Navigating the world of private student loans can feel like deciphering a complex financial code. Understanding interest rates is crucial, as they significantly impact the overall cost of your education. This guide delves into the intricacies of private student loan interest rates, exploring factors that influence them, comparing them to federal loan options, and offering strategies to potentially secure more favorable terms.

From fixed versus variable rates to the impact of your credit score and loan term length, we’ll break down the key elements you need to know to make informed borrowing decisions. We’ll also cover important associated fees and explore how economic conditions can affect interest rates over time. Making smart choices about your student loans can save you thousands of dollars in the long run.

Understanding Private Student Loan Interest Rates

Securing a private student loan involves understanding the interest rates, which significantly impact the overall cost of your education. These rates are influenced by several key factors, and choosing between fixed and variable rates is a crucial decision. This section will explore these aspects in detail.

Factors Influencing Private Student Loan Interest Rates

Several factors determine the interest rate a lender offers on a private student loan. Your creditworthiness plays a major role, as lenders assess your credit history and score to gauge your risk of default. A higher credit score generally translates to a lower interest rate. The loan amount also matters; larger loans may carry slightly higher rates due to increased risk for the lender. The loan term, or repayment period, can influence the interest rate as well; longer terms might result in higher rates to compensate for the extended risk. Finally, the lender’s own pricing policies and market conditions will also affect the interest rate you are offered. These factors interact to determine the final interest rate you will pay.

Fixed Versus Variable Interest Rates

Private student loans come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s term, providing predictability in your monthly payments. This offers stability and allows for easier budgeting. In contrast, a variable interest rate fluctuates based on a benchmark index, such as the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payments could increase or decrease over time, depending on market conditions. While a variable rate might start lower than a fixed rate, it carries more risk due to potential increases. Choosing between a fixed and variable rate depends on your risk tolerance and financial outlook.

Credit Score’s Impact on Interest Rates

Your credit score significantly impacts the interest rate you’ll receive on a private student loan. Lenders view a higher credit score as an indicator of lower risk. For example, an individual with an excellent credit score (750 or above) might qualify for an interest rate of 6%, while someone with a fair credit score (650-699) might face a rate of 9% or higher on the same loan. A poor credit score (below 650) could result in even higher rates, or even a loan denial. Improving your credit score before applying can lead to significant savings over the life of the loan.

Comparison of Interest Rates from Different Private Lenders

The following table compares interest rates offered by three hypothetical private lenders. Remember that actual rates vary based on individual circumstances and market conditions. It’s crucial to shop around and compare offers from multiple lenders before making a decision.

| Lender | APR (Approximate) | Loan Terms (Years) | Eligibility Requirements (Example) |

|---|---|---|---|

| Lender A | 7-11% | 5-15 | Credit score above 680, minimum income requirements |

| Lender B | 8-12% | 3-10 | Credit score above 660, co-signer may be required |

| Lender C | 9-13% | 5-12 | Credit score above 640, strong income verification needed |

Loan Term and Interest Rate Relationship

The length of your private student loan repayment term significantly impacts the total amount you’ll pay back. A longer loan term means smaller monthly payments, but you’ll end up paying considerably more in interest over the life of the loan. Conversely, a shorter loan term leads to higher monthly payments but significantly reduces the total interest paid. Understanding this relationship is crucial for making informed borrowing decisions.

The total interest paid is directly proportional to the loan term. This means that as the loan term increases, so does the total interest. This is because you’re accruing interest over a longer period. Choosing a shorter loan term, while resulting in higher monthly payments, can save you thousands of dollars in interest over the life of the loan.

Comparison of 10-Year and 15-Year Loan Terms

Let’s compare a $30,000 private student loan with a 7% fixed interest rate across two different repayment terms: 10 years and 15 years. We’ll use simplified calculations to illustrate the concept. Note that actual calculations will incorporate more complex amortization schedules.

| Loan Term | Monthly Payment (approx.) | Total Interest Paid (approx.) |

|---|---|---|

| 10 years | $340 | $10,800 |

| 15 years | $250 | $18,000 |

As the table shows, although the monthly payment for the 15-year loan is lower ($250 vs $340), the total interest paid is substantially higher ($18,000 vs $10,800). This demonstrates the significant cost savings associated with selecting a shorter loan term. This difference in total interest paid can be substantial, often amounting to thousands of dollars. Careful consideration of this trade-off between monthly payment affordability and long-term cost is essential.

