Navigating the complexities of federal student loans can feel overwhelming, particularly when understanding how interest rates impact your long-term financial health. This guide delves into the intricacies of federal student loan interest rates, providing a clear and concise overview of current rates, historical trends, repayment options, and available assistance programs. We’ll explore how these rates are determined, their impact on overall loan costs, and strategies to minimize their effect on your finances.

From understanding the differences between subsidized and unsubsidized loans to exploring various repayment plans and potential forgiveness programs, we aim to equip you with the knowledge necessary to make informed decisions about your student loan debt. We’ll analyze the influence of economic factors on interest rate fluctuations and provide practical advice for managing your student loans effectively.

Current Federal Student Loan Interest Rates

Understanding current federal student loan interest rates is crucial for prospective and current borrowers. These rates directly impact the total cost of your education and the monthly payments you’ll make after graduation. The rates are set annually and vary depending on the type of loan and the borrower’s circumstances.

Federal Student Loan Interest Rates by Loan Type

The interest rate you’ll receive depends on the type of federal student loan you obtain. Below is a table summarizing the current rates for various federal student loan programs. Note that these rates are subject to change and should be verified with the official government source before making any financial decisions. The rates shown are examples and may not reflect the exact current rates; it is imperative to check the official Federal Student Aid website for the most up-to-date information.

| Loan Type | Interest Rate (Example) | Details |

|---|---|---|

| Direct Subsidized Loans (Undergraduate) | 4.99% | Interest does not accrue while the borrower is in school at least half-time, during grace periods, and during deferment periods. |

| Direct Unsubsidized Loans (Undergraduate) | 6.54% | Interest accrues from the time the loan is disbursed. |

| Direct Unsubsidized Loans (Graduate) | 7.54% | Interest accrues from the time the loan is disbursed; higher rate than undergraduate unsubsidized loans. |

| Direct PLUS Loans (Graduate/Parent) | 8.05% | Higher interest rate than undergraduate loans; credit check required. |

Factors Influencing Federal Student Loan Interest Rates

Several factors contribute to the determination of a federal student loan’s interest rate. These factors work together to establish the final rate a borrower will receive.

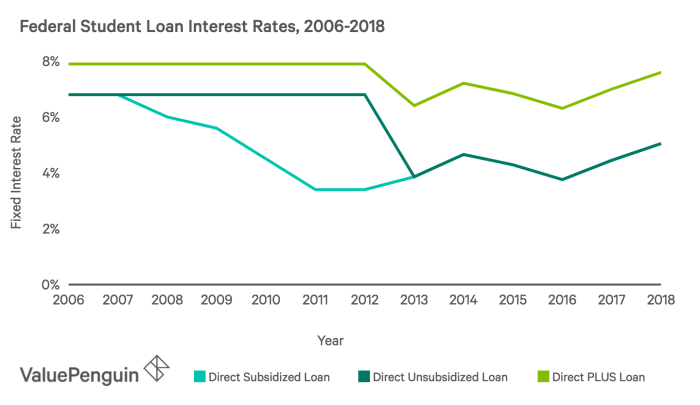

The most significant factor is the type of loan. Direct Subsidized Loans generally have lower rates than Unsubsidized Loans due to the government’s subsidy during certain periods. Graduate loans typically carry higher interest rates than undergraduate loans, reflecting the increased borrowing amount and often higher earning potential after graduation. Direct PLUS loans, designed for parents or graduate students, usually have the highest rates because of the higher risk associated with these loans. The government also considers prevailing market interest rates when setting the annual rates for federal student loans. These rates fluctuate based on economic conditions and overall borrowing costs.

Interest Rate Determination for Graduate and Undergraduate Loans

Interest rates for graduate and undergraduate loans are determined using a similar process, but the resulting rates differ. The key difference lies in the loan type and the perceived risk. Undergraduate loans, particularly subsidized ones, are viewed as lower risk, resulting in lower interest rates. Graduate loans, on the other hand, often involve larger loan amounts and are associated with a slightly higher risk profile, hence the higher interest rates. The government uses a formula that considers several factors, including the 10-year Treasury note rate, the cost of borrowing for the government, and other economic indicators, to set the annual interest rates for each loan type. The rates are then published annually and applied to loans disbursed during that academic year.

