Navigating the complexities of student loan repayment can feel overwhelming, especially with the various repayment plans available. Income-driven repayment (IDR) plans offer a potential lifeline for borrowers struggling to manage their debt, tailoring monthly payments to their income. Understanding the nuances of these plans—from eligibility requirements and payment calculations to forgiveness options and long-term implications—is crucial for making informed financial decisions.

This guide provides a comprehensive overview of income-driven student loan repayment, covering eligibility criteria for different IDR plans (ICR, PAYE, REPAYE, IBR), methods for calculating monthly payments, potential for loan forgiveness, and a comparison with standard repayment plans. We’ll also explore the long-term financial consequences and address common tax implications. By understanding these factors, borrowers can choose the repayment plan best suited to their individual circumstances and financial goals.

Income-Driven Repayment (IDR) Plan Eligibility

Choosing an income-driven repayment (IDR) plan can significantly impact your student loan payments. Understanding the eligibility requirements for each plan is crucial to selecting the best option for your financial situation. This section details the eligibility criteria, required documentation, and key differences between several common IDR plans.

Income Thresholds and Asset Limitations

Eligibility for IDR plans hinges on your income and, in some cases, your assets. The specific income thresholds and asset limitations vary depending on the plan. Generally, your income must be below a certain percentage of the median income for your state or family size. Asset limitations, while less common, may exist for certain plans. It’s important to check the specific requirements for the plan you are considering, as these limits are subject to change. For example, a higher income might qualify for a PAYE plan but not an IBR plan, depending on the specific income thresholds set for each. It’s recommended to consult the official Federal Student Aid website for the most up-to-date information.

Required Documentation for IDR Plan Application

Applying for an IDR plan requires providing specific documentation to verify your income and family size. This typically includes tax returns (Form 1040 and supporting schedules), W-2s, and pay stubs. You may also need to provide documentation related to your family size, such as marriage certificates or birth certificates. The specific documents required may vary depending on the chosen plan and the lender. Incomplete applications can lead to delays in processing. Therefore, it’s essential to gather all necessary documentation before submitting your application.

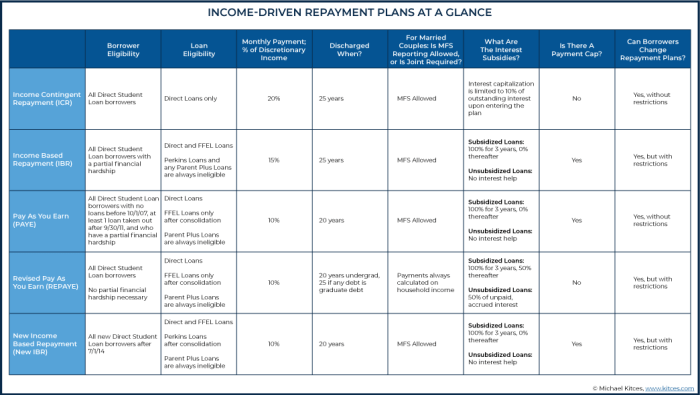

Comparison of Eligibility Requirements Across Different IDR Plans

Several IDR plans exist, each with slightly different eligibility requirements. While all require demonstrating income below a certain threshold, other factors such as loan type and when the loans were disbursed can influence eligibility. For instance, some plans might be more advantageous for borrowers with higher loan balances or those who borrowed recently. The differences can be subtle but can significantly impact your monthly payments and overall repayment period.

IDR Plan Eligibility Criteria Summary

| IDR Plan | Income Threshold | Asset Limitations | Other Requirements |

|---|---|---|---|

| Income-Based Repayment (IBR) | Based on AGI; varies by loan type and family size. | None | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans |

| Pay As You Earn (PAYE) | Based on AGI; 10% of discretionary income. | None | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, disbursed after October 1, 2007 |

| Revised Pay As You Earn (REPAYE) | Based on AGI; 10% of discretionary income. | None | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, Graduate PLUS Loans, Parent PLUS Loans |

| Income-Contingent Repayment (ICR) | Based on AGI and family size. | None | Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, Federal Family Education Loans (FFEL) |

Calculating Monthly Payments Under IDR Plans

Calculating your monthly student loan payment under an Income-Driven Repayment (IDR) plan can seem complex, but understanding the underlying principles and factors involved simplifies the process. The exact calculation depends on the specific IDR plan (e.g., ICR, PAYE, REPAYE, IBR) you qualify for, your income, and your loan details. These plans are designed to make your payments manageable based on your income, aiming to prevent borrowers from defaulting.

