Navigating the complexities of UK student loan interest rates can feel daunting, but understanding the system is crucial for graduates’ long-term financial well-being. This guide provides a clear and concise overview of how these rates are determined, how they impact repayment, and what strategies graduates can employ to manage their debt effectively. We’ll explore the various loan types, the influence of economic factors, and the government policies shaping this significant aspect of higher education financing in the UK.

From the historical context of interest rate fluctuations to projections of future repayment scenarios, we aim to demystify the process and empower readers with the knowledge necessary to make informed financial decisions. This exploration will equip you with the tools to understand your repayment obligations and plan for your financial future after graduation.

Understanding UK Student Loan Interest Rates

Navigating the UK student loan system can be complex, particularly understanding how interest accrues. This section clarifies the different loan types, their associated interest rates, and how these rates are calculated, providing a historical perspective for context.

Types of UK Student Loans and Their Interest Rates

The UK currently operates with two main types of student loans: Plan 1 and Plan 2. These loans differ in their interest rate calculations and repayment thresholds. Plan 1 loans are generally for students who began their courses before 2012, while Plan 2 loans are for those who started their studies from 2012 onwards. The interest rates applied to each plan are determined by a government-set formula linked to inflation and the Bank of England base rate. It’s crucial to understand which plan applies to your loan to accurately predict repayment.

Interest Rate Calculation for Each Loan Type

For Plan 1 loans, the interest rate is a fixed percentage point above the Bank of England base rate. This percentage point can vary depending on the income bracket of the borrower. Plan 2 loans, however, use a variable rate linked to the Retail Prices Index (RPI) inflation rate plus a variable percentage point. This means the interest rate fluctuates based on the RPI and is not tied directly to the Bank of England base rate like Plan 1 loans. The exact percentage added to the RPI can also change over time based on government policy. The interest is calculated daily on the outstanding loan balance.

Historical Overview of UK Student Loan Interest Rate Changes

Student loan interest rates have not remained static. Over the years, both Plan 1 and Plan 2 interest rates have seen fluctuations. For instance, during periods of low inflation, the interest rates on Plan 2 loans have been comparatively lower, while periods of high inflation have seen significant increases. Plan 1 rates have also experienced changes, reflecting adjustments to the fixed percentage point added to the Bank of England base rate. Accessing historical data from the government’s Student Loans Company website allows for a detailed analysis of these changes over time. These changes highlight the importance of understanding the dynamic nature of student loan interest.

Comparison of Interest Rates Across Different Loan Types and Repayment Plans

The following table provides a simplified comparison. Note that these figures are illustrative and subject to change based on government policy and economic indicators. Actual rates should be verified with official sources.

| Loan Type | Interest Rate Calculation | Typical Interest Rate Range (Illustrative) | Repayment Threshold (Illustrative) |

|---|---|---|---|

| Plan 1 | Bank of England base rate + variable percentage points | 1-5% (variable) | £27,295 (2023/24 tax year) |

| Plan 2 | RPI inflation + variable percentage points | 0-6% (variable) | £27,295 (2023/24 tax year) |

Factors Influencing Interest Rates

Understanding the factors that influence UK student loan interest rates is crucial for prospective and current students to accurately assess the long-term cost of their education. These rates aren’t static; they fluctuate based on a complex interplay of economic indicators and government policy.

The interest applied to UK student loans is not a fixed percentage; instead, it’s a dynamic figure influenced primarily by inflation and the Bank of England’s base rate. This means the total repayment amount can vary significantly depending on economic conditions during the repayment period.

Inflation’s Impact on Student Loan Interest Rates

Inflation, the rate at which the general level of prices for goods and services is rising, plays a significant role in determining student loan interest. The UK government often links student loan interest rates to the Retail Prices Index (RPI) measure of inflation, plus a margin. High inflation generally leads to higher interest rates on student loans, increasing the overall cost of borrowing. For example, a period of high inflation, such as that experienced in the late 1970s and early 1980s, would have resulted in significantly higher interest charges on student loans compared to periods of low inflation. Conversely, lower inflation generally translates to lower interest rates. This direct correlation ensures that the real value of the loan isn’t eroded by inflation, though the borrower still bears the cost of the increased interest.

The Bank of England’s Base Rate and Student Loan Interest

The Bank of England’s base rate, the interest rate at which commercial banks can borrow money from the Bank of England, acts as a benchmark for other interest rates in the UK economy. While not directly tied, changes in the base rate often influence the government’s decision-making process when setting student loan interest rates. A rise in the base rate often signals a tightening of monetary policy aimed at curbing inflation. This can lead to a corresponding increase in student loan interest rates, though the relationship isn’t always linear or immediate. For instance, if the Bank of England increases its base rate to combat rising inflation, the government might adjust student loan interest rates upwards to reflect the broader economic environment.

