Navigating the complexities of student loan repayment can feel daunting, especially when grappling with the often-overlooked yet significant aspect: interest. This guide delves into the intricacies of interest paid on student loans, demystifying the calculations, factors influencing rates, and strategies for minimizing your overall cost. From understanding fixed versus variable rates to exploring various repayment plans and their impact on total interest, we aim to equip you with the knowledge needed to make informed financial decisions.

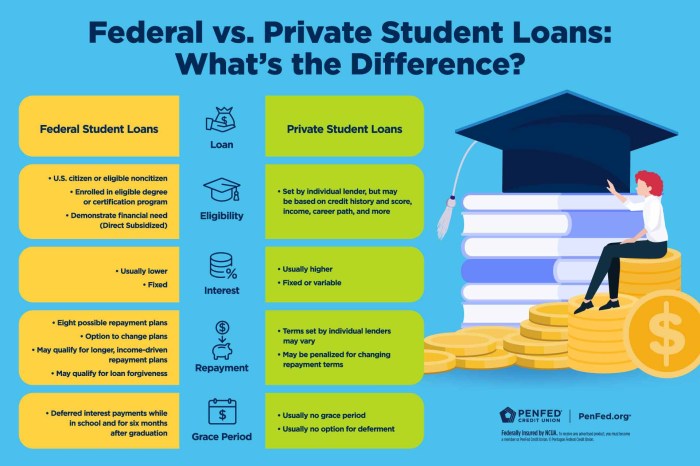

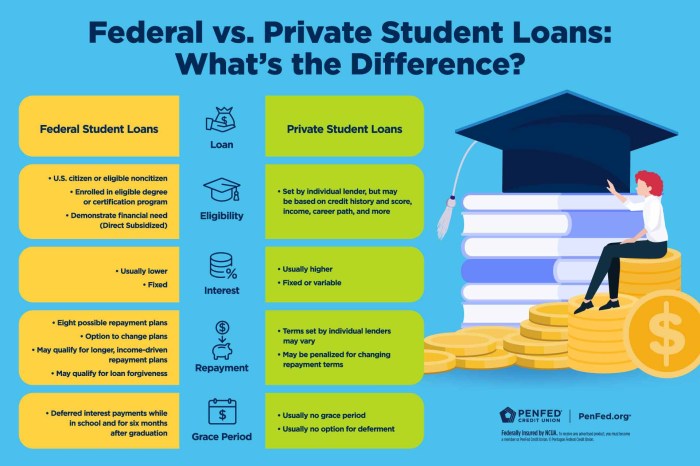

We’ll examine the various types of student loans, highlighting the differences in interest accrual methods and how these differences translate into varying total interest paid over the life of the loan. Furthermore, we will explore external factors like credit history and economic conditions, and how these influence the interest rate you’ll face. Understanding these dynamics is crucial for effective financial planning and minimizing long-term debt.

Types of Student Loan Interest

Understanding the different types of student loan interest is crucial for effective financial planning. This section will clarify the distinctions between fixed and variable rates, explain how interest accrues on various loan types, and provide illustrative examples of how these factors impact the total cost of borrowing.

Fixed versus Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s repayment period, providing predictability in monthly payments. In contrast, a variable interest rate fluctuates based on a benchmark index, such as the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payments could change over time, potentially increasing or decreasing depending on market conditions. Choosing between a fixed and variable rate depends on your risk tolerance and predictions about future interest rate movements. Generally, fixed rates offer stability, while variable rates might offer lower initial payments but carry the risk of higher payments later.

Interest Accrual Calculation Methods

The calculation of interest accrual differs slightly depending on the loan type. For subsidized federal student loans, the government pays the interest while you’re in school (under certain eligibility requirements) and during grace periods. Interest begins accruing on unsubsidized federal loans as soon as the loan is disbursed, regardless of your enrollment status. Private student loans also typically accrue interest from disbursement. The calculation itself generally uses simple interest, meaning interest is calculated on the principal balance. The formula is:

Interest = Principal x Interest Rate x Time

where ‘Time’ is expressed as a fraction of a year (e.g., 1 month = 1/12 year). The interest is then added to the principal balance, creating a new principal balance on which future interest is calculated. This is known as compounding interest. The frequency of compounding (monthly, daily, etc.) will affect the total interest paid.

