Navigating the complexities of student loan debt often feels like traversing a financial maze. Understanding the interest rate is crucial, as it significantly impacts the overall cost and repayment timeline. This guide unravels the intricacies of student loan interest rates, offering insights into how they’re determined, the factors influencing them, and effective strategies for management.

From the difference between fixed and variable rates to the impact of credit scores and economic conditions, we’ll explore the various aspects that determine your individual interest rate. We’ll also delve into practical strategies for minimizing interest payments, including refinancing options and government programs designed to assist borrowers.

Understanding Student Loan Interest Rates

Navigating the world of student loans requires a solid understanding of interest rates, as they significantly impact the total cost of your education. This section will clarify the different types of interest rates, how they’re determined, and the implications of interest capitalization.

Fixed vs. Variable Interest Rates

Student loans typically come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. A variable interest rate, on the other hand, fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payments could change over time, potentially increasing or decreasing depending on market conditions. Choosing between a fixed and variable rate depends on your risk tolerance and predictions about future interest rate trends. Generally, fixed rates offer more predictability but may have a slightly higher initial interest rate than variable rates.

Interest Rate Determination for Federal and Private Loans

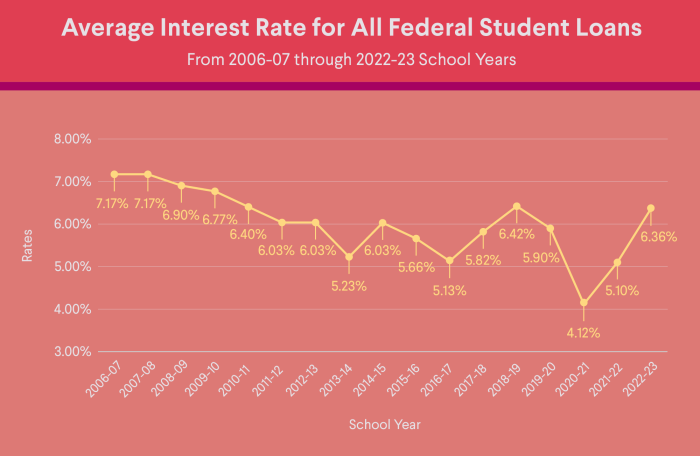

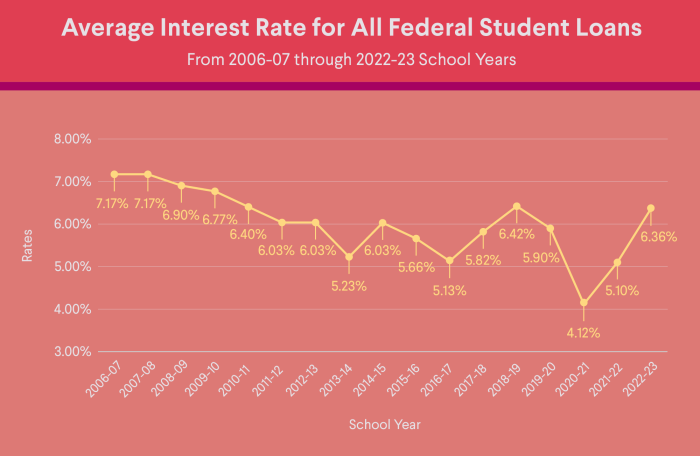

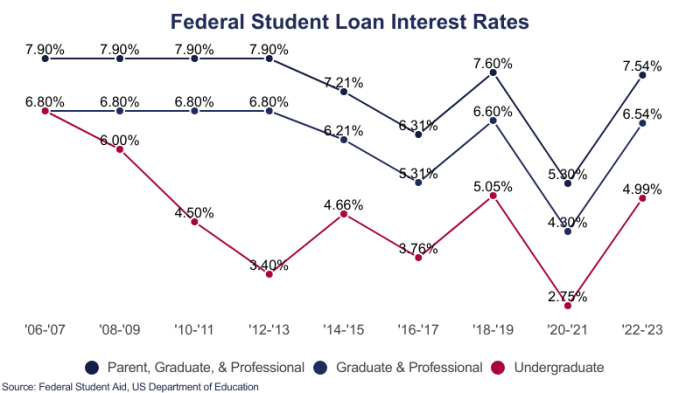

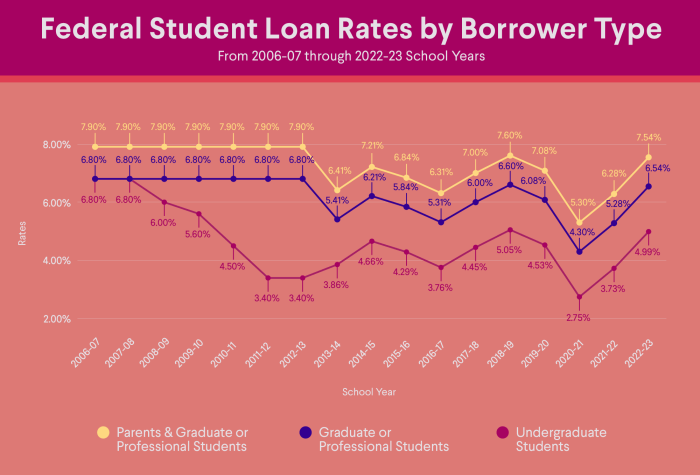

The way interest rates are determined differs between federal and private student loans. Federal student loan interest rates are generally set by Congress annually and are often influenced by the prevailing market interest rates. These rates can vary depending on the loan program (e.g., subsidized vs. unsubsidized loans) and the borrower’s credit history is not typically a factor. Private student loans, however, are offered by banks and credit unions. Their interest rates are determined by a variety of factors, including the borrower’s credit score, credit history, the loan amount, and the prevailing market conditions. Generally, borrowers with better credit scores qualify for lower interest rates.