Other Economic Factors Influencing Interest Rate Adjustments

Beyond inflation and the Bank of England’s base rate, other economic factors can indirectly affect student loan interest rates. Government fiscal policy, including decisions on government borrowing and spending, can impact overall interest rates. Global economic conditions, such as international interest rate movements and currency fluctuations, can also play a role, though this influence is usually less direct than domestic factors. The government’s overall economic priorities and forecasts also inform its decisions on student loan interest rate adjustments. For example, during periods of economic uncertainty, the government might opt for more conservative interest rate adjustments to avoid adding further burden to borrowers.

Comparison with Other Countries’ Student Loan Interest Rate Systems

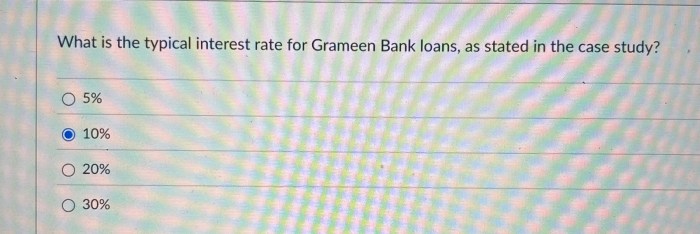

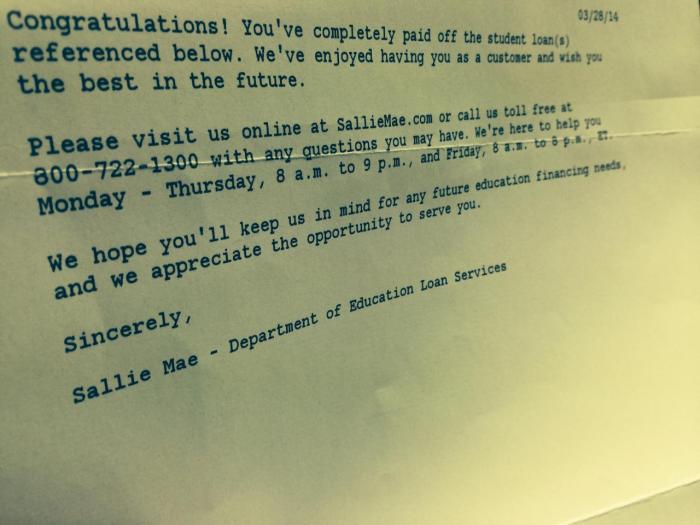

The UK’s system of variable student loan interest rates, often linked to inflation, differs from other countries. Some countries have fixed interest rates on student loans, while others may use different inflation indices or tie rates to other economic indicators. For example, the United States has a more complex system with varying interest rates depending on loan type and repayment plan, while some European countries may offer subsidized loans with lower or even zero interest rates for certain students. A comprehensive comparison would require a detailed analysis of individual countries’ systems, considering factors like loan eligibility, repayment terms, and overall economic contexts.

Repayment of Student Loans

Repaying your student loan in the UK depends on your income and the type of loan you have. The system is designed to ensure that graduates contribute to the cost of their education only when they are financially able to do so. This section details the mechanics of repayment, including thresholds, interest accrual, and example scenarios.

Repayment Thresholds and Methods

The repayment threshold is the annual income level above which you begin making repayments. This threshold varies depending on the year you started your course and the type of loan (Plan 1 or Plan 2). For Plan 1 loans, the threshold is currently set at £27,295 (as of 2023/24). For Plan 2 loans, the threshold is currently set at £28,500 (as of 2023/24). Repayments are made through the tax system, deducted directly from your earnings. The amount deducted is 9% of your income above the threshold.

Interest Accrual During Repayment

While you are repaying your loan, interest continues to accrue. The interest rate applied is variable and linked to inflation. Specifically, it’s the Bank of England’s Retail Prices Index (RPI) inflation rate plus a variable margin. This margin varies depending on the loan type and year of study. The interest is calculated daily and added to your outstanding loan balance. This means that the longer it takes to repay the loan, the more interest will be accumulated.

Repayment Scenarios

Let’s consider some examples:

Scenario 1: A graduate earning £35,000 annually (Plan 1 loan). Their repayment threshold is £27,295. Their taxable income above the threshold is £7,705 (£35,000 – £27,295). Their annual repayment would be £693.45 (£7,705 x 0.09).

