Navigating the complexities of student loan repayment can feel overwhelming, but understanding income-based repayment plans can significantly ease the burden. These plans tailor your monthly payments to your income, offering a potentially more manageable path to debt freedom. This guide provides a comprehensive overview of the income-based student loan form, from application to long-term implications, ensuring you’re well-equipped to make informed decisions about your financial future.

We’ll explore the various income-driven repayment (IDR) plans available, detailing their eligibility requirements and the necessary documentation. We’ll also delve into the application process itself, highlighting common pitfalls and offering tips for accurate completion. Finally, we’ll examine the long-term effects of IDR plans, including potential benefits like loan forgiveness and the impact on overall repayment costs.

Understanding Income-Based Repayment Plans

Income-driven repayment (IDR) plans offer a lifeline to student loan borrowers struggling with high monthly payments. These plans tie your monthly payment amount to your income and family size, making repayment more manageable. Several different plans exist, each with its own nuances. Understanding these differences is crucial for choosing the plan best suited to your individual financial situation.

Types of Income-Driven Repayment Plans

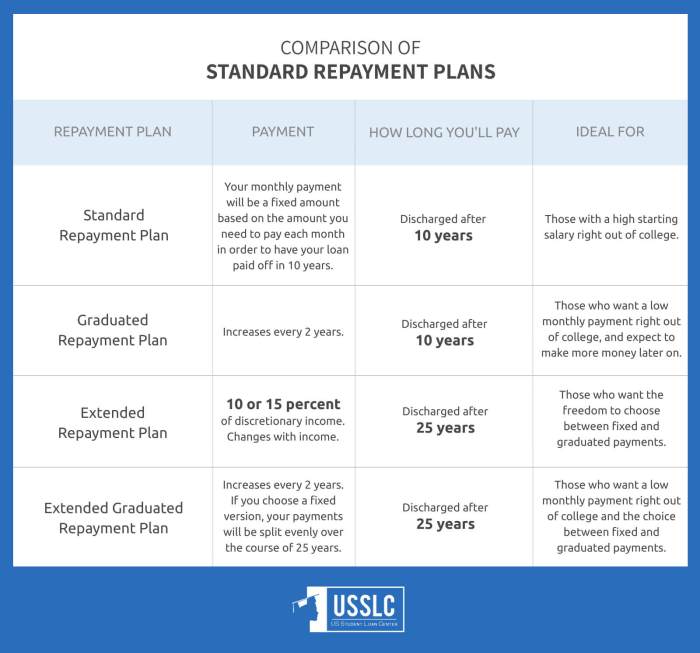

The federal government offers several income-driven repayment plans. These include Income-Driven Repayment (IDR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Based Repayment (IBR). Each plan calculates monthly payments differently, leading to varying payment amounts and potential loan forgiveness timelines. Understanding the specific features of each plan is essential for making an informed decision.

Eligibility Criteria for Income-Driven Repayment Plans

Eligibility requirements vary slightly depending on the specific IDR plan. Generally, you must have a federal student loan, not be in default, and be making payments on your loan. Specific plans may have additional requirements, such as the date you obtained your loans or your income level. It’s important to check the eligibility criteria for each plan to determine which one you qualify for.

Income Verification Processes for IDR Plans

The income verification process involves providing documentation of your income and family size. This typically involves submitting tax returns or pay stubs. The specific documents required may vary slightly between plans, and the frequency of verification can also differ. Some plans may require annual verification, while others may require it less frequently.

Applying for an Income-Driven Repayment Plan

Applying for an IDR plan is a straightforward process. You can generally apply online through the student loan servicer’s website. The steps typically involve completing an application, providing necessary documentation, and waiting for approval. After approval, your monthly payment will be recalculated based on your income and family size. The exact steps might vary slightly based on your loan servicer, but the overall process is fairly consistent.