Interest Capitalization

Interest capitalization is the process of adding accrued interest to the principal loan balance. This means that unpaid interest is added to the principal, increasing the amount of the loan. For example, if you have a $10,000 loan with a 5% interest rate and don’t make any payments during a grace period, the interest accrued will be added to the principal at the end of the grace period, increasing your loan balance. This has a significant impact on the total cost of the loan over time, as you will end up paying interest on the accumulated interest. Understanding when and how capitalization occurs is crucial for managing your student loan debt effectively.

Comparison of Student Loan Interest Rates

The following table provides a general comparison of interest rates across different loan programs. Note that these are average rates and actual rates can vary depending on various factors.

| Loan Type | Interest Rate Type | Average Interest Rate | Repayment Terms |

|---|---|---|---|

| Federal Subsidized Loan | Fixed | 4.99% (Example – This number is illustrative and changes yearly) | 10-20 years |

| Federal Unsubsidized Loan | Fixed | 6.08% (Example – This number is illustrative and changes yearly) | 10-20 years |

| Private Student Loan | Fixed or Variable | 6.50% – 12% (Variable) | 5-15 years |

Factors Influencing Student Loan Interest Rates

Securing a student loan involves understanding the factors that determine the interest rate you’ll pay. This rate significantly impacts the total cost of your education, so it’s crucial to be aware of the key elements influencing this figure. These factors are largely determined by your personal financial profile and the broader economic climate.

Credit Score’s Influence on Interest Rates

Your credit score is a significant factor in determining your student loan interest rate. Lenders use credit scores to assess your creditworthiness – essentially, your ability to repay borrowed funds. A higher credit score indicates a lower risk to the lender, resulting in a lower interest rate. Conversely, a lower credit score suggests a higher risk, leading to a higher interest rate or even loan denial. For example, a borrower with an excellent credit score (750 or above) might qualify for a significantly lower interest rate compared to a borrower with a fair credit score (650-699). The difference could amount to several percentage points over the loan’s lifetime, leading to thousands of dollars in additional interest payments.

