Navigating the complex world of student loans can feel overwhelming, but understanding the various options and strategies available is crucial for your financial future. This guide provides a clear and concise overview of student loan types, the application process, repayment options, and strategies for managing debt effectively. Whether you’re a prospective student planning for college or a current borrower seeking better management techniques, this resource will equip you with the knowledge to make informed decisions.

From federal loans and their diverse repayment plans to the intricacies of private loans and forgiveness programs, we’ll cover the essential aspects of student loan financing. We’ll also explore the importance of budgeting, the impact of loan debt on your credit score, and strategies for long-term financial planning.

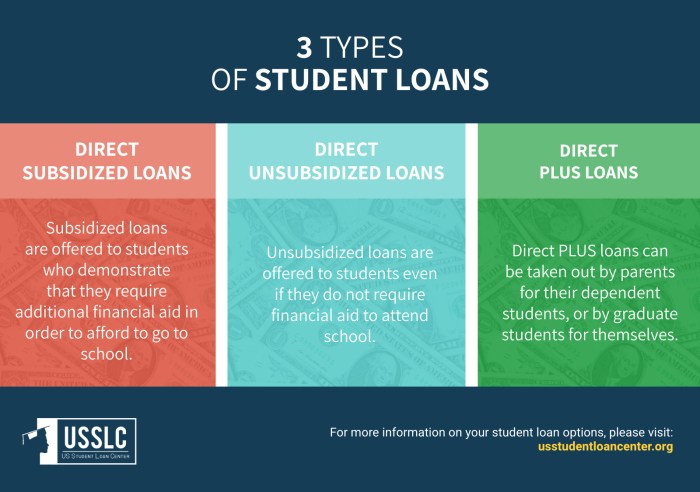

Types of Student Loans

Navigating the world of student loans can feel overwhelming, but understanding the fundamental differences between loan types is crucial for making informed financial decisions. This section will clarify the distinctions between federal and private student loans and Artikel the various repayment options available for federal loans.

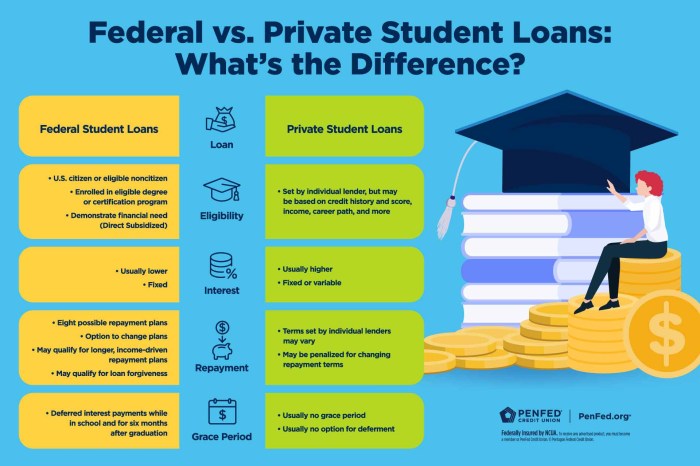

Federal vs. Private Student Loans

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. These protections include flexible repayment plans, income-driven repayment options, and loan forgiveness programs in certain circumstances. Private student loans, on the other hand, are provided by banks, credit unions, and other private lenders. They typically have less stringent eligibility requirements but often come with higher interest rates and fewer borrower protections. Choosing between federal and private loans depends heavily on individual financial situations and creditworthiness. Generally, it is advisable to exhaust federal loan options before considering private loans.

Federal Student Loan Repayment Plans

Several repayment plans are available for federal student loans, each designed to cater to different financial circumstances. Choosing the right plan can significantly impact your monthly payments and overall repayment cost.

Standard Repayment: This plan involves fixed monthly payments over a 10-year period. It is the simplest plan but may result in higher monthly payments.

Graduated Repayment: Payments start low and gradually increase over a 10-year period. This option can be helpful in the early years after graduation when income is typically lower.

Extended Repayment: This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher overall interest costs.