Illustrative Chart: Loan Term vs. Total Interest Paid

The following chart visually represents the relationship between loan term and total interest paid for a $30,000 loan at a 7% fixed interest rate. The chart demonstrates the exponential increase in total interest as the loan term lengthens.

| Loan Term (Years) | Total Interest Paid (approx.) |

|---|---|

| 5 | $5,000 |

| 10 | $10,800 |

| 15 | $18,000 |

| 20 | $26,400 |

Note: These are simplified calculations for illustrative purposes. Actual interest paid will vary based on the specific loan terms and amortization schedule. This chart illustrates the general trend: longer loan terms result in significantly higher total interest payments.

Fees Associated with Private Student Loans

Private student loans, while offering an alternative to federal loans, often come with various fees that can significantly impact the total cost of your education. Understanding these fees is crucial to making informed borrowing decisions and accurately budgeting for repayment. Failing to account for these additional costs can lead to unexpected financial strain after graduation.

It’s important to remember that these fees vary depending on the lender, the type of loan, and your creditworthiness. Always review the loan agreement carefully before signing to understand the full cost of borrowing.

Types of Private Student Loan Fees

Private student loan fees can be categorized into several distinct types. These charges, while seemingly small individually, can accumulate substantially over the life of the loan, increasing the overall amount you repay. Comparing loan offers from different lenders, paying close attention to these fees, is vital to securing the most cost-effective financing option.

- Origination Fees: These fees are charged by the lender upon loan disbursement. They typically range from 1% to 5% of the loan amount. For example, a $10,000 loan with a 3% origination fee would result in an upfront cost of $300, reducing the net amount received by the borrower to $9,700. This fee is often non-negotiable and is added to the principal loan balance, meaning interest will accrue on the entire amount, including the origination fee.

- Late Payment Fees: Missed or late payments can incur significant penalties. These fees vary widely but can range from $25 to $50 or more per late payment. Consistent late payments can quickly escalate the total cost of the loan and negatively impact your credit score. For instance, three late payments at $30 each add $90 to your debt, and further negatively affect your credit rating.

- Prepayment Penalties: Some lenders may charge a fee if you pay off your loan early. While less common now than in the past, it’s essential to check your loan agreement for any prepayment penalties. These can range from a small percentage of the remaining balance to a fixed dollar amount.

- Returned Payment Fees: If a payment is returned due to insufficient funds, you’ll likely face a returned payment fee. These fees can range from $25 to $50 or more, depending on the lender. Repeated occurrences significantly increase the overall cost of borrowing.

- Application Fees: Some lenders charge a fee simply for applying for a loan, even if you are not ultimately approved. These fees can range from $0 to $100. Always inquire about application fees upfront to avoid unexpected charges.

Impact of Fees on Overall Loan Cost

The cumulative effect of these fees can be substantial. Consider a scenario where a student takes out a $20,000 private student loan with a 4% origination fee, resulting in an upfront cost of $800. Over the life of the loan, even seemingly small late payment fees can add up considerably, increasing the total repayment amount significantly beyond the original loan principal. Furthermore, the origination fee increases the principal amount on which interest accrues, further escalating the overall cost. This illustrates how seemingly minor fees can have a significant long-term financial impact.

