Navigating the complexities of student loan financing can feel overwhelming, particularly when understanding interest rates. This guide delves into the specifics of Wells Fargo student loan interest rates, providing clarity on factors influencing these rates and offering strategies for effective debt management. We’ll explore variable versus fixed rates, calculation methods, and the impact of credit scores, ultimately empowering you to make informed decisions about your financial future.

Understanding your Wells Fargo student loan interest rate is crucial for budgeting and long-term financial planning. This involves comprehending the different loan types offered, the factors that determine your individual rate, and the various strategies available for managing your debt effectively. We will examine both the immediate and long-term implications of interest rate choices, equipping you with the knowledge to make sound financial decisions.

Wells Fargo Student Loan Interest Rate Basics

Understanding the interest rate on your Wells Fargo student loan is crucial for effective financial planning. The interest rate significantly impacts the total cost of your education, determining how much you’ll ultimately repay. Several factors influence the rate you’ll receive, and it’s essential to be aware of these to make informed borrowing decisions.

Factors Influencing Wells Fargo Student Loan Interest Rates

Several key factors determine the interest rate you’ll receive on a Wells Fargo student loan. These include your creditworthiness (if applicable, as some loans are credit-based), the type of loan (federal vs. private), the loan’s repayment term, and prevailing market interest rates. A strong credit history generally leads to lower interest rates, while longer repayment terms may result in higher rates due to increased risk for the lender. Market fluctuations also play a role, impacting the overall cost of borrowing. For example, during periods of economic uncertainty, interest rates tend to rise, making loans more expensive.

Types of Wells Fargo Student Loans and Their Associated Interest Rates

Wells Fargo offers various student loan options, each with its own interest rate structure. These options typically include private student loans, which are not government-backed, and may have variable or fixed interest rates. Variable rates fluctuate with market conditions, while fixed rates remain constant throughout the loan’s term. The specific interest rate offered will depend on the individual borrower’s creditworthiness and the chosen loan terms. It’s important to note that Wells Fargo may not offer all loan types in all states. Detailed rate information is available on their website and through their customer service representatives.

Comparison of Wells Fargo Student Loan Interest Rates with Other Major Lenders

Comparing interest rates across different lenders is essential before selecting a student loan. Wells Fargo’s rates are generally competitive with other major lenders like Sallie Mae, Discover, and Citizens Bank. However, rates can vary significantly based on individual credit profiles and loan terms. To find the best rate, it’s recommended to compare offers from multiple lenders, carefully considering factors beyond just the interest rate, such as fees, repayment options, and customer service. Using online loan comparison tools can streamline this process.

Example Interest Rates for Various Loan Amounts and Repayment Terms

The following table provides example interest rates. Remember that these are illustrative and actual rates will vary depending on individual circumstances and market conditions. Always confirm the current rates directly with Wells Fargo.

| Loan Amount | Repayment Term (Years) | Example Interest Rate (Fixed) | Example Interest Rate (Variable) |

|---|---|---|---|

| $10,000 | 5 | 6.5% | 5.0% – 7.0% (example range) |

| $25,000 | 10 | 7.2% | 5.5% – 7.5% (example range) |

| $50,000 | 15 | 8.0% | 6.0% – 8.0% (example range) |

Understanding Variable vs. Fixed Interest Rates

Choosing between a variable and a fixed interest rate for your Wells Fargo student loan is a crucial decision that will significantly impact your overall borrowing cost. Understanding the key differences between these two rate types is essential for making an informed choice that aligns with your financial situation and long-term goals.

Choosing between a variable and fixed interest rate involves weighing the potential benefits and risks of each. A fixed rate offers predictability, while a variable rate presents the possibility of lower payments initially, but with the inherent risk of increased payments later. Let’s examine these options in more detail.

Variable Interest Rates

Variable interest rates for Wells Fargo student loans fluctuate based on an underlying benchmark index, such as the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payment can change over the life of the loan. Initially, variable rates are often lower than fixed rates, making them attractive to borrowers. However, if the benchmark index rises, your interest rate and monthly payments will increase. This unpredictability can make budgeting more challenging.

