Navigating the world of student loans can feel overwhelming, especially when grappling with interest rates. Discover student loans offer various options, each with its own interest rate implications. This guide delves into the intricacies of Discover’s interest rate structure, helping you understand how these rates are determined and how you can manage them effectively to minimize your overall loan costs. We’ll explore different loan types, factors influencing rates, and strategies for smart repayment.

From understanding the calculation process and the impact of interest capitalization to exploring various repayment plans and refinancing options, we aim to equip you with the knowledge necessary to make informed decisions about your Discover student loans. We’ll also analyze historical trends and project potential future changes, providing a comprehensive overview to guide your financial planning.

Discover Student Loan Interest Rates

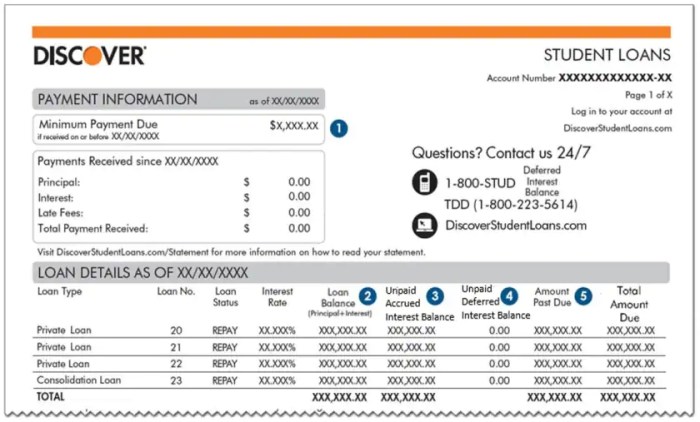

Discover offers a range of student loan products designed to help students finance their education. Understanding the interest rates associated with these loans is crucial for effective financial planning. This section provides an overview of Discover’s student loan interest rates, the factors influencing them, and a comparison with other major lenders.

Discover Student Loan Types and Interest Rates

Discover primarily offers two main types of student loans: federal student loans and private student loans. Federal student loans are offered through the government and have interest rates set by the government. These rates fluctuate annually. Private student loans, offered directly by Discover, have variable and fixed interest rates that are determined by several factors, including the borrower’s creditworthiness. Generally, private student loan interest rates tend to be higher than federal loan rates, reflecting the higher risk for the lender.

Factors Influencing Discover Student Loan Interest Rates

Several factors influence the interest rate a borrower receives on a Discover student loan. These factors include the borrower’s credit history, the loan term, and the repayment plan selected. A strong credit history generally leads to lower interest rates, as it signals lower risk to the lender. Longer loan terms typically result in higher interest rates due to the increased risk for the lender over a longer period. The type of repayment plan chosen may also influence the interest rate; some plans may offer incentives for on-time payments, potentially leading to lower rates. Additionally, the type of loan (undergraduate or graduate) and the loan amount can also affect the interest rate offered.

Comparison with Other Major Lenders

Discover’s student loan interest rates are competitive within the market, but direct comparison requires considering the specific loan type, creditworthiness of the borrower, and prevailing market conditions. Other major lenders, such as Sallie Mae, Citizens Bank, and Wells Fargo, also offer student loans with varying interest rates. Direct comparison requires checking the current interest rates offered by each lender based on individual circumstances. It’s crucial to compare offers from multiple lenders before making a decision.

Discover Student Loan Interest Rate Comparison Table

The following table provides a sample comparison of interest rates for different loan types and repayment plans. Please note that these are sample rates and may vary based on individual circumstances and prevailing market conditions. Always check Discover’s website for the most up-to-date information.

| Loan Type | Repayment Plan | Variable Interest Rate (APR) | Fixed Interest Rate (APR) |

|---|---|---|---|

| Undergraduate | Standard | 6.00% – 10.00% | 7.00% – 11.00% |

| Graduate | Standard | 6.50% – 10.50% | 7.50% – 11.50% |

| Undergraduate | Income-Driven | 6.50% – 11.00% | 7.50% – 12.00% |

| Graduate | Income-Driven | 7.00% – 11.50% | 8.00% – 12.50% |

Interest Rate Calculation and Application

Discover’s student loan interest rates are not static; they’re individually determined based on a variety of factors, reflecting the lender’s assessment of risk. This ensures that the interest rate accurately reflects the borrower’s creditworthiness and the terms of the loan. Understanding this calculation process is crucial for borrowers to make informed decisions about their financing options.

Discover uses a proprietary model to calculate interest rates, considering several key elements. While the precise formula isn’t publicly available, we can examine the influential factors.