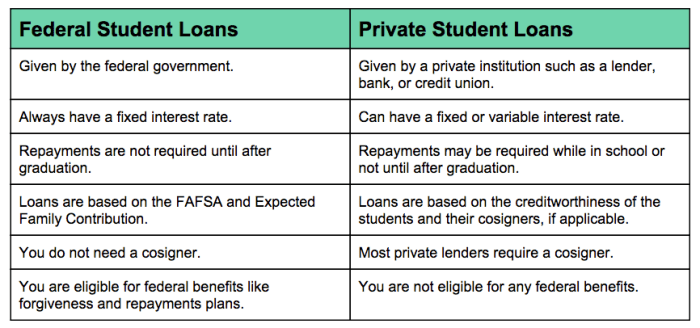

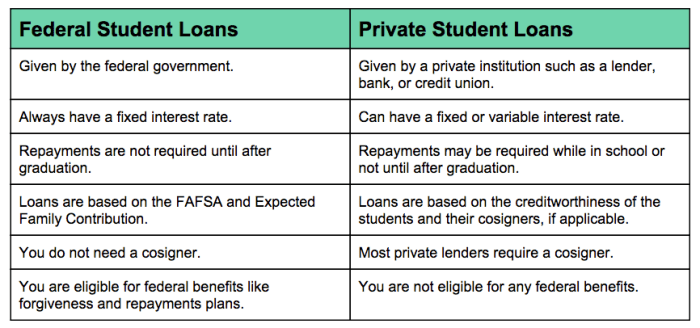

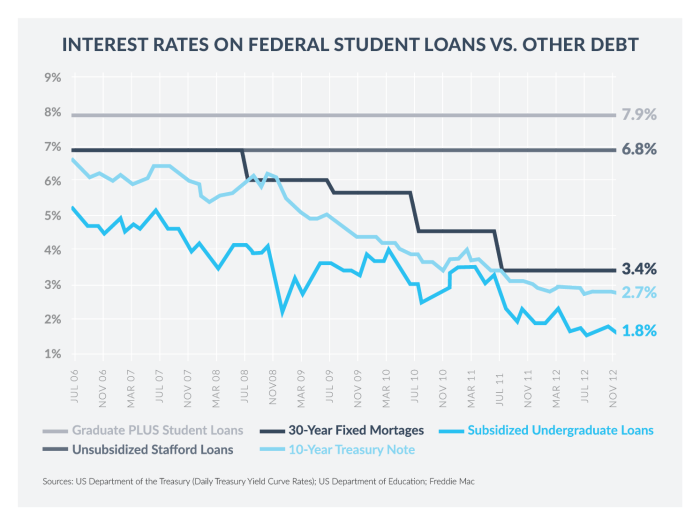

Comparison with Federal Student Loans

Choosing between private and federal student loans requires careful consideration of several key factors. Understanding the differences in interest rates, eligibility, repayment options, and overall benefits is crucial for making an informed decision that aligns with your financial situation and long-term goals. This section will compare and contrast these two loan types to help you navigate this important choice.

Private student loans and federal student loans differ significantly in several aspects. While both offer funding for higher education, their interest rates, eligibility criteria, and repayment options vary considerably, impacting the overall cost and borrower experience.

Interest Rate Differences

Private student loan interest rates are typically variable and tend to be higher than those offered on federal student loans. The rate a borrower receives depends on their creditworthiness, the loan amount, and the prevailing market interest rates. Federal student loan interest rates, on the other hand, are set by the government and are generally lower and fixed for the life of the loan, offering predictability in repayment planning. For example, a private loan might offer an interest rate of 7-12% while a federal subsidized loan might have a rate of around 4-6%. These numbers are approximate and change frequently based on market conditions and government policy.

Eligibility Requirements

Federal student loans are generally more accessible than private student loans. Eligibility for federal loans is primarily based on enrollment status and financial need (for subsidized loans). Private loans, however, require a credit check and often necessitate a co-signer if the applicant lacks a strong credit history. This means that students with limited or no credit history might find it difficult to qualify for a private student loan without a co-signer, while federal loans may be a more viable option.

Repayment Options and Benefits

Federal student loans offer a range of repayment plans, including income-driven repayment plans that adjust monthly payments based on income and family size. These plans can significantly reduce monthly payments for borrowers facing financial hardship. Furthermore, federal student loans often include borrower protections, such as deferment and forbearance options, which allow for temporary pauses in payments under specific circumstances. Private loans typically offer fewer repayment options and less flexibility in managing payments during times of financial difficulty. They also generally lack the same level of borrower protection as federal loans. For instance, a federal loan might offer an income-driven repayment plan, significantly lowering monthly payments for a low-income borrower, while a private loan may not offer such flexibility.

Advantages and Disadvantages of Federal Student Loans

Federal student loans offer several advantages, including lower interest rates, government-backed repayment options, and borrower protections. However, they might have lower loan limits compared to private loans. Also, the application process can be somewhat more involved than for private loans.

Advantages and Disadvantages of Private Student Loans

Private student loans can offer higher loan amounts, potentially covering more educational expenses. However, they usually come with higher interest rates, less flexible repayment options, and a lack of the same borrower protections afforded by federal loans. Borrowers should carefully weigh the potential benefits against the associated risks.

Strategies for Lowering Interest Rates

Securing a lower interest rate on your private student loan can significantly reduce the overall cost of borrowing. Several strategies can help borrowers achieve this, impacting the total amount repaid over the life of the loan. These strategies primarily focus on improving your financial profile to appear less risky to lenders.

