Navigating the complexities of student loan repayment can feel overwhelming, especially with the various repayment plans available. Income-based repayment (IBR) plans offer a potentially more manageable approach, tailoring monthly payments to your income. This guide explores the intricacies of IBR, detailing different plan types, eligibility criteria, and the impact of income fluctuations on your repayment journey. We’ll also delve into loan forgiveness possibilities, including Public Service Loan Forgiveness (PSLF), and highlight potential pitfalls to avoid.

Understanding the nuances of IBR is crucial for borrowers seeking long-term financial stability. This comprehensive overview aims to equip you with the knowledge needed to make informed decisions about your student loan repayment strategy, ultimately empowering you to navigate this process effectively and achieve financial well-being.

Understanding Income-Based Repayment (IBR) Plans

Income-Based Repayment (IBR) plans offer a lifeline to student loan borrowers struggling to manage their debt. These plans tie your monthly payments to your income and family size, making them more manageable than standard repayment plans. Understanding the nuances of different IBR plans is crucial for choosing the best option for your individual financial situation.

Types of IBR Plans

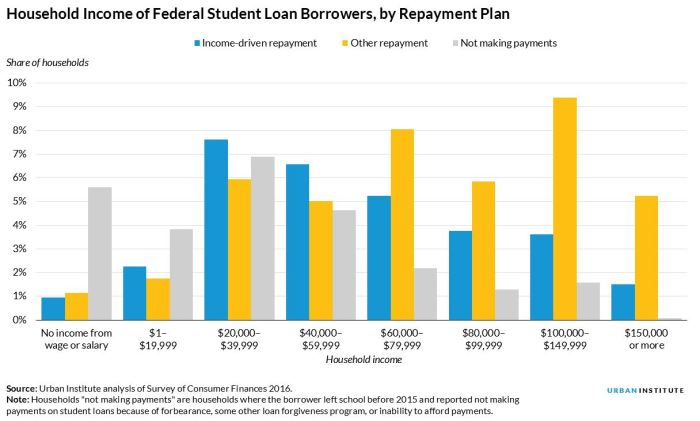

Several types of IBR plans have existed over the years, with some being phased out and replaced. Currently, the most common IBR plans available are Income-Driven Repayment (IDR) plans, which encompass several variations. These plans are designed to help borrowers manage their student loan debt by adjusting their monthly payments based on their income and family size. The specific plans and their availability may vary depending on your loan type and lender. It’s important to check with your loan servicer for the most up-to-date information.

IBR Plan Eligibility Criteria

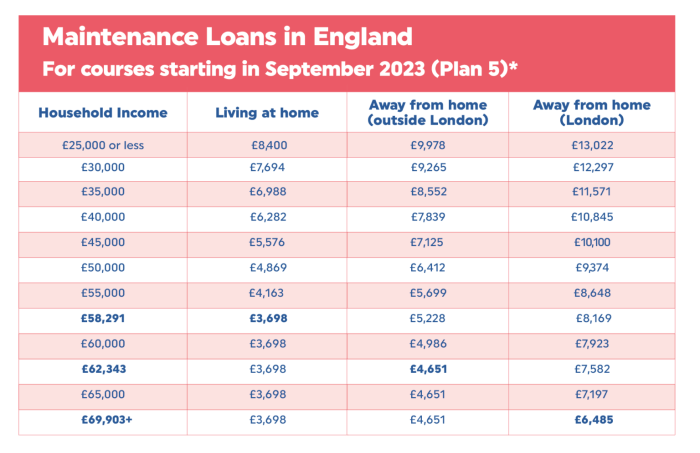

Eligibility for IBR plans generally requires borrowers to have federal student loans (direct loans or Federal Family Education Loan (FFEL) Program loans consolidated into Direct Loans). Specific requirements may vary slightly depending on the plan. For example, some plans might have income limitations or require a certain type of loan. Again, it is crucial to contact your loan servicer to determine your eligibility for a specific IBR plan. Proof of income and family size will typically be required during the application process.

