Navigating the complexities of student loan debt often involves consolidation, a process that can significantly impact your repayment journey. Understanding the interest rate applied to your consolidated loans is crucial, as it directly affects your monthly payments, total repayment amount, and overall financial health. This exploration delves into the factors influencing these rates, the various calculation methods employed, and the strategies you can utilize to manage and potentially reduce your interest costs.

From fixed versus variable rates to government programs offering subsidized options and the potential benefits and risks of refinancing, we will provide a comprehensive overview. We’ll equip you with the knowledge to make informed decisions, empowering you to navigate your student loan debt effectively and achieve your long-term financial goals. This guide aims to clarify the intricacies of consolidated student loan interest rates, enabling you to approach repayment with confidence and a clear understanding of your financial obligations.

Understanding Consolidated Student Loan Interest Rates

Consolidating your student loans can simplify repayment, but understanding how your new interest rate is determined is crucial. The interest rate on your consolidated loan isn’t a simple average of your previous loan rates; several factors play a significant role. This section will clarify these factors and the calculation process.

Factors Influencing Consolidated Student Loan Interest Rates

Several key factors influence the interest rate you’ll receive on a consolidated student loan. These include your credit history, the type of loans being consolidated (federal or private), the prevailing interest rates at the time of consolidation, and the specific loan consolidation program you choose. A strong credit history generally leads to a lower interest rate, while a weaker history may result in a higher one. Federal loan consolidation programs often offer fixed interest rates, while private loan consolidation options may offer either fixed or variable rates. The current economic climate also affects interest rates; higher prevailing interest rates generally translate to higher rates for new loans.

Interest Rate Calculation Methods

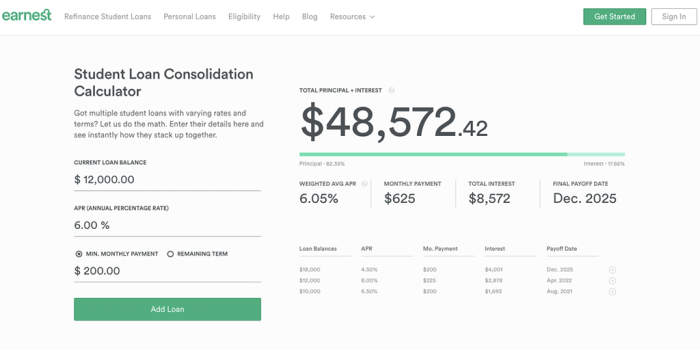

The calculation method for your consolidated loan’s interest rate varies depending on the type of loan and the lender. For federal student loans, a weighted average of your existing loan interest rates is typically used. This means that loans with larger balances will have a greater impact on the final rate. The calculation considers the outstanding principal balance of each loan and its interest rate. The formula is generally:

Weighted Average Interest Rate = (Sum of (Loan Balance * Interest Rate) for all loans) / (Total of all Loan Balances)

. Private lenders may use different methods, sometimes factoring in your credit score and other financial factors. It’s essential to carefully review the terms and conditions of your consolidation loan offer to understand precisely how your rate is calculated.

Examples of Interest Rate Calculation Scenarios

Let’s consider two scenarios. Scenario 1: You have two federal student loans: one with a $20,000 balance at 5% interest and another with a $10,000 balance at 7% interest. Using the weighted average formula: [(20000 * 0.05) + (10000 * 0.07)] / (20000 + 10000) = 0.0567 or 5.67%. Your consolidated loan would likely have an interest rate around 5.67%. Scenario 2: You have three private loans with balances of $15,000, $10,000, and $5,000, and interest rates of 6%, 8%, and 10%, respectively. A private lender might consider these rates but also adjust based on your credit score. If your credit score is excellent, the final rate might be lower than a simple weighted average. Conversely, a poor credit score might result in a higher rate.

