Payment Calculation Examples

Let’s illustrate IBR payment calculations with some examples. Remember, these are simplified examples and do not include all possible factors. Actual calculations may vary.

| Scenario | Adjusted Gross Income (AGI) | Family Size | 150% Poverty Guideline | Discretionary Income | Example Monthly Payment (Illustrative) |

|---|---|---|---|---|---|

| Scenario 1: Single Borrower, Low Income | $25,000 | 1 | $15,000 | $10,000 | $100 |

| Scenario 2: Married Couple, Moderate Income | $60,000 | 2 | $25,000 | $35,000 | $350 |

| Scenario 3: Family of Four, High Income | $100,000 | 4 | $40,000 | $60,000 | $600 |

Note: The example monthly payments are illustrative only and depend on the loan amount and interest rate.

Tax Filing Status and IBR Payments

Your tax filing status (single, married filing jointly, etc.) directly affects your AGI, which is a key component of the IBR calculation. Filing jointly with a spouse may result in a higher AGI, potentially leading to higher IBR payments. Conversely, filing as single may result in a lower AGI and lower payments. It’s essential to accurately report your tax information to ensure the most accurate IBR payment calculation. It is recommended to review your tax filing status in relation to your income and family size to determine the most beneficial option for your IBR plan.

Scenarios Illustrating IBR Payment Calculations

The following scenarios demonstrate how various factors influence IBR payments.

- Scenario A: Job Loss. A borrower experiences a job loss, resulting in a significant decrease in income. Their AGI drops substantially, leading to a lower discretionary income and consequently, a reduced monthly IBR payment. This illustrates the plan’s built-in flexibility.

- Scenario B: Income Increase. A borrower receives a promotion, increasing their income. Their AGI rises, resulting in higher discretionary income and a subsequent increase in their monthly IBR payment. This reflects the progressive nature of the plan.

- Scenario C: Marriage. A borrower gets married, and they now file jointly. Their AGI may increase due to combining incomes, potentially leading to a higher IBR payment. This highlights the impact of life changes on payment calculations.

- Scenario D: Change in Family Size. A borrower has a child, increasing their family size. This alters the applicable poverty guideline, potentially affecting their discretionary income and IBR payment. This underscores the sensitivity of the plan to family circumstances.

Loan Forgiveness under IBR

Income-Driven Repayment (IBR) plans offer the possibility of loan forgiveness after a set period of qualifying payments. This means that, under certain conditions, the remaining balance of your federal student loans could be discharged. Understanding the process, eligibility, and timeline is crucial for borrowers hoping to benefit from this program.

The process of loan forgiveness under IBR involves making consistent, on-time monthly payments for a specified period, based on your income and family size. This period varies depending on the specific IBR plan (IBR, ICR, PAYE, REPAYE) and the loan type. Once the required number of qualifying payments has been made, the remaining loan balance is forgiven. It’s important to note that forgiven amounts are generally considered taxable income.

Eligibility Requirements for Loan Forgiveness

Meeting the eligibility requirements is paramount to receiving loan forgiveness under IBR. These requirements generally include having federal student loans eligible for IBR, consistently making on-time payments according to your IBR plan, and maintaining an income below a certain threshold. The specific income threshold and the number of qualifying payments required will vary based on the chosen IBR plan and loan type. Furthermore, the type of loan significantly impacts eligibility; for example, certain types of federal loans might not qualify for IBR forgiveness. It’s advisable to consult the official government websites for the most up-to-date information on eligibility criteria.

Timeline for Loan Forgiveness under IBR

The timeline for loan forgiveness under IBR plans isn’t fixed and depends heavily on several factors, including the size of the initial loan, the borrower’s income, and the specific IBR plan chosen. Generally, forgiveness can be reached after 20 or 25 years of qualifying payments, depending on the plan. For example, under the REPAYE plan, forgiveness might be reached after 20 years of payments for undergraduate loans and 25 years for graduate loans. It’s essential to understand that these are maximum timelines; borrowers with lower loan balances and higher incomes might reach forgiveness sooner.

Examples of Loan Forgiveness under IBR

Consider two scenarios: A borrower with $50,000 in undergraduate loans on a REPAYE plan, consistently making payments based on their low income, could potentially reach loan forgiveness in 20 years. Conversely, a borrower with a significantly higher income might see their loan balance reduced more quickly, potentially reaching forgiveness in less than 20 years. A different scenario could involve a borrower with graduate loans on an IBR plan; their forgiveness timeline could extend to 25 years, depending on their income and payment history. These are illustrative examples; actual timelines will vary considerably.