Improving Credit Score to Obtain Lower Interest Rates

A higher credit score is a key factor in determining the interest rate you’ll receive on a private student loan. Lenders view a strong credit history as an indicator of responsible financial behavior, reducing their perceived risk. A higher credit score translates directly into a lower interest rate. For example, a borrower with a credit score above 750 might qualify for an interest rate several percentage points lower than someone with a score below 650. Improving your credit score involves consistent on-time payments on all debts, keeping credit utilization low (the amount of credit used compared to the total available), and maintaining a diverse range of credit accounts. Regularly checking your credit report for errors and addressing them promptly is also crucial.

The Impact of Co-signing on Interest Rates

Co-signing a private student loan involves having another person, typically a parent or guardian with a strong credit history, agree to be responsible for the loan repayment if the primary borrower defaults. This significantly reduces the lender’s risk, leading to lower interest rates for the borrower. The co-signer’s excellent credit history essentially acts as a guarantee for the loan, making the borrower a more attractive candidate for lower rates. However, it’s important to understand that the co-signer assumes significant financial responsibility. If the primary borrower fails to make payments, the co-signer will be held responsible for the outstanding balance. Therefore, careful consideration should be given to the implications of co-signing before agreeing to this arrangement.

Repayment Options and Interest Accrual

Understanding your repayment options and how interest accrues on your private student loans is crucial for managing your debt effectively and minimizing your overall cost. Different repayment plans offer varying levels of flexibility, but they also impact the total amount you’ll pay over the life of the loan. Careful consideration of these factors is essential for responsible financial planning.

Private student loan repayment options typically include standard repayment, graduated repayment, and extended repayment plans. Each plan offers a different monthly payment amount and loan repayment period, directly affecting the total interest paid. Additionally, understanding how interest accrues during periods of deferment and forbearance is vital to avoid unnecessary increases in your loan balance.

Standard Repayment

A standard repayment plan involves fixed monthly payments over a set loan term, usually 10 to 15 years. The payment amount remains consistent throughout the repayment period, ensuring predictable budgeting. Interest accrues and is added to the principal balance each month until the loan is fully repaid. The shorter repayment period, while resulting in higher monthly payments, generally leads to lower total interest paid compared to longer repayment options.

Graduated Repayment

With a graduated repayment plan, your monthly payments start low and gradually increase over time, usually annually. This can be beneficial for borrowers who anticipate increased income in the future. However, it’s important to note that while the initial payments are lower, the total interest paid will often be higher than with a standard repayment plan due to the longer repayment period and continued accrual of interest on the principal.

Extended Repayment

Extended repayment plans stretch your repayment period over a longer timeframe, typically 20 to 25 years. This results in lower monthly payments, making budgeting easier, particularly in the early years. However, significantly more interest will accrue over the extended repayment period, leading to a substantially higher total repayment amount.

Interest Accrual During Deferment and Forbearance

Interest continues to accrue on your loan balance during periods of deferment and forbearance, although the specific rules can vary depending on your lender. Deferment is typically granted for specific reasons, such as returning to school or experiencing unemployment, and it temporarily suspends your repayment obligations. Forbearance is similar but is usually granted for more general financial hardship. The accumulated interest during these periods is often capitalized, meaning it’s added to your principal balance, increasing the amount you owe and subsequently the interest you pay in the future.

Scenario: Impact of Repayment Plans on Total Interest Paid

Let’s consider a $30,000 private student loan with a 7% annual interest rate.

| Repayment Plan | Loan Term (Years) | Approximate Monthly Payment | Approximate Total Interest Paid |

|---|---|---|---|

| Standard | 10 | $330 | $10,000 |

| Graduated | 15 | Starts at ~$200, increases annually | $15,000 |

| Extended | 20 | ~$180 | $22,000 |

Note: These are approximate figures and actual amounts will vary depending on the specific loan terms and lender.

This scenario illustrates how choosing a longer repayment term, even with lower monthly payments, can significantly increase the total interest paid over the life of the loan. The longer the loan term, the more interest accrues. This emphasizes the importance of carefully considering your repayment options and choosing a plan that balances affordability with minimizing long-term costs.