Each IDR plan uses a different formula to determine your monthly payment. These formulas generally take into account your adjusted gross income (AGI), family size, loan balance, and interest rate. While the specific formulas are complex and vary by plan, the general principle remains consistent: lower income translates to lower monthly payments.

IDR Plan Formulas and Payment Calculation Examples

The formulas used to calculate monthly payments under different IDR plans are not publicly available in a single, simple form. They are complex and often involve internal calculations by the loan servicer. However, we can illustrate the general process using simplified examples. Assume a simplified formula where the monthly payment is a percentage of your discretionary income (income above a poverty guideline) applied to your loan balance.

Example 1: Let’s say a borrower has a $30,000 loan balance, an interest rate of 5%, and an adjusted gross income of $40,000. After subtracting a poverty guideline, their discretionary income is $25,000. Under a hypothetical IDR plan with a 10% payment rate, their monthly payment would be (0.10 * $25,000) / 12 = $208.33. This is a simplified example; actual calculations are far more intricate.

Example 2: Now consider a borrower with a $50,000 loan balance, a 6% interest rate, and an adjusted gross income of $60,000. With a discretionary income of $40,000 and a hypothetical 12% payment rate, their monthly payment would be (0.12 * $40,000) / 12 = $400. This demonstrates how a higher income and higher payment rate lead to larger monthly payments.

Factors Affecting Monthly Payments

Several key factors influence the calculated monthly payment under an IDR plan. These factors interact in complex ways, making it crucial to understand their individual and collective effects.

Understanding these factors is essential for budgeting and long-term financial planning. It’s important to note that the interest rate significantly impacts the total amount repaid over the life of the loan, even if the monthly payments are lower.

| Factor | Impact on Monthly Payment |

|---|---|

| Adjusted Gross Income (AGI) | Lower AGI generally results in lower monthly payments. |

| Family Size | Larger families may have lower payments due to higher poverty guidelines. |

| Loan Balance | Larger loan balances generally lead to higher monthly payments, even with the same income. |

| Interest Rate | Higher interest rates increase the total cost of the loan, potentially affecting the repayment schedule even under an IDR plan. |

| Loan Type | Different loan types (e.g., subsidized vs. unsubsidized) may have varying interest rates and repayment options. |

Step-by-Step Guide to Calculating Monthly Payments (Simplified)

While precise calculation requires using the specific formulas employed by your loan servicer, this simplified guide illustrates the general process. Remember, this is a simplified illustration and does not reflect the complexity of actual IDR plan calculations. Consult your loan servicer for accurate payment information.

- Determine your adjusted gross income (AGI): This is your gross income minus certain deductions, as defined by the IRS.

- Calculate your discretionary income: Subtract the applicable poverty guideline for your family size from your AGI.

- Determine your payment percentage: This varies by IDR plan and is usually a percentage of your discretionary income.

- Calculate your preliminary monthly payment: Multiply your discretionary income by your payment percentage, then divide by 12.

- Factor in interest: The actual monthly payment will also include interest accrual, which is not included in this simplified calculation. The interest calculation is complex and varies by loan type and plan.

Forgiveness and Loan Discharge Under IDR Plans

Income-Driven Repayment (IDR) plans offer the possibility of student loan forgiveness after a specified period of qualifying payments. However, the specific requirements and timelines vary significantly depending on the chosen plan. Understanding these differences is crucial for borrowers to make informed decisions and accurately plan their repayment strategy.

Loan Forgiveness Conditions Under Different IDR Plans

The conditions for loan forgiveness under IDR plans primarily revolve around the number of qualifying monthly payments made. A qualifying payment is generally defined as a payment equal to or greater than the amount calculated under the specific IDR plan. Factors such as the type of loan (federal vs. private), the loan’s interest rate, and the borrower’s income all influence the monthly payment amount and, consequently, the time it takes to reach forgiveness. For instance, a borrower with a higher income will typically make larger monthly payments, potentially leading to faster loan forgiveness. Conversely, a borrower with a lower income may make smaller payments, extending the timeline to forgiveness. Different plans also have different qualifying payment periods (e.g., 20 years, 25 years).

