The recent increase in student loan interest rates has sent ripples through the financial lives of millions. This shift significantly impacts borrowers’ monthly payments, long-term debt accumulation, and overall financial well-being. Understanding the complexities of these changes, from government policies to personal budgeting strategies, is crucial for navigating this challenging landscape. This exploration delves into the multifaceted effects of rising interest rates on student loan debt, offering insights into managing the increased financial burden and outlining potential long-term consequences.

We will examine the historical context of government involvement in student loan interest rates, exploring the factors influencing these adjustments and the potential political and economic implications. Furthermore, we will equip borrowers with practical strategies for managing higher monthly payments, including budgeting techniques, refinancing options, and resources available to those struggling with increased debt burdens. The analysis will also include a comparison of interest rates across various loan types, highlighting the disparities and their impact on borrowers’ long-term financial health.

Impact of Interest Rate Increases on Student Loan Borrowers

Interest rate hikes on student loans directly affect borrowers’ finances, potentially leading to significant challenges in managing their debt. The increased cost of borrowing translates to higher monthly payments, reduced disposable income, and increased overall financial strain. Understanding these impacts is crucial for borrowers to proactively manage their financial well-being.

Direct Financial Consequences of Higher Interest Rates

Higher interest rates directly increase the total amount paid over the life of the loan. This is because a larger portion of each monthly payment goes towards interest, leaving less to pay down the principal balance. For example, a borrower with a $50,000 loan at a 5% interest rate will pay significantly more in interest over the life of the loan compared to a borrower with the same loan amount at a 3% interest rate. The difference can amount to thousands of dollars, depending on the loan term and repayment plan. This increased interest burden can significantly impact a borrower’s long-term financial health.

Impact on Borrowers’ Budgets and Overall Financial Well-being

The increased monthly payments resulting from higher interest rates can strain borrowers’ budgets, leaving less money for essential expenses like housing, food, transportation, and healthcare. This can lead to financial stress, difficulty saving for the future, and potentially even defaulting on loans. Borrowers may need to adjust their spending habits, seek additional income, or consider alternative repayment options to manage the increased financial burden. For some, it may mean delaying major life decisions such as buying a home or starting a family.

Impact on Different Repayment Plans

Different repayment plans are affected differently by interest rate increases. For example, an income-driven repayment (IDR) plan, where monthly payments are tied to income, may see a smaller increase in monthly payments than a standard repayment plan with fixed monthly payments. However, even with IDR plans, the total amount paid over the life of the loan will increase due to the higher interest rate. Standard repayment plans will experience a more direct and substantial increase in monthly payments. Extended repayment plans will also see increased total costs due to the longer repayment period and accruing interest.

Comparison of Monthly Payments Under Various Interest Rate Scenarios

The following table illustrates the impact of different interest rates on monthly payments for a $30,000 loan with a 10-year repayment term. These are simplified examples and do not account for fees or other factors that may affect actual payments.