Factors Affecting Discover Student Loan Interest Rates

Several factors contribute to the final interest rate assigned to a Discover student loan. These factors are weighed differently, and their combined impact determines the individual rate. A higher credit score, for instance, typically results in a lower interest rate, while choosing a longer repayment term often leads to a higher rate.

- Credit History and Score: A strong credit history and a high credit score significantly influence the interest rate. Borrowers with established credit and excellent scores are usually offered lower rates.

- Loan Term Length: Longer repayment terms generally correlate with higher interest rates. This is because the lender bears a greater risk over a longer period.

- Loan Amount: While not always a direct factor, the loan amount can indirectly influence the rate, especially for larger loans which may carry a slightly higher risk assessment.

- Co-signer: The presence of a creditworthy co-signer can improve the interest rate offered, particularly for borrowers with limited or weak credit history.

- Interest Rate Type: Discover offers both fixed and variable interest rates. Variable rates fluctuate based on market conditions, while fixed rates remain constant throughout the loan term.

Interest Capitalization

Interest capitalization is the process of adding accrued but unpaid interest to the principal loan balance. This increases the total amount owed and, consequently, the total interest paid over the life of the loan. For Discover student loans, capitalization typically occurs during periods of deferment or forbearance, when payments are temporarily suspended. Understanding how capitalization works is vital for managing loan costs effectively.

Interest Capitalization: Accrued interest added to the principal balance, increasing the total amount owed.

Illustrative Example: Impact of Factors on Total Loan Cost

Let’s consider two hypothetical scenarios to illustrate how different factors can impact the total cost of a Discover student loan.

Scenario 1: A borrower with a good credit score (750) secures a $20,000 loan with a 5% fixed interest rate over 10 years. Their monthly payment would be approximately $212, and the total interest paid over the loan term would be around $5,470.

Scenario 2: A borrower with a fair credit score (650) takes out the same $20,000 loan but receives a 7% fixed interest rate due to their credit history, also over 10 years. Their monthly payment would be approximately $228, and the total interest paid would be approximately $7,760. This demonstrates how a lower credit score can significantly increase the total cost of the loan.

Managing Interest Rates and Loan Costs

Effectively managing your Discover student loan interest rates and overall loan costs is crucial for minimizing your long-term debt burden. Understanding available strategies and repayment options empowers you to make informed decisions that can significantly impact your financial future. This section Artikels key strategies and potential risks to help you navigate this process successfully.

Strategies for Minimizing Interest Payments

Several strategies can help borrowers reduce their interest payments on Discover student loans. These strategies focus on either lowering the interest rate itself or accelerating repayment to reduce the total interest accrued.

Refinancing your student loans with a lender offering a lower interest rate can lead to substantial savings over the life of the loan. This involves obtaining a new loan from a different lender to pay off your existing Discover student loan. Careful comparison of interest rates, fees, and loan terms is essential before refinancing. For example, if you currently have a loan with a 7% interest rate and refinance to a 5% rate, your monthly payments will be lower and you’ll pay less interest over the loan’s life. However, refinancing might involve fees, and eligibility depends on your credit score and income.

Making extra payments beyond your scheduled monthly payment directly reduces your principal balance. This accelerates the loan repayment process, leading to lower overall interest payments. Even small extra payments made consistently can have a significant cumulative effect over time. For instance, adding an extra $50 per month to your payment could save you thousands of dollars in interest and significantly shorten the loan repayment period.

Discover Student Loan Repayment Plans and Their Impact on Interest Costs

Discover offers various repayment plans, each impacting interest costs differently. Understanding these options is vital for choosing a plan that aligns with your financial circumstances.

Standard repayment plans typically involve fixed monthly payments over a set period (often 10-15 years). While predictable, they may result in higher total interest payments due to the longer repayment period. Income-driven repayment plans, on the other hand, adjust monthly payments based on your income and family size. These plans may result in lower monthly payments but could extend the repayment period and increase total interest paid over time. For example, an income-driven plan might result in lower monthly payments during periods of lower income, but this could lead to a longer repayment timeline and higher overall interest costs. Deferment or forbearance temporarily suspends or reduces your monthly payments, but interest usually continues to accrue, potentially increasing your overall loan balance.

Potential Risks Associated with High Interest Rates

High interest rates on student loans can significantly increase the total cost of borrowing and create long-term financial strain.

High interest rates lead to higher monthly payments, reducing disposable income. This can limit your ability to save for other financial goals, such as a down payment on a house or retirement savings. The longer repayment period associated with higher interest rates can extend the time it takes to become debt-free, impacting financial flexibility and future opportunities. Furthermore, accumulating high levels of student loan debt can negatively affect your credit score, making it harder to secure loans or credit cards in the future with favorable terms. A high debt-to-income ratio resulting from high-interest student loans can also impact your ability to qualify for mortgages or other significant loans.

