Navigating the complexities of federal student loan interest rates can feel overwhelming. Understanding these rates is crucial, however, as they significantly impact the total cost of your education and long-term financial health. This guide will demystify the process, exploring current rates, historical trends, influencing factors, and the ultimate impact on borrowers. We’ll equip you with the knowledge to make informed decisions about your student loan journey.

From the fluctuating market influences to the various loan types and repayment plans available, the information presented here aims to provide a comprehensive overview. We will analyze how government policies, economic shifts, and individual borrowing choices intertwine to shape the cost of higher education. By understanding these dynamics, you can better prepare for the financial responsibilities associated with student loans.

Current Federal Student Loan Interest Rates

Understanding current federal student loan interest rates is crucial for prospective and current borrowers. These rates directly impact the total cost of your education and the monthly payments you’ll face after graduation. The rates vary depending on the loan type and the year the loan was disbursed. It’s important to note that rates are subject to change.

Federal student loan interest rates are determined by a combination of factors, including market conditions and government policy. For many federal student loan programs, the interest rate is fixed for the life of the loan. This means that the interest rate you are initially given will not change. However, understanding how these rates are set and how they differ between loan types is essential for responsible borrowing.

Federal Student Loan Interest Rate Details

The following table provides a snapshot of current interest rates for various federal student loan programs. Remember that these rates are subject to change, and it is always best to check the official Federal Student Aid website for the most up-to-date information. This table presents a simplified view, and actual rates may vary based on loan disbursement date and other factors.

| Loan Type | Interest Rate (Fixed) | Index (if applicable) | Rate Adjustment |

|---|---|---|---|

| Direct Subsidized Loans (Undergraduate) | 5.00% (Example – check official source for current rate) | N/A | N/A |

| Direct Unsubsidized Loans (Undergraduate) | 5.00% (Example – check official source for current rate) | N/A | N/A |

| Direct PLUS Loans (Graduate Students) | 7.50% (Example – check official source for current rate) | N/A | N/A |

| Direct PLUS Loans (Parents) | 7.50% (Example – check official source for current rate) | N/A | N/A |

Note: The interest rates shown above are examples and may not reflect the current rates. Always refer to the official U.S. Department of Education website for the most accurate and current interest rate information.

Subsidized vs. Unsubsidized Loans: Interest Accrual

A key difference between subsidized and unsubsidized loans lies in how interest accrues. This impacts the total amount you will owe over the life of the loan.

With subsidized loans, the government pays the interest while you are in school at least half-time, during grace periods, and during deferment periods. This means that interest does not accumulate during these times, potentially saving you money in the long run. In contrast, with unsubsidized loans, interest begins to accrue from the moment the loan is disbursed, regardless of your enrollment status. This accumulated interest can be capitalized (added to the principal loan balance), increasing the total amount you owe.

For example, if you have a $10,000 unsubsidized loan with a 5% interest rate, and you don’t make payments during your four years of college, the interest will accumulate, resulting in a higher loan balance upon graduation. If this interest is capitalized, the final amount owed will be significantly more than the initial $10,000. Subsidized loans, on the other hand, would avoid this interest accumulation during the specified periods.

