Navigating the complexities of student loan interest rates can feel overwhelming. Understanding whether interest is calculated monthly or yearly, and how this impacts your total repayment, is crucial for effective financial planning. This guide explores the nuances of fixed versus variable rates, the amortization process, and strategies for managing your debt effectively, empowering you to make informed decisions about your student loan repayment.

From understanding the factors influencing interest rates to exploring various repayment options and the long-term financial implications of your choices, we aim to demystify the process and equip you with the knowledge to navigate your student loan journey confidently. We’ll cover federal versus private loans, calculation methods, and the impact of interest rate fluctuations, offering practical advice and tools to help you manage your debt effectively.

Understanding Student Loan Interest Rates

Navigating the world of student loans requires a clear understanding of interest rates, as they significantly impact the total repayment amount. This section will clarify the different types of interest rates, explain how interest capitalization works, and identify factors that influence these rates. Understanding these concepts empowers borrowers to make informed decisions about their student loan financing.

Fixed versus Variable Interest Rates

Student loans typically come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. Conversely, a variable interest rate fluctuates based on a benchmark index, such as the prime rate or LIBOR (though LIBOR is being phased out). This means your monthly payments could increase or decrease over time, depending on market conditions. Choosing between a fixed and variable rate depends on your risk tolerance and predictions about future interest rate movements. A fixed rate offers stability, while a variable rate could potentially lead to lower payments initially, but carries the risk of higher payments later.

Interest Capitalization

Interest capitalization is the process of adding accumulated interest to the principal loan balance. This typically occurs when payments are not made, or during periods of deferment or forbearance. For example, if you have unpaid interest accumulating during a grace period, that interest will be added to your principal balance, increasing the total amount you owe. This significantly impacts the total cost of the loan over time, as you’ll be paying interest on a larger principal amount. The more frequently interest capitalizes, the greater the impact on your overall loan repayment.

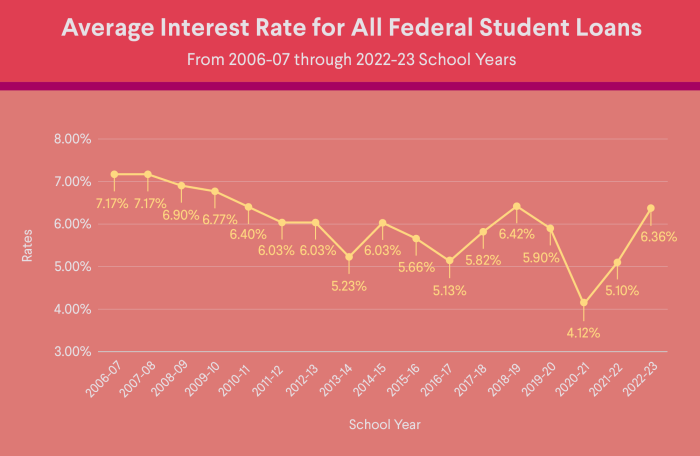

Factors Influencing Student Loan Interest Rates

Several factors influence the interest rate you’ll receive on your student loans. These include your credit history (for private loans), the type of loan (federal or private), the loan’s term length, and the prevailing market interest rates. Federal student loans generally have lower interest rates than private loans, as they are backed by the government. A strong credit history can help secure lower interest rates on private loans, while a longer loan term typically results in a lower monthly payment but higher overall interest paid. The current economic climate also plays a crucial role, with higher interest rates reflecting a stronger economy and increased borrowing costs.

Comparison of Student Loan Interest Rates

The following table provides a simplified comparison of interest rates from different federal and private student loan programs. Note that these rates are subject to change and are illustrative examples only. Always check with the lender for the most up-to-date information.

| Loan Type | Lender | Interest Rate Type | Approximate Interest Rate Range (as of October 26, 2023) |

|---|---|---|---|

| Federal Subsidized Loan | Federal Government | Fixed | 5.00% – 7.00% (This range is an approximation and depends on the loan’s disbursement date and other factors) |

| Federal Unsubsidized Loan | Federal Government | Fixed | 5.00% – 7.00% (This range is an approximation and depends on the loan’s disbursement date and other factors) |

| Private Student Loan | Various Banks and Credit Unions | Fixed or Variable | 7.00% – 15.00% (This range is a broad approximation and varies greatly depending on creditworthiness, loan terms, and lender) |

Calculating Monthly Payments

Understanding how student loan interest impacts your monthly payments is crucial for effective financial planning. This section will detail the calculation of monthly payments under different interest rate scenarios and explore the amortization process.

Calculating your monthly student loan payment involves several factors: the principal loan amount, the annual interest rate, and the loan term (length of repayment). For fixed-rate loans, the interest rate remains constant throughout the loan’s life, simplifying calculations. Variable-rate loans, however, present a more complex scenario as the interest rate fluctuates based on market conditions. This variability makes predicting long-term payments more challenging.