Visual Representation of the Typical Timeline to Loan Forgiveness

Imagine a graph. The horizontal axis represents time, measured in years, ranging from 0 to 25. The vertical axis represents the remaining loan balance, starting at the initial loan amount and decreasing gradually over time. The line representing the loan balance will slope downwards, but the rate of decrease will vary depending on income and payment amount. After 20 or 25 years (depending on the plan and loan type), the line will reach zero, indicating loan forgiveness. The steeper the downward slope, the faster the loan is paid off. This visual representation showcases the varying timelines based on individual circumstances.

IBR and its Impact

Choosing an Income-Based Repayment (IBR) plan for your student loans can significantly impact your finances over the long term. Understanding these potential effects is crucial for making an informed decision that aligns with your individual financial goals and circumstances. While IBR offers flexibility, it’s essential to weigh the advantages against potential drawbacks.

Long-Term Financial Implications of IBR

IBR plans offer lower monthly payments initially, making them attractive to borrowers with limited incomes. However, this lower monthly payment often translates to a longer repayment period, potentially extending the loan payoff by several years, even decades. This increased repayment timeframe leads to a higher total amount paid in interest over the life of the loan. For example, a borrower might see their monthly payment reduced by half, but end up paying double the total interest compared to a standard repayment plan. This increased interest expense needs careful consideration when comparing IBR to other repayment options.

Comparison of IBR with Other Student Loan Repayment Plans

IBR plans differ from other repayment plans like Standard, Graduated, and Extended Repayment plans. Standard plans have fixed monthly payments and a shorter repayment period. Graduated plans start with lower payments that gradually increase over time. Extended repayment plans offer a longer repayment period with fixed payments, but may not be as low as IBR payments. The key difference is that IBR payments are calculated based on your income and family size, making them potentially more manageable in the short term, but potentially leading to a significantly higher total repayment amount in the long run. Choosing the right plan depends heavily on individual circumstances and financial priorities.

Potential Drawbacks of IBR

A major drawback of IBR is the potential for a substantial increase in the total interest paid over the life of the loan. The extended repayment period means that interest accrues for a much longer time, ultimately increasing the overall cost. Furthermore, the initial low payments might create a false sense of financial security, potentially delaying other financial goals like saving for a down payment on a house or investing for retirement. Finally, some IBR plans have stricter eligibility requirements compared to other repayment plans.

Effect of IBR on Credit Score

While IBR itself doesn’t directly impact your credit score, consistently making on-time payments, regardless of the repayment plan, is crucial for maintaining a good credit score. However, the extended repayment period associated with IBR can indirectly affect your credit score. A longer repayment history, even with on-time payments, might slightly reduce your credit score compared to a shorter repayment history with a standard plan. This is because credit scoring models often consider the age of accounts and the proportion of credit used.

Factors to Consider Before Choosing an IBR Plan

Before enrolling in an IBR plan, consider several factors. First, assess your current and projected income. IBR is most beneficial for those with lower incomes. Second, evaluate your long-term financial goals. Determine if the potential increase in total interest payments aligns with your financial priorities. Third, compare IBR with other repayment options. Calculate the total cost of each plan over its entire repayment period to understand the full financial implications. Finally, understand the potential impact on your credit score and the eligibility requirements for IBR. A thorough evaluation of these factors will ensure a more informed decision.

Final Thoughts

Successfully managing student loan debt requires careful planning and a thorough understanding of available repayment options. The Income-Based Repayment (IBR) plan offers a viable strategy for many borrowers, providing a pathway towards more manageable monthly payments and potential loan forgiveness. However, it’s crucial to weigh the long-term implications, including potential tax consequences and the impact on your credit score. By carefully considering your individual financial circumstances and utilizing the information provided in this guide, you can make an informed decision that aligns with your long-term financial goals. Remember to consult with a financial advisor for personalized guidance.

Clarifying Questions

What happens if my income changes while I’m on an IBR plan?

You’ll need to update your income information with your loan servicer. Your monthly payment will be recalculated based on your new income.

Can I switch from another repayment plan to IBR?

Yes, you can generally switch to an IBR plan from other repayment plans. The process involves submitting an application to your loan servicer.

How long does it take to get approved for an IBR plan?

Processing times vary, but it typically takes several weeks. Faster processing may depend on the completeness of your application.

What if I don’t qualify for loan forgiveness under IBR?

Even if you don’t qualify for complete forgiveness, IBR still provides lower monthly payments than standard repayment plans, making it easier to manage your debt.

Does IBR affect my credit score?

Making on-time payments under any repayment plan, including IBR, is positive for your credit score. Consistent late payments can negatively impact your credit.