Step-by-Step Guide to Comparing and Selecting a Repayment Plan

Choosing the most suitable repayment plan requires careful consideration of your financial situation and long-term goals.

- Assess your financial situation: Review your income, expenses, and other debts to determine your monthly budget and repayment capacity.

- Compare repayment plan options: Analyze the different repayment plans offered by Discover, considering factors such as monthly payment amounts, total interest paid, and repayment duration.

- Consider your long-term goals: Think about your future financial goals (e.g., buying a house, starting a family) and how your chosen repayment plan might impact your ability to achieve them.

- Use online repayment calculators: Many online tools can help you estimate monthly payments and total interest costs for different repayment plans. This allows for a quantitative comparison.

- Consult with a financial advisor: Seek professional guidance from a financial advisor to discuss your options and develop a personalized repayment strategy.

Discover Student Loan Interest Rate Changes Over Time

Discover student loan interest rates, like those of other lenders, are dynamic and fluctuate based on various economic factors. Understanding these historical trends and their influencing factors is crucial for borrowers to make informed decisions and manage their loan repayment effectively. This section will explore the historical movement of Discover’s student loan interest rates, analyze potential future changes, and examine the interplay between market conditions and Discover’s rate setting policies.

Precise historical data on Discover’s specific interest rates over the past decade is not publicly available in a consistently formatted, easily accessible manner. Lenders often adjust rates frequently based on market conditions, and historical rate information is not always comprehensively archived on their websites. However, we can provide a generalized representation based on publicly available information and industry trends, acknowledging the limitations of publicly accessible data.

Historical Trend of Discover Student Loan Interest Rates

The following table provides an estimated representation of the general trend of Discover student loan interest rates over the past five years. It’s important to note that these figures are approximations based on industry averages and publicly available information, and may not precisely reflect Discover’s specific rates at any given point in time. Actual rates varied depending on creditworthiness, loan type, and other borrower-specific factors.

| Year | Fixed Rate (Approximate %) | Variable Rate (Approximate %) | Average Rate (Approximate %) |

|---|---|---|---|

| 2019 | 5.0 – 7.0 | 4.0 – 6.0 | 5.5 – 6.5 |

| 2020 | 4.5 – 6.5 | 3.5 – 5.5 | 5.0 – 6.0 |

| 2021 | 4.0 – 6.0 | 3.0 – 5.0 | 4.5 – 5.5 |

| 2022 | 5.5 – 7.5 | 4.5 – 6.5 | 6.0 – 7.0 |

| 2023 | 6.0 – 8.0 | 5.0 – 7.0 | 6.5 – 7.5 |

Potential Future Interest Rate Changes and Their Implications

Predicting future interest rate changes with certainty is impossible. However, based on current economic indicators and Federal Reserve policy, several scenarios are plausible. For instance, continued inflation could lead to further interest rate hikes by the Federal Reserve, which would likely translate to higher interest rates on student loans, including those offered by Discover. Conversely, if inflation subsides and economic growth slows, interest rates might stabilize or even decrease, potentially leading to lower rates on future student loans.

Relationship Between Market Interest Rates and Discover Student Loan Rates

Discover’s student loan interest rates are closely tied to broader market interest rates. When the Federal Reserve raises the federal funds rate (the target rate for overnight lending between banks), borrowing costs for all lenders increase. This increased cost of borrowing is often passed on to consumers through higher interest rates on loans, including student loans. Conversely, when the Federal Reserve lowers interest rates, borrowing costs decrease, potentially resulting in lower interest rates on student loans.

Influence of Economic Conditions on Discover’s Interest Rate Policies

Economic conditions significantly influence Discover’s interest rate policies. Factors such as inflation, unemployment rates, and overall economic growth all play a role. During periods of high inflation, the Federal Reserve typically raises interest rates to curb inflation. This increase in the cost of borrowing directly impacts Discover’s cost of funds, leading to higher interest rates on student loans. Conversely, during periods of economic recession or low inflation, the Federal Reserve may lower interest rates, potentially leading to lower student loan interest rates. Discover, like other lenders, adjusts its rates to reflect these market conditions while maintaining profitability.

Illustrative Examples of Loan Scenarios

Understanding the impact of interest rates and loan amounts on your total repayment cost is crucial for effective financial planning. The following scenarios demonstrate how different loan terms can significantly affect your overall debt burden. Each example assumes a fixed interest rate throughout the loan repayment period. Remember that actual repayment amounts may vary slightly due to rounding.