Fixed-Rate Loan Payment Calculation

The most common method for calculating monthly payments on a fixed-rate loan uses the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly payment

- P = Principal loan amount

- i = Monthly interest rate (Annual interest rate / 12)

- n = Total number of payments (Loan term in years * 12)

For example, a $10,000 loan at a 5% annual interest rate over 10 years (120 months) would have a monthly payment calculated as follows: i = 0.05/12 = 0.004167; n = 10 * 12 = 120. Substituting these values into the formula provides the monthly payment.

Variable-Rate Loan Payment Calculation

Calculating monthly payments for variable-rate loans is more complex because the interest rate changes over time. Each month, the interest is calculated based on the current interest rate and the outstanding principal balance. Therefore, a precise calculation requires knowing the interest rate for each payment period, which is usually not possible to predict accurately in advance. Loan calculators, discussed below, are particularly helpful for estimating payments under variable rate scenarios.

Amortization and its Effect on Principal and Interest

Amortization is the process of gradually paying off a loan over time through regular payments. Each payment consists of both principal (the original loan amount) and interest. In the early stages of repayment, a larger portion of the payment goes towards interest, while a smaller portion reduces the principal. As the loan progresses, the proportion shifts, with more of the payment applied to the principal and less to interest.

Hypothetical Amortization Schedule

The following table illustrates a simplified amortization schedule for a $10,000 loan at 5% interest over 10 years. Note that this is a simplified example and actual payments might vary slightly due to rounding.

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $10,000.00 | $106.07 | $41.67 | $64.40 | $9,935.60 |

| 2 | $9,935.60 | $106.07 | $41.40 | $64.67 | $9,870.93 |

| 3 | $9,870.93 | $106.07 | $41.13 | $64.94 | $9,805.99 |

| … | … | … | … | … | … |

| 120 | $64.40 | $106.07 | $2.68 | $103.39 | $0.00 |

Online Loan Calculators and Their Functionalities

Numerous online loan calculators are available to assist with these calculations. These calculators typically allow users to input the loan amount, interest rate, and loan term to determine the monthly payment and generate an amortization schedule. Some advanced calculators also allow for variable interest rate inputs and offer additional features, such as exploring different loan terms or prepayment scenarios. Examples include calculators offered by financial institutions, government websites, and reputable personal finance websites. These tools simplify the complex calculations and provide valuable insights into loan repayment.

Impact of Interest Rate Changes

Understanding how interest rates fluctuate is crucial for managing student loan debt effectively. Changes, whether increases or decreases, directly affect the total amount you’ll repay over the life of your loan. This impact is amplified by the length of the repayment period, making it a long-term financial consideration.

Interest rate increases significantly raise the total cost of a student loan. Each percentage point increase adds to the principal balance, leading to higher monthly payments and a substantially larger total repayment amount. Conversely, a decrease in interest rates reduces the overall cost, resulting in lower monthly payments and less overall debt. The magnitude of this effect depends on the loan amount, interest rate, and loan term. For example, a 1% increase on a $50,000 loan over 10 years could add thousands of dollars to the total repayment.

Effect of Interest Rate Increases and Decreases on Total Loan Cost

Increased interest rates lead to higher monthly payments and a larger total repayment amount. Conversely, decreased interest rates result in lower monthly payments and a smaller total repayment. The impact is proportional to the loan amount and repayment period. A longer repayment period magnifies the effect of even small interest rate changes. For instance, a 1% increase on a $30,000 loan over 15 years would result in a considerably higher total cost compared to the same increase on a 5-year loan. This difference is primarily due to the compounded interest accumulating over the longer repayment term.

Strategies for Managing Student Loan Debt During Fluctuating Interest Rates

Managing student loan debt during periods of fluctuating interest rates requires proactive strategies. One effective approach is to explore refinancing options when interest rates are low. Refinancing allows you to secure a lower interest rate, potentially reducing your monthly payments and overall repayment cost. Another strategy is to make extra principal payments whenever possible, which accelerates debt repayment and reduces the total interest paid. Budgeting meticulously and prioritizing debt reduction are also vital components of effective management. Consider exploring income-driven repayment plans if facing financial hardship; these plans adjust payments based on your income.

Fixed Versus Variable Interest Rates: Long-Term Financial Implications

Choosing between a fixed and a variable interest rate significantly impacts long-term financial implications. Loans with fixed interest rates offer predictable monthly payments throughout the loan’s life, regardless of market fluctuations. This predictability provides financial stability and simplifies budgeting. Variable interest rates, however, are subject to change based on market conditions. While they may initially offer lower rates, the potential for increases poses a risk of higher payments and increased total repayment costs. The choice depends on individual risk tolerance and financial forecasting abilities. For individuals seeking stability, a fixed-rate loan is generally preferred.