Timelines for Achieving Loan Forgiveness Under Each Plan

The timeline for loan forgiveness varies substantially among IDR plans. For example, the Revised Pay As You Earn (REPAYE) plan and the Income-Based Repayment (IBR) plan can lead to forgiveness after 20 or 25 years of qualifying payments, depending on the loan type and origination date. The Income-Contingent Repayment (ICR) plan, however, may require a longer repayment period, potentially exceeding 25 years. The Pay As You Earn (PAYE) plan also offers forgiveness after 20 years. It is essential to consult the specific terms and conditions of the chosen plan for precise details.

Examples of Loan Forgiveness Scenarios

Let’s consider two scenarios. Scenario A: A borrower with a high initial loan balance and a stable, high income might qualify for loan forgiveness under REPAYE after 20 years, assuming consistent qualifying payments. Scenario B: A borrower with a lower income and a smaller loan balance might reach forgiveness under IBR after 25 years, though the actual timeline might be affected by fluctuating income levels over the repayment period. These scenarios highlight the significant impact of individual financial circumstances on the loan forgiveness timeline. In cases where borrowers fail to make consistent qualifying payments, the forgiveness process can be delayed or even jeopardized.

Comparison of Forgiveness Requirements Across IDR Plans

| IDR Plan | Maximum Repayment Period (Years) | Qualifying Payment Definition | Forgiveness Eligibility |

|---|---|---|---|

| REPAYE | 20 or 25 | Payment calculated based on income and loan amount | After making qualifying payments for the specified period |

| IBR | 20 or 25 | Payment calculated based on income and loan amount | After making qualifying payments for the specified period |

| PAYE | 20 | Payment calculated based on income and loan amount | After making qualifying payments for 20 years |

| ICR | >25 (Potentially longer) | Payment calculated based on income and loan amount | After making qualifying payments for the specified period (potentially longer than other plans) |

Impact of IDR Plans on Long-Term Debt

Choosing an Income-Driven Repayment (IDR) plan can significantly impact your long-term debt situation. While these plans offer lower monthly payments, potentially making them more manageable in the short term, they often lead to a higher total repayment amount over the life of the loan due to accruing interest. Understanding these long-term implications is crucial before selecting an IDR plan.

Understanding the factors influencing the total amount repaid under an IDR plan is key to making an informed decision. The initial loan amount, the interest rate, the income-based payment calculation method, and the length of the repayment period all contribute to the final cost. Variations in income throughout the repayment period also significantly impact the total amount paid, as payments adjust accordingly. Furthermore, the specific IDR plan chosen (e.g., ICR, PAYE, REPAYE) will have different calculation methods, affecting the total cost.

Factors Influencing Total Repayment Amount

Several key factors determine the total amount paid over the life of a loan under an IDR plan. The interest rate is paramount; higher rates lead to significantly more interest accumulating over the extended repayment period. Your income directly influences your monthly payment; lower income results in lower payments but extends the repayment period and increases total interest. The specific IDR plan chosen also matters, as each has unique calculation formulas. Finally, unexpected life events, such as job loss or illness, can impact income and, consequently, the total repayment amount. For example, someone with a high initial loan balance and a high interest rate who experiences periods of lower income during repayment could end up paying substantially more than the original loan amount.

Benefits and Drawbacks of IDR Plans

It’s essential to weigh the potential advantages and disadvantages of IDR plans carefully.

Below is a list of potential benefits and drawbacks:

- Benefits: Lower monthly payments making budgeting easier, potential for loan forgiveness after 20-25 years depending on the plan and income, provides more financial flexibility in the short-term.

- Drawbacks: Significantly higher total repayment amount compared to standard repayment plans due to accumulated interest, longer repayment period, potential for unexpected changes in payment amounts based on income fluctuations, complex qualification and application processes.

Comparison of Total Interest Paid

The following table illustrates the potential difference in total interest paid between standard repayment plans and various IDR plans. These figures are illustrative examples and actual amounts will vary significantly based on individual loan terms, income, and chosen IDR plan.

| Loan Amount | Interest Rate | Standard Repayment Total Interest | IDR Plan (Example) Total Interest |

|---|---|---|---|

| $50,000 | 6% | $18,000 (estimated) | $35,000 (estimated) |

| $75,000 | 7% | $36,000 (estimated) | $65,000 (estimated) |

| $100,000 | 8% | $60,000 (estimated) | $100,000 (estimated) |

Navigating the Application and Enrollment Process

Applying for an Income-Driven Repayment (IDR) plan can seem daunting, but the process is manageable with a clear understanding of the steps involved. This section provides a step-by-step guide to help you navigate the application and enrollment process successfully, ensuring you choose the plan that best suits your financial situation. Remember to carefully review all documentation and keep accurate records throughout the process.