Comparison of Key Features of Income-Driven Repayment Plans

| Plan | Income Calculation | Payment Caps | Forgiveness Timelines |

|---|---|---|---|

| IBR | Adjusted Gross Income (AGI) | 15% of discretionary income | 25 years (for graduate loans); 10 years (for undergraduate loans) |

| PAYE | AGI | 10% of discretionary income | 20 years |

| REPAYE | AGI | 10% of discretionary income | 20 or 25 years (depending on loan type) |

| IDR | AGI or other income documentation | Varies by plan | Varies by plan |

Completing the Income-Based Repayment Application

Successfully navigating the income-based repayment (IBR) application process requires a clear understanding of the required information and supporting documentation. This section will guide you through the key steps, highlighting common pitfalls and offering practical advice to ensure a smooth application.

Key Sections and Required Information

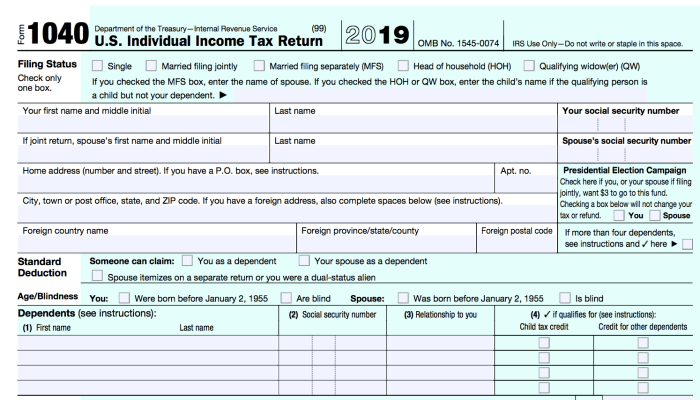

The IBR application typically includes sections requesting detailed personal information, income details, and expense information. Personal information usually includes your name, address, Social Security number, and student loan details (loan servicer, loan amounts, and interest rates). Income information will require details of your gross annual income, including wages, salaries, bonuses, and self-employment income. Expense information might request details on your housing costs, childcare expenses, and other significant financial obligations. Accurate and complete information in each section is crucial for a successful application.

Supporting Documentation

To support your income and expense claims, you’ll generally need to provide documentation such as W-2 forms (for employment income), tax returns (for self-employment income or to verify income from previous years), pay stubs, and bank statements. For expense claims, supporting documentation may include mortgage statements, rent receipts, childcare invoices, or other relevant financial records. The specific documents required may vary depending on your individual circumstances and the lender’s requirements. It is advisable to gather all necessary documents before starting the application process.

Common Application Errors and How to Avoid Them

Common errors include inaccurate reporting of income or expenses, missing required documentation, and failing to update information if your circumstances change. Inaccurate reporting can lead to an incorrect payment calculation, resulting in either overpayment or underpayment. Missing documentation delays the processing of your application. To avoid these errors, carefully review all instructions, double-check your entries for accuracy, and ensure you have all the necessary documentation readily available. Keep a copy of your completed application and supporting documents for your records.

Accurately Reporting Income and Family Size

Accurately reporting your income is paramount. This includes reporting all sources of income, even part-time jobs or freelance work. For family size, include yourself and all dependents who rely on your financial support. This is typically defined as a spouse and children, but may include other qualifying dependents, according to the specific program guidelines. Use the official definition of “family size” provided by your loan servicer to avoid errors. Providing incorrect information can lead to significant discrepancies in your payment calculations.

Sample Completed Application Form

| Section | Information |

|---|---|

| Applicant Name | Jane Doe |

| Social Security Number | XXX-XX-XXXX |

| Annual Gross Income | $55,000 |

| Family Size | 2 (Applicant and Spouse) |

| Housing Costs (Monthly) | $1,200 |

| Childcare Costs (Monthly) | $0 |

| Other Expenses (Monthly) | $500 |

| Loan Servicer | Example Loan Servicer |

| Loan Amount | $30,000 |

Income Documentation and Verification

Submitting accurate income documentation is crucial for determining your eligibility for an income-based repayment plan. The loan servicer will use this information to calculate your monthly payment, ensuring it aligns with your financial capacity. Providing complete and verifiable documentation streamlines the process and prevents delays.