Fixed Interest Rates

With a fixed interest rate, your monthly payment remains consistent throughout the loan’s term. This predictability offers significant financial stability, allowing for easier budgeting and financial planning. While the initial interest rate might be higher than a comparable variable rate, the consistency offers peace of mind. You know exactly what your monthly payment will be, regardless of market fluctuations.

Impact of Interest Rate Changes on Monthly Payments

Changes in interest rates directly affect your monthly payment amount. With a variable rate loan, an increase in the benchmark index translates to a higher interest rate and, consequently, a higher monthly payment. Conversely, a decrease in the index leads to a lower rate and payment. With a fixed rate loan, the monthly payment remains constant regardless of market interest rate changes.

Long-Term Cost Comparison: Fixed vs. Variable

Let’s consider a scenario: Suppose you borrow $20,000 with a 10-year repayment period. A fixed-rate loan might have a 6% annual interest rate, resulting in a consistent monthly payment (principal and interest) of approximately $222. A variable-rate loan might start at 4%, resulting in a lower initial monthly payment of roughly $190. However, if the variable rate increases to 8% over the life of the loan due to market fluctuations, the monthly payment could rise to approximately $250. Over the ten-year period, the total interest paid on the fixed-rate loan would be approximately $5,000, while the variable-rate loan could end up costing significantly more, depending on the rate fluctuations throughout the repayment period. This illustrates how seemingly small initial differences in interest rates can lead to substantial differences in the total cost of the loan over time. This example is illustrative and actual rates and payments may vary.

Interest Rate Calculation and Accrual

Understanding how Wells Fargo calculates and accrues interest on your student loan is crucial for effective financial planning. This section details the methods used, the impact of different repayment phases, and the benefits of making extra payments. Remember to always refer to your loan agreement for the most accurate and specific information regarding your individual loan terms.

Wells Fargo typically uses a daily interest calculation method for its student loans. This means that interest is calculated each day on your outstanding principal balance. The daily interest is then added to your principal balance, a process known as capitalization or compounding. The annual interest rate is divided by 365 to determine the daily interest rate. This daily interest rate is then multiplied by your outstanding principal balance to arrive at the daily interest charge. This daily interest accrues even during the grace period, adding to your overall loan balance. The method of calculation ensures that you pay interest on any accrued interest, making it crucial to stay on top of repayments.

Interest Accrual During Grace Period and Repayment

During the grace period (typically six months after graduation or leaving school), interest continues to accrue on your loan. This means your loan balance will grow even though you are not yet making payments. Once the grace period ends, your monthly payments will begin, and a portion of each payment will go toward paying down the principal balance, while the remainder covers the interest accrued. The proportion allocated to principal versus interest changes over time, with a greater portion going towards principal as your loan term progresses.

Impact of Extra Payments on Interest Accrual

Making extra payments on your student loan can significantly reduce the total interest paid over the life of the loan. These extra payments directly reduce your principal balance, thereby lowering the amount of interest calculated daily. This not only shortens the loan repayment term but also reduces the overall cost of borrowing. For example, an extra $100 payment each month could significantly impact the total interest paid over a 10-year loan period, potentially saving thousands of dollars.

Calculating Total Interest Paid

Calculating the total interest paid over the life of a loan requires a step-by-step approach. While precise calculation often requires specialized loan amortization calculators (readily available online), understanding the fundamental steps is valuable.

- Determine the total amount repaid: This is the sum of all your monthly payments over the loan’s term. This information can be found in your loan amortization schedule.

- Determine the original principal balance: This is the initial amount you borrowed.

- Subtract the principal balance from the total amount repaid: The difference represents the total interest paid over the life of the loan. For example, if the total repaid is $30,000 and the original principal was $20,000, the total interest paid is $10,000.

Total Interest Paid = Total Amount Repaid – Original Principal Balance

Factors Affecting Individual Interest Rates

Several key factors influence the interest rate you’ll receive on a Wells Fargo student loan. These factors are assessed during the application process and contribute to the final interest rate offered, which can vary significantly between borrowers. Understanding these factors empowers you to make informed decisions about your loan application and potentially secure a more favorable rate.

