Student loan debt can feel overwhelming, but understanding your repayment options is crucial for long-term financial well-being. Income-based repayment (IBR) programs offer a lifeline to borrowers struggling with high monthly payments, adjusting your payments based on your income and family size. This guide delves into the intricacies of IBR programs, exploring eligibility, calculation methods, potential for loan forgiveness, and the impact on your credit and financial planning. We’ll also address common misconceptions and compare IBR to alternative repayment strategies.

Understanding the nuances of income-based repayment plans is key to responsible debt management. This guide provides a comprehensive overview, equipping you with the knowledge to make informed decisions about your student loans and chart a path towards financial stability. We will cover various IBR plans, explore their advantages and disadvantages, and help you navigate the often complex process of applying for and utilizing these programs effectively.

Program Eligibility Requirements

Understanding the eligibility requirements for Income-Based Repayment (IBR) plans is crucial for borrowers seeking to manage their student loan debt. These plans adjust your monthly payments based on your income and family size, offering potential relief for those facing financial hardship. Eligibility hinges on several factors, including your income, loan type, and the specific IBR plan you choose.

Income Thresholds and Other Criteria

Eligibility for IBR programs is primarily determined by your adjusted gross income (AGI). This is your gross income minus certain deductions allowed by the IRS. The specific income thresholds vary depending on the IBR plan (Income-Driven Repayment plans), your family size, and the year. Beyond income, you must generally have federal student loans, and your loans must be in repayment status. Some plans may have additional requirements regarding loan type. For example, some may exclude Parent PLUS loans. It’s essential to check the current guidelines from the Department of Education or your loan servicer for the most up-to-date information.

Determining Adjusted Gross Income (AGI) for IBR Purposes

Calculating your AGI for IBR purposes mirrors the IRS method. You’ll use the AGI reported on your most recent federal tax return (Form 1040). This figure represents your total gross income less certain deductions and adjustments, as defined by the IRS. It’s crucial to use the correct AGI, as an inaccurate figure can lead to incorrect payment calculations and potential penalties. Consult the IRS website or a tax professional if you have questions about determining your AGI.

Comparison of Eligibility Requirements Across IBR Plans

Several IBR plans exist, each with slightly different eligibility requirements. While all consider income, the specific income limits and other criteria may vary. For instance, some plans may have stricter requirements for loan types or repayment history. Understanding these differences is vital in selecting the most suitable plan for your circumstances. The following table summarizes key differences:

| Plan Type | Income Limits | Other Relevant Factors | Loan Types |

|---|---|---|---|

| Income-Based Repayment (IBR) | Based on AGI and family size; varies annually. Specific limits are published by the Department of Education. | Must be in repayment; specific requirements may vary depending on the loan type. | Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (graduate and parent). May exclude certain loans. |

| Income-Contingent Repayment (ICR) | Based on AGI and family size; generally lower income limits than IBR. | Higher interest capitalization compared to other plans. | Similar to IBR, but specific eligibility may vary. Check with your servicer. |

| Pay As You Earn (PAYE) | Based on AGI and family size; specific limits are published by the Department of Education. | Borrowers must have received their first loan disbursement on or after July 1, 2014. | Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (graduate and parent). |

| Revised Pay As You Earn (REPAYE) | Based on AGI and family size; specific limits are published by the Department of Education. | No disbursement date restriction; includes both new and older loans. | Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (graduate and parent). |

Payment Calculation Methods

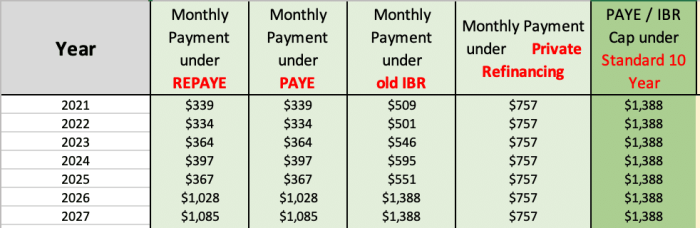

Income-Based Repayment (IBR) plans offer a flexible approach to student loan repayment, adjusting monthly payments based on your income and family size. Understanding how these calculations work is crucial for budgeting and long-term financial planning. The specific formulas and processes vary slightly depending on the particular IBR plan (e.g., IBR, ICR, PAYE, REPAYE), but the underlying principles remain consistent.