| Interest Rate | Monthly Payment | Total Interest Paid | Total Paid |

|---|---|---|---|

| 3% | $280 | $1,600 | $31,600 |

| 5% | $305 | $3,600 | $33,600 |

| 7% | $330 | $5,600 | $35,600 |

| 9% | $355 | $7,600 | $37,600 |

Government Policies and Student Loan Interest Rates

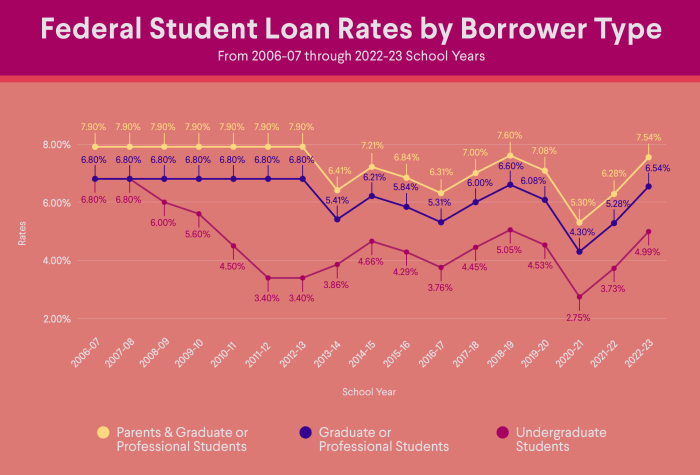

Government policies have profoundly shaped the landscape of student loan interest rates throughout history, influencing borrowing costs and the overall accessibility of higher education. Understanding this relationship is crucial for analyzing the current state of student loan debt and predicting future trends. The interplay between political considerations, economic factors, and social priorities creates a complex dynamic that significantly impacts millions of borrowers.

The historical relationship between government policy and student loan interest rates is characterized by periods of both subsidy and market-driven adjustments. Initially, federal student loan programs often offered subsidized interest rates, reflecting a commitment to making higher education accessible. However, budgetary constraints and shifts in political priorities have led to periods where interest rates have been tied more closely to market fluctuations, resulting in increased costs for borrowers. This shift reflects a broader tension between the government’s role in supporting education and managing fiscal responsibility.

Factors Influencing Government Decisions on Interest Rate Adjustments

Several key factors influence government decisions regarding student loan interest rate adjustments. These include prevailing economic conditions, such as inflation rates and overall interest rate environments. Budgetary considerations play a significant role, as government subsidies for student loans represent a considerable expenditure. Furthermore, political priorities, including the perceived importance of higher education accessibility and the desire to avoid alienating student voters, often weigh heavily in policy decisions. Finally, the level of existing student loan debt and the potential impact of rate changes on borrower repayment ability are also important considerations.

Political and Economic Implications of Raising Student Loan Interest Rates

Raising interest rates on student loans has significant political and economic ramifications. Politically, such increases can be unpopular, particularly among young voters who are heavily burdened by student debt. This can lead to negative impacts on the popularity of the governing party and potentially influence election outcomes. Economically, higher interest rates increase the overall cost of higher education, potentially deterring some students from pursuing further studies. This can have long-term consequences for the nation’s human capital and economic productivity. Furthermore, increased loan burdens can negatively impact borrowers’ financial well-being, potentially hindering their ability to save, invest, and contribute to the economy. For example, the 2005-2006 increase in Stafford loan interest rates led to significant criticism and a renewed focus on student loan reform.

Government Intervention to Mitigate the Effects of Rate Increases

Governments can implement several strategies to mitigate the negative effects of student loan interest rate increases on borrowers. These include income-driven repayment plans, which adjust monthly payments based on borrowers’ income and family size, offering relief to those struggling to repay their loans. Loan forgiveness programs, which cancel a portion or all of a borrower’s debt under certain circumstances, can also provide significant assistance. Furthermore, government investment in financial literacy programs can help borrowers better understand their loan terms and manage their finances effectively. Finally, increasing funding for grant programs and scholarships can reduce the reliance on loans, thereby minimizing the impact of interest rate fluctuations. The expansion of the Public Service Loan Forgiveness (PSLF) program, for instance, aims to incentivize public service and provide relief for borrowers working in qualifying professions.

Strategies for Managing Increased Student Loan Payments

Facing higher student loan payments can be daunting, but proactive strategies can significantly ease the burden. This section Artikels practical approaches to manage increased monthly payments, categorized for clarity and ease of understanding. Remember, seeking professional financial advice is always recommended when dealing with significant financial changes.

Budgeting Strategies for Increased Loan Payments

Effective budgeting is crucial when dealing with increased loan payments. Carefully analyzing your income and expenses allows you to identify areas for potential savings and adjust your spending habits accordingly. This involves creating a realistic budget that incorporates the new, higher loan payment while still allowing for essential living expenses and some discretionary spending.