Consequences of Ignoring Rising Interest Rates on Existing Loans

Ignoring rising interest rates on existing student loans can lead to several negative consequences. Increased monthly payments may strain your budget, potentially leading to late payments and damage to your credit score. The total repayment amount will increase significantly, leading to a larger overall debt burden. This could delay other financial goals, such as saving for a down payment on a house or investing for retirement. Proactive management, including exploring refinancing or making extra payments, is crucial to mitigate these risks.

Federal vs. Private Student Loans

Choosing between federal and private student loans is a crucial decision impacting your financial future. Understanding the key differences in interest rates, eligibility, and repayment terms is essential for making an informed choice that aligns with your individual circumstances. This section will compare and contrast these two loan types to help you navigate this important process.

Interest Rate Structures

Federal student loans generally offer fixed interest rates, meaning the rate remains constant throughout the loan’s life. These rates are set by the government and are typically lower than those offered by private lenders. In contrast, private student loans often have variable interest rates, which fluctuate based on market conditions. This means your monthly payment could change over time, potentially increasing your overall borrowing cost. The specific interest rate you qualify for with a private loan will depend on your credit history, credit score, and the lender’s current rates. Some private lenders may offer fixed-rate options, but these are usually at a higher rate than comparable federal loans.

Eligibility Requirements and Application Processes

Federal student loans are available to students who meet certain criteria, primarily enrollment in an eligible educational program and demonstration of financial need (for subsidized loans). The application process involves completing the Free Application for Federal Student Aid (FAFSA) form, which determines your eligibility for federal aid, including loans, grants, and work-study. Private student loans, on the other hand, typically require a creditworthy co-signer, especially for students with limited or no credit history. The application process for private loans usually involves completing an application with a private lender, providing financial information, and undergoing a credit check. Lenders will assess your creditworthiness and determine your eligibility and interest rate based on their internal risk assessment.

Choosing Between Federal and Private Student Loans

A step-by-step guide to choosing between federal and private student loans involves prioritizing federal loans first. Exhaust all available federal loan options before considering private loans. This is because federal loans generally offer more borrower protections, such as income-driven repayment plans and loan forgiveness programs, which are not typically available with private loans. Once you’ve determined the maximum amount of federal loans you can receive, then evaluate your remaining funding needs. If you still have a shortfall, explore private loan options. Carefully compare interest rates, repayment terms, and fees from multiple private lenders before making a decision. Consider the long-term cost of borrowing, factoring in both the interest rate and the total amount borrowed.

Advantages and Disadvantages of Federal and Private Student Loans

Understanding the advantages and disadvantages of each loan type is crucial for informed decision-making.

Before outlining the advantages and disadvantages, it’s important to remember that the specific terms and conditions of each loan can vary based on the lender and the borrower’s individual circumstances.

- Federal Student Loans: Advantages

- Generally lower interest rates than private loans.

- Flexible repayment options, including income-driven repayment plans.

- Potential for loan forgiveness programs.

- Stronger borrower protections.

- Federal Student Loans: Disadvantages

- Loan amounts may be limited based on financial need and cost of attendance.

- Application process involves completing the FAFSA.

- Private Student Loans: Advantages

- May be able to borrow larger amounts than with federal loans.

- Faster application process compared to federal loans in some cases.

- Private Student Loans: Disadvantages

- Generally higher interest rates than federal loans.

- Less flexible repayment options.

- Fewer borrower protections.

- Often requires a creditworthy co-signer.

Repayment Options and Strategies

Navigating student loan repayment can feel overwhelming, but understanding the available options and developing a strategic approach can significantly impact your financial future. Choosing the right repayment plan depends on your individual financial situation, income, and long-term goals. This section Artikels various federal student loan repayment plans and strategies to minimize interest and accelerate repayment.

Federal Student Loan Repayment Plans

Several federal student loan repayment plans offer varying monthly payment amounts and repayment timelines. The plan you choose directly influences your total interest paid and the length of your repayment period. Careful consideration of your current financial circumstances and future earning potential is crucial.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s a straightforward option, but monthly payments can be relatively high.

- Graduated Repayment Plan: Payments start low and gradually increase every two years over a 10-year period. This can be beneficial in the early years of your career when income may be lower, but payments become significantly higher later.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but significantly higher total interest paid.

- Income-Driven Repayment (IDR) Plans: These plans base monthly payments on your income and family size. They include Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically offer lower monthly payments than other options, but loan forgiveness may be available after 20 or 25 years of payments, depending on the plan. However, the extended repayment period often leads to substantially higher total interest paid.

Income-Driven Repayment Plans and Long-Term Interest Costs

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable for borrowers with lower incomes. Your monthly payment is calculated based on a percentage of your discretionary income (income above a certain poverty guideline). While this results in lower monthly payments, it significantly extends the repayment period, potentially leading to a much higher total interest paid over the life of the loan. For example, a borrower with a $50,000 loan might see their monthly payment reduced by 50% under an IDR plan, but their repayment period might extend from 10 years to 25 years, increasing the total interest paid by thousands of dollars.

