Navigating the complexities of student loan repayment can feel daunting, especially when understanding the nuances of subsidized loans. This guide delves into the intricacies of interest on subsidized student loans, providing clarity on how it accrues, the factors influencing rates, and strategies for effective management. We’ll explore the impact on long-term financial planning and examine relevant government policies. Understanding these aspects empowers borrowers to make informed decisions and achieve their financial goals.

From the difference between subsidized and unsubsidized loans to the long-term implications of interest capitalization, we aim to provide a comprehensive resource for anyone seeking to navigate the landscape of subsidized student loan debt. We’ll cover practical strategies for minimizing interest payments, exploring various repayment plans and offering valuable resources to assist you throughout the repayment process.

Understanding Subsidized Student Loan Interest

Navigating the world of student loans can be complex, particularly when differentiating between subsidized and unsubsidized loans. Understanding the nuances of interest accrual is crucial for responsible loan management and minimizing long-term costs. This section will clarify the key differences between subsidized and unsubsidized federal student loans, explain how interest accrues on subsidized loans under specific circumstances, compare interest rates across various loan programs, and illustrate the impact of interest capitalization on the total loan amount.

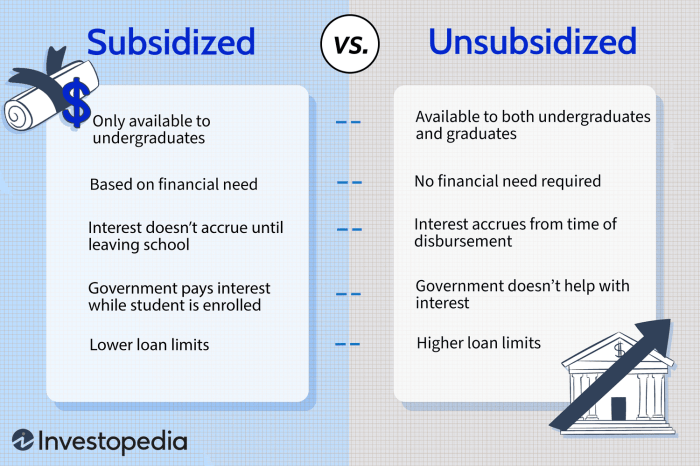

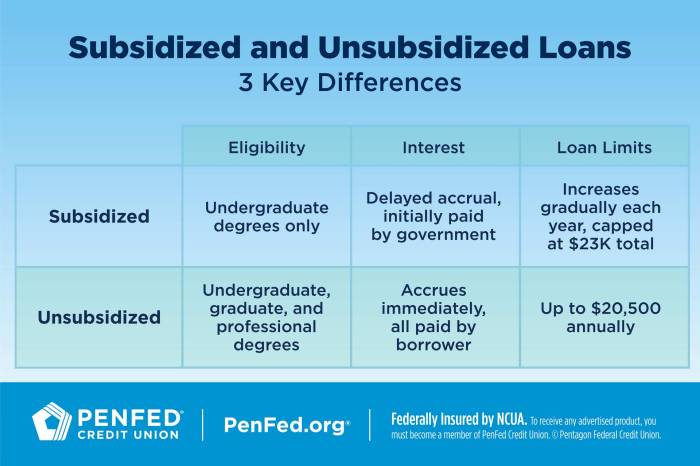

Subsidized and unsubsidized federal student loans are both designed to help students finance their education, but they differ significantly in how interest is handled. Subsidized loans are need-based, meaning your eligibility depends on your demonstrated financial need as determined by the Free Application for Federal Student Aid (FAFSA). Unsubsidized loans, on the other hand, are not need-based and are available to all eligible students regardless of their financial situation.

Interest Accrual on Subsidized Loans During Deferment or Forbearance

During periods of deferment or forbearance, the government pays the interest on subsidized loans. This means that interest does not accrue while your loan is in deferment or forbearance, and you do not need to make payments. This is a key advantage of subsidized loans compared to unsubsidized loans, where interest continues to accrue even during deferment or forbearance, leading to a larger loan balance upon repayment. It’s important to note that deferment and forbearance options are available for both subsidized and unsubsidized loans, but the interest implications differ significantly.