A sample budget might look like this:

| Category | Pre-Increase | Post-Increase | Difference |

|---|---|---|---|

| Income (Net) | $3000 | $3000 | $0 |

| Student Loan Payment | $200 | $300 | +$100 |

| Rent/Mortgage | $1000 | $1000 | $0 |

| Utilities | $200 | $200 | $0 |

| Groceries | $400 | $350 | -$50 |

| Transportation | $200 | $200 | $0 |

| Entertainment | $200 | $150 | -$50 |

| Savings | $300 | $200 | -$100 |

| Other Expenses | $200 | $200 | $0 |

This example shows a $100 increase in student loan payments. To compensate, the individual reduced their grocery budget by $50, their entertainment budget by $50, and their savings by $100. This highlights the necessity of prioritizing essential expenses and strategically reducing less essential spending.

Refinancing Strategies to Lower Student Loan Payments

Refinancing your student loans could potentially lower your monthly payments by securing a loan with a lower interest rate. This involves applying for a new loan from a different lender to pay off your existing student loans. However, carefully consider the terms and conditions of any refinancing offer, including the length of the loan and any associated fees. Refinancing might extend the repayment period, reducing monthly payments but increasing the total interest paid over the life of the loan.

Seeking Financial Assistance for Student Loan Payments

Several resources are available to assist borrowers struggling with increased loan payments. These programs often offer options such as income-driven repayment plans or temporary deferment or forbearance.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payments on your income and family size. Examples include the Revised Pay As You Earn (REPAYE), Pay As You Earn (PAYE), and Income-Based Repayment (IBR) plans. Eligibility criteria vary depending on the plan.

- Deferment: This temporarily suspends your loan payments, but interest may still accrue depending on the loan type. Deferment is often available for specific circumstances, such as unemployment or enrollment in school.

- Forbearance: Similar to deferment, forbearance temporarily postpones your payments. However, interest usually accrues during forbearance, potentially increasing your total loan balance.

- Student Loan Counseling: Non-profit credit counseling agencies can provide free or low-cost guidance on managing student loan debt and exploring available repayment options.

The Long-Term Effects of Higher Interest Rates on Student Loan Debt

The increase in student loan interest rates has significant and lasting implications for borrowers. Understanding these long-term effects is crucial for individuals navigating repayment and for policymakers aiming to create a more sustainable student loan system. The cumulative impact of even small interest rate increases can dramatically alter the total amount repaid over the loan’s lifespan.

The escalating cost of higher education, coupled with rising interest rates, creates a considerable financial burden for borrowers. This burden is not uniform; it disproportionately affects those with larger loan amounts and longer repayment periods, potentially leading to significant long-term financial consequences.

Long-Term Debt Burden Increase

Higher interest rates directly translate to a larger overall debt burden. The longer a borrower takes to repay their loan, the more interest accrues, significantly increasing the total amount owed. For example, a $50,000 loan at a 5% interest rate will cost considerably more than the same loan at a 3% interest rate, even with the same repayment plan. The difference becomes even more pronounced over longer repayment periods, potentially adding tens of thousands of dollars to the total cost.

Financial Consequences Based on Loan Amount and Interest Rate

Borrowers with larger loan balances face a steeper climb towards repayment. A 1% increase in interest on a $100,000 loan will result in a far greater increase in total repayment cost than a 1% increase on a $20,000 loan. Similarly, borrowers with higher interest rates will pay significantly more over the life of the loan. A longer repayment term exacerbates this effect, allowing interest to compound over a longer period. Consider two borrowers: one with a $40,000 loan at 4% interest and another with a $60,000 loan at 6% interest. Even with identical repayment plans, the second borrower will pay considerably more in interest over the life of the loan.

Cumulative Effect of Interest Rate Increases

The cumulative effect of interest rate increases over the life of a loan is substantial. Each year, interest is calculated on the remaining principal balance, plus any accrued interest. This compounding effect means that even small annual increases in interest rates can lead to a significant increase in the total repayment amount over time. A loan with a series of small interest rate increases over several years will result in a higher total cost compared to a loan with a consistently lower interest rate.