Credit Score and Credit History

Your credit score and history play a pivotal role in determining your student loan interest rate. A higher credit score, reflecting responsible borrowing and repayment behavior, generally leads to a lower interest rate. Lenders view a strong credit history as an indicator of lower risk. Conversely, a lower credit score, possibly due to missed payments or high credit utilization, often results in a higher interest rate, reflecting the increased perceived risk to the lender. For example, a borrower with a credit score above 750 might qualify for a significantly lower interest rate compared to a borrower with a score below 600. Wells Fargo will review your credit report to assess your creditworthiness. Consistent on-time payments on other credit accounts demonstrate financial responsibility and can positively influence the interest rate offered.

The Role of Co-signers

Adding a co-signer with a strong credit history can significantly impact your student loan interest rate. A co-signer essentially shares responsibility for the loan repayment. Because the lender has a second party guaranteeing repayment, the perceived risk is reduced, often leading to a lower interest rate for the primary borrower. The co-signer’s credit score and history are carefully reviewed during the application process. A co-signer with an excellent credit history can help secure a more favorable interest rate, even if the primary borrower has limited or poor credit. However, it’s crucial to remember that the co-signer is equally responsible for repayment should the primary borrower default.

Examples of Varying Interest Rates Based on Credit Profiles

Let’s consider three hypothetical borrowers applying for a Wells Fargo student loan:

| Borrower | Credit Score | Credit History | Co-signer | Approximate Interest Rate Range |

|---|---|---|---|---|

| Alice | 780 | Excellent, consistent on-time payments | No | 4.5% – 5.5% |

| Bob | 620 | Some late payments, limited credit history | Yes (760 Credit Score) | 6.0% – 7.0% |

| Charlie | 550 | Multiple late payments, bankruptcies | No | 8.0% – 9.0% or higher |

These are illustrative examples, and the actual interest rates offered will depend on several factors, including the loan amount, repayment term, and prevailing market interest rates. It’s important to note that interest rates are subject to change based on market conditions and Wells Fargo’s lending policies.

Refinancing Options and Their Impact on Interest Rates

Refinancing your Wells Fargo student loan can significantly impact your monthly payments and overall loan cost. This process involves replacing your existing loan with a new one from a different lender, often at a lower interest rate. Understanding the available options and their potential benefits and drawbacks is crucial before making a decision.

Wells Fargo Refinancing Options

Wells Fargo itself does not offer refinancing options for its existing student loans. If you’re a Wells Fargo student loan borrower looking to refinance, you’ll need to explore options with other lenders. This means comparing interest rates, terms, and fees from various institutions to find the most suitable option.

Refinancing a Wells Fargo Student Loan with Another Lender

The process of refinancing a Wells Fargo student loan with another lender typically involves applying online or through a loan officer. You’ll need to provide information about your current loan, your income, credit score, and desired loan terms. The lender will then assess your application and determine whether to approve your refinance request and at what interest rate. The approval process usually involves a credit check and verification of income and employment. Once approved, the new lender will pay off your Wells Fargo loan, and you’ll begin making payments on the new loan.

Benefits and Risks of Refinancing

Refinancing a student loan can offer several potential benefits, such as a lower interest rate, resulting in lower monthly payments and reduced overall interest paid. A longer repayment term may also be available, lowering monthly payments but potentially increasing the total interest paid over the life of the loan. However, refinancing also carries risks. For example, you might lose benefits associated with your federal student loans, such as income-driven repayment plans or loan forgiveness programs. Additionally, if your credit score declines after refinancing, you may be locked into a higher interest rate for the remaining loan term. A thorough assessment of your financial situation and long-term goals is essential before making a decision.

Comparison of Refinancing Lenders

The interest rates and terms offered by different refinancing lenders vary significantly depending on factors such as your credit score, income, loan amount, and the type of loan you’re refinancing. It’s essential to compare offers from multiple lenders before making a decision. The following table provides a hypothetical example, and actual rates may vary. Always check directly with the lender for the most up-to-date information.

