Navigating the complexities of student loan repayment can feel overwhelming, especially when faced with private loans. Understanding income-based repayment (IBR) plans is crucial for borrowers seeking manageable monthly payments and potential long-term relief. This guide explores the intricacies of private student loan IBR plans, offering clarity on eligibility, payment calculations, loan forgiveness possibilities, and potential drawbacks. We’ll delve into how these plans work, compare them to federal programs, and provide practical advice to help you make informed decisions.

From understanding the various types of IBR plans available to analyzing the impact of income fluctuations on your monthly payments, we’ll equip you with the knowledge needed to confidently manage your private student loan debt. We’ll also examine the potential for loan forgiveness and highlight the importance of carefully comparing plans from different lenders to find the best fit for your individual financial circumstances.

Understanding Income-Based Repayment (IBR) Plans

Income-based repayment (IBR) plans for private student loans offer a potentially more manageable repayment approach than standard repayment plans, tailoring monthly payments to your income. However, it’s crucial to understand that private loan IBR options differ significantly from federal loan IBR programs, often with less generous terms and fewer protections.

Types of Income-Driven Repayment Plans for Private Student Loans

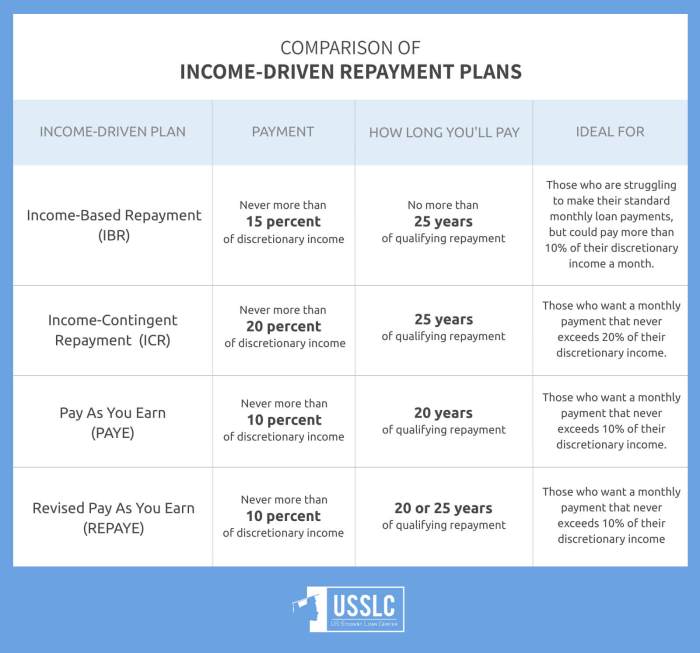

Private lenders offer a variety of income-driven repayment plans, but the specifics vary greatly depending on the lender and the loan agreement. There isn’t a standardized set of plans like those offered under the federal government’s programs (e.g., ICR, PAYE, REPAYE,IBR). Instead, each lender may design its own plan, potentially including features like variable interest rates, shorter repayment periods, or different income verification requirements. Some lenders might offer a modified version of traditional IBR, while others may not offer any income-driven option at all. Always review your loan agreement carefully to understand the available options.

Eligibility Criteria for Private Loan IBR Plans

Eligibility requirements for private loan IBR plans are determined by the individual lender. Common criteria often include demonstrating a need for reduced monthly payments based on your income and expenses. This usually requires submitting documentation such as tax returns, pay stubs, or other proof of income. Some lenders may also consider your debt-to-income ratio. It’s important to contact your lender directly to inquire about their specific eligibility requirements and the necessary documentation.

Applying for an IBR Plan for Private Student Loans

The application process for private loan IBR plans varies depending on the lender. Generally, you’ll need to contact your lender directly and request an income-driven repayment plan. You’ll likely be required to complete an application form and provide documentation verifying your income and expenses. The lender will then review your application and determine your eligibility. If approved, your monthly payments will be recalculated based on your income and the terms of the chosen IBR plan. Be prepared to recertify your income periodically, usually annually, to ensure your payments remain accurate.