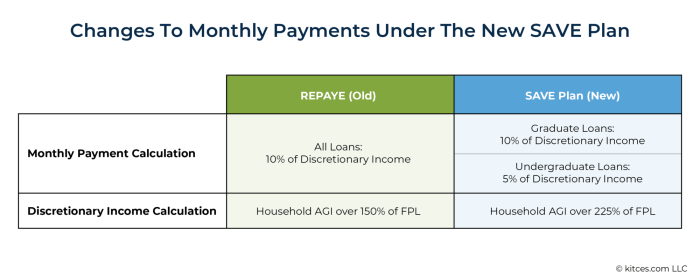

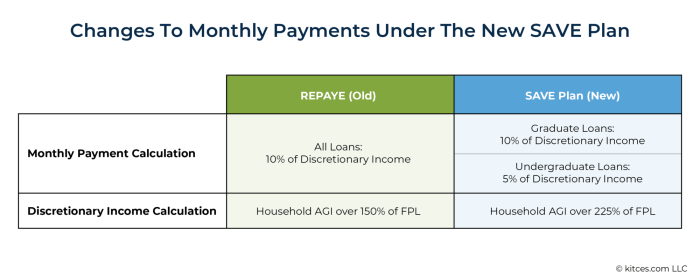

IBR plans generally use a formula that considers your Adjusted Gross Income (AGI), family size, and the total amount of your eligible student loan debt. The AGI is your gross income minus certain deductions allowed by the IRS. The formula then calculates a payment that is a percentage of your discretionary income – the amount left after subtracting a poverty guideline amount based on your family size and state of residence from your AGI. This percentage varies among the different IBR plans. For example, under the REPAYE plan, the payment is calculated as 10% of discretionary income. For other plans, the percentage may be different.

Income’s Impact on Monthly Payments

Changes in your income directly influence your monthly IBR payment. An increase in income generally leads to a higher monthly payment, as a larger percentage of your discretionary income will be allocated towards loan repayment. Conversely, a decrease in income typically results in a lower monthly payment, reflecting your reduced capacity to repay. The system is designed to be responsive to income fluctuations, offering a safety net during periods of financial hardship and adjusting upwards when income improves. For example, if your income increases by $10,000, your discretionary income will also increase, potentially leading to a higher monthly payment, though the exact amount depends on the specific IBR plan and other factors. Conversely, if your income decreases, the discretionary income decreases, and so does your payment.

Step-by-Step IBR Payment Calculation

Let’s illustrate a simplified IBR payment calculation. This example uses hypothetical figures and does not reflect the precise formulas used by the government. It serves as a conceptual illustration.

- Determine Adjusted Gross Income (AGI): Let’s assume an AGI of $60,000.

- Determine Poverty Guideline: For a family of four in a specific state, the poverty guideline might be $26,000. This figure is based on federal poverty guidelines and can vary based on location and family size.

- Calculate Discretionary Income: Subtract the poverty guideline from the AGI: $60,000 – $26,000 = $34,000.

- Apply the Percentage: Assume a 10% payment rate under REPAYE. Multiply the discretionary income by this percentage: $34,000 * 0.10 = $3,400.

- Determine Annual Payment: The result is the annual payment amount.

- Calculate Monthly Payment: Divide the annual payment by 12: $3,400 / 12 = $283.33 (approximately).

Note: This is a simplified example. The actual calculation involves more complex formulas and considers various factors, including loan balance and plan type. Consult the official government website for precise details.

Family Size’s Influence on Payment Calculation

Family size significantly impacts IBR payments through its effect on the poverty guideline. A larger family size generally leads to a higher poverty guideline, resulting in a lower discretionary income and consequently, a lower monthly payment. This reflects the increased financial burden associated with supporting a larger family. For instance, a family of six would typically have a higher poverty guideline than a single individual, leading to a lower monthly IBR payment, assuming similar AGI. The difference in payment could be substantial, emphasizing the importance of accurately reporting family size.

Loan Forgiveness and Discharge

Income-Based Repayment (IBR) plans offer a pathway to potential student loan forgiveness, but it’s crucial to understand the conditions and limitations before relying on this outcome. While forgiveness can provide significant financial relief, it’s not guaranteed and comes with specific requirements and potential drawbacks.

Loan forgiveness under IBR plans typically occurs after a set number of qualifying payments have been made. The exact number of payments and the specific eligibility criteria vary depending on the type of IBR plan (IBR, PAYE, REPAYE, ICR) and the date the loan was originated. Forgiveness isn’t a free pass; it’s contingent upon consistent on-time payments and meeting other stipulations, and even then, tax implications may arise.

Conditions for Loan Forgiveness

Several factors determine eligibility for loan forgiveness under an IBR plan. Meeting these conditions is essential for accessing this benefit. Failure to meet even one criterion can significantly impact the potential for forgiveness.