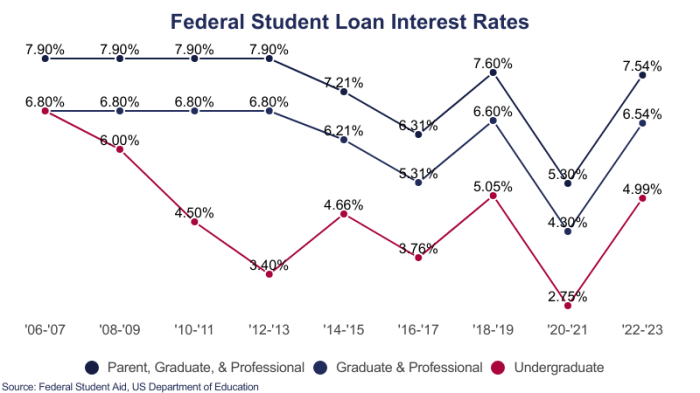

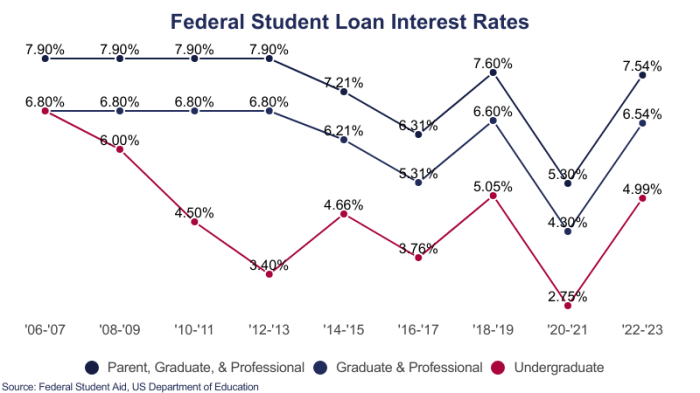

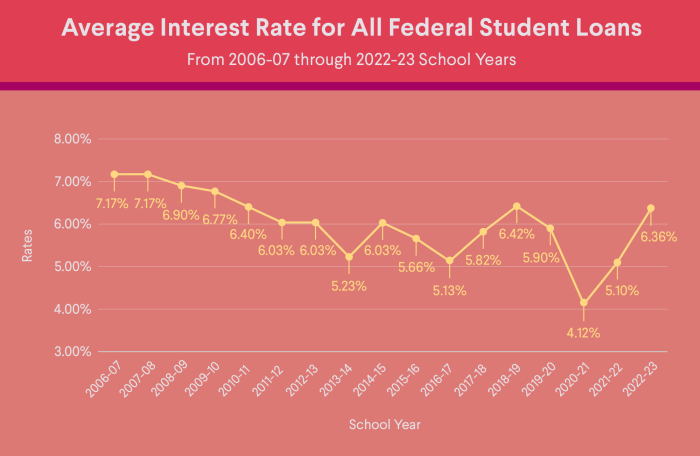

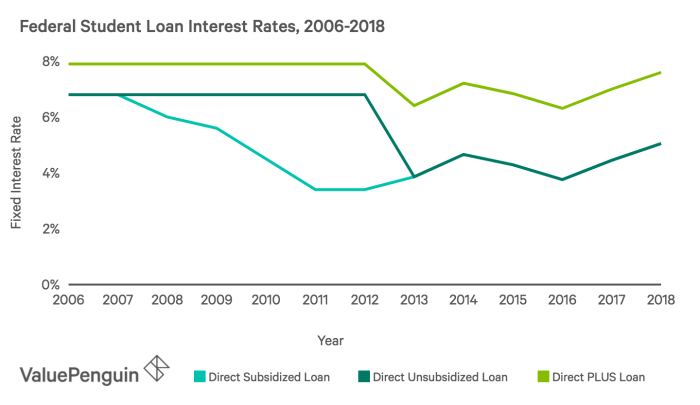

Historical Trends in Federal Student Loan Interest Rates

Understanding the historical fluctuations in federal student loan interest rates provides valuable context for current rates and helps illustrate the impact of economic conditions and government policies on student borrowing costs. Analyzing these trends reveals patterns that can inform future expectations and highlight the financial implications for borrowers.

A visual representation of federal student loan interest rates over the past two decades would show a fluctuating line graph. Imagine a graph with the years 2004-2024 on the x-axis and interest rates (as a percentage) on the y-axis. The line would demonstrate periods of both significant increases and decreases. For example, a noticeable peak might be observed around 2008-2010, corresponding to the Great Recession, followed by a period of relative stability before another increase around 2011-2013. Subsequent years might show a more moderate trend with occasional upward or downward adjustments. The graph wouldn’t show a perfectly smooth line; rather, it would reflect the dynamic nature of interest rate adjustments. A detailed quantitative analysis, beyond the scope of this textual description, would be needed to pinpoint exact percentages for each year.

Correlation Between Economic Events and Interest Rate Changes

Significant economic events and policy changes have demonstrably influenced federal student loan interest rates. The Great Recession of 2008, for instance, led to a period of generally lower interest rates across the board, including federal student loans, as the Federal Reserve implemented expansionary monetary policy to stimulate economic growth. Conversely, periods of economic expansion often see interest rates rise as the economy strengthens and inflation concerns increase. Changes in government policy, such as adjustments to the federal budget or specific legislative actions affecting student loan programs, also play a significant role. For example, legislative changes aimed at making college more affordable could potentially lead to lower interest rates or increased subsidies, while budgetary constraints might necessitate adjustments that lead to higher rates.