Visual Representation of Student Loan Debt Growth

Imagine a graph with time (in years) on the x-axis and total loan amount (in dollars) on the y-axis. Three lines are plotted, each representing a different interest rate scenario. Line A represents a loan with a fixed 4% interest rate. Line B shows a loan starting at 4% but increasing by 0.5% each year for five years, then remaining constant. Line C illustrates a loan starting at 6% and remaining constant. Line C will always be above Line A, showing the impact of a higher initial interest rate. Line B will start close to Line A but will gradually diverge, demonstrating the cumulative effect of incremental interest rate increases. The gap between Line A and Line C will be substantial, highlighting the significant difference in total repayment cost between a low and a high constant interest rate. The divergence between Line A and Line B will illustrate how even small, incremental increases in interest rates can significantly impact the total repayment amount over the life of the loan.

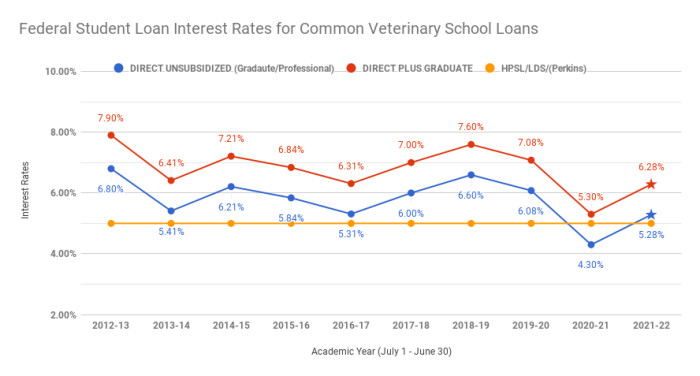

Comparison of Student Loan Interest Rates Across Different Loan Types

Understanding the nuances of student loan interest rates is crucial for borrowers to make informed decisions and plan for long-term financial well-being. Different loan types carry varying interest rates, significantly impacting the total repayment amount over the loan’s lifespan. This section compares federal and private student loan interest rates, explores the factors influencing these differences, and explains the long-term implications for borrowers.

Interest rates on student loans are influenced by several key factors, including the type of loan, the borrower’s creditworthiness, the prevailing market interest rates, and the loan’s terms. Federal loans generally offer more favorable rates than private loans, reflecting the government’s role in supporting access to higher education. However, even within federal loan programs, interest rates can vary.