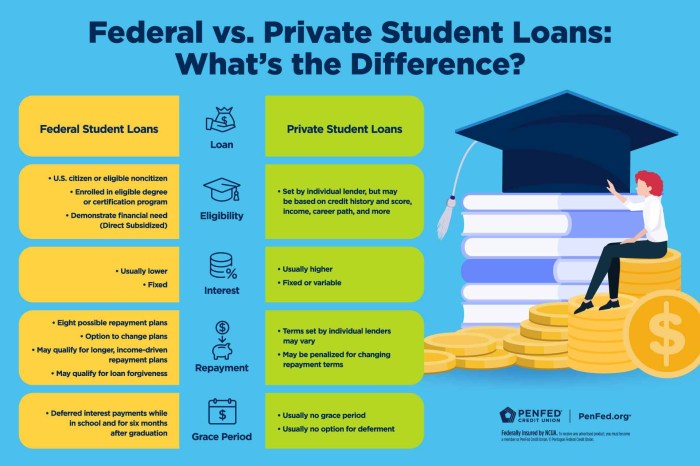

Impact of Economic Conditions on Interest Rates

Private student loan interest rates, unlike federally subsidized loans, are significantly influenced by broader economic conditions. These rates are not set by the government but rather by the lending institutions themselves, who base their decisions on a variety of factors, including prevailing interest rates in the overall financial market. Understanding this relationship is crucial for borrowers to anticipate potential rate changes and plan accordingly.

The overall health of the economy plays a substantial role in determining interest rates. Periods of economic expansion, characterized by low unemployment and strong consumer spending, typically see increased demand for credit. This heightened demand can lead lenders to raise interest rates on various loans, including private student loans, to manage their risk and maximize profits. Conversely, during economic downturns or recessions, lenders may lower rates to incentivize borrowing and stimulate economic activity. Inflation, a key indicator of economic health, also exerts considerable influence. High inflation erodes the purchasing power of money, prompting lenders to increase interest rates to compensate for the diminished value of future repayments.

Inflation’s Impact on Private Student Loan Interest Rates

High inflation directly impacts private student loan interest rates. Lenders must account for the decreased value of future repayments due to inflation. To maintain their profit margins and protect against losses from inflation, they adjust interest rates upwards. For example, during periods of high inflation, such as the late 1970s and early 1980s in the United States, interest rates on all types of loans, including private student loans, soared to levels far exceeding those seen during periods of lower inflation. Conversely, during periods of low or stable inflation, interest rates tend to remain lower. This correlation is not always perfectly linear, but the general trend is clear: higher inflation generally leads to higher interest rates.

Recessions and Interest Rate Fluctuations

Recessions, marked by economic contraction and high unemployment, often lead to a different dynamic in interest rates. While initially, one might expect interest rates to increase as lenders become more risk-averse, the reality is often more nuanced. Central banks frequently lower interest rates during recessions to stimulate borrowing and economic growth. This policy can indirectly influence private student loan rates, though the effect may be less direct and immediate than during inflationary periods. The 2008 financial crisis provides a pertinent example. While the initial response saw some increases in lending rates due to increased risk, the subsequent Federal Reserve actions to lower interest rates ultimately led to a decrease in borrowing costs across the board, including potentially for private student loans, though this would depend on the lender’s specific risk assessment and market conditions.

Predicting Future Interest Rate Changes

Predicting future interest rate changes for private student loans requires analyzing a complex interplay of economic indicators. Monitoring inflation rates (measured by indices like the Consumer Price Index), unemployment figures, and Federal Reserve announcements regarding monetary policy is crucial. Analyzing the yield curve (the relationship between short-term and long-term interest rates) can also provide insights into future interest rate trends. However, precise prediction remains challenging due to the inherent uncertainty in economic forecasting. While historical trends offer valuable guidance, unforeseen events like global crises or significant shifts in government policy can dramatically alter the economic landscape and impact interest rates in unpredictable ways. Therefore, it’s advisable for borrowers to consider a range of potential scenarios when planning for their student loan repayment.

Outcome Summary

Securing private student loans requires careful consideration of various factors. By understanding how interest rates are determined, the impact of loan terms, and available repayment options, you can make informed decisions that minimize your long-term financial burden. Remember to compare offers from multiple lenders, explore strategies to lower your interest rate, and always factor in associated fees to get a complete picture of the true cost of borrowing. Proactive planning empowers you to manage your student loan debt effectively.

Quick FAQs

What is an APR?

APR stands for Annual Percentage Rate. It represents the annual cost of borrowing, including interest and fees.

Can I refinance my private student loans?

Yes, refinancing can lower your interest rate if your credit has improved. However, be aware of any prepayment penalties.

What happens if I miss a payment?

Late payments will likely incur fees and negatively impact your credit score, potentially increasing future interest rates.

How does my credit score affect my interest rate?

A higher credit score typically qualifies you for lower interest rates, reflecting lower perceived risk to the lender.

What are the consequences of defaulting on a private student loan?

Defaulting can severely damage your credit score, potentially leading to wage garnishment or legal action.