Strategies for Minimizing Interest Payments and Accelerating Loan Repayment

Several strategies can help you minimize interest payments and pay off your student loans faster.

- Make extra payments: Even small extra payments can significantly reduce the total interest paid and shorten the repayment period. For example, paying an extra $50 per month on a $30,000 loan could save thousands in interest and shave several years off the repayment term.

- Refinance your loans: If you qualify for a lower interest rate, refinancing your loans can save you money on interest. However, carefully compare offers and ensure that refinancing doesn’t result in a longer repayment term or other unfavorable terms.

- Prioritize high-interest loans: If you have multiple loans with different interest rates, focus on paying down the loans with the highest interest rates first to minimize the overall interest paid.

- Consider loan consolidation: Combining multiple loans into a single loan can simplify repayment and potentially lower your monthly payment, but ensure the new interest rate is favorable.

Choosing a Repayment Plan

The following flowchart illustrates a simplified decision-making process for choosing a student loan repayment plan:

[Diagram Description: A flowchart would be included here. It would start with a central question: “What are your current financial circumstances and income?” This would branch into two options: “Low Income/High Debt” and “High Income/Low Debt”. The “Low Income/High Debt” branch would lead to “Consider Income-Driven Repayment (IDR) Plans”. The “High Income/Low Debt” branch would lead to “Consider Standard, Graduated, or Extended Repayment Plans”. Each of these would then have a further branch considering factors like “Tolerance for Higher Monthly Payments” and “Desired Repayment Timeframe” leading to specific plan recommendations (e.g., IBR, Standard, Extended). The flowchart would visually represent the decision-making process based on individual financial situations.]

Visual Representation of Interest Accrual

Understanding how interest accrues on student loans is crucial for effective repayment planning. A visual representation can significantly clarify this complex process, making it easier to grasp the long-term impact of interest on the total debt owed.

A helpful visual would be a graph charting the growth of a student loan balance over time. The x-axis would represent time, perhaps in years, while the y-axis would represent the loan balance. The graph would show two lines: one representing the principal loan amount (the original amount borrowed), which remains constant, and a second line illustrating the combined principal and accumulated interest. The interest line would start at zero and gradually curve upwards, increasing more steeply over time due to compounding interest. The gap between the principal line and the total balance line would visually represent the accumulating interest. Different colored lines could be used to clearly distinguish between principal and interest. For instance, the principal could be represented by a solid blue line, while the total balance (principal plus interest) could be a dashed red line. The area between these two lines could be shaded to further highlight the growing interest component. A key would clearly define each line and the shaded area.

Illustrative Graphic Description

The graph would begin at the time of loan disbursement, showing the initial principal balance. As time progresses along the x-axis, the red dashed line representing the total balance would rise steadily above the blue solid line representing the principal. The increasing distance between these lines dramatically illustrates the exponential growth of interest over the loan’s lifespan. For example, if the initial loan was $20,000, the graph might show the total balance reaching $25,000 after five years, with the shaded area clearly indicating the $5,000 accrued in interest. Further along the x-axis, perhaps at the ten-year mark, the gap between the lines would be significantly larger, highlighting the accelerating effect of compound interest. The visual impact of this expanding area would clearly demonstrate how a small initial interest rate can lead to a substantial increase in the total amount owed over time. The graph could also include markers showing points where payments are made, demonstrating how these payments initially reduce the principal but, in the early stages, barely affect the total balance due to the simultaneous accrual of interest.

Conclusive Thoughts

Successfully managing student loan debt requires a comprehensive understanding of interest rates and repayment strategies. By carefully considering the factors discussed – from interest calculation methods to repayment plan options – borrowers can significantly impact their long-term financial well-being. Remember to utilize available resources, such as online loan calculators and financial advisors, to create a personalized repayment plan that aligns with your individual financial circumstances and goals. Proactive management and informed decision-making are key to minimizing interest costs and achieving financial freedom.

FAQ

What is interest capitalization?

Interest capitalization is the process of adding accumulated unpaid interest to the principal loan balance. This increases the total amount you owe and ultimately leads to higher overall interest payments.

How often are student loan interest rates adjusted?

The frequency of interest rate adjustments depends on the loan type. Fixed-rate loans have a constant interest rate, while variable-rate loans can adjust periodically (e.g., monthly or annually), based on a benchmark index.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing can potentially lower your interest rate, but it often involves switching from federal to private loans, which may impact eligibility for certain repayment programs.

What happens if I miss a student loan payment?

Missing payments can negatively impact your credit score, lead to late fees, and potentially result in default, with serious financial consequences.