IBR Payment Calculation Methods

IBR plans calculate monthly payments based on a formula that considers your discretionary income (income above a certain poverty guideline) and your total student loan debt. The specific formula varies slightly depending on the plan. Generally, the calculation involves determining your adjusted gross income (AGI), subtracting a percentage based on the poverty guideline for your family size, and then dividing the resulting discretionary income by a factor based on your loan balance and repayment period. The resulting number represents your monthly payment. These calculations are generally handled automatically by your loan servicer.

Comparison of Key IBR Plan Features

The following table compares key features of different IDR plans. Remember that specific details can change, so it’s vital to check with your loan servicer for the most current information.

| Plan Name | Eligibility Requirements | Payment Calculation | Loan Forgiveness Provisions |

|---|---|---|---|

| Income-Driven Repayment (IDR) Plans (general category, encompassing several specific plans) | Federal student loans; income verification | Based on discretionary income, loan balance, and repayment period. Specific formula varies by plan. | Potential for loan forgiveness after 20 or 25 years of payments, depending on the plan and loan type. |

| Revised Pay As You Earn (REPAYE) Plan | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, and FFEL Program loans consolidated into Direct Consolidation Loans | 10% of discretionary income or standard 10-year repayment amount, whichever is less. | Remaining balance forgiven after 20 or 25 years of payments, depending on loan type. |

| Pay As You Earn (PAYE) Plan | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, and FFEL Program loans consolidated into Direct Consolidation Loans | 10% of discretionary income or standard 10-year repayment amount, whichever is less. | Remaining balance forgiven after 20 years of payments. |

| Income-Based Repayment (IBR) Plan | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, and FFEL Program loans consolidated into Direct Consolidation Loans (older plan, may be less common) | 15% of discretionary income or standard 10-year repayment amount, whichever is less. | Remaining balance forgiven after 25 years of payments. |

Impact of Income on Monthly Payments

Income-based repayment (IBR) plans are designed to make student loan repayment more manageable by adjusting your monthly payment based on your income and family size. This means your payments will fluctuate as your financial situation changes. Understanding this dynamic relationship is crucial for effective long-term loan management.

Your monthly payment under an IBR plan is directly calculated from your adjusted gross income (AGI) and family size. A higher AGI generally results in higher monthly payments, while a lower AGI leads to lower payments. The specific calculation varies depending on the type of IBR plan (e.g., IBR, PAYE, REPAYE), but the fundamental principle remains the same: your income dictates your payment amount. It’s important to note that even with a low income, you may still owe a small payment, though it’s designed to be affordable.

Income Recertification Process and Frequency

IBR plans require periodic recertification of your income. This process involves submitting updated tax information or other documentation to verify your current financial status. The frequency of recertification varies by plan and lender, but it typically occurs annually. Failure to recertify your income on time could result in inaccurate payment calculations, potentially leading to higher payments or even default. The recertification process usually involves submitting a simple form along with copies of relevant tax documents. Your lender will provide detailed instructions on how to complete this process.

Examples of Income Fluctuations and Their Impact on Payments

Let’s consider two examples to illustrate how income changes affect monthly payments. Imagine Sarah, who initially earns $40,000 annually and has a $30,000 student loan balance. Under her IBR plan, her monthly payment is $200. If her income increases to $60,000 the following year, her monthly payment might rise to $300, reflecting the increase in her earning capacity. Conversely, if John experiences a job loss and his income drops to $30,000, his monthly payment could decrease to $150, providing him with some financial relief during a challenging period. These are simplified examples; the actual impact depends on the specific IBR plan’s formula and other factors.

Hypothetical Scenario: Long-Term Effects of Consistent Income Growth

Consider Maria, who starts her career with an annual income of $45,000 and a $40,000 student loan balance. Her initial monthly payment under her IBR plan is $250. Over the next ten years, Maria receives consistent raises, increasing her annual income to $80,000. As her income rises, her monthly payments will also increase, reflecting her improved financial capacity. While her payments are higher than initially, the consistent increases ensure she makes steady progress towards paying off her loan. If Maria continues this trajectory, the increased payments could lead to a significantly shorter repayment period compared to someone with stagnant income. This scenario highlights the benefit of consistent income growth in accelerating loan repayment under an IBR plan. This is not to say that consistent income growth guarantees early loan payoff, as unforeseen circumstances could always alter this projection. However, it demonstrates the positive correlation between income and repayment speed within the framework of an IBR plan.