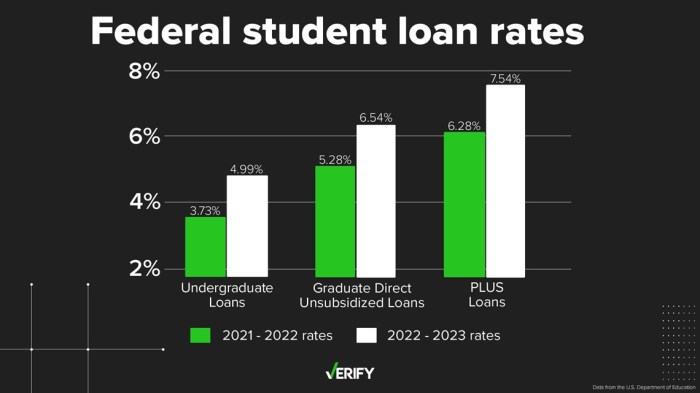

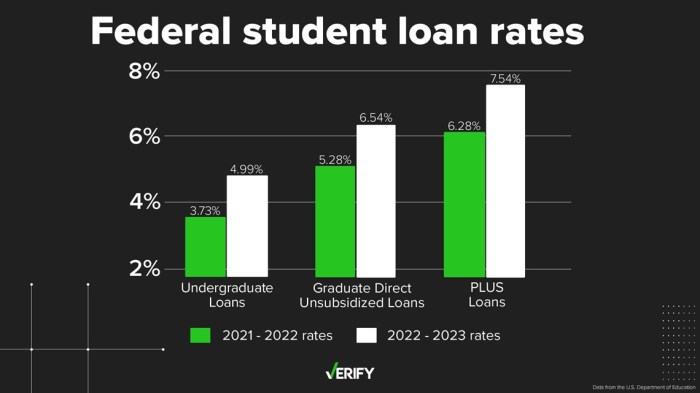

Federal Student Loan Interest Rates

Federal student loans are offered through the government and typically come with lower interest rates than private loans. These rates are set annually by Congress and can fluctuate. The specific rate depends on the type of federal loan (Subsidized, Unsubsidized, PLUS), the borrower’s credit history (for PLUS loans), and the loan disbursement year. For example, subsidized loans may have lower rates than unsubsidized loans because the government pays the interest during certain periods. Parent PLUS loans often have higher rates than undergraduate loans due to the perceived higher risk.

Private Student Loan Interest Rates

Private student loans are offered by banks and other financial institutions. These loans typically have higher interest rates than federal loans, and the rates are determined by the lender based on the borrower’s creditworthiness, credit score, and income. Borrowers with excellent credit scores and stable income will generally receive lower rates, while those with poor credit or limited income may face significantly higher rates. The interest rate may also be fixed or variable, further influencing the total repayment cost.

Comparison of Interest Rates

The following table provides a general comparison of interest rates for different types of student loans. Note that these are illustrative examples and actual rates may vary depending on the year, lender, and borrower’s individual circumstances. It’s crucial to check with the lender for the most up-to-date information.

| Loan Type | Interest Rate Type | Approximate Interest Rate Range (%) | Factors Influencing Rate |

|---|---|---|---|

| Federal Subsidized Loan | Fixed | 2-7 | Set annually by Congress; lower than unsubsidized loans |

| Federal Unsubsidized Loan | Fixed | 3-8 | Set annually by Congress; higher than subsidized loans |

| Federal Parent PLUS Loan | Fixed | 7-10 | Set annually by Congress; based on borrower creditworthiness |

| Private Student Loan | Fixed or Variable | 5-15+ | Based on borrower creditworthiness, income, and market rates |

Implications of Interest Rate Differences for Borrowers

The differences in interest rates across loan types have significant implications for borrowers’ long-term financial health. A higher interest rate translates to a larger total repayment amount over the life of the loan. For example, a borrower with a $50,000 loan at 7% interest will pay significantly more in interest over the life of the loan than a borrower with the same loan amount at 4% interest. This difference can impact a borrower’s ability to save for retirement, buy a home, or meet other financial goals. Choosing a loan with a lower interest rate, even if it requires higher monthly payments, can save a substantial amount of money in the long run. Careful consideration of the total cost of borrowing is paramount in making informed loan decisions.

Concluding Remarks

Navigating the complexities of rising student loan interest rates requires a multifaceted approach. From understanding the government’s role in shaping these rates to implementing effective personal financial management strategies, borrowers must proactively engage with their debt. By carefully considering budgeting adjustments, exploring refinancing possibilities, and utilizing available resources, individuals can mitigate the impact of higher payments and work towards a more secure financial future. Ultimately, a proactive and informed approach is key to successfully managing the increased financial burden of student loan debt in this evolving economic climate.

FAQ

What happens if I can’t afford my increased student loan payments?

Contact your loan servicer immediately. They can discuss options like deferment, forbearance, or income-driven repayment plans to help you manage your payments.

Can I refinance my student loans to get a lower interest rate?

Possibly. Refinancing options are available through private lenders, but be sure to compare rates and terms carefully. Note that refinancing federal loans into private loans can result in the loss of federal protections.

How do interest rate increases affect my total loan cost?

Higher interest rates increase the total amount you’ll pay over the life of the loan, significantly impacting your overall debt burden.

What are income-driven repayment plans?

These plans base your monthly payments on your income and family size, potentially lowering your payments and extending your repayment period.