Fixed vs. Variable Interest Rates

Consolidated loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, making budgeting easier. A variable interest rate fluctuates with market conditions, potentially leading to lower initial payments but increased risk of higher payments in the future. The choice between fixed and variable depends on your risk tolerance and financial outlook. If you prefer predictable payments, a fixed rate is generally better. If you anticipate interest rates decreasing, a variable rate might offer short-term savings, but it carries more risk.

Comparison of Loan Consolidation Programs and Interest Rates

| Program | Loan Type | Interest Rate Type | Approximate Interest Rate Range (as of October 26, 2023)* |

|---|---|---|---|

| Federal Direct Consolidation Loan | Federal Student Loans | Fixed | Variable, depending on the weighted average of the underlying loans |

| Private Loan Consolidation | Private Student Loans | Fixed or Variable | Variable, depending on credit score and market conditions; typically 5% – 15% |

*Note: Interest rate ranges are estimates and can vary significantly based on individual circumstances and market conditions. Contact lenders for current rates.

Impact of Interest Rates on Loan Repayment

Understanding the impact of interest rates on your consolidated student loans is crucial for effective financial planning. Higher interest rates significantly increase the total cost of borrowing, leading to larger monthly payments and a longer repayment timeline. Conversely, lower rates translate to lower overall costs and potentially shorter repayment periods. This section will delve into the specifics of this relationship.

The interest rate directly influences the total amount you repay. A higher interest rate means a larger portion of your monthly payment goes towards interest, leaving less to pay down the principal loan amount. This snowball effect results in a substantially larger total repayment amount over the life of the loan. Conversely, a lower interest rate allows a greater proportion of each payment to reduce the principal, leading to faster payoff and lower overall interest charges.

Interest Rate Impact on Repayment Amount and Duration

Different interest rates dramatically affect both the total amount repaid and the loan’s repayment period. Even small percentage point differences can lead to thousands of dollars in extra interest paid over the life of the loan, and extend the repayment period by several years. For example, a 7% interest rate on a $50,000 loan might result in a significantly higher total repayment cost and longer repayment period compared to a 5% interest rate. This difference highlights the importance of securing the lowest possible interest rate when consolidating student loans.

Monthly Payment Differences Based on Interest Rates and Loan Amounts

The following table illustrates the monthly payment differences for various loan amounts and interest rates, assuming a standard 10-year repayment plan. Note that these are simplified examples and do not account for potential fees or other loan-specific factors.

| Loan Amount | 5% Interest Rate | 7% Interest Rate | 9% Interest Rate |

|---|---|---|---|

| $20,000 | $212.47 | $238.98 | $267.79 |

| $40,000 | $424.94 | $477.95 | $535.57 |

| $60,000 | $637.41 | $716.93 | $803.36 |

Calculating Total Interest Paid

Calculating the total interest paid over the loan’s lifetime involves a multi-step process. While loan amortization calculators readily provide this information, understanding the underlying calculation is beneficial.

- Determine the monthly payment: Use a loan amortization calculator or formula to find your monthly payment. Many online resources are available for this calculation.

- Calculate the total amount repaid: Multiply your monthly payment by the total number of payments (loan term in months).

- Subtract the principal loan amount: Subtract the original loan amount from the total amount repaid. The result is the total interest paid over the loan’s lifetime.

For example: If your monthly payment is $500 and your loan term is 120 months (10 years), the total amount repaid is $60,000. If your original loan amount was $40,000, then the total interest paid is $20,000 ($60,000 – $40,000).

Repayment Strategies to Minimize High Interest Rate Impact

Several strategies can help mitigate the impact of high interest rates.

Making extra principal payments can significantly reduce the total interest paid and shorten the repayment period. Even small additional payments each month can make a considerable difference over time. Another effective strategy is to refinance your loan to a lower interest rate if possible, particularly if interest rates have fallen since you originally consolidated your loans. This can substantially lower your monthly payments and reduce the overall cost of the loan.