Loan Forgiveness and Public Service Loan Forgiveness (PSLF)

Income-Based Repayment (IBR) plans offer the possibility of loan forgiveness after a specific period of qualifying payments, providing significant financial relief to borrowers. However, the specifics and eligibility criteria vary depending on the plan and the borrower’s circumstances. Public Service Loan Forgiveness (PSLF) is a particularly noteworthy program designed to incentivize public service.

Loan forgiveness under IBR plans generally occurs after making a certain number of qualifying monthly payments, which is often tied to the length of the loan’s repayment period. The exact number of payments required varies depending on the specific IBR plan and the original loan amount. For instance, some plans might forgive the remaining balance after 20 or 25 years of consistent on-time payments. It’s crucial to understand that this forgiveness applies only to the remaining loan balance; borrowers are still responsible for all payments made prior to forgiveness. The amount of forgiven debt may be considered taxable income, a point to be clarified with a tax professional.

Public Service Loan Forgiveness (PSLF) Requirements

Public Service Loan Forgiveness (PSLF) is a federal program designed to forgive the remaining balance on certain federal student loans after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying employer. To qualify, borrowers must work for a government organization or a 501(c)(3) non-profit organization. Employment must be continuous for the duration of the 120 payments. Furthermore, the loans must be Direct Loans, and borrowers must be enrolled in an income-driven repayment plan. Failing to meet any of these requirements could result in ineligibility for PSLF.

Challenges in Achieving Loan Forgiveness

Several obstacles can hinder borrowers’ progress toward loan forgiveness. Maintaining consistent employment with a qualifying employer for ten years is a significant commitment. Changes in employment or a lapse in payments can significantly delay or even prevent forgiveness. Furthermore, the complexities of the application process, including the need for meticulous record-keeping and accurate documentation of employment and loan payments, can be daunting. Incorrect loan consolidation or enrollment in the wrong repayment plan can also jeopardize eligibility. Finally, even after completing the 120 payments, the application process itself can be lengthy and require substantial documentation.

Step-by-Step Guide for Borrowers Seeking PSLF

Successfully navigating the PSLF program requires a methodical approach. Careful planning and meticulous record-keeping are crucial.

- Verify Loan Eligibility: Confirm that your loans are eligible for PSLF. Only Direct Loans qualify. Consolidated loans should be reviewed to ensure they only include eligible loans.

- Choose an Income-Driven Repayment Plan: Enroll in an income-driven repayment plan (IDR). This will determine your monthly payments based on your income and family size.

- Maintain Continuous Employment: Secure and maintain full-time employment with a qualifying employer for the entire duration of the 120-payment period (10 years).

- Track Payments Carefully: Keep meticulous records of all your payments, including payment dates and amounts. This is critical for demonstrating compliance with the program’s requirements.

- Submit the PSLF Form Annually: Submit the PSLF Employment Certification Form annually to track your progress and ensure your payments are correctly counted towards forgiveness. This is crucial to catch and rectify any potential issues early.

- Monitor Your Progress: Regularly check your loan servicer’s website to monitor your payment count and overall progress towards forgiveness.

- Apply for Forgiveness: Once you have made 120 qualifying payments, submit the PSLF application. This requires comprehensive documentation of your employment and payment history.

Advantages and Disadvantages of IBR Plans

Income-Based Repayment (IBR) plans offer a potentially valuable tool for managing student loan debt, but it’s crucial to understand both their benefits and drawbacks before making a decision. Weighing these factors carefully will help borrowers choose the repayment plan that best aligns with their individual financial circumstances and long-term goals.

IBR plans adjust your monthly payments based on your income and family size, making them more manageable for borrowers facing financial hardship. However, they often lead to longer repayment periods and potentially higher overall interest paid. This section will explore the advantages and disadvantages in detail, comparing them to standard repayment plans and illustrating their impact on long-term financial planning.

Advantages of IBR Plans

IBR plans offer several key advantages for borrowers struggling to manage their student loan debt under standard repayment plans. These advantages can significantly impact a borrower’s financial well-being and reduce the stress associated with student loan repayment.

- Lower Monthly Payments: IBR plans significantly reduce monthly payments, making them more affordable for borrowers with lower incomes. This allows for better budgeting and reduces the risk of default.