Examples of Interest Accrual and Total Interest Paid

The following table illustrates how different interest rates and loan amounts affect the total interest paid over the loan term. These examples assume simple interest calculations and a consistent interest rate throughout the loan term for simplicity. In reality, the calculations are more complex and may vary depending on the loan servicer and repayment plan.

| Loan Amount | Interest Rate | Loan Term (Years) | Total Interest Paid (Approximate) |

|---|---|---|---|

| $20,000 | 5% | 10 | $5,800 |

| $30,000 | 7% | 15 | $23,850 |

| $10,000 | 4% | 5 | $2,000 |

Factors Influencing Interest Rates

Securing a student loan involves understanding the factors that determine the interest rate you’ll pay. These rates directly impact the total cost of your education, so it’s crucial to be informed. Several key elements influence the interest rate a lender offers.

Several factors contribute to the final interest rate on your student loan. These factors are assessed by lenders to determine the level of risk associated with lending you money. A higher perceived risk generally translates to a higher interest rate.

Credit History’s Impact on Student Loan Interest Rates

Your credit history plays a significant role in determining your student loan interest rate. Lenders view a strong credit history – characterized by on-time payments, low credit utilization, and no history of defaults – as an indicator of responsible financial behavior. Individuals with excellent credit scores typically qualify for lower interest rates, reflecting the lender’s reduced risk. Conversely, a poor credit history, including late payments or bankruptcies, can result in higher interest rates or even loan denial. The impact of credit history is particularly pronounced for private student loans, which often rely more heavily on creditworthiness assessments than federal loans.

Other Factors Considered by Lenders

Beyond credit history, lenders consider several other factors when setting interest rates. The creditworthiness of a co-signer, if one is involved, significantly influences the interest rate. A co-signer with a strong credit history can help secure a lower rate, even if the borrower has limited or poor credit. The type of loan itself impacts the interest rate; federal loans often have lower, fixed rates compared to private loans, which may offer variable rates and higher interest. Finally, the chosen repayment plan can indirectly affect the overall cost. While the initial interest rate might remain the same, opting for a longer repayment period will lead to higher total interest paid over the life of the loan.

The Influence of Prevailing Economic Conditions

Economic conditions exert a considerable influence on student loan interest rates. Interest rates are generally tied to broader market interest rates. When the Federal Reserve raises interest rates to combat inflation, for example, this typically leads to higher interest rates across the board, including student loans. Conversely, during periods of low inflation and economic uncertainty, the Federal Reserve might lower interest rates, potentially resulting in lower student loan interest rates. These changes often reflect the cost of borrowing for the lender and the overall risk in the financial market. For instance, during the 2008 financial crisis, many lenders tightened lending standards and increased interest rates due to heightened economic uncertainty.

Interest Capitalization

Interest capitalization is a process where accrued but unpaid interest on a student loan is added to the principal loan amount. This effectively increases the total amount you owe, leading to higher overall loan costs. Understanding how this works is crucial for effective student loan management.

Interest capitalization occurs when your loan enters a period of deferment or forbearance. During these periods, you are not required to make payments on your loan. However, interest continues to accrue. Instead of remaining separate, this accumulated interest is added to your principal balance, thus increasing the amount on which future interest is calculated. This creates a snowball effect, making the loan more expensive over time.

Interest Capitalization’s Impact on Loan Amount

Let’s illustrate how interest capitalization increases the total cost of a student loan with a step-by-step example. Imagine you have a $10,000 student loan with a 5% annual interest rate. If you enter a one-year deferment period, the interest accrued would be $500 ($10,000 x 0.05). After the deferment, your principal balance would no longer be $10,000 but $10,500. Future interest calculations will now be based on this higher amount. Subsequently, the interest for the following year would be calculated on $10,500, resulting in a larger interest payment than if capitalization hadn’t occurred. This cycle continues as long as periods of deferment or forbearance are utilized, compounding the debt.

Long-Term Financial Implications of Interest Capitalization

Consider a scenario where a student borrows $20,000 for their education with a 6% interest rate. They graduate and enter a repayment plan, but due to unforeseen circumstances, they need to utilize a 2-year deferment period. During this period, interest accrues and is capitalized. After the deferment, their principal balance significantly increases. Let’s assume the interest capitalized during the deferment is $2,400. Their new principal balance becomes $22,400. The interest accruing on this larger amount will now be considerably higher than if the interest had not been capitalized. The longer the deferment period, and the higher the interest rate, the more substantial the impact on the total loan cost will be. This can lead to a much larger total repayment amount and extend the repayment period, impacting their financial stability for years to come. The extra interest paid due to capitalization represents a significant increase in the overall cost of the loan. For example, in this scenario, the additional $2,400 is not just added to the initial loan amount; it also generates further interest over the repayment period, substantially increasing the total amount paid.