| Lender | Interest Rate (Variable) | Interest Rate (Fixed) | Repayment Terms (Years) |

|---|---|---|---|

| Lender A | 6.5% | 7.0% | 5, 10, 15 |

| Lender B | 6.0% | 7.5% | 5, 10 |

| Lender C | 7.2% | 8.0% | 10, 15 |

| Lender D | 6.8% | 7.8% | 5, 7, 10 |

Visual Representation of Interest Rate Changes Over Time

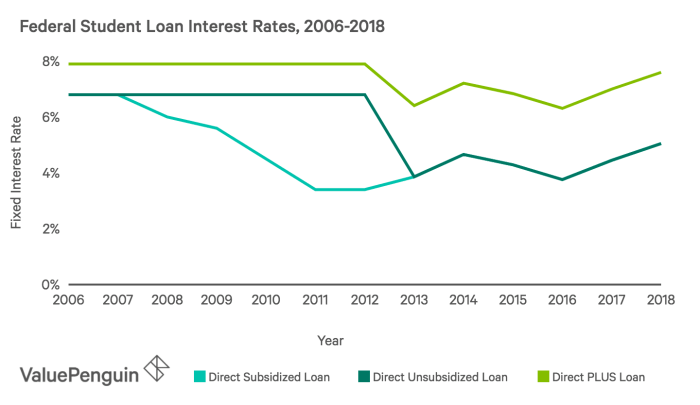

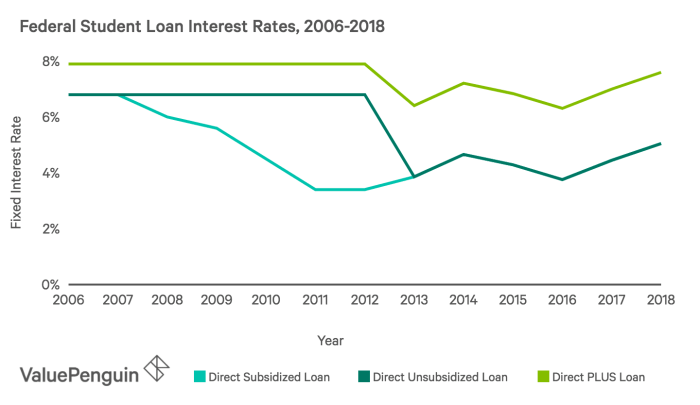

Understanding the historical trends of Wells Fargo student loan interest rates provides valuable context for borrowers and prospective borrowers. Analyzing these changes helps illustrate the impact of broader economic factors on individual borrowing costs. While precise historical data for Wells Fargo’s specific student loan interest rates over the past decade may not be publicly available in a readily graphable format, we can examine general trends in the student loan market to infer likely patterns.

The following description Artikels a hypothetical graph illustrating potential interest rate fluctuations. It is important to note that this is a representation based on general market trends and may not perfectly reflect Wells Fargo’s specific historical rates. Actual data would need to be obtained directly from Wells Fargo or a reputable financial data provider.

Hypothetical Graph of Student Loan Interest Rate Fluctuations

Imagine a line graph with the horizontal axis representing time (years, from 2014 to 2024) and the vertical axis representing the annual percentage rate (APR) for a hypothetical Wells Fargo student loan. The graph would show a general downward trend from 2014 to approximately 2016, reflecting the period of historically low interest rates following the 2008 financial crisis. A key data point might show an APR of around 6.5% in 2014, gradually decreasing to around 5% by 2016.

Following this initial decline, the graph would illustrate a period of relative stability or slight upward movement from 2016 to approximately 2018, potentially reaching an APR of around 5.5% by 2018. This reflects a period of gradual economic recovery and a potential rise in interest rates.

From 2018 to 2020, the graph might show another upward trend, possibly peaking at around 7% in 2020. This period coincides with potential economic growth and increased borrowing costs.

Finally, the graph would show a sharp decrease from 2020 to 2022, likely reflecting the impact of the COVID-19 pandemic and the Federal Reserve’s response, including significant interest rate cuts. This might represent a drop in APR to approximately 4%. Subsequently, the graph might illustrate a gradual increase from 2022 to 2024, possibly reaching an APR of around 6% by the end of the period, reflecting the overall economic recovery and adjustments in monetary policy.

Factors Contributing to Interest Rate Fluctuations

Several factors influence student loan interest rate fluctuations, including prevailing economic conditions, Federal Reserve monetary policy, and the overall creditworthiness of borrowers. Changes in the federal funds rate, the target rate set by the Federal Reserve, directly impact borrowing costs. Periods of economic expansion often lead to higher interest rates, while recessions or economic uncertainty tend to drive rates down. Furthermore, the credit risk associated with student loans also plays a role. If the perceived risk of default increases, lenders may adjust interest rates accordingly. Government regulations and subsidies related to student loans can also influence the rates offered by lenders like Wells Fargo.