Income-Driven Repayment (IDR): IDR plans base monthly payments on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans are designed to make repayment more manageable, especially for borrowers with lower incomes. After a set period of payments (usually 20 or 25 years), any remaining loan balance may be forgiven, though this forgiveness is considered taxable income.

Student Loan Interest Rates and Terms Comparison

| Loan Type | Interest Rate (Example) | Repayment Period (Example) | Eligibility Criteria |

|---|---|---|---|

| Federal Subsidized Loan | Variable, depends on loan year | 10-25 years (depending on repayment plan) | U.S. citizenship or eligible non-citizen, enrolled at least half-time in an eligible program |

| Federal Unsubsidized Loan | Variable, depends on loan year | 10-25 years (depending on repayment plan) | U.S. citizenship or eligible non-citizen, enrolled at least half-time in an eligible program |

| Private Student Loan | Variable, depends on creditworthiness and lender | 5-20 years (depending on lender and loan terms) | Credit history (often required), co-signer may be necessary |

| Federal PLUS Loan (Graduate/Parent) | Variable, depends on loan year | 10-25 years (depending on repayment plan) | U.S. citizenship or eligible non-citizen, enrolled at least half-time (graduate) or parent of a dependent student |

*Note: Interest rates and terms are subject to change and are presented as examples only. Actual rates and terms will vary depending on the lender, loan program, and individual circumstances.*

Loan Repayment and Management

Successfully navigating student loan repayment requires understanding the various repayment options and developing effective management strategies. This section will explore sample repayment schedules, debt management techniques, and debt consolidation options to help you effectively address your student loan debt.

Understanding your repayment options is crucial for managing your student loans effectively. Different repayment plans offer varying monthly payments and overall repayment periods, impacting the total interest paid. Choosing the right plan depends on your individual financial circumstances and goals.

Sample Repayment Schedule

The following table illustrates a sample repayment schedule for a $50,000 student loan at a 5% annual interest rate, amortized over 10 years. This is a simplified example and does not include any potential fees or changes in interest rates. Actual repayment amounts may vary.

| Year | Beginning Balance | Payment (approx.) | Interest Paid (approx.) | Principal Paid (approx.) | Ending Balance |

|---|---|---|---|---|---|

| 1 | $50,000.00 | $6,102.10 | $2,500.00 | $3,602.10 | $46,397.90 |

| 2 | $46,397.90 | $6,102.10 | $2,319.90 | $3,782.20 | $42,615.70 |

| 3 | $42,615.70 | $6,102.10 | $2,130.79 | $3,971.31 | $38,644.39 |

| 4 | $38,644.39 | $6,102.10 | $1,932.22 | $4,170.00 | $34,474.39 |

| 5 | $34,474.39 | $6,102.10 | $1,723.72 | $4,378.38 | $30,096.01 |

| 6 | $30,096.01 | $6,102.10 | $1,504.80 | $4,597.30 | $25,498.71 |

| 7 | $25,498.71 | $6,102.10 | $1,274.94 | $4,827.16 | $20,671.55 |

| 8 | $20,671.55 | $6,102.10 | $1,033.58 | $5,068.52 | $15,603.03 |

| 9 | $15,603.03 | $6,102.10 | $780.15 | $5,321.95 | $10,281.08 |

| 10 | $10,281.08 | $6,102.10 | $514.05 | $5,588.05 | $0.00 |

Strategies for Managing Student Loan Debt

Effective student loan debt management involves proactive planning and consistent effort. Several strategies can significantly improve your ability to repay your loans efficiently and minimize long-term costs.

- Create a Budget: Track your income and expenses to identify areas where you can reduce spending and allocate more funds towards loan repayment.

- Prioritize High-Interest Loans: Focus on paying down loans with the highest interest rates first to minimize the total interest paid over time. This is often referred to as the avalanche method.

- Explore Repayment Plans: Investigate different repayment plans offered by your loan servicer, such as income-driven repayment plans, which adjust your monthly payments based on your income and family size.

- Automate Payments: Set up automatic payments to ensure consistent and timely repayments, avoiding late fees and negative impacts on your credit score.

- Increase Payments When Possible: Making extra payments, even small amounts, can significantly reduce the overall repayment time and interest paid.