Comparison of Subsidized Loan Interest Rates Across Different Loan Programs

Interest rates for subsidized federal student loans vary depending on the loan program and the year the loan was disbursed. For example, Direct Subsidized Loans, offered under the Federal Direct Loan Program, typically have lower interest rates than other federal student loan programs. The interest rate is fixed for the life of the loan. The specific rate depends on the loan’s disbursement date and is set annually by the federal government. While precise historical data would require referencing official government sources like the Federal Student Aid website, it’s safe to say that rates have fluctuated over the years, generally remaining relatively low compared to other forms of borrowing.

Interest Capitalization and its Impact on Total Loan Amount

Interest capitalization occurs when accrued but unpaid interest is added to the principal loan balance. This increases the principal amount on which future interest is calculated, leading to a larger overall loan balance. For subsidized loans, capitalization typically happens when the loan enters repayment or if the deferment or forbearance period ends without the interest being paid.

For example, let’s imagine a student with a $10,000 subsidized loan. If they defer repayment for two years and interest accrues at 4% annually, the interest will be paid by the government during the deferment period. However, if they then enter repayment, that accrued interest could be capitalized, increasing the principal amount. This would result in a higher monthly payment and a greater total amount paid over the life of the loan. The longer the deferment period, the greater the impact of capitalization.

Factors Influencing Interest Rates on Subsidized Loans

Several key factors interact to determine the interest rate you’ll pay on your subsidized federal student loan. Understanding these factors can help you better manage your borrowing and repayment. These rates are set annually by Congress and are generally fixed for the life of the loan.

The most significant factor is the prevailing federal interest rate. This rate, established by the government, serves as a benchmark for all federal student loans, including subsidized ones. The government uses various economic indicators to set this rate, aiming to strike a balance between affordability for students and responsible fiscal policy. Fluctuations in the broader economy and government borrowing costs significantly influence this benchmark rate.

Federal Interest Rate’s Impact on Borrowers

Changes in the federal interest rate directly impact the interest rate on subsidized student loans. When the federal rate rises, so too does the interest rate on new subsidized loans. Conversely, a decrease in the federal rate leads to lower interest rates on new loans. For example, if the federal rate increases by 1%, a borrower taking out a new subsidized loan will see a corresponding increase in their interest rate. This increase affects the total amount they will repay over the loan’s lifespan, although the existing loan’s interest rate will remain unchanged.

Credit History’s Influence (or Lack Thereof)

Unlike many private student loans, subsidized federal student loans do not consider the borrower’s credit history when determining the interest rate. This means that students with poor credit or no credit history will receive the same interest rate as those with excellent credit. This is a key advantage of federal subsidized loans, making them accessible to all students regardless of their financial background.

Interest Rate Comparison Across Lending Institutions (Not Applicable)

It’s important to note that subsidized federal student loans are offered by the government, not private lending institutions. Therefore, a direct comparison of interest rates across different lenders is not applicable. All subsidized federal student loans issued in a given year will have the same interest rate, based on the federally determined rate for that year. Private student loans, on the other hand, are offered by various banks and credit unions and *do* factor in the borrower’s creditworthiness, resulting in variable interest rates.

Managing Interest on Subsidized Student Loans

Effectively managing subsidized student loan interest is crucial for minimizing overall debt and long-term financial burden. Understanding the various strategies and available resources can significantly impact your repayment journey. This section Artikels practical steps and tools to help you navigate this process successfully.

Minimizing Subsidized Student Loan Interest Payments: A Step-by-Step Guide

Minimizing interest payments involves proactive strategies implemented throughout your loan’s lifespan. The following steps provide a structured approach to achieving this goal.

- Understand Your Loan Terms: Carefully review your loan documents to understand your interest rate, repayment terms, and any applicable fees. Knowing these details empowers you to make informed decisions about repayment.

- Explore Repayment Plan Options: Different repayment plans offer varying monthly payments and total interest paid over the life of the loan. Research options like standard, extended, graduated, and income-driven repayment plans to determine the best fit for your financial situation. Consider the long-term implications of each plan, weighing lower monthly payments against higher total interest.

- Make Extra Payments: Whenever possible, make extra payments beyond your minimum monthly amount. Even small additional payments can significantly reduce your principal balance and the total interest accrued over time. Focus on paying down the highest-interest loans first.

- Refinance Your Loans (If Applicable): If interest rates have fallen since you took out your loans, refinancing could lower your monthly payments and total interest paid. However, carefully compare offers from multiple lenders and ensure the terms are favorable before refinancing.

- Consolidate Your Loans (If Applicable): Consolidating multiple loans into a single loan can simplify repayment and potentially lower your monthly payment. However, this might not always result in lower total interest paid, so weigh the pros and cons carefully.