Comparison of Private Loan IBR Plan Features

It’s difficult to provide a precise comparison table for private loan IBR plans because of the significant variations among lenders. However, the table below illustrates potential features you might encounter. Remember to check with your specific lender for accurate details.

| Feature | Plan A (Example) | Plan B (Example) | Plan C (Example) |

|---|---|---|---|

| Payment Calculation Method | Percentage of Discretionary Income | Fixed Percentage of Gross Income | Based on Income & Debt-to-Income Ratio |

| Loan Forgiveness Eligibility | After 20 years, remaining balance forgiven (potential tax implications) | No Forgiveness | Partial forgiveness after 15 years |

| Interest Capitalization | Annual | Monthly | No Capitalization |

| Income Verification | Tax Returns & Pay Stubs | Self-Reported Income | Tax Returns & Bank Statements |

Calculating Payments Under IBR

Income-Based Repayment (IBR) plans offer a lifeline to borrowers struggling with student loan debt by basing monthly payments on a percentage of discretionary income. Understanding how these payments are calculated is crucial for effective financial planning. This section details the calculation process, illustrating how income levels and loan amounts influence monthly payments under various IBR plans.

The precise formula for calculating monthly payments varies slightly depending on the specific IBR plan (e.g., IBR, PAYE, REPAYE). Generally, the calculation involves determining your discretionary income—the amount remaining after subtracting 150% of the poverty guideline for your family size from your adjusted gross income (AGI). This discretionary income is then multiplied by a payment percentage specific to the plan, and divided by 12 to obtain a monthly payment. The loan amount influences the payment duration; larger loan amounts will generally require longer repayment periods even with lower monthly payments.

IBR Payment Calculation Examples

Let’s illustrate with examples. Remember, these are simplified examples and actual calculations may be more complex due to factors like loan interest capitalization and the specific plan’s rules.

- Scenario 1: Low Income, High Loan Balance Assume a borrower has a $100,000 loan balance and an AGI of $30,000. After subtracting 150% of the poverty guideline (this value varies by family size and location, let’s assume $20,000 for this example), their discretionary income is $10,000. Under a plan with a 10% payment percentage, their monthly payment would be ($10,000 * 0.10) / 12 = $83.33. This low payment reflects the borrower’s limited income but results in a significantly longer repayment period.

- Scenario 2: High Income, Moderate Loan Balance Suppose a borrower has a $50,000 loan and an AGI of $80,000. With the same poverty guideline deduction ($20,000), discretionary income is $60,000. A 10% payment percentage would yield a monthly payment of ($60,000 * 0.10) / 12 = $500. This higher payment reflects the increased income, leading to a shorter repayment period.

- Scenario 3: Impact of Income Change Consider the borrower from Scenario 2. If their income increases to $100,000, their discretionary income (after the same poverty guideline deduction) becomes $80,000. Their new monthly payment would be ($80,000 * 0.10) / 12 = $666.67. This demonstrates how an income increase directly impacts monthly payments under IBR.

Hypothetical Scenario and Total Payment Comparison

Let’s consider a hypothetical borrower with a $60,000 loan balance. We’ll compare total payments and interest paid under different IBR plans assuming a consistent discretionary income of $40,000 annually. We will simplify by assuming the payment percentage remains constant throughout the repayment period. Note that in reality, this is not always the case, and recalculations are made periodically based on income adjustments.

| IBR Plan | Payment Percentage | Monthly Payment (approx.) | Estimated Repayment Period (years) | Total Payments (approx.) | Total Interest Paid (approx.) |

|---|---|---|---|---|---|

| Plan A | 10% | $333 | 20 | $79,920 | $19,920 |

| Plan B | 15% | $500 | 13 | $78,000 | $18,000 |

This table illustrates that while Plan B has higher monthly payments, the shorter repayment period results in less total interest paid over the life of the loan. The actual figures would vary depending on the precise IBR plan rules, interest rates, and any capitalization of interest.