- Affordability During Financial Hardship: If your income decreases (e.g., job loss, reduced work hours), your monthly payment will adjust accordingly, preventing overwhelming debt burdens.

- Potential for Loan Forgiveness: Depending on the specific IBR plan and your employment (e.g., public service), you may qualify for loan forgiveness after a set number of qualifying payments.

- Improved Cash Flow: Lower monthly payments free up more cash flow for other essential expenses like housing, food, and transportation, improving overall financial stability.

- Reduced Financial Stress: The reduced financial burden can significantly reduce stress and anxiety associated with managing student loan debt.

Disadvantages of IBR Plans

While IBR plans offer significant benefits, it’s important to acknowledge their potential drawbacks. Understanding these limitations is crucial for making informed decisions about your repayment strategy.

- Longer Repayment Periods: IBR plans typically extend the repayment period significantly, meaning you’ll be paying off your loans for many more years.

- Higher Total Interest Paid: The extended repayment period results in paying substantially more interest over the life of the loan compared to standard repayment plans.

- Complex Qualification and Application Process: Navigating the application process and understanding the nuances of IBR plans can be complex and time-consuming.

- Potential for Negative Impact on Credit Score (in some cases): While unlikely if payments are made consistently, consistent minimum payments can lead to longer periods of debt, potentially impacting credit score until the loan is paid in full.

- Uncertainty Regarding Loan Forgiveness: Loan forgiveness programs are subject to change, and there’s no guarantee that you will receive forgiveness even if you meet all the requirements.

Comparison of IBR and Standard Repayment Plans

Standard repayment plans offer fixed monthly payments over a 10-year period. IBR plans, in contrast, offer variable monthly payments based on income, extending the repayment period significantly. This table summarizes the key differences:

| Feature | Standard Repayment Plan | IBR Plan |

|---|---|---|

| Payment Amount | Fixed, higher | Variable, lower (based on income) |

| Repayment Period | 10 years | Up to 20-25 years or longer |

| Total Interest Paid | Lower | Higher |

| Loan Forgiveness | Not applicable | Potentially available (depending on plan and employment) |

Impact of IBR Plans on Long-Term Financial Planning

The extended repayment periods and higher total interest associated with IBR plans significantly impact long-term financial planning. For example, a borrower might delay major purchases like a house or car due to ongoing loan payments. Furthermore, the accumulation of interest can substantially reduce the amount of money available for retirement savings or other investments. Consider this example: A borrower with a $50,000 loan at a 6% interest rate would pay significantly more in interest over 25 years under an IBR plan than over 10 years under a standard plan. This difference in total cost needs to be carefully considered when planning long-term financial goals.

Potential Pitfalls and Considerations

Choosing an Income-Based Repayment (IBR) plan can significantly impact your financial future, but it’s crucial to understand the potential downsides alongside the benefits. While IBR plans offer flexibility, they aren’t without their complexities and potential pitfalls. Careful consideration is necessary to ensure it’s the right choice for your individual circumstances.

Impact on Credit Scores

IBR plans, while beneficial for managing monthly payments, can indirectly affect your credit score. Consistent on-time payments are vital for a good credit score. However, the extended repayment period associated with IBR can lead to a higher total amount paid over the life of the loan. This increased debt can, in some cases, negatively impact credit scores, especially if the loan balance remains high for an extended duration. Lenders may view a large, long-term loan as a higher risk. It’s essential to monitor your credit report regularly to understand how your IBR plan is affecting your score and take corrective measures if necessary, such as paying extra towards the principal.

Tax Implications of Loan Forgiveness

A key aspect of IBR plans is the potential for loan forgiveness after a specific period of payments. However, this forgiven debt is often considered taxable income by the IRS. This means that you may have to pay income taxes on the amount of debt forgiven. The amount taxed depends on the amount of loan forgiven and your individual tax bracket. For example, if $20,000 of your student loan debt is forgiven, you would likely owe taxes on that $20,000, potentially resulting in a significant tax bill. Proper financial planning and tax preparation are crucial to mitigate this unexpected tax liability. It’s advisable to consult with a tax professional to understand the potential tax implications before enrolling in an IBR plan.