Repayment Plans and Interest

Choosing the right student loan repayment plan significantly impacts the total interest you’ll pay over the life of your loan. Understanding the differences between various plans and employing smart strategies can save you thousands of dollars. This section will explore how different repayment options affect your monthly payments, repayment duration, and overall interest costs.

Comparison of Repayment Plan Impacts on Interest

Different repayment plans offer varying monthly payment amounts and loan terms, directly influencing the total interest accrued. Standard repayment plans typically involve fixed monthly payments over a 10-year period. Extended repayment plans stretch the repayment period, lowering monthly payments but increasing the total interest paid due to the longer repayment timeline. Income-driven repayment (IDR) plans tie monthly payments to your income, resulting in potentially lower payments but often extending the repayment period considerably, leading to higher overall interest charges.

Strategies for Minimizing Interest Paid

Effective repayment planning is crucial for minimizing interest costs. One key strategy is selecting a repayment plan that balances affordability with minimizing the overall repayment time. While IDR plans offer lower monthly payments, their extended repayment periods can significantly increase total interest. Prioritizing higher payments whenever possible, even if it means some financial strain, can substantially reduce the total interest paid over the loan’s lifetime. Another effective strategy is making extra payments whenever feasible. These extra payments directly reduce the principal balance, lowering the amount of interest accrued in subsequent months. Finally, refinancing your student loans to a lower interest rate can significantly decrease your overall interest burden, though this should be carefully considered based on your credit score and financial situation.

Comparison of Total Interest Paid Under Different Repayment Plans

The following table illustrates the potential differences in total interest paid under various repayment plans, assuming a $30,000 loan at a 6% interest rate. These figures are for illustrative purposes and actual amounts will vary depending on individual loan terms and interest rates.

| Repayment Plan | Monthly Payment (Estimate) | Total Repayment Period | Total Interest Paid (Estimate) |

|---|---|---|---|

| Standard (10-year) | $330 | 10 years | $11,700 |

| Extended (25-year) | $170 | 25 years | $25,500 |

| Income-Driven (Example: 20-year) | Variable (Example: $150- $250 depending on income) | 20 years | $20,000 – $28,000 (Variable depending on income adjustments) |

Managing Student Loan Interest

Successfully navigating student loan repayment requires a proactive approach to managing interest. Understanding how interest accrues and employing strategies to minimize it can significantly reduce the overall cost of your education. This section Artikels practical methods for reducing your interest payments and offers guidance on effective budgeting to minimize your long-term debt.

Methods for Reducing Interest Payments

Lowering your student loan interest payments involves a combination of strategic financial planning and proactive actions. These actions can lead to substantial savings over the life of your loans.

Making extra payments is a simple yet effective way to reduce the principal balance faster. This, in turn, reduces the amount of interest that accrues over time. Even small, consistent extra payments can make a noticeable difference. For example, if you have a $30,000 loan at 5% interest with a 10-year repayment plan, an extra $100 per month would reduce the total interest paid by approximately $2,000 and shorten the repayment period by roughly 1.5 years.

Refinancing your student loans could potentially lower your interest rate, resulting in lower monthly payments and less interest paid overall. However, it’s crucial to carefully compare offers from different lenders to ensure you’re getting the best rate and terms. Refinancing may not always be beneficial; for instance, if you have federal loans with government benefits like income-driven repayment plans, refinancing into a private loan could forfeit these protections.

Benefits and Drawbacks of Refinancing Student Loans

Refinancing student loans presents both advantages and disadvantages that require careful consideration.

The primary benefit is the potential for a lower interest rate, leading to reduced monthly payments and significant long-term savings on interest. A lower rate can also make it easier to manage your finances and potentially free up cash flow for other priorities. For example, refinancing from a 7% interest rate to a 4% interest rate on a $50,000 loan could save thousands of dollars over the life of the loan.

However, refinancing also carries risks. You may lose access to federal loan benefits such as income-driven repayment plans or deferment options. Furthermore, the process involves a hard credit inquiry, which can temporarily lower your credit score. Finally, locking into a fixed rate could be disadvantageous if interest rates subsequently decline. It is therefore essential to weigh the potential benefits against the potential drawbacks carefully before deciding to refinance.

Budgeting and Managing Student Loan Payments

Creating a comprehensive budget is crucial for effectively managing student loan payments and minimizing interest costs. This involves a structured approach to tracking income and expenses.

First, create a detailed budget outlining all your monthly income and expenses. This should include your student loan payments, rent or mortgage, utilities, food, transportation, and other essential costs. Identify areas where you can reduce spending to allocate more funds towards your student loans.