Interest Rate Comparisons Across Economic Periods

During periods of economic recession, like the Great Recession, interest rates on federal student loans tended to be lower than during periods of economic expansion. This is largely due to the Federal Reserve’s response to economic downturns, which often involves lowering interest rates to encourage borrowing and investment. In contrast, during periods of economic expansion, interest rates generally rise to manage inflation and maintain economic stability. This pattern is not unique to student loans; it’s a general characteristic of the broader financial market. However, the specific impact on student loan interest rates can be influenced by other factors, including government policies and the overall demand for student loans. The interaction between macroeconomic conditions and government policy creates a complex dynamic that influences the final interest rate borrowers face.

Factors Influencing Federal Student Loan Interest Rates

Several key economic and political factors interact to determine the interest rates applied to federal student loans. These rates aren’t arbitrary; they reflect a complex interplay of broader financial conditions and government policy decisions. Understanding these influences is crucial for borrowers and policymakers alike.

Several interconnected factors significantly shape the interest rates on federal student loans. These factors often work in concert, creating a dynamic environment where rates can fluctuate.

Inflation’s Role in Determining Interest Rates

Inflation, the rate at which the general level of prices for goods and services is rising, is a major factor influencing federal student loan interest rates. When inflation rises, the Federal Reserve typically increases interest rates to cool down the economy and curb inflation. This increase in the general interest rate environment often leads to higher interest rates on federal student loans, as the government seeks to reflect prevailing market conditions in its borrowing costs. Conversely, periods of low inflation may lead to lower interest rates on student loans. For example, during periods of low inflation, such as in the early 2010s, interest rates on federal student loans were relatively low. Conversely, during periods of higher inflation, like in the late 2021 and 2022, we saw a rise in interest rates.

Government Borrowing Costs and Their Impact

The cost of borrowing for the government itself directly affects the interest rates on federal student loans. When the government needs to borrow money to finance its spending, it issues Treasury bonds. The interest rate it pays on these bonds—the yield—serves as a benchmark for other government borrowing, including student loans. Higher yields on Treasury bonds generally translate to higher interest rates on student loans, as the government aims to remain competitive in the bond market. Conversely, lower Treasury yields typically lead to lower student loan interest rates. This relationship reflects the fundamental principle that government borrowing costs influence the overall cost of financing various government programs.

Congressional Legislation and Budgetary Decisions

Congressional legislation and budgetary decisions play a significant role in shaping student loan interest rates. Congress has the power to set interest rates directly through legislation, or to authorize the Department of Education to set rates based on market conditions within a defined range. Budgetary constraints can also indirectly influence rates. For instance, if Congress decides to allocate less funding to the student loan program, it might indirectly lead to higher interest rates to maintain the solvency of the program. Conversely, increased funding might allow for lower rates. The passage of the Higher Education Act, and subsequent amendments, provides a clear example of how legislative action directly shapes student loan interest rate policies.

Impact of Interest Rates on Student Loan Borrowers

Interest rates significantly influence the overall cost of a federal student loan and have profound long-term financial implications for borrowers. Understanding how interest rates affect repayment amounts is crucial for responsible financial planning. Even seemingly small differences in interest rates can lead to substantial variations in the total amount repaid over the loan’s lifespan.

The following sections detail the impact of varying interest rates and repayment plans on student loan borrowers, highlighting the importance of careful consideration when choosing a loan and repayment strategy.

Scenario: Comparing Repayment Costs at Different Interest Rates

This scenario illustrates the difference in total repayment cost between a 5% and a 7% interest rate on a $50,000 loan over 10 years. The calculations assume a standard repayment plan with equal monthly payments. Note that these are simplified calculations and do not include potential fees or other charges.

| Interest Rate | Monthly Payment | Total Interest Paid | Total Repayment Cost |

|---|---|---|---|

| 5% | $530 | $6,600 | $56,600 |

| 7% | $559 | $11,000 | $61,000 |

As the table shows, a seemingly small 2% difference in interest rates results in an extra $4,400 in interest paid over the 10-year repayment period. This highlights the significant long-term financial impact of even minor interest rate fluctuations.

Implications of Different Repayment Plans

Different repayment plans impact the total interest paid. A standard repayment plan typically involves fixed monthly payments over 10 years. Extended repayment plans stretch the repayment period, lowering monthly payments but increasing the total interest paid due to the longer repayment timeframe. Income-driven repayment plans adjust monthly payments based on income, potentially reducing short-term payments but potentially extending the repayment period significantly, leading to higher overall interest paid.

For example, a borrower on an income-driven plan might have lower monthly payments initially, but the extended repayment period could mean they end up paying significantly more interest over the life of the loan compared to a standard 10-year plan.