Locating Necessary Forms and Documentation

The first step is identifying the correct forms and gathering the necessary documentation. The specific forms and required documents vary depending on your loan servicer and the type of federal student loans you have. Generally, you’ll need information such as your Federal Student Aid (FSA) ID, your Social Security number, and details about your income and family size. You can usually find the necessary forms and instructions on your loan servicer’s website or the Federal Student Aid website (studentaid.gov). Contacting your loan servicer directly is also a helpful way to ensure you have the correct forms and understand the specific requirements for your situation.

Step-by-Step Application Process for an IDR Plan

The application process typically involves several steps. First, you’ll need to determine your eligibility for an IDR plan based on your income and family size. Next, you’ll choose the specific IDR plan that best fits your needs (e.g., ICR, PAYE, REPAYE,IBR). Then, you’ll complete the application form provided by your loan servicer, providing accurate and complete information about your income, family size, and other relevant details. After submitting your application, your servicer will review your information and notify you of their decision. Finally, you’ll need to sign and return any necessary documentation to finalize your enrollment in the chosen IDR plan. This entire process can take several weeks, so it’s important to start early.

Updating Income Information During Repayment

Maintaining accurate income information is crucial for ensuring your monthly payments are calculated correctly under your IDR plan. Most IDR plans require annual recertification of income. This involves submitting updated income documentation, typically your tax return or pay stubs, to your loan servicer within a specified timeframe. Failure to update your income information promptly can lead to inaccurate payment calculations, potentially resulting in higher payments or even missed opportunities for loan forgiveness. Your loan servicer will provide specific instructions on how and when to submit your updated income information; be sure to follow these instructions carefully.

Flowchart Illustrating the Application and Enrollment Process

A flowchart visually represents the application and enrollment process. Imagine a flowchart starting with a box labeled “Determine IDR Plan Eligibility.” This leads to a decision diamond: “Eligible?” If yes, it proceeds to a box labeled “Choose IDR Plan.” This then leads to a box labeled “Complete Application Form.” Next, a box labeled “Submit Application” connects to a decision diamond: “Application Approved?” If yes, it proceeds to a box labeled “Finalize Enrollment.” If no at either decision diamond, it leads to a box labeled “Review Application/Resubmit.” Finally, the process concludes with a box labeled “IDR Plan Enrollment Complete.” This simplified visual representation helps illustrate the sequential steps involved.

Understanding Tax Implications of IDR Plans

Income-driven repayment (IDR) plans offer a lifeline to many student loan borrowers, promising lower monthly payments and eventual loan forgiveness. However, this seemingly advantageous arrangement carries significant tax implications that borrowers must understand to avoid unpleasant surprises down the line. Failing to account for these tax consequences could lead to a substantial tax bill upon loan forgiveness.

Tax Implications of Loan Forgiveness Under IDR Plans

When your student loans are forgiven under an IDR plan, the forgiven amount is generally considered taxable income. This means the IRS will treat the forgiven debt as if you received it as income in the year of forgiveness, potentially pushing you into a higher tax bracket and resulting in a significant tax liability. This can be a substantial sum, especially after years of making reduced payments. The amount of forgiven debt that is taxable depends on the specific type of IDR plan and the individual’s circumstances. For example, a borrower with $50,000 in forgiven loans might owe thousands of dollars in taxes the year the forgiveness is applied.

Examples of Tax Consequences Under Different Scenarios

Let’s consider a few scenarios to illustrate the tax implications.

Scenario 1: A borrower with a high income and significant loan forgiveness might face a substantial tax liability, potentially impacting their overall financial well-being. The tax burden in this case could be considerable due to the higher tax bracket.

Scenario 2: A borrower with a lower income and less loan forgiveness will face a smaller tax liability, possibly even a minimal one, as the forgiven amount might fall into a lower tax bracket or be offset by other deductions.

Scenario 3: A borrower who strategically plans for the tax liability by setting aside funds throughout the repayment period will be better prepared to manage the tax burden upon loan forgiveness. This proactive approach minimizes the financial shock associated with the unexpected tax bill.