Scenario 2: A graduate earning £25,000 annually (Plan 2 loan). Their repayment threshold is £28,500. Since their income is below the threshold, they will make no repayments this year.

Scenario 3: A high earner on Plan 1 with an annual income of £80,000. Their taxable income above the threshold is £52,705 (£80,000 – £27,295). Their annual repayment would be £4,743.45 (£52,705 x 0.09).

Calculating Potential Repayment Amounts

A step-by-step guide to calculating your potential repayment amount:

1. Determine your repayment threshold: This depends on your loan plan and the year you started your course. Check the government website for the most up-to-date information.

2. Calculate your taxable income above the threshold: Subtract your repayment threshold from your annual gross income.

3. Calculate your annual repayment: Multiply your taxable income above the threshold by 9%.

4. Consider the impact of interest: Remember that interest will continue to accrue daily on your outstanding loan balance. The exact amount will depend on the prevailing RPI rate and the margin applicable to your loan.

To calculate your monthly repayment, divide your annual repayment by 12. However, remember that repayments are typically deducted monthly via your tax code.

The Impact of Interest Rates on Graduates

The interest rate applied to UK student loans significantly impacts graduates’ long-term financial well-being. Understanding how these rates affect repayment amounts and overall debt burden is crucial for effective financial planning after graduation. High interest rates can dramatically increase the total cost of a degree, potentially influencing career choices and overall financial stability for years to come.

The cumulative effect of interest on student loan repayments can be substantial, especially over the typical 30-year repayment period. This is particularly true given that the interest rate is variable and can increase unexpectedly, making accurate long-term financial planning challenging. This necessitates a proactive approach to debt management.

Long-Term Financial Implications of Student Loan Interest

High interest rates translate directly into higher monthly repayments and a significantly larger total amount paid over the loan’s lifespan. For example, a graduate with a £50,000 loan might find themselves paying considerably more than £50,000 over 30 years due to accruing interest. This increased cost can delay major life milestones such as homeownership, starting a family, or investing in retirement savings. The long shadow cast by student loan debt can impact financial security and overall quality of life for many years.

Effects of High Interest Rates on Graduate Career Choices

The weight of substantial student loan debt can influence graduates’ career choices. Some might prioritize higher-paying jobs, even if they are less fulfilling, to accelerate loan repayment. Others may delay pursuing further education or training opportunities due to concerns about increasing their debt burden. The pressure to repay loans quickly can limit career exploration and potentially hinder career progression in the long run. A graduate might forgo a slightly lower-paying but more personally rewarding role in favour of a higher-earning, perhaps more stressful, position to reduce the financial strain of their loan repayments.

Hypothetical Scenario: Cumulative Interest Over 30 Years

Let’s consider a hypothetical scenario: A graduate borrows £40,000 at a fixed interest rate of 6% per annum. Assuming a standard repayment plan, the total interest accrued over 30 years could easily exceed £40,000, potentially doubling the initial loan amount. This scenario illustrates the significant impact of compounding interest over a long repayment period. A fluctuating interest rate, as is common with UK student loans, would further increase this total cost. This illustrates the importance of understanding the repayment terms and the potential for the total cost to far surpass the original loan amount.

Strategies for Managing Student Loan Debt Effectively

Effective management of student loan debt is paramount. A proactive approach can significantly mitigate the long-term financial impact.

The following strategies can assist in managing student loan debt effectively:

- Budgeting and Financial Planning: Create a detailed budget to track income and expenses, prioritizing loan repayment.

- Prioritize High-Interest Debt: If you have other high-interest debts (e.g., credit cards), focus on paying them down first to minimize overall interest charges.

- Explore Repayment Options: Understand the different repayment plans available and choose the one that best suits your financial situation.

- Increase Income: Explore opportunities to increase your income through additional work, freelance projects, or career advancement.

- Seek Professional Advice: Consult a financial advisor for personalized guidance on debt management strategies.

Government Policies and Student Loans

The UK government’s approach to student loan interest rates has evolved significantly over time, reflecting changing economic conditions, political priorities, and societal views on higher education funding. The current system is a complex interplay of economic modelling, political decisions, and the need to balance affordability for students with the long-term sustainability of the loan system.

The rationale behind the current system rests on the principle of graduate contribution. The government argues that higher education provides significant benefits to individuals, enhancing their earning potential and contributing to economic growth. Therefore, graduates should contribute to the cost of their education through loan repayments. The interest rate mechanism aims to ensure the long-term viability of the student loan system, allowing future generations of students to access higher education. However, the system is also subject to ongoing debate, with criticisms levelled at its impact on graduate finances and potential unfairness.