Long-Term Financial Effects of High Interest Rates

High interest rates on student loans can have significant long-term financial consequences. The increased debt burden can delay major life milestones such as homeownership, starting a family, or saving for retirement. High interest payments can also restrict borrowers’ ability to save and invest, limiting their future financial opportunities and potentially hindering wealth accumulation. Furthermore, high interest rates can lead to financial stress and potentially negatively impact credit scores if payments are missed or become delinquent. In some cases, the accumulated debt can become unmanageable, leading to financial hardship.

Resources and Further Information for Student Loan Borrowers

Navigating the complexities of federal student loans can be challenging. Understanding your options for repayment, managing your debt effectively, and knowing where to find reliable information are crucial steps in successfully repaying your student loans. This section provides valuable resources and guidance to help you throughout the process.

Finding accurate and up-to-date information about your federal student loans is essential for responsible debt management. The following websites and government agencies offer comprehensive resources and tools to help you understand your loan terms, explore repayment options, and manage your debt effectively.

Reputable Websites and Government Agencies

Several reliable sources provide detailed information on federal student loan interest rates and repayment plans. These resources offer valuable tools and resources to help borrowers make informed decisions about their student loan debt.

- Federal Student Aid (FSA): This website, managed by the U.S. Department of Education, is the primary source for information on federal student aid programs, including interest rates, repayment plans, and loan forgiveness programs. It offers tools to calculate payments, explore repayment options, and manage your loans online.

- National Student Loan Data System (NSLDS): NSLDS provides a centralized database of student loan information. Borrowers can access their loan details, including interest rates, loan balances, and repayment history, through this system. Access requires a valid Federal Student Aid ID (FSA ID).

- StudentAid.gov: This website is a user-friendly portal for managing your federal student loans. It allows you to view your loan information, make payments, and explore different repayment options.

Contact Information for Relevant Government Agencies

Direct contact with relevant government agencies can be beneficial for addressing specific questions or concerns regarding your student loans. The following agencies offer assistance and support to student loan borrowers.

- Federal Student Aid (FSA): Contact information can be found on the StudentAid.gov website. They offer various methods of contact, including phone, email, and online chat.

- U.S. Department of Education: The Department of Education oversees federal student aid programs. Their website provides contact information for specific inquiries related to student loans.

Managing Student Loan Debt Effectively

Effective management of student loan debt requires proactive planning and informed decision-making. Exploring various options can significantly impact your repayment journey.

- Creating a Budget: Developing a detailed budget is crucial for tracking income and expenses, allowing you to allocate funds for student loan repayments. This helps prioritize debt repayment and avoid missed payments.

- Exploring Repayment Plans: Federal student loans offer various repayment plans, including standard, extended, graduated, and income-driven repayment plans. Choosing the plan that best aligns with your financial situation is vital. Income-driven repayment plans, for example, adjust payments based on your income and family size.

- Considering Refinancing: Refinancing your federal student loans with a private lender might offer lower interest rates or more favorable terms, but it’s important to carefully weigh the pros and cons. Refinancing federal loans means losing federal protections, such as income-driven repayment plans and loan forgiveness programs.

- Investigating Loan Forgiveness Programs: Certain professions, such as teaching and public service, may qualify for federal student loan forgiveness programs. These programs can partially or fully forgive your student loan debt after meeting specific requirements.

Summary

Successfully managing federal student loan debt requires a proactive approach and a thorough understanding of the interest rates involved. By carefully considering the factors influencing these rates, exploring different repayment options, and utilizing available resources, borrowers can significantly mitigate the long-term financial burden. Remember, informed decision-making is key to navigating this crucial aspect of higher education financing successfully. Proactive planning and resource utilization are essential steps toward responsible debt management.

Frequently Asked Questions

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), whereas unsubsidized loans do.

Can I refinance my federal student loans?

While refinancing options exist, be aware that refinancing federal loans into private loans may eliminate eligibility for federal repayment programs like income-driven repayment.

What happens if I don’t repay my student loans?

Defaulting on your loans can result in serious consequences, including damage to your credit score, wage garnishment, and tax refund offset.

Where can I find my current interest rate?

Your loan servicer’s website or your federal student aid account (studentaid.gov) will show your current interest rate and loan details.

What are income-driven repayment plans?

Income-driven repayment plans base your monthly payment on your income and family size, potentially leading to loan forgiveness after 20-25 years.