Loan Amount and Repayment Plan’s Impact

The amount you borrow and your chosen repayment plan also influence your interest rate. Larger loan amounts can sometimes lead to slightly higher interest rates because they represent a greater risk for the lender. Similarly, the repayment plan you select can affect your rate. For instance, longer repayment terms might seem appealing, but they generally result in higher overall interest payments due to the extended period of accruing interest. Shorter repayment terms, while requiring higher monthly payments, typically lead to lower total interest costs.

Economic Conditions and Interest Rates

Broad economic conditions, such as inflation and the prime rate, play a substantial role in shaping student loan interest rates. Inflation, which measures the rate of increase in prices, influences interest rates because lenders adjust their rates to compensate for the reduced purchasing power of money due to inflation. The prime rate, a benchmark interest rate that banks charge their most creditworthy customers, also significantly impacts student loan rates. When the prime rate rises, lenders tend to increase their student loan interest rates, and vice-versa. For example, during periods of high inflation, we might see a rise in both the prime rate and consequently, student loan interest rates.

Credit History’s Role in Determining Interest Rates

A borrower’s credit history provides lenders with a detailed picture of their past borrowing and repayment behavior. Factors like on-time payments, outstanding debts, and bankruptcies all contribute to the overall assessment of creditworthiness. A positive credit history, characterized by consistent on-time payments and responsible debt management, typically leads to more favorable interest rates. Conversely, a negative credit history, marked by late or missed payments, high debt-to-income ratios, or bankruptcies, can result in higher interest rates or even loan rejection.

Comparison of Interest Rates Across Lenders

Different lenders offer varying interest rates for similar loan amounts and borrower profiles. Factors like the lender’s operational costs, risk assessment models, and target market all influence their pricing strategies. It’s crucial for borrowers to compare offers from multiple lenders to secure the most favorable interest rate. For example, a federal student loan might offer a fixed interest rate, while a private lender might offer a variable rate that fluctuates with market conditions. Carefully comparing these offers, considering both the interest rate and other loan terms, is essential before committing to a loan.

Managing Student Loan Interest

Effectively managing student loan interest is crucial for minimizing long-term costs and achieving financial freedom sooner. Understanding the various strategies available and their implications is key to developing a personalized repayment plan. This section will explore practical methods for reducing interest payments and provide examples to illustrate their impact.

Strategies for Minimizing Interest Payments

Several strategies can significantly reduce the total interest paid over the life of your student loans. These strategies focus on accelerating repayment and leveraging refinancing opportunities.

- Making Extra Payments: Even small, consistent extra payments can dramatically shorten the loan repayment period and reduce overall interest paid. For example, making an extra $50 payment each month on a $10,000 loan could save thousands of dollars in interest and significantly reduce the loan’s lifespan. This is because extra payments are applied directly to the principal, reducing the amount on which interest is calculated in subsequent months.

- Refinancing Student Loans: Refinancing involves obtaining a new loan with a lower interest rate to replace your existing student loans. This can be particularly beneficial if interest rates have fallen since you initially took out your loans. However, it’s crucial to carefully compare offers and consider any potential fees or changes to loan terms before refinancing.

Sample Amortization Schedule

An amortization schedule details the breakdown of each payment, showing how much goes towards principal and interest over the loan’s life. The following table illustrates the impact of different payment amounts on a $10,000 loan with a 5% interest rate over 10 years.

| Payment Amount | Total Payments | Total Interest Paid | Loan Term (Years) |

|---|---|---|---|

| $106.07 (Minimum Payment) | $12728.40 | $2728.40 | 10 |

| $120 (Increased Payment) | $14400 | $2271.60 (Estimated, actual value will vary slightly) | ~9.5 |

| $150 (Significantly Increased Payment) | $18000 | $1627.20 (Estimated, actual value will vary significantly) | ~7 |

*Note: These are simplified examples. Actual amortization schedules will vary depending on the loan terms and interest rate.*

Refinancing Student Loans: A Step-by-Step Guide

Refinancing can be a powerful tool to lower your interest rate, but it requires careful planning.