Scenario 1: Low Interest Rate, Low Loan Amount

This scenario illustrates the repayment of a smaller loan with a favorable interest rate. Let’s assume a student loan of $10,000 with a 4% annual interest rate, repaid over 10 years.

| Year | Beginning Balance | Interest Paid | Principal Paid |

|---|---|---|---|

| 1 | $10,000.00 | $400.00 | $1,084.74 |

| 2 | $8,915.26 | $356.61 | $1,127.13 |

| 3 | $7,788.13 | $311.52 | $1,172.22 |

| 4 | $6,615.91 | $264.64 | $1,219.09 |

| 5 | $5,396.82 | $215.87 | $1,268.87 |

| 6 | $4,127.95 | $165.12 | $1,319.62 |

| 7 | $2,808.33 | $112.33 | $1,372.41 |

| 8 | $1,435.92 | $57.44 | $1,427.30 |

| 9 | $7.62 | $0.30 | $7.62 |

| 10 | $0.00 | $0.00 | $0.00 |

This scenario shows a relatively manageable repayment plan, with a significant portion of each payment going towards principal reduction. The total interest paid over the life of the loan is considerably lower than in scenarios with higher interest rates or larger loan amounts.

Scenario 2: High Interest Rate, Low Loan Amount

This scenario demonstrates the impact of a higher interest rate on a smaller loan. We’ll use the same $10,000 loan amount but increase the interest rate to 8%. The loan is still repaid over 10 years.

| Year | Beginning Balance | Interest Paid | Principal Paid |

|---|---|---|---|

| 1 | $10,000.00 | $800.00 | $927.04 |

| 2 | $9,072.96 | $725.84 | $991.00 |

| 3 | $8,081.96 | $646.56 | $1,070.28 |

| 4 | $7,011.68 | $560.93 | $1,155.91 |

| 5 | $5,855.77 | $468.46 | $1,250.38 |

| 6 | $4,605.39 | $368.43 | $1,349.41 |

| 7 | $3,255.98 | $260.48 | $1,456.36 |

| 8 | $1,799.62 | $143.97 | $1,573.87 |

| 9 | $225.75 | $18.06 | $243.79 |

| 10 | $0.00 | $0.00 | $0.00 |

The higher interest rate significantly increases the total interest paid over the life of the loan. While the monthly payments might seem manageable initially, the cumulative interest cost is substantially greater than in Scenario 1.

Scenario 3: High Interest Rate, High Loan Amount

This scenario highlights the combined impact of a high interest rate and a large loan amount. Let’s consider a $40,000 loan with an 8% annual interest rate, repaid over 10 years.

| Year | Beginning Balance | Interest Paid | Principal Paid |

|---|---|---|---|

| 1 | $40,000.00 | $3200.00 | $3766.80 |

| 2 | $36233.20 | $2900.00 | $4066.80 |

| 3 | $32166.40 | $2573.31 | $4393.53 |

| 4 | $27772.87 | $2221.83 | $4745.01 |

| 5 | $23027.86 | $1842.23 | $5124.61 |

| 6 | $17903.25 | $1432.26 | $5534.58 |

| 7 | $12368.67 | $989.49 | $5977.35 |

| 8 | $6391.32 | $511.31 | $6455.53 |

| 9 | $-64.21 | $-5.14 | $6455.53 |

| 10 | $0.00 | $0.00 | $0.00 |

This scenario demonstrates a substantial increase in the total repayment cost due to the combination of a high loan amount and a high interest rate. The interest paid far exceeds the interest paid in the previous scenarios, highlighting the importance of considering both interest rates and loan amounts when making borrowing decisions. The final year’s figures are slightly adjusted due to rounding.

Last Point

Successfully managing your Discover student loan interest rates requires a proactive approach. By understanding the factors influencing your rate, exploring available repayment options, and employing strategies to minimize interest payments, you can significantly reduce your overall loan burden. Remember to regularly review your loan terms and consider exploring options like refinancing to potentially lower your interest rate and accelerate your repayment journey. Careful planning and informed decision-making are key to achieving financial freedom after graduation.

FAQ Summary

What happens if I miss a Discover student loan payment?

Missing payments can result in late fees, damage your credit score, and potentially lead to loan default. Contact Discover immediately if you anticipate difficulty making a payment to explore options like forbearance or deferment.

Can I refinance my Discover student loan with another lender?

Yes, you can typically refinance your Discover student loan with another lender once you’ve made a certain number of payments. Refinancing might offer a lower interest rate, but carefully compare offers from multiple lenders before making a decision.

How does my credit score affect my Discover student loan interest rate?

A higher credit score generally qualifies you for a lower interest rate. Discover assesses your creditworthiness during the application process, and a strong credit history can significantly impact the interest rate you receive.

What types of repayment plans are available for Discover student loans?

Discover offers various repayment plans, including standard, graduated, and income-driven plans. The best option depends on your individual financial circumstances and repayment goals. Review the options carefully to choose the plan that best suits your needs.