Checklist of Factors to Consider Before Enrolling in an IBR Plan

Before committing to an IBR plan, carefully weigh the following factors:

- Your current and projected income: IBR plans are income-driven, so fluctuations in income can affect your monthly payments and the overall repayment timeline.

- Your long-term financial goals: Consider how an extended repayment period might impact your ability to save for retirement, buy a house, or achieve other financial objectives.

- The type of loan: IBR plans are available for various federal student loans but may not be applicable to private student loans.

- The potential tax implications of loan forgiveness: Understand that forgiven debt is often considered taxable income.

- The total cost of repayment: While monthly payments might be lower, the total amount repaid over the life of the loan will likely be higher.

- Your credit score and its potential impact: Be aware that a large, long-term loan can potentially affect your credit score.

Resources and Further Information

Navigating the complexities of Income-Based Repayment (IBR) plans can be challenging. Fortunately, numerous resources are available to help borrowers understand their options and successfully manage their student loan debt. This section provides a compilation of reliable sources and contact information to aid in this process.

Understanding your options and accessing the right support is crucial for effectively managing your student loans under an IBR plan. This information will empower you to make informed decisions and avoid potential pitfalls.

Reliable Resources for Borrowers

Several government agencies and non-profit organizations offer comprehensive information and assistance regarding IBR plans. These resources provide valuable tools and guidance, ensuring borrowers have access to accurate and up-to-date information.

- Federal Student Aid (FSA): The official website of the U.S. Department of Education’s office of Federal Student Aid. This website provides detailed information on all federal student loan programs, including IBR plans, repayment calculators, and application processes.

- StudentAid.gov: This website offers a wealth of information on federal student loans, including IBR plans, loan forgiveness programs, and repayment options. It provides access to your loan information and allows you to manage your account online.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that offers free and low-cost credit counseling services, including assistance with student loan repayment strategies. They can help you create a budget and explore different repayment options.

- The Institute for College Access & Success (TICAS): TICAS is a non-profit research and policy organization that conducts research and advocates for policies that make higher education more affordable and accessible. Their website offers valuable resources and information on student loan debt and repayment options.

Contact Information for Relevant Agencies and Organizations

Direct contact with these organizations can provide personalized assistance and address specific questions or concerns related to IBR plans. Don’t hesitate to reach out if you need help navigating the process.

- Federal Student Aid (FSA): 1-800-4-FED-AID (1-800-433-3243)

- National Foundation for Credit Counseling (NFCC): Find a local NFCC member agency through their website: [Insert NFCC Website Address Here]

- The Institute for College Access & Success (TICAS): Contact information can be found on their website: [Insert TICAS Website Address Here]

Applying for an IBR Plan

The application process for an IBR plan typically involves completing an online form through the StudentAid.gov website. The process requires providing income documentation and other relevant information to determine your eligibility and calculate your monthly payment.

The specific steps involved might vary depending on your loan servicer and the type of IBR plan you choose. However, generally, you’ll need to gather the necessary documents, complete the application form accurately, and submit it electronically. After submission, you’ll receive confirmation and updates regarding your application status. It is advisable to carefully review all the instructions and requirements before starting the application process to ensure a smooth and efficient experience. Contacting your loan servicer directly if you encounter any issues during the application process is recommended.

Closure

Successfully managing student loan debt often requires a strategic approach, and IBR plans can be a valuable tool. By carefully considering your income, eligibility for different plans, and the long-term implications of loan forgiveness, you can develop a repayment strategy that aligns with your financial goals. Remember to utilize the resources available and seek professional advice when needed to ensure a smooth and successful repayment journey. Making informed decisions today will positively impact your financial future.

Questions and Answers

What happens if my income decreases significantly?

Most IBR plans allow for income recertification, enabling you to adjust your monthly payments based on your reduced income. You’ll need to submit updated financial information to your loan servicer.

Are there any tax implications for loan forgiveness?

Yes, forgiven student loan debt may be considered taxable income in some cases. Consult a tax professional for personalized advice.

How do I apply for an IBR plan?

The application process varies depending on your loan servicer. Generally, you’ll need to complete an application online through your servicer’s website, providing necessary income documentation.

Can I switch IBR plans?

In many cases, you can switch between IBR plans, but there may be limitations depending on your specific circumstances and loan type. Check with your loan servicer for details.