- Consistent On-Time Payments: Making consistent, on-time payments for the required number of months is paramount. Any missed or late payments can significantly delay or even prevent loan forgiveness.

- Eligible Loan Types: Not all federal student loans are eligible for IBR plans, and consequently, not all are eligible for forgiveness under these plans. Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, and some Federal Family Education Loans (FFEL) are generally eligible, but this can change over time. Always verify your loan type’s eligibility with your loan servicer.

- Income-Driven Repayment Plan Enrollment: You must be enrolled in and actively making payments under a qualifying IBR plan (IBR, PAYE, REPAYE, or ICR). Switching plans or failing to maintain enrollment can interrupt the payment count towards forgiveness.

- Specific Payment Count: The required number of qualifying payments varies depending on the loan type and the IBR plan. For example, under some plans, forgiveness may be granted after 20 or 25 years of payments. This can be a considerable length of time.

Limitations and Potential Pitfalls

While loan forgiveness under IBR can be beneficial, it’s essential to be aware of potential drawbacks. These limitations can significantly impact the overall financial outcome.

- Lengthy Timeline: The process can take many years, potentially decades, before reaching the required payment count for forgiveness. This extended timeframe requires careful financial planning and consistency.

- Tax Implications: Forgiven loan amounts are often considered taxable income. This means you may owe taxes on the forgiven portion of your loan, potentially offsetting some of the financial benefits.

- No Guarantee of Forgiveness: Meeting all requirements doesn’t guarantee forgiveness. Changes in legislation or unforeseen circumstances could impact the program’s future.

- Impact on Credit Score: While loan forgiveness removes the debt, the extended repayment period might affect your credit score negatively if you had initially high credit utilization.

Examples of Loan Forgiveness Scenarios

Understanding scenarios where loan forgiveness is likely or unlikely helps in realistic expectation setting.

- Likely Forgiveness: A teacher with Direct Subsidized Loans consistently making on-time payments under PAYE for 20 years, meeting all eligibility criteria, is likely to qualify for loan forgiveness. This scenario aligns with the program’s design to support public service professionals.

- Unlikely Forgiveness: An individual with private student loans who frequently misses payments and switches between different repayment plans is unlikely to qualify. Private loans are generally not eligible for federal loan forgiveness programs.

Steps to Qualify for Loan Forgiveness

A structured approach increases the chances of successfully navigating the loan forgiveness process. Following these steps helps maximize the potential for success.

- Verify Loan Eligibility: Confirm your loans are eligible for an IBR plan and subsequent forgiveness.

- Enroll in an IBR Plan: Choose and enroll in a suitable IBR plan (IBR, PAYE, REPAYE, or ICR).

- Make Consistent On-Time Payments: Maintain consistent, on-time payments throughout the repayment period.

- Monitor Payment Count: Track your progress towards the required number of qualifying payments.

- Understand Tax Implications: Prepare for potential tax liabilities on the forgiven amount.

- Stay Informed About Program Changes: Keep updated on any changes to the IBR program or related legislation.

Impact on Credit Score and Financial Planning

Choosing an Income-Based Repayment (IBR) plan for your student loans can significantly affect your credit score and long-term financial planning. Understanding these potential impacts is crucial for making informed decisions about your repayment strategy. This section will explore the relationship between IBR and your creditworthiness, as well as provide guidance on incorporating IBR payments into a comprehensive financial plan.

IBR’s Effect on Credit Score

IBR plans, while offering lower monthly payments, can sometimes negatively impact credit scores. This is primarily because your monthly payment may be significantly lower than the minimum payment required under a standard repayment plan. Credit scoring models often consider payment history, and consistently making only the minimum payment, even if it’s a reduced amount under IBR, might be viewed less favorably than consistently making larger payments. However, the impact varies depending on the individual’s overall credit profile and the credit scoring model used. Consistent on-time payments, even small ones, are generally better than missed payments under any repayment plan. A significant negative impact is less likely if your credit history is already strong. Conversely, individuals with weak credit histories might see a more pronounced negative effect.

IBR’s Influence on Long-Term Financial Planning and Budgeting

Incorporating IBR payments into a long-term financial plan requires careful consideration. The lower monthly payments provide immediate relief, freeing up funds for other financial goals like saving for a down payment on a house or investing. However, the extended repayment period, potentially lasting 20 or 25 years, leads to higher total interest payments over the life of the loan. This increased interest expense needs to be factored into your budget and financial projections. For example, a borrower might choose to allocate additional funds towards accelerated loan repayment to mitigate the impact of the higher total interest cost. This requires disciplined saving and budgeting.

