Navigating the complexities of student loan repayment can feel overwhelming, but understanding the Income-Based Repayment (IBR) plan is crucial for many borrowers. This plan offers a potentially more manageable monthly payment based on your income and family size, ultimately aiming to make repayment more sustainable. This guide will explore the intricacies of IBR, from eligibility requirements to loan forgiveness possibilities, empowering you to make informed decisions about your student loan debt.

We will delve into the specific calculations used to determine your monthly payment, examining how factors like income, loan amount, and family size influence the final figure. Furthermore, we will analyze the impact of IBR on your credit score and discuss how life changes might necessitate a recalculation of your payments. By the end, you’ll have a clearer picture of whether the IBR plan is the right choice for your financial situation.

IBR Plan Eligibility Requirements

The Income-Based Repayment (IBR) plan offers a pathway to manage federal student loan debt by basing your monthly payments on your income and family size. Understanding the eligibility requirements is crucial before applying. This section details the necessary criteria for IBR plan enrollment.

Income Requirements for IBR Plan Eligibility

To qualify for an IBR plan, your adjusted gross income (AGI) must be below a certain threshold. This threshold is calculated annually and varies based on the type of IBR plan (IBR, PAYE, REPAYE). Your AGI is your gross income minus certain deductions as defined by the IRS. The Department of Education uses your AGI as reported on your most recent tax return to determine your eligibility. Failing to accurately report your income can lead to repayment plan ineligibility or even penalties. Specific income limits are published annually by the Department of Education and can be found on their website.

Eligible Federal Student Loan Types for IBR

Not all federal student loans are eligible for IBR plans. Generally, Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for graduate and professional students), and Direct Consolidation Loans are eligible. However, FFEL Program loans (Federal Family Education Loan Program) are not eligible for IBR plans. It’s vital to check the specific loan type before assuming eligibility. A consolidated loan that includes ineligible loan types may also not qualify for IBR.

Step-by-Step Process for Determining IBR Plan Eligibility

- Determine your loan type(s): Identify the type of federal student loans you have. This information can usually be found on your loan servicer’s website or your federal student aid account.

- Calculate your Adjusted Gross Income (AGI): Use your most recent tax return to determine your AGI. This requires understanding IRS guidelines on allowable deductions.

- Check the income thresholds: Visit the Department of Education’s website to find the current income thresholds for IBR plans. Compare your AGI to these limits to see if you qualify.

- Verify loan eligibility: Confirm that all your loans are eligible for IBR. If you have FFEL loans, they are ineligible.

- Apply for IBR: If you meet the requirements, apply for the IBR plan through your loan servicer’s website.

Flowchart Illustrating IBR Eligibility Criteria

The following describes a flowchart illustrating the eligibility process. The flowchart begins with a “Start” node. It then branches to a decision node asking “Are all loans Direct Loans?”. If yes, it proceeds to a decision node asking “Is AGI below the threshold?”. If yes, the path leads to “Eligible for IBR”. If no, the path leads to “Ineligible for IBR”. If the first decision node is no (not all loans are Direct Loans), the path directly leads to “Ineligible for IBR”. The flowchart ends with an “End” node.

Comparison of IBR Plan Eligibility with Other Repayment Plans

| Repayment Plan | Income-Based? | Loan Type Eligibility | Credit Check Required? |

|---|---|---|---|

| IBR | Yes | Direct Loans (generally) | No |

| PAYE | Yes | Direct Loans (generally) | No |

| REPAYE | Yes | Direct Loans and FFEL Program loans (after consolidation) | No |

| Standard Repayment | No | Most federal loans | No |

IBR Plan Calculation Methods

Understanding how your monthly IBR plan payments are calculated is crucial for effective student loan management. This section details the process, including the determination of discretionary income and provides illustrative examples. We will also briefly compare IBR calculations with other Income-Driven Repayment (IDR) plans.

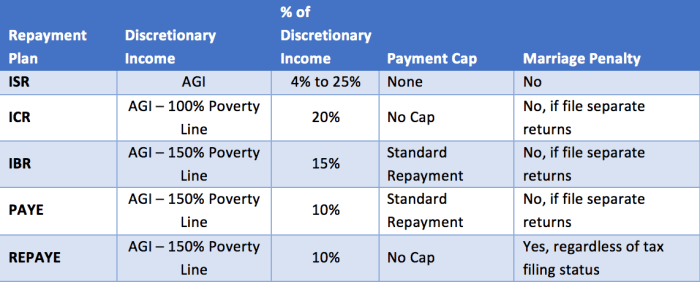

The IBR plan calculates your monthly payment based on your discretionary income, which is your adjusted gross income (AGI) minus 150% of the poverty guideline for your family size and state. Your AGI is your gross income minus certain deductions allowed by the IRS. The resulting discretionary income is then used to determine your monthly payment, which is a percentage of your discretionary income. The specific percentage varies depending on the type of IBR plan (IBR, PAYE, REPAYE) and the age of your loans.