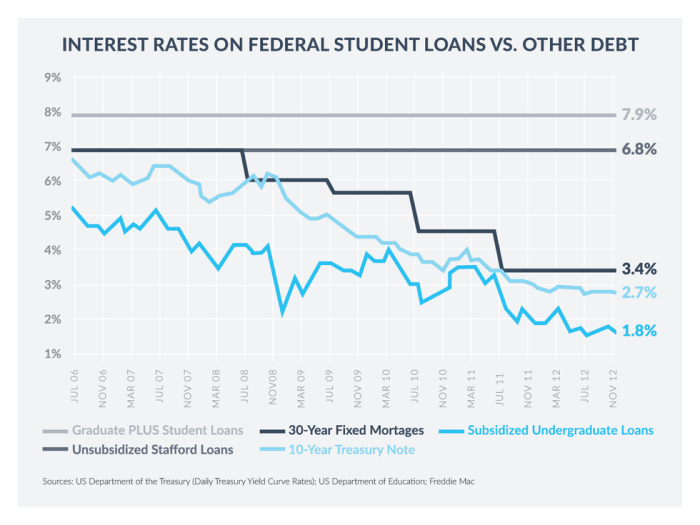

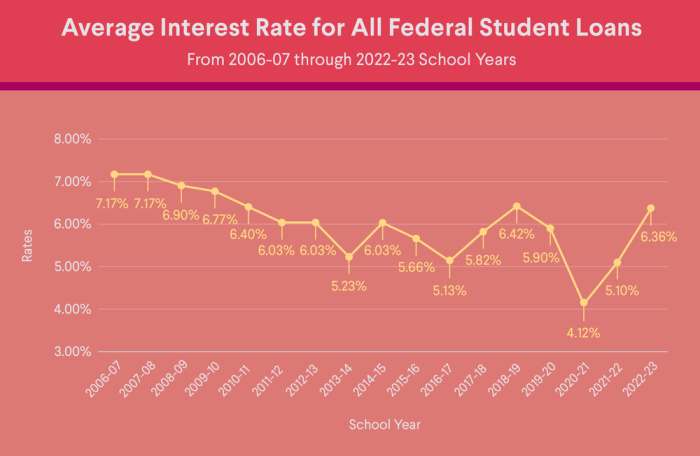

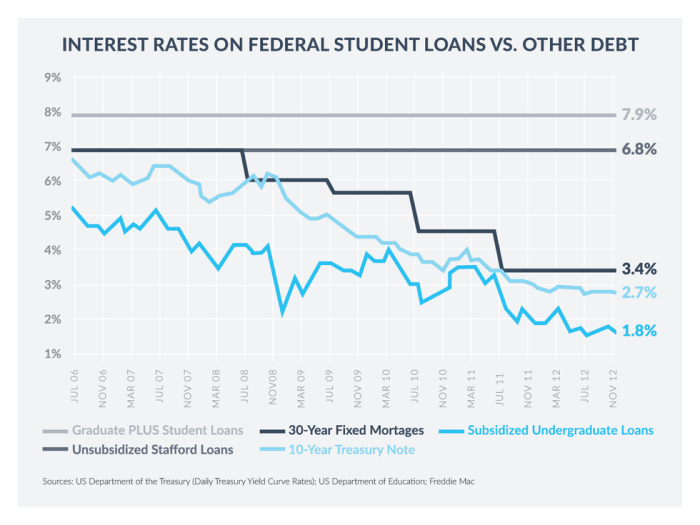

Historical Trends in Federal Student Loan Interest Rates

Understanding the historical fluctuations in federal student loan interest rates provides valuable context for current rates and helps illustrate the impact of broader economic factors on borrowing costs for students. These rates haven’t remained static; instead, they’ve responded to shifts in the overall economic climate and government policy.