Next, prioritize your student loan payments. Consider using automatic payments to ensure timely payments and avoid late fees, which can add to your overall costs. Explore different repayment plans offered by your lender to find one that best fits your current financial situation.

Finally, regularly review and adjust your budget as needed. Your financial circumstances may change over time, so it’s important to regularly reassess your budget and make adjustments to maintain a manageable repayment plan. Tracking your progress toward your debt reduction goals can also serve as a strong motivator. Consistent monitoring and adaptation will help ensure you stay on track and minimize the impact of interest.

Visual Representation of Interest Accrual

Understanding how student loan interest accumulates over time is crucial for effective repayment planning. Visual representations, such as graphs and charts, can significantly aid this understanding by providing a clear picture of the growth of both principal and interest. This allows borrowers to better grasp the financial implications of their loan and make informed decisions about repayment strategies.

Visualizing the growth of principal and interest over the loan term is best achieved using a line graph. The horizontal axis represents time (in months or years), and the vertical axis represents the dollar amount. Two lines are plotted: one for the outstanding principal balance and another for the cumulative interest paid. The principal line will generally decrease over time as payments are made, while the interest line will steadily increase until the loan is paid off. The steeper the slope of the interest line, the faster the interest is accumulating. For example, a graph might show a relatively flat principal line in the early years if the repayment plan focuses primarily on interest payments, followed by a steeper decline in principal as more of the payment goes toward reducing the loan balance. Conversely, an aggressive repayment plan will show a steeper decline in the principal line and a correspondingly less steep increase in the interest line.

Graph of Principal and Interest Growth

Imagine a line graph depicting the growth of principal and interest on a $20,000 student loan over 10 years with a fixed interest rate of 5%. The principal line begins at $20,000 and gradually decreases to $0 over the 10-year period, reflecting the repayment of the loan. The interest line starts at $0 and steadily increases, eventually reaching a total interest paid amount (this amount will depend on the repayment plan). The area between the two lines represents the total interest paid over the life of the loan. The graph visually demonstrates how a larger portion of early payments goes towards interest, while later payments contribute more significantly to principal reduction. The difference in the total area under the interest curve will be visually apparent when comparing different repayment plans.

Visual Illustration of Repayment Strategies

A bar chart can effectively compare the total interest paid under different repayment strategies. For instance, consider three scenarios: a standard repayment plan, an accelerated repayment plan (making larger monthly payments), and an income-driven repayment plan. Each bar represents a repayment strategy, and its height corresponds to the total interest paid over the loan’s lifetime. The bar representing the accelerated repayment plan would be significantly shorter than the standard plan, clearly demonstrating the substantial savings in interest achieved through faster repayment. The income-driven repayment plan bar would likely be the tallest, reflecting the higher total interest paid due to a longer repayment period. This visual comparison highlights the financial implications of choosing a specific repayment plan. For example, a comparison could show a standard plan resulting in $10,000 in interest, an accelerated plan in $5,000, and an income-driven plan in $15,000, immediately illustrating the financial benefits of faster repayment.

Ultimate Conclusion

Successfully managing student loan interest requires a proactive approach combining understanding, planning, and strategic action. By grasping the fundamentals of interest accrual, identifying factors influencing rates, and leveraging effective repayment strategies, you can significantly reduce the overall cost of your student loans. Remember, proactive management empowers you to navigate your repayment journey with confidence and achieve financial freedom sooner. This guide serves as a starting point – further research and consultation with financial professionals can further enhance your understanding and planning.

Question Bank

What is interest capitalization?

Interest capitalization is the process of adding accrued but unpaid interest to your principal loan balance. This increases the amount you owe and, consequently, the total interest paid over the life of the loan.

Can I deduct student loan interest from my taxes?

In some countries (like the US), you may be able to deduct a portion of the interest you paid on student loans from your federal income taxes, subject to certain limitations and income thresholds. Consult a tax professional for personalized advice.

What happens if I don’t make my student loan payments?

Failure to make student loan payments can result in delinquency, negatively impacting your credit score and potentially leading to wage garnishment or tax refund offset. Contact your loan servicer immediately if you anticipate difficulty making payments to explore options like forbearance or deferment.

How does refinancing affect my student loans?

Refinancing involves replacing your existing student loans with a new loan, often at a lower interest rate. This can save you money on interest over time, but it may also impact your eligibility for certain repayment plans or forgiveness programs. Carefully weigh the pros and cons before refinancing.