- Check Your Credit Score: A higher credit score typically qualifies you for better interest rates.

- Shop Around for Lenders: Compare interest rates, fees, and repayment terms from multiple lenders.

- Review Loan Terms Carefully: Understand the terms and conditions of the new loan, including any prepayment penalties or fees.

- Complete the Application Process: Provide the necessary documentation and complete the lender’s application.

- Close on the Loan: Once approved, finalize the refinancing process and ensure the old loans are paid off.

Long-Term Cost Implications of Various Repayment Plans

Different repayment plans have significant long-term cost implications. For instance, extending the repayment period lowers monthly payments but increases total interest paid over time. Conversely, choosing a shorter repayment period increases monthly payments but reduces the overall interest cost. A $20,000 loan at 6% interest will accrue significantly more interest over a 20-year repayment period compared to a 10-year repayment period, even if the monthly payments are lower in the longer term plan. The longer repayment term would likely result in thousands of dollars more in interest payments. Therefore, carefully weigh the trade-offs between monthly affordability and long-term interest costs when selecting a repayment plan.

Government Programs and Student Loan Interest Rates

Government programs significantly impact student loan interest rates and repayment. Understanding these programs is crucial for borrowers to navigate the complexities of loan repayment and potentially minimize their overall cost. These programs offer various avenues for managing debt, including income-driven repayment plans and loan forgiveness options.

Income-Driven Repayment Plans and Interest Accrual

Income-driven repayment (IDR) plans adjust your monthly payment based on your income and family size. While this lowers your monthly payments, it’s important to understand the implications for interest accrual. Because your monthly payment may not cover the accruing interest, interest can capitalize—meaning it’s added to your principal balance, increasing the total amount you owe over the life of the loan. Different IDR plans (like PAYE, REPAYE, IBR, and ICR) have varying eligibility requirements and calculations, affecting how much interest accrues and the length of your repayment period. For example, a borrower with a high initial loan balance and low income might see substantial interest capitalization under an IDR plan, extending their repayment timeline significantly. Careful consideration of your financial situation and long-term repayment goals is essential when choosing an IDR plan.

Government Subsidies and Their Impact on Interest Rates

Government subsidies directly influence student loan interest rates, particularly for federal student loans. These subsidies lower the interest rate borrowers pay, making loans more affordable. The amount of the subsidy varies depending on the loan type and program. For example, subsidized federal Stafford loans don’t accrue interest while the borrower is enrolled in school at least half-time, while unsubsidized loans do. This difference directly impacts the total interest paid over the loan’s life. The availability and amount of these subsidies can change based on government policy and budget allocations. Understanding these changes is important for borrowers to make informed decisions about their financing options.

Applying for Loan Forgiveness Programs and Interest Implications

Loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness, can eliminate remaining loan balances after meeting specific criteria. The process typically involves consistent on-time payments for a set period, working in a qualifying public service job, and submitting the necessary paperwork to the loan servicer. While these programs offer the potential for complete loan forgiveness, it’s crucial to understand that interest still accrues during the repayment period before forgiveness is granted. A borrower might make substantial payments, even under an IDR plan, before loan forgiveness is applied. Failing to meet the specific requirements can result in the borrower being ineligible for forgiveness, leaving them responsible for the entire loan balance plus accumulated interest.

Comparison of Government Repayment Plans

Choosing the right repayment plan is a crucial decision that impacts both your monthly payments and total interest paid. The following Artikels some key pros and cons of different government repayment plans:

- Standard Repayment Plan:

- Pros: Fixed monthly payment, shortest repayment period.

- Cons: Highest monthly payments, potential for higher total interest paid.

- Extended Repayment Plan:

- Pros: Lower monthly payments than standard plan.

- Cons: Longer repayment period, higher total interest paid.

- Graduated Repayment Plan:

- Pros: Lower initial monthly payments that increase over time.

- Cons: Payments can become unaffordable later, longer repayment period, higher total interest paid.