Managing Student Loan Debt and Interest Payments

Effectively managing student loan debt requires a proactive approach encompassing budgeting, strategic repayment planning, and understanding available resources. Minimizing interest payments is crucial to reducing the overall cost of your education loan. This section Artikels practical strategies to achieve these goals.

Successful student loan management hinges on a well-defined plan. This involves understanding your loan terms, creating a realistic budget, and exploring repayment options that align with your financial capabilities. Prioritizing payments and seeking assistance when needed are also vital components of a successful strategy.

Budget Creation for Student Loan Payments

Creating a comprehensive budget is the cornerstone of effective student loan management. This involves meticulously tracking income and expenses to determine how much can be allocated towards loan repayment. A detailed budget allows for proactive financial planning and helps avoid missed payments, which can negatively impact your credit score and increase overall loan costs due to late fees and accruing interest.

A step-by-step guide to creating a budget incorporating student loan payments might include: 1) Listing all monthly income sources; 2) Categorizing all monthly expenses (housing, food, transportation, etc.); 3) Calculating total income and expenses; 4) Determining the amount available for student loan payments; 5) Scheduling loan payments within the budget; 6) Regularly reviewing and adjusting the budget as needed. For example, if your monthly income is $3000 and your expenses total $2000, you have $1000 remaining. Allocating $500 towards your student loan payment leaves $500 for other needs or savings.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer a viable option for borrowers struggling with high monthly payments. These plans adjust your monthly payment based on your income and family size, making them particularly beneficial during periods of financial hardship or career transitions. While IDR plans extend the loan repayment period, resulting in higher total interest paid over the life of the loan, they provide short-term affordability and prevent default.

Several IDR plans exist, each with specific eligibility criteria and payment calculation methods. For example, the Revised Pay As You Earn (REPAYE) plan bases monthly payments on 10% of discretionary income, while the Income-Based Repayment (IBR) plan considers 15% of discretionary income. Choosing the right plan requires careful consideration of your individual financial circumstances and long-term financial goals. It is advisable to consult with a financial advisor to determine the most suitable IDR plan.

Strategies for Borrowers Facing Payment Difficulties

Borrowers facing difficulties making their monthly payments should explore several options to avoid default. These include contacting their loan servicer to discuss options such as forbearance or deferment, which temporarily suspend or reduce payments. Additionally, borrowers can explore options like income-driven repayment plans or loan consolidation to potentially lower monthly payments. Seeking professional financial counseling can provide personalized guidance and support in navigating financial challenges.

For instance, if a borrower is experiencing unexpected job loss, contacting their loan servicer to request a forbearance might prevent immediate default. During the forbearance period, interest may still accrue, depending on the loan type, so it’s crucial to understand the terms and conditions. Simultaneously, the borrower could actively seek employment and develop a plan to resume payments once their financial situation stabilizes. Failure to communicate with the loan servicer could lead to more severe consequences.

Last Point

Securing a student loan is a significant financial commitment, and understanding the intricacies of interest rates is paramount. By carefully considering the factors influencing your Wells Fargo student loan interest rate, including your credit history and loan type, you can make informed decisions that align with your financial goals. Remember to explore all available options, including refinancing, and actively manage your debt to minimize long-term costs and pave the way for a financially secure future. Proactive planning and informed choices are key to successfully navigating the student loan repayment process.

Answers to Common Questions

What happens if I miss a student loan payment?

Missing a payment can lead to late fees, damage your credit score, and potentially impact your ability to refinance or access future loans. Contact Wells Fargo immediately if you anticipate difficulty making a payment to explore options.

Can I pay off my Wells Fargo student loan early?

Yes, you can typically pay off your loan early without penalty. This can save you money on interest in the long run.

How often are Wells Fargo student loan interest rates reviewed?

The frequency of interest rate reviews depends on whether you have a fixed or variable rate loan. Fixed rates remain consistent, while variable rates can adjust periodically based on market conditions. Your loan agreement will specify the terms.

Does Wells Fargo offer any hardship programs for student loan borrowers?

Wells Fargo may offer forbearance or deferment options in certain hardship situations. Contact their customer service to discuss your specific circumstances and available programs.