Your income documentation will be used to verify your reported income and determine your payment plan. Acceptable forms of documentation generally include pay stubs, tax returns, and W-2 forms. The specific requirements may vary slightly depending on your loan servicer, so it’s always best to check their specific guidelines. However, the core documentation types remain consistent across most servicers.

Acceptable Forms of Income Documentation

Several types of documents prove your income. Each offers a different snapshot of your financial situation, and some might be more suitable depending on your employment status. The loan servicer will assess the documentation provided to determine its suitability for verification.

- Pay stubs: Recent pay stubs (typically from the last two months) clearly showing your gross pay, net pay, and pay frequency provide a current picture of your income. They should include your employer’s name and contact information for verification purposes.

- Tax returns: Your most recent federal income tax return (Form 1040) provides a comprehensive overview of your annual income. This is particularly useful if you are self-employed or have multiple income streams.

- W-2 forms: Your W-2 form(s) from your employer(s) confirm your wages and other compensation for the tax year. This is a vital document for verifying employment-based income.

Income Verification Process

Once you submit your application, the loan servicer will review your provided documentation. They may contact your employer(s) or request additional documentation to verify the information you have provided. This verification process is essential to ensure the accuracy of your payment plan calculation.

The verification process typically involves the servicer comparing the information you provide against information they obtain independently. For instance, they may directly contact your employer to confirm your salary or independently verify your tax information with the IRS. This process can take several weeks to complete.

Potential Issues During Income Verification and Resolution

Discrepancies between the information you provide and the information the servicer verifies can cause delays. These discrepancies might stem from simple errors, such as a typographical error on a pay stub, or more complex issues, such as discrepancies between your reported income and your tax return.

- Discrepancies in reported income: If there’s a mismatch, the servicer will likely contact you to clarify the difference. Providing additional documentation, such as corrected pay stubs or amended tax returns, is crucial to resolve this. Promptly responding to their inquiries helps expedite the process.

- Missing documentation: Failure to provide all necessary documentation can lead to delays. It’s important to submit all required forms and information as requested by the servicer.

- Unverifiable information: If the servicer is unable to verify your income information, they may request additional documentation or alternative forms of verification.

Situations Requiring Additional Documentation

Certain circumstances may require additional documentation beyond the standard pay stubs, tax returns, and W-2s. This is to ensure a complete and accurate picture of your income for the repayment plan calculation.

- Self-employment: Self-employed individuals may need to provide additional documentation, such as profit and loss statements or tax schedules, to verify their income.

- Multiple income sources: Individuals with multiple jobs or income streams (e.g., salary, freelance work, investments) will need to provide documentation for each source of income.

- Recent changes in employment: If you have recently started a new job or experienced a change in income, you may need to provide documentation reflecting these changes.

Potential Income Sources Requiring Reporting

It is important to report all sources of income to ensure your repayment plan accurately reflects your financial situation. Failing to report all income can lead to issues later on.

- Wages and salaries from employment

- Self-employment income

- Investment income (dividends, interest)

- Rental income

- Alimony or child support received

- Social Security benefits (in certain cases)

- Unemployment benefits

Understanding Payment Calculations and Adjustments

Income-based repayment (IBR) plans offer a flexible approach to managing student loan debt by basing your monthly payments on your income and family size. Understanding how these calculations work and how to adjust your payments when your circumstances change is crucial for effective debt management.

Your monthly IBR payment is determined by a formula that considers your adjusted gross income (AGI), family size, and the total amount of your eligible student loans. The specific formula varies depending on the type of IBR plan (e.g., ICR, PAYE, REPAYE), but generally involves dividing your AGI by a specific factor, then dividing the result by the number of months in a year. This calculation yields a payment amount that is typically lower than what you’d pay under a standard repayment plan. It’s important to note that the payment may be $0 if your income is low enough.