Loan Forgiveness and Public Service Loan Forgiveness (PSLF)

Private student loan forgiveness differs significantly from the federal Public Service Loan Forgiveness (PSLF) program. While federal loans offer established forgiveness pathways, private loan forgiveness is largely dependent on the lender’s specific programs and is considerably less common. Understanding these differences is crucial for borrowers navigating repayment strategies.

The possibility of loan forgiveness under private income-based repayment (IBR) plans is limited. Unlike federal loans, there isn’t a standardized government program offering forgiveness after a set period of payments. Private lenders may offer limited forgiveness programs, often tied to specific employment or hardship situations, but these are typically not as generous or easily accessible as federal options. The terms and conditions vary significantly between lenders and are often less transparent.

Private IBR Loan Forgiveness Limitations and Requirements

Private lenders offering IBR plans may include loan forgiveness provisions within their contracts, but these are rarely as comprehensive as federal PSLF. Eligibility criteria are typically stricter and may include requirements such as continuous on-time payments for a specified number of years, specific employment in a designated field (often less broadly defined than public service), or demonstration of financial hardship. The documentation needed to prove eligibility is often extensive and the forgiveness process can be lengthy and complex. Furthermore, the amount of loan forgiveness offered is usually less than the total loan balance, and it’s not uncommon for lenders to place restrictions on future borrowing.

Comparison of Eligibility Criteria and Forgiveness Timelines

Eligibility for private IBR loan forgiveness programs is determined by each lender independently, leading to inconsistencies across programs. Unlike federal PSLF, which has clearly defined eligibility criteria (120 qualifying monthly payments while employed full-time in public service), private loan forgiveness requirements are not standardized. Forgiveness timelines are also highly variable, ranging from several years to potentially never, depending on the lender’s terms and the borrower’s circumstances. The application and approval process for private loan forgiveness is generally less streamlined and transparent than the federal PSLF process.

Key Differences Between Private IBR Loan Forgiveness and Federal PSLF

| Feature | Private IBR Loan Forgiveness | Federal PSLF | Notes |

|---|---|---|---|

| Eligibility Criteria | Varies greatly by lender; often stricter and less clearly defined than PSLF. May require specific employment or financial hardship. | 120 qualifying monthly payments under an income-driven repayment plan while employed full-time in qualifying public service. | Private lenders may have unique requirements beyond on-time payments. |

| Forgiveness Amount | Often partial, not necessarily the entire remaining loan balance. | Remaining loan balance after 120 qualifying payments. | Federal PSLF forgives the remaining balance, while private forgiveness is often limited. |

| Forgiveness Timeline | Highly variable, potentially extending for many years or indefinitely, depending on the lender and individual circumstances. | Potentially 10 years (120 payments), depending on the repayment plan and payment amounts. | PSLF provides a more predictable timeframe. |

| Application Process | Typically complex and less transparent, requiring significant documentation. | Generally more streamlined and transparent, with clear guidelines and resources available. | The federal government provides resources and support for the PSLF application process. |

Potential Drawbacks and Considerations

While Income-Based Repayment (IBR) plans for private student loans offer flexibility, they also present potential drawbacks that borrowers should carefully consider before opting for this repayment strategy. Understanding these limitations is crucial for making informed financial decisions and avoiding unforeseen difficulties. Failing to fully grasp the implications can lead to a longer repayment period and ultimately, a higher total cost.

IBR plans, unlike federal IBR programs, are offered by private lenders and vary significantly in terms of their features and limitations. These variations often lead to less transparency and potentially less favorable terms compared to their federal counterparts. Therefore, a thorough comparison of different repayment options, including standard repayment plans, is strongly recommended.

Interest Capitalization

Interest capitalization is a significant factor influencing the long-term cost of IBR plans for private student loans. This occurs when accrued interest is added to the principal loan balance, increasing the amount on which future interest is calculated. With IBR, lower monthly payments often mean more interest accrues over time, which then gets capitalized, leading to a snowball effect. For example, imagine a $50,000 loan with a 7% interest rate. If only the minimum payment under an IBR plan is made, a substantial portion of the payment will go towards interest, with a smaller amount applied to the principal. Over several years, this unpaid interest will accumulate and be capitalized, potentially adding thousands of dollars to the total loan amount. This results in a much higher overall cost despite the seemingly manageable monthly payments.