Discretionary Income Determination

Discretionary income is the key factor in IBR calculations. It’s calculated by subtracting 150% of the federal poverty guideline for your family size and state from your adjusted gross income (AGI). The poverty guidelines are updated annually by the Department of Health and Human Services and are readily available online. For example, if your AGI is $60,000 and 150% of the poverty guideline for a single person in your state is $18,000, your discretionary income would be $42,000 ($60,000 – $18,000). This figure is then used in the subsequent payment calculation.

IBR Payment Calculation Examples

Let’s consider a few scenarios to illustrate how IBR payments are calculated. These are simplified examples and actual calculations may vary slightly depending on the specific loan program and other factors.

Scenario 1: Individual with $40,000 in student loan debt, AGI of $50,000, and a discretionary income of $32,000 (after applying the 150% poverty guideline). Assuming a 10% payment rate, the monthly payment would be approximately $267 ($32,000/12 months * 10%).

Scenario 2: A couple with $80,000 in combined student loan debt, a combined AGI of $100,000, and a discretionary income of $60,000. With a 10% payment rate, their monthly payment would be approximately $500 ($60,000/12 months * 10%).

Scenario 3: An individual with $20,000 in student loan debt, AGI of $30,000, and a discretionary income of $10,000. Using a 10% payment rate, the monthly payment would be approximately $83 ($10,000/12 months * 10%).

It’s crucial to note that these are simplified examples. The actual payment amount will depend on several factors, including the specific loan program, interest rates, and the length of the repayment period.

Comparison with Other IDR Plans

While IBR is an IDR plan, its calculation method differs slightly from others like PAYE (Pay As You Earn) and REPAYE (Revised Pay As You Earn). PAYE and REPAYE generally use a 10% payment rate of discretionary income, whereas IBR’s payment rate can vary. Furthermore, the calculation of discretionary income might have minor variations depending on the specific plan. Each plan also has its own set of eligibility requirements and loan forgiveness provisions. It’s recommended to carefully compare the features of each plan to determine which best suits individual circumstances.

Steps in Calculating an IBR Payment

The calculation of an IBR payment can be broken down into these key steps:

- Determine your Adjusted Gross Income (AGI) from your tax return.

- Find the 150% federal poverty guideline for your family size and state for the relevant year.

- Subtract the 150% poverty guideline from your AGI to calculate your discretionary income.

- Determine your applicable payment rate based on your IBR plan type and loan age.

- Multiply your discretionary income by your payment rate and divide by 12 to determine your monthly payment.

Note: This is a simplified overview. The actual calculation might involve additional factors and may vary depending on your specific loan servicer and the type of IBR plan you are enrolled in. Consult your loan servicer for precise details.

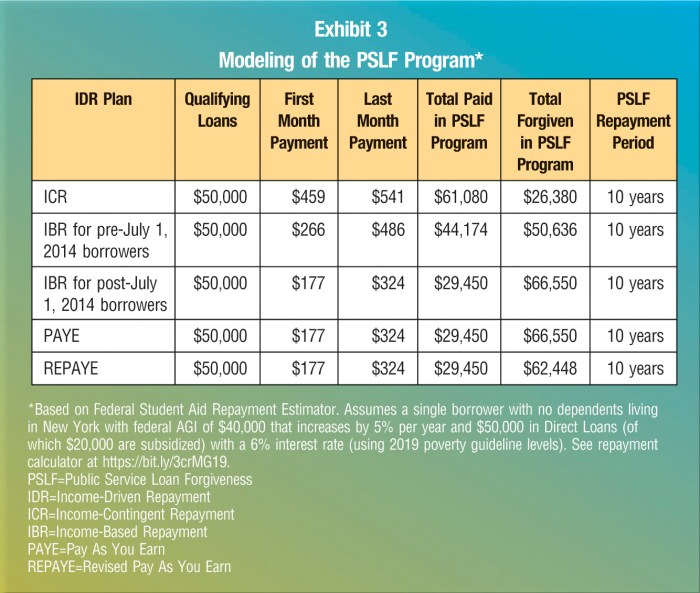

IBR Plan and Loan Forgiveness

The Income-Based Repayment (IBR) plan offers a pathway to potential student loan forgiveness, but it’s crucial to understand the conditions and factors involved. This section details the requirements, timelines, and processes associated with IBR loan forgiveness. It’s important to remember that the specifics can change, so always consult the official Department of Education website for the most up-to-date information.