Debt Consolidation Options

Debt consolidation involves combining multiple loans into a single loan with potentially more favorable terms. This can simplify repayment and potentially lower your monthly payments or interest rate. However, it’s crucial to carefully consider the terms of any consolidation loan before proceeding.

- Federal Direct Consolidation Loan: This option combines multiple federal student loans into a single federal loan. It simplifies repayment but may not necessarily lower your interest rate.

- Private Consolidation Loan: Private lenders offer consolidation loans that can combine federal and/or private student loans. These loans may offer lower interest rates than your existing loans, but they typically come with stricter eligibility requirements.

- Balance Transfer Credit Card: While not strictly a consolidation loan, a balance transfer credit card can be used to pay off student loans, particularly if it offers a 0% introductory APR period. However, it’s important to pay off the balance before the promotional period ends to avoid high interest charges.

Student Loan Forgiveness Programs

Navigating the complex landscape of student loan repayment can be daunting. Fortunately, several federal programs offer pathways to loan forgiveness, providing relief to borrowers who meet specific criteria. Understanding these programs and their eligibility requirements is crucial for effective debt management.

Student loan forgiveness programs aim to alleviate the burden of student loan debt for specific groups of borrowers. These programs generally offer partial or complete loan forgiveness based on factors like employment in public service, income level, or loan type. However, it’s important to understand that these programs often have stringent eligibility requirements and may take years to complete. Careful consideration of the benefits and drawbacks is essential before relying on these programs for debt elimination.

Eligibility Criteria for Various Student Loan Forgiveness Programs

Eligibility for student loan forgiveness programs varies significantly depending on the specific program. For example, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under an income-driven repayment (IDR) plan while working full-time for a qualifying government or non-profit organization. Other programs, such as Teacher Loan Forgiveness, target specific professions and have their own unique requirements. The details of each program, including income limits and employment criteria, are carefully defined by the federal government and are subject to change. It’s crucial to consult the official government websites for the most up-to-date and accurate information.

Benefits and Drawbacks of Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust monthly payments based on your income and family size. A key benefit is lower monthly payments, making repayment more manageable for borrowers with limited income. However, a significant drawback is that IDR plans typically extend the repayment period, leading to potentially higher total interest paid over the life of the loan. Furthermore, remaining loan balances after the repayment period may be forgiven, but this forgiveness is considered taxable income. For example, a borrower with a $50,000 loan balance forgiven under an IDR plan might face a significant tax liability on that amount. Careful consideration of the long-term financial implications is essential.

Public Service Loan Forgiveness (PSLF) Application Process

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on Direct Loans after 120 qualifying monthly payments under an income-driven repayment plan while employed full-time by a qualifying government or non-profit organization. The application process involves several steps, including consolidating federal student loans into a Direct Consolidation Loan if necessary, certifying employment with a qualifying employer, and submitting an Employment Certification Form annually. A crucial aspect is ensuring that your payments consistently meet the requirements for PSLF. Failing to make timely payments or choosing the wrong repayment plan can significantly delay or even jeopardize loan forgiveness. Detailed instructions and forms are available on the official Federal Student Aid website. Thorough review and adherence to the program’s guidelines are critical for successful application and loan forgiveness.

Understanding Interest Rates and Fees

Navigating the world of student loans requires a clear understanding of interest rates and associated fees. These factors significantly impact the total cost of your education, influencing your monthly payments and overall debt burden. Understanding these components empowers you to make informed decisions and plan effectively for repayment.

Student loan interest rates are determined by several factors. The primary factor is the type of loan. Federal student loans generally have fixed interest rates set by the government, while private student loans often have variable rates that fluctuate with market conditions. Your creditworthiness also plays a role; borrowers with strong credit histories may qualify for lower rates. The prevailing economic climate and the overall market interest rates influence both federal and private loan rates. Finally, the loan term (length of the repayment period) can also affect the interest rate; longer repayment terms might come with slightly higher rates.

Interest Rate Calculation

The interest rate determines the percentage of your loan principal that accrues as interest over time. This interest is usually calculated daily on the outstanding loan balance. The formula for simple interest is: Interest = Principal x Rate x Time. However, student loans typically use compound interest, meaning interest accrues on both the principal and previously accrued interest, leading to a larger total interest paid over the life of the loan.