Interest rates on federal student loans are not set in stone; they’re dynamic, influenced by various economic indicators and government decisions. Examining the past decade reveals a pattern of fluctuation, reflecting the interplay of these factors.

A Decade of Fluctuation: A Visual Representation

Imagine a line graph charting the annual average interest rates for federal student loans over the past ten years (e.g., 2014-2024). The y-axis represents the interest rate percentage, and the x-axis represents the year. The graph would likely show a somewhat erratic, though generally upward, trend. There might be a noticeable peak around 2018-2019, reflecting potentially higher interest rates during a period of economic growth and increased borrowing demand. Conversely, a trough might be observed in 2020-2021, corresponding to the economic downturn caused by the COVID-19 pandemic, during which the government implemented 0% interest rates as a stimulus measure. Subsequent years would show a gradual increase as the economy recovered and interest rates normalized. The graph would not be a smooth curve but rather a series of rises and falls reflecting the complex interplay of economic and political factors. Specific numerical data would be needed to accurately depict the graph, but this description provides a general visualization of the expected pattern.

Comparison of Past and Present Rates

A comparison between the average interest rates of the past decade and current rates would highlight the differences. For instance, the average rate during the earlier years of the decade (say, 2014-2016) might have been considerably lower than the average rate in the latter years (2022-2024). This difference could be attributed to various factors, including changes in the federal funds rate, inflation levels, and government policies concerning student loan interest rates. A specific quantitative comparison (e.g., “The average rate in 2015 was 4.29%, while the current rate is 6.54%”) would strengthen this analysis. The impact of government interventions, such as the 0% interest rate period during the pandemic, would also be a key element of this comparison.

Economic Conditions and Interest Rate Changes

Economic conditions significantly influence federal student loan interest rates. Periods of economic expansion often lead to higher interest rates as the demand for loans increases and the Federal Reserve may raise interest rates to control inflation. Conversely, during economic downturns or recessions, interest rates may decrease as the government seeks to stimulate borrowing and economic activity. For example, the significant drop in interest rates during the 2020-2021 period was a direct response to the economic crisis caused by the COVID-19 pandemic, with the goal of easing the financial burden on borrowers and encouraging spending. The subsequent rise in rates can be linked to efforts to combat inflation and return to a more “normal” economic state. Inflation, unemployment rates, and overall economic growth all play significant roles in shaping the trajectory of student loan interest rates.

Repayment Plans and Interest Rates

Choosing the right federal student loan repayment plan significantly impacts the total amount you’ll pay back, influencing both the monthly payment and the overall interest accrued. Understanding the nuances of each plan is crucial for effective financial planning post-graduation. This section compares various repayment plans and explores the role of interest capitalization in increasing the overall loan cost.

Different repayment plans cater to various financial situations and income levels. The key differences lie in monthly payment amounts, loan repayment periods, and ultimately, the total interest paid over the life of the loan.

Federal Student Loan Repayment Plan Comparison

The following Artikels the characteristics of common federal student loan repayment plans and their impact on total interest paid. Note that these are general comparisons, and individual experiences may vary based on loan amounts, interest rates, and income.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. While it offers the shortest repayment timeline, leading to less interest paid overall compared to longer-term plans, the monthly payments can be higher and may present a challenge for some borrowers.

- Extended Repayment Plan: This plan stretches payments over a longer period, typically up to 25 years. Lower monthly payments are a benefit, but significantly more interest will accrue over the extended repayment period. This is suitable for borrowers who prioritize affordability over faster repayment.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This plan can initially be more manageable but leads to higher payments later and significant interest accumulation. It is useful for borrowers who anticipate income growth.

- Income-Driven Repayment (IDR) Plans: These plans (such as ICR, PAYE, REPAYE, and IBR) base monthly payments on your discretionary income and family size. Payments are typically lower, potentially resulting in loan forgiveness after 20 or 25 years, depending on the plan. However, because of the longer repayment period, total interest paid can be substantially higher than with shorter-term plans.