Conditions for IBR Loan Forgiveness

IBR loan forgiveness isn’t automatic; it requires consistent on-time payments over a significant period, typically 20 or 25 years, depending on the loan type and when the loan was disbursed. The key condition is making qualifying monthly payments based on your income and family size. These payments are recalculated annually, reflecting changes in your income. Forgiveness is generally only applied to the remaining principal balance after the extended repayment period. Important considerations include the type of federal student loan, the specific IBR plan (there are variations), and whether the loans are subsidized or unsubsidized.

Factors Affecting the Timeframe for Loan Forgiveness

Several factors influence how long it takes to reach loan forgiveness under IBR. Higher incomes lead to larger monthly payments, potentially shortening the repayment period. Conversely, lower incomes result in smaller payments, extending the timeframe. Family size also plays a role, as the calculation considers the number of dependents. The type of loan and its initial balance are significant factors; larger loans naturally take longer to repay. Finally, any periods of deferment or forbearance will extend the overall repayment timeline, as these periods do not count towards loan forgiveness.

Applying for IBR Loan Forgiveness

The application process for IBR loan forgiveness isn’t a single application submitted at the end of the repayment period. Instead, your loan servicer automatically tracks your payments and eligibility. Once you’ve made the required number of qualifying payments, your servicer will notify you about the forgiveness process. This typically involves completing some final paperwork to confirm your identity and income information. It’s crucial to keep your contact information updated with your loan servicer to ensure timely communication.

Examples of Scenarios Leading to Loan Forgiveness Under IBR

Scenario 1: A borrower with a $50,000 loan, consistently making payments under IBR for 20 years, based on a low and stable income, might see the remaining balance forgiven after the 20-year mark.

Scenario 2: A borrower with a $30,000 loan, experiencing fluctuating income but maintaining consistent payments, might reach forgiveness after 25 years due to lower monthly payments in certain years.

Scenario 3: A borrower who initially made consistent payments but then experienced a period of unemployment (leading to deferment) will have a longer repayment timeline before reaching forgiveness.

Timeline Illustrating the Process from IBR Enrollment to Potential Loan Forgiveness

| Stage | Description | Timeframe |

|---|---|---|

| IBR Enrollment | Apply for and be approved for an IBR repayment plan. | Immediately upon loan disbursement or consolidation. |

| Consistent Monthly Payments | Make qualifying monthly payments based on income and family size. | 20-25 years, depending on loan type and income. |

| Annual Income Recalculation | Income and family size are reassessed annually to adjust payments. | Annually. |

| Loan Forgiveness Notification | Servicer notifies borrower of potential forgiveness. | After making the required number of payments. |

| Final Paperwork and Forgiveness | Complete any final paperwork; loan is forgiven. | Within several months of notification. |

IBR Plan and Credit History

Choosing an income-driven repayment (IDR) plan like IBR can significantly impact your credit history. Understanding these effects is crucial for making informed financial decisions. While offering lower monthly payments, IBR plans have implications that extend beyond your monthly budget.

IBR plans, while designed to make repayment more manageable, don’t automatically improve your credit score. In fact, the impact on your credit history is multifaceted and depends on several factors, including your payment history while enrolled in the plan. Consistent on-time payments are essential for maintaining a positive credit profile, regardless of the repayment plan selected.

IBR Plan Impact on Credit Scores

The effect of IBR on your credit score is primarily determined by your payment behavior. Making timely payments on your student loans while enrolled in an IBR plan will generally have a positive impact, similar to any other loan repayment plan. However, if you miss payments, even under an IBR plan, your credit score will suffer. The severity of the negative impact depends on the frequency and duration of missed payments. Furthermore, your credit report will reflect the fact that your loan is in repayment, even with a reduced monthly payment, which could potentially affect your credit score.