Government Programs and Subsidized Loans

Consolidating your student loans can offer significant advantages, but understanding the various government programs and their associated interest rates is crucial for making informed decisions. This section details several key programs, their eligibility requirements, and the advantages and disadvantages of participation. It’s important to remember that eligibility criteria and interest rates are subject to change, so always check the official government websites for the most up-to-date information.

Federal Direct Consolidation Loan Program

The Federal Direct Consolidation Loan Program allows borrowers to combine multiple federal student loans into a single loan, often simplifying repayment. This program doesn’t inherently offer lower interest rates than your existing loans; instead, the interest rate is a weighted average of your existing loans’ rates, rounded up to the nearest one-eighth of a percent.

Eligibility for this program requires having eligible federal student loans, such as Direct Subsidized and Unsubsidized Loans, Federal Stafford Loans, and Federal PLUS Loans. Borrowers must also meet standard credit requirements.

Advantages include simplified repayment with a single monthly payment and potentially a longer repayment term, leading to lower monthly payments. However, a disadvantage is that the weighted average interest rate might not be significantly lower, and extending the repayment period could lead to paying more interest overall. The application process involves completing a Direct Consolidation Loan application online through the Federal Student Aid website, providing information about your existing loans.

Income-Driven Repayment Plans

Several income-driven repayment (IDR) plans, offered under the Federal Direct Loan Program, adjust your monthly payment based on your income and family size. While these plans don’t directly lower your interest rate, they can significantly reduce your monthly payment, making repayment more manageable. These plans include Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

Eligibility varies depending on the specific plan, but generally requires having federal student loans and meeting certain income requirements. Documentation usually includes tax returns and proof of income.

The primary advantage is affordability, as monthly payments are tailored to your income. However, disadvantages include potentially extending the repayment period significantly, resulting in more interest paid over the life of the loan, and the possibility of loan forgiveness after a certain number of years, but this forgiveness is considered taxable income. The application process is typically done online through the Federal Student Aid website, requiring the submission of income documentation.

Public Service Loan Forgiveness (PSLF) Program

The PSLF program forgives the remaining balance on your federal student loans after you’ve made 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying employer. This program doesn’t directly lower interest rates, but it eliminates the remaining loan balance.

Eligibility requires working full-time for a qualifying government or non-profit organization and making 120 qualifying monthly payments under an IDR plan. Detailed documentation of employment and loan repayment history is required.

The primary advantage is the potential for complete loan forgiveness. The disadvantage is the lengthy 10-year commitment required to qualify and the stringent requirements for qualifying employment and repayment. The application process involves submitting an employment certification form annually and maintaining accurate records of your employment and loan repayment.

Refinancing Options and Their Implications

Refinancing your consolidated student loans can be a strategic move to potentially lower your monthly payments and save money over the life of your loan. However, it’s crucial to understand the process, compare offers, and carefully weigh the potential benefits against the risks before making a decision. This section will guide you through the key aspects of refinancing your consolidated student loans.

Refinancing consolidated student loans involves taking out a new private loan to pay off your existing federal student loans. This new loan will typically have a different interest rate, repayment term, and lender than your original loans. The process generally begins by comparing offers from multiple private lenders, applying for the loan that best suits your financial situation, and then using the loan proceeds to pay off your existing federal loans. This replaces your federal loans with a private loan.

Interest Rates Offered by Private Lenders

Private lenders offer a wide range of interest rates on student loan refinancing, influenced by factors such as your credit score, income, debt-to-income ratio, and the loan amount. Generally, borrowers with higher credit scores and lower debt-to-income ratios qualify for lower interest rates. For example, a borrower with an excellent credit score might receive an interest rate of 5%, while a borrower with a fair credit score might receive a rate of 8% or higher. These rates are typically fixed, meaning they remain constant throughout the loan term, or variable, meaning they can fluctuate based on market conditions. It’s essential to compare rates from multiple lenders to find the most competitive offer. Some lenders might advertise lower rates but charge higher fees, so it’s crucial to consider the total cost of the loan.