Interest Capitalization

Interest capitalization is the process of adding accumulated unpaid interest to the principal loan balance. This occurs when a borrower makes less than the accruing interest payment or during periods of forbearance or deferment. The capitalized interest then accrues interest itself, effectively increasing the total loan amount and ultimately leading to a higher overall cost. This compounding effect significantly impacts the total repayment amount.

Interest Capitalization: Adding unpaid interest to the principal loan balance, increasing the total amount owed and the overall interest paid.

Illustrative Scenario: $50,000 Loan Repayment

Let’s consider a $50,000 federal student loan with a 5% annual interest rate to illustrate the differences in total interest paid under various repayment plans. These figures are estimates and actual amounts may vary based on specific loan terms and individual circumstances. For simplicity, we assume no additional fees or changes in interest rates.

| Repayment Plan | Approximate Monthly Payment | Approximate Loan Repayment Period | Approximate Total Interest Paid |

|---|---|---|---|

| Standard (10 years) | $536 | 120 months | $14,320 |

| Extended (25 years) | $267 | 300 months | $35,100 |

| Graduated (10 years) | Variable, starting lower | 120 months | $15,000 (Estimate, as payments vary) |

| Income-Driven (20 years, assuming consistent low income) | Variable, based on income | 240 months | $30,000 (Estimate, highly variable based on income) |

This table highlights the significant difference in total interest paid across various repayment plans. While the extended and income-driven plans offer lower initial monthly payments, the substantially longer repayment periods result in a considerably higher total interest cost compared to the standard repayment plan. Careful consideration of your financial situation and long-term goals is crucial when selecting a repayment plan.

Interest Rate Subsidies and Forgiveness Programs

Federal student loan borrowers can potentially reduce their overall loan burden through various interest rate subsidies and loan forgiveness programs. These programs are designed to assist specific groups of borrowers, often based on income, employment, or type of loan. Understanding the eligibility criteria and limitations is crucial for determining potential benefits.

Several federal programs offer either interest rate subsidies, which reduce the amount of interest accruing on the loan, or loan forgiveness, which eliminates a portion or all of the remaining loan balance. These programs often have stringent eligibility requirements and limited funding, making it essential to carefully review the specifics before relying on them to manage student loan debt.

Income-Driven Repayment Plans and Interest Subsidies

Income-driven repayment (IDR) plans adjust monthly payments based on your income and family size. While they don’t directly subsidize interest rates, they can indirectly lower the overall interest paid over the life of the loan by keeping monthly payments lower. Some IDR plans, after a set number of qualifying payments (often 20 or 25 years), may lead to loan forgiveness of any remaining balance. This effectively acts as a substantial interest subsidy since the borrower avoids paying the accumulated interest.

For example, consider a borrower with a $50,000 federal student loan at a 5% interest rate. Under a standard repayment plan, their monthly payment would be significantly higher than under an IDR plan. Over 25 years, the total interest paid under the standard plan could exceed $30,000. With an IDR plan, the monthly payments would be lower, and if loan forgiveness is achieved after 25 years, the significant interest savings become apparent. The exact savings will depend on individual income fluctuations over the repayment period. Note that any forgiven amount may be considered taxable income.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on federal student loans after 120 qualifying monthly payments under an IDR plan while working full-time for a qualifying government or non-profit organization.

Eligibility requires employment by a qualifying employer and making consistent on-time payments under an IDR plan. There are specific requirements for the type of employment and loan types that qualify. The program has faced criticism for its complex application process and stringent requirements, resulting in lower-than-expected forgiveness rates. However, for those who successfully meet all requirements, the potential savings are immense – the complete elimination of the remaining loan balance after 10 years of payments.

Teacher Loan Forgiveness Program

The Teacher Loan Forgiveness Program provides forgiveness of up to $17,500 in eligible federal student loans for teachers who have completed five consecutive years of full-time teaching in a low-income school or educational service agency.