Benefits and Drawbacks of IBR on Credit History

One potential benefit of IBR is that it can help prevent delinquency and default, thereby avoiding the significant negative impact on credit scores associated with those events. By reducing monthly payments to a manageable level, IBR increases the likelihood of consistent on-time payments. However, a drawback is that the extended repayment period under IBR can potentially keep negative information on your credit report for a longer time. While your payment history is the most influential factor, the overall length of your repayment process might indirectly influence your credit score. Additionally, the lower monthly payment might not be perceived as favorably by some credit scoring models compared to higher payments made under other plans.

Comparison of IBR with Other Repayment Plans

| Repayment Plan | Monthly Payment | Repayment Period | Credit Impact |

|---|---|---|---|

| Standard Repayment | High | Short | Potentially positive if payments are on time; risk of delinquency if payments are too high. |

| IBR | Low (income-based) | Long | Positive if payments are on time; negative if payments are missed; extended repayment period may affect credit score indirectly. |

| Graduated Repayment | Low initially, increasing over time | Medium to long | Potentially positive if payments are consistently made; risk of delinquency as payments increase. |

| Extended Repayment | Lower than standard | Long | Similar to IBR; positive if payments are on time; extended repayment period may affect credit score indirectly. |

Scenarios of Positive and Negative IBR Impact

Positive Impact: A borrower with fluctuating income enrolls in IBR. The adjustable payments prevent missed payments, maintaining a good payment history and a positive credit score. Consistent on-time payments, even with a lower payment amount, demonstrate financial responsibility.

Negative Impact: A borrower enrolls in IBR but struggles to manage even the reduced payments due to unforeseen circumstances. Missed payments result in a significant drop in their credit score, potentially leading to further financial difficulties. The extended repayment period doesn’t help if consistent on-time payments are not maintained.

IBR Plan and Changing Circumstances

Life changes are inevitable, and the Income-Based Repayment (IBR) plan is designed to offer flexibility to borrowers facing significant shifts in their financial situations. Events like marriage, job loss, or an increase in family size can substantially impact your income and, consequently, your IBR payment amount. Understanding how these changes affect your payments and the process for recalculating them is crucial for managing your student loan debt effectively.

Changes in income, family size, or marital status can all trigger a recalculation of your IBR payment. The process is designed to ensure your monthly payments remain manageable and aligned with your current financial capacity. Failure to update your information could result in overpayments or, conversely, payments that are insufficient to cover the accruing interest. It’s important to act proactively to adjust your payment plan as your circumstances change.

Recalculation of IBR Payments Due to Changed Circumstances

The process of requesting a recalculation typically involves submitting an updated income verification form to your loan servicer. This form usually requires documentation that verifies the change in your circumstances, such as a new tax return, a pay stub reflecting a change in employment, or a marriage certificate. The servicer will then review the submitted information and recalculate your monthly payment based on the updated data and the IBR formula. The recalculation is typically effective from the date you submit the updated information, though there may be a processing delay. It is important to retain copies of all documentation submitted to the loan servicer.

Examples of Life Events Impacting IBR Payments

Let’s consider some examples. Suppose a borrower’s annual income was $50,000 before marriage, and their monthly payment was $300 under the IBR plan. After marriage, their combined household income increased to $75,000. This would likely result in a higher monthly payment, potentially around $450, reflecting the increased income. Conversely, if a borrower experienced a job loss, reducing their annual income from $60,000 to $30,000, their monthly payment would likely decrease significantly, perhaps to $150 or less, depending on the specific IBR plan and other factors. Having a child, increasing expenses, and potentially reducing available income, may also lead to a lower payment. These are illustrative examples; the actual impact will depend on the specific details of the borrower’s situation and the IBR plan’s calculation method.

Necessary Documentation for Recalculation Request

The specific documents required may vary depending on the life event and the loan servicer, but generally, you’ll need to provide documentation supporting the change in your circumstances. This could include:

- Tax returns: The most common form of income verification is a copy of your most recent federal tax return (Form 1040).

- Pay stubs: Current pay stubs can provide evidence of your current income and employment status.

- Marriage certificate: Required if your marital status has changed.

- Birth certificate (for children): To demonstrate an increase in family size.

- Documentation of job loss: This might include a layoff notice or unemployment benefits paperwork.

Common Life Events Triggering Recalculation

It’s beneficial to understand which life events commonly prompt a recalculation of your IBR payments. This allows for proactive management of your student loans and ensures your payments remain affordable and aligned with your financial capabilities.