Benefits and Risks of Refinancing

Refinancing can offer several benefits, including lower monthly payments due to a longer repayment term or a lower interest rate. This can free up cash flow for other financial priorities. However, refinancing also carries risks. The most significant risk is losing the benefits of federal student loans, such as income-driven repayment plans and loan forgiveness programs. Additionally, refinancing with a variable interest rate exposes you to the risk of higher payments if interest rates rise. Finally, if your credit score deteriorates after refinancing, you might face difficulties in managing your loan.

Factors to Consider When Choosing a Refinancing Option

Several key factors should influence your refinancing decision. Your credit score and debt-to-income ratio significantly impact the interest rate you’ll qualify for. Consider the loan’s terms, including the interest rate, repayment period, and any associated fees. Compare offers from multiple lenders to ensure you’re getting the best deal. Finally, evaluate whether the potential benefits of refinancing outweigh the risks of losing federal student loan protections. For example, if you anticipate needing an income-driven repayment plan in the future, refinancing might not be the best option.

Questions to Ask Potential Lenders

Before committing to a refinancing plan, it’s vital to thoroughly investigate each lender’s offer. This involves asking specific questions to clarify details and ensure you understand the terms completely.

- What is the annual percentage rate (APR) and how is it calculated?

- What are the loan’s terms and conditions, including the repayment period and any prepayment penalties?

- What are the lender’s requirements for loan eligibility, such as credit score and debt-to-income ratio?

- What are the lender’s fees, including origination fees, late payment fees, and other charges?

- What happens if I miss a payment or experience financial hardship?

- Does the lender offer different repayment options, such as fixed or variable interest rates?

- What is the lender’s customer service reputation and complaint resolution process?

Managing and Reducing Interest Costs

Successfully navigating student loan repayment requires a proactive approach to managing and minimizing interest costs. Understanding various strategies and available options empowers borrowers to make informed decisions that can significantly impact their long-term financial well-being. This section Artikels key methods for reducing your overall interest burden.

Extra Payments and Their Benefits

Making extra payments on your consolidated student loans can substantially reduce the total interest paid and shorten the repayment period. Even small additional payments, made consistently, can accelerate the payoff process. For example, paying an extra $50 per month on a $30,000 loan could save thousands of dollars in interest and shave years off the repayment timeline. The interest savings are maximized when these extra payments are applied directly to the principal balance, rather than just the current month’s interest.

Repayment Plan Implications

The choice of repayment plan significantly influences the total interest paid over the loan’s life. Standard repayment plans offer fixed monthly payments over a 10-year period, but longer repayment plans, such as extended repayment or graduated repayment, may lower monthly payments initially, but result in higher overall interest costs due to the extended repayment period. Income-driven repayment plans adjust monthly payments based on income and family size, providing more flexibility, but potentially extending the repayment period and increasing total interest paid. Borrowers should carefully weigh the short-term benefits of lower monthly payments against the long-term cost of increased total interest.

Appealing a High Interest Rate

While challenging, it’s possible to appeal a high interest rate on a consolidated student loan under specific circumstances. This typically involves presenting evidence of errors in the calculation of the interest rate or demonstrating extenuating circumstances that justify a rate reduction. Documentation of such errors or circumstances, such as proof of incorrect application of a federal program or demonstrable financial hardship, is crucial for a successful appeal. The appeal process often involves contacting the loan servicer directly and following their formal appeals procedure.

Managing Loan Repayment Difficulties: A Flowchart

The following flowchart illustrates the steps to take when facing difficulties with student loan repayment:

[Start] –> [Identify the problem (missed payments, inability to afford payments, etc.)] –> [Contact your loan servicer immediately] –> [Explore options: Deferment, forbearance, income-driven repayment plan] –> [If options insufficient, consider credit counseling] –> [If still struggling, explore options like loan consolidation or refinancing (if applicable)] –> [If no resolution, consult with a financial advisor] –> [End]

Long-Term Financial Planning and Student Loans

Consolidated student loans, while simplifying repayment, significantly impact long-term financial planning. Understanding the interest rate on these loans is crucial for making informed decisions about your financial future, from purchasing a home to investing for retirement. Failing to account for loan repayments can severely restrict your financial flexibility and potentially delay the achievement of major life goals.