The Evolution of UK Student Loan Interest Rate Policies

The UK’s student loan interest rate system hasn’t always been as it is today. Several key policy shifts have shaped its current form. Understanding this timeline provides context for the current debate surrounding affordability and fairness.

For example, prior to the introduction of the current system, interest rates were often linked directly to the Retail Prices Index (RPI) or other benchmark interest rates. This resulted in periods of high interest accrual, leading to significant debt burdens for graduates. Subsequent government interventions aimed to make the system more manageable for borrowers, including changes in the way interest is calculated and the introduction of income-contingent repayment plans.

Comparison of Government Approaches to Student Loan Interest

Different governments have adopted varying approaches to student loan interest, reflecting their differing economic and social priorities. For instance, some governments have prioritized keeping interest rates low to alleviate the burden on graduates, even if it meant increasing the overall cost to the taxpayer. Others have focused on ensuring the long-term financial sustainability of the loan system, potentially leading to higher interest rates for borrowers. These differing approaches have had significant consequences for graduates, affecting their post-graduation financial planning and long-term debt levels.

A direct comparison requires detailed analysis of specific policy changes under different administrations, considering factors such as the prevailing economic climate, the political context, and the specific goals of each government’s policy.

Government Initiatives to Mitigate the Impact of High Interest Rates

Recognising the potential hardship caused by high interest rates, the government has implemented several initiatives aimed at mitigating their impact on borrowers. These initiatives may include targeted support for vulnerable groups, changes to the repayment thresholds, or adjustments to the interest rate calculation methodology. The effectiveness of these initiatives is a subject of ongoing debate and evaluation.

Examples of such initiatives could include adjustments to the repayment plan, offering different repayment options based on income levels, or providing financial literacy programs to help graduates manage their student loan debt effectively. The impact of these measures on graduate financial well-being is a complex issue requiring detailed economic analysis.

Visual Representation of Interest Accrual

Understanding how student loan interest accrues over time is crucial for graduates. A visual representation, such as a line graph, can effectively demonstrate the impact of different interest rates on the overall debt. This allows for a clear comparison of potential repayment scenarios.

A line graph would be the most suitable visual aid. The horizontal axis (x-axis) would represent time, measured in years, starting from the year the loan is taken out. The vertical axis (y-axis) would represent the total amount of loan debt, including both the principal amount borrowed and the accumulated interest. Multiple lines would be plotted on the graph, each representing a different interest rate applied to the same initial loan amount.

Line Graph Depicting Loan Debt Growth at Varying Interest Rates

The graph would show several lines, each representing a different annual interest rate applied to a hypothetical £50,000 student loan. For example, one line could represent a 1.5% interest rate (the current rate for Plan 1 loans in England as of October 2023), another a 3% rate (a hypothetical higher rate for illustrative purposes), and another a 0% rate (for comparison). Each line would start at £50,000 at year zero. Over time, the lines would diverge, with the higher interest rate lines showing a steeper upward trend, indicating faster growth in the total debt. The 0% line would remain flat at £50,000. The graph’s title would be “Growth of £50,000 Student Loan with Varying Interest Rates.” The legend would clearly indicate which line corresponds to which interest rate. Data points could be marked yearly to show the precise amount of debt at each anniversary of the loan. The y-axis would be scaled appropriately to accommodate the maximum projected debt amount at the end of the loan repayment period. This visual representation allows for easy comparison of the impact of different interest rates on the overall cost of the loan. The difference between the lines would clearly demonstrate the significant long-term financial consequences of even seemingly small variations in interest rates.

Outcome Summary

Successfully managing student loan debt requires a proactive approach and a thorough understanding of the interest rate system. By grasping the factors influencing interest rates, utilizing effective repayment strategies, and staying informed about government policies, graduates can navigate the complexities of loan repayment and build a secure financial future. Remember that proactive planning and informed decision-making are key to minimizing the long-term impact of student loan debt.

Top FAQs

What happens if I don’t repay my student loan?

Failure to repay your student loan can lead to debt collection actions, impacting your credit score and potentially leading to legal proceedings.

Can I make overpayments on my student loan?

Yes, you can usually make overpayments on your student loan, reducing the overall amount and interest accrued.

How are interest rates affected by changes in government?

Government policies directly influence interest rates; changes in policy can lead to adjustments in the calculation methods or the rates themselves.

What if my income falls below the repayment threshold?

If your income falls below the repayment threshold, interest will still accrue, but you won’t be required to make monthly payments until your income rises above the threshold.