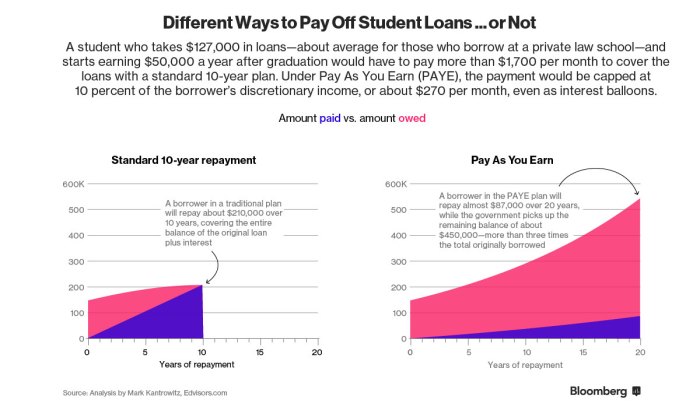

Financial Implications: IBR vs. Other Repayment Plans

Comparing IBR to other repayment plans, such as Standard Repayment or Graduated Repayment, highlights the trade-offs involved. Standard and Graduated plans offer faster loan payoff but demand higher monthly payments. IBR offers lower monthly payments, but the total interest paid is usually significantly higher. For instance, a $50,000 loan with a 6% interest rate might be repaid in 10 years under a Standard plan, but 20 years under an IBR plan, resulting in a substantially larger total interest paid. The choice depends on individual financial priorities. If prioritizing immediate affordability is key, IBR might be preferable. If prioritizing minimizing total interest paid is more important, a Standard or Graduated plan might be better.

Sample Financial Plan Incorporating IBR Payments

Let’s consider Sarah, a recent graduate with $40,000 in student loans and an IBR monthly payment of $300.

| Scenario | Monthly IBR Payment | Additional Monthly Payment | Total Monthly Payment | Loan Payoff Time (Estimated) | Total Interest Paid (Estimated) |

|---|---|---|---|---|---|

| Scenario 1: Minimum Payment | $300 | $0 | $300 | 20 years | $20,000 (estimated) |

| Scenario 2: Accelerated Repayment | $300 | $200 | $500 | 10 years | $10,000 (estimated) |

In Scenario 1, Sarah makes only the minimum IBR payment, resulting in a longer repayment period and higher total interest. In Scenario 2, she commits to an additional $200 monthly payment, significantly reducing the loan payoff time and interest expense. These estimations assume a constant interest rate and no changes in income or loan terms. Actual outcomes may vary. This illustrates how incorporating additional payments can improve the financial outcome under an IBR plan.

Common Misconceptions and Challenges

Understanding the Income-Based Repayment (IBR) program requires careful consideration of its nuances. Many borrowers enter the program with inaccurate assumptions, leading to potential difficulties down the line. This section clarifies common misconceptions and Artikels strategies for navigating the challenges associated with IBR.

Common Misunderstandments about IBR

The IBR program, while designed to make student loan repayment more manageable, is often misunderstood. Several key misconceptions can lead borrowers to underestimate the program’s complexities or overestimate its benefits. A clear understanding of these misconceptions is crucial for effective utilization of the program.

Potential Challenges Faced by IBR Borrowers

While IBR offers significant advantages, several potential challenges can arise during the repayment process. These challenges, if not properly addressed, can negatively impact a borrower’s financial well-being and overall experience with the program.

Strategies for Navigating Challenges and Maximizing IBR Benefits

Successfully navigating the IBR program requires proactive planning and a thorough understanding of its mechanics. By implementing effective strategies, borrowers can mitigate potential challenges and optimize the program’s benefits to achieve long-term financial stability. Regular monitoring of your loan balance and payment amounts, combined with proactive communication with your loan servicer, are key to a successful experience.

Summary of Common Misconceptions and Corrections

| Misconception | Correction | Example | Impact |

|---|---|---|---|

| IBR automatically forgives all remaining debt after 20 or 25 years. | IBR reduces monthly payments based on income and family size, but loan forgiveness is contingent upon meeting specific requirements and making payments for the required period. Forgiveness is not guaranteed. | A borrower might believe they will owe nothing after 25 years, but may still owe a significant amount due to not meeting all requirements. | Unexpected debt after the forgiveness period. |

| IBR payments are always significantly lower than standard repayment plans. | While IBR often results in lower monthly payments, the total amount paid over the life of the loan may be higher due to the extended repayment period. | A borrower might choose IBR expecting dramatically lower monthly payments, only to find the difference is minimal compared to other income-driven repayment plans. | Potential for higher total interest paid. |