Comparison of Repayment Plans and Their Impact on Total Interest Paid

The choice of repayment plan significantly affects the total interest paid. This table illustrates a comparison, using hypothetical examples for illustrative purposes. Actual figures will vary based on individual loan terms and interest rates.

| Repayment Plan | Monthly Payment (Example) | Loan Term (Example) | Total Interest Paid (Example) |

|---|---|---|---|

| Standard | $300 | 10 years | $3,000 |

| Extended | $200 | 20 years | $6,000 |

| Graduated | $200 (increasing annually) | 10 years | $4,000 |

| Income-Driven | Variable (based on income) | 20-25 years | Variable (potentially high) |

Strategies for Effective Management of Subsidized Student Loan Debt

Effective debt management involves a combination of proactive strategies and consistent monitoring.

- Budgeting and Financial Planning: Create a detailed budget to track income and expenses, ensuring sufficient funds for loan repayments. Include loan payments as a non-negotiable expense.

- Automatic Payments: Set up automatic payments to avoid missed payments and late fees, which can negatively impact your credit score.

- Regular Monitoring: Regularly check your loan balance and payment history online to ensure accuracy and identify any potential issues.

- Financial Counseling: Consider seeking professional financial counseling for personalized guidance and support in managing your student loan debt.

Resources for Borrower Assistance with Loan Repayment

Several resources offer support and guidance for managing student loan repayment.

- Federal Student Aid Website: Provides comprehensive information on federal student loans, repayment plans, and available assistance programs.

- National Foundation for Credit Counseling (NFCC): Offers free and low-cost credit counseling services, including assistance with student loan debt management.

- Your Loan Servicer: Your loan servicer can provide information about your loan terms, repayment options, and available hardship programs.

The Impact of Subsidized Loan Interest on Long-Term Financial Planning

Subsidized student loans, while offering a crucial pathway to higher education, can significantly influence long-term financial well-being if not managed effectively. The interest accrued, even if deferred during schooling, ultimately impacts a borrower’s ability to achieve major financial goals, such as purchasing a home or securing a comfortable retirement. Understanding this impact is crucial for making informed financial decisions throughout life.

The accumulation of interest on subsidized student loans directly affects a borrower’s long-term financial goals. For instance, a larger loan balance due to accumulated interest reduces the amount available for a down payment on a house, potentially delaying homeownership or necessitating a smaller, less desirable property. Similarly, the added debt from interest payments can limit contributions to retirement savings plans, leading to a smaller nest egg upon retirement. The longer it takes to repay the loans, the more interest accrues, compounding the problem and potentially reducing the overall quality of life in later years.

Subsidized Loan Interest and Homeownership

High student loan debt, inflated by accumulated interest, can severely restrict a borrower’s ability to qualify for a mortgage. Lenders consider the debt-to-income ratio (DTI) a critical factor in loan approval. A high DTI, largely influenced by significant student loan payments, may prevent loan approval or result in higher interest rates on the mortgage itself, increasing the overall cost of homeownership. For example, an individual with $50,000 in student loan debt, after accruing significant interest, may find it difficult to secure a mortgage compared to someone with a significantly lower debt burden. The larger monthly student loan payment directly reduces the amount available for mortgage payments, impacting affordability and eligibility.

Subsidized Loan Interest and Retirement Planning

Student loan debt, including the impact of accrued interest, directly competes with retirement savings. Money allocated to monthly loan payments is money that cannot be invested in retirement accounts like 401(k)s or IRAs. This lost investment potential, compounded over time, can significantly reduce the size of a retirement nest egg. For instance, consider two individuals: one with minimal student loan debt and the other with substantial debt including accrued interest. Over 30 years, the difference in retirement savings between these two individuals could be substantial, potentially impacting their retirement lifestyle significantly. The earlier a borrower starts aggressively paying down student loans, the sooner they can redirect funds towards retirement investments.

Consequences of Defaulting on Subsidized Student Loans

Defaulting on subsidized student loans carries severe financial consequences. A default results in a significant negative impact on credit scores, making it extremely difficult to obtain future loans (mortgages, auto loans, credit cards). Furthermore, the government may garnish wages, seize tax refunds, or even take legal action to recover the debt. This can lead to financial instability and significant hardship, impacting all aspects of long-term financial planning. The damage to credit scores can persist for years, even decades, making it extremely challenging to rebuild financial stability.