Common Student Loan Fees

Several fees can be associated with student loans. Origination fees are charged by the lender to process and issue the loan. These fees can be deducted from the loan amount upfront or added to the principal. Late payment fees are incurred if you miss a payment. These fees can vary depending on the lender and loan type. Some lenders may also charge prepayment penalties if you pay off your loan early. Finally, there may be fees associated with loan consolidation or deferment.

Impact of Interest Rates on Total Loan Cost

The following table illustrates how different interest rates affect the total cost of a student loan over various repayment periods. These are illustrative examples and actual costs can vary depending on the specific loan terms and lender.

| Loan Amount | Interest Rate | Repayment Period (Years) | Total Interest Paid |

|---|---|---|---|

| $10,000 | 5% | 10 | $2,580 |

| $10,000 | 7% | 10 | $3,670 |

| $20,000 | 5% | 10 | $5,160 |

| $20,000 | 7% | 15 | $10,200 |

Financial Aid and Scholarships

Securing funding for higher education often involves navigating a complex landscape of financial aid options. Understanding the differences between grants, scholarships, and student loans is crucial for making informed decisions and maximizing your financial resources. This section will clarify these distinctions and provide guidance on accessing available funds.

Grants, scholarships, and loans represent distinct forms of financial aid, each with its own characteristics and implications. Grants are essentially free money awarded based on financial need or merit. Scholarships are also awarded based on merit, academic achievement, or specific criteria set by the awarding institution or organization. Unlike grants and scholarships, student loans require repayment with interest after graduation or the completion of studies.

Types of Financial Aid

Grants, scholarships, and loans are all valuable tools for funding higher education, but they differ significantly in their terms and conditions. Grants are typically awarded based on demonstrated financial need, assessed through the Free Application for Federal Student Aid (FAFSA). They don’t need to be repaid. Scholarships, on the other hand, are often awarded based on academic merit, athletic ability, or other specific criteria. These too are generally not required to be repaid. Student loans, in contrast, are borrowed funds that must be repaid with interest, typically over a set period. Failing to repay student loans can have serious financial consequences.

Resources for Finding Scholarships and Grants

Numerous resources exist to help students identify and apply for scholarships and grants. The federal government, through agencies like the Department of Education, offers various grant programs. Many colleges and universities also have their own scholarship programs for both incoming and current students. Private organizations, foundations, and corporations also offer a wide range of scholarships based on various criteria. Online scholarship search engines can aggregate listings from various sources, simplifying the search process. Examples include Fastweb, Scholarships.com, and Peterson’s. Directly contacting the financial aid office at your chosen institution is also highly recommended, as they often have a wealth of information on available funding opportunities.

Creating a Budget that Incorporates Student Loan Payments

Budgeting is essential for managing finances effectively, especially when incorporating student loan payments. A realistic budget should account for all income and expenses. Start by listing all sources of income, such as part-time jobs, grants, scholarships, and any other financial aid. Then, list all expenses, including tuition, housing, food, transportation, books, and entertainment. Finally, include your estimated monthly student loan payment. A useful tool is a spreadsheet or budgeting app to track income and expenses, and to project your future financial situation. For example, if your monthly income is $2000 and your expenses, including a $300 student loan payment, total $1800, you have $200 left for savings or other discretionary spending. Regularly reviewing and adjusting your budget is vital to ensure it remains aligned with your financial circumstances. Remember that unexpected expenses may arise, so building a small emergency fund is also advisable.

Defaulting on Student Loans

Defaulting on student loans is a serious financial event with far-reaching consequences. It occurs when a borrower fails to make payments for a specific period, typically 270 days. The repercussions extend beyond impacting credit scores; they can significantly hinder future financial opportunities.

Defaulting on your student loans can have severe consequences that affect your financial life for years to come. These consequences can include wage garnishment, tax refund offset, difficulty obtaining credit, and even legal action. Understanding these risks is crucial for responsible loan management.