| Your credit score will not be affected by being on an IBR plan. | While IBR itself doesn’t directly damage credit, consistently making on-time payments is crucial for maintaining a good credit score. Late payments or defaults will negatively impact your credit. | A borrower might assume their credit score is unaffected, but late payments under IBR can still negatively affect their score. | Negative impact on creditworthiness. |

| Once enrolled in IBR, you cannot switch to another repayment plan. | You can generally switch between repayment plans, but there may be restrictions or implications depending on your specific loan type and circumstances. | A borrower might believe they are locked into IBR indefinitely, missing opportunities for potentially more advantageous plans later. | Missed opportunities for potentially lower interest payments or faster loan payoff. |

Alternatives to Income-Based Repayment

While Income-Based Repayment (IBR) plans offer significant benefits to borrowers facing financial hardship, they aren’t the only repayment option available. Understanding the alternatives allows borrowers to choose the plan best suited to their individual circumstances and financial goals. Different plans offer varying levels of flexibility and long-term implications, so careful consideration is crucial.

Standard Repayment Plan

The Standard Repayment Plan is a fixed monthly payment plan spread over 10 years. This plan offers the shortest repayment period, leading to less interest paid overall. However, the fixed monthly payment can be quite high, potentially creating financial strain for some borrowers. The benefit is that it allows for quicker loan payoff and less total interest accumulation compared to income-driven repayment plans. For example, a $30,000 loan with a 6% interest rate would result in a monthly payment of approximately $330 and total interest paid around $6,000 over the 10-year period.

Graduated Repayment Plan

The Graduated Repayment Plan features lower initial monthly payments that gradually increase over time. This structure can ease the initial financial burden, especially for recent graduates entering the workforce. However, the increasing payments can become challenging to manage as they rise. The total repayment period is still 10 years, but the overall interest paid will generally be higher than with the Standard Repayment Plan due to the longer time the loan balance is accruing interest. A $30,000 loan with a 6% interest rate might start with monthly payments around $200, increasing over the 10 years, resulting in a higher total interest paid compared to the Standard Repayment Plan.

Extended Repayment Plan

The Extended Repayment Plan extends the repayment period to 25 years. This significantly reduces the monthly payment amount, making it manageable for borrowers with lower incomes or higher debt loads. However, it results in substantially higher total interest paid over the life of the loan. For a $30,000 loan at 6% interest, the monthly payment would be significantly lower than the Standard or Graduated plans, but the total interest paid could exceed $15,000. This plan is best suited for those prioritizing affordability over minimizing total interest paid.

Comparison of Repayment Plans

The choice between IBR and these alternative plans depends heavily on individual financial circumstances. IBR plans offer lower monthly payments based on income and family size, but they often extend the repayment period significantly, leading to higher total interest payments. Standard and Graduated plans offer quicker repayment but may require higher initial payments. The Extended Repayment Plan provides the lowest monthly payments but results in the highest total interest cost. A borrower with a stable, high income might find the Standard Repayment Plan more beneficial, while someone with fluctuating income or significant financial hardship might prefer an IBR plan. A careful analysis of one’s current and projected income, expenses, and long-term financial goals is essential for selecting the most appropriate repayment plan.

Last Recap

Successfully managing student loan debt requires careful planning and a thorough understanding of available repayment options. Income-based repayment programs offer a flexible approach, tailoring payments to individual financial circumstances. While loan forgiveness is a potential benefit, it’s crucial to understand the conditions and limitations. By carefully weighing the pros and cons of IBR and considering alternative repayment plans, borrowers can develop a sustainable strategy that aligns with their long-term financial goals and minimizes the impact on their credit scores. Remember to thoroughly research and consult with a financial advisor to determine the best path for your unique situation.

Question Bank

What happens if my income changes during the IBR repayment period?

Your monthly payment will be recalculated to reflect your new income. You’ll typically need to submit updated income information to your loan servicer.

Can I switch from one IBR plan to another?

Generally, yes. The availability of switching depends on your loan type and the specific plans involved. Check with your loan servicer for eligibility.

What happens if I don’t make my IBR payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in loan default. Contact your loan servicer immediately if you anticipate difficulties making payments.

Does IBR apply to all types of student loans?

No, IBR programs primarily apply to federal student loans. Private student loans generally do not offer income-driven repayment plans.

How long does it typically take to qualify for loan forgiveness under IBR?

The time it takes to qualify for loan forgiveness varies greatly depending on the plan, your income, and the amount of your loan. It can take 20-25 years or more in some cases.