Resources for Understanding Tax Implications of IDR Plans

Several resources can help borrowers understand the tax implications of IDR plans. The IRS website provides comprehensive information on the tax treatment of forgiven student loans. Financial advisors specializing in student loan debt can offer personalized guidance based on your individual circumstances. Furthermore, educational materials from non-profit organizations focused on student loan debt management can provide valuable insights into navigating the tax implications of loan forgiveness. Consulting these resources can equip borrowers with the knowledge necessary to make informed decisions and plan effectively for potential tax liabilities.

Comparison with Standard Repayment Plans

Choosing between an Income-Driven Repayment (IDR) plan and a standard repayment plan depends heavily on your individual financial circumstances and long-term goals. Both offer ways to repay your student loans, but they differ significantly in their payment calculations, potential for loan forgiveness, and overall impact on your finances. Understanding these differences is crucial for making an informed decision.

IDR plans and standard repayment plans represent distinct approaches to managing student loan debt. Standard plans typically involve fixed monthly payments over a set period (usually 10 years), while IDR plans adjust payments based on your income and family size, potentially extending the repayment period significantly. This flexibility comes with trade-offs, which we’ll explore in detail.

Advantages of IDR Plans over Standard Repayment Plans

IDR plans offer significant advantages for borrowers facing financial hardship or anticipating fluctuating income. Lower monthly payments can provide much-needed breathing room in a budget, making it easier to manage other expenses. The potential for loan forgiveness after a certain number of qualifying payments is a powerful incentive, especially for borrowers with substantial loan balances. For example, a teacher with a large loan balance might find the Public Service Loan Forgiveness (PSLF) program, often used with IDR plans, particularly appealing. This program could lead to loan forgiveness after 120 qualifying payments.

Situations Favoring IDR Plans

IDR plans are generally more advantageous in situations where: Income is low or unpredictable; High debt burdens relative to income exist; The borrower anticipates a period of lower income (e.g., during graduate school or a career change); The borrower qualifies for loan forgiveness programs tied to IDR plans (e.g., PSLF).

Advantages of Standard Repayment Plans over IDR Plans

While IDR plans offer flexibility, standard repayment plans have their own merits. The fixed payment and shorter repayment period mean you’ll pay off your loans faster and accrue less interest over the life of the loan. This translates to lower overall loan costs compared to an IDR plan, which can extend repayment for 20-25 years or more. For borrowers with stable, relatively high incomes, this accelerated repayment can be a financially sound strategy.

Situations Favoring Standard Repayment Plans

Standard repayment plans might be a better choice when: Income is consistently high and stable; The borrower prioritizes paying off loans quickly to minimize interest costs; The borrower does not anticipate needing the flexibility of income-based payments; The borrower does not qualify for or wish to participate in loan forgiveness programs.

Key Differences Between IDR and Standard Repayment Plans

| Feature | IDR Plan | Standard Repayment Plan |

|---|---|---|

| Payment Calculation | Based on income and family size | Fixed, based on loan amount and interest rate |

| Repayment Period | Potentially much longer (20-25 years or more) | Typically 10 years |

| Total Interest Paid | Generally higher due to longer repayment period | Generally lower due to shorter repayment period |

| Loan Forgiveness | Possible after a certain number of qualifying payments | Not available |

End of Discussion

Successfully managing student loan debt requires careful planning and a thorough understanding of available repayment options. Income-driven repayment plans provide a flexible approach, aligning monthly payments with income levels. While the potential for loan forgiveness offers significant long-term benefits, it’s essential to weigh the potential for extended repayment periods and accrued interest. By carefully considering eligibility requirements, payment calculations, and long-term financial implications, borrowers can navigate the complexities of IDR plans and develop a sustainable repayment strategy that aligns with their individual financial circumstances.

Expert Answers

What happens if my income changes during the repayment period?

Most IDR plans allow you to update your income annually. You’ll need to submit updated documentation to your loan servicer to recalculate your monthly payment.

Can I consolidate my loans before applying for an IDR plan?

Consolidation can simplify repayment, but it may affect your eligibility for certain IDR plans or reset the repayment clock for forgiveness. Consult with a financial advisor before consolidating.

What if I don’t qualify for an IDR plan?

If you don’t meet the eligibility requirements for an IDR plan, explore other repayment options like standard repayment, extended repayment, or graduated repayment. A financial advisor can help determine the best option for your situation.

Are there any penalties for missing payments under an IDR plan?

Missing payments can lead to late fees, negative credit reporting, and potentially impact your eligibility for loan forgiveness. It is crucial to make timely payments.