Consequences of Student Loan Default

Defaulting on student loans triggers a cascade of negative effects. Your credit score will plummet, making it challenging to secure loans for a car, house, or even a credit card in the future. The government may garnish your wages, seizing a portion of your earnings to repay the debt. Your tax refunds can also be seized to offset the loan balance. Furthermore, your ability to obtain employment in certain fields may be affected, as some employers conduct credit checks. In some cases, legal action may be taken to recover the outstanding debt. The longer the default persists, the more severe these consequences become.

Options for Borrowers Facing Loan Default

Several options exist for borrowers facing imminent default. Before reaching default, proactive measures are essential. Contacting your loan servicer to discuss repayment options is a critical first step. They may offer options like income-driven repayment plans, which adjust your monthly payments based on your income and family size. Deferment or forbearance might also be available, temporarily suspending payments under specific circumstances. Consolidation could simplify repayment by combining multiple loans into one. If you are already in default, rehabilitation might be an option. This involves making nine on-time payments within 20 days of the due date to restore your loan to good standing.

Resources for Borrowers Struggling with Student Loan Repayment

Several resources are available to assist borrowers struggling with student loan repayment. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, providing guidance on budgeting and debt management strategies. The Student Loan Borrower Assistance website provides information and resources on various student loan programs and repayment options. Your loan servicer is another valuable resource, offering personalized support and information about available repayment plans and programs. Additionally, many colleges and universities have financial aid offices that can offer guidance and support to students struggling with loan repayment. Seeking professional help from a financial advisor can provide a personalized strategy for managing student loan debt effectively.

Impact of Student Loans on Future Finances

Student loan debt can significantly impact your financial future, extending far beyond your graduation date. Understanding these long-term implications is crucial for responsible financial planning and achieving your long-term goals. The weight of student loan repayments can affect major life decisions and your overall financial well-being for years to come.

The presence of student loan debt can influence various aspects of your financial life. Repayments represent a recurring monthly expense that directly reduces disposable income. This can limit your ability to save for retirement, invest in other opportunities, or handle unexpected financial emergencies. The longer the repayment period, the more interest accrues, increasing the overall cost of your education.

Student Loan Debt and Credit Scores

Student loan debt directly impacts your credit score. On-time payments demonstrate responsible borrowing behavior, positively influencing your creditworthiness. Conversely, missed or late payments negatively affect your credit score, making it harder to obtain loans, mortgages, or even rent an apartment in the future. A lower credit score translates to higher interest rates on future loans, perpetuating a cycle of debt. Maintaining a good payment history is paramount for protecting your credit health. For example, consistently making your monthly student loan payments on time can significantly improve your credit score, potentially saving you thousands of dollars in interest on future loans like a mortgage.

Planning Major Life Events with Student Loan Debt

Managing student loan debt while planning significant life events like buying a house or starting a family requires careful financial planning and budgeting. Creating a realistic budget that incorporates loan repayments is essential. Exploring different repayment plans, such as income-driven repayment, can help manage monthly expenses and free up funds for other priorities. For instance, a couple planning to buy a house might need to prioritize paying down their student loans to improve their credit score and qualify for a better mortgage interest rate. Similarly, parents expecting a child may need to adjust their repayment plan to accommodate the increased financial responsibilities. Effective budgeting and prioritizing debt reduction are vital strategies for achieving these life goals despite existing student loan debt.

Ending Remarks

Securing a higher education is a significant investment, and understanding student loans is paramount to making this investment work for you. By carefully considering the different loan types, understanding the application processes, and developing effective repayment strategies, you can mitigate the financial burden of student loan debt and build a solid foundation for your future financial success. Remember, proactive planning and informed decision-making are key to navigating this crucial aspect of your educational journey.

Expert Answers

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage to your credit score, and eventually, loan default. Contact your loan servicer immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I refinance my student loans?

Yes, refinancing can lower your interest rate and monthly payment, but it often involves switching from federal to private loans, potentially losing federal protections like income-driven repayment plans.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during certain deferment periods. Unsubsidized loans accrue interest from the time the loan is disbursed.

How do I find scholarships?

Numerous online resources like Fastweb, Scholarships.com, and the College Board website offer scholarship search tools. Check with your college’s financial aid office as well.