Factors Influencing Payment Amounts

Several key factors significantly influence your monthly IBR payment. Your adjusted gross income (AGI) is the most critical factor; a higher AGI generally leads to higher monthly payments. Family size also plays a role, as plans typically adjust the payment calculation based on the number of dependents you have. A larger family size often results in a lower monthly payment. Finally, the total amount of your eligible student loans directly impacts the payment calculation; larger loan balances generally lead to higher payments, even with lower income.

Payment Adjustment Process

If your income or family circumstances change significantly, you can typically request a payment adjustment. This usually involves submitting updated documentation to your loan servicer, such as a new tax return or proof of a change in family size. The servicer will then recalculate your monthly payment based on the new information. It’s essential to promptly notify your servicer of any changes to avoid potential issues with your repayment plan. The specific process and required documentation will vary depending on your loan servicer and the type of IBR plan you have.

Examples of Income Changes Affecting Monthly Payments

Changes in income directly impact your monthly IBR payment. For instance, a promotion resulting in a substantial salary increase will generally lead to a higher monthly payment. Conversely, a job loss or reduction in work hours resulting in a decrease in income will likely result in a lower monthly payment, or even a $0 payment depending on the plan and your income level. These adjustments ensure that your payments remain aligned with your current financial capacity.

Hypothetical Scenario: Income Change Impact

Let’s imagine Sarah, a single parent with $50,000 in student loans, initially earns $40,000 annually and has one dependent child. Under her IBR plan, her monthly payment is calculated to be $200. After receiving a promotion, her annual income increases to $60,000. Her loan servicer recalculates her payment based on the new income, and her monthly payment increases to $300. This example illustrates how a rise in income directly translates into a higher monthly payment under an IBR plan. Conversely, if her income were to decrease to $30,000 annually, her monthly payment might be reduced to $150 or even less, depending on the specific plan parameters.

Long-Term Implications of Income-Based Repayment

Choosing an income-driven repayment (IDR) plan for your student loans involves long-term considerations that extend beyond the immediate monthly payment. Understanding these implications is crucial for making informed financial decisions. This section will explore the potential benefits and drawbacks of IDR plans, focusing on their impact on loan forgiveness, total interest paid, and overall repayment costs.

Loan Forgiveness Under Income-Driven Repayment

Income-driven repayment plans offer the potential for loan forgiveness after a specific period of qualifying payments, typically 20 or 25 years, depending on the plan and loan type. This forgiveness can significantly reduce or eliminate your student loan debt. However, it’s important to understand that the forgiven amount is considered taxable income in the year it’s forgiven. This means you’ll need to account for this potential tax liability when planning your finances. For example, if $50,000 is forgiven, you will owe income taxes on that amount. Careful financial planning is essential to prepare for this tax obligation.

Impact of Extended Repayment Periods on Total Interest Paid

IDR plans often stretch repayment periods considerably longer than standard repayment plans. While lower monthly payments are attractive, this extended timeframe can lead to significantly higher total interest paid over the life of the loan. For instance, a loan with a 10-year repayment period under a standard plan might accrue $10,000 in interest, while the same loan under an IDR plan with a 25-year repayment period could accrue $30,000 or more in interest. The longer you take to repay, the more interest you will pay.

Comparison of Total Repayment Costs Across Different Repayment Plans

The total cost of repayment—principal plus interest—can vary substantially depending on the repayment plan selected. A standard repayment plan, with its shorter repayment period, will typically result in a lower total cost compared to an IDR plan, even though monthly payments might be higher. Conversely, while IDR plans offer lower monthly payments, the extended repayment timeline leads to higher overall interest payments, resulting in a greater total cost. A detailed comparison, considering specific loan amounts, interest rates, and plan terms, is essential to determine the most cost-effective option for individual circumstances. For example, comparing a 10-year standard plan versus a 20-year IDR plan on a $50,000 loan at 5% interest would reveal a substantial difference in the total repayment amount.