The interest rate on your consolidated student loans directly affects the total amount you’ll repay. A higher interest rate translates to a larger overall cost and longer repayment period, leaving less money available for other financial priorities. This impact extends beyond the immediate repayment period; it can influence your ability to save, invest, and build wealth over the long term. For instance, a higher interest rate could mean less money available for a down payment on a house or contributions to a retirement account.

Incorporating Loan Repayment into a Comprehensive Financial Plan

Creating a realistic budget that incorporates your student loan payments is paramount. This requires a clear understanding of your monthly income, expenses, and the total amount due on your loans. A comprehensive financial plan should Artikel not only your loan repayment strategy but also savings goals, investment plans, and other financial objectives. This integrated approach ensures that your loan payments don’t overshadow other essential financial aspects of your life.

Budgeting Strategies to Accommodate Loan Payments

Several budgeting methods can help manage student loan payments effectively. The 50/30/20 rule, for example, suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Alternatively, the zero-based budget method involves meticulously tracking every dollar earned and ensuring that every dollar is allocated to a specific purpose, including loan payments. A detailed monthly budget, updated regularly, allows you to monitor progress and adjust spending habits as needed. For instance, if your loan payment is $500, ensuring this is accounted for in the ‘needs’ category, and that the ‘wants’ category is carefully monitored to ensure it doesn’t compromise loan repayment, is critical.

Considering Interest Rates When Making Major Financial Decisions

Interest rates on your consolidated student loans should heavily influence significant financial choices. For example, when considering purchasing a home, a higher student loan payment might limit your borrowing capacity for a mortgage. Similarly, planning for retirement requires careful consideration of the loan repayment burden, as it will directly affect how much you can contribute to retirement savings. Investing strategies should also reflect the financial constraints imposed by student loan payments. A realistic assessment of your overall financial picture, including loan obligations, is essential for making well-informed decisions.

Resources for Borrowers Seeking Financial Guidance

Several resources are available to assist borrowers in navigating the complexities of student loan repayment and financial planning.

- The National Foundation for Credit Counseling (NFCC): Offers free and low-cost credit counseling services, including debt management plans.

- Your Loan Servicer: Provides information on repayment plans, options, and assistance programs.

- The Consumer Financial Protection Bureau (CFPB): Offers educational resources and tools to help consumers understand their rights and responsibilities.

- Financial Aid Offices at Colleges and Universities: Often provide post-graduation financial planning resources and workshops.

Conclusive Thoughts

Effectively managing consolidated student loan interest rates requires a proactive and informed approach. By understanding the factors that influence these rates, exploring available government programs and refinancing options, and employing strategic repayment strategies, you can significantly impact your overall repayment burden. Remember, proactive planning, careful consideration of your options, and a commitment to responsible financial management are key to successfully navigating your student loan debt and achieving long-term financial well-being.

FAQ Summary

What is the difference between a fixed and variable interest rate on a consolidated student loan?

A fixed interest rate remains constant throughout the loan’s life, while a variable rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates could potentially lead to lower initial payments but higher payments later if rates rise.

Can I consolidate private and federal student loans together?

Generally, you can only consolidate federal student loans together. Private loans usually require separate refinancing.

What happens if I miss a payment on my consolidated student loan?

Missing payments can negatively impact your credit score, potentially leading to late fees and even default. Contact your loan servicer immediately if you anticipate difficulty making a payment.

How long does the consolidation process take?

The timeframe for consolidating federal loans varies, but it typically takes several weeks. Private loan refinancing processes can also vary depending on the lender.