- Income-Driven Repayment Plans (PAYE, REPAYE, IBR, ICR):

- Pros: Monthly payments based on income, potentially lower payments, possibility of loan forgiveness after 20-25 years.

- Cons: Interest can capitalize, longer repayment periods, may not be suitable for all borrowers.

The Role of Interest Rates in Student Loan Debt

Understanding interest rates is crucial for navigating the complexities of student loan repayment. These rates directly impact the total amount you’ll ultimately repay, significantly influencing your long-term financial health. Failing to grasp this fundamental aspect can lead to unexpected financial burdens and prolonged repayment periods.

Interest rates determine the cost of borrowing money. In the context of student loans, the interest rate is a percentage of the principal loan amount that accrues over time. This means that the longer you take to repay your loan, the more interest you will pay, substantially increasing the overall cost beyond the initial loan amount. For example, a $20,000 loan with a 5% interest rate will cost significantly more than the same loan with a 2% interest rate over the same repayment period. The difference can amount to thousands of dollars.

The Impact of High Interest Rates on Borrowers

High interest rates can create significant psychological stress for student loan borrowers. The weight of a large, ever-growing debt can lead to anxiety, depression, and feelings of being overwhelmed. This financial pressure can impact various aspects of life, including career choices, housing decisions, and overall well-being. The constant worry about repayment can affect mental health and prevent borrowers from focusing on other important life goals. For instance, a borrower struggling with a high-interest loan might delay starting a family or purchasing a home due to the financial strain. The perceived impossibility of repayment can be debilitating.

Strategies for Minimizing Interest Accrual

Several strategies can help borrowers minimize the accumulation of interest on their student loans. One effective approach is to explore repayment plans that offer lower monthly payments, even if it means extending the repayment period. This reduces the immediate financial pressure while limiting the amount of interest paid over the long term. Another crucial step is to make extra payments whenever possible. These additional payments directly reduce the principal balance, decreasing the amount of interest that accrues over the life of the loan. For example, an extra $100 payment each month can significantly reduce the total interest paid and shorten the repayment timeline. Finally, refinancing your loans to a lower interest rate, if available, can substantially reduce the overall cost of borrowing.

Long-Term Financial Consequences of High Interest Rates

High interest rates on student loans can have profound long-term financial consequences. The accumulated interest can delay major life milestones such as homeownership, starting a family, or saving for retirement. The persistent debt can limit financial flexibility and restrict opportunities for investing and wealth building. Furthermore, high interest payments can lead to a lower credit score, making it more difficult to secure loans for future purchases, such as a car or a house. In extreme cases, the burden of high interest can lead to default, resulting in severe consequences such as wage garnishment and damage to credit history. The long shadow of high-interest student loan debt can impede financial progress for years, even decades, after graduation. Consider a scenario where a borrower takes 20 years to repay a loan due to high interest; the opportunity cost of that extended repayment period, in terms of potential investments and savings, is substantial.

End of Discussion

Successfully managing student loan debt requires a proactive and informed approach. By understanding the nuances of interest rates, exploring available repayment options, and employing effective management strategies, borrowers can significantly reduce their overall loan burden and pave the way for a more secure financial future. Remember, seeking professional financial advice can provide personalized guidance tailored to your specific circumstances.

Answers to Common Questions

What is the difference between fixed and variable interest rates for student loans?

Fixed rates remain constant throughout the loan term, providing predictable monthly payments. Variable rates fluctuate based on market indices, leading to potentially lower initial payments but with the risk of increasing payments over time.

Can I negotiate my student loan interest rate?

Negotiating interest rates is generally difficult with federal loans. For private loans, it’s possible, but success depends on your creditworthiness and the lender’s policies. A strong credit score and a history of responsible borrowing can improve your chances.

What happens if I don’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in collection actions, wage garnishment, and even legal proceedings. Contact your lender immediately if you anticipate difficulties making payments to explore options like forbearance or deferment.

How does interest capitalization work?

Interest capitalization occurs when unpaid interest is added to the principal loan balance, increasing the total amount you owe. This increases the total interest paid over the life of the loan.