Budgeting and Financial Literacy in Managing Student Loan Debt

Effective budgeting and strong financial literacy are paramount in managing student loan debt and minimizing the long-term impact of interest. Creating a realistic budget that prioritizes loan repayment allows borrowers to allocate funds effectively. Financial literacy education equips borrowers with the knowledge to understand repayment options, explore strategies for debt reduction, and make informed financial decisions to mitigate the long-term effects of student loan interest. Understanding concepts like amortization schedules and interest capitalization helps borrowers make proactive choices to minimize the overall cost of borrowing. Utilizing free resources available from non-profit organizations and government agencies can further improve financial literacy and debt management skills.

Government Policies and Subsidized Student Loan Interest

Government policies significantly influence the cost and availability of subsidized student loans. These policies, shaped by economic conditions and political priorities, have a direct and lasting impact on borrowers. Understanding the historical context and potential future changes is crucial for anyone considering or currently managing subsidized student loans.

The history of government involvement in student lending reveals a gradual expansion of programs designed to make higher education more accessible. Initially, programs were smaller and more targeted. Over time, they evolved into the large-scale federal loan programs we see today. This expansion has been driven by a desire to increase educational attainment and boost the nation’s skilled workforce. However, this growth has also led to concerns about rising student debt levels and the long-term sustainability of these programs.

The Evolution of Subsidized Student Loan Interest Rate Policies

The interest rates on subsidized federal student loans haven’t remained static. They’ve fluctuated based on several factors, including prevailing market interest rates and specific legislative actions. Early subsidized loan programs often had fixed, relatively low interest rates. However, more recent programs have incorporated variable rates tied to market indices, leading to greater uncertainty for borrowers. This shift reflects a broader trend toward market-based pricing in government lending programs. The change from fixed to variable rates has introduced more risk for borrowers, making it harder to accurately predict the total cost of their education.

Potential Impact of Future Policy Changes on Borrowers

Future policy changes could significantly alter the landscape of subsidized student loan interest. For example, increased government funding could lead to lower interest rates or even loan forgiveness programs. Conversely, budget constraints could result in higher interest rates, reduced loan amounts, or stricter eligibility criteria. These changes could disproportionately affect low-income borrowers or those pursuing specific fields of study. A hypothetical example would be a policy change that increases interest rates for certain fields deemed less essential to the national economy, potentially making those degrees more expensive.

Benefits and Drawbacks of Different Government Policies

Different government policies related to subsidized student loan interest present both advantages and disadvantages. Policies that keep interest rates low, for example, make education more affordable and accessible, promoting social mobility. However, these policies can increase the overall cost to taxpayers. Conversely, policies that raise interest rates might reduce the government’s financial burden, but could limit access to higher education for some individuals. A policy that offers income-based repayment plans could reduce the burden on borrowers, but may lead to a longer repayment period. Finding the right balance between affordability and fiscal responsibility is a constant challenge for policymakers.

Timeline of Significant Changes in Subsidized Student Loan Interest Rates and Policies

Tracking the changes in subsidized student loan interest rates and associated policies requires examining legislative actions and market fluctuations. A detailed timeline would include specific years and corresponding legislative acts impacting rates and eligibility. For example, it would include information on the shift from fixed to variable rates, changes to income-based repayment plans, and the creation or modification of loan forgiveness programs. Such a timeline would clearly illustrate the dynamic nature of these policies and their impact on borrowers over time.

Last Point

Effectively managing interest on subsidized student loans requires a proactive approach, combining understanding with strategic planning. By carefully considering the factors that influence interest rates, exploring different repayment options, and utilizing available resources, borrowers can significantly reduce their overall debt burden and pave the way for a secure financial future. Remember that proactive planning and financial literacy are key to successfully navigating this crucial aspect of higher education financing.

Answers to Common Questions

What happens to the interest on my subsidized loan while I’m in school?

The government pays the interest on subsidized loans while you’re enrolled at least half-time or during a grace period.

Can I refinance my subsidized student loans?

Yes, you can refinance subsidized federal student loans with a private lender. However, this will often mean losing federal protections.

What is interest capitalization?

Interest capitalization is when unpaid interest is added to your principal loan balance, increasing the total amount you owe.

What happens if I default on my subsidized student loans?

Defaulting can result in wage garnishment, tax refund offset, and damage to your credit score, making it harder to obtain loans or credit in the future.

Are there income-driven repayment plans for subsidized loans?

Yes, several income-driven repayment plans are available for federal student loans, including subsidized loans, adjusting your monthly payments based on your income and family size.