To qualify, teachers must meet specific requirements regarding their teaching location and the type of school or agency where they work. The program is designed to encourage individuals to pursue careers in education, particularly in underserved communities. A teacher with $30,000 in eligible loans could save $17,500, a substantial reduction in their overall debt. The remaining balance would still accrue interest until paid, but the substantial reduction offers significant relief.

Impact of Interest Rates on Student Loan Debt

The interest rate applied to your federal student loans significantly impacts the total amount you’ll repay over the life of the loan. Even small differences in interest rates can lead to substantial variations in the overall cost, potentially affecting your long-term financial health and future planning. Understanding this impact is crucial for effective debt management.

Understanding how interest rates affect the total cost of your student loans is essential for effective financial planning. The longer you take to repay your loans, the more interest accrues, increasing the total amount owed. Conversely, higher interest rates accelerate this accumulation, making repayment more challenging. This section will explore the long-term financial implications of varying interest rates and strategies for mitigating their impact.

Long-Term Financial Implications of Varying Interest Rates

Different interest rates dramatically alter the repayment trajectory of student loans. A higher interest rate necessitates larger monthly payments to keep the loan on track for timely repayment or extends the repayment period, leading to a significantly higher total repayment amount. For example, a $50,000 loan at 5% interest over 10 years will cost considerably less than the same loan at 7% interest over the same period. The difference accumulates over time, potentially delaying major life milestones like homeownership or starting a family. Borrowers should carefully consider the long-term implications of interest rates when choosing repayment plans and making financial decisions.

Strategies for Minimizing the Impact of High Interest Rates

Several strategies can help borrowers mitigate the impact of high interest rates on their student loan debt. These strategies focus on reducing the principal amount owed as quickly as possible and, thus, the overall interest paid.

Repayment Strategies to Reduce Interest Costs

Making extra payments on your loan principal is the most effective way to reduce the overall interest paid. Even small additional payments can significantly shorten the loan repayment period and decrease the total interest cost. Another effective strategy is to refinance your loans to a lower interest rate, if available. This can often save considerable money over the life of the loan, provided the terms of the new loan are favorable. Finally, exploring income-driven repayment plans can provide lower monthly payments, making repayment more manageable, although it may extend the repayment period and ultimately increase the total interest paid.

Illustrative Example of Interest Paid on Student Loans

The table below illustrates the total interest paid over the life of a loan for various interest rates and loan amounts. These figures assume a standard 10-year repayment plan and do not include any potential fees or charges.

| Loan Amount | Interest Rate (5%) | Interest Rate (7%) | Interest Rate (9%) |

|---|---|---|---|

| $20,000 | $5,144 | $7,688 | $10,480 |

| $40,000 | $10,288 | $15,376 | $20,960 |

| $60,000 | $15,432 | $23,064 | $31,440 |

Final Conclusion

Successfully managing federal student loan debt requires a thorough understanding of interest rates and available repayment options. By carefully considering the information presented—current rates, historical trends, repayment plan comparisons, and available assistance programs—borrowers can develop a personalized strategy to minimize their overall costs and navigate their debt responsibly. Remember to explore all available resources and seek professional financial advice if needed to create a plan that aligns with your individual circumstances and financial goals.

Top FAQs

What is the difference between subsidized and unsubsidized federal student loans?

Subsidized loans don’t accrue interest while you’re in school (at least half-time), during grace periods, and in deferment. Unsubsidized loans accrue interest throughout your education, increasing your total debt.

Can I refinance my federal student loans?

Yes, but refinancing federal student loans with a private lender means losing federal protections like income-driven repayment plans and potential forgiveness programs. Carefully weigh the pros and cons before refinancing.

What happens if I don’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in wage garnishment or tax refund offset.

How can I lower my monthly student loan payments?

Explore income-driven repayment plans, which adjust your monthly payment based on your income and family size. Consolidation may also offer lower monthly payments but potentially increase the total interest paid.