Extended Repayment Periods and Increased Total Interest Paid

IBR plans typically extend the repayment period over a longer timeframe than standard repayment plans. While this lowers monthly payments, it significantly increases the total interest paid over the life of the loan. The longer the repayment period, the more interest accrues, leading to a substantially higher overall cost. For instance, a loan repaid over 20 years under an IBR plan might accumulate twice the interest compared to the same loan repaid over 10 years using a standard repayment plan. This increased interest burden can significantly impact a borrower’s long-term financial health.

Scenarios Where Alternative Repayment Strategies Might Be More Beneficial

There are scenarios where alternative repayment strategies, such as refinancing or accelerating payments, might be more advantageous than an IBR plan for private student loans. If a borrower has a stable income and the ability to make higher monthly payments, a faster repayment plan can significantly reduce the total interest paid and shorten the repayment period. Refinancing the loan with a lower interest rate could also drastically reduce the overall cost. For example, a borrower with a high credit score and steady employment might secure a significantly lower interest rate through refinancing, resulting in substantial savings compared to continuing with a private IBR plan. Similarly, if a borrower receives a bonus or inherits money, using these funds to make extra principal payments can drastically shorten the loan’s repayment period and reduce the total interest paid.

Finding and Choosing a Suitable IBR Plan

Navigating the world of income-based repayment (IBR) plans for private student loans can feel overwhelming. However, with a systematic approach, you can find a plan that aligns with your financial situation and long-term goals. This section will guide you through the process of researching, comparing, and selecting a suitable IBR plan.

Understanding the nuances of different private lender offerings is crucial for making an informed decision. Careful consideration of terms, conditions, and lender reputation will help you avoid potential pitfalls and secure a plan that best suits your needs.

Researching and Comparing Private Lenders

Begin by identifying private lenders who offer IBR plans. Many large financial institutions and specialized student loan lenders provide these programs. Utilize online search engines, compare loan websites, and check the websites of individual lenders directly. Compile a list of potential lenders that meet your initial criteria. Then, systematically compare their IBR plans using standardized criteria to ensure a fair and comprehensive evaluation. This structured approach enables efficient comparison and reduces the likelihood of overlooking crucial details. Consider creating a spreadsheet to track key features and compare different options side-by-side.

Understanding IBR Plan Terms and Conditions

Before committing to any IBR plan, thoroughly review the terms and conditions. Pay close attention to the following aspects: the calculation method for monthly payments (is it based on your discretionary income or a percentage of your income?), the definition of “income” used in the calculation (gross income, adjusted gross income, etc.), the length of the repayment period (how long will it take to repay the loan under the plan?), the interest capitalization policy (how and when will accrued interest be added to your principal balance?), and the loan forgiveness provisions (are there any specific conditions that must be met to qualify for loan forgiveness?). Misunderstanding these details could lead to unexpected financial burdens later on.

Factors to Consider When Choosing an IBR Plan

Several factors influence the suitability of an IBR plan. Lender reputation is paramount; research the lender’s history, customer reviews, and Better Business Bureau rating. Strong customer service is crucial, especially when dealing with complex financial matters. Look for lenders who offer multiple communication channels (phone, email, online chat) and have a track record of responsive and helpful customer support. Flexibility in payment options, such as the ability to temporarily reduce payments during periods of financial hardship, is another vital consideration. Finally, consider the overall cost of the loan, including interest rates, fees, and any potential penalties for missed payments. A seemingly attractive IBR plan might ultimately prove more expensive than a less flexible option.

Questions to Ask Lenders Before Selecting an IBR Plan

A structured approach to gathering information is essential. Before selecting an IBR plan, prepare a list of questions for potential lenders. This proactive approach ensures you have all the necessary information to make an informed decision.

- What is the specific calculation method used to determine my monthly payment under your IBR plan?