- Marriage

- Divorce

- Job loss or change in employment

- Birth or adoption of a child

- Significant change in income (increase or decrease)

- Death of a spouse

- Disability

IBR Plan Resources and Support

Navigating the complexities of the Income-Based Repayment (IBR) plan for student loans can be challenging. Fortunately, numerous resources and support services are available to help borrowers understand their options and manage their payments effectively. This section Artikels key resources, contact information, and available support to ensure a smoother experience.

Understanding the intricacies of IBR requires access to reliable information and supportive services. This section provides a comprehensive overview of the resources available to assist borrowers in managing their IBR plans successfully. The information presented is intended to guide borrowers towards the appropriate channels for assistance and ensure they have the tools necessary for effective loan management.

Government Agencies and Organizations

The federal government provides several avenues for obtaining information and assistance regarding IBR plans. The primary source of information is the Federal Student Aid website. This website offers detailed explanations of IBR, eligibility requirements, and calculation methods. Additionally, borrowers can contact the Federal Student Aid Information Center directly via phone or email for personalized assistance. The Department of Education also plays a crucial role in overseeing the IBR program and can provide further clarification on policy and procedures.

Direct contact with government agencies ensures access to official information and guidance. These agencies provide essential support for navigating the IBR process and resolving any issues that may arise.

- Federal Student Aid (FSA): Website: StudentAid.gov; Phone: 1-800-4-FED-AID (1-800-433-3243)

- Department of Education: Website: studentaid.gov/contact-us

Non-Governmental Organizations

Several non-profit organizations and consumer advocacy groups offer valuable resources and support to student loan borrowers. These organizations often provide free or low-cost counseling services, helping borrowers understand their repayment options and navigate the complexities of the IBR program. They can also provide guidance on debt management strategies and assist with loan consolidation or refinancing options.

Independent organizations provide unbiased information and support. Their services can complement the information and assistance offered by government agencies.

- National Foundation for Credit Counseling (NFCC): (Find local NFCC member agencies through their website)

- The Institute of Student Loan Advisors (TISLA): (Check their website for certified advisors)

Support Services for IBR Borrowers

The support available to IBR borrowers extends beyond information resources. Many loan servicers offer personalized assistance through phone, email, and online portals. These servicers can help borrowers understand their payment amounts, track their progress towards loan forgiveness, and address any issues that may arise during their repayment period. They also provide tools and resources to help borrowers manage their loans effectively, such as online account access and payment scheduling options.

Direct support from loan servicers is crucial for effective loan management. These services are designed to assist borrowers throughout their repayment journey.

Frequently Asked Questions about the IBR Plan

Understanding the key aspects of IBR can help borrowers make informed decisions about their repayment strategies. The following frequently asked questions address common concerns and provide clear explanations.

- What is the IBR plan? The Income-Based Repayment (IBR) plan is a student loan repayment plan that adjusts your monthly payments based on your income and family size.

- Am I eligible for IBR? Eligibility depends on your loan type, income, and family size. Check the Federal Student Aid website for specific criteria.

- How is my IBR payment calculated? Your payment is calculated based on a formula that considers your discretionary income and loan balance. The exact formula varies depending on the specific IBR plan.

- What happens if my income changes? You can request a recalculation of your monthly payment based on your updated income and family size.

- Can I get loan forgiveness under IBR? Yes, after making payments for a specific period (usually 20 or 25 years, depending on the plan), the remaining balance may be forgiven. Tax implications apply to forgiven amounts.

Conclusion

Successfully managing student loan debt requires careful planning and understanding of available repayment options. The IBR plan offers a viable pathway for many borrowers to navigate their debt responsibly, potentially leading to loan forgiveness after a significant repayment period. By understanding the eligibility criteria, calculation methods, and potential impact on credit, you can make informed decisions that align with your long-term financial goals. Remember to utilize the available resources and seek assistance when needed to ensure a smooth and successful repayment journey.

User Queries

What happens if my income changes significantly while on the IBR plan?

You can request a recalculation of your monthly payment. You’ll need to provide documentation supporting the income change.

Can I switch from another repayment plan to IBR?

Yes, you can generally switch to IBR from other repayment plans. Check with your loan servicer for specific requirements.

What types of loans qualify for IBR?

Generally, Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans qualify. Specific eligibility depends on loan type and disbursement date.

Is there a penalty for paying off my loan early under IBR?

No, there’s no penalty for early repayment.

How long does the loan forgiveness process take under IBR?

The timeframe for loan forgiveness varies greatly depending on your loan amount, income, and payment history; it can take 20-25 years.