Effect of Income Levels on Total Repayment Period

Your income directly influences the length of your repayment period under an IDR plan. Lower incomes typically result in lower monthly payments and, consequently, a longer repayment period. Higher incomes, conversely, lead to higher monthly payments and a shorter repayment period. This dynamic highlights the importance of accurately reporting your income annually to ensure your payments are appropriately adjusted and your progress towards potential loan forgiveness remains on track. For instance, a significant income increase might substantially reduce the repayment period, accelerating the path to potential loan forgiveness. Conversely, a period of unemployment could significantly extend the repayment period.

Resources and Support for Borrowers

Navigating the complexities of income-based repayment (IBR) plans can be challenging. Fortunately, numerous resources are available to assist borrowers throughout the process, from understanding eligibility to resolving disputes. This section details these resources and provides guidance on accessing support.

Understanding the available support systems is crucial for borrowers to successfully manage their student loan debt. Effective use of these resources can prevent missed payments, penalties, and ultimately, financial hardship. The following sections provide information on accessing help and resolving potential issues.

Available Resources for Borrowers

Several resources can assist borrowers with income-based repayment plans. These include the Federal Student Aid website (studentaid.gov), which offers comprehensive information on all federal student loan programs, including IBR plans. Many student loan servicers also provide dedicated support channels, such as phone lines, online portals, and email addresses, specifically designed to address IBR-related inquiries. Additionally, some non-profit organizations offer free financial counseling services, providing guidance on managing student loan debt and navigating IBR processes. Finally, many colleges and universities have financial aid offices that can offer assistance and guidance to their alumni.

Contact Information for Relevant Agencies and Servicers

The Federal Student Aid website (studentaid.gov) is the primary source for information on federal student loans. Contact information for specific student loan servicers can be found on the website by logging in to your account and reviewing your loan details. The contact information varies depending on the servicer handling your loans. It’s important to note that contact information may change, so always verify the most up-to-date details on the official website. For general inquiries about federal student aid, borrowers can contact the Federal Student Aid Information Center.

Appealing an Income-Based Repayment Decision

Borrowers who disagree with a decision regarding their income-based repayment plan can file an appeal. The specific process for appealing a decision varies depending on the nature of the dispute. Generally, borrowers must submit a written appeal outlining the reasons for their disagreement, along with supporting documentation. This documentation might include evidence of incorrect income information, errors in calculation, or extenuating circumstances. The appeal will be reviewed by the student loan servicer or the relevant government agency, and a decision will be communicated to the borrower in writing. The appeal process is clearly Artikeld on the Federal Student Aid website.

Frequently Asked Questions about Income-Based Repayment

Understanding income-based repayment often involves addressing common questions. The following provides answers to some frequently asked questions.

- Q: What is income-based repayment? A: Income-based repayment plans adjust your monthly student loan payments based on your income and family size.

- Q: Am I eligible for an income-based repayment plan? A: Eligibility depends on your loan type and income. Check the Federal Student Aid website for detailed eligibility criteria.

- Q: How often is my payment recalculated? A: Recalculations typically occur annually, though the frequency may vary depending on the specific plan.

- Q: What happens after 20 or 25 years of payments? A: Depending on the plan and your repayment history, remaining loan balances may be forgiven.

- Q: What if my income changes significantly? A: You should contact your loan servicer to update your income information so your payments can be adjusted accordingly.

Closure

Successfully navigating the income-based student loan repayment system requires careful planning and a thorough understanding of the process. By understanding the different IDR plans, meticulously completing the application, and proactively managing your income documentation, you can significantly reduce the financial strain of student loan debt. Remember to utilize the available resources and seek assistance when needed – your financial well-being is paramount.

FAQ Resource

What happens if my income changes during the repayment period?

You can usually request a payment adjustment based on your changed income. Contact your loan servicer to initiate this process; they’ll require updated income documentation.

Can I switch from one income-driven repayment plan to another?

Generally, yes, but there may be limitations and eligibility requirements depending on the specific plans involved. Check with your loan servicer for details and potential timelines.

What happens if I don’t make my income-based payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in loan default. Contact your loan servicer immediately if you anticipate difficulties making payments.

How long does it typically take to get approved for an income-driven repayment plan?

Processing times vary depending on the servicer and the completeness of your application. Allow several weeks to several months for approval.