- What definition of “income” is used in the payment calculation?

- What is the maximum repayment period under your IBR plan?

- What is your policy on interest capitalization?

- What are the specific conditions for loan forgiveness under your IBR plan?

- What are your customer service channels and hours of operation?

- What is your complaint resolution process?

- What are the fees associated with your IBR plan?

- What are your policies regarding payment deferment or forbearance?

- What is your lender’s Better Business Bureau rating and history?

Illustrative Examples of IBR Plans in Action

Income-Based Repayment (IBR) plans can significantly alter the student loan repayment journey, offering both advantages and challenges depending on individual circumstances. Understanding these diverse outcomes through real-world examples helps illustrate the plan’s complexities and potential impact.

A Successful IBR Plan Scenario

Consider Sarah, a teacher with a $60,000 student loan debt at a 6% interest rate. Her annual income is $45,000. Under a standard repayment plan, her monthly payments would be substantial, potentially hindering her ability to save for retirement or handle unexpected expenses. However, with an IBR plan, her monthly payments are significantly reduced, based on her income and family size (assuming she’s single). This allows her to comfortably manage her debt while still meeting her living expenses. Over the extended repayment period, she may pay more in interest overall, but the reduced monthly burden significantly improves her financial well-being and reduces the risk of default. The lower monthly payment allows her to contribute more to savings and investments, building a more secure financial future.

A Challenging IBR Plan Scenario

In contrast, consider Mark, a freelance graphic designer with fluctuating income. He has a $40,000 student loan at 7% interest. His income varies significantly from year to year, sometimes falling below the threshold for substantial payment reductions under his IBR plan. While his payments are lower during low-income periods, they can spike during high-income years, making budgeting difficult. Furthermore, because of the fluctuating income, the total interest paid over the life of the loan might be unexpectedly high. The extended repayment period, coupled with fluctuating income and interest accumulation, could potentially lead to a higher overall repayment amount than anticipated. This scenario highlights the importance of carefully considering income stability and the potential for interest accrual before opting for an IBR plan.

Visual Comparison of Standard and IBR Repayment

Imagine a graph charting loan balance over 20 years. The blue line represents a standard repayment plan, showing a steep downward slope as the loan is paid off relatively quickly. The total amount repaid is clearly visible at the end of the 20-year period. The red line represents an IBR plan. It shows a much gentler slope initially, reflecting the lower monthly payments. However, the line remains above zero for the full 20 years, indicating a longer repayment period. The total area under the red line, representing the total amount repaid over 20 years, is significantly larger than the area under the blue line, highlighting the increased total repayment cost due to extended repayment and accumulated interest under the IBR plan. The visual contrast emphasizes the trade-off between lower monthly payments and a higher overall repayment cost over time. The graph would clearly show that while the IBR plan offers immediate financial relief through lower monthly payments, the total cost of the loan is ultimately higher due to prolonged interest accrual.

Last Point

Successfully managing private student loan debt often hinges on selecting and utilizing the right repayment strategy. Income-based repayment plans can provide crucial flexibility and potentially lead to loan forgiveness, but it’s vital to understand their nuances and potential limitations. By carefully considering your income, loan amount, and long-term financial goals, you can make an informed decision about whether an IBR plan is the right choice for you. Remember to thoroughly research lenders and plan terms before committing to any specific program.

Popular Questions

What happens if my income decreases significantly?

Most IBR plans allow for adjustments to your monthly payment based on income changes. You’ll typically need to re-certify your income with your lender, potentially leading to a lower payment amount.

Are there any tax implications associated with IBR plans?

Potentially, yes. Forgiven loan amounts may be considered taxable income in some cases. Consult a tax professional for personalized advice.

Can I switch from one IBR plan to another?

This depends on your lender’s policies. Some lenders allow for switching plans, while others may have restrictions. Check with your lender for specific details.

What if I miss a payment under an IBR plan?

Missing payments will negatively impact your credit score and could lead to penalties or default. Contact your lender immediately if you anticipate difficulty making a payment.